Professional Documents

Culture Documents

Segment and Intrim Reporting Handout

Uploaded by

Mulugeta Niguse0 ratings0% found this document useful (0 votes)

22 views7 pagesThis document discusses segment reporting and interim financial reports. It defines a business segment and explains that segment reporting provides disaggregated financial data for different parts of a diversified business. Non-traceable expenses must be allocated to segments using reasonable bases, such as payroll, revenue, and asset ratios. A segment is considered significant if it meets revenue, profit/loss, or asset tests based on percentages of total amounts. Interim reports provide more timely information and should recognize revenue and associated costs consistently with annual reports.

Original Description:

Original Title

segment and intrim reporting handout

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses segment reporting and interim financial reports. It defines a business segment and explains that segment reporting provides disaggregated financial data for different parts of a diversified business. Non-traceable expenses must be allocated to segments using reasonable bases, such as payroll, revenue, and asset ratios. A segment is considered significant if it meets revenue, profit/loss, or asset tests based on percentages of total amounts. Interim reports provide more timely information and should recognize revenue and associated costs consistently with annual reports.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views7 pagesSegment and Intrim Reporting Handout

Uploaded by

Mulugeta NiguseThis document discusses segment reporting and interim financial reports. It defines a business segment and explains that segment reporting provides disaggregated financial data for different parts of a diversified business. Non-traceable expenses must be allocated to segments using reasonable bases, such as payroll, revenue, and asset ratios. A segment is considered significant if it meets revenue, profit/loss, or asset tests based on percentages of total amounts. Interim reports provide more timely information and should recognize revenue and associated costs consistently with annual reports.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

CHAPTER FIVE

SEGMENTS AND INTERIM REPORTS

5.1. SEGMENT REPORTING

5.1.1 Meaning of segments

The Accounting Principles Board defined a business segment as a component of an entity whose

activities represent a separate major line of business or class of customers. The wave of conglomerate

business combinations in past years, involving companies in different industries or markets, led to

consideration of appropriate methods for reporting disaggregated financial data for business segments.

Financial analysts and other interested in comparing one diversified business enterprise with another

found that consolidated financial statements did not supply enough information for meaningful

comparative statistics regarding operations of the diversified enterprises in specified industries. In other

words a segment is part of an organization or particular activity of an organization which is providing

separate information. The concept of segment reporting was controversial because it was opposed to the

philosophy that consolidated financial statements rather than separate financial statements fairly

represent the financial position and operating result of an economic entity.

5.2Allocation of non-traceable expenses to segments

Those expenses that are directly identifiable with a particular segment is known as traceable expenses,

while commonly incurred expenses are known as non-traceable expenses and cannot be recognized

separately. The FASB required that non traceable expenses should be allocated to each segment on

reasonable basis. The reasonable basis is upon the pronouncement of Cost Accounting Standard Board

(CASB) in Cost Accounting Standard CAS -403. Allocation of home office expenses commonly

incurred for the segments should be made on the basis of Arithmetic average of three factor ratio.

These three factors are

1. Ratio of segment Pay roll to total pay roll of all segments.

2. Ratio of segment operating revenue to total revenue of all segments

3. Ratio of segment Average Plant assets and inventory to total of all segments plant assets and

inventories.

WU,COBE,ACFN,ADVANCED FINANCIAL ACCOUNTING CHAPTER

1

FIVE HANDOUT

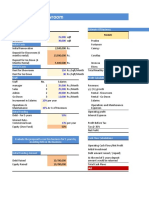

Illustration 1

Data for Home office and two industrial segments of a Multiproduct corporation is given below.

Home Segments

Office Chemical Food Total

Product Product

Net Sales ( Operating

revenue $550,000 $450,000 $1,000,000

Traceable Expenses 300,000 350,000 650,000

Non traceable expenses

of segments $200,000 ---- ----- 200,000

Total Expenses 200,000 300,000 350,000 850,000

Income before tax 150,000

Income tax 60,000

Net Income 90,000

Pay roll total 60,000 160,000 240,000 460,000

Average Plant assets &

Inventories 80,000 620,000 1,380,000 2,080,000

Required:

1. Compute Three Factor Ratios under CAS 403

2. Allocate Non traceable expenses

3. Find Operating profit of loss for two segments

WU,COBE,ACFN,ADVANCED FINANCIAL ACCOUNTING CHAPTER

2

FIVE HANDOUT

Solution:

1 Computation of three factor ratio under CAS 403

Chemical Food

Product % Product %

1.Ratio of segment pay roll 160,000 x100 240,000 x 100

to Total pay roll of segments 400,000 40% 400,000 60%

2. Ratio of segment revenue 550,000 x 100 450,000 x 100

to total revenue of segments 1,000,000 55% 1,000,000 45%

3. Ratio segment Plant 620,000 x 100 1380,000 x 100

assets & inventory 2,000,000 31% 2,000,000 69%

Total 126 174

Average 126/3 174/3

= 42% 58%

2. Allocation of Non Traceable Expenses

To Chemical Product segment = 200,000 x 42% = $ 84,000

To Food Products = 200,000 x 58% =116,000

Total 200,000

3. Computation of Operating Profit or (Loss)

Chemical Food

Products Products Total

Net sales $550,000 $450,000 $1,000,000

Less: Cost & Expenses

Traceable Expenses 300,000 350,000 650,000

Non traceable expenses 84,000 116,000 200,000

Total Expenses 384,000 466,000 850,000

Operating Profit or (Loss ) 166,000 (16,000) 150,000

WU,COBE,ACFN,ADVANCED FINANCIAL ACCOUNTING CHAPTER

3

FIVE HANDOUT

5.3 Determination of significant segments

If a segment is significant, its financial statements should be reported. The FASB decided that an

industry segment is significant, if it meets one or more or the following tests. There are three tests

namely

1. Revenue test

2. Profit and loss test and

3. Asset test.

1. Revenue Test: If a segments revenue (including sales to un affiliated customers and inter segment

sales or transfer) is 10% or more of the combined revenue of all enterprise’s industry segments.

2. Profit and loss test: A segment’s operating profit or loss is 10% or more of the greater of

a) The combined profit of all that did not incur an operating loss

b) The combined operating loss of all that did incur a loss.

3. Assets test: A segment’s identifiable assets are 10% or more of combined assets of all segments.

Illustration: 2

Determine the significant industry segments of a business enterprise having four segments. The

following details are given for the year ended December 31, Year 5.

SEGMETNTS

A B C D TOTAL

Revenue $60,000 80,000 20,000 50,000 $210, 0000

Operating Profit (loss) (20,000) 30,000 (10,000) 30,000 30,000

Identifiable Assets 500,000 400,000 100,000 300,000 1,300,000

Solution:

1. Revenue Test.

10% of the combined revenue = 210,000 X 10% = 21,000

Segments A , B & D meet the requirement of revenue test. So they are significant segments. Segment

C is not significant according to revenue test. So it is to apply the Profit and loss test for segment C

2. Profit and loss Test

a) Combined profit of all that did not incur a loss

B 30000 + D 30000 = 60000

WU,COBE,ACFN,ADVANCED FINANCIAL ACCOUNTING CHAPTER

4

FIVE HANDOUT

b) Combined Loss of all that did incur a loss

A 20,000 + C 10,000 = 30,000

Greater of the two above = 60,000

10% of the greater = 6,000

Segment C’s loss (10000) is greater than the calculated amount above. So Segment C also is significant.

So All Segments are significant.

Applying third test

3. Asset Test.

Combined assets of all segments = 1.300,000

10% of the combined = 130,000

According to this test Segment C is not significant, but it is significant as per profit and loss test.

So, final conclusion is that all segments are significant.

5.4 INTERIM FINANCIAL REPORTS

The APB established guidelines for interim financial reports. It is to provide investors and creditors with

more timely information than is provided by annual report. Companies provide financial information for

periods to time less than one year. It may be for monthly, quarterly, or half yearly. According to

guidelines given by APB, the following components should be included in interim financial reports.

1. Revenue: Revenue should be recognized in the interim period in the same way as they are recognized

on an annual basis. For example, revenue from long term construction project accounted for under

percentage of completion for annual purpose should also be recognized in interim statements on a

percentage of completion basis.

2. Cost associated with revenue: Enterprise using Gross profit method to estimate cost of goods sold

should disclose the fact in the interim financial report. Enterprise that use LIFO method and deplete the

base layer of inventories or LIFO liquidation should include in cost of goods sold the estimated cost of

replacing the depleted LIFO base layer. For example: Inventories on hand 200 units on the beginning

date. Purchase during the interim period 400 units, sold during the interim period 450 units, (under

LIFO, 400 unit’s purchased and 50 units from the inventory on hand) is sold, the 50 units are termed as

depletion of base layer of inventories.

WU,COBE,ACFN,ADVANCED FINANCIAL ACCOUNTING CHAPTER

5

FIVE HANDOUT

Illustration: 3

Liquid Products Company began the first quarter with 100 units of inventory that cost $10 per unit.

During the first quarter 200 units were purchased at a cost of $15 per unit and sales of 240 units at $20

per unit were made. During the second quarter, the company expects to replace the units of beginning

inventory sold at a cost of $17 per unit.

Required:

1. Calculate the gross profit for the first quarter.

2. Show Journal entry to record cost of goods sold in the first quarter.

3. Show journal entry to record the purchase of 500 units @$17 in the second quarter.

Solution

1. Computation of Gross Profit for the first quarter.

Sales (240 x 20) $4,800

Less: Cost Of Goods sold

200x 15 = 3000

40x 17 = 680 3,680

Gross Profit 1,120

2. Cost of goods Sold 3680

Inventory 3400

Liability from depletion 280

(To record the Cost of goods for first quarter)

INVENTORY ACCOUNT

Beginning Balance 100x10 1000 Cost of Goods Sold

Account Payable 200x15 3000 200x15= 3000

40x 10= 400 3400

Balance 600

COST OF GOODS SOLD

Inventory 3400 Income statement (transfer) 3680

Liability from depletion (40x7)

280

Total 3680 Total 3680

WU,COBE,ACFN,ADVANCED FINANCIAL ACCOUNTING CHAPTER

6

FIVE HANDOUT

3. Inventories (8500- 280) 8220

Liability from depletion 280

Account Payable 8500

(To record purchase and restoration of depleted base layer)

WU,COBE,ACFN,ADVANCED FINANCIAL ACCOUNTING CHAPTER

7

FIVE HANDOUT

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Chapter 35 Operating SegmentDocument4 pagesChapter 35 Operating SegmentEllen MaskariñoNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Chapter 10Document22 pagesChapter 10Ryze100% (1)

- Chapter 13: Operating Segment Segment Reporting - Core PrincipleDocument10 pagesChapter 13: Operating Segment Segment Reporting - Core PrinciplePaula BautistaNo ratings yet

- Operating Segment Revenue and Profit ReportingDocument21 pagesOperating Segment Revenue and Profit ReportingLouise83% (6)

- Manage inventory transactions with vouchers in TallyDocument12 pagesManage inventory transactions with vouchers in TallySubramaniam KrishnamoorthiNo ratings yet

- Act 6010 C Fall 2022 Final Sem ExaminationsDocument5 pagesAct 6010 C Fall 2022 Final Sem ExaminationsSimon JosiahNo ratings yet

- Costing Methods Comparison for Umbrella ManufacturerDocument70 pagesCosting Methods Comparison for Umbrella ManufacturerNavin Joshi70% (10)

- Corporate Finance 3rd Edition Graham Solution ManualDocument15 pagesCorporate Finance 3rd Edition Graham Solution ManualMark PanchitoNo ratings yet

- Acc 109 p2 Quiz Statement of Comprehensive IncomeDocument10 pagesAcc 109 p2 Quiz Statement of Comprehensive IncomeRhea Lalas100% (4)

- Management Accounting Exam Practice KitDocument405 pagesManagement Accounting Exam Practice Kittshepiso msimanga100% (4)

- MA2Document68 pagesMA2Isabella Gimao100% (2)

- BSBLDR413 Project Portfolio Part4Document26 pagesBSBLDR413 Project Portfolio Part4Alia Karki100% (1)

- Chapter 13, Modern Advanced Accounting-Review Q & ExrDocument16 pagesChapter 13, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PFRS 8 Operating Segment Interim ReportDocument16 pagesPFRS 8 Operating Segment Interim ReportJohn Mark FernandoNo ratings yet

- Financial Accounting - Tugas 5 - 30 Oktober 2019Document3 pagesFinancial Accounting - Tugas 5 - 30 Oktober 2019AlfiyanNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- ACC10007 Sample Exam 2Document9 pagesACC10007 Sample Exam 2dannielNo ratings yet

- Operating Segment: C. 71,000 AnswerDocument152 pagesOperating Segment: C. 71,000 AnswerRuby Jane33% (3)

- Bill French CaseDocument6 pagesBill French CaseAnthonyTiuNo ratings yet

- SAP T-Code FormDocument1 pageSAP T-Code FormSudarshan DawNo ratings yet

- Undertaking Business Permit-ToledoDocument2 pagesUndertaking Business Permit-Toledojunjunsscribdaccount100% (1)

- Segment ReportDocument30 pagesSegment ReportAira Shynne AsperaNo ratings yet

- Chapter 8Document6 pagesChapter 8Villanueva, Jane G.No ratings yet

- Prepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsDocument6 pagesPrepare A Segmented Income Statement That Differentiates Traceable Fixed Costs From Common Fixed Costs and Use It To Make DecisionsMiljane PerdizoNo ratings yet

- Compre Quiz No. 6Document10 pagesCompre Quiz No. 6Bea LadaoNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- IA3 AssignmentDocument7 pagesIA3 AssignmentJaeNo ratings yet

- Pfrs 8: Operating Segments Scope PFRS 8 Applies To The Separate or Individual Financial Statements of An Entity (And To The ConsolidatedDocument4 pagesPfrs 8: Operating Segments Scope PFRS 8 Applies To The Separate or Individual Financial Statements of An Entity (And To The Consolidatedpanda 1No ratings yet

- Management Accounting: Group 5Document9 pagesManagement Accounting: Group 5YATIN BAJAJNo ratings yet

- Interim and Segment ReportingDocument4 pagesInterim and Segment ReportingMarife PoliranNo ratings yet

- Solution 2009Document6 pagesSolution 2009Mukesh LalaNo ratings yet

- Chapter 10Document5 pagesChapter 10Xynith Nicole RamosNo ratings yet

- Module 33 Operating SegmentsDocument10 pagesModule 33 Operating SegmentsAngelica Sanchez de VeraNo ratings yet

- PROBLEM 4 (Evaluation of Performance) : TotalDocument3 pagesPROBLEM 4 (Evaluation of Performance) : TotalArt IslandNo ratings yet

- ACCA102 - 15 Operating SegmentsDocument24 pagesACCA102 - 15 Operating SegmentsMary Kate OrobiaNo ratings yet

- Seatwork 4 Reportable SegmentsDocument7 pagesSeatwork 4 Reportable SegmentsMon RamNo ratings yet

- QUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEDocument6 pagesQUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEAllen Kate Malazarte0% (1)

- Lagura - Ass04 Statement of Comprehensive IncomeDocument7 pagesLagura - Ass04 Statement of Comprehensive IncomeShane LaguraNo ratings yet

- Calculate ROI, Residual Income for divisionsDocument4 pagesCalculate ROI, Residual Income for divisionsLealyn CuestaNo ratings yet

- What Is A Segment?: in Financial ReportingDocument74 pagesWhat Is A Segment?: in Financial ReportingJerianne PascoNo ratings yet

- PFRS 8 Segment ReportingDocument3 pagesPFRS 8 Segment ReportingAllaine ElfaNo ratings yet

- Statement of Comprehensive Income practice problemsDocument2 pagesStatement of Comprehensive Income practice problemsXivaughn SebastianNo ratings yet

- Review Session 2024 SolutionsDocument3 pagesReview Session 2024 SolutionsHitesh MehtaNo ratings yet

- Cost accounting analysisDocument14 pagesCost accounting analysismanasa k pNo ratings yet

- HW Chap 12Document6 pagesHW Chap 12phương vũNo ratings yet

- Unit 1 Advanced AccountingDocument130 pagesUnit 1 Advanced AccountingNigussie BerhanuNo ratings yet

- Midterm Test Performance Measurement: Regular ClassDocument6 pagesMidterm Test Performance Measurement: Regular ClassIvonie NursalimNo ratings yet

- Management Accounting Extends Cost AccountingDocument6 pagesManagement Accounting Extends Cost AccountingchitkarashellyNo ratings yet

- Acc123 J&BPDocument20 pagesAcc123 J&BPCali SiobhanNo ratings yet

- Advanced Accounting Unit 1Document14 pagesAdvanced Accounting Unit 1yasinNo ratings yet

- Case Bill FrenchDocument3 pagesCase Bill FrenchROSHAN KUMAR SAHOONo ratings yet

- IPCC Cost - Kol73cck4annhfcjovu6Document17 pagesIPCC Cost - Kol73cck4annhfcjovu6aryanraghuvanshi758No ratings yet

- Module 5 (Chapter 24) - Managing Productivity & MKTG EffectivenessDocument28 pagesModule 5 (Chapter 24) - Managing Productivity & MKTG Effectivenessdakis cherishjoyfNo ratings yet

- L19 RC Problems On ROI and EVADocument8 pagesL19 RC Problems On ROI and EVAapi-3820619100% (2)

- Accounting and Finance Assignment AnalysisDocument6 pagesAccounting and Finance Assignment AnalysisAravindh ArulNo ratings yet

- Introduction To Management AccountingDocument55 pagesIntroduction To Management AccountingUsama250100% (1)

- Analyze financial statements and cash flowsDocument15 pagesAnalyze financial statements and cash flowsKapil Singh RautelaNo ratings yet

- Rebyuer NiggaDocument77 pagesRebyuer NiggaAldrich AmoguisNo ratings yet

- Chapter 1 InventoryDocument16 pagesChapter 1 InventoryTolesa MogosNo ratings yet

- Optonic - Winter of 2015Document13 pagesOptonic - Winter of 2015arijit nayakNo ratings yet

- Vitrox q32016Document12 pagesVitrox q32016Dennis AngNo ratings yet

- AVIATION IN INDIA - Mega Max PDFDocument11 pagesAVIATION IN INDIA - Mega Max PDFRishikesh MishraNo ratings yet

- Strategic Management First ActivityDocument3 pagesStrategic Management First ActivityGio DaleNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewLokesh SharmaNo ratings yet

- Financial Reporting: Ca P. C. SainiDocument103 pagesFinancial Reporting: Ca P. C. SainiFaraz AliNo ratings yet

- The Following Selected Transactions Were Completed by Green Lawn SuppliesDocument1 pageThe Following Selected Transactions Were Completed by Green Lawn SuppliesAmit PandeyNo ratings yet

- Case Studies On The Success or Failure of FuturesDocument18 pagesCase Studies On The Success or Failure of FuturesMohamed AbdelSalamNo ratings yet

- Research Report For Praedico GlobalDocument3 pagesResearch Report For Praedico GlobalAbhishek PatilNo ratings yet

- Demonetisation Case StudyDocument17 pagesDemonetisation Case StudyRidhtang DuggalNo ratings yet

- Project Formulation - Solidaridad NetworkDocument22 pagesProject Formulation - Solidaridad NetworkLuis Raúl Arzola TorresNo ratings yet

- Set up car showroom business planDocument14 pagesSet up car showroom business planshrish guptaNo ratings yet

- Venicia CaseDocument2 pagesVenicia CaseJesse YusufuNo ratings yet

- AirtelDocument25 pagesAirtelSrabani PalNo ratings yet

- The Learners Independently Prepare and Cook Vegetable DishesDocument4 pagesThe Learners Independently Prepare and Cook Vegetable DishesJunelyn SabrosoNo ratings yet

- Project Report On Brand EngagementDocument35 pagesProject Report On Brand EngagementChinmoy Das0% (2)

- Chapter 6Document25 pagesChapter 6syafikaabdullahNo ratings yet

- Miftah Contemporary BusinessDocument14 pagesMiftah Contemporary BusinessSanjana TasmiaNo ratings yet

- Manajemen Persediaan Bahan BakuDocument95 pagesManajemen Persediaan Bahan BakuAnto San JaYaNo ratings yet

- Decision Making at Igate and Patni ComputersDocument16 pagesDecision Making at Igate and Patni ComputersAnkita NirolaNo ratings yet

- Vega Agnitya E.P.-17312053 Soal UAS Semester Antara - 2019-2020 - AyuCL-MCSDocument5 pagesVega Agnitya E.P.-17312053 Soal UAS Semester Antara - 2019-2020 - AyuCL-MCSVEGA AGNITYA EKA PANGESTINo ratings yet

- Stanadyne Packaging and Shipping GuidelinesDocument39 pagesStanadyne Packaging and Shipping GuidelinesABDELOUAHEB HAMIDINo ratings yet

- E-2021-01-02-21-02-091 - Demand NoticeDocument2 pagesE-2021-01-02-21-02-091 - Demand NoticeHari KiranNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice Questionskhankhan1No ratings yet