Professional Documents

Culture Documents

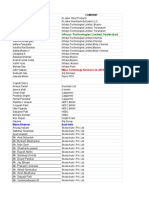

Key Vocabulary Important Concepts: Unit 4a: Government and The Macroeconomy - Demand and Supply Side Policies

Uploaded by

happyproofOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Key Vocabulary Important Concepts: Unit 4a: Government and The Macroeconomy - Demand and Supply Side Policies

Uploaded by

happyproofCopyright:

Available Formats

Important Concepts Key Vocabulary Unit 4a: Government and the

Macroeconomic goals of government 1. Ad valorem taxes 1. In Latin means “to the value” and is a tax levied based

macroeconomy – demand

There are five traditional macro-economic goals of government:

Economic Governments aim to increase real GDP overtime, pushing the

on the value of an item which is charged at the point and supply side policies

of sale (e.g. VAT).

growth PPF outwards and improving standards of living. 2. Aggregate 2. The total demand across an economy from expenditure, Key sources:

Full Having all people employed and contributing to the economy will Demand exports, investment and government spending. • Economics IGCSE Revision Guide (Titley & Carrier, 2014)

employment mean operating on the curve of the PPF. However, there is often 3. Aggregate 3. The total supply across an economy. • http://www.i-study.co.uk/Economics/IGCSE%20Eco%20main%20page.html (accessed on 27.06.17)

frictional unemployment, Supply • Complete Economics for Cambridge IGCSE® and O Level (Moynihan & Titley, 2016)

• http://www.dineshbakshi.com/ib-economics/macroeconomics/revision-notes/728-circular-flow-

Price stability By keeping inflation low and steady (2-3%) allows businesses 4. Base rate 4. The interest rate that a central bank will charge to lend of-income (accessed on 22.06.17).

and individuals to plan for the future. commercial banks money.

Redistribution Most governments aim to ensure some level of equality by 5. Budget 5. Annual financial statement documenting government

of income taxing the rich at a higher rate (progressive taxation) and expenditure and income.

Facts to commit to memory

providing to the poor through social welfare payments. 6. Budget Deficit 6. A situation where government expenditure is greater

Favourable Governments prefer to have a positive balance of payments than income for the given year. 1. Governments use policy instruments to help achieve macro-

Balance of where the amount of money flowing into an economy through 7. Budget Surplus 7. A situation where government expenditure is smaller economic objectives.

Payments the sale of exports is greater than, or balanced with, the money than income for the given year. 2. Public spending can be broken into current expenditure and capital

(BoP) leaving the economy through the purchase of imports. 8. Capital gains tax 8. Tax levied on the sale of an asset that has increased in expenditure.

value. 3. Public expenditures are financed by taxes and other revenues.

Demand-side policies 9. Corporation tax 9. Tax levied on company profits.

1. The government has a number of policy instruments that it can use to affect aggregate 4. Taxes can have progressive, regressive or proportional impacts on

10. Current 10. Short-term government spending that is recurrent, for

demand in the economy.

expenditure example salaries paid to people working in the state income.

2. As well as affecting output, controlling aggregate demand also affects employment, 5. Taxes on incomes and wealth are known as direct taxes.

sector.

inflation and the BoP. 6. Indirect taxes are incurred when consumers spend their incomes.

11. Capital 11. Government spending that has a long-term impact on

3. The two main demand-side instruments are fiscal policy and monetary policy.

expenditure both supply and demand and includes spending on

4. Fiscal policy involves government spending and taxation.

physical assets like roads, bridges, hospitals and

5. Monetary policy involves the money supply and the interest rate.

6. Demand-side policies can be expansionary, leading to an increase in aggregate

schools. Important Diagrams

demand, or contractionary, leading to a decrease in aggregate demand. 12. Deregulation 12. The process of reducing or removing legislation and

7. Expansionary policies will tend to increase spending and borrowing whilst reducing red tape. Circular Flow of Income

saving. 13. Direct tax 13. Taxes levied on income and wealth (examples include

8. Contractionary policies will tend to decrease spending and borrowing whilst increasing income tax, corporation tax, inheritance tax and capital

saving. gains tax).

Contractionary 14. Effective tax rate 14. The average tax rate that a person or corporation pays

Policy Tool or Output Employment Inflation over their whole income.

expansionary 15. Excise duties 15. An indirect tax levied on the manufacture, sale or use of

↑ Taxes Contractionary ↓ ↓ ↓ 16. Funding 16.

a good, e.g. the tax on cigarettes.

Long-term government debt that the government issues

Fiscal

↓ Gov.

spending

Contractionary ↓ ↓ ↓ to reduce the money supply (e.g. securities and bonds).

Policy ↓ Taxes Expansionary ↑ ↑ ↑ 17. Indirect tax 17. Taxes levied on spending (examples include VAT,

export and import taxes).

↑ Gov.

spending

Expansionary ↑ ↑ ↑ 18. Interest rates 18. The cost of borrowing money.

19. Macro- 19. The study of economics at the level of the national

↑ interest

rate

Contractionary ↓ ↓ ↓ economics economy.

20. Micro-economics 20. The study of economics at the individual level of the

Monetary

↓ money

supply*

Contractionary ↓ ↓ ↓ consumer or supplier.

21. Open market 21. The borrowing and repayment of short-term public sector

Policy ↓ interest

rate

Expansionary ↑ ↑ ↑ operations debt by the private sector and individuals.

22. Payroll tax 22. A tax that an employer pays on behalf of its staff and

↑ money

supply*

Expansionary ↑ ↑ ↑ that is calculated as a percentage of an employee’s

Source: http://www.dineshbakshi.com/ib-economics/macroeconomics/revision-

notes/728-circular-flow-of-income

* Note: the government can manipulate the money supply through a number of mediums wage.

including quantitative easing, funding, open market operations and special deposits (see 23. Personal income 23. A direct tax levied on a person’s income. Overview

definitions opposite). tax 1. The circular flow of income represents a simplified economy.

24. Privatisation 24. The sale of state owned assets to the private sector. 2. There are five economic agents – firms, hhds, banks, government and

Supply-side policies 25. Progressive tax 25. A taxation system that taxes higher earners a higher % abroad (firms, government and individuals).

1. Supply-side policies aim to influence the aggregate supply in an economy. of their income. 3. The diagram shows how money moves around the economy, how it can

2. They can also be grouped into market-orientated and interventionist approaches. 26. Proportional tax 26. A tax system that levies the same percentage of tax enter an economy (injections) and how it can leave an economy

3. Market-oriented involves strategies to free-up the market and reduce government from all taxpayers irrespective of their income. (withdrawals/leakages).

intervention. 27. Quantitative 27. A form of monetary policy where the government credits

4. Interventionist strategies involve the government taking an active role in the market. easing its own account and then buys financial assets like Injections

government bonds to increase money supply and 1. Government can inject money into an economy through current and capital

Market-orientated approaches: encourage spending. spending (G).

1. Reduce taxes on firms. 28. Regressive tax 28. A taxation system where the tax rate falls as income 2. Firms can make capital investments (I).

2. Reduce bureaucracy and red tape to make production more efficient. increases taking a larger % of tax from lower income 3. Foreign people, governments and firms can buy exported goods (X).

3. Curb the power of trade unions which will reduce their ability to demand higher wages earners than from higher earners.

and to take industrial action which in turn should increase output. 29. Special deposits 29. An order by the central bank for commercial banks to Leakages/Withdrawals

4. Reduce/remove unemployment benefits. deposit money with it for a certain period of time thus 1. The government taxes directly and indirectly which removes money from

5. Remove the minimum wage. reducing the money circulating in the economy. the economy (T).

30. Subsidies 30. A payment made by the government to suppliers to 2. Hhds can save their money removing it from the circular flow (though it is

Interventionist strategies: increase output and/or keep prices low. often lent by banks for investment) (S).

1. Invest in healthcare and education/training to make the workforce healthier and more 31. Tariffs 31. A tax levied on imported goods and services. 3. Domestically, individuals and firms can import foreign goods/services

productive. 32. Tax revenue 32. The total amount of revenue gained by the government which represents money leaking from the economy (M).

2. Subsidise entire industries to make them more competitive and reduce the costs of from taxation.

production for firms. 33. Transfer taxes 33. A tax levied on the transfer of property from one Economy grows if… G + I + X > T + S + M

3. Invest in technology and research and development to help improve the efficiency of

production.

person to another.

Economy shrinks if… T + S + M > G + I + X

34. User charges 34. A fee charged for using a product or service, e.g. a

Key issue with supply-side policies – they have a time-lag!

highway toll.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Basic Accounting: Basic Accounting Made Easy Author: Win Ballada Prepared By: Michael AlonzoDocument18 pagesBasic Accounting: Basic Accounting Made Easy Author: Win Ballada Prepared By: Michael Alonzoroland uson91% (35)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Economics - Microeconomics of Banking - Freixas, RochetDocument323 pagesEconomics - Microeconomics of Banking - Freixas, RochetGabriel MerloNo ratings yet

- Monaco'S British: CastleDocument3 pagesMonaco'S British: CastleHai Anh33% (3)

- 10.2 MetalsDocument6 pages10.2 MetalshappyproofNo ratings yet

- Section 5 Atomic Physics (Radioactivity)Document31 pagesSection 5 Atomic Physics (Radioactivity)happyproofNo ratings yet

- Sulfur: Sources & Uses: Unit - (12) Sulfur & Sulfuric AcidDocument2 pagesSulfur: Sources & Uses: Unit - (12) Sulfur & Sulfuric AcidhappyproofNo ratings yet

- List of Computer Abbreviations and Acronyms PDF: Abbreviation Stands ForDocument8 pagesList of Computer Abbreviations and Acronyms PDF: Abbreviation Stands Forhappyproof100% (1)

- Chapter 5: Input & Output DevicesDocument19 pagesChapter 5: Input & Output DeviceshappyproofNo ratings yet

- 1.3 Data Storage - Part 2Document17 pages1.3 Data Storage - Part 2happyproofNo ratings yet

- 1.3 Data Storage - Part 3Document28 pages1.3 Data Storage - Part 3happyproofNo ratings yet

- 1.1.4 Binary Systems - Lesson 4Document20 pages1.1.4 Binary Systems - Lesson 4happyproofNo ratings yet

- 1.2 Hexadecimal - Part 1Document15 pages1.2 Hexadecimal - Part 1happyproofNo ratings yet

- 1.3 Data Storage - Part 1Document15 pages1.3 Data Storage - Part 1happyproofNo ratings yet

- Easy Steps To Chinese 2 WorkbookDocument194 pagesEasy Steps To Chinese 2 Workbookhappyproof100% (18)

- Easy Steps To Chinese 2 TextbookDocument80 pagesEasy Steps To Chinese 2 TextbookhappyproofNo ratings yet

- Easy Steps To Chinese 1 TextbookDocument68 pagesEasy Steps To Chinese 1 TextbookhappyproofNo ratings yet

- Easy Steps To Chinese 1 WorkbookDocument91 pagesEasy Steps To Chinese 1 Workbookhappyproof94% (16)

- African Metalurgy v2Document20 pagesAfrican Metalurgy v2Yvar Justiça100% (1)

- 2018 Spa AcacioDocument2 pages2018 Spa AcacioRussell Galvez HufanoNo ratings yet

- Economics of Money Banking and Financial Markets 9th Edition Mishkin Test BankDocument21 pagesEconomics of Money Banking and Financial Markets 9th Edition Mishkin Test Banklucnathanvuz6hq100% (25)

- Hamachandru S Infosys Technologies Limited, Hyderabad: Name CompanyDocument6 pagesHamachandru S Infosys Technologies Limited, Hyderabad: Name CompanyreenajoseNo ratings yet

- Committee/Commission Head ObjectiveDocument5 pagesCommittee/Commission Head ObjectiveadmNo ratings yet

- IBM556 Written ReportDocument15 pagesIBM556 Written ReportFaiz FahmiNo ratings yet

- The Times They Are Not Changin': Days and Hours of Work in Old and New Worlds, 1870-2000Document30 pagesThe Times They Are Not Changin': Days and Hours of Work in Old and New Worlds, 1870-2000StefanoNo ratings yet

- Booklet 2023 Indonesia UpdateDocument50 pagesBooklet 2023 Indonesia UpdateJulius TariganNo ratings yet

- Embedded - Finance - Predictions - 1685447121 2023-05-30 11 - 45 - 23Document30 pagesEmbedded - Finance - Predictions - 1685447121 2023-05-30 11 - 45 - 23Sohail ShaikhNo ratings yet

- CIRPASS PresentationDocument9 pagesCIRPASS PresentationGustavo GarciaNo ratings yet

- Aum Equity 31.7.10Document38 pagesAum Equity 31.7.10Neeraj ShahNo ratings yet

- Chapter10 Investment Function in BankDocument38 pagesChapter10 Investment Function in BankTừ Lê Lan HươngNo ratings yet

- Latest GST Changes 28-5-21Document5 pagesLatest GST Changes 28-5-21phani raja kumarNo ratings yet

- Tally AssingmentDocument19 pagesTally AssingmentTaranNo ratings yet

- Sr. No Subject NoDocument5 pagesSr. No Subject NoKailash Chandra Pradhan0% (1)

- Role of Government in Economic PolicyDocument22 pagesRole of Government in Economic PolicyMiss PauNo ratings yet

- Session No. 2 / Week 2: Cities of Mandaluyong and PasigDocument13 pagesSession No. 2 / Week 2: Cities of Mandaluyong and PasigShermaine CachoNo ratings yet

- 7-68-0562 Rev 5 Operating PlatformDocument3 pages7-68-0562 Rev 5 Operating PlatformMazher AliNo ratings yet

- Certificate On Distribution of Physical Acknowledgements of Kharif 2022 and Rabi 2022-23Document1 pageCertificate On Distribution of Physical Acknowledgements of Kharif 2022 and Rabi 2022-23John StephenNo ratings yet

- BANKINGDocument1 pageBANKINGAswinNo ratings yet

- AMFEIX - Monthly Report (August 2019)Document5 pagesAMFEIX - Monthly Report (August 2019)PoolBTCNo ratings yet

- Taxation of Business Entities 2017 8th Edition Spilker Solutions ManualDocument11 pagesTaxation of Business Entities 2017 8th Edition Spilker Solutions Manualotisviviany9zoNo ratings yet

- A Queen Dies Slowly - The Rise and Decline of Iloilo CityDocument17 pagesA Queen Dies Slowly - The Rise and Decline of Iloilo CityJohn Feil JimenezNo ratings yet

- Transforming Nigerian Informal Settlementsinto Liveable CommunitiesDocument43 pagesTransforming Nigerian Informal Settlementsinto Liveable CommunitiesAngelo NgoveneNo ratings yet

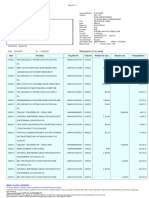

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLakshay SharmaNo ratings yet

- Tax Law Assignment Final DraftDocument5 pagesTax Law Assignment Final DraftTatenda MudyanevanaNo ratings yet

- Downtown Calgary Strategy Implementation and 2020 Annual Report - PFC2021-0779Document6 pagesDowntown Calgary Strategy Implementation and 2020 Annual Report - PFC2021-0779CityNewsTorontoNo ratings yet