Professional Documents

Culture Documents

A Level Accounting Revision Questions

Uploaded by

TARMAK MC LYONOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Level Accounting Revision Questions

Uploaded by

TARMAK MC LYONCopyright:

Available Formats

“A” LEVEL ACCOUNTING

ACCOUNTING RATIOS

REVISION QUESTIONS

BOOKLET

Tinofamba nevanofamba

1|Page TINOFAMBA NEVANOFAMBA

QUESTION 1

On 31 March 2016, the accountant of Shumi Power Ltd provided the following balances:

Debit Credit

$000 $000

Sales 900

Cost of sales

Operating expenses 490

Interest paid 30

Ordinary shares of $0,75 each 10 750

8% Preference shares of $1 each 100

7,5% Debentures 200

Interim ordinary dividend paid 4

Notes

1. The market price of each ordinary share was $1,50.

2. Corporation tax charged for the year was $22 000.

3. Ordinary dividends of $0,15 per share was paid.

Required

a. Prepared an Income Statement together with a Profit and Loss Appropriation Account

for the year ended 31 March 2016. [8]

b. Calculate, correct to two decimal places, the following ratios for the year ended 31

March 2016:

i. Net profit percentage

ii. Interest cover

iii. Earnings per share

iv. Price earnings ratio

v. Dividend cover

vi. Dividend yield [12]

c. i. How can a company use ratios to assess its own performance? [3]

ii. Why is return on capital employed an important measure of performance of a

company? [2]

2|Page TINOFAMBA NEVANOFAMBA

QUESTION 2

The Statement of financial position of Boyd Limited on 31 December 2007 showed the

following information:

$ (000)

Ordinary shares of $2 each 36 000

8% Preference shares of $1 each 18 000

General reserve 3 600

Profit and loss account 7 440

12% Debentures 24 000

During the year ended 31 December 2008, Boyd made an operating profit of $10 080 000.

The directors made the following recommendations on 31 December 2008:

1. An amount of $1 200 000 was to be transferred to the general reserve.

2. An ordinary dividend of 20 cents per share was to be paid.

The market value of ordinary shares was $4,80 on 31 December 2008.

Required

a. Boyd’s appropriation account for the year ended 31 December 2008. [6]

b. Calculate the following ratios for 2008 showing all workings.

i) Return on ordinary shareholders’ funds [2]

ii) Gearing [2]

iii) Earnings per share [2]

iv) Interest cover [2]

v) Dividend cover [2]

vi) Price earnings ratio [2]

vii) Dividend yield [2]

3|Page TINOFAMBA NEVANOFAMBA

QUESTION 3

Ali operates a small trading business.

For the year ended 31 December 2014 he provides the following information:

Gross profit margin 54%

Profit margin 18%

Current ratio 1.6 : 1

Trade receivables turnover 40 days

Return on capital employed 5.4%

Cost of sales $248 400

Closing inventory $38 000

Cash and cash equivalents $30 308

Long-term loan $1 000 000

REQUIRED

(a) Prepare for Ali’s business in as much detail as possible:

(i) the income statement for the year ended 31 December 2014 [5]

(ii) the statement of financial position at 31 December 2014. [6]

Note: Calculations should be to the nearest $ where appropriate.

(b) State two advantages and two disadvantages of ratio analysis. [4]

Additional information

For the year ended 31 December 2013 Ali has calculated the following ratios:

Current ratio 1.3 : 1

Trade receivables turnover 30 days

Gross profit margin 48%

Profit margin 12%

REQUIRED

(c) Assess the performance of the business in respect of liquidity and profitability. [7]

4|Page TINOFAMBA NEVANOFAMBA

You might also like

- Sample Midterm QuestionDocument3 pagesSample Midterm QuestionAleema RokaiyaNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- 9706 31 Insert o N 20Document5 pages9706 31 Insert o N 20chirag mehtaNo ratings yet

- Department of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamDocument1 pageDepartment of Commerce, Bahauddin Zakariya University, Multan Instructions For The ExamTHIND TAXLAWNo ratings yet

- Financial Managerial Accounting SB611 Dec 2008 MBA PT-FTDocument16 pagesFinancial Managerial Accounting SB611 Dec 2008 MBA PT-FTyeunzi socialNo ratings yet

- Unit 1 2018 Paper 2Document9 pagesUnit 1 2018 Paper 2Pettal BartlettNo ratings yet

- ACCT10002 tutorial exercisesDocument5 pagesACCT10002 tutorial exercisesJING NIENo ratings yet

- 9706 - m19 - QP - 22 AdjustedDocument20 pages9706 - m19 - QP - 22 Adjustedhusse fokNo ratings yet

- November 2020 Insert Paper 31Document12 pagesNovember 2020 Insert Paper 31Shahmeer HasanNo ratings yet

- Financial Accounting A November 2013Document7 pagesFinancial Accounting A November 2013Munodawafa ChimhamhiwaNo ratings yet

- Mock BPP P2 (3 8)Document32 pagesMock BPP P2 (3 8)naveedawan3210% (1)

- Accountancy Sample Question PaperDocument8 pagesAccountancy Sample Question PaperSoNam ZaNgmoNo ratings yet

- ACCN. LOCKDOWN WORKSHEET 2aDocument2 pagesACCN. LOCKDOWN WORKSHEET 2aRyno de BeerNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- KL Business Finance Nov Dec 2014Document2 pagesKL Business Finance Nov Dec 2014Towhidul IslamNo ratings yet

- Bac 101 Fundamentals of Accounting IiDocument8 pagesBac 101 Fundamentals of Accounting IiShadddie SnrNo ratings yet

- Fs ExerciseDocument6 pagesFs ExerciseDIVINE GRACE ROSALESNo ratings yet

- T6int 2009 Jun QDocument9 pagesT6int 2009 Jun QRana KAshif GulzarNo ratings yet

- Analysis and Interpretation of Financial Statements PDFDocument11 pagesAnalysis and Interpretation of Financial Statements PDFKudakwashe MujungwaNo ratings yet

- 9706 w19 QP 31Document13 pages9706 w19 QP 31PontuChowdhuryNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Acc_N2020_P3_(1)Document7 pagesAcc_N2020_P3_(1)chauromweaNo ratings yet

- MSS Financial AnalysisDocument7 pagesMSS Financial AnalysisDr Hossam AbbasNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelSSSNIPDNo ratings yet

- Butler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsDocument2 pagesButler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsJem JemNo ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service CommissionkarimNo ratings yet

- Sample MCQDocument8 pagesSample MCQJacky LamNo ratings yet

- AC 310 Lab Problems - 9.7.2021Document2 pagesAC 310 Lab Problems - 9.7.2021Abdullah alhamaadNo ratings yet

- ACCA Strategic Business Reporting (SBR) Achievement Ladder Step 8 Questions & AnswersDocument22 pagesACCA Strategic Business Reporting (SBR) Achievement Ladder Step 8 Questions & AnswersAdam MNo ratings yet

- B205B Financial ExamplesDocument6 pagesB205B Financial ExamplesAhmad RahjeNo ratings yet

- Accountancy Exam QuestionsDocument7 pagesAccountancy Exam QuestionsMalathi RajaNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- Unit 3 - Essay QuestionsDocument4 pagesUnit 3 - Essay QuestionsJaijuNo ratings yet

- Ae 191 F-Test 1Document3 pagesAe 191 F-Test 1Venus PalmencoNo ratings yet

- TIE5205201505 Business Studies IV Financial AnalysisDocument12 pagesTIE5205201505 Business Studies IV Financial AnalysisMarlon KamupiraNo ratings yet

- 9706 m17 QP 32Document12 pages9706 m17 QP 32FarrukhsgNo ratings yet

- Financial Accounting - Reporting November 2021 Question PaperDocument9 pagesFinancial Accounting - Reporting November 2021 Question PaperMunodawafa ChimhamhiwaNo ratings yet

- Ratio Analysis Review QuestionsDocument5 pagesRatio Analysis Review QuestionsPASTORYNo ratings yet

- Form 6 Acc (Z)Document16 pagesForm 6 Acc (Z)David MutandaNo ratings yet

- Ias 8Document9 pagesIas 8Syed Huzaifa SamiNo ratings yet

- BF CA1 - Jul 2022 TermDocument4 pagesBF CA1 - Jul 2022 Termmuhammad navidulhaqNo ratings yet

- 07 Objective Type IAS 7 Statement of Cash Flows A35Document9 pages07 Objective Type IAS 7 Statement of Cash Flows A35Haris IshaqNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- Understanding the Importance of Group Cash Flow StatementsDocument8 pagesUnderstanding the Importance of Group Cash Flow Statementsriya_pramodNo ratings yet

- 71487bos57500 p8Document29 pages71487bos57500 p8OPULENCENo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Rinconada - ProjectDocument29 pagesRinconada - ProjectRINCONADA ReynalynNo ratings yet

- Paper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Document8 pagesPaper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Jeremy LuNo ratings yet

- CAPE Accounting 2017 U1 P2 PDFDocument11 pagesCAPE Accounting 2017 U1 P2 PDFmama12222No ratings yet

- Workshop 2 - Questions - Introduction To Accounting and FinanceDocument7 pagesWorkshop 2 - Questions - Introduction To Accounting and FinanceSu FangNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- Cash Flow Statement UDpdfDocument18 pagesCash Flow Statement UDpdfrizwan ul hassanNo ratings yet

- Assignment 2 - FSADocument7 pagesAssignment 2 - FSAzazaNo ratings yet

- Nov 19 Q PDFDocument9 pagesNov 19 Q PDFTenywa SalimNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- LaForge Systems Net Income Adjustments for FCFF and FCFEDocument6 pagesLaForge Systems Net Income Adjustments for FCFF and FCFEDina WongNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- "A" Level Accounting: Changes in EquityDocument2 pages"A" Level Accounting: Changes in EquityTARMAK MC LYONNo ratings yet

- Accounting Weekend ExercisesDocument6 pagesAccounting Weekend ExercisesTARMAK MC LYONNo ratings yet

- A Level Accounting Depreciation Revision QuestionsDocument7 pagesA Level Accounting Depreciation Revision QuestionsTARMAK MC LYONNo ratings yet

- Acc Qns N Answers ZimsecDocument181 pagesAcc Qns N Answers ZimsecTARMAK MC LYON100% (1)

- 'A' LEVEL ACCOUNTING STUDY PACK VOLUME 1 1 May 2012 PDFDocument377 pages'A' LEVEL ACCOUNTING STUDY PACK VOLUME 1 1 May 2012 PDFFegason Fegy79% (14)

- Introduction To MacroeconomicsDocument21 pagesIntroduction To MacroeconomicsTARMAK MC LYONNo ratings yet

- Bpo Interview QuestionsDocument4 pagesBpo Interview QuestionsSohail AnwarNo ratings yet

- DGQADocument2 pagesDGQASakethNo ratings yet

- MakeAnimated PowerPoint Slide by PowerPoint SchoolDocument9 pagesMakeAnimated PowerPoint Slide by PowerPoint SchoolMUHAMMAD HAMZA JAVEDNo ratings yet

- 252 Anand Chinmayanand Pandey Acc.Document7 pages252 Anand Chinmayanand Pandey Acc.Anand PandeyNo ratings yet

- PBB 2019 List Eligible SchoolDocument29 pagesPBB 2019 List Eligible SchoolJen SottoNo ratings yet

- SMCC-13 Memorial For Opposite PartyDocument21 pagesSMCC-13 Memorial For Opposite PartyUdhithaa S K KotaNo ratings yet

- AR Jawattie 2019 PDFDocument233 pagesAR Jawattie 2019 PDFSyafira AdeliaNo ratings yet

- Dhan Ki BaatDocument12 pagesDhan Ki Baattest hrmNo ratings yet

- 4 Revenue 10 QuestionsDocument2 pages4 Revenue 10 QuestionsEzer Cruz BarrantesNo ratings yet

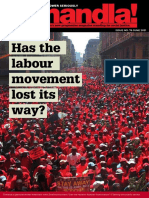

- South Africa's New Progressive Magazine Standing For Social JusticeDocument48 pagesSouth Africa's New Progressive Magazine Standing For Social JusticeBenjamin Glyn FogelNo ratings yet

- 2019 USPS Postage Rate Guide: Effective January 27, 2019Document1 page2019 USPS Postage Rate Guide: Effective January 27, 2019NonoNo ratings yet

- Portofoliu Tradeville Mai 2023Document2 pagesPortofoliu Tradeville Mai 2023fk6dfdxjkhNo ratings yet

- Final Assignment: Mct1074 Business Intelligence and AnalyticsDocument28 pagesFinal Assignment: Mct1074 Business Intelligence and AnalyticsAhmad Shahir NohNo ratings yet

- Tender Notice For BC 2012 13 HQ 01 Construction of 4th Floor Building of Nha Headquarters 1Document2 pagesTender Notice For BC 2012 13 HQ 01 Construction of 4th Floor Building of Nha Headquarters 1Abn e MaqsoodNo ratings yet

- 1 s2.0 S0747563221004507 MainDocument12 pages1 s2.0 S0747563221004507 Mainchit_monNo ratings yet

- Planning For Film Tourism Active Destination Image ManagementDocument11 pagesPlanning For Film Tourism Active Destination Image ManagementSamuel SNo ratings yet

- Social Science All in One (Preli)Document363 pagesSocial Science All in One (Preli)Safa AbcNo ratings yet

- Exclusive Garnet Distributor MalaysiaDocument1 pageExclusive Garnet Distributor MalaysiaFarouq YassinNo ratings yet

- ENTREPRENEURSHIP 5 C'SDocument9 pagesENTREPRENEURSHIP 5 C'Skhizar naseemNo ratings yet

- Black Money in IndiaDocument19 pagesBlack Money in Indiadeysi rojasNo ratings yet

- The Expenditure Cycle 2Document12 pagesThe Expenditure Cycle 2Princess Nicole Posadas OniaNo ratings yet

- Planning Reports and Proposals: 12/28/20 Chapter 11-1Document27 pagesPlanning Reports and Proposals: 12/28/20 Chapter 11-1H. U. KonainNo ratings yet

- General Comments: The Chartered Institute of Management AccountantsDocument25 pagesGeneral Comments: The Chartered Institute of Management AccountantsSritijhaaNo ratings yet

- Accounting for Investments under AS 13Document6 pagesAccounting for Investments under AS 13anshNo ratings yet

- Cs403 Short NotesDocument5 pagesCs403 Short NotesChanda KhanNo ratings yet

- Answer Key For MarketingDocument3 pagesAnswer Key For Marketingtammy a. romuloNo ratings yet

- Pricing Decisions: Global MarketingDocument19 pagesPricing Decisions: Global MarketingAsif_Jamal_9320No ratings yet

- Cultural Studies GoldsmithsDocument8 pagesCultural Studies Goldsmithsmoebius70No ratings yet

- Starlet Shoes Women's Day Sale! Flat 20% Off On ENTIRE STOCK, Limited Time Offer - WhatsOnSaleDocument2 pagesStarlet Shoes Women's Day Sale! Flat 20% Off On ENTIRE STOCK, Limited Time Offer - WhatsOnSaleAamir ShahidNo ratings yet

- New 1Document6 pagesNew 1Teddy Parker da SilvaNo ratings yet