Professional Documents

Culture Documents

TaxMarvel - Modifications in Form GSTR 3B and New Disclosure Requirements

Uploaded by

Amit AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TaxMarvel - Modifications in Form GSTR 3B and New Disclosure Requirements

Uploaded by

Amit AgrawalCopyright:

Available Formats

Goods and Services Tax – Update July 8, 2022

Update Category Reporting of ITC in GSTR 3B and other details in GSTR 1 and GSTR 3B

Update Source Circular No 170/02/2022-GST dated 6th July 2022 Issued by CBIC

Release No. TM/GST/168 dated 8th July 2022

The GST Council in their 47th meeting at Chandigarh proposed changes in Form GSTR 3B as well as suggested new

disclosure requirements for GSTR 1 and GSTR 3B.

We have summarised the Circular No 170/02/2022-GST dated 6th July 2022 as well as presented the changed Form

GSTR 3B for better understanding and clarity –

Mandatory furnishing of correct and proper information of inter-State supplies and amount of ineligible/blocked

Input Tax Credit and reversal thereof in return in FORM GSTR-3B and statement in FORM GSTR-1

A. Need for amendment in disclosure requirements in GSTR 3B –

Auto Population of details in GSTR 3B commenced with effect from Dec 2020 based on furnishing of GSTR 1 and

generation of Form GSTR 2B.

It was observed certain inconsistency in reporting of outward supplies in relation to inter-State supplies made to

unregistered person (URD), Composition Tax Payers and UIN Holders.

Also, lack of clarity appears regarding reporting of information about reversal of Input Tax Credit (hereinafter

referred to as the “ITC”) as well as ineligible ITC in Table 4 of FORM GSTR-3B.

B. Clarification on Furnishing of information regarding ITC availed, reversal thereof and ineligible ITC in Table 4 of

GSTR-3B

observed certain inconsistency in reporting of outward supplies in relation to inter-State supplies made to

unregistered person

Table 4(A) of the FORM GSTR-3B is getting auto-populated from various entries of FORM GSTR-2B.

However, various reversals of ITC on account of Rule 42 and 43 (Common Credit Reversal) of the CGST Rules or

for any other reasons are required to be made, on his own ascertainment, in Table 4(B) of the said FORM.

It has been observed that different practices are being followed to report ineligible ITC as well as various

reversals of ITC in FORM GSTR-3B.

The amount of Net ITC Available as per Table 4(C) of FORM GSTR-3B gets credited into the electronic credit ledger

(ECL). Therefore, it is important that any reversal of ITC or any ITC which is ineligible under any provision of the

CGST Act should not be part of Net ITC Available

Entire ITC available in FORM GSTR-2B is carried to the table 4 in FORM GSTR-3B, except below details -

a. on account of limitation of time period as delineated in sub-section (4) of section 16 of the CGST Act;

b. where the recipient of an intra-State supply is located in a different State / UT than that of POS. Example

being Tax Payer registered in Telangana and stays in a hotel in Delhi. The ITC appears in GSTR 2B of Tax

payer as CGST and SGST but is restricted due to Local supply and POS reported as Delhi.

TaxMarvel Consulting Services LLP

Contact – Rohit - +91-9503031788 / Amit - +91-9903129064 Email – Amit@taxmarvel.com

Goods and Services Tax – Update July 8, 2022

C. Procedure to be followed for correct reporting of information in Form GSTR 3B –

It may be noted that the ineligible ITC, which was earlier not part of calculation of eligible/available ITC, is now

part of calculation of eligible/available ITC in view of auto-population of Table 4(A) of FORM GTSR-3B from

various tables of FORM GTSR-2B.

Thereafter, the registered person is required to manually identify ineligible ITC as well as the reversal of ITC to

arrive at the Net ITC available, which is to be credited to the ECL.

1. Population of ITC in GSTR 3B (Table 4A) - Total ITC (eligible as well as ineligible) is being auto-populated

from FORM GSTR-2B, except for the ineligible ITC on account of limitation of time period as per Sec 16(4);

or where the recipient of an intra-State supply is located in a different State / UT than that of POS

2. Non-Reclaimable (Permanent) Reversal to be reported in Table 4(B)(1) of GSTR 3B – ITC reversal

permanent in nature which is not to be reclaimed in future i.e. (i) Rule 38 (reversal of credit by a banking

company or a financial institution), (ii) Rule 42 & 43 (reversal on input, input services and Capital Goods

on account of supply of exempted goods or services) (iii) Ineligible ITC under section 17(5).

3. Reclaimable (non-permanent) Reversal to be reported in Table 4(B)(2) of GSTR 3B – ITC reversal which

is not permanent in nature and which is to be reclaimed in future subject to fulfilment of specific

conditions i.e. (i) Rule 37 (non-payment of consideration to supplier within 180 days), (ii) section 16(2)(b)

(Receipt of goods or services at a later date); (iii) Section 16(2)(c) (Payment of tax by supplier

subsequently)

4. Reclaim earlier reversed non-permanent ITC in Table 4(A)(5) of GSTR 3B - Such ITC may be reclaimed in

Table 4(A)(5) on fulfilment of necessary conditions. Further, all such reclaimed ITC shall also be shown in

Table 4(D)(1). Table 4 (B) (2) may also be used by registered person for reversal of any ITC availed in Table

4(A) in previous tax periods because of some inadvertent mistake.

5. Availment of Net ITC in Form GSTR 3B - The net ITC Available will be calculated in Table 4 (C) which is as

per the formula (4A - [4B (1) + 4B (2)]) and same will be credited to the ECL of the registered person. To

say total ITC populated (Table 4A) through Form GSTR 2B reduced by Permanent (Table 4(B)(1) and non-

permanent (Table 4(B)(2) reversal.

6. Disclosure of Ineligible ITC as per Sec 17(5) - As the details of ineligible ITC under section 17(5) are being

provided in Table 4(B) – Reversal, no further details of such ineligible ITC will be required to be provided

in Table 4(D)(1).

7. Reporting of non-available ITC through Form GSTR 2B in Table 4D(2) of GSTR 3B - ITC not available, on

account of limitation of time period as delineated in Sec 16(4) or POS being in different State, may be

reported by the registered person in Table 4D (2). Such details are available in Table 4 of FORM GSTR-2B.

8. Correct disclosure of Reversal of ITC – Disclosure of ineligible credit u/s 17(5) or any other provisions of

the CGST Act and rules thereunder is required to be made under Table 4(B) and NOT under Table 4(D) of

FORM GSTR-3B.

TaxMarvel Consulting Services LLP

Contact – Rohit - +91-9503031788 / Amit - +91-9903129064 Email – Amit@taxmarvel.com

Goods and Services Tax – Update July 8, 2022

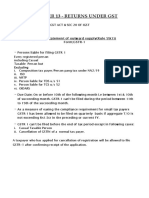

D. Illustration –

A Registered person M/s TaxMarvel LLP is a supplier of goods. He supplies both taxable as well as exempted

goods. In a specific month, say April, 2022, he has received input and input services as detailed in Table 1 below.

The details of auto-population of Input Tax Credit on all Inward Supplies in various rows of Table 4 (A) of FORM

GSTR-3B are shown in column (7) of the Table 1 below:

S. No Details IGST CGST SGST Total Remarks

1 Import of Goods 1,00,000 - - 1,00,000 Auto-populated in Table 4(A)(1)

2 Import of Services 50,000 - - 50,000

3 ITC on RCM 0 25,000 25,000 50,000 Auto-populated in Table 4(A)(3)

4 ITC from ISD 50,000 0 0 50,000 Auto-populated in Table 4(A)(4)

5 All other ITC 2,00,000 1,50,000 1,50,000 5,00,000 Auto-populated in Table 4(A)(5)

6 Total ITC 4,00,000 1,75,000 1,75,000 7,50,000

Notes –

1. Of the other inward supplies of All other ITC (row 5), ITC of IGST is barred under section 17(5) of Rs. 50,000/-

2. Reversal on account of Rule 42 and 43 is required of Rs. 75,500/- (IGST) Rs. 52,000/- (CGST and SGST each)

3. All other ITC (Row 5) includes supply not received during April, 2022 for IGST of Rs. 10,000/-

4. ITC of Rs 500/- each under CGST and SGST has been reversed under Rule 37 i.e. not payment within 180 days

5. An amount of ITC of Rs 10,000/- each under CGST and SGST being ineligible on account of limitation of time

period as per Sec 16(4), has not been auto-populated in Table 4(A) of FORM GSTR-3B from GSTR-2B.

Disclosure of ITC – Form GSTR 3B format -

TaxMarvel Consulting Services LLP

Contact – Rohit - +91-9503031788 / Amit - +91-9903129064 Email – Amit@taxmarvel.com

Goods and Services Tax – Update July 8, 2022

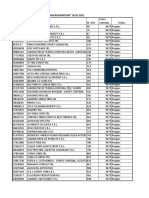

Solution – Based on the facts mentioned in Table 1 above, M/s TaxMarvel LLP is required to avail ITC after

making necessary reversals in Table 4 of FORM GSTR-3B as detailed below:

Form GSTR 3B

Details IGST CGST SGST Remarks

Table 4 – Eligible ITC

1 2 3 4

(A) ITC available

(whether in Full or Part)

1. Import of Goods 1,00,000 - -

2. Import of Services 50,000 - -

3. ITC on RCM (other 0 25,000 25,000

than 1 and 2 above)

4. ITC from ISD 50,000 0 0

5. All other ITC 2,00,000 1,50,000 1,50,000

(B) ITC reversed/

Reduced

1. Reversal of ITC as per 1,25,500 52,000 52,000Ineligible ITC of Integrated tax of Rs. 50,000/-

rule 42 and 43 of CGST under section 17(5) [Note 1]

Rules Reversal of Rs. 75,500/- integrated tax, Rs.

52,000/- central tax and Rs. 52,000/- state tax

under rule 42 and 43 [Note 2]

2. Others 10,000 500 500 Reversal of IGST of Rs. 10,000/-, where supply

is not received [Note 3]

Reversal of ITC of Rs 500/- CGST & SGST each

on account of Rule 37- Non Payment to

suppliers [Note 4]

(C) Net ITC available 2,64,500 1,22,500 1,22,500 C=A1+A2+A3+A4+A5-B1-B2

(A) – (B)

(D) Ineligible ITC

1. As per Sec 17(5) 0 0 0 Reversals u/s 17(5) are not required to be

shown in this row. The same are to be shown

under 4(B)(1) – Permanent Reversal

2. Others 10,000 10,000 Ineligible ITC on account of limitation of time

period as delineated in Sec 16(4), which has

not been auto-populated in Table 4(A) of

GSTR-3B – Permanent reversal

TaxMarvel Consulting Services LLP

Contact – Rohit - +91-9503031788 / Amit - +91-9903129064 Email – Amit@taxmarvel.com

Goods and Services Tax – Update July 8, 2022

E. Furnishing of information regarding inter-State supplies made to URD, composition persons and UIN holders -

It has been noticed that a number of taxpayers are not reporting the correct details of inter-State supplies made

to URD, Composition Taxpayers and UIN holders, as required to be declared in Table 3.2 of FORM GSTR-3B. For

assisting the registered persons, Table 3.2 of FORM GSTR-3B is being auto-populated on the portal based on the

details furnished by them in their FORM GSTR-1.

It is also noticed that the address of URD person are incorrectly captured, especially those belonging to banking,

insurance, finance, stock broking, telecom, digital payment facilitators, OTT platforms and E-com operators,

leading to wrong declaration of Place of Supply (PoS) in the invoices and in Table 3.2 of FORM GSTR-3B.

Advisory for Tax Payers making Inter-State Supplies –

A. Supplier made to the URD persons – Taxpayers shall also report the details of such supplies, POS-wise, in

Table 3.2 of FORM GSTR-3B and Table 7B or Table 5 or Table 9/10 of FORM GSTR-1, as the case may be;

B. Supplier made to Composition persons and UIN Holders – Taxpayers shall also report the details of such

supplies, place of supply-wise, in Table 3.2 of FORM GSTR-3B and Table 4A or 4C or 9 of FORM GSTR-1, as

the case may be, as mandated by the law.

C. Update database with correct POS – Taxpayers to update their customer database properly with correct

State name and ensure that correct PoS is declared in the tax invoice and in Table 3.2 of FORM GSTR-3B

while filing their return, so that tax reaches the Consumption State as per the principles of destination-based

taxation system.

D. Amend GSTR 3B Table 3.2 when making amendment of POS in GSTR 1 - Any amendment carried out in

Table 9 or Table 10 of FORM GSTR-1 or any entry in Table 11 of FORM GSTR-1 relating to such supplies

should also be given effect to while reporting the figures in Table 3.2 of FORM GSTR-3B.

About TaxMarvel:

TaxMarvel is a Consulting firm focused on providing GST services to small and medium enterprises. We offer host of GST

Services be it registration or compliance or consulting or litigation support. We make GST easy for businesses by bringing

in technology and subject matter expertise.

TaxMarvel is founded by Chartered Accountants, Company Secretaries and Management Graduates who have extensive

industry expertise. The founders have experience in Big4 consulting firm at a managerial level and has also headed a

leading GST Suvidha Provider (GSP).

Our bouquet of services:

GST Compliance Services | GST Advisory and Consulting | GST Health Check | GST Annual Return | ITC Management |

GST Refund Assistance | Advance Ruling and Litigation Support | GST E-Way Bill Services | GST Training and SOP

Development

You can contact us at: Email: support@taxmarvel.com | Mobile No. +91-9903129064 | For GST Updates pls visit our

website www.taxmarvel.com

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Disclaimer: This alert contains general information which is provided on an "as is" basis without warranties of any kind, express or implied and is not

intended to address any particular situation. The information should not be construed as specific advice or opinion and no reliance should be placed or

acted upon or used as a basis for any decision or action that may affect you or your business. It is also expressly clarified that this alert is not intended to

be a form of solicitation or invitation or advertisement to create any adviser-client relationship.

TaxMarvel Consulting Services LLP

Contact – Rohit - +91-9503031788 / Amit - +91-9903129064 Email – Amit@taxmarvel.com

You might also like

- Cir 170 02 2022 CGSTDocument7 pagesCir 170 02 2022 CGSTTushar AgrawalNo ratings yet

- 47 Council Meeting FinalDocument38 pages47 Council Meeting FinalAbhishek PareekNo ratings yet

- GSTR 9 9C FY 22 23 DUE 31st December 2023 1694345252Document7 pagesGSTR 9 9C FY 22 23 DUE 31st December 2023 1694345252RajatNo ratings yet

- Advisory On GSTR-2B Dated 02.04.2021Document6 pagesAdvisory On GSTR-2B Dated 02.04.2021V RawalNo ratings yet

- Changes in ITC Reporting in GSTR - 3BDocument6 pagesChanges in ITC Reporting in GSTR - 3BKirtan Ramesh JethvaNo ratings yet

- GST Annual Return and AuditDocument34 pagesGST Annual Return and Auditdasari satishNo ratings yet

- FORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedDocument4 pagesFORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedSachin KNNo ratings yet

- GSTR-9 ArticleDocument8 pagesGSTR-9 Articlecihoni1143No ratings yet

- All About Electronic Credit Reversal N Re-Claimed Statement - CA Swapnil MunotDocument4 pagesAll About Electronic Credit Reversal N Re-Claimed Statement - CA Swapnil MunotkevadiyashreyaNo ratings yet

- Statement Outwrad SupplyDocument4 pagesStatement Outwrad SupplyTushar GoelNo ratings yet

- GSTR-9 & 9C TrainingDocument2 pagesGSTR-9 & 9C TrainingKavita RanaNo ratings yet

- Key Highlights of Simplified Form GSTR 9 and Form GSTR 9c PDFDocument2 pagesKey Highlights of Simplified Form GSTR 9 and Form GSTR 9c PDFPriyanka BahiratNo ratings yet

- Igst Itc 11112022Document18 pagesIgst Itc 11112022hrtclients1No ratings yet

- Advisory 2710 2Document20 pagesAdvisory 2710 2Pushpraj SinghNo ratings yet

- Latest Updation in GSTN PortalDocument47 pagesLatest Updation in GSTN PortalVenkat BalaNo ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- Faqs Form Gstr-3B About Form Gstr-3BDocument8 pagesFaqs Form Gstr-3B About Form Gstr-3BAsh WNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- Goods & Services Tax (GST) News and Updates 2Document1 pageGoods & Services Tax (GST) News and Updates 2Terin IsaacNo ratings yet

- GST Circular clarifies ITC rules for Feb-Aug 2020Document3 pagesGST Circular clarifies ITC rules for Feb-Aug 2020Gulrana AlamNo ratings yet

- Action For Difference in ITC Between 3B and 2ADocument46 pagesAction For Difference in ITC Between 3B and 2Aphani raja kumarNo ratings yet

- Presentation On ECRRS 1697947536Document10 pagesPresentation On ECRRS 1697947536Jayant JoshiNo ratings yet

- Cir 183 15 2022 CGSTDocument5 pagesCir 183 15 2022 CGSTAmritesh RaiNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- Faqs Viewing Form Gstr-2B Form Gstr-2B: TH TH TH THDocument5 pagesFaqs Viewing Form Gstr-2B Form Gstr-2B: TH TH TH THAsh WNo ratings yet

- GST Reports ListsDocument8 pagesGST Reports Listsmandarjejurikar100% (1)

- Circular CGST 197Document5 pagesCircular CGST 197Jaipur-B Gr-2No ratings yet

- IDT Corrigendum For Nov 22 ExamsDocument8 pagesIDT Corrigendum For Nov 22 Examspreeti sinhaNo ratings yet

- GSTR-9 AND GSTR-9C - OutwardDocument39 pagesGSTR-9 AND GSTR-9C - OutwardRahul KLNo ratings yet

- Record Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Document16 pagesRecord Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Sha dowNo ratings yet

- STP 07 - 2020Document1 pageSTP 07 - 2020Fiza. MNorNo ratings yet

- Section 61 of The CGST ActDocument2 pagesSection 61 of The CGST ActBipin DurgapalNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Circular CGST 193Document4 pagesCircular CGST 193Jaipur-B Gr-2No ratings yet

- Major Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIADocument4 pagesMajor Changes in New Form 3CD (Tax Audit Report Format) #SIMPLETAXINDIAశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- FORMS ListDocument7 pagesFORMS ListPanchal YashNo ratings yet

- Instructions GSTR-9Document9 pagesInstructions GSTR-9pankajNo ratings yet

- Circular CGST 123Document4 pagesCircular CGST 123AKSHATANo ratings yet

- Internal Circular (Restricted Circular For Office Use Only)Document16 pagesInternal Circular (Restricted Circular For Office Use Only)Manish K JadhavNo ratings yet

- Judicial Rulings BY ABHAY DESAIDocument27 pagesJudicial Rulings BY ABHAY DESAIPiyush PatelNo ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- PPT-on-GST Annual-ReturnDocument33 pagesPPT-on-GST Annual-Returnshrutha p jainNo ratings yet

- Claim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022Document3 pagesClaim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022ravindra kumar jainNo ratings yet

- Instructions ITR5 AY2021 22Document196 pagesInstructions ITR5 AY2021 22Nikhil KumarNo ratings yet

- Instructions For Form GSTR-9Document8 pagesInstructions For Form GSTR-9param.ginniNo ratings yet

- Instructions For Filling Out FORM ITR 3Document231 pagesInstructions For Filling Out FORM ITR 3Samantha JNo ratings yet

- GST Returns and ComplianceDocument11 pagesGST Returns and ComplianceJay PawarNo ratings yet

- GSTR-9 AND GSTR-9C - InwardDocument18 pagesGSTR-9 AND GSTR-9C - InwardRahul KLNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Amendment Booklet NOV 21 - by CA Yachaa Mutha BhuratDocument46 pagesAmendment Booklet NOV 21 - by CA Yachaa Mutha BhuratSuraj BijlaniNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3Bhiteshmohakar15No ratings yet

- FAQs On Form GSTR9 Annual ReturnDocument14 pagesFAQs On Form GSTR9 Annual ReturnIyengar PrasadNo ratings yet

- Insertion of New Tables in GSTR-1Document5 pagesInsertion of New Tables in GSTR-1rvsiddharth054No ratings yet

- Sec 183Document1 pageSec 183goelshubham92No ratings yet

- GSTR-3B SummaryDocument7 pagesGSTR-3B SummaryAtul VermaNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BMUJAHIDUL ISLAM SHAIKHNo ratings yet

- GST Annual Return Filing DeadlineDocument61 pagesGST Annual Return Filing DeadlineRishav AnandNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- TaxMarvel - Clarification On GST Issues - Perquisite, Ineligible ITC and Payment of GSTDocument4 pagesTaxMarvel - Clarification On GST Issues - Perquisite, Ineligible ITC and Payment of GSTAmit AgrawalNo ratings yet

- Form 27 Application For Assignment of New Registration Mark To A Motor VehicleDocument2 pagesForm 27 Application For Assignment of New Registration Mark To A Motor VehicleAmit AgrawalNo ratings yet

- Key Highlights Companies Amendment BillDocument2 pagesKey Highlights Companies Amendment BillAmit AgrawalNo ratings yet

- MAT Credit CircularDocument5 pagesMAT Credit CircularAmit AgrawalNo ratings yet

- Taxation of Non Residents Under Indian Income Tax LawDocument4 pagesTaxation of Non Residents Under Indian Income Tax Lawuma92No ratings yet

- ARC's 3rd Report on Crisis Management AcceptedDocument26 pagesARC's 3rd Report on Crisis Management AcceptedAmit AgrawalNo ratings yet

- Direct Subcontracting Process (SAP SD & MM)Document23 pagesDirect Subcontracting Process (SAP SD & MM)sarmaelectricalNo ratings yet

- Sub Contracting Process: 1) .Create BOM (Bill of Material)Document6 pagesSub Contracting Process: 1) .Create BOM (Bill of Material)Amit AgrawalNo ratings yet

- Sub Contracting Process: 1) .Create BOM (Bill of Material)Document6 pagesSub Contracting Process: 1) .Create BOM (Bill of Material)Amit AgrawalNo ratings yet

- Sub Contracting Process: 1) .Create BOM (Bill of Material)Document6 pagesSub Contracting Process: 1) .Create BOM (Bill of Material)Amit AgrawalNo ratings yet

- Sub Contracting Process: 1) .Create BOM (Bill of Material)Document6 pagesSub Contracting Process: 1) .Create BOM (Bill of Material)Amit AgrawalNo ratings yet

- Sales Return Letter To Channel PartnersDocument2 pagesSales Return Letter To Channel PartnersAmit AgrawalNo ratings yet

- Seminar 2 Presentation QuestionsDocument17 pagesSeminar 2 Presentation QuestionsJennifer YoshuaraNo ratings yet

- Case Ratios and Financial Planning at EaDocument6 pagesCase Ratios and Financial Planning at EaAgus E. SetiyonoNo ratings yet

- Pop Quiz For AccountingDocument2 pagesPop Quiz For AccountingダニエルNo ratings yet

- Solutions Manual To Accompany International Corporate Finance 9780073530666Document4 pagesSolutions Manual To Accompany International Corporate Finance 9780073530666JamieBerrypdey100% (46)

- BATA Blackbook AkshitDocument76 pagesBATA Blackbook AkshitKhan YasinNo ratings yet

- Garrison Industries Consolidated EPS SensitivityDocument4 pagesGarrison Industries Consolidated EPS SensitivitySTEIVERNo ratings yet

- File Uttarpradesh20191Document165 pagesFile Uttarpradesh20191ali khan SaifiNo ratings yet

- Kap 1 6th Workbook Te CH 7Document96 pagesKap 1 6th Workbook Te CH 7Gurpreet KaurNo ratings yet

- CASE STUDY-Walmart VS AmazonDocument3 pagesCASE STUDY-Walmart VS AmazonManasi VermaNo ratings yet

- Perspectivespaper ESGinBusinessValuationDocument12 pagesPerspectivespaper ESGinBusinessValuationsreerahNo ratings yet

- CB510 Project Cash Flow AnalysisDocument3 pagesCB510 Project Cash Flow AnalysisShroukAdelMohamedGaribNo ratings yet

- CH9 SolutionsDocument11 pagesCH9 SolutionsGhadeer MohammedNo ratings yet

- BUDGETING - Exercises: UnitsDocument2 pagesBUDGETING - Exercises: UnitsLeo Sandy Ambe CuisNo ratings yet

- Form 16 - Vijaya Raja SelvanDocument4 pagesForm 16 - Vijaya Raja SelvansadhanaNo ratings yet

- Supply Chain ManagementDocument2 pagesSupply Chain Managementsuraj rouniyarNo ratings yet

- C.MGT Relevant of Chapter 2 STBCDocument12 pagesC.MGT Relevant of Chapter 2 STBCNahum DaichaNo ratings yet

- - मुख्यमंत्री सीखो कमाओ योजनाDocument81 pages- मुख्यमंत्री सीखो कमाओ योजनाAmitNo ratings yet

- A Study On Responsibility Accounts On StakeholdersDocument6 pagesA Study On Responsibility Accounts On StakeholdersresearchparksNo ratings yet

- Acjc 2021 H2 Ec P2Document3 pagesAcjc 2021 H2 Ec P2anonymous wheatsNo ratings yet

- An Overview of Support For Women Entrepreneurs in Indonesia and Canada: Focus On Smes and Start-UpsDocument24 pagesAn Overview of Support For Women Entrepreneurs in Indonesia and Canada: Focus On Smes and Start-UpsbuNo ratings yet

- A Research Report Submitted in Partial Fulfillment of The Requirements of The Degree of Mba (Finance & Control)Document62 pagesA Research Report Submitted in Partial Fulfillment of The Requirements of The Degree of Mba (Finance & Control)Master PrintersNo ratings yet

- Pratik JadhavDocument64 pagesPratik JadhavSandip ChavanNo ratings yet

- tổng hợp đề KTQT 2Document43 pagestổng hợp đề KTQT 2Ly BùiNo ratings yet

- Discontinued OperationsDocument15 pagesDiscontinued OperationsEjaz AhmadNo ratings yet

- Masura 1Document108 pagesMasura 1ClaudiuNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument2 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableRoka Unichu CamachoNo ratings yet

- Investment Policy Statement ExampleDocument12 pagesInvestment Policy Statement ExampleCheeseong LimNo ratings yet

- Merchandise ManagementDocument32 pagesMerchandise ManagementMonika Sharma100% (1)

- Tata Motors OperationsDocument5 pagesTata Motors OperationsbubaimaaNo ratings yet

- Statement Nov 2022Document25 pagesStatement Nov 2022Josué SoteloNo ratings yet