Professional Documents

Culture Documents

The Effect of The Integration of Non-Cash Payment Systems On Inflation and Financial Stability of The Money Supply (M1) As An Intervening Variabel

The Effect of The Integration of Non-Cash Payment Systems On Inflation and Financial Stability of The Money Supply (M1) As An Intervening Variabel

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Effect of The Integration of Non-Cash Payment Systems On Inflation and Financial Stability of The Money Supply (M1) As An Intervening Variabel

The Effect of The Integration of Non-Cash Payment Systems On Inflation and Financial Stability of The Money Supply (M1) As An Intervening Variabel

Copyright:

Available Formats

Volume 7, Issue 6, June – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The Effect of the Integration of Non-Cash Payment

Systems on Inflation and Financial Stability of the

Money Supply (M1) as an Intervening Variabel

Laila Rahmawati1, Caecilia Widi Pratiwi2,

Magister of Management Information System, Magister of Management Information System,

Gunadarma University, Jakarta, Indonesia, Gunadarma University2, Jakarta, Indonesia,

Abstract:- Inflation is one of the macroeconomic only done for cash withdrawals afterall, there are still many

variables, where the rate of inflation that occurs in a ordinary people who oppose the use of non-cash transaction

country indicates economic development in that country. facilities and there are still many shops or merchants who use

The money supply is one of the factors that cause cash payments.

inflation. Nevertheless, the money supply these days is due

to the innovation of non-cash payment systems. The study In this study, the researchers were interested in using

aimed to find out and test the effect of non-cash payment cash payment systems as independent variables and money

systems on inflation and the amount of money as supply as interrelated variables to see how central banks

intervention variables. The research was conducted on maintain financial stability by balancing the money supply to

monthly reports of non-cash payment systems, inflation, avoid inflation.

and money apply at Bank Indonesia in 2016-2020. Sample

selection in the study used non-probability sampling. II. MATERIALS AND METODHS

Methods using descriptive analysis methods. Data

analysis is done with AMOS using analysis tests. The A. Irving Fisher's Theory

results in this study are nominally generated by credit The theory of demand for money or better known as the

cards, ATMDB and e-money affect the money supply. In quantity theory of money initiated by the classical figure,

the same time the money supply does not effect on Irving Fischer, was formulated as follows:

inflation. E-money, ATMDB do not effect on inflation.

Credit cards affect inflation. ATMDB, and E-money M.V = P.T

affect inflation mediated or intervening by the money

supply. But not with a credit card. With M as money supply, V as the velocity of money or

speed of movement of money, P is price, and T as the number

Keywords:- Non-Cash Payment System, APMK, Money of transactions that occur in the economy. This theory it is

Supply, Inflation. explains that the change in the money supply would be

proportional to the change in price if V and T were assumed

I. INTRODUCTION to be constant.

According to the development of payment systems B. Keynes's theory

innovate from year to year due to of advances in information Keynes's money theory is derived from the Cambridge

technology. This is in line with the advancement of the theory, but Keynes proposed something completely different

digitalization system of financial services and payment from classical monetary theory. This distinction is in the

transaction instruments. Payment system innovations in emphasis by Keynes on another function of money, namely

manual and conventional systems must first bring physical as a store of value and not just as a medium of exchange. This

money and join the queue at the bank payment counter, then theory came to be known as the liquidity preference theory

innovate to the payment system with instruments. Non-cash [4].

use Card Payment Instruments (APMK) such as ATM and

Debit cards and credit cards. Currently, the transformation According to Keynes, there are three purposes of society

with the latest innovation is the digitization of payment to hold money, namely:

systems with electronic money models (e-electronic).

Purpose of transaction

This study showed that non-cash transactions had a Keynes still accepted Cambridges opinion that people

positive and significant effect on the money supply. This held money to fulfill and conduct transactions and that

means that the higher the use of non-cash transactions will national income levels and interest rates influenced the

increase the money supply in the community. The pressure of demand for money from the public for this purpose.

the use of public funds without funds by Bank Indonesia, it

has not directly impacted on the money supply in the

community. it is because the use of non-cash transactions is

IJISRT22JUN1551 www.ijisrt.com 1279

Volume 7, Issue 6, June – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Purpose just in case According to the Indonesian monetary system, the

Keynes also distinguished the demand for money to money supply in the broadest sense (M2) is often called

make irregular payments or those that were outside the financial liquidity. M2 is defined as M1 plus term deposits

regular transaction plan, for example, for emergency and savings balances belonging to the public in banking

payments such as accidents, illnesses, and other unexpected because the development of M2 can also affect the

payments. development of prices, production, and economic conditions

in general.

Purpose of speculation M2 = M1 + TD + SD

The motive of holding money for the purpose of

speculation is primarily to get the "profit" that can be gained Where:

if the money holder predicts what will happen. TD = term deposit

SD = savings deposit

C. Cambridge Theory (Marshall-Pigou)

Cambridge's theory crows on the function of money as The generally accepted definition of M2 for all countries

the mean of exchange. Therefore, classical theory saw the does not exist, as the ordinary things of each country need to

need for money (the demand for money) from society as the be considered. In Indonesia, the M2 measure includes all term

need for liquid tools for transaction purposes. deposits and savings balances in rupiah to banks with small

deposits but excludes term deposits and savings balances in

D. Financial Stability foreign currencies.

Monetary policy is a policy that regulates the supply of

money in a country in achieving specific goals. In addition, G. Payment Systems and Instruments

monetary policy is a policy that aims to achieve internal

balance, external balance and achieve macroeconomic goals Non-Cash Payment System

themselves in the form of maintaining economic stabilization Some innovations in non-cash payment systems are

of a country. In Indonesia, monetary policy is the main card-based electronic payment systems, namely APMK and

guideline in regulating and controlling the value of the rupiah. electronic money. APMK is a payment system instrument

Maintaining rupiah exchange rate stability, among others, that is generally card-based, among others: Automatic Teller

maintains the rupiah against the price of goods and services Machine (A.T.M) card, credit card, debit card, and other types

with indications of inflation and maintains the stability of the of cards that can be used as a means of payment such as

rupiah exchange rate against foreign currencies. smartcards, e-wallets, as well as several other payment tools

that can be fill with cards.

E. Inflation

According to Bank Indonesia, inflation is interpreted as From some of the above understandings, Financial

an increase in goods and services in general and continuously Technology (Fintech) is a service that provides financial

within a certain period. Deflation is the opposite of inflation, products by using and utilizing emerging information

a general and continuous decline in the price of goods. technology.

Low and stable inflation is a prerequisite for sustainable The size of the APMK tool is as follows.

economic growth that ultimately benefits people's well-being. Atm and debit transaction value is the value and face of

The importance of controlling inflation is based on the cash withdrawal transactions, expenses, intrabank funds

consideration that high and unstable inflation negatively transfer, and funds transfers between banks conducted

impacts the socioeconomic conditions of society. First, high using ATM cards or debit cards in the research period.

inflation will cause people's real incomes to continue to fall Credit card transaction value is the value and face of

so that people's living standards fall and eventually make withdrawal transactions and cash expenditures made

everyone, especially the poor, poorer. Second, unstable using credit cards during the research period.

inflation will create uncertainty for economic actors in In this study, the variables used as indicators of e-money

making decisions. use are:

The value of e-money transactions is the value and face of

F. Money Supply expenditure transactions carried out using electronic

Money supply in the narrow sense (M1) is defined as money during the research period.

money coupled with currency in added demand deposits. [4]

M1 = C + DD III. RESEARCH METHODS

Where: A. Research Object

M1 = Money supply in a narrow sense The objects used in the study were the characteristics

C = Currency studied, namely non-cash payment systems, among others:

DD = Demand Deposits volume and nominal credit cards, ATM debits, and e-money.

The study is conduct on a monthly report for 2016-2020. The

data sample between 2016-2020 is record as many as 60 data.

IJISRT22JUN1551 www.ijisrt.com 1280

Volume 7, Issue 6, June – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

B. Measurement of Research Variables APMK

The increasing use of non-cash payment systems such

Inflation (Y2) as APMK (ATM cards, debit cards, credit cards) and

Inflation is an event that indicates a general rise in price electronic money has impacted the money demand function

levels and continues. From the definition, three criteria need where the demand for money is one of the critical factors for

to be consider to see the occurrence of inflation, namely price the central bank in determining its monetary policy. It

increases, in general, and occurs continuously in a specific happens because this type of payment card users have become

period. If the price increase occurs a moment later, it falls an alternative transaction tool other than money.

again; it cannot be say to be experiencing inflation. So that

inflation can be interpreted by the increase in price levels that The definition of e-money issued by the Bank for

occur continuously, affecting individuals, entrepreneurs, and International Settlement (BIS) is a stored or prepaid value

governments. The index is use to measure how high inflation product owned by a person, in which a certain amount of

is with cpi. The average price of goods and services is use value for money has been stored in electronic media used as

as consumption by households. Monthly C.P.I measures a means of transaction.

inflation changes for the period 2016-2020. The calculation

of inflation can be seen in the formula [7]: Variables are taken between 2016-2020, using

transaction units.

ATM/Debit transaction value (X1)

Credit Card Transaction Value (X2)

Electronic Money (E-money) (X3)

Data Analysis Techniques

The data analysis technique used in this study was a

pathway analysis test using AMOS version 26.

IV. RESULTS AND DISCUSSIONS

Fig 1. Formula of Inflation

Development of Models Based on Theory

Money Supply Liquidity (Y1) The development model in this study consists of three

The currency in circulation has been issued and types of variables used, and intervention variables, namely

circulated by the Central Bank. Currencies are of two types, the money supply. APMK and e-money are Independent

namely coins and banknotes. Thus the currency in circulation variables (Exogenous), and Inflation are dependent

is the same as the money. In contrast, money supply is all (endogenous) variables.

types of money in the economy, namely the amount of

currency in circulation coupled with giral money in

commercial banks. Money is divided into two

understandings, namely in a narrow and broad sense.

In the narrow sense (M1), money supply is defined as

money coupled with giral money (currency plus current

account). This variable was taken between 2016-2020, using

units of trillion rupiah.

C. Non-Cash Payment System

The use of this technology is carried out in transactions

and relationships between the community and banks such as

e-money and ATM, where the use of these two fintech

instruments provides convenience, effectiveness, and

efficiency in conducting financial activities the community.

On the other hand, transaction or savings activities through e- Fig 2. Flowchart Variables

money and ATMs have a high level of security, and fintech Source: data processed in AMOS v.26.

also increases the mobility of community transactions

(Rusdianasari, 2018). [8] Based on the path diagram formed, the following path

equations can be formed:

JUB = -0.41 CC + 0.65 ATMDB + 0.47 EMONEY + 0.92

JUB

INFLATION = 0.65 CC + 0.37 ATMDB -0.24 EMONEY –

0.26 JUB

INFLATION = - 0.26 JUB + 0.70

IJISRT22JUN1551 www.ijisrt.com 1281

Volume 7, Issue 6, June – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Normality Test Fit Goodness Test

Table 1. Result Normality Test

Based on the results of test data from table 1 of the

normality test above that the normality test value can be seen

from the multivariate c.r (critical ratio), where the data can be Table 3. Fit Goodness Test

said to be the normal distribution if it is at the significance

level of 0.01 if the value of c.r multivariate, slope (skewness) From the table above, it can be concluded that all models

or tapering (kurtosis) is in the range of values between ± 2.58. have significant value in this study and are good enough to

The table above shows that there is no univariate value below relate from one indicator to another.

± 2.58. Indicates that the data is being distributed normally.

Hypothesis Test

Outliners Test H1: Credit Card Transactions Affect the Money Supply

Based on the output results, it can be seen that the data H2: ATM + Db transactions affect the Money Supply

does not have extreme value, so the data is not an outlier and H3: e-money transactions affect the money supply

can be done to the next stage. H4: Money Supply Affects Inflation

H5: Credit Card Transactions Affect Inflation

Residual Value Test H6: ATM + Db transactions affect inflation

H7: E-money transactions affect inflation

Hypotheses affect indirectly:

H8: Credit Card Transactions Affect Inflation through Money

Supply

H9: ATMDB transactions affect inflation through money

supply

H10: E-money transactions affect inflation through Money

Supply

V. DISCUSSION

Hypothesis Test

Table 2. Residual Value Test

No residual value exceeds the value of 2.58 so, there is

no need to modify the research model. Based on the

remaining output of Covariances above, there is no number

that exceeds +2.58 so the model matches and does not need

to modify the model.

Table 4. Regression Weights

IJISRT22JUN1551 www.ijisrt.com 1282

Volume 7, Issue 6, June – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Negative e-money does not effect on inflation. This

means that e-money does not have a different effect than the

theory. In this case, the ease of transactions and the turnover

of money in e-money does not affect inflation because higher

usage and nominal use of e-money transactions do not cause

the money supply to be disrupted. This is due to the increasing

number of merchants or innovations that can be accessed by

the public using e-money.

ATMDB (money debit) does not effect on inflation.

This could be because the turnaround in debit money speed

does not trigger factors that cause inflation such as prices to

rise, or the public can control the level of consumption by

Table 5. Interpretation of Results financial theory with the motive of keeping money in

circulation and prices are getting higher is not consumptive,

Interpretation of results so this lowers demand. Debit or leave money savings. So

Credit cards nominally generated the results in this that the amount of money in circulation will be controlled so

study on the money supply, due to the increasing number of as not to cause inflation.

nominal uses of credit cards, such as the data tested. This will

increase the money supply in the community. The nominal generated by credit cards has a significant

positive effect on inflation. With a result of 0,000. The money

It is also supported by data and graphs of spending supply supports this as mediation for increased nominal use

consumption and cash withdrawals via credit cards with of transactions. The use of credit cards on cash or credit

trillions of units. In this case, the shopping transaction is withdrawals will affect the amount of money in circulation.

much larger. This means that the money in circulation is less In this case, it has been explained how Bank Indonesia as a

than the use of cash where people can now meet all their monetary bank can set the policy of the loan fund so that the

consumption needs and is increasingly facilitated and money supply can be channeled properly. Because the

practical with various payment offers using non-cash and will amount of money in circulation is increasingly stable will

affect the money supply. suppress high inflation.

The nominal generated by ATMDB has a significant

positive effect on the money supply. This will impact the ATMDB and e-money CC affect inflation mediated or

money supply because the higher the nominal non-cash interfered with by the money supply. But not with a credit

withdrawal transaction used by the community, this will card. This is measured by comparing the magnitude of the

interfere with the policy --Monetary in the speed of money standard direct effect with the standard indirect effect. If the

turnover. High consumption with cash transactions makes amount of money in circulation that comes from depositing

money in circulation more and more. money into e-money but is not adjusted to the transaction

used/spent will cause imbalance so that the turnover of money

The nominal generated by e-money has a significant that occurs cannot rotate properly, then there will be inflation.

positive effect on the money supply. With a result of 0,000.

In this case, because e-money is very liquid equivalent to In this case, ATMDB transactions also indirectly

cash. If e-money increases, then the circulation of money will influence inflation through the amount of money in

decrease. The higher the nominal transaction used, the more circulation. Because since it is grown innovation of non-cash

proportional directly to the money supply. This is supported payments makes the community less and less to transactions

by the data below. It can be seen that nominal transactions using cash. If this continues to be done and the government

using e-money always increase every year (data presented in does not make loanable funds on public money in the bank,

trillions). This is due to ease, practicality, and safe. Moreover, then

it can also be seen from the side of banks or e-money issuing

companies that are increasing. This will cause inflation. Credit cards do not directly

affect the amount of transactions used in both cash and credit

The money supply does not effect on inflation. It also can be channeled properly. So that the loanable fund policy

shows that the speed of the money supply is accelerating with run by the government to control inflation can be applied so

evolving systems, transactions, and nominal non-cash that the amount of money supply in the community does not

payments such as credit card shopping through cash. affect inflation.

Alternatively, in the form of loans and ATMDB can still be

controlled by bank Indonesia as a monetary bank so that there

is no long-term or sustainable price increase that can cause

inflation.

IJISRT22JUN1551 www.ijisrt.com 1283

Volume 7, Issue 6, June – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

VI. CONCLUSIONS https://doi.org/10.35313/ekspansi.v11i2.1608.

[12]. Ferdiansyah, F. (2016). Analysis of The Influence of

Based on the results of the process and analysis of data The Money Supply (M1), SBI Interest Rate, Deposit

in AMOS v.26, hypothesis testing and discussion of this study Rate Exchange, Rate Against Inflation Rate. Media

can be concluded as follows: Economics Trisakti University, Vol. 19, No. 3, 43–68.

The results in this study are nominally generated by credit [13]. Ferdinand, A. (2000). Structural Equation Modeling in

cards, ATMDB, and e-money affect the money supply. Management Research. Semarang: Publisher of

While the money supply does not effect on inflation. E- Diponegoro University.

money, ATMDB do not effect on inflation. Credit cards [14]. Ferdinand, A. (2002). Structural Equation Modeling in

affect inflation. Management Research. Edition 2, Key Library Series

ATMDB and E-money affect inflation mediated or 03/BP UNDIP.

intervening by the money supply. But not with a credit [15]. Ferdinand, A. (2006). Structural Equation Modeling in

card. Semarang Management Research. Diponegoro

University Publishing Body.

REFERENCES [16]. Gabor, D., & Brooks, S. (2017). The digital revolution

in financial inclusion : international development in the

[1]. Manik, Tumpal. (2019). Analysis of the Effect of fintech era. New Political Economy, 0(6), 1–14.

Electronic Money Digitalization Transactions on https://doi.org/10.1080/1356 3467.2017.1259298

Cashless Society and Electronic Money Infrastructure Gujarati.

as a Desecration Variable. Indonesian Scientific Journal [17]. Gerlach, S., & Tillmann, P. (2011). Inflation Targeting

of Accounting and Finance, 2(2), 27–40. and Inflation Persistence in AsiaPacific (No. 252011).

https://doi.org/10.31629/jiafi.v2i2.1714. Taken from the Hong Kong Institute for Monetary.

[2]. Permatasari, K., Purwohandoko. (2020). Effect of non- [18]. Ghozali, Imam. (2006). Multivariate Analysis

cash payments on macroeconomic variables in Application with SPSS Program. Fourth Print.

Indonesia in 2010-2017. Journal of Management Semarang: Diponegoro University Issuing Board.

Science, 8, 225–232. [19]. Ghozali, Imam. (2007). Multivariate Analysis

[3]. Working papers: Pramono, Bambang, et al. 2006. Application With SPSS Program, Diponogoro

Impact of Non-Cash Payments on the Economy and University, Semarang Ghozali, Imam, (2009).

Monetary Policy. Bank Indonesia Working Paper No. Multivariate Analysis Application With SPSS Program,

11. Fourth Edition, Publisher of Diponegoro University.

[4]. Boediono. (1994). Monetary Economics, Introductory [20]. Ghozali, (2014). Multivariate analysis application with

Series of Economics No. 2. BPFE: Yogyakarta. SPSS Program. UNDIP Publishing Agency, Semarang.

[5]. Candra, Y., Setiarini, A., & Rengganis, I. (2011). [21]. Hadad, M.D., & Ph, D. (2017). Financial Technology

Introduction to Research Methods. Makara Journal of (FinTech) in Indonesia. Kashiwagi, R. (2016). FinTech

Health Research, 15(1), 44–50. is key.

[6]. Bank of Indonesia. (2021). Main Monetary Function of [22]. Hataiseree, R. (2008). Development of e-payments and

Inflation. Downloaded from www.bi.go.id (accessed challenges for Central Banks: Thailand's recent

April 07, 2021). experience. retrieved from

[7]. Bank Indonesia. (20 11). Payment Instruments using www.ecb.int/home/pdf/research/WP_2008_01.pdf.

cards. (accessed April 7, 2021). [23]. Haryono, Siswoyo. (2017). SEM Method for

[8]. Rusdiana, Fitri. (2018). Role of Financial Inclusion Management Research AMOS, LISREL PLS,luxima.

through Fintech Integration in The Stability of [24]. Hermawan, A. Yusran, H. L,. (2017). Quantitative

Indonesia's Financial System. Journal of Applied Business Research Approach. Depok: Kencana.

Quantitative Economics, p. 244-253, Aug. 2018. ISSN [25]. Beautiful Yuliana, SE., MM. (2008). Analysis of The

2303-0186. Effect of Inflation, Sbi Interest Rates and Exchange Rate

[9]. Dienillah, A. A., & Anggraeni, L. (2016). Impact of on The Amount of Money Circulating in Indonesia

Financial Inclusion on Financial System Stability in Period 2001 S/D 2006 [IQTISHODUNA], Vol 4, No. 1.

Asia. Bulletin of Monetary Economics and Banking, [26]. I Wayan Wenagama, K. S. S. (2019). Effect of Interest

18(4), 409–430. Rates, LN_INFlasi Rates, US Dollar Exchange Rates on

https://doi.org/10.21098/bemp.v18i4.57 The Money Supply in Indonesia. E-Journal of

[10]. Fajarwati, R. Y., & Setiawina, N. D. (2018). Analysis of Economics, Vol. 8, No. 4 Pp (703-940). Construction of

the Impact of Monetary Policy on The Money Supply, Udayana University.

Foreign Exchange Reserves and Inflation Rate in [27]. Insukindro. (1987). Journal of Economics and Business

Indonesia in 2010-2016. E-Journal EP Unud, 7(6), Indonesia, Vol 2 of 1987 Journal of Economics and

1168–1198. Business indonesia, Vol 2 of 1987. 2(2)

https://ojs.unud.ac.id/index.php/eep/article/view/3893. https://jurnal.ugm.ac.id/jieb/article/view/40691/22724.

[11]. Fatmawati, M. N., & Yuliana, I. (2019). Effect of Non- [28]. Khatimah, H., & Halim, F. (2014). Consumers' intention

Cash Transactions on The Money Supply In Indonesia to use e-money in Indonesia based on Unified Theory of

In 2015-2018 With Inflation as a Moderation Variable. Acceptance and Use of Technology (UTAUT).

Expansion: Journal of Economics, Finance, Banking American-Eurasian Journal of Sustainable Agriculture,

and Accounting, 11(2), 269–283. 8(12), 34–40.

IJISRT22JUN1551 www.ijisrt.com 1284

Volume 7, Issue 6, June – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[29]. Cashmere, 2008, Financial Statement Analysis, Fourth [44]. Sipayung, P., & Kembar Sri Budhi, M. (2013). Effect of

Edition. Jakarta: PT. RajaGrafindo Persada. GDP, Exchange Rate and Money Supply on Inflation in

[30]. Kristianto. (2018). Foundation of Theory. Indonesia Period 1993-2012. E-Jurnal Ekonomi

Landasanteori.Com, 1-12. Pembangunan Udayana University.

http://www.landasanteori.com/2015/09/pengertian- [45]. Sobel Test (2021). Calculation for the Sobel Test.

kreativitas-definisi-aspek.html. http://quantpsy.org/sobel/sobel.htm (accessed april 13,

[31]. Lintangsari, N. N., Hidayati, N., Purnamasari, Y., 2021).

Carolina, H., & Ramadhan, W. F. (2018). Analysis of [46]. Stix, H. (2004). The Impact of ATM Transactions and

the Effect of Non-Cash Payment Instruments on Cashless Payments on Cash Demand in Austria.

Financial System Stability in Indonesia. Journal of Monetary Policy & the Economy, (1), 90–105.

Economic Dynamics of Development, 1(1), 47.

https://doi.org/10.14710/jdep.1.1.47-62.

[32]. Luwihadi Nih LuhGede Ari, A. S. (2017). Determinant

of The Money Supply and Inflation Rate in Indonesia

Period 1984-2014. In the Faculty of Economics and

Business (Vol. 6, Issue 4).

[33]. Muzdalifa, I., Rahma, I. A., & Novalia, B. G. (2018).

The Role of Fintech in Improving Inclusive Finance in

MSMEs in Indonesia (Islamic Finance Approach).

Journal of Masharif Al-Syariah: Journal of Islamic

Economics and Banking, 3(1).

https://doi.org/10.30651/jms.v3i1.1618.

[34]. Nachrowi, Djalal Nachrowi, Hardius Usman 2006,

Popular and Practical Approach to Economic and

Financial Analysis, University of Indonesia Issuing

Institution, Jakarta.

[35]. Ningsih, S., & Kristiyatnti, L. (2016). Analysis of The

Effect of The Money Supply, Interest Rates, and

Exchange Rate On Inflation in Indonesia Period 2014-

2016. Journal of Resource Management Economics,

20(1), 8.

[36]. Preacher, K. J and Hayes, A. F., 2004. SPSS and SAS

Procedures for Estimating Indirect Effects in Simple

Mediation Models. Behavior Research Methods,

Instruments, & Computers, 36(4), 717-731.

Psychonomic Society, Inc.

[37]. Son, I Komang. 2014. Vactor Auto Regressive (VAR)

Analysis of Causality Between Money Supply and

Inflation. Bachelor of Development Economics thesis at

the Faculty of Economics and Business Udayana

University.

[38]. Rahma, U.S.M. (2017). Economic important of

electronic money. Al SiddigTalha Mohmed Rahma,

5(1), 008–019.

[39]. Rahmanto, D. N. A., & Nasrulloh. (2019). Risks and

Regulations: Fintech for Financial Stability Systems.

Innovation, 15(1), 44–52.

[40]. Rahmayuni, S. (2019). The Effect of E-Money and E-

Commerce on Inflation Rates. Sebatik, 23(1), 148–152.

https://doi.org/10.46984/sebatik.v23i1.460.

[41]. Saksonova, S. and M. I. K. (1982). A Silicon Mediated

Homo-Claisen Rearrangement. Journal of the American

Chemical Society, 104(4), 1124–1126.

[42]. Sarmanu. (2017). Basic Quantitative, Qualitative and

Statistical Research Methodology. Surabaya: Airlangga

University Press.

[43]. Silitonga, T. 2013. Electronic Money Demand Analysis

(E-money) to Velocity of Money in Indonesia. USU:

Terrain.

IJISRT22JUN1551 www.ijisrt.com 1285

You might also like

- Libro 1Document76 pagesLibro 1MARIO PADILLANo ratings yet

- SBI Education Loan StatementDocument2 pagesSBI Education Loan StatementVivek ChandakNo ratings yet

- ECS3701 NotesDocument138 pagesECS3701 NoteschumaNo ratings yet

- Base24EPS TransactionProcessingDocument225 pagesBase24EPS TransactionProcessingTommy Cox100% (7)

- An Appraisal of Electronic Payment Infrastructure Towards An Efficient Cashless PolicyDocument15 pagesAn Appraisal of Electronic Payment Infrastructure Towards An Efficient Cashless PolicyPearl LenonNo ratings yet

- The Effect of Non-Cash Payments On Inflation Rate With Cash Circulation As An Intervening Variable During The Covid 19 PandemicDocument4 pagesThe Effect of Non-Cash Payments On Inflation Rate With Cash Circulation As An Intervening Variable During The Covid 19 PandemicInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mahesh ProjectDocument40 pagesMahesh ProjectBurugu MaheshNo ratings yet

- Significant Effect of The Central Bank Digital Currency On The Design of Monetary PolicyDocument28 pagesSignificant Effect of The Central Bank Digital Currency On The Design of Monetary PolicyArif RamadhanNo ratings yet

- Ecn 102 by WestminsterDocument7 pagesEcn 102 by WestminsterTriggersingerNo ratings yet

- Review of Literature OldDocument52 pagesReview of Literature OldRohit GowdaNo ratings yet

- Cashless Payment: A Behaviourial Change To Economic Growth Neetu KumariDocument22 pagesCashless Payment: A Behaviourial Change To Economic Growth Neetu KumariRobinsNo ratings yet

- Analisis Pengaruh Penggunaan Alat Pembayaran Menggunakan Kartu (APMK) Dan Uang Elektronik Terhadap Jumlah Uang Beredar Periode 2009-2019Document8 pagesAnalisis Pengaruh Penggunaan Alat Pembayaran Menggunakan Kartu (APMK) Dan Uang Elektronik Terhadap Jumlah Uang Beredar Periode 2009-2019Imron HilmyNo ratings yet

- Last Exam of MonetaryDocument5 pagesLast Exam of Monetary044 Librania SeptaNo ratings yet

- Presentation 1 - Introduction To Money, Credit, and BankingDocument28 pagesPresentation 1 - Introduction To Money, Credit, and BankingNigel N. SilvestreNo ratings yet

- Jurnal Internasional 7Document10 pagesJurnal Internasional 7awtiti868No ratings yet

- Money Banking and Financial Markets 3rd Edition Cecchetti Solutions ManualDocument20 pagesMoney Banking and Financial Markets 3rd Edition Cecchetti Solutions ManualJoshuaSnowexds98% (49)

- E Naira Digital Currency and Financial Performance of Listed Deposit Money Banks in NigeriaDocument8 pagesE Naira Digital Currency and Financial Performance of Listed Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- 2 Ahmad Zafrullah TayibnapisDocument5 pages2 Ahmad Zafrullah TayibnapisAnonymous t7VrrOuNo ratings yet

- Financial Innovation: Editor - In-Chief M. Zarif AminyarDocument3 pagesFinancial Innovation: Editor - In-Chief M. Zarif AminyarZarif AminyarNo ratings yet

- BibliographyDocument14 pagesBibliographySadia SulehriaNo ratings yet

- Analisis Pengaruh Instrumen Pembayaran Non-Tunai Terhadap Stabilitas Sistem Keuangan Di IndonesiaDocument16 pagesAnalisis Pengaruh Instrumen Pembayaran Non-Tunai Terhadap Stabilitas Sistem Keuangan Di IndonesiaRamona KurniaNo ratings yet

- III. Central Banks and Payments in The Digital EraDocument30 pagesIII. Central Banks and Payments in The Digital EraForkLogNo ratings yet

- Digitization of The Financial System in The World EconomyDocument9 pagesDigitization of The Financial System in The World EconomyxombakaNo ratings yet

- Monetary Policy, Central Bank Digital Currency: A Study in VietnamDocument10 pagesMonetary Policy, Central Bank Digital Currency: A Study in Vietnamindex PubNo ratings yet

- Macroeconomics Assignment Created by Maksudul Alam (Reg. No - 2018-25-15)Document10 pagesMacroeconomics Assignment Created by Maksudul Alam (Reg. No - 2018-25-15)maksudulrmstuNo ratings yet

- SESSION-13 (REPORT) - Jessa LimpiadaDocument8 pagesSESSION-13 (REPORT) - Jessa LimpiadaJessaLimpiadaNo ratings yet

- MPRA Paper 76391Document9 pagesMPRA Paper 76391Leon BhuyanNo ratings yet

- Analysis of The Impact of E-Payment On Culinary Business Development in Kupang CityDocument7 pagesAnalysis of The Impact of E-Payment On Culinary Business Development in Kupang CityClariss CrisolNo ratings yet

- 03 Ch3 Money Market - Practice SheetDocument17 pages03 Ch3 Money Market - Practice SheetDhruvi VachhaniNo ratings yet

- Cashless EconomyDocument5 pagesCashless EconomykumaresanNo ratings yet

- Central Bank Research PaperDocument7 pagesCentral Bank Research PaperzgkuqhxgfNo ratings yet

- Essay On Monetary Policy and Economic Growth: Bojan Dimitrijević, PHD Ivan Lovre, M.SCDocument28 pagesEssay On Monetary Policy and Economic Growth: Bojan Dimitrijević, PHD Ivan Lovre, M.SCSamsam RaufNo ratings yet

- Entropy Increase Through Modern Money Creation of Fractional Reserve System in BankingDocument6 pagesEntropy Increase Through Modern Money Creation of Fractional Reserve System in BankingdrcetinerNo ratings yet

- Monetary Policy in KenyaDocument29 pagesMonetary Policy in KenyaSimon MutekeNo ratings yet

- Money Demand (1) - 1Document9 pagesMoney Demand (1) - 1kritikachhapoliaNo ratings yet

- Supply and Demand For Money 1Document25 pagesSupply and Demand For Money 1Diana AcostaNo ratings yet

- Central Bank Digital CurrenciesDocument12 pagesCentral Bank Digital CurrenciesGabrielNo ratings yet

- The Economics of Digital CurrenciesDocument11 pagesThe Economics of Digital CurrencieschrisallNo ratings yet

- Ecb - rb221031 A05030021c.enDocument7 pagesEcb - rb221031 A05030021c.enaldhibahNo ratings yet

- BDCC Bank 21Document60 pagesBDCC Bank 21SandhyaNo ratings yet

- Monetary Policy Analysis On The Dutch EconomyDocument98 pagesMonetary Policy Analysis On The Dutch EconomySam KhanNo ratings yet

- Money SupplyDocument31 pagesMoney SupplyDivya JainNo ratings yet

- Monetarism and CryptocurrencyDocument1 pageMonetarism and CryptocurrencyTay NewNo ratings yet

- AP43 - Alice Han - Dealing With Digital Yuan CompressedDocument20 pagesAP43 - Alice Han - Dealing With Digital Yuan CompressedmaureenNo ratings yet

- New Regulatory Approach To Ecuador's Electronic Money From A Comparative International ScopeDocument23 pagesNew Regulatory Approach To Ecuador's Electronic Money From A Comparative International ScopeHasfi YakobNo ratings yet

- Unit II The Concept of Money SupplyDocument24 pagesUnit II The Concept of Money SupplyLoungo GopaneNo ratings yet

- Banking Assignment On "Credit and Monetary Policies": Submitted byDocument22 pagesBanking Assignment On "Credit and Monetary Policies": Submitted byAshok VenkatNo ratings yet

- SUPRIYA Final SYNOPSISDocument38 pagesSUPRIYA Final SYNOPSISpoonammadan0001No ratings yet

- Note On Demand For Money and Stock of MoneyDocument7 pagesNote On Demand For Money and Stock of MoneyJyoti SinghNo ratings yet

- ECB 301 Money, Banking and Finance Previous Year QuestionsDocument44 pagesECB 301 Money, Banking and Finance Previous Year Questionshashtagsonam04No ratings yet

- Money and Banking 1Document90 pagesMoney and Banking 1Saba SuleNo ratings yet

- Financial InnovationsDocument16 pagesFinancial InnovationsPrasadVM100% (1)

- 1 Asha Kumari 16EGJEE011Document13 pages1 Asha Kumari 16EGJEE011Dhruv Kumar AgrawalNo ratings yet

- Mobile Banking Penetration in Suburban Maharashtra: An Analytical Study With Reference To BaramatiDocument15 pagesMobile Banking Penetration in Suburban Maharashtra: An Analytical Study With Reference To BaramatiChayan GargNo ratings yet

- Research in International Business and Finance: Ahmed H. Elsayed, Muhammad Ali NasirDocument5 pagesResearch in International Business and Finance: Ahmed H. Elsayed, Muhammad Ali NasirNguyễn Quỳnh AnhNo ratings yet

- Factors Affecting The Intention To Use of Internet Banking of Customers in Vietnams Commercial Banks in Industrial Revolution Context 4 0Document11 pagesFactors Affecting The Intention To Use of Internet Banking of Customers in Vietnams Commercial Banks in Industrial Revolution Context 4 0Nhi Phan Hoàng UyểnNo ratings yet

- An Appraisal of Cashless Economy Policy in Development of Nigerian EconomyDocument17 pagesAn Appraisal of Cashless Economy Policy in Development of Nigerian EconomyAnonymous aXFUF6No ratings yet

- Assignment-1: Research MethodologyDocument7 pagesAssignment-1: Research MethodologyNikita ParidaNo ratings yet

- Monetary Policy Transmission and Credit Cards - Evidence From IndoDocument27 pagesMonetary Policy Transmission and Credit Cards - Evidence From IndoNanang ArifinNo ratings yet

- 14613-Tekst Artykułu-40456-1-10-20190809 PDFDocument12 pages14613-Tekst Artykułu-40456-1-10-20190809 PDFHimanshu GargNo ratings yet

- Analyzing The Covid 19 Pandemic Effect On Forecasting of Loan Disbursement in Financial TechnologyDocument7 pagesAnalyzing The Covid 19 Pandemic Effect On Forecasting of Loan Disbursement in Financial TechnologyEditor IJTSRDNo ratings yet

- Digital Currencies - Bank For International SettlementsDocument17 pagesDigital Currencies - Bank For International SettlementsAtish KissoonNo ratings yet

- Assessment of Integrated Poultry Manure and Synthetic Fertilizer Effects on Maize (Zea mays) Growth and Soil Properties: A Study from Bayero University, KanoDocument15 pagesAssessment of Integrated Poultry Manure and Synthetic Fertilizer Effects on Maize (Zea mays) Growth and Soil Properties: A Study from Bayero University, KanoInternational Journal of Innovative Science and Research Technology100% (1)

- Seasonal Variation and Distribution Patterns of Endophytic Community in Withania SomniferaDocument7 pagesSeasonal Variation and Distribution Patterns of Endophytic Community in Withania SomniferaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Utilizing Chicken Eggshells and Waste Glass Powder as Cement Fillers for Environmental StabilityDocument6 pagesUtilizing Chicken Eggshells and Waste Glass Powder as Cement Fillers for Environmental StabilityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Personal Capabilities of The Non-Teaching Personnel and Client SatisfactionDocument8 pagesPersonal Capabilities of The Non-Teaching Personnel and Client SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Transforming Challenges to Victories: An Inquiry on Transformational Leadership of School Leaders in the Public Elementary SchoolsDocument54 pagesTransforming Challenges to Victories: An Inquiry on Transformational Leadership of School Leaders in the Public Elementary SchoolsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Influence of Continuance Commitment on Job Satisfaction of Barangay Health Workers in Malaybalay City, BukidnonDocument14 pagesThe Influence of Continuance Commitment on Job Satisfaction of Barangay Health Workers in Malaybalay City, BukidnonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Intelligent Clinical Documentation: Harnessing Generative AI For Patient-Centric Clinical Note GenerationDocument15 pagesIntelligent Clinical Documentation: Harnessing Generative AI For Patient-Centric Clinical Note GenerationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring The Potential Advantages of Traditional Therapies in Autoimmune Blistering Illnesses: A Comprehensive Review and Analysis, ResearchDocument12 pagesExploring The Potential Advantages of Traditional Therapies in Autoimmune Blistering Illnesses: A Comprehensive Review and Analysis, ResearchInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Meta Land: Redefining Virtual Communities Through Centralized Governance, Inclusivity and InnovationDocument5 pagesMeta Land: Redefining Virtual Communities Through Centralized Governance, Inclusivity and InnovationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Solar Based Multilevel Inverter F o R BLDC Motor DriveDocument8 pagesSolar Based Multilevel Inverter F o R BLDC Motor DriveInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Skin Disease Detection and Remedial SystemDocument7 pagesSkin Disease Detection and Remedial SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design and Development of Multi-Featured Medical StretcherDocument4 pagesDesign and Development of Multi-Featured Medical StretcherInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- EmoConnect: Nurturing Trust and Relationship Bonds in Alzheimer's ConversationsDocument3 pagesEmoConnect: Nurturing Trust and Relationship Bonds in Alzheimer's ConversationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Unlocking Sentiments: Enhancing IOCL Petrol Pump ExperiencesDocument8 pagesUnlocking Sentiments: Enhancing IOCL Petrol Pump ExperiencesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart and Secure Home With ChatbotDocument9 pagesSmart and Secure Home With ChatbotInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Preparation and Identification of Magnetic Iron Nanoparticle Based On A Natural Hydrogel and Its Performance in Targeted Drug DeliveryDocument17 pagesPreparation and Identification of Magnetic Iron Nanoparticle Based On A Natural Hydrogel and Its Performance in Targeted Drug DeliveryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Development of Smart Ground Fault Location Model For Radial Distribution SystemDocument14 pagesDevelopment of Smart Ground Fault Location Model For Radial Distribution SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fall Detection and Boundary Detection in Care HomesDocument7 pagesFall Detection and Boundary Detection in Care HomesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Application of Plant Growth Promoting Rhizobacteria On Vegetative Growth in Chili Plants (Capsicum Frutescens L.)Document7 pagesApplication of Plant Growth Promoting Rhizobacteria On Vegetative Growth in Chili Plants (Capsicum Frutescens L.)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring The Post-Annealing Influence On Stannous Oxide Thin Films Via Chemical Bath Deposition Technique: Unveiling Structural, Optical, and Electrical DynamicsDocument7 pagesExploring The Post-Annealing Influence On Stannous Oxide Thin Films Via Chemical Bath Deposition Technique: Unveiling Structural, Optical, and Electrical DynamicsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Reading Intervention Through "Brigada Sa Pagbasa": Viewpoint of Primary Grade TeachersDocument3 pagesReading Intervention Through "Brigada Sa Pagbasa": Viewpoint of Primary Grade TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Firm Size As A Mediator Between Inventory Management Andperformance of Nigerian CompaniesDocument8 pagesFirm Size As A Mediator Between Inventory Management Andperformance of Nigerian CompaniesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Application of Game Theory in Solving Urban Water Challenges in Ibadan-North Local Government Area, Oyo State, NigeriaDocument9 pagesApplication of Game Theory in Solving Urban Water Challenges in Ibadan-North Local Government Area, Oyo State, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Global Warming Reduction Proposal AssessmentDocument6 pagesGlobal Warming Reduction Proposal AssessmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- On The Development of A Threat Driven Model For Campus NetworkDocument14 pagesOn The Development of A Threat Driven Model For Campus NetworkInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Detection of Phishing WebsitesDocument6 pagesDetection of Phishing WebsitesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Study To Assess The Knowledge Regarding Teratogens Among The Husbands of Antenatal Mother Visiting Obstetrics and Gynecology OPD of Sharda Hospital, Greater Noida, UpDocument5 pagesA Study To Assess The Knowledge Regarding Teratogens Among The Husbands of Antenatal Mother Visiting Obstetrics and Gynecology OPD of Sharda Hospital, Greater Noida, UpInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- PHREEQ C Modelling Tool Application To Determine The Effect of Anions On Speciation of Selected Metals in Water Systems Within Kajiado North Constituency in KenyaDocument71 pagesPHREEQ C Modelling Tool Application To Determine The Effect of Anions On Speciation of Selected Metals in Water Systems Within Kajiado North Constituency in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mandibular Mass Revealing Vesicular Thyroid Carcinoma A Case ReportDocument5 pagesMandibular Mass Revealing Vesicular Thyroid Carcinoma A Case ReportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Esophageal Melanoma - A Rare NeoplasmDocument3 pagesEsophageal Melanoma - A Rare NeoplasmInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Reviewer in Banking and Finance - Docx1Document14 pagesReviewer in Banking and Finance - Docx1Regine VegaNo ratings yet

- FO UEF 0.025 Customer Information Form CIF - Rev.07 PDFDocument2 pagesFO UEF 0.025 Customer Information Form CIF - Rev.07 PDFJoyce HerreraNo ratings yet

- Buổi 7. Chứng Từ Và Quy Trình Làm Việc Của Hãng TàuDocument51 pagesBuổi 7. Chứng Từ Và Quy Trình Làm Việc Của Hãng TàuHa DoNo ratings yet

- Travel Expense Claim: P R o C e D U R eDocument13 pagesTravel Expense Claim: P R o C e D U R eB singhNo ratings yet

- Tender 91070 Hall of Gram Panchayat Land at Bamanwada BhagatDocument131 pagesTender 91070 Hall of Gram Panchayat Land at Bamanwada BhagatFaizan KhanNo ratings yet

- FABM2 Week 9 Bank AccountsDocument7 pagesFABM2 Week 9 Bank AccountsLoresse Guillian Asiado DiataNo ratings yet

- SWIFT Handbook PDFDocument120 pagesSWIFT Handbook PDFMehbub Mustain Mehdi100% (2)

- Circular Fees and Charges External Website v3 10182019Document8 pagesCircular Fees and Charges External Website v3 10182019Kim Orven KhoNo ratings yet

- INZ 1175 App From A Resident JUL21 1.0Document14 pagesINZ 1175 App From A Resident JUL21 1.0Mohd BarNo ratings yet

- Ivend Retail For SAP Business OneDocument10 pagesIvend Retail For SAP Business OneCitiXsys TechnologiesNo ratings yet

- Worldpay Ecomm Iq Reporting and Analytics User Guide V4.10Document474 pagesWorldpay Ecomm Iq Reporting and Analytics User Guide V4.10santosh sbbsNo ratings yet

- Major Project HDFC InternshipDocument68 pagesMajor Project HDFC InternshipJaskaran SinghNo ratings yet

- DC 0x37379bd0d07f991bDocument5 pagesDC 0x37379bd0d07f991bMohammad SaqerNo ratings yet

- Embedded Payments Guide - CryptoDocument1 pageEmbedded Payments Guide - CryptoOlegNo ratings yet

- Bank AlfalahDocument62 pagesBank AlfalahMuhammed Siddiq KhanNo ratings yet

- PaypalDocument79 pagesPaypalOctavio AlonsoNo ratings yet

- UPI - What Is UPIDocument3 pagesUPI - What Is UPIAnoop MathewNo ratings yet

- StatementDocument8 pagesStatementJayamkondan0% (1)

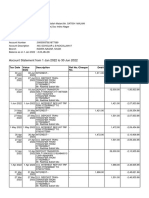

- Account Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancenaveen kumarNo ratings yet

- RBL Bank Paisa On Demand Credit Card Terms and ConditionsDocument4 pagesRBL Bank Paisa On Demand Credit Card Terms and ConditionskishoreNo ratings yet

- Cash Handling ManualDocument88 pagesCash Handling ManualSrishti Vasdev100% (1)

- University of Akureyri - Handbook For Exchange StudentsDocument20 pagesUniversity of Akureyri - Handbook For Exchange StudentsEszti100% (1)

- Loan Documentation - 20210905100946Document13 pagesLoan Documentation - 20210905100946598dqczrn6No ratings yet

- Cash Sales vs. Installment Sales An Analysis of Consumer Payment Methods in MotorstarDocument34 pagesCash Sales vs. Installment Sales An Analysis of Consumer Payment Methods in Motorstarjuvel urbanaNo ratings yet

- Monthly One Liner Current Affairs PDF JulyDocument70 pagesMonthly One Liner Current Affairs PDF JulyJanardhan ChNo ratings yet

- Soneri Annual Report 2017 FINALDocument172 pagesSoneri Annual Report 2017 FINALaliNo ratings yet

- ARGOS Cape - Credit - AgreementDocument12 pagesARGOS Cape - Credit - Agreementlomaxpl1No ratings yet