Professional Documents

Culture Documents

Istishna Buying On Home Ownership Loans

Uploaded by

aijbmOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Istishna Buying On Home Ownership Loans

Uploaded by

aijbmCopyright:

Available Formats

American International Journal of Business Management (AIJBM)

ISSN- 2379-106X, www.aijbm.com Volume 4, Issue 09 (September-2021), PP 61-65

CASE STUDY: RISK ANALYSIS IN IMPLEMENTATION OF

ISTISHNA BUYING ON HOME OWNERSHIP LOANS

FINANCING PRODUCTS AT BANK BTN SYARIAH

Tanti Widia Nurdiani

Abstract TheIstishna product is a type of product for which the bank can make payment in multiple installments

(terms). The Islamic banks also use the istishna scheme. The purpose of this study is to assess the risk associated

with the implementation of istishna buying and selling of mortgage financing products at Bank BTN Syariah

Malang, specifically the home ownership loans Indensya BTN iB product. This is a case study research using an

analytical method with the Bank BTN Syariah Branch Office Malang as the subject of study. The primary data

for this study were gathered through observation and in-depth interviews with informants, specifically banking

officials and staff. Secondary data is the information gathered by researcher from published works or other

official documents.The study's findings indicated that the implementation of istishna financing collateral at Bank

BTN Syariah Malang was consistent with the existing collateral. In conclusion, there were no issues or risks

associated with an incompatible implementation of theIstishna product at Bank BTN Syariah Malang.

Keywords: istishna, collateral, Islamic bank, risk

I. INTRODUCTION

Banking is a high-risk business that, when managed properly and prudently, can yield substantial

profits. It is considered a high-risk business because the majority of its operations rely on funds entrusted by the

public in the form of savings, current accounts, and time deposits. Islamic banks provide financing based on the

mudharabah and musyarakah principles, as well as buying and selling transactions based on the murabahah,

salam, and istishna principles, as well as leasing assets based on the ijarah principle. They also offer other

products such as rahn and qardhul-hasan. Risk is defined as the possibility that an event (or series of events)

will occur that will result in financial loss.

Despite the positive trend in the Islamic banking industry, the istishna financing scheme has not

accelerated as anticipated. Islamic Banking Statistics (December 2008) data demonstrates unequivocally that

this is the case. Istishna is a type of product for which the bank can make payment in multiple installments

(terms). Islamic banks typically use the istishna scheme to finance manufacturing and construction. The general

provision for Istishna financing is that the ordered goods' specifications, such as their type, size, quality, and

quantity, must be clear. The agreed upon selling price is included in the istishna collateral and is not subject to

change during the collateral's validity. If the order criteria or the price of the collateral change after the collateral

is signed, the customer will remain responsible for all additional costs (Karim, 2010:100). In this financing, the

customer, as the buyer, places an order with the bank, as the seller, for the procurement or manufacture of

specific objects, which the bank will then sell to the customer at the original price plus the bank's profit margin

(Zulkifli, 2007: 76).

Istishna is a type of financing in which Islamic banks repay the borrower in installments or multiple

payments over a specified period of time. The primary requirements for the goods are clearly defined, as are

their specifications. Istishna financing is typically used to finance construction or house construction. According

to Karim (2010:265), it is defined by advance payments and difficult delivery of goods. As a result, the non-

deliverable risk of non-deliverable risk has not yet been realized as a financing object. Bank default risk can be

anticipated by setting a covenant ratio of 220 percent collateral, which is 100 percent greater than the industry

standard of 120 percent. (2) The possibility of declining commodity prices (price drop risk). The risk of

declining commodity prices is mitigated by stipulating that this type of financing is only available for contracts

(orders) that have been determined at a price.

This study would examine the implementation and application of istishna financing patterns in greater

detail. The research will be conducted at Bank BTN Syariah Malang with a focus on istishna financing.

II. LITERATURE REVIEW

a. Istishna

Antonio asserts (1999:145) Istishna derives from the Sanskrit word for "asking to be made." Karim

(2010:126) explains that buying and selling istishna 'is a sale and purchase collateral in the form of producing

certain goods according to certain criteria and conditions agreed upon by the buyer (mustashni’) and seller

*Corresponding Author: Tanti WidiaNurdiani 1 www.aijbm.com 61 | Page

CASE STUDY: RISK ANALYSIS IN IMPLEMENTATION OF ISTISHNA...

(sani'). Ba'i al-istishna, according to Jumhur Fuqaha, is a special type of collateral for ba'i as-salam. This type is

typically used in manufacturing. Thus, ba'i al-provisions istishna are consistent with the provisions and rules of

agunana ba'i as-salam. (Antonio, 2001, pp. 113–114).

b. Istishna in the Banking Technical Department

According to Gozali (2005:30), istishna is a buying and selling transaction based on an order, in which

the buyer orders an item to be made for him, and payment can be made immediately, gradually as the work

progresses, or even in long-term installments, all of which can be agreed upon. In sharia banking, financing

products that utilize Istishna collateral are referred to as financing for home purchases, or more commonly, as

home ownership loans financing, or mortgages. In practice, the istishna collateral for mortgages is referred to as

"parallel istishna." Consumers in need of a house come to the bank and place an order for a house with specific

specifications. The consumer and the bank then agree on the terms of the house's transfer, the selling price, and

the payment method.

This collateral can be used more freely to facilitate mortgages on still-indented homes. Using this

collateral, transactions can be initiated even if the subject of the sale or purchase does not yet exist. Islamic

banks generally use the istishna'scheme to finance manufacturing, small and medium-sized businesses, and

construction. Istishna collateral is no longer used in isolation in financing products, but is combined with other

collateral such as ijarah, murabahah, and wakalah. Previously used primarily in the plantation sector, Istishna is

now used to finance construction, particularly housing (e.g. house construction) (BTN Syariah, 2010).

III. METHOD

This is a qualitative study. The case study method was used to examine the phenomenon and

implementation of Istishna financing as a mortgage financing product in this study. This study was conducted at

Bank BTN Syariah's Malang branch office. The primary data for this study was gathered through observation

and in-depth interviews with informants, specifically banking officials and staff. The secondary data was

collected by researcher through literature studies and includes the following: performance reports from 2006 to

2009, financial reports from 2009, branch work plans, organizational structure and job descriptions, and

customer data on those who have performed well at BTN Syariah.

IV. RESULTS AND DISCUSSIONS

Implementation of Istishna Financing Collateral at Bank BTN Syariah

Based on an interview with one of the informants, Staff Account Officer of Bank BTN Syariah Branch

Office Malang, said things related to Istishna financing at Bank BTN Syariah Malang as follows:

"Indeed, in the early years we (BTN Syariah Malang) did not dare to carry out the realization of the

Istishna home ownership loans financing product because we did not know what the performance of developers

and contractors in Malang was like. Because if we carry out the realization of the Istishna home ownership loans

financing, the house has not yet been completed, while we have disbursed some of the funds to the developer

and contractor accounts.....after we know the performance of each developer, then we start collaborating with

developers with good performance to carry out financing realization home ownership loans with istishna

collateral for individual customers who buy houses at the developer by means of home ownership loans

Indensya BTN iB with istishna collateral at Bank BTN Syariah…”

From the collateral for home ownership loans Indensya BTN iB financing between BTN Syariah and

the customer in articles 10 and 11, it is necessary to derive that the home ownership loans indensya BTN iB

BTN Syariah financing product was designed from the start with various risk mitigations against the financing

guarantee, with a value greater than the ceiling financing, it is even required to have ad hoc financing.

Bank BTN Syariah's Practice of Istishna Financing

Bank BTN Malang Syariah Branch Office engages in murabahah, mudharabah, and musyarakah

financing, as well as other financing products such as istishna financing and other financing schemes. The

murabahah financing scheme still dominates the financing portfolio of Bank BTN's Syariah Branch Office in

Malang. This total financing has reached Rp 51,075 billion with an increase of 160% from the 2008 recap target

or a portfolio of 75% murabahah. Murabaha financing is designed for retail customers seeking a sharia-

compliant mortgage. Meanwhile, housing contractors and developers are the intended recipients of mudharabah

and musyarakah financing. Since the official opening of BTN Syariah at the end of 2005, the Malang Syariah

Branch office has not offered theistishna scheme. Istishna financing was implemented at Bank BTN Syariah's

Malang branch office in the second quarter of 2008. The Bank BTN Syariah Branch Office Malang's Financial

Performance Report includes financing items associated with the assets listed in the Financial Plan.

Meanwhile, through interviews with several informants, it was determined that the following factors

contributed to Bank BTN Syariah Branch Office Malang's compliance with financing analysis procedures:

*Corresponding Author: Tanti WidiaNurdiani 1 www.aijbm.com 62 | Page

CASE STUDY: RISK ANALYSIS IN IMPLEMENTATION OF ISTISHNA...

a. Bank BTN Syariah Branch Office Malang has a Guide Book in this case, Circular Letter number

07/DIR/DSYA/2006 dated September 1, 2006, which details the implementation of home ownership loans

Indensya BTN iB financing instructions.

b. Ongoing internal audit reviews or inspections of each financing product provided. This inspection is divided

into two categories: periodic inspections conducted four times a year and unannounced inspections.

The following factors act as impediments to compliance with Bank BTN Syariah Branch Office

Malang's financing analysis procedures:

a. Inadequate staffing in the credit/financing section of the Bank BTN Syariah Malang branch office. Bank BTN

Syariah Malang Branch Office currently has three credit officers. This deficiency is caused by the unfulfilled

formation of optimal credit department employees, as determined by the formation of as many as seven or eight

employees.

b. Lack of management training focused on a comprehensive understanding of customer business for bank

employees/employees. Management training that is specific to the customer's business is required.

The Risks Involved in Istishna Financing at Bank BTN Syariah

The Islamic banks have banking operational activities, one of which is a financing product based on

istishna collateral, which is called home ownership loans Indensya BTN iB at Bank BTN Syariah Malang.

According to Karim's previous research (2010:156), the following risks may be associated with the home

ownership loans Indensya BTN iB BTN product:

Non-deliverable risk

Price drop risk

As a result of the explanation above, it is fairly obvious that istishna transactions

are subject to financial risk (which can also be referred to as financing risk). Because banks analyze customers'

income to determine whether they are able to pay monthly installments or not, the possibility of high moral

hazard arises from one of the parties. As a financing institution, istishna collateral transactions are inextricably

linked to financing risk, specifically the risk associated with a customer's failure or inability to repay the amount

of financing received within the specified time period.

Minimizing Istishna Financing Risk at Bank BTN Syariah

Bank BTN Syariah's efforts in 2009 focused on a variety of issues and/or business management

strategies. These efforts result in issues and/or strategies that are discussed and decided collectively at the board

of directors meeting, one of which is the Risk Management Division, which stipulates, among other things:

- Development of a risk management system, which includes the development of a risk management culture

and the regular socialization of standard operating procedures (SOP) through the Branch Risk Control Office

(catastrophic).

- Basel II implementation, which includes preparing for Basel II compliance using Bank Indonesia's road map,

preparing credit risk measurements using the Standardized Approach, calculating minimum capital requirements

using the Basic Indicator Approach for operational risk and the Standardized Model for market risk.

- Appropriate placement of Division Risk Control Officers (DRCOs) and Brand Risk Control Officers (BRCOs)

within the bank's organizational structure. As of the end of December 2009, the Head Office was home to three

Division Risk Control Officers (DRCO), namely Market Risk, Credit Risk, and Operational Risk. Meanwhile,

as of the end of December 2009, the Bank had assigned 46 Branch Risk Control Officers (BRCO) to 46 Branch

Offices in 60 Branch Offices. For Branch Offices that have not yet been assigned a BRCO, risk management

monitoring is conducted by the BRCO assigned to the Branch Office closest to the BRCO.

- Risk management policies and procedures are also improved through a review of internal policies in order to

comply with the latest regulator regulations. This is accomplished through gap analysis and the incorporation of

best practices commonly used to improve the quality of risk management implementation.

- Create an information system for risk management. At the outset, the focus will be on collecting and

improving the risk database, which will be developed and integrated into an information technology system in

order to enable the risk measurement and monitoring processes to be carried out in an integrated manner and

presented in a timely manner.

- Risk profile development and management, including market risk, liquidity risk, operational risk, legal risk,

reputation risk, strategic risk, and compliance risk, with a particular emphasis on credit/financing risk.

- Human resource development in the field of risk management, through the implementation of several human

resource development programs in the areas of education and training for risk management officials,

specifically: Branch Risk Control Officers in the performance of their function of providing second opinions and

consideration of risks inherent in every bank business. Meanwhile, the bank has conducted internal training and

developed a pre-test to assess knowledge capacity in the field of risk management for officials and employees

who will sit for the Risk Management Certification Agency's certification exam.

*Corresponding Author: Tanti WidiaNurdiani 1 www.aijbm.com 63 | Page

CASE STUDY: RISK ANALYSIS IN IMPLEMENTATION OF ISTISHNA...

Financing Risk

The Bank minimizes or mitigates this financing risk by conducting continuous billing, communicating

with customers via telephone, sending warning letters to customers, and inviting customers to work together to

find solutions. This is stated in the collateral for the Indensya BTN iB home ownership loans financing between

the customer and BTN Syariah, namely that the customer is declared in default if he fails to properly fulfill his

obligations or violates the provisions of this Collateral.

If a financing risk arises during the grace period of the development period, the developer offers a

buyback guarantee. Developers must purchase back bank-guaranteed land and buildings if there is a risk that

customer financing will default on installment payments to the bank due to the developer's inability to complete

the customer's house order within six months.

Non-deliverable Risk

Bank BTN Syariah Malang Branch Office mitigates the risk of late delivery of goods by establishing a

covenant ratio that is 100% greater than the standard price. Bank BTN Syariah Malang branch's risk mitigation

measures are effective. Examining the Collateral that should be submitted to the Bank, which should include an

original certificate of at least the right to use the splitting building, an IMB Location Permit, a Site Plan, and a

Flood Peil.

To minimize the risk of non-delivery of goods, the bank divides the disbursement into three stages: (a)

Building progress 0% of funds are distributed to developers; 40% of the financing ceiling for home ownership

loans Indensya BTN iB customers is distributed to developers. (b) At 60% construction progress, 40% of the

financing ceiling is sought from the developer; (c) At 100% construction progress, the remaining 20% of the

financing ceiling is sought from the developer. Where the bank disburses funds after the house is actually

financed on time and in the prescribed manner.

According to the researcher, additional actions are required to minimize risk or mitigate risk that have

not been taken by the Bank BTN Syariah Malang branch, namely: Conducting regular monitoring and routines

on the progress of houses constructed as an early wear system for home ownership loans Indensya BTN iB

financing. According to the author, the central office's monitoring provisions include conducting a House

Construction Achievement Check and Final Examination prior to disbursing funds to the developer's account.

Moral Hazard for Developers

Bank BTN Syariah Malang Branch's efforts to mitigate moral hazard and minimize risk risk is to

mitigate developer moral hazard, as stated in Chapter II of the General Provisions for Mortgage Financing

Indensya SE Directors No.07/DIR/DSYA/2006. Article 3 has the following indents:

- Developers and administrators must have experience managing and constructing at least two housing projects

totaling at least 50 housing units.

- For a period of at least two years, the developer has engaged in business activities as a Developer.

- Developers and management have an excellent track record, as measured by the following criteria: (1)

Excluded from the List of Non-Performing Loans/Financing at Banks and/or Other Banks, as well as from the

Bank Indonesia's Black List. (2) At the moment, developers and management are not facing lawsuits that would

jeopardize the construction of housing. (3) Management is in good standing and is not the subject of a lawsuit.

(4) The Developer's projects are successfully completed and managed. (5) The developer maintains a checking

account with the bank and keeps track of his financial transactions there. (6) As an integral part of the Financing

Collateral, the developer submits the following: (a) Budget Plan and (b) Building Specifications for each type of

property to be traded with the assistance of the Indensya home ownership loans financing facility.

- The developer consents to the following notarial deeds being executed: (1) Agreement between the Bank and

the Developer regarding the provision of Indensya Mortgage Financing in front of a Notary. (2) Before a

Notary/PPAT, a Deed of Buy Back Guarantee is executed, which includes a guarantee from the Developer to

purchase back land and houses sold to the Customer if the Developer is unable to complete the construction

within the time limit specified by the Developer, at a price equal to the difference between the sale and purchase

prices plus a margin., fines, and costs incurred as a result of the Indensya home ownership loans financing. (3)

The developer is willing to cover the full cost of signing the Deed of Cooperation Agreement, the Deed of Buy-

Back Guarantee, and any other deeds.

V. CONCLUSION

The following conclusions can be drawn based on the results of data collection, data management, and

data analysis with a theoretical foundation as described in previous chapters:

- The implementation of istishna financing collateral at Bank BTN Syariah Malang is consistent with the

existing collateral, indicating that there are no issues or risks associated with an incompatible implementation at

Bank BTN.

- There are no issues with the practice of home ownership loans Indensya BTN iB transactions at Bank BTN

Syariah Malang because it complies with the existing implementation instructions.

*Corresponding Author: Tanti WidiaNurdiani 1 www.aijbm.com 64 | Page

CASE STUDY: RISK ANALYSIS IN IMPLEMENTATION OF ISTISHNA...

- There are indeed several risks associated with the implementation of istishna buying and selling of home

ownership loans Indensya BTN iB financing products at Bank BTn Syariah Malang, including the following: 1)

financing risk, 2) failure to deliver goods, and 3) moral hazard risk. - The most prominent risk is the risk of

failing to deliver the goods, which is very common due to the developer's poor performance in working on the

project. As a result, the performance of other users, namely the customer of home ownership loans Indensya

BTN iB financing as a house buyer and the Bank as a financier for the purchase of a home ownership loans

Indensya BTN iB house via an istishna sale and purchase agreement, is not as expected.

- Based on the characteristics of istishna financing risks identified in this study, Bank BTN Syariah Malang has

implemented several risk mitigation measures to mitigate the risk of istishna financing in Islamic banks.

REFERENCES

[1]. Antonio, M. S. I. (1999). Bank Syariah Wacana Ulama dan Cendekiawan. Jakarta: Tazkia Institute.

[2]. Gozali, A. (2005). Janganadabunga di antarakita: serba-serbikreditsyariah. Elex Media Komputindo.

[3]. Karim, A., & Islam, B. (2006). Analisisfiqih dan Keuangan. Jakarta: PT Raja GrafindoPersada.

[4]. BTN Syariah (2010). BukuPetunjukPelaksanaan Consumer Financing. Jakarta.

[5]. Zulkifli.(2007). Panduan Praktis Transaksi Perbankan Syariah. Padang: Universitas Andalas

*Corresponding Author: Tanti WidiaNurdiani 1 www.aijbm.com 65 | Page

You might also like

- Sub To ContractsDocument36 pagesSub To ContractsSam Dalkins100% (6)

- Real Estate Riches - Dolf de RoosDocument219 pagesReal Estate Riches - Dolf de RoosPius Wesley Quiambao95% (19)

- Securities OutlineDocument58 pagesSecurities OutlineJonDoeNo ratings yet

- Jurnal Hukum PembaharuanDocument8 pagesJurnal Hukum PembaharuanNasfiahtul Istani DaelyNo ratings yet

- Interest Free Banking-1Document5 pagesInterest Free Banking-1Areej AslamNo ratings yet

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceSandesh UdhaneNo ratings yet

- ''Provision of Bank Guarantees As Guarantees For Export Import Implementation at Foreign Exchange Banks''Document17 pages''Provision of Bank Guarantees As Guarantees For Export Import Implementation at Foreign Exchange Banks''VhiraNo ratings yet

- Loans and Advances: Aishwarya ParthasarathyDocument31 pagesLoans and Advances: Aishwarya ParthasarathyNikita Rane InamdarNo ratings yet

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceRuby PrajapatiNo ratings yet

- Chapter-1: FinanceDocument86 pagesChapter-1: Financemanjunathb790% (1)

- Retail Banking A ST 8bklzgDocument9 pagesRetail Banking A ST 8bklzgNageshwar SinghNo ratings yet

- Islamic Theroy Finance Burj BankDocument13 pagesIslamic Theroy Finance Burj Bankibrahim_ghaznaviNo ratings yet

- MurabahaDocument44 pagesMurabahaAnumHashmiNo ratings yet

- Xpress Cash Financing-IDocument15 pagesXpress Cash Financing-ISyirah Che AzizNo ratings yet

- Assignment 2 Fin536Document6 pagesAssignment 2 Fin536mypinkladyNo ratings yet

- Comparative Analysis of Home Loan in UTI BankDocument95 pagesComparative Analysis of Home Loan in UTI BankMitesh SonegaraNo ratings yet

- UNIT 2 Process and DocumentationDocument27 pagesUNIT 2 Process and DocumentationAroop PalNo ratings yet

- Commercial BankingDocument6 pagesCommercial BankingHarsh SadavartiaNo ratings yet

- Chapter 1. L1.2 Principles of LendingDocument5 pagesChapter 1. L1.2 Principles of LendingvibhuNo ratings yet

- My ReportDocument48 pagesMy ReportSaik Sadat Ibna IslamNo ratings yet

- What Is BankDocument38 pagesWhat Is BankappyNo ratings yet

- Growth of Consumer Financing in PakistanDocument7 pagesGrowth of Consumer Financing in Pakistannimra khaliqNo ratings yet

- Arushi ProjectDocument77 pagesArushi ProjectshagunNo ratings yet

- Plant and Machinery Under IjarahDocument23 pagesPlant and Machinery Under IjarahKamran Ali AbbasiNo ratings yet

- Assignment - Retail BankingDocument6 pagesAssignment - Retail BankingShivam GoelNo ratings yet

- A Study of Various Categories of Loans Provided by The Indian Banks With Special Reference To Digitalisation and Pre-Approved Personal Loans (Papl)Document11 pagesA Study of Various Categories of Loans Provided by The Indian Banks With Special Reference To Digitalisation and Pre-Approved Personal Loans (Papl)sutarnn8No ratings yet

- Commercial Banking 2Document5 pagesCommercial Banking 2polmulitriNo ratings yet

- Unit 2 DBDocument28 pagesUnit 2 DBDeepika. BabuNo ratings yet

- Chapter 3 & 4 Banking An Operations 2Document15 pagesChapter 3 & 4 Banking An Operations 2ManavAgarwalNo ratings yet

- Slide (Modes of Investment)Document50 pagesSlide (Modes of Investment)Mickey NicholsonNo ratings yet

- Icici BankDocument37 pagesIcici BankNitinAgnihotriNo ratings yet

- Istisna As A Mode of Finance: RisksDocument2 pagesIstisna As A Mode of Finance: RisksIsrar AhmadNo ratings yet

- Financial Lending - Bajaj FinDocument53 pagesFinancial Lending - Bajaj Finarvindkumar.yNo ratings yet

- Banking PortfolioDocument25 pagesBanking Portfolioranahaider081315No ratings yet

- Artikel - Widiyah (1908203054)Document16 pagesArtikel - Widiyah (1908203054)Inggih RahayuNo ratings yet

- Chapter 1 - Introduction To Bank Lending PDFDocument10 pagesChapter 1 - Introduction To Bank Lending PDFH SinghNo ratings yet

- 1 1meaningDocument21 pages1 1meaningadtyshkhrNo ratings yet

- Co-Operative Bank Rahul ChourasiyaDocument46 pagesCo-Operative Bank Rahul ChourasiyaNitinAgnihotriNo ratings yet

- Chapter - : Money and Banking: Best Higher Secondary SchoolDocument11 pagesChapter - : Money and Banking: Best Higher Secondary Schoolapi-232747878No ratings yet

- What Is A Bank?Document6 pagesWhat Is A Bank?Bhabani Sankar DashNo ratings yet

- Business of BankingDocument8 pagesBusiness of BankingUzma AliNo ratings yet

- Commercial Lendings by BanksDocument65 pagesCommercial Lendings by Banksvivek satviNo ratings yet

- CHAPTER I Principles of Lending Types of Credit FacilitiesDocument6 pagesCHAPTER I Principles of Lending Types of Credit Facilitiesanand.action0076127No ratings yet

- Sip Project SBI HomeloanDocument45 pagesSip Project SBI HomeloanAkshay RautNo ratings yet

- Chapter 5 EditedDocument10 pagesChapter 5 EditedSeid KassawNo ratings yet

- Functions of Commercial BanksDocument10 pagesFunctions of Commercial BanksGaganjot KaurNo ratings yet

- Dipali Project ReportDocument58 pagesDipali Project ReportAshish MOHARENo ratings yet

- ProjectDocument72 pagesProject9463684355No ratings yet

- MAFDocument3 pagesMAFannastasia luyahNo ratings yet

- Accounting For Musyarakah FinancingDocument16 pagesAccounting For Musyarakah FinancingHadyan AntoroNo ratings yet

- Banking DomainDocument7 pagesBanking DomainManju DarsiNo ratings yet

- Credit AppraisalDocument63 pagesCredit Appraisaltejal panchalNo ratings yet

- Islamic Retail ProductsDocument34 pagesIslamic Retail Productsmehzil haseebNo ratings yet

- Bajaj Internship ReportDocument69 pagesBajaj Internship ReportCoordinator ABS100% (2)

- Reliance Mutual Funds ProjectDocument58 pagesReliance Mutual Funds ProjectShivangi SinghNo ratings yet

- Murali ReportDocument75 pagesMurali Reportsachin mohanNo ratings yet

- PanchatantraDocument10 pagesPanchatantraBinaya SahooNo ratings yet

- Assignment No 2Document4 pagesAssignment No 2Basit KhanNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Ultimate Beginners Guide to Real Estate Investing Financing: Real Estate Investing, #10From EverandUltimate Beginners Guide to Real Estate Investing Financing: Real Estate Investing, #10No ratings yet

- The Impact of Business Intelligence On Sustainable Business Entrepreneurship in The Jordanian Pharmaceutical Industrial CompaniesDocument12 pagesThe Impact of Business Intelligence On Sustainable Business Entrepreneurship in The Jordanian Pharmaceutical Industrial CompaniesaijbmNo ratings yet

- Exploration of Islamic Business Ethics in B3 Waste Management: A Case Study of PT Kaltim Prima CoalDocument15 pagesExploration of Islamic Business Ethics in B3 Waste Management: A Case Study of PT Kaltim Prima CoalaijbmNo ratings yet

- Integrating Blockchain Technology With Small and Medium Enterprises (Smes) For Economic Development in AfricaDocument14 pagesIntegrating Blockchain Technology With Small and Medium Enterprises (Smes) For Economic Development in AfricaaijbmNo ratings yet

- Public Accountability As A Moderating Influence of Legislative Member Competence and Community Participation On Regional Budget OversightDocument7 pagesPublic Accountability As A Moderating Influence of Legislative Member Competence and Community Participation On Regional Budget OversightaijbmNo ratings yet

- Optimization of Production Results From Panciro Village Tempe Manufacturing Factory Using Simplex MethodDocument9 pagesOptimization of Production Results From Panciro Village Tempe Manufacturing Factory Using Simplex MethodaijbmNo ratings yet

- Empowering Women in Entrepreneurship: Unlocking Growth Potential in Rural Kenya and Urban SlumsDocument6 pagesEmpowering Women in Entrepreneurship: Unlocking Growth Potential in Rural Kenya and Urban SlumsaijbmNo ratings yet

- Analysis of Financial Performance in The FUNERAL HOME BUSINESS (Case Study On The Paraside Foundation's Business "Sky Garden")Document6 pagesAnalysis of Financial Performance in The FUNERAL HOME BUSINESS (Case Study On The Paraside Foundation's Business "Sky Garden")aijbmNo ratings yet

- A Comparative Study of The Iddah Judgments in Which There Is A Difference Between Islamic Jurisprudence and Jordanian Personal Status LawDocument4 pagesA Comparative Study of The Iddah Judgments in Which There Is A Difference Between Islamic Jurisprudence and Jordanian Personal Status LawaijbmNo ratings yet

- Research On Purchase Behavior, Satisfaction and Loyalty of Fast Food RestaurantDocument9 pagesResearch On Purchase Behavior, Satisfaction and Loyalty of Fast Food RestaurantaijbmNo ratings yet

- The Impact of Intangible Assets On Financial Policy With Assets Size and Leverage As Control VariablesDocument7 pagesThe Impact of Intangible Assets On Financial Policy With Assets Size and Leverage As Control VariablesaijbmNo ratings yet

- Effect of Capital Structure, Liquidity, and Profitability On Financial Distress With The Effectiveness of The Audit Committee As Variable ModerateDocument20 pagesEffect of Capital Structure, Liquidity, and Profitability On Financial Distress With The Effectiveness of The Audit Committee As Variable ModerateaijbmNo ratings yet

- Physiotherapist'S Task Performance:The Impact of Empowering Leadership, Work Engagement, and ProfessionalismDocument14 pagesPhysiotherapist'S Task Performance:The Impact of Empowering Leadership, Work Engagement, and ProfessionalismaijbmNo ratings yet

- Factors Affecting The Realization of Blud Capital Expenditure (Case Study at Lamongan Regencyhealth Center 2018-2020)Document17 pagesFactors Affecting The Realization of Blud Capital Expenditure (Case Study at Lamongan Regencyhealth Center 2018-2020)aijbmNo ratings yet

- Tracer Study of Public Administration Students: Glenn Velmonte JD, PH.DDocument6 pagesTracer Study of Public Administration Students: Glenn Velmonte JD, PH.DaijbmNo ratings yet

- Nudging in Changing Employee Behavior: A Novel Approach in Organizational TransformationDocument8 pagesNudging in Changing Employee Behavior: A Novel Approach in Organizational TransformationaijbmNo ratings yet

- Drajat Sunaryadi, Amiartuti Kusmaningtyas, Riyadi Nugroho: American International Journal of Business Management (AIJBM)Document8 pagesDrajat Sunaryadi, Amiartuti Kusmaningtyas, Riyadi Nugroho: American International Journal of Business Management (AIJBM)aijbmNo ratings yet

- N 54123137Document15 pagesN 54123137aijbmNo ratings yet

- The Impact of Strategic Thinking On The Performance of Industrial Companies Listed On The Amman Stock ExchangeDocument21 pagesThe Impact of Strategic Thinking On The Performance of Industrial Companies Listed On The Amman Stock ExchangeaijbmNo ratings yet

- Firdaus Tubagus, Wiwiekmardawiyahdaryanto: American International Journal of Business Management (Aijbm)Document18 pagesFirdaus Tubagus, Wiwiekmardawiyahdaryanto: American International Journal of Business Management (Aijbm)aijbmNo ratings yet

- Book Value Assets Total Unsecured Realizable ValueDocument9 pagesBook Value Assets Total Unsecured Realizable ValueJPNo ratings yet

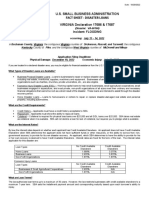

- U.S. Small Business Administration Fact Sheet - Disaster LoansDocument2 pagesU.S. Small Business Administration Fact Sheet - Disaster LoansNews 5 WCYBNo ratings yet

- 3 C's of CreditDocument45 pages3 C's of Creditsushant1903No ratings yet

- MoaeDocument8 pagesMoaerahulNo ratings yet

- HVS - U.S. Hotel Development Cost Survey 201415Document12 pagesHVS - U.S. Hotel Development Cost Survey 201415Jose Miguel GonzalezNo ratings yet

- FRIA LAW Purpose and NatureDocument6 pagesFRIA LAW Purpose and NatureAnneNo ratings yet

- Lanao Del Norte Electric Cooperatice v. Government of Lanao Del NorteDocument9 pagesLanao Del Norte Electric Cooperatice v. Government of Lanao Del NorteCarla DomingoNo ratings yet

- Ross. Westerfield. Jaffe. Jordan Chapter 30 TestDocument12 pagesRoss. Westerfield. Jaffe. Jordan Chapter 30 TestLrac Olegna Arevir0% (1)

- Sample Hardship LettersDocument7 pagesSample Hardship LettersTodd Temaat100% (2)

- Questions Oblicon - ValenciaDocument8 pagesQuestions Oblicon - ValenciaFaith Imee RobleNo ratings yet

- Judgment Against BPTP LimitedDocument27 pagesJudgment Against BPTP LimitedSUKHBIR YADAV ADVNo ratings yet

- Assign 2 CLO 3Document3 pagesAssign 2 CLO 3DIVA RTHININo ratings yet

- Mortgage CalculatorDocument13 pagesMortgage CalculatorDaniilKharmsNo ratings yet

- FIN 3331 Critical Thinking AssignmentDocument3 pagesFIN 3331 Critical Thinking AssignmentHelen Joan BuiNo ratings yet

- Commercial Court 2016 65Document31 pagesCommercial Court 2016 65Mwesigwa DaniNo ratings yet

- MATH AssignmentDocument24 pagesMATH AssignmentVernon NgNo ratings yet

- When A Steel Company Goes Bankrupt, Other Companies in The Same Industry Benefit Because They Have One Less Competitor. But When A Bank Goes Bankrupt Other Banks Do Not Necessarily Benefit.Document5 pagesWhen A Steel Company Goes Bankrupt, Other Companies in The Same Industry Benefit Because They Have One Less Competitor. But When A Bank Goes Bankrupt Other Banks Do Not Necessarily Benefit.alka murarka100% (3)

- Orris Aster CourtDocument10 pagesOrris Aster CourtGreen Realtech Projects Pvt LtdNo ratings yet

- Homeowners Savings and Loan Bank Vs DailoDocument1 pageHomeowners Savings and Loan Bank Vs DailoCarlota Nicolas VillaromanNo ratings yet

- Jaime v. SalvadorDocument25 pagesJaime v. SalvadorKaren Ryl Lozada BritoNo ratings yet

- Aayansh Finance - Quick Loans Services Provider in PuneDocument7 pagesAayansh Finance - Quick Loans Services Provider in PuneseoaayanshfinanceNo ratings yet

- Development Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Document4 pagesDevelopment Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Kimberly SendinNo ratings yet

- Credit Management of Janata Bank Limited: Internship ReportDocument57 pagesCredit Management of Janata Bank Limited: Internship ReportTareq AlamNo ratings yet

- Subdivision DevelopmentDocument118 pagesSubdivision Developmentsarah dinas100% (1)

- International Mortgages - Introducer Interest Rates 1 July 2018 (Full Doc Lo Doc)Document5 pagesInternational Mortgages - Introducer Interest Rates 1 July 2018 (Full Doc Lo Doc)Eli LiNo ratings yet

- 17 Winslow LeicesterDocument1 page17 Winslow LeicesterWendy Rotchford BurdettNo ratings yet

- Power Review Law - NewDocument17 pagesPower Review Law - NewVladimir Marquez100% (4)