Professional Documents

Culture Documents

Select Plan

Uploaded by

Luis EscobarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Select Plan

Uploaded by

Luis EscobarCopyright:

Available Formats

your return to your home country for the sole purpose of obtaining treatment for an illness or injury that

began while traveling shall void any home country coverage provided under the terms of this agreement.

For all non-U.S. citizens electing coverage “Excluding the U.S.” and for all U.S. citizens or residents, no

coverage is provided within the U.S., except for U.S. citizens or residents during an eligible incidental home

country visit or an eligible benefit period.

Except for a benefit period, coverage provided under this Master Policy is for a maximum duration of 364

days. Any extension is based upon the eligibility rules in force and is solely at our discretion.

Notwithstanding the foregoing, coverage under all plans shall terminate on the date we, at our sole option,

elect to cancel all members of the same sex, age, class or geographic location, provided we give no less

than 30 days advance written notice by mail to your last known address.

Plan Details

Overall Maximum Limit $600,000

Maximum per Injury / Illness $300,000

Deductibles (except Emergency Room) $35 per injury or illness within the Preferred Provider

Organization (PPO) network or student health center;

otherwise $70 per injury or Illness.

If treatment received outside of U.S., $35 per illness or injury.

Emergency Room Deductible (claims $200 for treatment received in an emergency room

incurred in U.S. only)

Coinsurance - Claims Incurred in the U.S.

In-Network Payment Within the PPO: We will pay 80% of the next $5,000 of

eligible expenses, after the deductible, then 100% to the

overall maximum limit

Out-Of-Network Payment Outside the PPO: Usual, reasonable, and customary. You

may be responsible for any charges exceeding the payable

amount.

Coinsurance - Claims Incurred Outside We will pay 100% of eligible expenses, after the deductible,

the U.S. up to the overall maximum limit.

Eligible expenses are subject to deductible, coinsurance, overall maximum limit,

and are per certificate period unless specifically indicated otherwise.

Benefit Limit

Hospital Room and Board Average semi-private room rate, including nursing services

Intensive Care Unit Up to the overall maximum limit

Local Ambulance Up to $750 per injury or illness, when covered illness or

injury results in hospitalization as inpatient. - not subject to

coinsurance

7 StudentSecure Select Description of Coverage | WorldTrips

Outpatient Treatment Up to the overall maximum limit

Outpatient Prescription Drugs 50% of actual charges - not subject to deductible or

coinsurance

Outpatient Physical Therapy & Up to $50 per visit per day - not subject to coinsurance

Chiropractic Care

Must be ordered in advance by a physician and not obtained

at a student health center

Sports & Activities - Leisure, Up to the overall maxium limit

Recreational, Entertainment, or Fitness

Optional Intercollegiate, Interscholastic, Up to $5,000 maximum per injury or illness, medical

Intramural, or Club Sports Rider expenses only

Mental Health Disorders (includes drug Treatment must not be provided at a student health center.

abuse and alcohol abuse)

Outpatient: Maximum of 30 visits.

Inpatient: Maximum of 30 days.

Maternity Care for a Covered Pregnancy Up to $10,000. We will pay:

Within the PPO: 80% of the next $5,000 of eligible

expenses, after the deductible, then 100% up to $10,000.

Outside the PPO: Usual, reasonable, and customary up

to $10,000. You may be responsible for any charges

exceeding the payable amount.

Outside the U.S.: 100% coinsurance, after the deductible,

up to $10,000.

Nursery Care of Newborn Up to $750 - not subject to coinsurance

Therapeutic Termination of Pregnancy Up to $500 - not subject to coinsurance

Dental Treatment due to Accident Up to $250 maximum per tooth; $500 maximum per

certificate period - not subject to coinsurance

Emergency Dental (Acute Onset of Pain) Up to $100 - not subject to deductible or coinsurance

Acute Onset of Pre-existing Condition Up to $25,000 lifetime maximum for eligible medical

(Excludes chronic and congenital expenses

conditions)

Terrorism Up to $50,000 lifetime maximum, eligible medical expenses

only.

All Other Eligible Medical Expenses Up to the overall maximum limit

Emergency Travel Benefits Limit

Emergency Medical Evacuation Up to $300,000 lifetime maximum - not subject to deductible,

coinsurance, or overall maximum limit

Repatriation of Remains Up to $50,000 lifetime maximum - not subject to deductible,

coinsurance, or overall maximum limit

Emergency Reunion Up to $5,000, subject to a maximum of 15 days - not subject

to deductible, coinsurance, or overall maximum limit

8 StudentSecure Select Description of Coverage | WorldTrips

Accidental Death & Dismemberment Lifetime Maximum - $25,000

Death - $25,000

Loss of 2 Limbs - $25,000

Loss of 1 Limb - $12,500

- not subject to deductible, coinsurance, or overall maximum

limit

Optional Accidental Death & Lifetime Maximum - $25,000

Dismemberment Rider Death - $25,000

Loss of 2 Limbs - $25,000

Loss of 1 Limb - $12,500

- not subject to deductible, coinsurance, or overall maximum

limit

Optional Crisis Response Rider- Ransom, Up to $100,000

Personal Belongings, and Crisis

- not subject to deductible, coinsurance, or overall maximum

Response Fees and Expenses

limit

Certificate Period means the period of time beginning on the date and time of the certificate effective

date and ending on the date and time of the certificate termination date, up to 364 days, after which a

new certificate period will begin.

Coinsurance means your payment of eligible expenses as specified in the Schedule of Benefits and Limits.

Deductible means the dollar amount of eligible expenses, specified in the Schedule of Benefits and Limits

that you must pay per certificate period before eligible expenses are paid.

Usual, Reasonable and Customary means the lesser of the following:

1. One and a half times (150%) of the charges payable under the United States Medicare program, for

claims incurred outside the PPO network within the U.S., or

2. Most common charge for similar services, medicines or supplies within the area in which the charge

is incurred, so long as those charges are reasonable. What is defined as usual, reasonable and

customary charges will be determined by us. In determining whether a charge is usual, reasonable

and customary, we may consider one or more of the following factors: the level of skill, extent of

training, and experience required to perform the procedure or service; the length of time required to

perform the procedure or services as compared to the length of time required to perform other

similar services; the severity or nature of the illness or injury being treated; the amount charged for

the same or comparable services, medicines or supplies in the locality; the amount charged for the

same or comparable services, medicines or supplies in other parts of the country; the cost to the

provider of providing the service, medicine or supply; such other factors we, in the reasonable

exercise of discretion, determine are appropriate.

Nothing contained in this insurance restricts or interferes with your right to select the hospital, physician

or other medical service provider of your choice. Nothing contained in this insurance restricts or interferes

with the relationship between you and the hospital, physician or other providers with respect to

9 StudentSecure Select Description of Coverage | WorldTrips

You might also like

- Isoa Hea OMPASS - 2016 - 2017 PDFDocument13 pagesIsoa Hea OMPASS - 2016 - 2017 PDFSharif M Mizanur RahmanNo ratings yet

- Studentsecure: Pursuing Your Education Outside Your Home Country?Document6 pagesStudentsecure: Pursuing Your Education Outside Your Home Country?Importaciones Zhong WenNo ratings yet

- Safe Travels Usa Cost Saver Insurance Policy DocumentDocument18 pagesSafe Travels Usa Cost Saver Insurance Policy DocumentShabana AqilNo ratings yet

- Silver: Dedicated Insurance For International StudentsDocument13 pagesSilver: Dedicated Insurance For International StudentsDoucouré HawaNo ratings yet

- Compass: Gold / SilverDocument16 pagesCompass: Gold / SilverStan SmithNo ratings yet

- Lewermark Health Insurance Copay Plan For Delta State UniversityDocument3 pagesLewermark Health Insurance Copay Plan For Delta State Universityroby sorianoNo ratings yet

- Brandeis University: World Class Coverage PlanDocument12 pagesBrandeis University: World Class Coverage Plansunil singhNo ratings yet

- Guard - Me Benefit Summary 2018Document2 pagesGuard - Me Benefit Summary 2018Luna AdonayNo ratings yet

- Heart Lum Sum Loyal 9 0029 Bro v3 FL - v3Document8 pagesHeart Lum Sum Loyal 9 0029 Bro v3 FL - v3aristides.gilNo ratings yet

- Product Fact Sheet Year 2024Document6 pagesProduct Fact Sheet Year 2024Shanis LinNo ratings yet

- Cost Saver Mummy PlanDocument4 pagesCost Saver Mummy PlanjuhilNo ratings yet

- Accident & Sickness Insurance For International Students OnDocument14 pagesAccident & Sickness Insurance For International Students OnFilipe SoaresNo ratings yet

- Ochure NaDocument9 pagesOchure NaAlex MonNo ratings yet

- TransAmerica Accident AdvanceDocument9 pagesTransAmerica Accident AdvancepreparebenefitsNo ratings yet

- CIEE Insurance CoverageDocument2 pagesCIEE Insurance CoverageMiguelNo ratings yet

- Understanding Clinical Research Course KeynotesDocument26 pagesUnderstanding Clinical Research Course KeynotesAugusto BritoNo ratings yet

- Fhpv23apr231218j7r2 Veasna UkDocument6 pagesFhpv23apr231218j7r2 Veasna UkSela SinNo ratings yet

- Aflac Hospital Indemnity - BrochureDocument4 pagesAflac Hospital Indemnity - BrochuregalaganrxNo ratings yet

- Blue Royale PlanDocument8 pagesBlue Royale PlanMikele Molina BetervoNo ratings yet

- 2022 Patriot America Plus PATAP PGTAPDocument37 pages2022 Patriot America Plus PATAP PGTAPmaNo ratings yet

- QBE PA Prestige - Brochure - 051120 - BrochureDocument10 pagesQBE PA Prestige - Brochure - 051120 - BrochureCheah Chee MunNo ratings yet

- Blue-Cross-Premier-Platinum-Extra-Dental-Vision CareerDocument8 pagesBlue-Cross-Premier-Platinum-Extra-Dental-Vision Careerapi-248930594No ratings yet

- Lawe Silver BrochureDocument6 pagesLawe Silver BrochureLavinea SmithNo ratings yet

- Patriot America Plus: Certificate of InsuranceDocument35 pagesPatriot America Plus: Certificate of InsuranceNavidadNo ratings yet

- Participant DocumentsDocument8 pagesParticipant DocumentsSergiu EniNo ratings yet

- ISO Care Unlimited Student Insurance 2019Document14 pagesISO Care Unlimited Student Insurance 2019Ivory PlatypusNo ratings yet

- Ms Out of Pocket Protection BrochureDocument4 pagesMs Out of Pocket Protection Brochureapi-425909885No ratings yet

- Benefit SummaryDocument2 pagesBenefit SummaryJ BNo ratings yet

- Supreme Health: One Solution For All Your Hospitalisation Needs, For LifeDocument11 pagesSupreme Health: One Solution For All Your Hospitalisation Needs, For LifeNorvin LewNo ratings yet

- BCBS Enrollment GuideDocument6 pagesBCBS Enrollment GuideAnonymous Lri40PrlkNo ratings yet

- 5 - 2019+Insurance+Plan+v2 PDFDocument8 pages5 - 2019+Insurance+Plan+v2 PDFalvalverdeNo ratings yet

- 2022 Patriot International Lite PATII PGTIIDocument37 pages2022 Patriot International Lite PATII PGTIIbriisabnm7No ratings yet

- Aflac Choice Hospital PlanDocument12 pagesAflac Choice Hospital PlanGrazynaNo ratings yet

- Aia Flexi PaDocument16 pagesAia Flexi PaNigel LamNo ratings yet

- Personal Accident IndemnityDocument6 pagesPersonal Accident Indemnitymillican11No ratings yet

- Benefits Package OutlineDocument5 pagesBenefits Package Outlinedavidjones.n2012No ratings yet

- Manu 3Document4 pagesManu 3Temp RoryNo ratings yet

- 2021 Patriot America Platinum PPLAI PPLGADocument39 pages2021 Patriot America Platinum PPLAI PPLGAFaiq QayyumNo ratings yet

- Perkspot Discount Program FlyerDocument2 pagesPerkspot Discount Program FlyerKay BeeNo ratings yet

- Blue Royale Brochure Full - 2023-09 (September 22)Document12 pagesBlue Royale Brochure Full - 2023-09 (September 22)Invictus InsuranceNo ratings yet

- Liaison MajesticDocument6 pagesLiaison MajesticJasonNo ratings yet

- Prepaga 2017 RB Medical Elite - Rev7Document4 pagesPrepaga 2017 RB Medical Elite - Rev7Jrac JoalNo ratings yet

- AMERICAN HEALTH SOLUTIONS CAT Office 97-2003Document7 pagesAMERICAN HEALTH SOLUTIONS CAT Office 97-2003Safe2day FinancialNo ratings yet

- World Safari Travel Insurance GuideDocument9 pagesWorld Safari Travel Insurance GuideAkash GoyalNo ratings yet

- Select Brochure Full - 2022 10 (October 01)Document12 pagesSelect Brochure Full - 2022 10 (October 01)Erl D. MelitanteNo ratings yet

- Athletics Australia: Summary of CoverDocument2 pagesAthletics Australia: Summary of Coverapi-245918180No ratings yet

- 미국 BSML Insurance - PlanDocument2 pages미국 BSML Insurance - PlanJoins 세계유학No ratings yet

- Policy - Bat323447 - 1516770465 - Jan 25 2024 21 6 50Document20 pagesPolicy - Bat323447 - 1516770465 - Jan 25 2024 21 6 50Flofie PerezNo ratings yet

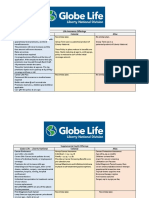

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina Hughes0% (1)

- 20230117032741premier Brochure Full - 2023-01 (January 17)Document8 pages20230117032741premier Brochure Full - 2023-01 (January 17)jadetorresNo ratings yet

- Quality Coverage When You Need It Most: Critical Illness InsuranceDocument8 pagesQuality Coverage When You Need It Most: Critical Illness InsuranceVin BitzNo ratings yet

- VIC BrochureDocument8 pagesVIC BrochureArnab AcharyaNo ratings yet

- KP - Plan Summary Medical - PPODocument3 pagesKP - Plan Summary Medical - PPOshanegbaker51No ratings yet

- 20210326092901select Brochure Full - 01 April 2021Document12 pages20210326092901select Brochure Full - 01 April 2021iqbal_anggaraNo ratings yet

- JF Elite Plus Student Insurance: General Enquiry Why Buy Insurance?Document2 pagesJF Elite Plus Student Insurance: General Enquiry Why Buy Insurance?Jayesh GoplaniNo ratings yet

- Financial Protection in Case of A Critical Illness DiagnosisDocument8 pagesFinancial Protection in Case of A Critical Illness Diagnosisaq7672No ratings yet

- San Antonio ISD Summary of Benefits: Critical Illness Protection Plan (CIPP)Document5 pagesSan Antonio ISD Summary of Benefits: Critical Illness Protection Plan (CIPP)kamila auliyaNo ratings yet

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacDocument3 pagesLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina HughesNo ratings yet

- VOLUME I Conditions of Contract and Priced Bill of QuantitiesDocument15 pagesVOLUME I Conditions of Contract and Priced Bill of QuantitieshNo ratings yet

- Joe Childs' Superintendent ContractDocument4 pagesJoe Childs' Superintendent ContractinforumdocsNo ratings yet

- Health Insurance ParentsDocument1 pageHealth Insurance ParentscagopalofficebackupNo ratings yet

- PNBMetlife Gauranteed Future PlanDocument4 pagesPNBMetlife Gauranteed Future PlanManager Pnb LucknowNo ratings yet

- (English) History of Insurance in India - Keerthi History (DownSub - Com)Document5 pages(English) History of Insurance in India - Keerthi History (DownSub - Com)Monnu montoNo ratings yet

- Benefits Amazon Enrollment InformationDocument31 pagesBenefits Amazon Enrollment InformationShira KreissNo ratings yet

- Makati Dev't Corp v. Empire Insurance Co., GR L-21780, 20 SCRA 557 (1967)Document4 pagesMakati Dev't Corp v. Empire Insurance Co., GR L-21780, 20 SCRA 557 (1967)Andrei Hans Ochoa Puno0% (1)

- INSU - Week 8 - Lopez Vs Cia de SegurosDocument2 pagesINSU - Week 8 - Lopez Vs Cia de SegurosadniNo ratings yet

- WellsFargoDocument7 pagesWellsFargosayma kandafNo ratings yet

- LICs New Group Gratuity Cash Accumulation Plan (UIN 512N281V01)Document11 pagesLICs New Group Gratuity Cash Accumulation Plan (UIN 512N281V01)Hari GopalaNo ratings yet

- Not PrecedentialDocument12 pagesNot PrecedentialScribd Government DocsNo ratings yet

- Ong Vs PCIBDocument3 pagesOng Vs PCIBGenevieve BermudoNo ratings yet

- DownloadDocument1 pageDownloadRohit JoshiNo ratings yet

- Manjeet Singh Vs National Insurance Company LTDDocument30 pagesManjeet Singh Vs National Insurance Company LTDVANSHIKA SINGHNo ratings yet

- Reliance General Insurance Company LimitedDocument8 pagesReliance General Insurance Company Limitednandhini nadarNo ratings yet

- Georgia Insurance Policy Information CardDocument2 pagesGeorgia Insurance Policy Information CardMoe EllingtonNo ratings yet

- Individual and Family Plans Made SimpleDocument16 pagesIndividual and Family Plans Made SimpleShNo ratings yet

- Transportation Law - DigestDocument41 pagesTransportation Law - DigestPJ SLSRNo ratings yet

- CS1A September22 EXAMDocument9 pagesCS1A September22 EXAMJia SNo ratings yet

- Apsun PDFDocument8 pagesApsun PDFStafford34CaldwellNo ratings yet

- Case Pan Atlantic Insurance Co - LTD v. Pine Top Insurance Co LTD 1995 15.09.41Document6 pagesCase Pan Atlantic Insurance Co - LTD v. Pine Top Insurance Co LTD 1995 15.09.41My Trần HàNo ratings yet

- MumbaiDocument162 pagesMumbaiEkta AdlakhaNo ratings yet

- Ias 37 Provisions, Contingent Liabilities and Contingent AssetsDocument41 pagesIas 37 Provisions, Contingent Liabilities and Contingent Assetsdương nguyễn vũ thùyNo ratings yet

- Pas 37 - Provisions Contingent Liab Contingent AssetsDocument18 pagesPas 37 - Provisions Contingent Liab Contingent AssetsCyril Grace Alburo BoocNo ratings yet

- Relax. We've Got You Covered.: Edelweiss Goods Carrying Vehicle Liability Only Insurance - UIN: IRDAN159P0003V01201718Document6 pagesRelax. We've Got You Covered.: Edelweiss Goods Carrying Vehicle Liability Only Insurance - UIN: IRDAN159P0003V01201718Vibha PandeyNo ratings yet

- Report 3Document19 pagesReport 3sachinkumar chalgeriNo ratings yet

- #3 Sy vs. Westmont GR 201074Document1 page#3 Sy vs. Westmont GR 201074RajkumariNo ratings yet

- Independent Contractor Agreement This Independent Contractor AgreementDocument14 pagesIndependent Contractor Agreement This Independent Contractor AgreementJohanna DuarteNo ratings yet

- 53 Lucasan Vs PDICDocument2 pages53 Lucasan Vs PDICk santosNo ratings yet

- PC Niapolicyschedulecirtificatepc 74502404Document3 pagesPC Niapolicyschedulecirtificatepc 74502404AJOONEE AUTO PARTSNo ratings yet