Professional Documents

Culture Documents

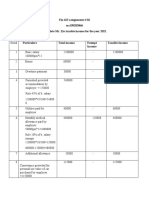

Employee Compensation Sheet - Create The Following Worksheet and Do The Following Emp. ID. Gender Employee Name Basic Salary P.M

Employee Compensation Sheet - Create The Following Worksheet and Do The Following Emp. ID. Gender Employee Name Basic Salary P.M

Uploaded by

Vishnu teja Kasi0 ratings0% found this document useful (0 votes)

9 views1 pageThe document contains an employee compensation sheet with 115 entries listing employee ID, gender, name, and basic salary. It provides instructions to calculate total gross salary, net salary, dearness allowance, house rent allowance, provident fund, conveyance allowance, and income tax for each employee based on their basic salary. The calculations are to be used to filter, sort, highlight, and analyze the employee data.

Original Description:

Original Title

Employee Compensation Sheet

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains an employee compensation sheet with 115 entries listing employee ID, gender, name, and basic salary. It provides instructions to calculate total gross salary, net salary, dearness allowance, house rent allowance, provident fund, conveyance allowance, and income tax for each employee based on their basic salary. The calculations are to be used to filter, sort, highlight, and analyze the employee data.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageEmployee Compensation Sheet - Create The Following Worksheet and Do The Following Emp. ID. Gender Employee Name Basic Salary P.M

Employee Compensation Sheet - Create The Following Worksheet and Do The Following Emp. ID. Gender Employee Name Basic Salary P.M

Uploaded by

Vishnu teja KasiThe document contains an employee compensation sheet with 115 entries listing employee ID, gender, name, and basic salary. It provides instructions to calculate total gross salary, net salary, dearness allowance, house rent allowance, provident fund, conveyance allowance, and income tax for each employee based on their basic salary. The calculations are to be used to filter, sort, highlight, and analyze the employee data.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Employee Compensation Sheet - Create the following worksheet and do the following

Emp. ID. Gender Employee Name Basic Salary p.m.

101 M Ajay Kumar 18000

102 M Sahil Kapoor 12000

103 M Neeraj Tandon 19000

104 M Naresh Gupta 19000

105 F Rita Basu 25000

106 M Vivek Kaul 24500

107 F Shubha Kumar 19500

108 M Raj Merchant 16500

109 M Krishana Kumar 19600

110 M Rajeev Arya 25500

111 M Vineet Jain 26000

112 M Anoop Handa 18700

113 M Dennis Arnum 19000

114 M Sidharth Birla 19000

115 M Jaswinder Ahuja 16800

Calculate the Total Gross Salary and Net Salary as per the following details make

assumption, if necessary):

a. Dearness Allowance is 50% of Basic Pay

b. House Rent Allowance is 35% of (Basic Pay + DA)

c. Provident Fund is deducted at 12% of (Basic Pay + DA)

d. Conveyance Allowance is paid

i) at 5% of Basic Pay to those employees who are drawing Basic Pay less

than or equal to 20000

ii) at 7.5% of Basic Pay to those employees who are drawing Basic Pay more

than 20000

e. Income Tax is deducted as per the following rules:

i) No Tax if taxable salary is less than 2 Lakh per annum

ii) 10% Tax if taxable salary is between 2 Lakh and 3 Lakh

iii) 20% Tax if taxable salary is between 3 Lakh and 4 Lakh

iv) 30% Tax if taxable salary is above 4 lakhs

f. Arrange the data according to highest net salary and then by name of the employee

g. Using Filters, extract the list of the employees:

i) Drawing maximum Net salary

ii) Drawing minimum Net salary

iii) Paying maximum tax

iv) Drawing Net salary between Rs. 20000 and Rs. 30000

v) Having “Kumar” in their names

vi) Names starting with alphabet “R”

h. Highlight the largest Basic Salary value in Red and the smallest value in blue.

i. Total and average salary for each change in Gender.

j. Given the Employee No., write a formula that yields the Dearness and Conveyance

Allowance.

You might also like

- Contract of Employment: Know All Men by These PresentsDocument5 pagesContract of Employment: Know All Men by These PresentsRose DS100% (2)

- Passing Mechanical Aptitude TestsDocument235 pagesPassing Mechanical Aptitude Testsinderjit100% (3)

- EBK and The Regulation of Engineering Profession in KenyaDocument12 pagesEBK and The Regulation of Engineering Profession in KenyaCharles Ondieki50% (4)

- CASE STUDY SHRMDocument4 pagesCASE STUDY SHRMAshita Singla100% (2)

- Unemployment QuestionnaireDocument4 pagesUnemployment QuestionnaireAnonymous 2gGScOaS7100% (6)

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- 75 Questions Test - SolutionDocument65 pages75 Questions Test - SolutionCute BabiesNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Roshan BSLDocument7 pagesRoshan BSLroshan satpathyNo ratings yet

- 3.tax Free PDFDocument3 pages3.tax Free PDFArun ShettarNo ratings yet

- Taxation Assignment No 1Document8 pagesTaxation Assignment No 1Ha MimNo ratings yet

- Income From Salaries - ProblemsDocument25 pagesIncome From Salaries - ProblemsAbishek SharmaNo ratings yet

- Income TaxDocument4 pagesIncome TaxsebastianksNo ratings yet

- Final QuizDocument5 pagesFinal Quizanamika prasadNo ratings yet

- HRA Sums.Document4 pagesHRA Sums.Saranya kandhasamyNo ratings yet

- ABM-numerical With Solutions by Neeraj AgnihotriDocument23 pagesABM-numerical With Solutions by Neeraj AgnihotriMuralidhar Goli100% (5)

- ACCOUNTANCY - II MID - Quastion PaperDocument6 pagesACCOUNTANCY - II MID - Quastion PaperveenaNo ratings yet

- Unit 3Document10 pagesUnit 3Swathi ShanmuganathanNo ratings yet

- Questions & Answers - Salary IncomeDocument14 pagesQuestions & Answers - Salary IncomeKiran BendeNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Income Tax Test 2020-21Document6 pagesIncome Tax Test 2020-21Arihant DagaNo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- Partnership AppDocument22 pagesPartnership AppPeter AkramNo ratings yet

- Fin - 623 Assignment 2Document5 pagesFin - 623 Assignment 2Abdussalam gillNo ratings yet

- Remidial Assignment B.tech - Bbs n'22Document9 pagesRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriNo ratings yet

- Duration: 1 Hour Max. Marks: 20Document2 pagesDuration: 1 Hour Max. Marks: 20Khushi TanejaNo ratings yet

- Nested If AssignmentDocument20 pagesNested If AssignmentSAMRAT CHOWDHURYNo ratings yet

- B - Com - Tally I Sem Exam Set 3Document2 pagesB - Com - Tally I Sem Exam Set 3Vikas100% (1)

- SALARYDocument43 pagesSALARYDrishtiNo ratings yet

- Particulars Amount Exemption Net AmountDocument29 pagesParticulars Amount Exemption Net AmountDead Beat's RandomNo ratings yet

- Tax Management ModelDocument17 pagesTax Management ModelZacharia VincentNo ratings yet

- Duration: 1 Hour Max. Marks: 20: Admin@Document2 pagesDuration: 1 Hour Max. Marks: 20: Admin@Narsingh Das AgarwalNo ratings yet

- Tally AssingmentDocument19 pagesTally AssingmentTaranNo ratings yet

- Rekap Gaji Bulan Oktober: NIK Nama Jabatan Gaji Pokok Tunjangan Total GajiDocument4 pagesRekap Gaji Bulan Oktober: NIK Nama Jabatan Gaji Pokok Tunjangan Total GajiDiah SyawaliaNo ratings yet

- Question No 1 TallyDocument2 pagesQuestion No 1 TallyAnjali Singh50% (2)

- Business Plan FinalDocument6 pagesBusiness Plan FinalJina PhukanNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Unit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Document5 pagesUnit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singh100% (1)

- No Name Salary Zone Age Grade DeptDocument3 pagesNo Name Salary Zone Age Grade DeptSonali DasNo ratings yet

- Mega Test PDFDocument73 pagesMega Test PDFFalak HanifNo ratings yet

- Test29th AugustDocument2 pagesTest29th Augustemraan_aazamNo ratings yet

- 56 Income Tax I Repeaters 2014 15 OnwardDocument7 pages56 Income Tax I Repeaters 2014 15 OnwardDivyasree DsNo ratings yet

- Taxation - MAR 2021Document2 pagesTaxation - MAR 2021hemanNo ratings yet

- Tally Question PaperDocument2 pagesTally Question PaperRAAGHAV GUPTANo ratings yet

- Budgetary Control AssignmentDocument4 pagesBudgetary Control AssignmentYash AggarwalNo ratings yet

- Tally TestDocument2 pagesTally TestHK DuggalNo ratings yet

- RA - M16UCM12 - B.Com. - 24.03.2021 - FNDocument4 pagesRA - M16UCM12 - B.Com. - 24.03.2021 - FNkavinilavan14072004No ratings yet

- B4 Voucher 4 (9.4.2024)Document2 pagesB4 Voucher 4 (9.4.2024)vihanjangid223No ratings yet

- Q.P. Voc-I Direct TaxDocument4 pagesQ.P. Voc-I Direct TaxNitin DhawleNo ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- Management Accounting PAPERDocument7 pagesManagement Accounting PAPERtemailggNo ratings yet

- Basic Accounting NotesDocument17 pagesBasic Accounting NotesAdilrabia rslNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- 16UCO5MC03Document4 pages16UCO5MC03Ñìkíl G KårølNo ratings yet

- Taxable Salary Problem With Solution Part 1Document2 pagesTaxable Salary Problem With Solution Part 1NagadeepaNo ratings yet

- Tally With GSTDocument2 pagesTally With GSTRishikaNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Set 1 & 3 PDFDocument6 pagesSet 1 & 3 PDFCorona VirusNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- Assessment of Salaried Individual Person TY 2023Document61 pagesAssessment of Salaried Individual Person TY 2023abdullah80203062No ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- Adam Borne Resume-Rv 2017Document2 pagesAdam Borne Resume-Rv 2017api-353825790No ratings yet

- Payroll System SIADocument51 pagesPayroll System SIAChristine Dao-angNo ratings yet

- Career MGMTDocument109 pagesCareer MGMTshan4600No ratings yet

- Chapter 1 Introduction HRMDocument19 pagesChapter 1 Introduction HRMjankevinmendezNo ratings yet

- Iuac 2Document1 pageIuac 2Dhilipan GunaNo ratings yet

- Area II FacultyDocument35 pagesArea II FacultyDennis Esik MaligayaNo ratings yet

- Sons of Divine Providence Internal Staff Regulations December Nairobi Presentation of The Sons of Divine ProvidenceDocument12 pagesSons of Divine Providence Internal Staff Regulations December Nairobi Presentation of The Sons of Divine ProvidencestuffkibaoNo ratings yet

- United Technologies Corporation - Corporate PrinciplesDocument1 pageUnited Technologies Corporation - Corporate Principlesjaelle moNo ratings yet

- Carter Principles2Document6 pagesCarter Principles2ddum292No ratings yet

- Short Notes Mgt211Document38 pagesShort Notes Mgt211mankhokharNo ratings yet

- Intervivew City - Interview Date - Joining City (India/Abroad Joining Within 3 Months Only) - Department (Functional Area)Document3 pagesIntervivew City - Interview Date - Joining City (India/Abroad Joining Within 3 Months Only) - Department (Functional Area)Thaveswaran ANo ratings yet

- Noe 4th Ed Chap005Document39 pagesNoe 4th Ed Chap005vikram622No ratings yet

- Atmanirbhar Bharat Rojgar YojanaDocument7 pagesAtmanirbhar Bharat Rojgar YojanaAnusree RoyNo ratings yet

- Job Design, & Job Analysis-2Document33 pagesJob Design, & Job Analysis-2AlishaNo ratings yet

- IndiGo Offer LetterDocument4 pagesIndiGo Offer Letterpidola6206No ratings yet

- Madison M Blain Resume 1Document1 pageMadison M Blain Resume 1Madison BlainNo ratings yet

- International General Certificate: Reference Information Provided, in Particular Web Links, Was Correct As of 03/04/17Document23 pagesInternational General Certificate: Reference Information Provided, in Particular Web Links, Was Correct As of 03/04/17Satyadip TeraiyaNo ratings yet

- Introduction To Management: History of Management ThoughtDocument41 pagesIntroduction To Management: History of Management ThoughtRahma Mutiara JeyhanNo ratings yet

- Chapter 1 - The Nature of Human Resource Management: ANSWER: FalseDocument14 pagesChapter 1 - The Nature of Human Resource Management: ANSWER: FalseShailene DavidNo ratings yet

- Retirement BenefitsDocument9 pagesRetirement BenefitsSaptarshi PalNo ratings yet

- Emergency Action Plan: Active Shooter: Organization: Address: City, State, Zipcode: Phone Number: WebsiteDocument10 pagesEmergency Action Plan: Active Shooter: Organization: Address: City, State, Zipcode: Phone Number: WebsiteGet Ready Group100% (2)

- Perceived Organisational Support - An Overview OnDocument14 pagesPerceived Organisational Support - An Overview OnJayasree KrishnanNo ratings yet

- Computer Application ExcelDocument1 pageComputer Application ExcelAmirah NatasyaNo ratings yet

- Airlines Personnel Management Information System: Bestlink College of The PhilippinesDocument62 pagesAirlines Personnel Management Information System: Bestlink College of The PhilippinesLian Emerald SmithNo ratings yet

- 4 - Code of EthicsDocument96 pages4 - Code of EthicsMark Angelo VarillaNo ratings yet