Professional Documents

Culture Documents

Tata Power-DDL Commnets On Real Time Markets 31 08 2018

Tata Power-DDL Commnets On Real Time Markets 31 08 2018

Uploaded by

Harry Edward0 ratings0% found this document useful (0 votes)

11 views4 pagesTPDDL REAL-TIME MARKET

Original Title

14. Tata Power-DDL commnets on Real Time Markets 31 08 2018

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTPDDL REAL-TIME MARKET

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views4 pagesTata Power-DDL Commnets On Real Time Markets 31 08 2018

Tata Power-DDL Commnets On Real Time Markets 31 08 2018

Uploaded by

Harry EdwardTPDDL REAL-TIME MARKET

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

cv)

TATA POWER-DDL

Tata Power DDL/PMG/CERC/31082018 Dated 31" August’ 2018

Mr. Sanoj Kumar Jha

The Secretary,

Central Electricity Regulatory Commission,

4" Floor, Chanderlok Building, 36, Janpath

Delhi - 110033

‘Subject: Discussion paper on Re-designing Real Time Electricity Markets in India.

Dear Sir,

This has reference to the public notice number No.RA-14026(11)/2/2018-CERC dated 25'*

July’ 2018 issued by Hon'ble CERC on the above captioned matter, wherein, comments and

suggestions on the subject matter were invited latest by 31st August, 2018

In line with the above, please find enclosed our comments on the subject matter as an

annexure to this letter.

Please let us know in case further clarification/ details are required on the same.

Thanking you,

Yours sincerely,

For Tata Power Delhi Distribution Limited,

‘TATA POWER DELHI DISTRIBUTION LIMITED

(Tata Power and Delhi Government Joint Venture)

Cerperat fce: NDPL House Hutson Lins Kingsvay Camp Dei 110 008

Annexure

Tata Power-DDL Comments/Suggestions on Discussion Paper on ‘Re-designing Real Time Electricity Markets in

India”

Background: From the (Draft) Discussion Paper on ‘Re-designing Real Time Electricity Markets in India it is

understood that Present Power Market Design lacks certain flexibilities for ensuring availability of power on real time

basis in a cost effective manner which is one of the reasons for volume traded under intra-day market being at a very

miniscule level of less than 19%, With the passage of time, and considering the emerging needs of large scale RE

integration, the present power Market Design in india needs to be reviewed to ensure more efficiency in real time

operations, optimal utilization of resources on a country wide basis and reduction in overall cost of power

procurement. Major limitations of the present Intra-day Power Markets have been listed below for reference:

a. The price discovery methodology of current intraday trade (Le. continuous trading based on pay as you bid

principle) is based on price matching as against the auction based price discovery in which uniform clearing

price is worked out for each time block/hour. The current intra-day methodology does not reflect the actual

cost of power being traded.

b. Currently we need at least a gap of 3 clear hours between the trading time and commencement of supply (for

example to purchase power during 20:00 to 21:00 hrs the intraday bid needs to be placed latest by 17:00

hours. This means that for 3 hours on an intraday basis, there is virtually no availability of power in short term

Market.

Bids in the present intraday market have to be placed for one complete hour. Bids cannot be placed for any

specific 15 minute block of any hour.

d. The above leads to less liquidity and flexibility in the intraday markets.

fe. Asperthe provision in Tariff Policy, 2016, beneficiaries have an option to offer its un-requisitioned generating

capacity to the respective generators at least 24 hours before 00.00 hrs of the day of dispatch. However, the

same has failed to exude much response due to uncertainty associated with day Ahead Exchange Rates and

non-availability of real time (hourly) markets.

f Current intraday Market structure is not capable enough to meet the sudden variation in demand and

schedule which has become a reality now due to the ongoing and proposed large scale integration of RE

generation. Moreaver any contingency in the form of Generation outage would lead to over-drawl from Grid

in the absence of a robust hour ahead intra-day market.

Page 1 of 3

8. Asarresult of the above and due to non-availability of real-time trading instruments, there is over dependence

on DSM / UL by the utilities and exce:

fe reliance on ancillary services for longer durations as they do not

have a choice of real time power procurement/sale.

‘Tata Power-DDL point wise submissions on the subject have been appended below:

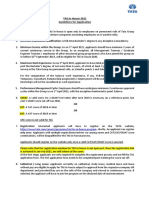

Tata Power-DDL welcomes the Proposed Real-time Market (RTM) design as provided in the subject discussion paper

as mentioned below:

RTM Auction | RTM Auction End | RTM Clearing Interval | Communication with | Delivery Period

Start Time Time RLDC/SLOC and {Delivery on the

Schedule Preparation Same

Day, MCP and

MCV will be

discovered for

each 15 minute

block)

22:30 Hrs 23:00 Hrs 23:00 Hrs—23:30 Hrs | 23:30 Hrs —24:00 Hrs (00:00:00 -

(of the previous | (of the previous _| (of the previous day) 01:00:00,

day) day)

23:30 His 00:00 Hrs (00:00 Hrs -00:30 Hrs | 00:30 Hrs—01:00 Hrs E

of the previous | (of the delivery 02:00:00

day) day)

07:30 Hrs (08:00 Hrs 08:00 Hrs -08:30 Hrs) | 08:30 Hrs — 08:00 Hrs (09:00:00 —

10:00:00

20H 22:00Hrs 22:00 Hrs —22:30Hrs | 22:30 Hrs — 23:00 Hrs 23:00:00—

00:00:00

‘The above changes in the power market design would bring the following benefi

a. The price discovery would be based on double sided closed auctions with uniform market clearing price.

The same would result into more transparent and efficient (hourly/block wise) price discovery in power

exchange and rates so discovered would be a reflection of real time demand supply situation.

b. The real time market shall be conducted once in every hour for delivery in four fifteen minute blocks in each

hour. Such faster transaction/settlement would give an opportunity to the Discoms to vary their schedules

in line with actual operating conditions and meet the real time demand in a more efficient manner rather

than depending heavily on DSM/UI and Ancillary services as being done in the present case.

Page 2 0f3

c. The same would definitely bring more capacity vying for getting dispatched in the open market, thereby

resulting into reduction in intraday prices and providing growth to the economy as power would be

available at cheaper rates.

d. Intraday block wise contracts would be financially binding and the same would bring more discipline in the

power markets.

. As the buyers and sellers would have an option of buy/sell power close to real time, this hourly intraday

auction market will help in handling variations of renewable energy generation in the system,

Tata Power-DDL queries/suggestions:

1, The provision of Gate closure being proposed to be introduced needs to be explained in detail from the

perspective of State Discoms. Even today for any sale bid being placed on power exchange bya State Discom

on a day ahead basis the cut off time is 12:00 hours of the current day and once the Sale or purchase

obligation is firmed up by the exchange, there is no provision for revision of such sale or purchase quantum.

In other words, any day sale/purchase bid being placed by a State Discoms is already a firm and binding

contract with no schedule revision permitted by the seller/buyer. In this context how the provision of Gate

closure is going to impact the State Discoms/utilities needs further explanation.

2. Aroad map needs to be worked out to specify the detailed operating procedures regarding as to how the

real time co-ordination between different agencies like RLDC, SLDC, NLDC, Buyers/sellers and Power

Exchanges would take place for clearing an approval of real time transactions.

3. Apart from the proposed changes in the Real Time Market Design, a detailed mechanism is also required to

be specified wher

Discoms are allowed to sell their surplus power directly from the Generators bus

without sharing any revenue with the generator on account of such sale of surplus power. if such sale is

executed, on an advance basis, within a certain predefined time frame, then in such case, PoC transmission

charges to the extent of quantum less withdrawn ( against its LTA) by the Discoms should also be adjusted

in the monthly long term transmission charges bill of such Discom. it will also result into increased liquidity

of low cost surplus power in open market.

Page 3 of |

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- W01 (P-101) - Work Instructions and Operating Guideline - Rev02 - 28052021Document59 pagesW01 (P-101) - Work Instructions and Operating Guideline - Rev02 - 28052021Harry EdwardNo ratings yet

- TQM & Daily Work ManagementDocument31 pagesTQM & Daily Work ManagementHarry EdwardNo ratings yet

- TAS In-House 2021 Guidelines For ApplicationDocument1 pageTAS In-House 2021 Guidelines For ApplicationHarry EdwardNo ratings yet

- Meter Removal Form: TP-DDLDocument3 pagesMeter Removal Form: TP-DDLHarry EdwardNo ratings yet

- CAT 2021 Slot 2Document53 pagesCAT 2021 Slot 2Harry EdwardNo ratings yet

- Coordinate GeometryDocument1 pageCoordinate GeometryHarry EdwardNo ratings yet

- Data Power Delhi Distribution Limited: Tatapower-DdlDocument38 pagesData Power Delhi Distribution Limited: Tatapower-DdlHarry EdwardNo ratings yet

- Battery Energy Storage System: Online Training ProgramDocument2 pagesBattery Energy Storage System: Online Training ProgramHarry EdwardNo ratings yet

- Glossary of Abbreviations: Future Ready For Smart ChoicesDocument3 pagesGlossary of Abbreviations: Future Ready For Smart ChoicesHarry EdwardNo ratings yet

- Partnership To Advance Clean Energy - Deployment (PACE-D) Technical Assistance ProgramDocument3 pagesPartnership To Advance Clean Energy - Deployment (PACE-D) Technical Assistance ProgramHarry EdwardNo ratings yet

- FMS Case - Tata Power Delhi Distribution - Automation Vs - ManPowerDocument17 pagesFMS Case - Tata Power Delhi Distribution - Automation Vs - ManPowerHarry EdwardNo ratings yet