Professional Documents

Culture Documents

For The Petitioner. For The Respondent

Uploaded by

911 Support0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

2022_140_taxmann_com_463_Delhi_19_07_2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesFor The Petitioner. For The Respondent

Uploaded by

911 SupportCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

[2022]

140 taxmann.com 463 (Delhi)[19-07-2022]

INCOME TAX : HC quashes order u/s 148A(d) as AO

had wrongly concluded that LTCG from property sale

was not disclosed in ITR

• While passing the impugned order under Section

148A(d) of the Act, the Assessing Officer has wrongly

concluded that the assessee had not disclosed the sale of

the property and long term capital gain in the ITR filed or

was accepted by the Assessing Officer. Keeping in view

the aforesaid, the impugned order and notice dated 30th

June, 2022 issued under Section 148A(d)/148 of the Act

are set aside and the matter is remanded back to the

Assessing Officer for fresh consideration in accordance

with law within four weeks.

■■■

[2022] 140 taxmann.com 463 (Delhi)

HIGH COURT OF DELHI

Seema Gupta

v.

Income Tax Officer, Ward 70(1)

MANMOHAN AND MS. MANMEET PRITAM SINGH ARORA, JJ.

W.P.(C) 10740 OF 2022

JULY 19, 2022

Ruchesh Sinha, Adv. for the Petitioner. Ruchir Bhatia,

Standing Counsel for the Respondent.

ORDER

C.M.No.31175/2022

1. Exemption allowed, subject to all just exceptions.

2. Accordingly, the application stands disposed of.

W.P.(C) No.10740/2022 & C.M.No.31174/2022

3. Present writ petition has been filed challenging the order

dated 30th June, 2022 passed under Section 148A(d) of the

Income Tax Act, 1961 (hereinafter referred to as the 'Act') and

the consequential notice dated 30th June, 2022 issued under

Section 148 of the Act for the Assessment Year 2013-14.

4. Learned counsel for the petitioner submits that the

reassessment proceeding in the case of the petitioner is clearly a

case of 'change of opinion'. In support of his submission, he

draws this Court's attention to the original assessment

proceedings, which culminated in an order under Sections 143(3)

and 154 of the Act.

5. A perusal of the paper book reveals that the issue which is

sought to be reopened in the proceeding under Section 148 of the

Act had been discussed, deliberated and verified by the Assessing

Officer at the time of original assessment proceedings. It seems

that the Assessing Officer had applied its mind and then passed

the assessment order in favour of the petitioner.

6. However, while passing the impugned order under Section

148A(d) of the Act, the Assessing Officer has wrongly concluded

that the assessee had not disclosed the sale of the property and

long term capital gain in the ITR filed or was accepted by the

Assessing Officer.

7. Keeping in view the aforesaid, the impugned order and notice

dated 30th June, 2022 issued under Section 148A(d)/148 of the

Act are set aside and the matter is remanded back to the

Assessing Officer for fresh consideration in accordance with law

within four weeks.

8. Accordingly, the present writ petition along with pending

application stands disposed of.

■■

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- President Donald Trump's 1776 Commission - Final ReportDocument45 pagesPresident Donald Trump's 1776 Commission - Final Reportcharliespiering98% (140)

- Erie Doctrine Flow ChartDocument1 pageErie Doctrine Flow Chartdmt320100% (2)

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats91% (11)

- Assignment No. 5 - Case Digest - Legal CounselingDocument10 pagesAssignment No. 5 - Case Digest - Legal CounselingglennNo ratings yet

- Criminal Law ProjectDocument14 pagesCriminal Law ProjectParth TiwariNo ratings yet

- Nueva Ecija II Electric Cooperative Inc.20220913-11-H8h0weDocument3 pagesNueva Ecija II Electric Cooperative Inc.20220913-11-H8h0weReynaldo GasparNo ratings yet

- Kusum Gupta v. ITO (Delhi HC)Document6 pagesKusum Gupta v. ITO (Delhi HC)Avar LambaNo ratings yet

- 1684303940-ITA No.1070-D-2022 - Havells India LTDDocument5 pages1684303940-ITA No.1070-D-2022 - Havells India LTDArulnidhi Ramanathan SeshanNo ratings yet

- (Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)Document6 pages(Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)rigiyanNo ratings yet

- JH Foøe Flag KnoDocument12 pagesJH Foøe Flag KnoLatha VenugopalNo ratings yet

- Rajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsDocument10 pagesRajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsSubramanyam SettyNo ratings yet

- 03 WP GST - Ipsum - v2Document47 pages03 WP GST - Ipsum - v2noorensaba01100% (1)

- PJD Regency (CA) - (2019) MLJU 2067Document10 pagesPJD Regency (CA) - (2019) MLJU 2067hzx2495971147No ratings yet

- Ap Shuhada Anor V Ah Design Comm (Sessions Appeal) - Appeal +@001Document8 pagesAp Shuhada Anor V Ah Design Comm (Sessions Appeal) - Appeal +@001MCSNo ratings yet

- Law On Physical Verification Under CGSTDocument4 pagesLaw On Physical Verification Under CGSTteamNo ratings yet

- Sanjay Kashinath Nanoskar: 53-WP-3058.2022Document6 pagesSanjay Kashinath Nanoskar: 53-WP-3058.2022Bhanushree JainNo ratings yet

- 2020 P T D Trib 614Document8 pages2020 P T D Trib 614haseeb AhsanNo ratings yet

- DCIT Vs Force Motors Limited ITAT PuneDocument11 pagesDCIT Vs Force Motors Limited ITAT PuneNIMESH BHATTNo ratings yet

- (M. R. Shah and C. T. Ravikumar, JJ.) : by The Supreme Court) M. Venkatesh & Ors. VDocument6 pages(M. R. Shah and C. T. Ravikumar, JJ.) : by The Supreme Court) M. Venkatesh & Ors. VRAJAGOPAL VASUDEVANNo ratings yet

- Jurisprudence Insurance Law 2021-4Document11 pagesJurisprudence Insurance Law 2021-4dyosaNo ratings yet

- STATE TAX OFFICER CaseDocument31 pagesSTATE TAX OFFICER Casedevanshi jainNo ratings yet

- Google Ads 439141Document56 pagesGoogle Ads 439141aishwary thakurNo ratings yet

- Rahul Builders Vs Arihant Fertilizers and ChemicalS071214COM58590Document5 pagesRahul Builders Vs Arihant Fertilizers and ChemicalS071214COM58590tamilNo ratings yet

- Company Appeal (AT) (Ins.) No. 727-728 of 2023Document26 pagesCompany Appeal (AT) (Ins.) No. 727-728 of 2023Surya Veer SinghNo ratings yet

- 148d 50 LAC Cost ImposedDocument36 pages148d 50 LAC Cost ImposedNeena BatlaNo ratings yet

- Bright Star Plastic Industries Vs Additional Commissioner of Sales Tax Orissa High CourtDocument8 pagesBright Star Plastic Industries Vs Additional Commissioner of Sales Tax Orissa High CourtteamNo ratings yet

- CaselawsDocument5 pagesCaselawsRam PrasadNo ratings yet

- JudgementbyjdateDocument27 pagesJudgementbyjdateBasanta Kumar SahooNo ratings yet

- Jurisprudence Insurance Law 2021-3Document11 pagesJurisprudence Insurance Law 2021-3dyosaNo ratings yet

- CP (IB) No. 13/Chd/Hry/2022Document11 pagesCP (IB) No. 13/Chd/Hry/2022NivasNo ratings yet

- 2023 150 Taxmann Com 227 Rajasthan 30 10 2018 Principal Commissioner of Income Tax VsDocument11 pages2023 150 Taxmann Com 227 Rajasthan 30 10 2018 Principal Commissioner of Income Tax VsAbhishek JainNo ratings yet

- In The High Court of Delhi at New Delhi W.P. (C) 6905/2022 & CM Appls.21038-21039/2022 and 21119/2022Document5 pagesIn The High Court of Delhi at New Delhi W.P. (C) 6905/2022 & CM Appls.21038-21039/2022 and 21119/2022AMAR GUPTANo ratings yet

- 8 - Global Fresh Products, Inc. v. CIRDocument13 pages8 - Global Fresh Products, Inc. v. CIRCarlota VillaromanNo ratings yet

- 351 of 2020Document21 pages351 of 2020prabhu pujarNo ratings yet

- Fau Presentation-1Document4 pagesFau Presentation-1Ambrose ApolinaryNo ratings yet

- Can GST Scrutiny Be There After Audit 1705059483Document5 pagesCan GST Scrutiny Be There After Audit 1705059483RajatNo ratings yet

- Gan Chee Hui - Approval Before or After SPA Void - Ang Ming LeeDocument15 pagesGan Chee Hui - Approval Before or After SPA Void - Ang Ming LeeHanenFamNo ratings yet

- Before The Commissioner Inland Revenue (Appeal-Iii) KarachiDocument6 pagesBefore The Commissioner Inland Revenue (Appeal-Iii) Karachiiqbal sheikhNo ratings yet

- Cta 2D CV 10517 R 2023may18 AssDocument14 pagesCta 2D CV 10517 R 2023may18 AssgregmanilaNo ratings yet

- Versus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeDocument7 pagesVersus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeshailjaNo ratings yet

- Qcourt: 3republic of Tbe LlbilippinesDocument10 pagesQcourt: 3republic of Tbe LlbilippinesThe Supreme Court Public Information Office100% (1)

- CasesDocument79 pagesCasesJoel MendozaNo ratings yet

- Sumit Balkrishna Guptavs Assistant Commissionerof IncomDocument3 pagesSumit Balkrishna Guptavs Assistant Commissionerof IncomjusticesharknluNo ratings yet

- Itat Audit 527487Document7 pagesItat Audit 527487Azhar SheikhNo ratings yet

- 'CL 2021 22 (1) 3Document24 pages'CL 2021 22 (1) 3aakash jainNo ratings yet

- IA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)Document6 pagesIA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)NivasNo ratings yet

- Before Shri P.M. Jagtap, AMDocument14 pagesBefore Shri P.M. Jagtap, AMPriyanka Porwal JainNo ratings yet

- Piyush Shamjibhai Vasoya Vs Union of India and OrsGJ2021230621170837110COM917632Document3 pagesPiyush Shamjibhai Vasoya Vs Union of India and OrsGJ2021230621170837110COM917632Subbu RajNo ratings yet

- In The High Court of Delhi at New Delhi % Date of Decision: 10.03.2022 W.P. (C) 6158/2021 and CM APPL. 19532/2021Document7 pagesIn The High Court of Delhi at New Delhi % Date of Decision: 10.03.2022 W.P. (C) 6158/2021 and CM APPL. 19532/2021venugopal murthyNo ratings yet

- Wa-25-380-12 (2019) - Asiaspace SDN BHD V Ketua Pengrah Kastam Dan EksaisDocument14 pagesWa-25-380-12 (2019) - Asiaspace SDN BHD V Ketua Pengrah Kastam Dan EksaisCheng LeongNo ratings yet

- Maruti Suzuki India LTD 0Document97 pagesMaruti Suzuki India LTD 0AMAN KUMAR 20213009No ratings yet

- (Anil Choudhary) Member (Judicial) : (Order Dictated in The Open Court)Document2 pages(Anil Choudhary) Member (Judicial) : (Order Dictated in The Open Court)Akash chandoraNo ratings yet

- (2022) 141 Taxmann - Com 207 (Karnataka) - (2022) 64 GSTL 66 (Karnataka) (28-01-2022) Shree Renuka Sugars Ltd. vs. Joint Commissioner of Central GST & Central ExciseDocument3 pages(2022) 141 Taxmann - Com 207 (Karnataka) - (2022) 64 GSTL 66 (Karnataka) (28-01-2022) Shree Renuka Sugars Ltd. vs. Joint Commissioner of Central GST & Central Exciseprathmesh agrawalNo ratings yet

- 2022 134 Taxmann Com 214 Madras 2022 285 Taxman 141 Madras 22 10 2021Document8 pages2022 134 Taxmann Com 214 Madras 2022 285 Taxman 141 Madras 22 10 2021diksha chouhanNo ratings yet

- IGST Refund Claim Cannot Be Withheld When ITC Towards Purchase From Risky Supplier Had Already Been Reversed - Taxguru - inDocument6 pagesIGST Refund Claim Cannot Be Withheld When ITC Towards Purchase From Risky Supplier Had Already Been Reversed - Taxguru - inIrfan ShaikhNo ratings yet

- Skyline Pipes para WiseDocument4 pagesSkyline Pipes para WiseAjay SinghNo ratings yet

- Tax Audit G.R. No. 172045-46, June 16, 2009 FANDocument25 pagesTax Audit G.R. No. 172045-46, June 16, 2009 FANQuinciano MorilloNo ratings yet

- Northern Tobacco Redrying Co., Inc. v. Commissioner of Internal RevenueDocument21 pagesNorthern Tobacco Redrying Co., Inc. v. Commissioner of Internal RevenueVince Lupango (imistervince)No ratings yet

- No Itc Reversal Demand W o Investigating Supplier DB Calhc 1690968957Document10 pagesNo Itc Reversal Demand W o Investigating Supplier DB Calhc 1690968957Dhanashree Prasanna Phadke ValanjooNo ratings yet

- 918 Unibros V All India Radio 19 Oct 2023 514762Document8 pages918 Unibros V All India Radio 19 Oct 2023 514762Saurav AnandNo ratings yet

- Cta 2D CV 10240 M 2021mar01 AssDocument8 pagesCta 2D CV 10240 M 2021mar01 AssFirenze PHNo ratings yet

- Case Law Relating To Section 153C of Income Tax ActDocument3 pagesCase Law Relating To Section 153C of Income Tax Actyegawo4725No ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Service Bulletin: © Honeywell International Inc. Do Not Copy Without Express Permission of HoneywellDocument29 pagesService Bulletin: © Honeywell International Inc. Do Not Copy Without Express Permission of HoneywellJuan Ruben GarciaNo ratings yet

- Belgica vs. Ochoa Case DigestDocument2 pagesBelgica vs. Ochoa Case DigestTynny Roo BelduaNo ratings yet

- Republic of The Philippines Province of La Union Municipality of San Juan Barangay NaguitubanDocument3 pagesRepublic of The Philippines Province of La Union Municipality of San Juan Barangay NaguitubanSundae AngenetteNo ratings yet

- Ma-Ao Sugar Central Co., Inc. vs. Court of AppealsDocument11 pagesMa-Ao Sugar Central Co., Inc. vs. Court of AppealsYeu GihNo ratings yet

- Trzaska v. L'Oreal USA Inc. Et Al. OpinionDocument15 pagesTrzaska v. L'Oreal USA Inc. Et Al. OpinionThe Fashion LawNo ratings yet

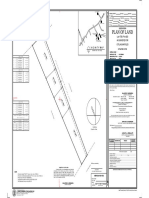

- Plan of Land: Lot 1759, Pls-823Document1 pagePlan of Land: Lot 1759, Pls-823John Rey MontemorNo ratings yet

- Pre-Trial Locus Visit Distinguished From Post Trial Locus VisitDocument2 pagesPre-Trial Locus Visit Distinguished From Post Trial Locus VisitLDC Online Resources100% (1)

- Leave EmpAttendanceReportDocument1 pageLeave EmpAttendanceReportDeepak ParmarNo ratings yet

- MR1SS5 India-ETA Cert PDFDocument2 pagesMR1SS5 India-ETA Cert PDFShantanuNo ratings yet

- Gibbs & Sterrett Mfg. Co. v. Brucker, 111 U.S. 597 (1884)Document5 pagesGibbs & Sterrett Mfg. Co. v. Brucker, 111 U.S. 597 (1884)Scribd Government DocsNo ratings yet

- Rajasthan Electricity Regulatory Commission: Petition No. RERC-1905/21 and 1933/21Document32 pagesRajasthan Electricity Regulatory Commission: Petition No. RERC-1905/21 and 1933/21bhupendra barhatNo ratings yet

- American Government Final Exam Fall 2021Document11 pagesAmerican Government Final Exam Fall 2021Lauren ColeNo ratings yet

- 2018 NAMCYA CHILDREN'S RONDALLA ENSEMBLE GuidelinesDocument3 pages2018 NAMCYA CHILDREN'S RONDALLA ENSEMBLE GuidelinesJohn Cedrick JagapeNo ratings yet

- Names and Address of Advocates-on-Record (AoR) of Supreme Court of India - As On 06/08/2012Document123 pagesNames and Address of Advocates-on-Record (AoR) of Supreme Court of India - As On 06/08/2012Shrikant Hathi86% (7)

- GC Dalton Industries vs. Equitable PCI BankDocument5 pagesGC Dalton Industries vs. Equitable PCI BankJoshua CuentoNo ratings yet

- Corporate Governance Kelompok 2Document16 pagesCorporate Governance Kelompok 2Nabillah ANo ratings yet

- Transfer Payment AgreementDocument18 pagesTransfer Payment AgreementGrant LaFlecheNo ratings yet

- Zolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Document2 pagesZolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Kunal AgarwalNo ratings yet

- Payment and Settlement Systems ActDocument7 pagesPayment and Settlement Systems ActGirish ReddyNo ratings yet

- Warm Up and StretchingDocument2 pagesWarm Up and StretchingRaffaeleSalapeteNo ratings yet

- Labour Rights and The Constitution: Law Academic Twice Winner of UCT Book PrizeDocument12 pagesLabour Rights and The Constitution: Law Academic Twice Winner of UCT Book PrizeXolani MpilaNo ratings yet

- Performance of ContractDocument6 pagesPerformance of ContractUser1No ratings yet

- Panel Ii: Reconstruction Revisited: The Supreme Court and The History of Reconstruction-And Vice-VersaDocument22 pagesPanel Ii: Reconstruction Revisited: The Supreme Court and The History of Reconstruction-And Vice-VersassaramailNo ratings yet

- Datar Switchgears LTD V Tata Finance LTDDocument4 pagesDatar Switchgears LTD V Tata Finance LTDSaideep SmileNo ratings yet

- Jammu/Srinagar: Finance Department (Codes Division) Civil SecretariatDocument2 pagesJammu/Srinagar: Finance Department (Codes Division) Civil SecretariatVishal ChoudharyNo ratings yet

- University of Health Sciences, Lahore: Admission Form ForDocument2 pagesUniversity of Health Sciences, Lahore: Admission Form ForZahid SarfrazNo ratings yet