Professional Documents

Culture Documents

Mid-Day Market Pulse 220103

Uploaded by

maradona ligaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mid-Day Market Pulse 220103

Uploaded by

maradona ligaCopyright:

Available Formats

Market Pulse| Indonesia

Sekuritas

03 Jan 2022

Trading Ideas

Research Team ● (62) 21-2970 9431 ● research-mailbox@ocbcsekuritas.com

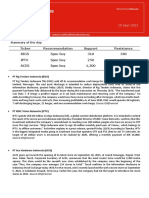

Summary of the day

Ticker Recommendation Support Resistance

ACES Spec buy 1,300 1,450

MDKA Trading buy 3,900 4,100

INDY Spec buy 1,400 1,550

• Ace Hardware Indonesia Tbk (ACES)

ACES opens 4 new stores in December 2021.So that the total opening of new ACE stores in 2021 is 13 stores with a

total of 216 stores currently throughout Indonesia.Yoelius Saputra, General Manager Marketing of PT ACE

Hardware Indonesia, Tbk said, "With the opening of 4 stores at the end of 2021, it shows ACE's commitment to

providing the best service and getting closer to customers, so that the needs for household and lifestyle equipment

can be fulfilled and easier to get.”Source: IDNFinancial

• Merdeka Copper Gold Tbk (MDKA)

MDKA plans to take over 50.1% of PT Andalan Bersama Investama (ABI) for IDR 1.14 trillion, equal to USD 80.2

million.ABI is an investment company related to MDKA, as confirmed by Adi Adriansyah Sjoekri, Corporate Secretary

of MDKA, in the information disclosure in Indonesia Stock Exchange (IDX). The affiliation is formed through the

same shareholder of ABI and MDKA. After this takeover, MDKA would gain 50.1% of ABI’s shares. The acquisition

would be finalised after ABI issued new shares. Source: IDNFinancial

• Indika Energy Tbk (INDY)

INDY released its Consolidated Financial Statements for the nine month period ended 30 September 2021

(9M 2021). The company recorded a core profit of US$ 83.9 million, a significant increase compared to a core loss

of US$ 5.5 million in the same period the previous year. However, the loss from discontinued operations of US$

98.1 million related to the divestment transaction of Mitrabahtera Segara Sejati (MBSS) on a 100% basis caused the

Company to record a loss attributable to owners of the parent entity of US$ 6.0 million, compared to a loss of US$

52.5 million in the 9M 2020 period. During 9M 2021, Indika Energy posted revenues of US$ 2,155.6 million, an

increase of 43.3% from US$ 1,504.1 million in the same period the previous year. The increase in revenue mainly

came from Kideco Jaya Agung (Kideco) which recorded revenue of US$1,486.1 million, an increase of 61.8% due to

higher average selling price (+39.7% YoY) and higher sales volume (+15.9% YoY). Source: IDNFinancial

ANALYST DECLARATION:

For analysts’ shareholding disclosure on individual companies, please refer to the latest reports of the

companies.

DISCLAIMER FOR RESEARCH REPORT

This report is solely for information and general circulation only and may not be published, circulated,

reproduced or distributed in whole or in part to any other person without the written consent of PT OCBC

Sekuritas Indonesia (“PTOS” or “we”). This report should not be construed as an offer or solicitation for the

subscription, purchase or sale of the securities mentioned herein or to participate in any particular trading or

investment strategy. Whilst we have taken all reasonable care to ensure that the information contained in

this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or

completeness, and you should not act on it without first independently verifying its contents. Any opinion or

estimate contained in this report is subject to change without notice. We have not given any consideration

to and we have not made any investigation of the investment objectives, financial situation or particular needs

of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability

whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any

class of persons acting on such information or opinion or estimate. You may wish to seek advice from a

financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your

investment objectives, financial situation or particular needs, before making a commitment to invest in the

securities. In the event that you choose not to seek advice from a financial adviser, you should consider

whether investment in securities and the securities mentioned herein is suitable for you. PTOS and their

respective connected and associated corporations together with their respective directors and officers may

have or take positions in the securities mentioned in this report and may also perform or seek to perform

broking and other investment or securities related services for the corporations whose securities are

mentioned in this report as well as other parties generally. There may be conflicts of interest between

Oversea-Chinese Banking Corporation Limited (“OCBC Bank”), Bank of Singapore Limited, OCBC

Investment Research Private Limited, OCBC Securities Private Limited, PTOS or other members of the

OCBC Group and any of the persons or entities mentioned in this report of which PTOS and its analyst(s)

are not aware due to OCBC Bank’s Chinese Wall arrangement.

The information provided herein may contain projections or other forward-looking statements regarding

future events or future performance of countries, assets, markets or companies. Actual events or results may

differ materially. Past performance figures are not necessarily indicative of future or likely performance.

Privileged / confidential information may be contained in this document. If you are not the addressee

indicated in this document (or responsible for delivery of this message to such person), you may not copy or

deliver this message to anyone. Opinions, conclusions and other information in this document that do not

relate to the official business of PTOS and their respective connected and associated corporations shall be

understood as neither given nor endorsed.

RATINGS AND RECOMMENDATIONS:

- PTOS’ technical comments and recommendations are short-term and trading oriented.

- PTOS’ fundamental views and ratings (BUY, HOLD, SELL) are medium-term calls within a 12-month

investment horizon.

- PTOS’ BUY rating indicates a total expected return in excess of 10% based on the current price; a HOLD

rating indicates total expected returns within +10% and -5%; a SELL rating indicates total expected returns

less than -5%.

Isfhan Helmy

Head of Research

Published by PT OCBC Sekuritas Indonesia

You might also like

- Mid-Day Market Pulse 210910Document2 pagesMid-Day Market Pulse 210910maradona ligaNo ratings yet

- Powerpack 240522Document2 pagesPowerpack 240522sibabrata chatterjeeNo ratings yet

- Keraton October 2011Document1 pageKeraton October 2011Gladys Valencia AndersonNo ratings yet

- Schroder Dana Prestasi Plus MF IDENDocument1 pageSchroder Dana Prestasi Plus MF IDENHatta WiryaNo ratings yet

- Frasers Commercial Trust: Charted TerritoryDocument2 pagesFrasers Commercial Trust: Charted TerritoryventriaNo ratings yet

- Thesis Unit Trust Management FundsDocument7 pagesThesis Unit Trust Management Fundsgjhs6kjaNo ratings yet

- 2 Federal Bank - One Pager Result Update Jan 24Document3 pages2 Federal Bank - One Pager Result Update Jan 24raghavanseshu.seshathriNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- IDirect BhartiAirtel QC Mar16Document2 pagesIDirect BhartiAirtel QC Mar16arun_algoNo ratings yet

- Firststepblue 010622Document3 pagesFirststepblue 010622boss savla VikmaniNo ratings yet

- Thesis On Mutual FundsDocument5 pagesThesis On Mutual FundsCustomThesisPapersCanada100% (2)

- Technical Report 28th March 2012Document5 pagesTechnical Report 28th March 2012Angel BrokingNo ratings yet

- Literature Review Sbi Mutual FundDocument6 pagesLiterature Review Sbi Mutual Fundxfeivdsif100% (1)

- Id IciciDocument11 pagesId IciciKhaisarKhaisarNo ratings yet

- Preserving & Growing Your Savings: The Karachi Stock ExchangeDocument2 pagesPreserving & Growing Your Savings: The Karachi Stock ExchangeAyeshaJangdaNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Investment Decision" (Icici Bank)Document78 pagesInvestment Decision" (Icici Bank)Paavan Kumar67% (3)

- Study On Changing Scenario of Investment in Financial MarketDocument81 pagesStudy On Changing Scenario of Investment in Financial Marketnitin gargNo ratings yet

- Daily Technical Report: Sensex (16913) / NIFTY (5114)Document4 pagesDaily Technical Report: Sensex (16913) / NIFTY (5114)Angel BrokingNo ratings yet

- High Conviction Technical Basket: Digital Theme: Scrip CMP Buying Range Weightage Technical RationaleDocument2 pagesHigh Conviction Technical Basket: Digital Theme: Scrip CMP Buying Range Weightage Technical RationaleAshish KudalNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaNo ratings yet

- Marudyog 20110607Document3 pagesMarudyog 20110607hemen_parekhNo ratings yet

- Capital Letter May 2011Document6 pagesCapital Letter May 2011marketingNo ratings yet

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingNo ratings yet

- Technical Report 1st February 2012Document5 pagesTechnical Report 1st February 2012Angel BrokingNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksrajdeeppawarNo ratings yet

- Technical Report 22nd March 2012Document5 pagesTechnical Report 22nd March 2012Angel BrokingNo ratings yet

- Research Thesis On Mutual FundsDocument4 pagesResearch Thesis On Mutual Fundsandreaariascoralsprings100% (2)

- Technical Report 30th March 2012Document5 pagesTechnical Report 30th March 2012Angel BrokingNo ratings yet

- Daily Technical Report, 22.07.2013Document4 pagesDaily Technical Report, 22.07.2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17033) / NIFTY (5165)Document4 pagesDaily Technical Report: Sensex (17033) / NIFTY (5165)Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Technical Report 26th March 2012Document5 pagesTechnical Report 26th March 2012Angel BrokingNo ratings yet

- Research Paper On Mutual Funds in India PDFDocument6 pagesResearch Paper On Mutual Funds in India PDFlxeikcvnd100% (1)

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Tata Steel (TISCO) : Deal Augurs Well Debt To Remain Elevated..Document2 pagesTata Steel (TISCO) : Deal Augurs Well Debt To Remain Elevated..Shiv PrakashNo ratings yet

- ICICIdirect AlokInds QC Jan2013Document1 pageICICIdirect AlokInds QC Jan2013bosudipta4796No ratings yet

- Opportunities in Times of Adversity!: Event UpdateDocument3 pagesOpportunities in Times of Adversity!: Event UpdateJanani SubramanianNo ratings yet

- Technical Report 2nd May 2012Document4 pagesTechnical Report 2nd May 2012Angel BrokingNo ratings yet

- Research Paper On Analysis of Investment DecisionDocument4 pagesResearch Paper On Analysis of Investment Decisionmgrekccnd100% (1)

- Daily Technical Report: FormationDocument5 pagesDaily Technical Report: FormationAngel BrokingNo ratings yet

- India BullsDocument131 pagesIndia BullsAkiiNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16649) / NIFTY (5050)Document4 pagesDaily Technical Report: Sensex (16649) / NIFTY (5050)Angel BrokingNo ratings yet

- Technical Report 23rd January 2012Document5 pagesTechnical Report 23rd January 2012Angel BrokingNo ratings yet

- Comparative Study of Mutual Funds and Fixed Deposit by SangramDocument32 pagesComparative Study of Mutual Funds and Fixed Deposit by SangramIrin Chhinchani100% (1)

- Technical Teport 2nd February 2012Document5 pagesTechnical Teport 2nd February 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Document4 pagesDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Monthly Call: Apollo TyresDocument4 pagesMonthly Call: Apollo TyresRajasekhar Reddy AnekalluNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Equity Research On Banking SectorDocument72 pagesEquity Research On Banking Sectorpawansup50% (2)

- State Bank of India (STABAN) : Stress Levels More Comfortable Than PeersDocument2 pagesState Bank of India (STABAN) : Stress Levels More Comfortable Than PeersvijayNo ratings yet

- Technical Report 20th July 2011Document3 pagesTechnical Report 20th July 2011Angel BrokingNo ratings yet

- Technical Report 25th January 2012Document5 pagesTechnical Report 25th January 2012Angel BrokingNo ratings yet

- Index Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortFrom EverandIndex Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortRating: 5 out of 5 stars5/5 (38)

- Stock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersFrom EverandStock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersNo ratings yet

- Private Placement and Preferential AllotmentDocument2 pagesPrivate Placement and Preferential AllotmentAparajita MarwahNo ratings yet

- Form 70 Notice of Appointment and Situation of Office or Liquidator (Winding Up by The Court)Document1 pageForm 70 Notice of Appointment and Situation of Office or Liquidator (Winding Up by The Court)olingirlNo ratings yet

- Internship Report of BankDocument41 pagesInternship Report of BankHusnain AwanNo ratings yet

- Baobab Final Admission Doc Clean No CPRDocument161 pagesBaobab Final Admission Doc Clean No CPRAbhishek Ranjan SinghNo ratings yet

- Act001 ActivityDocument7 pagesAct001 ActivitygloryfeilagoNo ratings yet

- Investor Relations: A Strategic Enabler: April 2019Document28 pagesInvestor Relations: A Strategic Enabler: April 2019Audi RamadhanNo ratings yet

- Cmpo-Hvkm N Cizn N Kvioan/V - P - N Nc-A-Ip-Dn V: S ( - P-HCN 2017 HneDocument52 pagesCmpo-Hvkm N Cizn N Kvioan/V - P - N Nc-A-Ip-Dn V: S ( - P-HCN 2017 HneshabeervmkNo ratings yet

- Corporation Law Finals Outline WMSUDocument5 pagesCorporation Law Finals Outline WMSUGayFleur Cabatit RamosNo ratings yet

- Abm 1-W6.M3.T1.L3Document21 pagesAbm 1-W6.M3.T1.L3mbiloloNo ratings yet

- Depreciation Expense - Asset A 3,900Document4 pagesDepreciation Expense - Asset A 3,900ZeeNo ratings yet

- Corporate Valuation of Saas Companies: A Case Study Of: ISM International School of Management, Paris, FranceDocument15 pagesCorporate Valuation of Saas Companies: A Case Study Of: ISM International School of Management, Paris, FranceМаксим ЧернышевNo ratings yet

- Jack Wright Case 1Document7 pagesJack Wright Case 1ehte19797177No ratings yet

- BK Stat 04 4Document2 pagesBK Stat 04 4Mentesenot AnetenhNo ratings yet

- MPRA Paper 36783Document8 pagesMPRA Paper 36783ksmuthupandian2098No ratings yet

- Using The Books Review CenterDocument31 pagesUsing The Books Review CentercarlaNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- Chapter 9 Agency Conflicts and Corporate GovernanceDocument7 pagesChapter 9 Agency Conflicts and Corporate GovernanceSwee Yi LeeNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- Investment BankingDocument64 pagesInvestment BankinganuragchogtuNo ratings yet

- Accounting Theory and Analysis Chart 16 Test BankDocument14 pagesAccounting Theory and Analysis Chart 16 Test BankSonny MaciasNo ratings yet

- Table 1. Projects Which Were Not Recognized As Assets Upon Delivery and CompletionDocument5 pagesTable 1. Projects Which Were Not Recognized As Assets Upon Delivery and CompletionbimbyboNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- Chapter 16Document28 pagesChapter 16Kevin HenricoNo ratings yet

- Voltas LTD: Strong Performance of UCP SegmentDocument10 pagesVoltas LTD: Strong Performance of UCP SegmentVipul Braj BhartiaNo ratings yet

- Financial Management - Midterm Exam: False P126,000Document3 pagesFinancial Management - Midterm Exam: False P126,000Jalyn Jalando-onNo ratings yet

- Intax ExerciseDocument26 pagesIntax ExerciseJosh CruzNo ratings yet

- Sample Paper 2023-24Document172 pagesSample Paper 2023-24shouryayadav87267% (3)

- Module 3 - Topic 2Document4 pagesModule 3 - Topic 2Moon LightNo ratings yet

- Chapter 11 - Home Office, Brance and Agency AccountingDocument23 pagesChapter 11 - Home Office, Brance and Agency AccountingMohammad Allem AlegreNo ratings yet