Professional Documents

Culture Documents

NJ PNL With Indexation

Uploaded by

Rohan DangareOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NJ PNL With Indexation

Uploaded by

Rohan DangareCopyright:

Available Formats

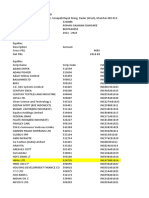

Dhananjay Patil

Profit & Loss Report Between 01-04-2021 and 31-03-2022

Your Relationship Handler

Rohan Dangare Name : Dhananjay Patil

Address : Cement Colony,J-6 Main Road,Warananagar Tal- Panhala,Dist- Kolhapur Off-Address :

Nivrutti Colony, Warananagar. Tal-Panhala, Dist-Kolhapur.PIN-416113

City : Kolhapur

City : Warana Nagar

Pincode : 416113

Pincode : 416113

E-Mail : ROHAN_DANGARE@YAHOO.COM

Phone : 02328224368

Mobile : 8888370018 Mobile : 9850578767

E-Mail : gurudhaninvestment@gmail.com

(9) (10) (11)

(8)

(4) (5) (7) Indexed Cost Capital Gain/Loss Capital Gain/Loss

(1) (2) (3) (6) Cost Inflation

Sr.No. Folio No Investor ISIN Cost Inflation Purchase Purchase of without with

Sale Amount Sale Date Sale Fin. Year Purchase Date index of

index of Sale Amount Fin. Year Purchase(#) Indexation Indexation

Purchase

(5 * 4 / 8) (1 - 5) (1 - 9)

1 Nippon India Strategic Debt Fund - Segregated Portfolio 1 - Gr Plan

Rohan

* 488175415773 Gajanan - 26.13 27-01-2022 2021-22 317.00 7.40 10-10-2017 2017-18 272.00 8.62 18.73 17.51

Dangare

Rohan

* 488175415773 Gajanan - 24.81 27-01-2022 2021-22 317.00 7.40 10-01-2019 2018-19 280.00 8.38 17.41 16.44

Dangare

Rohan

* 488175415773 Gajanan - 25.04 27-01-2022 2021-22 317.00 7.40 10-12-2018 2018-19 280.00 8.38 17.64 16.67

Dangare

Rohan

* 488175415773 Gajanan - 25.19 27-01-2022 2021-22 317.00 7.40 12-11-2018 2018-19 280.00 8.38 17.79 16.81

Dangare

Rohan

* 488175415773 Gajanan - 25.34 27-01-2022 2021-22 317.00 7.40 10-10-2018 2018-19 280.00 8.38 17.94 16.96

Dangare

Rohan

* 488175415773 Gajanan - 25.37 27-01-2022 2021-22 317.00 7.40 10-09-2018 2018-19 280.00 8.37 17.97 17.00

Dangare

Rohan

* 488175415773 Gajanan - 25.32 27-01-2022 2021-22 317.00 7.40 10-08-2018 2018-19 280.00 8.37 17.93 16.95

Dangare

Rohan

* 488175415773 Gajanan - 25.58 27-01-2022 2021-22 317.00 7.40 10-07-2018 2018-19 280.00 8.38 18.18 17.20

Dangare

Rohan

* 488175415773 Gajanan - 25.79 27-01-2022 2021-22 317.00 7.40 11-06-2018 2018-19 280.00 8.38 18.39 17.41

Dangare

Rohan

* 488175415773 Gajanan - 25.71 27-01-2022 2021-22 317.00 7.39 10-05-2018 2018-19 280.00 8.37 18.31 17.34

Dangare

Rohan

* 488175415773 Gajanan - 25.51 27-01-2022 2021-22 317.00 7.39 10-04-2018 2018-19 280.00 8.37 18.11 17.14

Dangare

Rohan

* 488175415773 Gajanan - 25.85 27-01-2022 2021-22 317.00 7.41 12-03-2018 2017-18 272.00 8.63 18.44 17.22

Dangare

Rohan

* 488175415773 Gajanan - 25.88 27-01-2022 2021-22 317.00 7.40 12-02-2018 2017-18 272.00 8.62 18.48 17.25

Dangare

Rohan

* 488175415773 Gajanan - 25.98 27-01-2022 2021-22 317.00 7.40 10-01-2018 2017-18 272.00 8.62 18.58 17.36

Dangare

Rohan

* 488175415773 Gajanan - 25.98 27-01-2022 2021-22 317.00 7.40 11-12-2017 2017-18 272.00 8.62 18.58 17.35

Dangare

Rohan

* 488175415773 Gajanan - 25.98 27-01-2022 2021-22 317.00 7.40 10-11-2017 2017-18 272.00 8.62 18.58 17.35

Dangare

Rohan

* 488175415773 Gajanan - 1.89 27-01-2022 2021-22 317.00 0.53 11-09-2017 2017-18 272.00 0.62 1.36 1.27

Dangare

Total 411.34 118.92 292.43 275.22

2 SBI Savings Fund - Gr

Rohan

* 17660555 Gajanan INF200K01636 4,955.12 24-02-2022 2021-22 317.00 3,919.68 05-01-2018 2017-18 272.00 4,568.16 1,035.43 386.96

Dangare

Rohan

* 17660555 Gajanan INF200K01636 45.80 24-02-2022 2021-22 317.00 36.55 05-03-2018 2017-18 272.00 42.60 9.25 3.21

Dangare

Total 5,000.92 3,956.23 1,044.69 390.16

Grand Total 5,412.26 4,075.15 1,337.11 665.38

Note:

1) The above report uses the First-In-First-Out (FIFO) principle in determining capital gains. This report is for reference purpose only and please consult your tax adviser or chartered accountant to determine your income tax liability before filing

income tax returns.

2) As per existing Income Tax Rule, Cost Inflation indexation benefit for Long Term Capital Gain/Loss is only applicable for Investments in MF DEBT Schemes.

3) This Report is Strictly Private and confidential only for clients of NJ IndiaInvest Pvt Ltd. The Information given above is correct and to the best of our knowledge. For any discrepancy on the same contact the nearest Office of NJ IndiaInvest Pvt Ltd.

4) As per amendment in Income Tax Act, Capital Gain Tax does not arise in case of consolidation/merger of Mutual Fund Schemes w.e.f 1st April 2016. (Ref - Section 47 (xviii) of Income Tax Act).

Dhananjay Patil

5) (#) To calculate Indexed Cost of Purchase Where sell date >= 01/04/2017, we have considered Current Value as on 01/04/2001 as a Purchase Amount if purchase date < 01/04/2001.And for purchase date >= 01/04/2001, we have considered

actual Purchase Amount.

6) As per Union Budget 18-19, Capital Gain Tax on Equity Oriented Mutual Fund will be levied w.e.f. 01 April 2018. Further there is no cost indexation benefit is available for calculation of LTCG.

7) For Scheme merger cases, Purchase trade's (SWI) Amount is displayed in blue color font with underline.

8) In Redemptions done from the scheme merger SWI trxn ,Eventhough the scheme name is being displayed is of the new scheme, the trxn data are of the old schemes.Purchase NAV & Units have been adjusted to derive the actual investment

amount.

9) ISIN column provides a number which is a unique identifier for the schemes which are listed on the stock exchange(s). ISIN value is being displayed irrespective of the Transaction Mode. Further, If the investment has been made into the

Dividend Option scheme(s) then the ISIN will get displayed is of the Latest Option opted on that Scheme + Folio No.

10) Folio No. with * symbol indicate Destatementized Folios.

You might also like

- Angela Stark 3-21-10 Omar TRNSCRPTDocument15 pagesAngela Stark 3-21-10 Omar TRNSCRPTB-Nicole Williams100% (7)

- PayslipDocument1 pagePayslipmallikarjunamargam100% (3)

- A 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaDocument2 pagesA 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaNilesh ChauhanNo ratings yet

- Demand and Supply Analysis 1Document5 pagesDemand and Supply Analysis 1Casiño B ACNo ratings yet

- Bank Reconciliation ExercisesDocument8 pagesBank Reconciliation ExercisesBrian Reyes Gangca67% (12)

- Short Selling Around The 52-Week and Historical Highs: Eunju - Lee@uml - Edu Npiqueira@bauer - Uh.eduDocument32 pagesShort Selling Around The 52-Week and Historical Highs: Eunju - Lee@uml - Edu Npiqueira@bauer - Uh.eduBrock TernovNo ratings yet

- Firstamerican Bank Credit Default SwapsDocument8 pagesFirstamerican Bank Credit Default SwapssarafmonicaNo ratings yet

- MF AccountStatement-unlockedDocument2 pagesMF AccountStatement-unlockedRahul SonawaneNo ratings yet

- Portfolio TheoryDocument78 pagesPortfolio TheoryAmit PrakashNo ratings yet

- Detail Engineering ScopeDocument37 pagesDetail Engineering ScopeRohan DangareNo ratings yet

- Demand and Supply Analysis 1Document5 pagesDemand and Supply Analysis 1Casiño B ACNo ratings yet

- Line Sizing SheetDocument1 pageLine Sizing SheetRohan DangareNo ratings yet

- Valuation ReportDocument5 pagesValuation Reportjai dNo ratings yet

- CBR EcoDocument8 pagesCBR EcoVishnu JeevandasNo ratings yet

- Kotak Mahindra Bank Limited Consolidated Financials FY18Document60 pagesKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiNo ratings yet

- Annual Report 2018Document519 pagesAnnual Report 2018MR RockyNo ratings yet

- Materi Mekanisme Perdagangan LMKA Nov 2020 - BPK IrvanDocument29 pagesMateri Mekanisme Perdagangan LMKA Nov 2020 - BPK IrvannurlisaNo ratings yet

- BD FinanceDocument5 pagesBD Financesibgat ullahNo ratings yet

- Iain 26 SeptDocument27 pagesIain 26 SeptHarisNo ratings yet

- IDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Document28 pagesIDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Essantio DeniraNo ratings yet

- Top Glove Ar 2021Document170 pagesTop Glove Ar 2021WONG WEI QINo ratings yet

- Toy Segmentation % of Manufactured Toy Categories % of SoldDocument75 pagesToy Segmentation % of Manufactured Toy Categories % of SoldUtkarsh tiwariNo ratings yet

- Canara Rob Emerging Equitties FundDocument1 pageCanara Rob Emerging Equitties Fundjaspreet AnandNo ratings yet

- Godrejpropertiessummerinternship 180813054328 PDFDocument20 pagesGodrejpropertiessummerinternship 180813054328 PDFNitin DawarNo ratings yet

- Marketing Plan: Demand & Supply Analysis Projected Demand Year of Operation Total Projected DemandDocument5 pagesMarketing Plan: Demand & Supply Analysis Projected Demand Year of Operation Total Projected DemandMaritess MunozNo ratings yet

- Diwali Dhamaka 2020Document25 pagesDiwali Dhamaka 2020Prachi PatwariNo ratings yet

- Star Publications (Malaysia) Berhad: Special Dividend Surprise - 13/10/2010Document2 pagesStar Publications (Malaysia) Berhad: Special Dividend Surprise - 13/10/2010Rhb InvestNo ratings yet

- Gail Project Phase 1Document17 pagesGail Project Phase 1S.K. PraveenNo ratings yet

- National Stock Exchange: Research ReportDocument21 pagesNational Stock Exchange: Research ReportPramod KamathNo ratings yet

- Leverage AnalysisDocument8 pagesLeverage AnalysisShubhangi GargNo ratings yet

- Gross Domestic Product in ASEAN, at Constant Prices (Real), in Billions National CurrencyDocument1 pageGross Domestic Product in ASEAN, at Constant Prices (Real), in Billions National CurrencyGIANG LE NGUYEN HUONGNo ratings yet

- ACE - Fundtech LargeCap BA-FOTMDocument12 pagesACE - Fundtech LargeCap BA-FOTMMotilal Oswal Financial ServicesNo ratings yet

- CF-Export-05-03-2024 10Document11 pagesCF-Export-05-03-2024 10v4d4f8hkc2No ratings yet

- Kotak Affordable - Housing - Deep - DiveDocument121 pagesKotak Affordable - Housing - Deep - DiveYogeshNo ratings yet

- Diwali Picks 2017Document16 pagesDiwali Picks 2017Vijay Kumar NandagiriNo ratings yet

- Eadr Project On Infosys CompanyDocument5 pagesEadr Project On Infosys CompanyDivyavadan MateNo ratings yet

- EMBASSY 27062023185711 EmbassyREITIndiaREITPrimerJune272023Document28 pagesEMBASSY 27062023185711 EmbassyREITIndiaREITPrimerJune272023Abel IGNo ratings yet

- Group 4 Forecasted FSDocument9 pagesGroup 4 Forecasted FSNISREEN WAYANo ratings yet

- Nisha PPT 1Document13 pagesNisha PPT 1Anonymous Fr37v90cqNo ratings yet

- Financial Model Asian PaintsDocument19 pagesFinancial Model Asian Paintssantoshj423No ratings yet

- Draft Financial Performance of Nairobi Stock ExchangeDocument9 pagesDraft Financial Performance of Nairobi Stock ExchangekinduNo ratings yet

- CITIC-Telecom 2022-Annual-Results-PPT ENG 20230316-V13 20230316 1057Document26 pagesCITIC-Telecom 2022-Annual-Results-PPT ENG 20230316-V13 20230316 1057freddie2018freelancerNo ratings yet

- Pnb-Punjab National Bank: - Tejeshwar Jolly E-59 - Priyadarshini Tyagi E-35 - Sriya A-41 1Document9 pagesPnb-Punjab National Bank: - Tejeshwar Jolly E-59 - Priyadarshini Tyagi E-35 - Sriya A-41 1Priyadarshini TyagiNo ratings yet

- Financials Infosys Last 5 Years Annual Revenue History and Growth RateDocument7 pagesFinancials Infosys Last 5 Years Annual Revenue History and Growth RateDivyavadan MateNo ratings yet

- B 88 Tulsi Bunglows Radhanpur Road Mahesana Mahesana - 384002 Gujarat, IndiaDocument2 pagesB 88 Tulsi Bunglows Radhanpur Road Mahesana Mahesana - 384002 Gujarat, IndiaJigs PatelNo ratings yet

- 1 Eco - 21155Document22 pages1 Eco - 21155KLN CHUNo ratings yet

- Statistics CIA 3 - 2nd SemesterDocument23 pagesStatistics CIA 3 - 2nd SemesterHigi SNo ratings yet

- FMC Phase 2 ReportDocument22 pagesFMC Phase 2 ReportS.K. PraveenNo ratings yet

- Adi Sarana Armada: Anteraja's Collaboration With Grab and GojekDocument7 pagesAdi Sarana Armada: Anteraja's Collaboration With Grab and Gojekbobby prayogoNo ratings yet

- Analysis of Bop Position of India in Last 10 Years: Ritika Kamboj Mba Finance Sec A A001110719068Document7 pagesAnalysis of Bop Position of India in Last 10 Years: Ritika Kamboj Mba Finance Sec A A001110719068Simran chauhanNo ratings yet

- BRITANIADocument6 pagesBRITANIAmeenatchi shaliniNo ratings yet

- Sekolah Pasar ModalDocument33 pagesSekolah Pasar ModalNaz WarNo ratings yet

- Infosys LTD 20361 - Research and Analysis Report - ICICIdirectDocument6 pagesInfosys LTD 20361 - Research and Analysis Report - ICICIdirectVivek GuptaNo ratings yet

- 2030 Strategy - V17Document53 pages2030 Strategy - V17IPDC RDSNo ratings yet

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasNo ratings yet

- CF-Export-05-03-2024 20Document11 pagesCF-Export-05-03-2024 20v4d4f8hkc2No ratings yet

- L&T India Value FundDocument1 pageL&T India Value Fundjaspreet AnandNo ratings yet

- PRM Assignment 3Document18 pagesPRM Assignment 3ABDULNo ratings yet

- Demand and Supply Analysis 1Document5 pagesDemand and Supply Analysis 1Casiño B ACNo ratings yet

- Payment System Statistics - December 2018Document4 pagesPayment System Statistics - December 2018Kwao LazarusNo ratings yet

- Dialog Group Berhad: Secured E&C Contract Worth SG$21.3mDocument3 pagesDialog Group Berhad: Secured E&C Contract Worth SG$21.3mRhb InvestNo ratings yet

- Last Survey Manoj SirDocument38 pagesLast Survey Manoj Sirneupanebaburam84No ratings yet

- ManesarDocument10 pagesManesarankurNo ratings yet

- Consolidated Financial Statements - FY23Document59 pagesConsolidated Financial Statements - FY23Bhuvaneshwari .ANo ratings yet

- ErosRosdiana ALK UTSDocument2 pagesErosRosdiana ALK UTSIndah Siti AulyaNo ratings yet

- Akshay Ghalme Summer Internship ProjectDocument18 pagesAkshay Ghalme Summer Internship ProjectPooja R AakulwadNo ratings yet

- Data FeasibDocument13 pagesData FeasibPau SantosNo ratings yet

- Tax PL Report - 2021 22 - HC455392Document5 pagesTax PL Report - 2021 22 - HC455392Rohan DangareNo ratings yet

- Tax 2122Document34 pagesTax 2122Rohan DangareNo ratings yet

- Annexure Car IvDocument3 pagesAnnexure Car IvRahul kumarNo ratings yet

- BGS Micro NotesDocument1 pageBGS Micro NotesAvinash JhaNo ratings yet

- Cost and Management Accounting Topic-Ratio Analysis and Cash Flow Statement of Reliance Industries Ltd. 2019 - 2020Document8 pagesCost and Management Accounting Topic-Ratio Analysis and Cash Flow Statement of Reliance Industries Ltd. 2019 - 2020sarans goelNo ratings yet

- W2 - Key Tutorial 3Document5 pagesW2 - Key Tutorial 3Rules of Survival MALAYSIANo ratings yet

- Forex Simle Best Manual Trading System: Nick HolmzDocument4 pagesForex Simle Best Manual Trading System: Nick HolmznickholmzNo ratings yet

- 11370Document2 pages11370nagesh abbaramainaNo ratings yet

- Dividend Policy: FM, PGDM 2019-21Document27 pagesDividend Policy: FM, PGDM 2019-21chandel08No ratings yet

- Hikal VPNDocument12 pagesHikal VPNRakesh KumarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ganesh PrabuNo ratings yet

- MOCK - MCQ PracticeDocument10 pagesMOCK - MCQ PracticeArjun RastogiNo ratings yet

- Yash ParakDocument31 pagesYash ParakYash ParakNo ratings yet

- Case Study Key Highlights:: Balance Sheet Sources of FundsDocument2 pagesCase Study Key Highlights:: Balance Sheet Sources of FundsVenkat ThiagarajanNo ratings yet

- Economic Reforms in India:: Dr. Raj AgrawalDocument43 pagesEconomic Reforms in India:: Dr. Raj AgrawalSarang KapoorNo ratings yet

- Unit 2 Financial Statement AnalysisDocument17 pagesUnit 2 Financial Statement AnalysisalemayehuNo ratings yet

- Forward-Forward Contract and Forward Rate Agreement.Document6 pagesForward-Forward Contract and Forward Rate Agreement.tinotendacarltonNo ratings yet

- Time Value of Money AnnuitiesDocument26 pagesTime Value of Money AnnuitiesRatul HasanNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersProto Proffesor TshumaNo ratings yet

- Test BankDocument76 pagesTest BankshuguftarashidNo ratings yet

- Chapter 2 - AFM - UEH - F2023 - ExercicesDocument3 pagesChapter 2 - AFM - UEH - F2023 - Exercicestoantran.31211025392No ratings yet

- Addition dt.12-07-2021 Revised Date of BCG-604 (Old Syllabus) dt.08-07-2021Document2 pagesAddition dt.12-07-2021 Revised Date of BCG-604 (Old Syllabus) dt.08-07-2021RohitNo ratings yet

- 731 Audit IssuesDocument4 pages731 Audit IssuesLCNo ratings yet

- Explain Briefly The Significance of Money in The Economy of A CountryDocument1 pageExplain Briefly The Significance of Money in The Economy of A CountryCarl Emerson GalaboNo ratings yet

- Accountancy ProfessionDocument5 pagesAccountancy Professionpanda 1No ratings yet

- Lí thuyết kiểm toánDocument13 pagesLí thuyết kiểm toánLinh Nguyễn Thị KhánhNo ratings yet