Professional Documents

Culture Documents

ErosRosdiana ALK UTS

Uploaded by

Indah Siti AulyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ErosRosdiana ALK UTS

Uploaded by

Indah Siti AulyaCopyright:

Available Formats

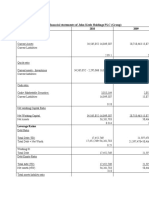

Nama : Eros Rosdiana (Dinyatakan dalam miliaran Rupiah,

NPM : 10220048 kecuali dinyatakan lain)

RASIO KEUANGAN

PT ASTRA INTERNATIONAL Tbk

Rasio Liquiditas

Current Ratio (Rasio Lancar) Cash Turn Over (Rasio Perputaran Kas)

Current Asset Net Sales

Current Ratio = Cash Turn Over=

Current Liabilities Working Capital

132,308 Working Capital = Current asset – Current Liabilities

2020 1.543

85,736 175,046

2020 3.759

160,262 46,572

2021 1.544

103,778 233,485

2021 4.134

Quick Ratio (Rasio Cepat) 56,484

Current Asset - Inventory Inventory To Net Working Capital

Quick Ratio =

Current Liabilities Iventory

InventoryNWC=

132,308 17,929 Working Capital

85,736 17,929

2020 2020 0.385

114,379 46,572

85,736 1.334 21,815

2021 0.386

160,262 21,815 56,484

103,778

2021

138,447 Standar

1.334 No Jenis Ratio 2020 2021

103,778 Industri

Cash Ratio (Rasio Kas) 1 Current Ratio 1.543 1.544 2 kali

Cash + Bank 2 Quick Ratio 1.334 1.334 1.5 kali

Cash Ratio=

Current Liabilities 3 Cash Ratio 55.5% 61.6% 50%

47,553 4 Cash Turn Over 375.861% 413.365% 10%

2020 0.555

85,736 5 Inventory to NWC 38.50% 38.62% 12%

63,947

2021 0.616

103,778

Rasio Solvabilitas

Debt to Asset Ratio LTDtER Times Interest Earned

Total Debt Long Term Debt Ebit

DAR= LTDtER = TIE =

Total Aset Equity Interest

142,749 57,013 21,741

2020 0.422 2020 0.292 2020 9.283

338,203 195,454 2,342

151,696 47,918 32,350

2021 0.413 2021 0.222 2021 12.671

367,311 215,615 2,553

Debt to Equity Ratio

Total Debt Standar

DER = No Jenis Ratio 2020 2021

Equity Industri

142,749 1 Debt to Asset Ratio 42.208% 41.299% 35%

2020 0.730

195,454 2 Debt to Equity Ratio 73.035% 70.355% 90%

151,696 3 (LTDtER) 0.292% 0.222% 10

2021 0.704

215,615 4 Times Interest Earned 9.283 12.671 10 kali

Nama : Eros Rosdiana (Dinyatakan dalam miliaran Rupiah,

NPM : 10220048 kecuali dinyatakan lain)

Activity Ratio ( Rasio Aktivitas )

Receivable Turnover Working Capital Turnover

Receivable Penjualan Kredit Penjualan Bersih

WCT

turnover = Piutang Modal Kerja

175,046 175,046 3.759

2020 16.117 2020

10,861 46,572

233,485 233,485 4.134

2021 19.214 2021

12,152 56,484

Days Of Receivable Fixed Asset Turnover

Jumlah hari dalam 1 tahun Sales

DOR = FAT

Perputaran Piutang Total fixed Assets

360 175,046

2020 22.337 2020 2.955

16.117 59,230

360 233,485

2021 18.74 2021 4.218

19.214 55,349

Inventory Turnover Asset Turnover

Inventory Penjualan Sales

Asset Turnover

Turnover Persediaan Total Asset

175,046 175,046

2020 9.763 2020 0.518

17,929 338,203

233,485 233,485

2021 10.703 2021 0.636

21,815 367,311

Days Of Inventory

Jumlah hari dalam 1 tahun Standar

DOI= No Jenis Ratio 2020 2021

Perputaran Persediaan Industri

360 1 Receivable Turn Over 16.117 19.214 15 kali

2020 36.873

9.763 2 Days of Receivable 22.337 18.737 60 hari

360 3 Inventory Turn Over 9.763 10.703 20 kali

2021 33.64

10.70 4 Days of Intentory 36.873 33.636 19 hari

5 Working Capital Turn 3.759 4.134 6 kali

6 Fixed Asset Turn Over 2.955 4.218 5 kali

7 Total Asset Turn Over 0.518 0.636 2 kali

Rasio Profitabilitas

Profit Margin Return on Equity Earning per Share of Common Stock

Penjualan bersih - HPP EAIT Laba Saham Biasa

Profit Margin = ROE = EPSOCS =

Sales Equity Saham biasa yg beredar

38,778 18,571 399

2020 0.222 2020 0.095 2020 0.010

175,046 195,454 40,484

51,033 18,571 499

2021 0.219 2021 0.086 2021 0.012

233,485 215,615 40,484

Return on Investment

EAIT Standar

ROI = No Jenis Ratio 2020 2021

Total Asset Industri

18,571 1 Net Profit Margin 22.15% 21.86% 20%

2020 0.055

338,203 2 Return on Investment 5.491% 5.056% 30%

18,571 3 Return on Equity 9.501% 8.613% 40%

2021 0.051

367,311 4 Earning per Share of Common Stock

0.010 0.012

You might also like

- PRM Assignment 3Document18 pagesPRM Assignment 3ABDULNo ratings yet

- Accounting Final ProjectDocument15 pagesAccounting Final ProjectSam KhalilNo ratings yet

- Ratio Analysis On Financial Statements of John Keels Holdings PLC (Group)Document11 pagesRatio Analysis On Financial Statements of John Keels Holdings PLC (Group)Shesha Nimna GamageNo ratings yet

- Lang - Culculate Case StudyDocument6 pagesLang - Culculate Case StudyTrang ĐàiNo ratings yet

- Calculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Document1 pageCalculation of Free Cashflow To The Firm: DCF Valuation (Amounts in Millions)Prachi NavghareNo ratings yet

- ACME - Ratio AnalysisDocument1 pageACME - Ratio AnalysistashnimNo ratings yet

- Analisis ProfitabilitasDocument6 pagesAnalisis Profitabilitastheresia paulintiaNo ratings yet

- Usman FileDocument4 pagesUsman FileManahil FayyazNo ratings yet

- BRITANIADocument6 pagesBRITANIAmeenatchi shaliniNo ratings yet

- M/S Pandey Enterprises: Pro-Abhinav KumarDocument2 pagesM/S Pandey Enterprises: Pro-Abhinav KumarPARASHAR GULSHANNo ratings yet

- Hariharan A - F21143 - HCL - Capital BudgetingDocument3 pagesHariharan A - F21143 - HCL - Capital BudgetingJoseph JohnNo ratings yet

- RatioDocument4 pagesRatioMd Junayed IslamNo ratings yet

- New Microsoft Excel WorksheetDocument3 pagesNew Microsoft Excel WorksheetARIFNo ratings yet

- SL2-Corporate Finance Ristk ManagementDocument17 pagesSL2-Corporate Finance Ristk ManagementKrishantha WeerasiriNo ratings yet

- DCF ModelDocument4 pagesDCF Modeljuilee bhoirNo ratings yet

- Sensitivity Analysis in Excel TemplateDocument8 pagesSensitivity Analysis in Excel TemplateMohd Yousuf MasoodNo ratings yet

- Axis Bank - AR21 - Consolidated Financial StatementsDocument48 pagesAxis Bank - AR21 - Consolidated Financial StatementsRakeshNo ratings yet

- Vap & Associates: Company SecretariesDocument5 pagesVap & Associates: Company Secretariesvivek singhNo ratings yet

- Balance Sheet: ASAT31 MARCH, 2017Document2 pagesBalance Sheet: ASAT31 MARCH, 2017Mandeep BatraNo ratings yet

- Sensitivity Analysis in Excel TemplateDocument8 pagesSensitivity Analysis in Excel Templateuyenbp.a2.1720No ratings yet

- PT AmfgDocument29 pagesPT AmfgPinasti PutriNo ratings yet

- Data Finansial Gap IncDocument4 pagesData Finansial Gap IncTohirNo ratings yet

- Key Financial Indicators: Statement of Financial PositionDocument2 pagesKey Financial Indicators: Statement of Financial PositionZahid UsmanNo ratings yet

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Problem Set - Week 4 - SolutionsDocument5 pagesProblem Set - Week 4 - SolutionsShravan DeshmukhNo ratings yet

- Aether & LICDocument6 pagesAether & LICPranjal KalaNo ratings yet

- ABC Limited Income Statement: Particulars Amounts 2016 2017 2018Document2 pagesABC Limited Income Statement: Particulars Amounts 2016 2017 2018Rezaul KarimNo ratings yet

- Transaction AssumptionsDocument21 pagesTransaction AssumptionsSuresh PandaNo ratings yet

- Straco AR2021Document188 pagesStraco AR2021Lim Yee FattNo ratings yet

- Statement For HDFC Bank Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Document4 pagesStatement For HDFC Bank Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Rushika BavaniaNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Forward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Document19 pagesForward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Wahid Arief AuladyNo ratings yet

- Forward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Document19 pagesForward PE Rp34,524 Rp27,704 Simplified DCF Rp28,520 Rp26,180Wahid Arief AuladyNo ratings yet

- CF-Export-05-03-2024 7Document11 pagesCF-Export-05-03-2024 7v4d4f8hkc2No ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- Lenich Ratios 2024Document2 pagesLenich Ratios 2024mumbinganga6No ratings yet

- Financials VTLDocument13 pagesFinancials VTLmuhammadasif961No ratings yet

- Activity Statement: Account InformationDocument7 pagesActivity Statement: Account InformationresourcesficNo ratings yet

- Axis Bank - AR21 - Standalone Financial StatementsDocument80 pagesAxis Bank - AR21 - Standalone Financial StatementsArbaz TaiNo ratings yet

- A01252381 - Examen - Edos Fin OXY SimplificadosDocument20 pagesA01252381 - Examen - Edos Fin OXY SimplificadosAnhia ChavezNo ratings yet

- BritanniaDocument4 pagesBritanniaHiral JoshiNo ratings yet

- Common Size Income Statement Gilbert Lumber CompanyDocument2 pagesCommon Size Income Statement Gilbert Lumber CompanySiddharth BendaleNo ratings yet

- Paramount Textile PLC Ratio Analysis FinalDocument16 pagesParamount Textile PLC Ratio Analysis Finalraufun huda dipNo ratings yet

- Financial Statement Analysis: Jeddah International College Answer PaperDocument4 pagesFinancial Statement Analysis: Jeddah International College Answer PaperBushraYousafNo ratings yet

- PromotionDocument309 pagesPromotionRohith RaoNo ratings yet

- Finanical SpreadsDocument11 pagesFinanical Spreadsnauman farooqNo ratings yet

- Activity in Finance Nov 20Document1 pageActivity in Finance Nov 20LANSANGAN, MYRA MAE - ABMNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghNo ratings yet

- Balance Sheet Bien HechoDocument21 pagesBalance Sheet Bien HechoRicardo PuyolNo ratings yet

- Horana Plantation Ratio Analysis - Accounting AssignmentDocument7 pagesHorana Plantation Ratio Analysis - Accounting AssignmentNuwani ManasingheNo ratings yet

- FA AssignmentDocument29 pagesFA AssignmentManvendra SinghNo ratings yet

- Intrinsic Value Calculator by MeDocument6 pagesIntrinsic Value Calculator by Menkw123No ratings yet

- Samorita Hospital (Last 6 Month Financial Report)Document11 pagesSamorita Hospital (Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Document6 pagesParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANo ratings yet

- As Per Our Report Attached For and On Behalf of The Board of DirectorsDocument26 pagesAs Per Our Report Attached For and On Behalf of The Board of DirectorsAnup Kumar SharmaNo ratings yet

- Morrison and Sainsburry RatioDocument5 pagesMorrison and Sainsburry RatioTariq KhanNo ratings yet

- Uts Finance IvanDocument28 pagesUts Finance IvanIvan ZackyNo ratings yet

- SIVBQ SVB Financial Group Annual Balance Sheet - WSJDocument1 pageSIVBQ SVB Financial Group Annual Balance Sheet - WSJSanchit BudhirajaNo ratings yet

- Function of Financial MarketsDocument4 pagesFunction of Financial MarketsFrances Mae Ortiz MaglinteNo ratings yet

- Kinerja Keuangan Dan Ukuran PerusahaanDocument14 pagesKinerja Keuangan Dan Ukuran Perusahaanmelly nkmlsrNo ratings yet

- Exercises: Set B: InstructionsDocument4 pagesExercises: Set B: InstructionsRabie HarounNo ratings yet

- Stock Market Project VaibhavDocument71 pagesStock Market Project VaibhavVaibhav DhayeNo ratings yet

- Letter of Offer Dated September 22-2021Document477 pagesLetter of Offer Dated September 22-2021Arush JamwalNo ratings yet

- Income Tax Planning Related Bonus ShareDocument14 pagesIncome Tax Planning Related Bonus Sharealokshri25100% (2)

- MK - Kuliah MM 2-20Document33 pagesMK - Kuliah MM 2-20Dewi Murni Susanti100% (1)

- Unclaimed Dividend 2016-17Document139 pagesUnclaimed Dividend 2016-17harkeshNo ratings yet

- PDF Trading Stocks IntradaypdfDocument10 pagesPDF Trading Stocks IntradaypdfBommaNo ratings yet

- Capital Market BAFDocument21 pagesCapital Market BAFJaswant JaiswarNo ratings yet

- SS 3 CF CostOfCapitalDocument22 pagesSS 3 CF CostOfCapitalmanish guptaNo ratings yet

- IPO Versus RTODocument5 pagesIPO Versus RTOpaksengNo ratings yet

- Session 6 Case Study Questions Workbrain Corp - A Case in Exit StrategyDocument2 pagesSession 6 Case Study Questions Workbrain Corp - A Case in Exit Strategyeruditeaviator0% (1)

- Shares: Meaning and Nature of SharesDocument9 pagesShares: Meaning and Nature of SharesNeenaNo ratings yet

- Precautions of Online TradingDocument6 pagesPrecautions of Online TradingAnkit AgarwalNo ratings yet

- Alpha-Research and Investment Club: Task 3Document1 pageAlpha-Research and Investment Club: Task 3Shitanshu YadavNo ratings yet

- Description: S&P 500 Dividend AristocratsDocument7 pagesDescription: S&P 500 Dividend AristocratsCalvin YeohNo ratings yet

- FINAL PROSPECTUS - ATRAM Alpha Opportunity Fund (UPDATED June 4, 2018)Document55 pagesFINAL PROSPECTUS - ATRAM Alpha Opportunity Fund (UPDATED June 4, 2018)Mai Whill TolentinoNo ratings yet

- Project Report FMDocument1 pageProject Report FMmuhammad shamsadNo ratings yet

- FM Cia 3Document14 pagesFM Cia 3MOHAMMED SHAHIDNo ratings yet

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Document38 pagesNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNo ratings yet

- Dentsu (TKS:) - : Public Company ProfileDocument22 pagesDentsu (TKS:) - : Public Company ProfileLorcan BondNo ratings yet

- Fs SP 500 Shariah IndexDocument8 pagesFs SP 500 Shariah IndexJimot DLangapaNo ratings yet

- Graham Number DefinitionDocument1 pageGraham Number Definitionrony chidiacNo ratings yet

- The System Building BlueprintDocument8 pagesThe System Building Blueprintstormin64No ratings yet

- Fact Book 2013Document215 pagesFact Book 2013Eka ChandraNo ratings yet

- DividendsDocument3 pagesDividendsjano_art2125% (8)

- Fundamental Analysis: Lynn GilletteDocument36 pagesFundamental Analysis: Lynn GilletteMuhammad Abu BakrNo ratings yet

- 2 Marks BsDocument38 pages2 Marks BsShankar ReddyNo ratings yet

- UntitledDocument88 pagesUntitledJacob PriyadharshanNo ratings yet