Professional Documents

Culture Documents

Closure Activities - Share-Based Compensation Answer Key

Uploaded by

John Mark FernandoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Closure Activities - Share-Based Compensation Answer Key

Uploaded by

John Mark FernandoCopyright:

Available Formats

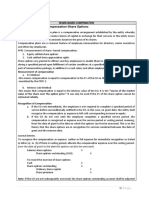

Problem A

(1) 2019

Compensation expense (500 x 100 x 30/ 3 x1st year) 500,000

2020

Cumulative Compensation expense (500-30-30 x 100 x 30/3 x 2nd year) 880,000

Compensation expense-2019 500,000

Compensation Expense-2020 380,000

2021

Cumulative compensation expense (500-30-20 x 100 x 30/3 x 3rd year) 1,350,000

Cumulative expense as of 2020 880,000

Compensation expense- 2021 470,000

Problem B

(2) 2019 Comp exp (30,000 x 30) 900,000/3 x 1 300,000

2020 Comp exp (30,000 x 30) 900,000/3 x 2=600,000-300,000 300,000

2021 Comp exp (30,000 x 25) 750,000/3x 3-600,000 150,000

Problem C

(3) 2019 (50,000 x 24) 1,200,000/3 x 1 400,000

2020 (50,000 x 51) 2,550,000/3 x 2=1,700,000-400,000 1,300,000

2021 (50,000 x 51) 2,550,000-1,700,000 850,000

Problem D

(4) FV of equipment equal to the cash price 2,000,000

FV of liability (15,000 shares x 80) (1,200,000)

Equity component 800,000

Equipment 2,000,000

Accounts Payable 1,200,000

SO Outstanding 800,000

(5) FV of liability (15,000 shares x 100) 1,500,000

FV of liability- Jan 1 (1,200,000)

Implied interest 300,000

Problem E

(6) Total Compensation 6,000,000

Compensation in 2017 (1,500,000)

Compensation in 2018 (1,300,000)

Compensation in 2019 3,200,000

(7) Cash payment 5,000,000

Compensation in 2017 (1,500,000)

Compensation in 2018 (1,300,000)

Compensation in 2019 2,200,000

Problem F

(8) FV of SO (10,000 x 5 x 50) 2,500,000

Compensation expense for 2019 (2,500,000/4) 625,000

Salaries-SO 625,000

SO Outstanding 625,000

Problem G

(9) 2019 Accrued compensation-12/31/2019 (50,000 x 15) 750,000

Salaries 750,000

Accrued salaries payable 750,000

2020 Accrued compensation- 12/31/2020 (50,000 x 15) 750,000

Accrued compensation-12/31/2019 (750,000)

0

Accrued salaries payable 750,000

Cash 750,000

Problem H

(10) FV of share alternative (25,000 shares x 48) 1,200,000

FV of liability (20,000 shares x 51) 1,020,000

Equity component 180,000

December 31, 2019

Salaries (180,000/3) 60,000

SO Outstanding 60,000

Salaries 360,000

Accrued salaries payable 360,000

Share basis (20,000 x 54) 1,080,000

Accrued liability-12/31/2019 (1,080,000/3x 1st year) 360,000

Compensation expense to SO 60,000

Compensation expense to cash alternative 360,000

420,000

(11) December 31, 2020

Salaries (180,000/3) 60,000

SO Outstanding 60,000

Salaries 440,000

Accrued salaries payable 440,000

Share basis (20,000 x 60) 1,200,000

Accrued liability (1,200,000 3 x 2) 800,000

Accrued liability -12/31/2019 (360,000)

Compensation expense 2020 440,000

Total compensation expense for 2020 (60k + 440K) 500,000

(12) December 31, 2021

Salaries (180,000/3) 60,000

SO Outstanding 60,000

Salaries 500,000

Accrued salaries payable 500,000

share basis (20,000 x 65) 1,300,000

Total liability-2021 1,300,000

Accrued liability-2020 (800,000)

Compensation for 2021 500,000

Total compensation exp for 2021 (60k + 500k) 560,000

Accrued salaries payable 1,300,000

SO Outstanding 180,000

SC (25,000 x 30) 750,000

SP 730,000

(13) Accrued salaries payable 1,300,000

SO Outstanding 180,000

Cash (20,000 x 65) 1,300,000

SP 180,000

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Golf Course Business Plan - Union College 2009Document48 pagesGolf Course Business Plan - Union College 2009flippinamsterdam100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business Plan For FloristDocument26 pagesBusiness Plan For Floristmohammed hajiademNo ratings yet

- Sandeep DhamijaDocument15 pagesSandeep DhamijaSiddharthNo ratings yet

- Chapter 17 Capital Structure-TestbankDocument12 pagesChapter 17 Capital Structure-TestbankLâm Thanh Huyền NguyễnNo ratings yet

- MODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodDocument16 pagesMODULE-FinalTerm-FAR 3-Operating Segment, Interim Reporting & Events After Reporting PeriodJohn Mark FernandoNo ratings yet

- Structure and Writing Style: ADI, Deborah MDocument18 pagesStructure and Writing Style: ADI, Deborah MJohn Mark FernandoNo ratings yet

- Honey Quines ReportDocument17 pagesHoney Quines ReportJohn Mark FernandoNo ratings yet

- Leigh Ramos ReportDocument9 pagesLeigh Ramos ReportJohn Mark FernandoNo ratings yet

- ENG ReportDocument66 pagesENG ReportJohn Mark FernandoNo ratings yet

- Final PresentationDocument7 pagesFinal PresentationJohn Mark FernandoNo ratings yet

- Bothan ReportDocument10 pagesBothan ReportJohn Mark FernandoNo ratings yet

- 3Document1 page3John Mark FernandoNo ratings yet

- MODULE-Midterm-FAR-3-NCHFS, DO &ACDocument18 pagesMODULE-Midterm-FAR-3-NCHFS, DO &ACJohn Mark FernandoNo ratings yet

- Lessee Accounting: Right To Control The Use of An AssetDocument33 pagesLessee Accounting: Right To Control The Use of An AssetJohn Mark FernandoNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoNo ratings yet

- Closure Activities-Answer KeyDocument5 pagesClosure Activities-Answer KeyJohn Mark FernandoNo ratings yet

- Cash and Accrual Basis and Single EntryDocument21 pagesCash and Accrual Basis and Single EntryJohn Mark FernandoNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- MODULE - SHARE-BASED COMPENSATION (SO AND SARs)Document15 pagesMODULE - SHARE-BASED COMPENSATION (SO AND SARs)John Mark FernandoNo ratings yet

- Annual Report PPFDocument71 pagesAnnual Report PPFBhuvanesh Narayana SamyNo ratings yet

- Dunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Document2 pagesDunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Cath VeluzNo ratings yet

- Acct Statement - XX8283 - 29122023bDocument20 pagesAcct Statement - XX8283 - 29122023baseefbhatta143No ratings yet

- Consumer Behaviour at EdelweissDocument16 pagesConsumer Behaviour at EdelweissTArun KumArNo ratings yet

- FIM PresentationDocument14 pagesFIM Presentationsomeone specialNo ratings yet

- Bajaj Allianz InsuranceDocument93 pagesBajaj Allianz InsuranceswatiNo ratings yet

- MSC Finance and Strategy Online BrochureDocument12 pagesMSC Finance and Strategy Online BrochureSiphoKhosaNo ratings yet

- Materi Neraca LajurDocument5 pagesMateri Neraca Lajurhana prativiNo ratings yet

- Chapter 11Document68 pagesChapter 11Nguyen NguyenNo ratings yet

- Central Banking and Financial RegulationsDocument9 pagesCentral Banking and Financial RegulationsHasibul IslamNo ratings yet

- Man307 2017 18 Final Exam Questions SiUTDocument4 pagesMan307 2017 18 Final Exam Questions SiUTKinNo ratings yet

- Fees & ExpensesDocument3 pagesFees & ExpensesJames JenkinsNo ratings yet

- NCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 1 PDFDocument74 pagesNCERT Solutions For Class 12 Accountancy Partnership Accounts Chapter 1 PDFÀñüpäm MíshråNo ratings yet

- Twelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsDocument1 pageTwelve-Month Cash Flo YEAR 1: Jan-18 Fiscal Year BeginsTun Izlinda Tun BahardinNo ratings yet

- Suppose The Government Borrows 20 Billion More Next Year ThanDocument2 pagesSuppose The Government Borrows 20 Billion More Next Year ThanMiroslav GegoskiNo ratings yet

- Icici Bank Deposits Recurring Deposits: FeaturesDocument6 pagesIcici Bank Deposits Recurring Deposits: FeaturesDhiraj AhujaNo ratings yet

- Document No 76 - Debt Fund Update Jan' 23Document3 pagesDocument No 76 - Debt Fund Update Jan' 23AmrutaNo ratings yet

- Kyc Supplemental Form: Signature Over Printed Name / Date SignedDocument1 pageKyc Supplemental Form: Signature Over Printed Name / Date SignedRoan Noreen DazoNo ratings yet

- BBA Major ProjectDocument40 pagesBBA Major ProjectDeepak Bhatia100% (5)

- BA Tutorial Schedule Spring 2021Document8 pagesBA Tutorial Schedule Spring 2021Usama JavaidNo ratings yet

- World Bank (IBRD & IDA)Document5 pagesWorld Bank (IBRD & IDA)prankyaquariusNo ratings yet

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocument5 pagesAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNo ratings yet

- Galgotias University Vishwajeet Singh S/O Kuldeep SinghDocument1 pageGalgotias University Vishwajeet Singh S/O Kuldeep SinghAashika SinghNo ratings yet

- Soneri Bank Internship+ (Marketing)Document66 pagesSoneri Bank Internship+ (Marketing)qaisranisahibNo ratings yet

- DanielDocument17 pagesDanielJerome MogaNo ratings yet