Professional Documents

Culture Documents

2022-2023 Income Guideline

Uploaded by

Denise NelsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022-2023 Income Guideline

Uploaded by

Denise NelsonCopyright:

Available Formats

Income Eligibility Guidelines for Determining Free and Reduced-Price Benefits

Effective from July 1, 2022 to June 30, 2023

Family Annually Monthly Twice per Month Every Two Weeks Weekly

Size

Free Reduced Free Reduced Free Reduced Free Reduced Free Reduced

1 $17,667 $25,142 $1,473 $2,096 $737 $1,048 $680 $967 $340 $484

2 $23,803 $33,874 $1,984 $2,823 $992 $1,412 $916 $1,303 $458 $652

3 $29,939 $42,606 $2,495 $3,551 $1,248 $1,776 $1,152 $1,639 $576 $820

4 $36,075 $51,338 $3,007 $4,279 $1,504 $2,140 $1,388 $1,975 $694 $988

5 $42,211 $60,070 $3,518 $5,006 $1,759 $2,503 $1,624 $2,311 $812 $1,156

6 $48,347 $68,802 $4,029 $5,734 $2,015 $2,867 $1,860 $2,647 $930 $1,324

7 $54,483 $77,534 $4,541 $6,462 $2,271 $3,231 $2,096 $2,983 $1,048 $1,492

8 $60,619 $86,266 $5,052 $7,189 $2,526 $3,595 $2,332 $3,318 $1,166 $1,659

For each additional family member add:

+$6,136 +$8,732 +$512 +$728 +$256 +$364 +$236 +$336 +$118 +$168

Texas Department of Agriculture | Food and Nutrition Division

Income Eligibility Guidelines Chart | February 17, 2022 | Page 1 of 1

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- S. Harris SeparationDocument8 pagesS. Harris SeparationDenise NelsonNo ratings yet

- TEA Report - Harris RedactedDocument2 pagesTEA Report - Harris RedactedDenise NelsonNo ratings yet

- City View Bobby Morris InvoicesDocument5 pagesCity View Bobby Morris InvoicesDenise NelsonNo ratings yet

- WFISD 2024-2025 Calendar Draft A and Explanation-1New PDFDocument1 pageWFISD 2024-2025 Calendar Draft A and Explanation-1New PDFDenise NelsonNo ratings yet

- City View 15-Day Letter To AG - Text MessagesDocument5 pagesCity View 15-Day Letter To AG - Text MessagesDenise NelsonNo ratings yet

- Administrative Leave Letter 6 27 22Document1 pageAdministrative Leave Letter 6 27 22Denise NelsonNo ratings yet

- WFISD Facility HistoryDocument1 pageWFISD Facility HistoryDenise NelsonNo ratings yet

- Rucker Resignation LetterDocument1 pageRucker Resignation LetterDenise NelsonNo ratings yet

- 2022-08-18 City View ISD Contract With Walsh GallegosDocument3 pages2022-08-18 City View ISD Contract With Walsh GallegosDenise NelsonNo ratings yet

- WFISD Transfers 2021-2022Document1 pageWFISD Transfers 2021-2022Denise NelsonNo ratings yet

- Michael Payne JudgmentDocument6 pagesMichael Payne JudgmentDenise NelsonNo ratings yet

- Administrative Leave Letter 12-30-14Document1 pageAdministrative Leave Letter 12-30-14Denise NelsonNo ratings yet

- WFISD Transfers 2019-2020Document1 pageWFISD Transfers 2019-2020Denise NelsonNo ratings yet

- Lyde Administrative Leave LetterDocument1 pageLyde Administrative Leave LetterDenise NelsonNo ratings yet

- Lyde Affidavit and Unsigned WarrantDocument1 pageLyde Affidavit and Unsigned WarrantDenise NelsonNo ratings yet

- Pantry ListDocument2 pagesPantry ListDenise NelsonNo ratings yet

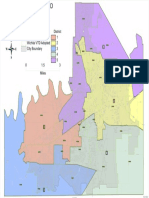

- Attendance Zones PresentationDocument3 pagesAttendance Zones PresentationDenise NelsonNo ratings yet

- Transfer FiguresDocument2 pagesTransfer FiguresDenise NelsonNo ratings yet

- WFISD Transfers 2019-2020Document1 pageWFISD Transfers 2019-2020Denise NelsonNo ratings yet

- WFISD Transfers 2019-2020Document1 pageWFISD Transfers 2019-2020Denise NelsonNo ratings yet

- WFISD Transferes 2020-2021Document1 pageWFISD Transferes 2020-2021Denise NelsonNo ratings yet

- Gary Patterson Contract RedactedDocument3 pagesGary Patterson Contract RedactedDenise NelsonNo ratings yet

- WFISD Transfers 2019-2020Document1 pageWFISD Transfers 2019-2020Denise NelsonNo ratings yet

- Wfisd Esser BudgetsDocument3 pagesWfisd Esser BudgetsDenise NelsonNo ratings yet

- WFISD Adopted Plan For DistrictsDocument1 pageWFISD Adopted Plan For DistrictsDenise NelsonNo ratings yet

- WFISD GMP Summary For ConstructionDocument1 pageWFISD GMP Summary For ConstructionDenise NelsonNo ratings yet

- WFISD Legacy Construction UpdateDocument2 pagesWFISD Legacy Construction UpdateDenise NelsonNo ratings yet

- The State of Texas vs. Jeffery C. LydeDocument1 pageThe State of Texas vs. Jeffery C. LydeDenise Nelson100% (1)

- WFISD Agenda Special SessionDocument1 pageWFISD Agenda Special SessionDenise NelsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)