Professional Documents

Culture Documents

Application Form: Occupations Details

Uploaded by

nitin doonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Form: Occupations Details

Uploaded by

nitin doonCopyright:

Available Formats

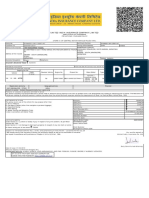

IIFL Finance Limited (IIFL) (Formerly known as “IIFL Holdings Limited”) BRANCH COPY

CIN: L67100MH1995PLC093797 / RBI CoR No. N-13.02386

Regd. Office: IIFL House, Sun Infotech Park, Road No. 16V, Plot No. B-23, Thane Industrial Area,

Wagle Estate, Thane - 400 604Tel: (91-22) 4103 5000 • Fax: (91-22) 2580 6654

Corporate Office: 802, 8th Floor, Hub Town Solaris, N.S. Phadke Marg, Vijay Nagar, Andheri East, Mumbai - 400 069

Tel: (91-22) 6788 1000 • Fax: (91-22) 6788 1010 • E-mail: reach@iifl.com • Website: www.iifl.com

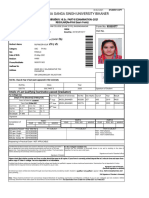

APPLICATION FORM Occupations Details BORROWER’S PHOTO

Amount of Loan : ₹ 37,900.00 GL No.: GL22085762 Source of Income: Business

CUID No.: A91BA8EC Scheme: IIFL Q26 Purpose of Loan:: Others

Nationality : INDIAN CKYC No: 50029656020070 Type of Activity:

Account type: Normal Simplified Land type:

Application type: New Update Land holding (In Acre): 0.00

Other allied activity:

Loan category: NON-PSU

Gross Annual Income: ₹ 1,40,000.00

Occupation :

Identification Details: Pan -CNUPN3067K

Personal Details

Applicant Name : Mr.NITIN chote PAN Card No./ Form 60: CNUPN3067K Date of Birth: 19/08/1992

Gender: Male Qualification: UNDER GRADUATE No. of years of current residence: 10.0 Marital Status: MARRIED

Father Name: chote Mother Name: pinki

Maiden Name: Spouse Name: chitraleaha

Residential Address: flat no 201, shyam park nawada extension Permanent Address:

near bank of baroda, -, DK Mohan garden West Delhi

City: New Delhi Pin code: 110059 City: New Delhi Pin code:

Land mark: Alankar jewelers, hno. State/U.T : Delhi Land mark: State/U.T :

12 block no.52

dehrakas near alankar

jewelers

Residential Tel: Mobile: 7827793424 Date: 08/06/2022 2:53:50 PM Office Tel.:

Individuals: 1) Photo ID Proof 2) Residence Proof

For list of acceptable documents, kindly refer to KYC Documentation Policy available on our website www.iifl.com

I/We hereby request you to kindly grant the above mentioned amount of Rs. ₹ 37,900.00 (Rupees Thirty Seven Thousand Nine Hundred Only) by taking

total jewellery of 11.11 grams as security towards the above said amount. The details of the gold are mentioned below.)

DETAILS OF THE PLEDGED ARTICLES (Gold Ornaments and other articles)

Particulars Units Caret Total Wt

Ring 4.00 22 11.11

11.11

I/ We declare and understand that purity of the gold as aforesaid is atleast carat, however same is subject to reconfirmation by

Auditors/ Valuers appointed by IIFL, whose decision shall be final and binding on me/ us ("Lender's Record"). The pledged gold’s

value has been arrived as per average of closing price of 22 carat gold for preceding 30 days as quoted by the Bombay Bullion

Association Ltd. or the historical spot gold price published by regulated commodity exchange.

The proportionate net weight at 22 carats is 10.80 gms.

Principal Amount : ₹ 37,900.00 (Rupees Thirty Seven Thousand Nine Hundred Only )

Principal Due Date: 08/06/2024 (subject to standard terms) Interest Due Date: 8 of Every 3rd Month Tenure: 24 months (subject to standard terms)

Interest Rate: 21.96 per annum Additional Interest Rate:6.00 per annum Repayment Type: Querterly Mode of Computation: Simple Interest

Purpose: Others

SCHEDULED OF CHARGES (Exclusive of Taxes) Rebate for early payment of interest is available as given in Rates applicable for early payment of

Particular Amount/Percent the chart below(Applicable for FBL scheme only) interest as given in chart below:

Processing Fee Rs.0.00 IF PAID WITHIN Rebate Effective ROI p.a

Closure and Part payment 0.00 % If Paying Within Effective ROI p.a

charges

MTM charges Rs.500

Auction Charges Rs.1500

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

Franking Charges applicable as Rs.0.00

per the state

Detailed terms & conditions attached. Kindly acknowledge the receipt of copy of Most Important Terms & Conditions and Standard Terms.

DECLARATION ON GST

GST related Details:

Registered:

GST Number:

GST Registered Address:

I/We, residing at

do hereby declare and undertake that : State:

1. I/We declare and accept that I/We have approached IIFL for the grant of loan facility and IIFL may agree to grant the said loan to me/us on the terms and conditions set out in the loan documentation.

2. I/We declare and accept that I am /We are registered under Goods and Service Tax Act, 2017 (Hereinafter referred to as the ‘GST Act’) rules and regulations AND/OR in case I/We become notified

under GST Act in the due course of time, and I/We shall abide by the any such regulations applicable to me/us from time to time.

3. I/We declare and state that the abovementioned GST details furnished by me/us to IIFL are true and genuine and I/We shall undertake to inform and update IIFL in case of any change in my/our GST

related details.

4. I/We agree that any changes in GST related details intimated by me/us to IIFL shall be given effect prospectively by IIFL, from the date of receipt of such change request.

5. I/We declare and state that I/We shall submit the proof of GST No. and other GST related details, in case I/We am/are registered under the GST Act, to IIFL as and when required by IIFL.

6. I/We acknowledge and agree that IIFL would not be responsible for any non-receipt/short receipt of GST credit due to incorrect/inaccurate/incomplete information provided by me/us to IIFL.

7. In the event, IIFL issues a credit note in relation to charges levied, I/ We shall reverse the GST input tax credit availed, if any , within the month in which the discrepancy is communicated. If the same is

not rectified (for any reasons whatsoever), which results in any additional liability (whether in form of tax, interest, penalty or otherwise) for IIFL, I/We shall promptly pay and/or reimburse such amount

to IIFL.

8. In the event, I/ We, do not provide IIFL with necessary GST related information, IIFL may consider us as ‘unregistered’ and Proceed accordingly.

9. Any references to words ‘Service Tax’, ‘Value Added Tax’ or ‘VAT’ in the loan documentation shall be read as Goods and Service Tax (GST) and taxes would accordingly be collected as per applicable

rate.

10. I am/ We are aware that it is on the faith of our aforesaid undertakings that IIFL may disburse the said loan or continue with such facility

END USE DECLARATION

I confirm that I shall use the loan amount only for the Purpose stated in the Application Form and not for any other purpose.

I shall indemnify IIFL in the event of any loss or damage incurred by IIFL, arising out of or in connection with false / incorrect declaration / misrepresentation of information by me.

DECLARATION

I/ We, Mr.NITIN chote the undersigned (hereinafter referred to as “I” with all its grammatical variations or “the Borrower” and the term shall include their successors, transferees, novatees and

permitted assigns) represent and declare that (i) I am a citizen of India; (ii) I have not submitted any application for insolvency, been declared insolvent nor has any insolvency/ bankruptcy proceeding

been initiated against me; (iii) the information furnished by me in this Application is true and correct. (iv) I have not defaulted on any repayment of any other loan interest or any other amount to any

lender or creditor and my name does not appear on the Reserve Bank of India’s (“RBI”) list of defaulters and Export & Credit Guarantee Corporation’s (“ECGC”) caution list or any list/notifications issued

by the RBI with respect to anti money laundering or combating financing of terrorism or any sanctions lists published by the United Nations Security Council with respect to terrorist related activities; (v) I

am the true and lawful owner of the gold ornaments and other articles (“Pledged Articles”). (vi) I am residing at the address given hereinabove and that address is the address for all communications and

I shall immediately intimate IIFL , if there is any change in my address. (vii) I confirm having read and understood the Standard Terms which would apply to the Facility being requested under this

Application Form. (viii) I understand that the sanction of the Facility and any disbursement thereunder is at the sole discretion of IIFL, which reserves its right to reject the Application , and that IIFL shall

not be responsible /liable in any manner whatsoever for such rejection or any delay in notifying me of such rejection. I understand and agree that IIFL and/ or its group companies reserve the rights to

retain the photographs and documents submitted with this Application. I shall promptly inform IIFL about any change in any information furnished. The Borrower(s) further undertake to provide any

further information/ documents that IIFL and/ or its group companies and/ or its agents may require. (ix) I

understand that IIFL shall have the discretion to change the rate of interest prospectively and levy charges as applicable to the Facility; (x) I/We consent / acknowledge the consent given by the

Borrower / such third parties (as required) to IIFL to obtain Borrower’s KYC and credit related information/documents from third parties including Unique Identification Authority of India, Credit

Information Bureau of India Ltd and other entities and also further consents that IIFL may, by its self or through authorised persons, verify any information given, check credit references, employment

details and obtain KYC related documents or credit reports to determine genuineness of the Borrower and/or creditworthiness from time to time. The Borrower(s) have no objection to IIFL exchanging

and sharing information with its affiliates, regulatory bodies, government and credit agencies and other such authority as may be required.

In case there are more than one Borrower(s), each Borrower shall be jointly and severally liable to make payments under the Loan.

The Borrower(s) represent that information furnished in this Application is true and correct. The Borrower(s) represent that none of the applicants have defaulted on any loan repayments with any of its

creditors.

I/We have no objection to IIFL and/ or its group companies and/ or its agents providing me/us information on various products, offers and services provided by IIFL and/ or its group companies through

any mode (including telephone calls, SMSs/ emails, letters etc.) and authorize IIFL and/ or its group companies and/ or its agents for the above purpose. I confirm that laws in relation to the unsolicited

communication referred in "National Do Not Call Registry" as laid down by 'TELECOM REGULATORY AUTHORITY OF INDIA' will not be applicable for such information/ communication to me.

Date: 7/26/2022 1:11:03 PM

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

TOP UP DETAILS, IF APPLICABLE

Top-up Loan GL GL22085762 is a linked loan to Parent GL

*Linked Loan details

Prospect No ROI Tenure

GL22085762 1.83 % 24 Months

DECLARATION AND VERIFICATION ON OWNERSHIP OF GOLD JEWELS*

This declaration is being obtained from Mr/Miss/Mrs Mr.NITIN chote against Prospect number for confirmation and verification

of ownership of jewels.

1. In case if Bill /Invoice for purchase of ownership are available - Refer Bill / Invoice attached. o

2. In case of the above not being available I confirm the following details. þ

The gold provided by me is (a) Ancestral þ (b) Self Purchased o

Jewel Detail Jewel Ownership Details Jewel 1 Jewel 2 Jewel 3 Jewel 4 Jewel 5

Jewel Detail Item Name Ring - - - -

Item Count 4 - - - -

Purchase Date(If Available) 1900-01-01 - - - -

Purchase cost(Approx) (If Available) 0.00 - - - -

Jeweller Details Shop Name(If Available) - - - -

Address(If Available) - - - -

Phone number(If Available) - - - -

Reason for bill/ invoice not being available - - - -

Name of the person from whom gold is received (If nitin - - - -

Ancestral)

Date on which received (If Ancestral) - - - -

Relationship of the person (If Ancestral) self - - - -

*Attach separate sheets, if required.

BANK DETAILS

Bank Name:

Bank Branch Name:

Account No.: IFSC code:

Declared by: Mr.NITIN chote Signature:

Date: 08/06/2022 2:53:50 PM Place: DEHRADUN

DECLARATION BY THE BORROWER AND ACKNOWLEDGMENT OF LOAN (BRANCH COPY)

Borrower accepts and acknowledges the receipt of Rs. 37900.00 Rupees Thirty Seven Thousand Nine Hundred Only) under the Gold Loan Facility.

Date: 08/06/2022 2:53:50 PM

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

STANDARD TERMS (GOLD LOAN FACILITY)

I hereby understand and agree that I may apply for one or more loans by submitting the Application Form(s) and IIFL Finance Limited (formerly known as “IIFL Holdings Limited”) (“IIFL” or “Lender”) may

agree to grant such loan (s) (each a “Loan” or “Facility”) that are or will be governed by these terms and conditions (“Standard Terms”) read together with the Application Form(s), MITC and any other

document as exchanged between the parties (together referred to as “Transaction Document”). Capitalised terms used but not defined herein shall have the meaning ascribed in Application Form and

MITC and other terms and conditions mentioned in the Transaction Documents. I hereby read, understand, agree, accept and acknowledge all the terms and conditions governing such Loan(s) including

the Standard Terms mentioned herein.

I hereby confirm that these Standard Terms can be accepted by me electronically by verifying the One-Time Password (OTP) sent to me by my Lender. I understand that such verification by way of OTP

shall be conclusive evidence of my acceptance of these Standard Terms and the same shall be binding on me

1. Sanction and Disbursement:

1.1 I understand and agree that the Lender may grant the loan against gold jewellery/ornaments (“Facility”) on the basis of the representations made by me. I understand and agree that the Lender may

disburse loans to me (each disbursement referred to as “Loan”).

1.2 I understand and agree and hereby request the Lender to extend the Loan for a maximum period of 2 years, subject to its policies from time to time. Provided however, I understand and agree that

the initial grant of loan will only be for the Tenure (with the Principal Due Date) as stipulated in the Application Form and thereafter the Lender may exercise its sole discretion to extend the Tenure (and

the corresponding Principal Due Date) from time to time. Provided further that, in absence of a communication by the Lender conveying the extension, last communicated Tenure and Principal Due Date

shall be deemed to be final.

1.3 I understand and agree that in the event that the Lender accepts my request for the Facility and sanctions the Facility, the Lender may disburse Loans into my account, prepaid cards, my e-wallet or

by cash.The lender has my explicit consent to issue ICICI Bank prepaid card.

2. Interest, other charges and Payments:

2.1 I understand and agree that the interest and charges on the Loan(s) shall be charged as specified in the Transaction Document and I acknowledge and agree that the rate of interest specified is

reasonable and may be changed prospectively as determined by the Lender.

2.2 I understand and agree that all income tax, any other tax, and all other imposts, duties including stamp duty and relevant registration and filing charges in connection with the Facility (as applicable)

shall be borne by me and that if any such cost is incurred by the Lender on my account, I shall forthwith reimburse the same to the Lender.

2.3 I understand and agree that the interest shall be charged on an actual/reducing balance assuming a year of 365 days and interest shall be payable on monthly intervals unless otherwise specified. I

understand and agree that notwithstanding anything mentioned herein once a Loan is disbursed, minimum interest for seven (7) days will be charged on the Loan even if it is repaid within such period.

2.4 I understand and agree that additional interest as specified by the Lender shall be charged in case of any failure to make timely payments.

2.5 I understand and agree that I shall make each payment (in freely transferable funds, without any set off, counter claim or any deduction) on or before the respective due date and if it is not a

business day, then I agree to make payment on the preceding business day.

3. Terms in relation to Gold:

3.1 I understand and agree that that I am the absolute owner and is in rightful possession of certain gold jewellery/ ornaments (along with any stone or diamonds attached to such jewellery) which have

been pledged to the Lender by way of first and exclusive charge (“Pledged Articles”) in a sealed packet to be kept with Lender and there is no lien, encumbrance, charge(s) or claim(s) on the same apart

from that created in favour of the Lender.

3.2 I understand and agree that the Lender shall be entitled, without furnishing any notice or intimation, to open such sealed packets during the tenor of the Loan and conduct investigation/s in

connection with the quality of the Pledged Articles (including but not limited to melting/cutting/ conducting destructive tests or other tests on the Pledged Articles) at my risk and cost at any time and I

hereby provide consent for the same. I understand, agree and undertake that the findings of the Lender shall be final and binding and I shall not dispute the same in any manner whatsoever.

3.3 I understand and agree that the Pledged Articles and any other security furnished by me to the Lender will be released only upon payment in full of the dues outstanding under Loan(s) by me to the

satisfaction of the Lender.

3.4 I understand and agree that my title to the Pledged Articles is not defective or challenged in any manner nor it is spurious or of inferior quality.

3.5 I understand and agree that in the event of loss of the Pledged Articles due to theft or any natural calamity like fire, floods, earthquake, etc., the liability of the Lender is limited to replacing the lost

Pledged Articles with the amount in cash equivalent to the value of gold in the Pledged Articles as per the records of Lender, after adjusting all the outstanding dues of the Lender and further, that the

replacement cost shall be calculated by way of weight and purity (as maintained in Lender’s record) and multiplying the same by current date price of gold as per published data and the same shall be

final and binding upon me.

3.54. 4. Valuation of Pledged Articles:

4.1 I understand and agree that the valuation of the Pledged Articles shall be done by an assayer authorized and appointed by the Lender and the Loan amount shall be determined by the Lender on the

basis of the value of the Pledged Articles as set out in the valuation report supplied by the assayer. Such value shall be subject to the market price of the Pledged Articles from time to time.

4.2 I understand and agree and confirm that the value of the Pledged Articles as maintained in Lender’s record is acceptable, conclusive, final and binding upon me and the same shall not be disputed in

any manner, at any point in time.

4.3 I understand and agree that by virtue of the Loan being sanctioned by the Lender to me, it does not mean, the Lender confirms or accepts the gold ornaments pledged is of a particular carat

purity.4.4 I understand and agree that iif the Pledged Article is found to be fake or spurious or of lesser purity, or stolen, Lender reserves the right to initiate appropriate investigation/criminal action as

deemed fit and on account of this, if any loss incurred by the Lender, I shall be solely liable and responsible for the same.

4.5 I understand, and agree that only gold component of the Pledged Articles shall be considered for any valuation purposes and Lender will not consider the value of stone or diamond embedded in

jewellery / ornaments at any time including at the time of loss replacement.

5. Margin:

5.1 I understand and agree that I shall ensure at all times, aggregate amounts outstanding under the Transaction Documents is not more than 90% of value of Pledged Articles, as maintained in Lender's

Record or such other percentage as stipulated by the Lender from time to time (“Margin”).

5.2 I understand and agree that the value of the Pledged Articles shall be monitored on regular basis and if value of the Pledged Articles is less than the Margin requirements, Lender may demand

creation of additional security or repayment of Loan in part or full and I shall promptly upon such demand comply with the requirement.

5.3 I understand and agree that in case of failure to comply with additional margin requirements by me, additional margin shortfall charges for every such breach shall be levied by the Lender and the

same shall be payable by me without any delay, demur or protest.

5.4 I understand and agree that notwithstanding anything mentioned herein, if in the opinion of the Lender, value of the Pledged Articles is not sufficient to discharge my obligations or if there exists any

circumstance/s which may materially affect my ability to fulfil my obligations under these Standard Terms, Lender may sell the Pledged Articles by auction at anytime, even before the expiry of tenure

and I hereby consent to the same and shall not dispute the same in any manner at any point in time.

6. Covenants:

6.1 I understand and agree that I shall indemnify, keep indemnified and hold harmless the Lender for all losses, expenses, charges, damages, costs and liabilities (including due to claims by a third party),

incurred by the Lender as a result of any breach by it of any Transaction Documents or any misrepresentation made in relation to the Facility or Pledged Articles. I understand and agree that I shall also

reimburse the Lender for any cost and expenses in connection with the Loan(s) including cost for insuring the securities, enforcement costs, clearance of arrears of all taxes and any other levies of

Government, etc. without any delay, demur or protest.

6.2 I understand and agree that I shall not utilize the funds for purchase of gold in any form, (including primary gold, gold bullion, gold jewellery, gold coins, units of gold exchange traded funds (ETF) and

units of gold mutual funds).

6.3 I understand and agree and accept that notwithstanding any of the provisions of the Indian Contract Act, 1872 or any other applicable law or anything contained in the Transaction Documents, the

amounts repaid by me shall be appropriated first towards cost, charges and expenses and other monies; secondly towards interest on the delayed payments; thirdly towards interest payable under the

Transaction Documents and lastly towards repayment of any principal amounts.

6.4 I understand and agree that I shall furnish all documents/information as may be required by the Lender from time to time and that the Lender may by itself or through its agents verify any

information given, check credit references, employment details and obtain credit reports or any other information deemed necessary by the Lender, from time to time.

7. Events of Default: I understand and agree and accept that the following would include Events of Default:

7.1 Default has occurred in the payment/ repayment of any monies (whether at stated due date, by acceleration or otherwise) under the Transaction Documents.

7.2 I have defaulted (other than a payment default) in the performance of any covenant and such covenant is not remedied with 3(three) days of such breach.

7.3 I have, or there is a reasonable apprehension that I would, voluntarily or involuntarily become the subject of proceedings under any bankruptcy or insolvency law.

7.4 My death, or the change of my constitution without the consent of the Lender.

7.5 The security, if any, for the Facility is in jeopardy or ceases to have effect.

7.6 If any of my representations are found to be false, misleading or incorrect.

7.7 Upon detection of any systemic fraud in relation to the quality of the Pledged Article.

7.8 If the value of the Pledged Articles falls lower than the required Margin as stipulated from time to time, due to change in market price or any other reason. I understand, agree and accept that upon

occurrence of any of the above, Lender may:

(a) call upon me to pay forthwith the outstanding balance of the Facility together with interest and all sums payable as per Transaction Documents;

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

(b) call upon me to pay all claims, costs, losses and expenses that may be incurred by the Lender because of any act or default on my part of with respect to the Facility and/or for the recovery of the

outstanding dues (including legal/attorney fee) and/or on account of my failure of any of the terms and conditions under the Transaction Documents; (c) sell the Pledged Articles by auction.

i. I understand and agree that auction shall be conducted by the Lender by giving one advertisement in daily newspapers in vernacular language and another advertisement in a national daily newspaper,

after giving me a notice of 10 business days which I agree is a reasonable period for the purposes of Section 176 of the Indian Contract Act, 1872. I understand and agree that the reserved price for the

auction would not be less than 85% of the previous 30 days’ average closing price of 22 carat gold as declared by the Bombay Bullion Association Ltd. or the historical spot gold price published by

regulated commodity exchange.

ii. I understand and agree that I shall be intimated by registered letter/courier service, SMS or telephone or personal intimation or via email or via any other mode of communication regarding its intent

to subject the Pledged Articles to public auction. iii. I understand and agree that the Auction shall be conducted as per the guidelines issued by Reserve Bank of India and other concerned regulator from

time to time. iv. I understand and agree that the proceeds so realized from the sale of the Pledged Articles shall be utilized towards the repayment of dues under the Loan and in the event the proceeds

so realized are insufficient to meet the amount of dues, Lender reserves its right to take further action at its discretion.

(d) disclose and publish the information about me and my default in the public domain including through social media.

(e) enforce any rights available to it under any law or contract.

8. Additional Facilities:

8.1 I understand and agree that I may apply for further/additional facilities (continuing the pledge for such additional Loan(s)) using online secure platforms (Online Facility) or by making the call to the

toll free numbers of the Lender. Lender may at its discretion extend such additional loan subject to the Borrower complying with the Lender's credit parameters and submitting all

documents/information as may be required. I understand and agree that the Lender shall have the right of lien and set off in respect of the Pledged Articles and any proceeds of sale thereof, in respect of

any other facilities availed by me from the Lender from time to time.

9. Miscellaneous:

9.1 I understand and agree that any notice or request to be given by me must be in writing. All notices or requests shall be deemed to have been duly received by the party to whom it is addressed if it is

given or made at the address specified below or at such other address as may be agreed:

• For the Lender:

• Regd. Office: IIFL House, Sun Infotech Park, Road No. 16V, Plot No. B-23, Thane Industrial Area, Wagle Estate, Thane - 400 604, Corporate Office: 802, 8th Floor, Hub Town Solaris, N.S. Phadke Marg,

Vijay Nagar, Andheri East, Mumbai - 400 069 • For me:

• The address as stated in the Application Form.

9.2 I understand and agree that any and all claims and disputes arising out of or in connection with the Transaction Documents or its performance shall be settled by arbitration by a single arbitrator to

be appointed by the Lender. The venue of arbitration shall be in Mumbai. The arbitration shall be conducted under the provisions of the Arbitration and Conciliation Act, 1996 or any statutory

modification or re-enactment thereof for the time being in force and the award of such arbitrator shall be final and binding upon the Borrower and the Lender.

9.3 I understand and agree that the Lender shall, without prejudice to any other agreement, at its sole discretion, be at liberty to apply any other money, amounts, securities and other property

belonging to me (whether singly or jointly with another or others) in possession of the Lender or any of its subsidiary/affiliate/associate company in or towards payment of the dues under any facility

granted by the Lender to me.

9.4 I understand and agree that the Lender shall be entitled at my sole risk and cost to engage one or more person(s) to collect my dues and shall further be entitled to share such information, facts and

figures pertaining to me as the Lender deems fit.

9.5 I understand and agree that the Lender may, at any time, assign or transfer all or any of its rights, benefits and obligations under the Transaction Documents.

9.6 I understand and agree that all transactions shall be only executed between the regular working hours of the Lender on business days only.

9.7 I understand and agree that the Lender reserves the right to amend the terms of these Standard Terms (except amendment to interest rate) by intimating the same to me. Interest Rate shall not be

changed without my prior consent.

9.8 I understand and agree that by utilising the Facility provided, I am unconditionally and irrevocably accepting the terms and conditions listed hereunder and as may be amended from time to time and

shall abide by and be bound by them at all times.

9.9 Co-Lending

I understand and agree that the Lender has entered into co-lending arrangement with (a) DCB Bank, (b) DBS Bank India Limited and (c) certain other banks in accordance with co-lending guidelines

notified by RBI vide notification dated November 05, 2020 titled “Co-Lending by Banks and NBFCs to Priority Sector” (Co-lending Guidelines”) pursuant to which such banks (“Bank”) can exercise their

option to participate in the loan granted under these Standard Terms and become a co lender along with the Lender to the extent of 80% of the total principal to be lent by the Lender (“Bank

Contribution”) and such part of the loan will be novated to the Bank (“Bank’s Participation”) absolutely and forever, to the end and intent that the Bank shall be deemed to be the full and absolute owner

of the Bank’s Participation and as such legally and beneficially entitled to all such portion of the loan, free from all encumbrances. Further, upon transfer by the Bank of the Bank Contribution to the

Lender, the terms of the loan will be deemed to be novated/assigned in such a manner to the relevant Bank that the said bank will become a co-lender of the loan under these Standard Terms and will

be deemed to have executed this document as a co-lender along with the Lender. Accordingly, the said Bank shall be entitled to enforce all rights under the Standard Terms as a lender of the loan to you

9.10 KYC clause

I understand and agree that for facilitating the Co-lending arrangement as above, the Know Your Customer (KYC) and my related details are required to be shared with the Bank. By signing the pledge

documents, I hereby provide my consent to the Lender for sharing such information with the Bank being a participant to this Co-Lending arrangement. Further I hereby consent to the Lender and the

Bank to disclose any information or data related to the loan and my personal KYC information to the Credit Information Bureau (India) Limited and / or any other agency authorized by the Reserve Bank

of India, Central KYC Registry or any other competent authority. I understand, agree and am aware that such agencies may use or share such information as they deem fit and proper. I authorise the

Lender and the relevant Bank to share my personal details with third party/ies for such purpose(s), including but not limited to, gold appraisal, credit assessment, background verification, analysis,

marketing, fraud prevention, credit checks, loan servicing, payment processing, loan collection activities etc. as may be required by the Lender. The Lender and the relevant Bank may disclose my and/or

the loan information to Reserve Bank of India, other statutory/regulatory authorities, arbitrator, credit bureaus, local authority, credit rating agency, information utility, marketing agencies, service

providers if required, or to its affiliates whether in India or otherwise for offering services, risk management, business purposes, etc. I understand and agree that my/our personal information may be

held and processed on computers of the Lender and the relevant Bank, their service providers and/or contractors for providing certain value-added services, statistical analysis, etc. I confirm that I have

read, understood and agree to the privacy policy of the lenders.

9.11 FATCA

I understand, agree and hereby confirm that I am a citizen and permanent resident of India and subject to the tax regime of India.

9.12 Asset Classification

Pursuant to the Reserve Bank of India vide their Notification on "Prudential norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances - Clarifications" dated 12th

November 2021, I, the Borrower shall note the following loan classification structure:

Classification DPD BUCKET Description

RANGE

SMA-0 Up to 30 Days If due date of a loan account is March 31, 2021, and full dues are not received before the day-end process for this date, the date of overdue shall be

March 31, 2021 it shall get tagged as SMA-0 on March 31, 2021.

SMA-1 More than 30 Days and Continuing from the above, if the account continues to remain overdue, then it shall get tagged as SMA-1 upon running day-end process on April 30,

up to 60 Days 2021 i.e. upon completion of 30 days of being continuously overdue.

SMA-2 More than 60 Days and Continuing from the above, if the account continues to remain overdue, it shall get tagged as SMA-2 upon running day-end process on May 30, 2021

up to 90 days i.e. upon completion of 60 days of being continuously overdue.

Non-Performing Asset More than 90 Days Continuing from the above, and if continues to remain overdue further, it shall get classified as NPA upon running day-end process on June 29, 2021.

(NPA) Once an accounts become NPA i.e. remains continue overdue for 90 days, it will be tagged as NPA till it clears all overdue amount* and its DPD

becomes 0.

Any partial payments made will not change the NPA status.

Overdue amount is Interest due or Principal and Interest due as per the repayment schedule

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

VERNACULAR DECLARATION

son/daughter/wife of aged

residing at years,

do hereby state and declare that:

a. I have been read out and explained, in the language known to me, the contents of the loan documents, security documents (if any) and other documents

incidental to availing the loan from IIFL Finance Limited (IIFL).

b. I have signed the aforesaid documents after understanding each of its terms and conditions.

Name:

Signed by OTP

08/06/2022 2:53:50 PM

Signature of Borrower

Name:

Address:

Relation to the Borrower:

Signature of the person who has read out and explained the documents to the Borrower

(Third Party other than employee of IIFL Finance Limited)

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

IIFL Finance Limited (IIFL) (Formerly known as “IIFL Holdings Limited”) BORROWER COPY

CIN: L67100MH1995PLC093797 / RBI CoR No. N-13.02386

Regd. Office: IIFL House, Sun Infotech Park, Road No. 16V, Plot No. B-23, Thane Industrial Area,

Wagle Estate, Thane - 400 604Tel: (91-22) 4103 5000 • Fax: (91-22) 2580 6654

Corporate Office: 802, 8th Floor, Hub Town Solaris, N.S. Phadke Marg, Vijay Nagar, Andheri East, Mumbai - 400 069

Tel: (91-22) 6788 1000 • Fax: (91-22) 6788 1010 • E-mail: reach@iifl.com • Website: www.iifl.com

MOST IMPORTANT TERMS

Prospect Number GL22085762

1. We refer to the application form dated 08/06/2022 2:53:50 PM for grant of the Facility described below.

2. The Borrower acknowledges and confirms that the below mentioned are the most important terms and conditions in the application for the Facility (and which would apply to

the Borrower in respect of the Facility, if the request for the Facility is accepted by the Lender) and they shall be read in conjunction with theApplication Form(s) and the

Standard Terms (Gold Loan Facility):

Borrower Mr.NITIN chote

Facility Gold loan

Principle Amount ₹ 37,900.00

Tenure 24 months (subject to Standard Terms)

Rate of Interest 21.96 % p.a. at fixed rate of interest

Interest Due Date 8 of every 3rd Month

Mode of Computation Simple Interest Mode Of Disbursement: CASH

Principal Due Date 08/06/2024 (subject to Standard Terms)

Additional Interest Rate 6.00 % p.a.

Purpose Others

Risk Category Medium

Pledge The gold ornaments have been deposited with IIFL to secure the Facility and only gold component of pledged

Articles will be considered for valuation

Margin Borrowers shall ensure that the at all time aggregate amounts outstanding is not more than 90% of value of

Pledged Articles or such other percentage as stipulated by the Lender from time to time

Auction IIFL may auction the Gold as per its policy in case of breach of terms

SCHEDULED OF CHARGES (Exclusive of Taxes) Rebate for early payment of interest is available as given in Rates applicable for early payment of

Particular Amount/Percent the chart below(Applicable for FBL scheme only) interest as given in chart below:

Processing Fee Rs.0.00 IF PAID WITHIN Rebate Effective ROI p.a

Closure and Part payment 0.00 % If Paying Within Effective ROI p.a

charges

MTM charges Rs.500

Auction Charges Rs.1500

Franking Charges applicable as Rs.0.00

per the state

3. The Borrower understands that the Lender has adopted risk based pricing, which is arrived by taking into account, broad parameters like customers profile and various other

parameters. Applicable interest rates are arrived at taking into account the prevailing market rates at the time of sanctioning. For policy details refer – www.iifl.com.

Further, the Borrower acknowledges and confirms that the Lender shall have the discretion to change prospectively the rate of interest and other charges applicable to the

Facility.

4. The Borrower acknowledges and confirms having received a copy of each Transaction Document and agrees that this letter is a Transaction Document.

5. Borrower understands that all payment receipts are provided electronically only. However if physical payment confirmation is required, please obtain the same from our

branch on paying nominal charges.

6. The Borrower understand that all payment shall be made abiding by the amortisation schedule as mentioned in the following section.

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

Amortization Schedule

Payment Due Date Interest Payable Amount Principle Payble Amount

08-09-22 2097.81 -

08-12-22 2075.01 -

08-03-23 2052.21 -

08-06-23 2097.81 -

08-09-23 2097.81 -

08-12-23 2075.01 -

08-03-24 2075.01 -

08-06-24 2097.81 37900.00

In case of early repayment the Interest Amount to be considered as per applicable rate

TOP UP DETAILS, IF APPLICABLE

Top-up Loan GL22085762 is a linked loan to Parent

GL GL

*Linked Loan details

Prospect No ROI Tenure

GL22085762 1.83 % 24 Months

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

STANDARD TERMS (GOLD LOAN FACILITY)

I hereby understand and agree that I may apply for one or more loans by submitting the Application Form(s) and IIFL Finance Limited (formerly known as “IIFL Holdings Limited”) (“IIFL” or “Lender”) may

agree to grant such loan (s) (each a “Loan” or “Facility”) that are or will be governed by these terms and conditions (“Standard Terms”) read together with the Application Form(s), MITC and any other

document as exchanged between the parties (together referred to as “Transaction Document”). Capitalised terms used but not defined herein shall have the meaning ascribed in Application Form and

MITC and other terms and conditions mentioned in the Transaction Documents. I hereby read, understand, agree, accept and acknowledge all the terms and conditions governing such Loan(s) including

the Standard Terms mentioned herein.

I hereby confirm that these Standard Terms can be accepted by me electronically by verifying the One-Time Password (OTP) sent to me by my Lender. I understand that such verification by way of OTP

shall be conclusive evidence of my acceptance of these Standard Terms and the same shall be binding on me

1. Sanction and Disbursement:

1.1 I understand and agree that the Lender may grant the loan against gold jewellery/ornaments (“Facility”) on the basis of the representations made by me. I understand and agree that the Lender

may disburse loans to me (each disbursement referred to as “Loan”).

1.2 I understand and agree and hereby request the Lender to extend the Loan for a maximum period of 2 years, subject to its policies from time to time. Provided however, I understand and agree that

the initial grant of loan will only be for the Tenure (with the Principal Due Date) as stipulated in the Application Form and thereafter the Lender may exercise its sole discretion to extend the Tenure (and

the corresponding Principal Due Date) from time to time. Provided further that, in absence of a communication by the Lender conveying the extension, last communicated Tenure and Principal Due Date

shall be deemed to be final.

1.3 I understand and agree that in the event that the Lender accepts my request for the Facility and sanctions the Facility, the Lender may disburse Loans into my account, prepaid cards, my e-wallet or

by cash.The lender has my explicit consent to issue ICICI Bank prepaid card.

2. Interest, other charges and Payments:

2.1 I understand and agree that the interest and charges on the Loan(s) shall be charged as specified in the Transaction Document and I acknowledge and agree that the rate of interest specified is

reasonable and may be changed prospectively as determined by the Lender.

2.2 I understand and agree that all income tax, any other tax, and all other imposts, duties including stamp duty and relevant registration and filing charges in connection with the Facility (as applicable)

shall be borne by me and that if any such cost is incurred by the Lender on my account, I shall forthwith reimburse the same to the Lender.

2.3 I understand and agree that the interest shall be charged on an actual/reducing balance assuming a year of 365 days and interest shall be payable on monthly intervals unless otherwise specified. I

understand and agree that notwithstanding anything mentioned herein once a Loan is disbursed, minimum interest for seven (7) days will be charged on the Loan even if it is repaid within such period.

2.4 I understand and agree that additional interest as specified by the Lender shall be charged in case of any failure to make timely payments.

2.5 I understand and agree that I shall make each payment (in freely transferable funds, without any set off, counter claim or any deduction) on or before the respective due date and if it is not a

business day, then I agree to make payment on the preceding business day.

3. Terms in relation to Gold:

3.1 I understand and agree that that I am the absolute owner and is in rightful possession of certain gold jewellery/ ornaments (along with any stone or diamonds attached to such jewellery) which

have been pledged to the Lender by way of first and exclusive charge (“Pledged Articles”) in a sealed packet to be kept with Lender and there is no lien, encumbrance, charge(s) or claim(s) on the same

apart from that created in favour of the Lender.

3.2 I understand and agree that the Lender shall be entitled, without furnishing any notice or intimation, to open such sealed packets during the tenor of the Loan and conduct investigation/s in

connection with the quality of the Pledged Articles (including but not limited to melting/cutting/ conducting destructive tests or other tests on the Pledged Articles) at my risk and cost at any time and I

hereby provide consent for the same. I understand, agree and undertake that the findings of the Lender shall be final and binding and I shall not dispute the same in any manner whatsoever.

3.3 I understand and agree that the Pledged Articles and any other security furnished by me to the Lender will be released only upon payment in full of the dues outstanding under Loan(s) by me to the

satisfaction of the Lender.

3.4 I understand and agree that my title to the Pledged Articles is not defective or challenged in any manner nor it is spurious or of inferior quality.

3.5 I understand and agree that in the event of loss of the Pledged Articles due to theft or any natural calamity like fire, floods, earthquake, etc., the liability of the Lender is limited to replacing the lost

Pledged Articles with the amount in cash equivalent to the value of gold in the Pledged Articles as per the records of Lender, after adjusting all the outstanding dues of the Lender and further, that the

replacement cost shall be calculated by way of weight and purity (as maintained in Lender’s record) and multiplying the same by current date price of gold as per published data and the same shall be

final and binding upon me.

3.54. 4. Valuation of Pledged Articles:

4.1 I understand and agree that the valuation of the Pledged Articles shall be done by an assayer authorized and appointed by the Lender and the Loan amount shall be determined by the Lender on

the basis of the value of the Pledged Articles as set out in the valuation report supplied by the assayer. Such value shall be subject to the market price of the Pledged Articles from time to time.

4.2 I understand and agree and confirm that the value of the Pledged Articles as maintained in Lender’s record is acceptable, conclusive, final and binding upon me and the same shall not be disputed in

any manner, at any point in time.

4.3 I understand and agree that by virtue of the Loan being sanctioned by the Lender to me, it does not mean, the Lender confirms or accepts the gold ornaments pledged is of a particular carat

purity.4.4 I understand and agree that iif the Pledged Article is found to be fake or spurious or of lesser purity, or stolen, Lender reserves the right to initiate appropriate investigation/criminal action as

deemed fit and on account of this, if any loss incurred by the Lender, I shall be solely liable and responsible for the same.

4.5 I understand, and agree that only gold component of the Pledged Articles shall be considered for any valuation purposes and Lender will not consider the value of stone or diamond embedded in

jewellery / ornaments at any time including at the time of loss replacement.

5. Margin:

5.1 I understand and agree that I shall ensure at all times, aggregate amounts outstanding under the Transaction Documents is not more than 90% of value of Pledged Articles, as maintained in

Lender's Record or such other percentage as stipulated by the Lender from time to time (“Margin”).

5.2 I understand and agree that the value of the Pledged Articles shall be monitored on regular basis and if value of the Pledged Articles is less than the Margin requirements, Lender may demand

creation of additional security or repayment of Loan in part or full and I shall promptly upon such demand comply with the requirement.

5.3 I understand and agree that in case of failure to comply with additional margin requirements by me, additional margin shortfall charges for every such breach shall be levied by the Lender and the

same shall be payable by me without any delay, demur or protest.

5.4 I understand and agree that notwithstanding anything mentioned herein, if in the opinion of the Lender, value of the Pledged Articles is not sufficient to discharge my obligations or if there exists

any circumstance/s which may materially affect my ability to fulfil my obligations under these Standard Terms, Lender may sell the Pledged Articles by auction at anytime, even before the expiry of

tenure and I hereby consent to the same and shall not dispute the same in any manner at any point in time.

6. Covenants:

6.1 I understand and agree that I shall indemnify, keep indemnified and hold harmless the Lender for all losses, expenses, charges, damages, costs and liabilities (including due to claims by a third

party), incurred by the Lender as a result of any breach by it of any Transaction Documents or any misrepresentation made in relation to the Facility or Pledged Articles. I understand and agree that I shall

also reimburse the Lender for any cost and expenses in connection with the Loan(s) including cost for insuring the securities, enforcement costs, clearance of arrears of all taxes and any other levies of

Government, etc. without any delay, demur or protest.

6.2 I understand and agree that I shall not utilize the funds for purchase of gold in any form, (including primary gold, gold bullion, gold jewellery, gold coins, units of gold exchange traded funds (ETF)

and units of gold mutual funds).

6.3 I understand and agree and accept that notwithstanding any of the provisions of the Indian Contract Act, 1872 or any other applicable law or anything contained in the Transaction Documents, the

amounts repaid by me shall be appropriated first towards cost, charges and expenses and other monies; secondly towards interest on the delayed payments; thirdly towards interest payable under the

Transaction Documents and lastly towards repayment of any principal amounts.

6.4 I understand and agree that I shall furnish all documents/information as may be required by the Lender from time to time and that the Lender may by itself or through its agents verify any

information given, check credit references, employment details and obtain credit reports or any other information deemed necessary by the Lender, from time to time.

7. Events of Default: I understand and agree and accept that the following would include Events of Default:

7.1 Default has occurred in the payment/ repayment of any monies (whether at stated due date, by acceleration or otherwise) under the Transaction Documents.

7.2 I have defaulted (other than a payment default) in the performance of any covenant and such covenant is not remedied with 3(three) days of such breach.

7.3 I have, or there is a reasonable apprehension that I would, voluntarily or involuntarily become the subject of proceedings under any bankruptcy or insolvency law.

7.4 My death, or the change of my constitution without the consent of the Lender.

7.5 The security, if any, for the Facility is in jeopardy or ceases to have effect.

7.6 If any of my representations are found to be false, misleading or incorrect.

7.7 Upon detection of any systemic fraud in relation to the quality of the Pledged Article.

7.8 If the value of the Pledged Articles falls lower than the required Margin as stipulated from time to time, due to change in market price or any other reason. I understand, agree and accept that upon

occurrence of any of the above, Lender may:

(a) call upon me to pay forthwith the outstanding balance of the Facility together with interest and all sums payable as per Transaction Documents;

(b) call upon me to pay all claims, costs, losses and expenses that may be incurred by the Lender because of any act or default on my part of with respect to the Facility and/or for the recovery of the

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

outstanding dues (including legal/attorney fee) and/or on account of my failure of any of the terms and conditions under the Transaction Documents; (c) sell the Pledged Articles by auction.

i. I understand and agree that auction shall be conducted by the Lender by giving one advertisement in daily newspapers in vernacular language and another advertisement in a national daily newspaper,

after giving me a notice of 10 business days which I agree is a reasonable period for the purposes of Section 176 of the Indian Contract Act, 1872. I understand and agree that the reserved price for the

auction would not be less than 85% of the previous 30 days’ average closing price of 22 carat gold as declared by the Bombay Bullion Association Ltd. or the historical spot gold price published by

regulated commodity exchange.

ii. I understand and agree that I shall be intimated by registered letter/courier service, SMS or telephone or personal intimation or via email or via any other mode of communication regarding its intent

to subject the Pledged Articles to public auction. iii. I understand and agree that the Auction shall be conducted as per the guidelines issued by Reserve Bank of India and other concerned regulator from

time to time. iv. I understand and agree that the proceeds so realized from the sale of the Pledged Articles shall be utilized towards the repayment of dues under the Loan and in the event the proceeds

so realized are insufficient to meet the amount of dues, Lender reserves its right to take further action at its discretion.

(d) disclose and publish the information about me and my default in the public domain including through social media.

(e) enforce any rights available to it under any law or contract.

8. Additional Facilities:

8.1 I understand and agree that I may apply for further/additional facilities (continuing the pledge for such additional Loan(s)) using online secure platforms (Online Facility) or by making the call to the

toll free numbers of the Lender. Lender may at its discretion extend such additional loan subject to the Borrower complying with the Lender's credit parameters and submitting all

documents/information as may be required. I understand and agree that the Lender shall have the right of lien and set off in respect of the Pledged Articles and any proceeds of sale thereof, in respect of

any other facilities availed by me from the Lender from time to time.

9. Miscellaneous:

9.1 I understand and agree that any notice or request to be given by me must be in writing. All notices or requests shall be deemed to have been duly received by the party to whom it is addressed if it

is given or made at the address specified below or at such other address as may be agreed:

• For the Lender:

• Regd. Office: IIFL House, Sun Infotech Park, Road No. 16V, Plot No. B-23, Thane Industrial Area, Wagle Estate, Thane - 400 604, Corporate Office: 802, 8th Floor, Hub Town Solaris, N.S. Phadke Marg,

Vijay Nagar, Andheri East, Mumbai - 400 069 • For me:

• The address as stated in the Application Form.

9.2 I understand and agree that any and all claims and disputes arising out of or in connection with the Transaction Documents or its performance shall be settled by arbitration by a single arbitrator to

be appointed by the Lender. The venue of arbitration shall be in Mumbai. The arbitration shall be conducted under the provisions of the Arbitration and Conciliation Act, 1996 or any statutory

modification or re-enactment thereof for the time being in force and the award of such arbitrator shall be final and binding upon the Borrower and the Lender.

9.3 I understand and agree that the Lender shall, without prejudice to any other agreement, at its sole discretion, be at liberty to apply any other money, amounts, securities and other property

belonging to me (whether singly or jointly with another or others) in possession of the Lender or any of its subsidiary/affiliate/associate company in or towards payment of the dues under any facility

granted by the Lender to me.

9.4 I understand and agree that the Lender shall be entitled at my sole risk and cost to engage one or more person(s) to collect my dues and shall further be entitled to share such information, facts and

figures pertaining to me as the Lender deems fit.

9.5 I understand and agree that the Lender may, at any time, assign or transfer all or any of its rights, benefits and obligations under the Transaction Documents.

9.6 I understand and agree that all transactions shall be only executed between the regular working hours of the Lender on business days only.

9.7 I understand and agree that the Lender reserves the right to amend the terms of these Standard Terms (except amendment to interest rate) by intimating the same to me. Interest Rate shall not be

changed without my prior consent.

9.8 I understand and agree that by utilising the Facility provided, I am unconditionally and irrevocably accepting the terms and conditions listed hereunder and as may be amended from time to time

and shall abide by and be bound by them at all times.

9.9 Co-Lending

I understand and agree that the Lender has entered into co-lending arrangement with (a) DCB Bank, (b) DBS Bank India Limited and (c) certain other banks in accordance with co-lending guidelines

notified by RBI vide notification dated November 05, 2020 titled “Co-Lending by Banks and NBFCs to Priority Sector” (Co-lending Guidelines”) pursuant to which such banks (“Bank”) can exercise their

option to participate in the loan granted under these Standard Terms and become a co lender along with the Lender to the extent of 80% of the total principal to be lent by the Lender (“Bank

Contribution”) and such part of the loan will be novated to the Bank (“Bank’s Participation”) absolutely and forever, to the end and intent that the Bank shall be deemed to be the full and absolute owner

of the Bank’s Participation and as such legally and beneficially entitled to all such portion of the loan, free from all encumbrances. Further, upon transfer by the Bank of the Bank Contribution to the

Lender, the terms of the loan will be deemed to be novated/assigned in such a manner to the relevant Bank that the said bank will become a co-lender of the loan under these Standard Terms and will

be deemed to have executed this document as a co-lender along with the Lender. Accordingly, the said Bank shall be entitled to enforce all rights under the Standard Terms as a lender of the loan to you

9.10 KYC clause

I understand and agree that for facilitating the Co-lending arrangement as above, the Know Your Customer (KYC) and my related details are required to be shared with the Bank. By signing the pledge

documents, I hereby provide my consent to the Lender for sharing such information with the Bank being a participant to this Co-Lending arrangement. Further I hereby consent to the Lender and the

Bank to disclose any information or data related to the loan and my personal KYC information to the Credit Information Bureau (India) Limited and / or any other agency authorized by the Reserve Bank

of India, Central KYC Registry or any other competent authority. I understand, agree and am aware that such agencies may use or share such information as they deem fit and proper. I authorise the

Lender and the relevant Bank to share my personal details with third party/ies for such purpose(s), including but not limited to, gold appraisal, credit assessment, background verification, analysis,

marketing, fraud prevention, credit checks, loan servicing, payment processing, loan collection activities etc. as may be required by the Lender. The Lender and the relevant Bank may disclose my and/or

the loan information to Reserve Bank of India, other statutory/regulatory authorities, arbitrator, credit bureaus, local authority, credit rating agency, information utility, marketing agencies, service

providers if required, or to its affiliates whether in India or otherwise for offering services, risk management, business purposes, etc. I understand and agree that my/our personal information may be

held and processed on computers of the Lender and the relevant Bank, their service providers and/or contractors for providing certain value-added services, statistical analysis, etc. I confirm that I have

read, understood and agree to the privacy policy of the lenders.

9.11 FATCA

I understand, agree and hereby confirm that I am a citizen and permanent resident of India and subject to the tax regime of India.

9.12 Asset Classification

Pursuant to the Reserve Bank of India vide their Notification on "Prudential norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances - Clarifications" dated 12th

November 2021, I, the Borrower shall note the following loan classification structure:

Classification DPD BUCKET Description

RANGE

SMA-0 Up to 30 Days If due date of a loan account is March 31, 2021, and full dues are not received before the day-end process for this date, the date of overdue shall be

March 31, 2021 it shall get tagged as SMA-0 on March 31, 2021.

SMA-1 More than 30 Days and Continuing from the above, if the account continues to remain overdue, then it shall get tagged as SMA-1 upon running day-end process on April 30,

up to 60 Days 2021 i.e. upon completion of 30 days of being continuously overdue.

SMA-2 More than 60 Days and Continuing from the above, if the account continues to remain overdue, it shall get tagged as SMA-2 upon running day-end process on May 30, 2021

up to 90 days i.e. upon completion of 60 days of being continuously overdue.

Non-Performing Asset More than 90 Days Continuing from the above, and if continues to remain overdue further, it shall get classified as NPA upon running day-end process on June 29, 2021.

(NPA) Once an accounts become NPA i.e. remains continue overdue for 90 days, it will be tagged as NPA till it clears all overdue amount* and its DPD

becomes 0.

Any partial payments made will not change the NPA status.

Overdue amount is Interest due or Principal and Interest due as per the repayment schedule

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

GOLD DEPOSIT RECEIPT

Date: 08/06/2022 2:53:50 PM Prospect Number: GL22085762

Name of Borrower: Mr.NITIN chote

Unique Identity Number: PanNo : CNUPN3067K PAN Number: CNUPN3067K

Gold Loan Account Number: GL22085762 Telephone Number : 7827793424

BORROWER’S PHOTO JEWELLERY PHOTO

Branch Name: DEHRADUN-SHIMLA BY PASS ROAD GL

Branch Code: BM6313

Branch Address: Surya Complex First Floor Shimla By pass

road , Above ICICI Bank Dehradun 248001

DETAILS OF THE PLEDGED ARTICLES (Gold Ornaments and other articles)

Particulars Units Caret Total Wt

Ring 4.00 22 11.11

Total 11.11

This is electronically generated document and does not require any further signature

ACKNOWLEDGMENT OF LOAN APPLICATION FORM

Dear Sir/ Madam

This is to acknowledge the receipt of the above Loan Application Form. It is our endeavour to process the Loan Application within 30 days, Subject to

furnishing of all the necessary documents as required by IIFL

Date: 08/06/2022 2:53:50 PM STAMP & SIGNATURE

Signed via OTP:

08/06/2022 2:53:50 PM

Signature of Borrower

For any help or assistance call Toll Free Number: 1860-267-3000 / 7039-050-000 or E-mail gold-helpline@iifl.com Please refer our

Website/Branch Notice Board for Fair Practice code and visit our nearest branch for schemes/applicable interest rate.

GL/FY/2020/02/017

You might also like

- CPR 2022 Tax ReturnDocument1 pageCPR 2022 Tax ReturnUmair MughalNo ratings yet

- Mutual FundsDocument14 pagesMutual FundsSiddharthNo ratings yet

- REG NO: KA28EU8808: Registration Certificate For VehicleDocument1 pageREG NO: KA28EU8808: Registration Certificate For VehicleMD ZubairNo ratings yet

- Inprinciple LetterDocument1 pageInprinciple LetterDeep PratyakshNo ratings yet

- Siddharth Canara 17733213733Document3 pagesSiddharth Canara 17733213733SiddharthNo ratings yet

- Acknowledgement For IMPS Online TransactionDocument1 pageAcknowledgement For IMPS Online Transactionaditya singhNo ratings yet

- Communication Constable PDFDocument1 pageCommunication Constable PDFAjay Puri0% (1)

- D JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219Document2 pagesD JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219amardeepjassal85No ratings yet

- Globalization and EducationDocument7 pagesGlobalization and Educationbambi rose espanola50% (2)

- Transaction ReceiptDocument1 pageTransaction ReceiptMuhammed ZekariyaNo ratings yet

- Application Form GL8692662 02 012018153659 PDFDocument9 pagesApplication Form GL8692662 02 012018153659 PDFAnonymous sIoYMlRpNo ratings yet

- Tax Invoice for Arasi Soaps Coconut Oil Bath SoapDocument1 pageTax Invoice for Arasi Soaps Coconut Oil Bath SoapSreedharNo ratings yet

- Sbi AnalyticalDocument21 pagesSbi AnalyticalGurjeevNo ratings yet

- Gmail - PSG PDFDocument1 pageGmail - PSG PDFJehangir Allam100% (2)

- Loan AgreementDocument20 pagesLoan AgreementRANJIT BISWAL (Ranjit)No ratings yet

- Online Vehicle Registration Receipt in MaharashtraDocument1 pageOnline Vehicle Registration Receipt in MaharashtraBhushanNo ratings yet

- Agricultural Economics and Marketing - Review Exam Set 1 Select The Best AnswerDocument20 pagesAgricultural Economics and Marketing - Review Exam Set 1 Select The Best AnswerSean HooeksNo ratings yet

- Acknowledgement Slip for Return of IncomeDocument4 pagesAcknowledgement Slip for Return of IncomeferozaNo ratings yet

- Piramal SOAREPORT02023 07 01 11 31 000Document3 pagesPiramal SOAREPORT02023 07 01 11 31 000Om PrakashNo ratings yet

- Butler SolutionDocument82 pagesButler Solutionriffy4550% (2)

- Img PDFDocument2 pagesImg PDFlalit chhabraNo ratings yet

- IDBI Bank Home LoanDocument11 pagesIDBI Bank Home Loansahil7827No ratings yet

- Temporary Registration Certificate for Motorcycle in TelanganaDocument1 pageTemporary Registration Certificate for Motorcycle in TelanganaPatel PatelNo ratings yet

- Online Tax PaymentDocument1 pageOnline Tax PaymentRaam Honda Sales HiriseNo ratings yet

- Capri Global Capital LTD.: Loan Application Form Occupation Details Applicant PhotographDocument3 pagesCapri Global Capital LTD.: Loan Application Form Occupation Details Applicant PhotographAbhishek Bhalla100% (1)

- BorrowerDocument11 pagesBorrowerrk sainiNo ratings yet

- Regeveoine BorrowerDocument1 pageRegeveoine BorrowerJ.D The GamerNo ratings yet

- Bajaj Finserv Loan ApprovalDocument2 pagesBajaj Finserv Loan Approvalprsnjt11No ratings yet

- Amazon InvoiceDocument1 pageAmazon InvoiceChandra BhushanNo ratings yet

- Manba Finance Closing LetterDocument2 pagesManba Finance Closing LetterRudhvi100% (1)

- DigitalApproval Letter PDFDocument1 pageDigitalApproval Letter PDFreddynagiNo ratings yet

- Circular To All Branches and Offices in India: BCC:BR:106/383 01.09.2014Document32 pagesCircular To All Branches and Offices in India: BCC:BR:106/383 01.09.2014amilcarNo ratings yet

- AmanDocument7 pagesAmanGaba StudioNo ratings yet

- Tax invoice for headphonesDocument1 pageTax invoice for headphonesRichest TechNo ratings yet

- Loan Details: TWO - Wheeler Sandhya Automotives, KURNOOLDocument1 pageLoan Details: TWO - Wheeler Sandhya Automotives, KURNOOLmohammed rafiNo ratings yet

- Computation 22-23Document2 pagesComputation 22-23Ruloans VaishaliNo ratings yet

- Acknowledgment of Loan Application Form: Capri Global Capital LTDDocument9 pagesAcknowledgment of Loan Application Form: Capri Global Capital LTDRahul MahankalNo ratings yet

- Payment Receipt: Cholamandalam Investment and Finance Company LTDDocument1 pagePayment Receipt: Cholamandalam Investment and Finance Company LTDRakesh KumarNo ratings yet

- Reliance General Insurance Company Limited: Policy Number: 607322123120149904 Proposal/Covernote No: R22092149927Document6 pagesReliance General Insurance Company Limited: Policy Number: 607322123120149904 Proposal/Covernote No: R22092149927SAKUNTALA PANIGRAHINo ratings yet

- Ogl 219031648640601749Document5 pagesOgl 219031648640601749Rajesh KumarNo ratings yet

- United India Insurance Company LimitedDocument2 pagesUnited India Insurance Company LimitedThoufeeq IbrahimNo ratings yet

- CERSAI Asset Search ReportDocument3 pagesCERSAI Asset Search ReportARPIT MAHESHWARI100% (1)

- Manappuram Finance Loan DocumentDocument3 pagesManappuram Finance Loan DocumentDeependra SinghNo ratings yet

- MahindraDocument1 pageMahindraFor InsuranceNo ratings yet

- Muthoot Finance Loan Sanction LetterDocument30 pagesMuthoot Finance Loan Sanction LetterTHE PHILOSOPHER MADDYNo ratings yet

- Acknowledgement Slip: Fixed DepositDocument1 pageAcknowledgement Slip: Fixed DepositAneesh BangiaNo ratings yet

- Form 36 MahindraDocument2 pagesForm 36 MahindraRohan GangotriNo ratings yet

- Loan Sanction-Letter With kfs4330739025633689315Document4 pagesLoan Sanction-Letter With kfs4330739025633689315Sapan MishraNo ratings yet

- eOTS090123120153764 NOC1Document1 pageeOTS090123120153764 NOC1piyaanNo ratings yet

- Jaipur Passport Office Grants Passport to Akash BhushanDocument1 pageJaipur Passport Office Grants Passport to Akash BhushanAkash BhushanNo ratings yet

- E-Boarding Pass QR Code For Bag TagsDocument1 pageE-Boarding Pass QR Code For Bag TagsSong AdrianaNo ratings yet

- BoardingPass EB38NT PDFDocument2 pagesBoardingPass EB38NT PDFParul SinghNo ratings yet

- VF 20 05 2017Document1 pageVF 20 05 2017rameshNo ratings yet

- Private Car Insurance Policy SummaryDocument3 pagesPrivate Car Insurance Policy Summarycommission sompoNo ratings yet

- Loan Cum Hypothecation Agreement: L&T Finance Limited (Erstwhile Known As Family Credit LTD.)Document19 pagesLoan Cum Hypothecation Agreement: L&T Finance Limited (Erstwhile Known As Family Credit LTD.)niranjan krishnaNo ratings yet

- Maharaja Ganga Singh University Bikaner: ExaminationDocument3 pagesMaharaja Ganga Singh University Bikaner: ExaminationRavi kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurupatel dharmeshNo ratings yet

- 2018091800024Document3 pages2018091800024Gunjan ShahNo ratings yet

- GST Challan ReceiptDocument1 pageGST Challan ReceiptamirNo ratings yet

- CRISIL Upgrades Muthoot Finance Long Term Debt Rating From AA-/stable To AA/stable (Company Update)Document2 pagesCRISIL Upgrades Muthoot Finance Long Term Debt Rating From AA-/stable To AA/stable (Company Update)Shyam SunderNo ratings yet

- WP Online: IPA No.: 036604573160714Document7 pagesWP Online: IPA No.: 036604573160714SelvaGaneshNo ratings yet

- Borrowerff9ecd07 E646 4e12 A80d 9da394bcdf5eDocument11 pagesBorrowerff9ecd07 E646 4e12 A80d 9da394bcdf5enitin doonNo ratings yet

- BorrowerDocument11 pagesBorrowerShubham TalekarNo ratings yet

- 2024 Predictions - by Luke Belmar by Luke Belmar Dec, 2023 MediumDocument1 page2024 Predictions - by Luke Belmar by Luke Belmar Dec, 2023 MediumdsupqkheqnvxoincdrNo ratings yet

- FAR610 - Consolidated Financial StatementsDocument3 pagesFAR610 - Consolidated Financial StatementsAmirul AimanNo ratings yet

- Basics of Materials Management-ACMDocument16 pagesBasics of Materials Management-ACMUmar MohammadNo ratings yet

- Analysis of Lego Storytelling Marketing Strategy and Bilateral Relationship Business ModelDocument13 pagesAnalysis of Lego Storytelling Marketing Strategy and Bilateral Relationship Business ModelHien GiangNo ratings yet

- Monopolistic Competition and Oligopoly: ©2002 South-Western College PublishingDocument42 pagesMonopolistic Competition and Oligopoly: ©2002 South-Western College PublishingAisa Castro ArguellesNo ratings yet

- Be Dru Overview of Ethiopian CooperativesDocument26 pagesBe Dru Overview of Ethiopian CooperativesFisehaNo ratings yet

- PLD Lectures OldDocument343 pagesPLD Lectures OldVarunNo ratings yet

- IFC Promotes Private Sector Growth in Developing NationsDocument7 pagesIFC Promotes Private Sector Growth in Developing NationsJawad Ali RaiNo ratings yet

- Economic GlobalizationDocument2 pagesEconomic GlobalizationFerly Ann BaculinaoNo ratings yet

- Uyanage Heshan Ruwantha de Silva (21478284)Document6 pagesUyanage Heshan Ruwantha de Silva (21478284)Natasha de SilvaNo ratings yet

- Becton Dickinson Flyer 005 (Updated)Document7 pagesBecton Dickinson Flyer 005 (Updated)Pulkit AgarwalNo ratings yet

- 12 Activity 1Document2 pages12 Activity 1Jong-suk OppxrNo ratings yet

- Strategy Formulation in Accelerating The Process of Sea Import Cargo Issuance (DHL Global Forwarding Indonesia in 2021)Document6 pagesStrategy Formulation in Accelerating The Process of Sea Import Cargo Issuance (DHL Global Forwarding Indonesia in 2021)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Uber CLDDocument9 pagesUber CLDKHALKAR SWAPNILNo ratings yet

- This Study Resource Was: Chapter 2 HWDocument4 pagesThis Study Resource Was: Chapter 2 HWJoice BobosNo ratings yet

- Asm 2543Document10 pagesAsm 2543Sushma AgarwalNo ratings yet

- Tutorial 6 - Cost of EquitiesDocument1 pageTutorial 6 - Cost of EquitiesAmy LimnaNo ratings yet

- Sindh Waste To Energy Policy (Swep) 2021Document20 pagesSindh Waste To Energy Policy (Swep) 2021Sadaqat islamNo ratings yet

- Country selection factorsDocument26 pagesCountry selection factorsShirley Low40% (5)