Professional Documents

Culture Documents

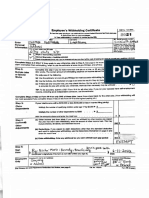

New W4

Uploaded by

Roberto MonterrosaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New W4

Uploaded by

Roberto MonterrosaCopyright:

Available Formats

OMB No.

1545-0074

Form W - 4 Employee?s W i t h h o l d i n g Certificate

(Rev. December 2020) > C o m p l e t e F o r m W - 4 s o t h a t y o u r e m p l o y e r can w i t h h o l d t h e c o r r e c t f e d e r a l i n c o m e t a x f r o m y o u r pay.

Department of the Treasury > Give Form W-4 to your employer.

Internal Revenue Service > Y o u r w i t h h o l d i n gis s u b j e c t t o r e v i e w b y t h e IRS.

,

Enter > Does your n a m e

? ?

c a r d ? if not, to e n s u r e y o u get

I n f o r m a t i o n C io r tt o wy n , s t a t e , a n d Z I P c o d e c r e d i t for y o u r e a r i n g s , c o n t a c t

SSA at 800-772-1213 or go to

WWW. SSB.gOV.

(©) ( S o ir Married

n filingseparately

g l e

( 1 Marriedfiling jointly or Qualitying widow(er}

( 7 ) Heado f household (Checkonlyi f you're unmarriedandpay morethanhalf thecosts ofkeeping up ahomef o r yourselfand a qualifyingindividual.)

C o m p l e t e S t e p s 2~4 O N L Y i f t h e y a p p l y t o you; o t h e r w i s e , s k i p t o Step 5. See p a g e 2 for m o r e infogmation on e a c h step, w h o can

claim e x e m p t i o n f r o m withholding, when to use t h e estimator at www.irs.gov/W4App, and privacy.

S t e p 2: C o m p l e t e this step if you (1) hold m o r e than o n e j o b at a time, o r (2) are married filing jointly and your s p o u s e

Multiple Jobs also w o r k s . The correct a m o u n t of withholding d e p e n d s on i n c o m e earned f r o m all of these jobs.

or Spouse Do only one of the following.

Works (a) U s e t h e estimator at w w w . i r s . g o v / W 4 A p p f o r m o s t accurate withholding for this step (and S t e p s 3 - 4 ) ; o r

(b) U s e the M u l t i p l e J o b s W o r k s h e e t o n p a g e 3 a n d e n t e r t h e result in S t e p 4(c) b e l o w f o r r o u g h l y a c c u r a t e w i t h h o l d i n g ; o r

(c) If there are only t w o j o b s total, you may check this box. Do t h e s a m e on Form W - 4 for t h e o t h e r job. This option

is accurate for jobs with similar pay; otherwise, m o r e tax than necessary may be w i t h h e l d . .

. . . »

T I P : To be accurate, s u b m i t a 2021 Form W - 4 for all other jobs. If you (or y o u r spouse) have s e l f - e m p l o y m e n t

income, including a s an independent contractor, use t h e estimator.

C o m p l e t e S t e p s 3 - 4 { b ) on F o r m W - 4 f o r o n l y O N E of t h e s e j o b s . Leave t h o s e steps blank for t h e other j o b s . (Your w i t h h o l d i n g will

be m o s t a c c u r a t e i f you c o m p l e t e Steps 3-4(b) on the Form W - 4 for t h e highest paying job.)

S t e p 3: if your total income will be $200,000 or less ($400,000 or less if married filing jointly):

Claim .

Dependents Multiply the number of qualifying children under age 17 by $2,000 > $

Multiply the number of other dependents by$500 . . . . hm

$

A d d t h e a m o u n t s a b o v e a n d enter t h e t o t a l here

Step 4 (a) Other income (not from jobs). If you want tax withheld for o t h e rincome you expect

(optional): this year that won't have withholding, enter the amount of other Income here. This may

Other include interest, dividends, and retirement income . r e

Adjustments

(b) D e d u c t i o n s . If y o u e x p e c t to claim d e d u c t i o n s other than t h e s t a n d a r d deduction

a n d w a n t t o reduce y o u rw i t h h o l e l i n g , use t h e Deductions W o r k s h e e t onp a g e $3 and

enter t h e result here . hoe

(c) E x t r a w i t h h o l d i n g . Enter a n y a d d i t i o n a l tax y o u w a n t withheld e a c h p a y p e r l o d

EXEMPT

Informational purposes only. Done in good faith. Given for Patent Rights. All rights reserved. Authorized Representative.

By:

Y E m p l o y e e ' s s i g n a t u r e (This f o r m Is n o t valid unless you sign it.)

First d a t e o f Employer identification

Employers| Employer's name and address

employment number (EIN)

Only

For P r i vAac tca nyd Paperwork Reduction A c t Notice, see page 3. Cat, No. 102200 Form W - 4 (2021)

You might also like

- Ein Extensive ListDocument60 pagesEin Extensive ListRoberto Monterrosa100% (2)

- Employee's Withholding Certificate: Step 1: Enter Personal InformationDocument4 pagesEmployee's Withholding Certificate: Step 1: Enter Personal InformationSejar AiclNo ratings yet

- W4 Example 2Document1 pageW4 Example 2Roberto MonterrosaNo ratings yet

- How To NotesDocument16 pagesHow To NotesRoberto Monterrosa100% (15)

- Live Life Claim ExampleDocument2 pagesLive Life Claim ExampleRoberto Monterrosa100% (3)

- Employee's Withholding Certificate: Step 1: Enter Personal InformationDocument4 pagesEmployee's Withholding Certificate: Step 1: Enter Personal InformationPrince TzarNo ratings yet

- Form 3575Document1 pageForm 3575c100% (1)

- What Is Form 1040-VDocument2 pagesWhat Is Form 1040-VLamont RylandNo ratings yet

- Test w4Document1 pageTest w4Arend EstesNo ratings yet

- Instructions For Completing Inf 70 Request For Record InformationDocument5 pagesInstructions For Completing Inf 70 Request For Record InformationAfzal ImamNo ratings yet

- IRS Form 1040Document2 pagesIRS Form 1040fox43wpmt50% (2)

- f4506c AccessibleDocument2 pagesf4506c AccessibleRoberto Monterrosa100% (1)

- Questions Answers UpdatedDocument2 pagesQuestions Answers UpdatedRoberto Monterrosa100% (2)

- Judicial Notice For Emergency Nutrition and Cash AssistanceDocument2 pagesJudicial Notice For Emergency Nutrition and Cash AssistanceRoberto Monterrosa96% (26)

- Application For An Identity Protection Personal Identification Number (IP PIN)Document2 pagesApplication For An Identity Protection Personal Identification Number (IP PIN)Pete BorgesNo ratings yet

- PS Form 6387 Rural Money Order TransactionDocument1 pagePS Form 6387 Rural Money Order TransactionRoberto MonterrosaNo ratings yet

- Application For An Identity Protection Personal Identification Number (IP PIN)Document2 pagesApplication For An Identity Protection Personal Identification Number (IP PIN)Pete BorgesNo ratings yet

- How To Conduct Yourself in Court HearingDocument2 pagesHow To Conduct Yourself in Court HearingRoberto MonterrosaNo ratings yet

- Application For An Identity Protection Personal Identification Number (IP PIN)Document2 pagesApplication For An Identity Protection Personal Identification Number (IP PIN)Pete BorgesNo ratings yet

- Live Life Claim Glen AdamDocument1 pageLive Life Claim Glen AdamRoberto Monterrosa100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Group 2 - Fiscal PolicyDocument24 pagesGroup 2 - Fiscal PolicyJune MadriagaNo ratings yet

- Income TaxDocument3 pagesIncome TaxKim Joyce Pantanoza AlimorongNo ratings yet

- 2014 Federal 1040 (Esther)Document2 pages2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- Last Pay CertificateDocument2 pagesLast Pay Certificatekingfairgod100% (1)

- Outline For Policy Analysis Paper 1 SW 4710Document5 pagesOutline For Policy Analysis Paper 1 SW 4710api-295520606No ratings yet

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 2Document23 pagesMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 2Jesse Rielle CarasNo ratings yet

- Problem 3 56 GOVTDocument5 pagesProblem 3 56 GOVTskmasambongcouncilNo ratings yet

- Student'S Weekly Activity SheetDocument13 pagesStudent'S Weekly Activity SheetJulie Ranjo100% (1)

- Form 26QBDocument1 pageForm 26QBYashu GoelNo ratings yet

- Tax On Rental Income 2015-16Document8 pagesTax On Rental Income 2015-16Uganda Revenue AuthorityNo ratings yet

- Payroll SampleDocument6 pagesPayroll Samplepedpalina100% (15)

- ABB Balance SheetDocument6 pagesABB Balance SheetJyoti Prakash KhataiNo ratings yet

- Gs NotesDocument490 pagesGs NotesSyed BukhariNo ratings yet

- TAX87 16 Local Preferential With Answers PDFDocument5 pagesTAX87 16 Local Preferential With Answers PDFJohn Carlo CruzNo ratings yet

- Revenue Memorandum Circular No. 39-2007Document6 pagesRevenue Memorandum Circular No. 39-2007Charmaine GraceNo ratings yet

- 1835-Article Text-9082-1-10-20221214 PDFDocument10 pages1835-Article Text-9082-1-10-20221214 PDFYahengjin DjinNo ratings yet

- Chen Wholesalers LTD Incurred The Following Transactions Related To CurrentDocument1 pageChen Wholesalers LTD Incurred The Following Transactions Related To CurrentMiroslav GegoskiNo ratings yet

- Input Tax CreditDocument5 pagesInput Tax CreditSowmya GuptaNo ratings yet

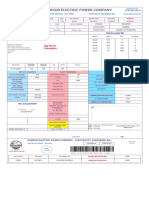

- Sepco Online Bill PDFDocument1 pageSepco Online Bill PDFSyed Junaid BukhariNo ratings yet

- Donor's Tax: Answer: DDocument6 pagesDonor's Tax: Answer: DAngela Miles DizonNo ratings yet

- Crystal Autocars Private Limited: Accessory - Tax InvoiceDocument2 pagesCrystal Autocars Private Limited: Accessory - Tax InvoiceDeepak BrohmaNo ratings yet

- Chi MangaDocument3 pagesChi MangaHAbbunoNo ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation LawTaraChandraChouhanNo ratings yet

- BIR Form 1901Document1 pageBIR Form 1901Abdul Nassif Faisal80% (5)

- Karlson Software Company Is Located in State H Which EnablesDocument1 pageKarlson Software Company Is Located in State H Which EnablesMuhammad ShahidNo ratings yet

- M2 Introdution To Business TaxDocument19 pagesM2 Introdution To Business TaxAlicia FelicianoNo ratings yet

- Clubbing, Set-Off & Deduction U - C VI-A - SolutionDocument6 pagesClubbing, Set-Off & Deduction U - C VI-A - SolutionBharatbhusan RoutNo ratings yet

- ASSIGNMENT NO. 1 - Chapter 5 Final Income TaxationDocument5 pagesASSIGNMENT NO. 1 - Chapter 5 Final Income TaxationElaiza Jayne PongaseNo ratings yet

- Fundamental Principle of Local Government Taxation - DomondonDocument4 pagesFundamental Principle of Local Government Taxation - DomondonTimothy Mark MaderazoNo ratings yet

- Chromalloy Castings Tampa Corporation 09-00137Document3 pagesChromalloy Castings Tampa Corporation 09-00137Integrity FloridaNo ratings yet