Professional Documents

Culture Documents

Problem 3 56 GOVT

Uploaded by

skmasambongcouncil0 ratings0% found this document useful (0 votes)

30 views5 pagesOriginal Title

Problem-3-56-GOVT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views5 pagesProblem 3 56 GOVT

Uploaded by

skmasambongcouncilCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

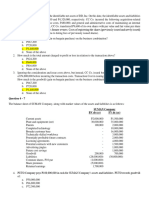

BASALO, MARIELLE M.

BSA 4-2

Problem 3-5

a. Receipt of notice of appropriation amounting to P1,000,000.

Recording in the Registry of Appropriations and Allotments (RAPAL).

b. Receipt of allotment from DBM amounting to P980,00.

Recording in the Registry of Appropriations and Allotments (RAPAL) and appropriate

Registries of Allotments, Obligations and Disbursements (RAOD).

c. Incurrence of obligations amounting to P880,000.

Recording in the Registries of Allotments, Obligations and Disbursements (RAOD) and

Obligation Request and Statues (ORS).

d. Receipt of Notice of Cash Allocation amounting to P850,000.

Cash-Modified Disbursement System (MDS), Regular 850,000

Subsidy from National Government 850,000

To recognize receipt of NCA from DBM

e. Accrual of P500,000 salaries upon approval of payroll. The breakdown is as follows:

Salaries and Wages P450,000

Personal Economic Relief Allowance (PERA) 50,000

Gross Compensation P500,000

Withholding Tax P125,000

GSIS 25,000

Pag-IBIG 20,000

PhilHealth 12,000

Total Salary Deductions P182,000

Salaries and Wages, Regular 450,000

Personal Economic Relief Allowance (PERA) 50,000

Due to BIR 125,000

Due to GSIS 25,000

Due to Pag-IBIG 20,000

Due to PhilHealth 12,000

Due to Officers and Employees 318,000

To recognize payable to officers and employees upon approval of payroll

f. Granting of cash advance for the payroll.

Advances for Payroll 318,000

Cash-Modified Disbursement System (MDS), Regular 318,000

To recognize grant of cash advance for payroll

g. Liquidation of the cash advance for payroll.

Due to Officers and Employees 318,000

Advances for Payroll 318,000

To recognize liquidation of Payroll Fund

h. Receipt of delivery of purchased office supplies worth P200,000 from current year’s

obligation.

Office Supplies Inventory 200,000

Accounts Payable 200,000

To recognize delivery of office supplies.

i. Payment of P180,000 accounts payable. Taxes withheld amount to P10,000.

Accounts Payable 180,000

Due to BIR 10,000

Cash-Modified Disbursement System (MDS), Regular 170,000

To recognize payment of accounts payable

j. Remittance of other amounts withheld to the BIR.

Cash-Tax Remittance Advice 135,000

Subsidy from National Government 135,000

To recognize the constructive receipt of NCA for TRA

Due to BIR 135,000

Cash-Tax Remittance Advice 135,000

To recognize the constructive remittance of taxes withheld to the BIR

through TRA

k. Remittance of other amounts withheld to the other government agencies concerned.

Due to GSIS 25,000

Due to Pag-IBIG 20,000

Due to PhilHealth 12,000

Cash-Modified Disbursement System (MDS), Regular 57,000

To recognize remittance to GSIS, Pag-IBIG and PhilHealth

l. Billing of revenue for Power Supply System Fees amounting to P200,000.

Accounts Receivable 200,000

Power Supply System Fees 200,000

To recognize billing of income

m. Collection of P200,000 from billed revenue and remittance of the total collection to the

National Treasury

Cash - Collecting Officers 200,000

Accounts Receivable 200,000

To recognize collection of billed income

Cash - Treasury/Agency Deposit, Regular 200,000

Cash - Collecting Officers 200,000

To recognize remittance of income to BTr

n. Reversion of unused NCA

Subsidy from National Government 305,000

Cash-Modified Disbursement System (MDS), Regular 305,000

Cash-Modified Disbursement System (MDS), Regular

Receipt of NCA 850,000 318,000 Advances for payroll

170,000 Payment of accounts

57,000 Remittances to other

government agencies

305,000 end

o. How much is reported as unreleased appropriation in the entity’s Budget Accountability

Report?

Appropriation P1,000,000

Allotment (980,000)

Unreleased Appropriation P20,000

p. How much is reported as unobligated allotment in the entity’s Budget Accountability

Report?

Allotment P980,000

Obligations (880,000)

Unobligated Allotment P100,000

q. How much is reported as Not yet Due and Demandable Obligations in the entity’s

Budget Accountability Report?

Obligations P880,000

Gross Compensation (500,000)

Purchase of Office Supplies (200,000)

Not yet Due and Demandable Obligations P180,000

Problem 3-6.

1. Receipt of P1,000,000 NCA

Cash-Modified Disbursement System (MDS), Regular 1,000,000

Subsidy from National Government 1,000,000

To recognize receipt of NCA from DBM

2. Remittance to the BIR of P100,000 taxes withheld

Cash-Tax Remittance Advice 100,000

Subsidy from National Government 100,000

To recognize the constructive receipt of NCA for TRA

Due to BIR 100,000

Cash-Tax Remittance Advice 100,000

To recognize the constructive remittance of taxes withheld to the BIR

through TRA

3. Receipt of P1,000,000 allotment

Recording in the Registry of Appropriations and Allotments (RAPAL) and appropriate

Registries of Allotments, Obligations and Disbursements (RAOD).

4. Receipt of P1,200,000 appropriation

Recording in the Registry of Appropriations and Allotments (RAPAL).

5. Entering into a purchase contract for future delivery. The contract price is P500,000

Recording in the Registries of Allotments, Obligations and Disbursements (RAOD) and

Obligation Request and Statues (ORS).

6. Entering into employment contracts worth P200,000

Recording in the Registries of Allotments, Obligations and Disbursements (RAOD) and

Obligation Request and Statues (ORS).

7. Billing of P250,000 revenue for Affiliation Fees, subsequent collection of P200,000

therefrom, and full remittance of the collection to the BTr

Account Receivable 250,000

Affiliation Fees 250,000

To recognize billing of income

Cash - Collecting Officers 200,000

Accounts Receivable 200,000

To recognize collection of billed income

Cash - Treasury/Agency Deposit, Regular 200,000

Cash - Collecting Officers 200,000

To recognize remittance of income to BTr

8. Reversion of P50,000 unused NCA

Subsidy from National Government 50,000

Cash-Modified Disbursement System (MDS), Regular 50,000

To recognize the reversion of unused NCA

9. Receipt of office equipment purchased on account for P100,000

Office Equipment 100,000

Accounts Payable 100,000

To recognize office equipment

10. Payment of accounts payable from purchase of office supplies worth P60,000. Tax

withheld amount to P3,000

Accounts Payable 60,000

Due to BIR 3,000

Cash-Modified Disbursement System (MDS), Regular 57,000

To recognize payment of office supplies on account.

You might also like

- Engaging Activity 1-Unit 3 Government Accounting ProcessDocument6 pagesEngaging Activity 1-Unit 3 Government Accounting ProcessJaihlyn DemataNo ratings yet

- Activity1 JournalizingDocument3 pagesActivity1 JournalizingLightNo ratings yet

- CH Proble 3 8 PDFDocument29 pagesCH Proble 3 8 PDFYogun Bayona100% (1)

- Local Media6884512623317631833Document29 pagesLocal Media6884512623317631833Yogun BayonaNo ratings yet

- ADVACC3 ATsDocument5 pagesADVACC3 ATsgazer beam100% (1)

- The Government Accounting Process: Problem 3-1: True or FalseDocument41 pagesThe Government Accounting Process: Problem 3-1: True or Falsemaria isabella75% (8)

- Asi Chapter 3 The Govt Acctg ProcessDocument41 pagesAsi Chapter 3 The Govt Acctg ProcessSunshine PaglinawanNo ratings yet

- AE119 Group-2Document7 pagesAE119 Group-2Richard Rhamil Carganillo Garcia Jr.No ratings yet

- The Government Accounting ProcessDocument33 pagesThe Government Accounting Processanna paulaNo ratings yet

- Government Accounting Chapter 3: Government Accounting ProcessDocument5 pagesGovernment Accounting Chapter 3: Government Accounting Process뿅아리No ratings yet

- Je Homework GovaccDocument6 pagesJe Homework GovaccEizzel SamsonNo ratings yet

- Lecture 3Document3 pagesLecture 3Philip Jhon BayoNo ratings yet

- Government Accounting Process: Basic Transactions of The Government EntityDocument20 pagesGovernment Accounting Process: Basic Transactions of The Government EntityMaricar San AntonioNo ratings yet

- AC - Acctg Gov Quiz 01 SolutionsDocument12 pagesAC - Acctg Gov Quiz 01 SolutionsErjohn Papa100% (1)

- Chapter 3 The Government Accounting ProcessDocument10 pagesChapter 3 The Government Accounting ProcessEthel Joy Tolentino GamboaNo ratings yet

- Answer Key AccgovDocument13 pagesAnswer Key AccgovDeloria DelsaNo ratings yet

- Ac - Acctggov Act. 01 Problem 1Document3 pagesAc - Acctggov Act. 01 Problem 1TRCLNNo ratings yet

- Receipt of Foreign Grant For The Construction of ExpresswayDocument7 pagesReceipt of Foreign Grant For The Construction of ExpresswayLorraineMartinNo ratings yet

- Government Accounting Quiz 2 Write The Letter Pertaining To Best AnswerDocument6 pagesGovernment Accounting Quiz 2 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Comprehensive JEV Preparation NGAs 2Document2 pagesComprehensive JEV Preparation NGAs 2Eizzel SamsonNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- Mahusay-Bsa416 E-PortfolioDocument15 pagesMahusay-Bsa416 E-PortfolioJeth MahusayNo ratings yet

- The Government Accounting ProcessDocument24 pagesThe Government Accounting Processyen claveNo ratings yet

- Accounting 7Document17 pagesAccounting 7Sophia Anne MonillasNo ratings yet

- Module 7 GAM IllustrationDocument21 pagesModule 7 GAM IllustrationElla EspenesinNo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- Illustrative Problem Basic RecordingDocument36 pagesIllustrative Problem Basic RecordingLeila OuanoNo ratings yet

- Quiz 2 - Accounting ProcessDocument3 pagesQuiz 2 - Accounting ProcessPrincess NozalNo ratings yet

- Governement Accounting - Journal Entries-2Document16 pagesGovernement Accounting - Journal Entries-2LorraineMartin100% (1)

- Governement Accounting - Journal Entries-1Document8 pagesGovernement Accounting - Journal Entries-1LorraineMartinNo ratings yet

- Pract ExDocument3 pagesPract ExRomyleen WennaNo ratings yet

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Document6 pagesAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteNo ratings yet

- Ansay, Allyson Charissa T - Activity 3Document9 pagesAnsay, Allyson Charissa T - Activity 3カイ みゆきNo ratings yet

- Problem 17 - 2 Hill Company Statement of Cash Flows Year Ended 2019 Cash Flows From Operating ActivitiesDocument2 pagesProblem 17 - 2 Hill Company Statement of Cash Flows Year Ended 2019 Cash Flows From Operating ActivitiesRouise Gagalac100% (1)

- Government Accounting Quiz 4 Write The Letter Pertaining To Best AnswerDocument6 pagesGovernment Accounting Quiz 4 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Financial Statements PreparationDocument6 pagesFinancial Statements Preparationana lopezNo ratings yet

- Chapter 3 - The Government ProcessDocument48 pagesChapter 3 - The Government ProcessJoyce CandelariaNo ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

- Govt Acctg 1234Document5 pagesGovt Acctg 1234taylor swiftyyyNo ratings yet

- Problem 3-7:worksheet PreparationDocument3 pagesProblem 3-7:worksheet PreparationMaria Erica AligamNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Billing of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3Document4 pagesBilling of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3Jean Rose Tabagay BustamanteNo ratings yet

- PLP Government Accounting Mid-Term ExamDocument4 pagesPLP Government Accounting Mid-Term ExamApril Manjares100% (2)

- Project in Government Accounting and Accounting FoDocument11 pagesProject in Government Accounting and Accounting FoRosy MoradosNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- HO 4 - Journal Entries - DisbursementsDocument12 pagesHO 4 - Journal Entries - DisbursementsMELBERT JOHN M. BRILLANTESNo ratings yet

- Basic Recording Discussion 1Document47 pagesBasic Recording Discussion 1Leila OuanoNo ratings yet

- INCOME TAXATION - Fringe Benefit TaxDocument7 pagesINCOME TAXATION - Fringe Benefit TaxErlle AvllnsaNo ratings yet

- Governtment AccountingDocument2 pagesGoverntment Accountingjessica amorosoNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Chapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDocument12 pagesChapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDrew BanlutaNo ratings yet

- A. Record The Transactions and Events: Plaza, Nerish MDocument12 pagesA. Record The Transactions and Events: Plaza, Nerish MaskmokoNo ratings yet

- 2 GovaccDocument1 page2 Govaccyes yesnoNo ratings yet

- NGA - JE ExercisesDocument3 pagesNGA - JE ExercisesShannise Dayne ChuaNo ratings yet

- Advanced Accounting Chapter 22Document9 pagesAdvanced Accounting Chapter 22LJ AggabaoNo ratings yet

- PrelimsDocument2 pagesPrelimsBryan IbarrientosNo ratings yet

- RMC No. 13-2024 - Annex B - Illustrations and Accounting EntriesDocument1 pageRMC No. 13-2024 - Annex B - Illustrations and Accounting EntriesAnostasia NemusNo ratings yet

- 9420 - Government Accounting ManualDocument8 pages9420 - Government Accounting ManualShannen D. CalimagNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Walker Kent Resume 2013Document2 pagesWalker Kent Resume 2013api-202711573No ratings yet

- ENRM 257 - Case Study Donsol Whale Shark-Bungag-David-De LunaDocument5 pagesENRM 257 - Case Study Donsol Whale Shark-Bungag-David-De LunaJake50% (2)

- Corrective Action Guidelines (2014-07-XX)Document15 pagesCorrective Action Guidelines (2014-07-XX)Chicago Transit Justice CoalitionNo ratings yet

- Data Analytics in Everyday LifeDocument25 pagesData Analytics in Everyday LifeDaniel PulgarNo ratings yet

- Greenberg v. Union Camp, 1st Cir. (1995)Document35 pagesGreenberg v. Union Camp, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- 18 Fy13ce Economics Detailed SolutionsDocument13 pages18 Fy13ce Economics Detailed SolutionsBrijaxzy Flamie Teai100% (1)

- Independent Survey Report SampleDocument27 pagesIndependent Survey Report SampleCK KangNo ratings yet

- Cover Letter For Eu InstitutionsDocument7 pagesCover Letter For Eu Institutionslumecaahf100% (1)

- Chapter 3Document55 pagesChapter 3Ahmed hassanNo ratings yet

- Job AnalysisDocument58 pagesJob AnalysisRobinhood Leonardo D Caprio100% (1)

- 5 Valenzuela V Caltex, PhilDocument6 pages5 Valenzuela V Caltex, PhilNeil reyesNo ratings yet

- Maternal Leave Policies - An International Survey by Harvard Women's Law JournalDocument27 pagesMaternal Leave Policies - An International Survey by Harvard Women's Law JournalAishvarya PujarNo ratings yet

- Stemming The Tide - Why Women Leave EngineeringDocument64 pagesStemming The Tide - Why Women Leave EngineeringgiffarizakawalyNo ratings yet

- Trainee Relocation Policy NHS Lothian 2015 FINAL DRAFTDocument13 pagesTrainee Relocation Policy NHS Lothian 2015 FINAL DRAFTjkNo ratings yet

- Document 2 Epi Tax Form 2017Document10 pagesDocument 2 Epi Tax Form 2017ABC Action NewsNo ratings yet

- Conver LetterDocument2 pagesConver Letterapi-309365379No ratings yet

- Rajpal GroupDocument19 pagesRajpal GroupRavy SinghNo ratings yet

- Aggregate Demand and SupplyDocument41 pagesAggregate Demand and SupplySonali JainNo ratings yet

- Kirthika PDFDocument5 pagesKirthika PDFSylvia RachelNo ratings yet

- FD GDocument4 pagesFD Grajbirbhatti8775No ratings yet

- Organization Psychlogy JawapanDocument19 pagesOrganization Psychlogy JawapanjzariziNo ratings yet

- Discussion On Difficulties and Countermeasures in The Construction of Financial Shared Service Center Under The Background of DigitizationDocument6 pagesDiscussion On Difficulties and Countermeasures in The Construction of Financial Shared Service Center Under The Background of DigitizationEditor IJTSRDNo ratings yet

- Why SiemensDocument3 pagesWhy SiemensAbdul RafaeNo ratings yet

- Developing and Sustaining Employees EngagementDocument11 pagesDeveloping and Sustaining Employees EngagementJabri JuhininNo ratings yet

- Ravago v. Esso Eastern MarineDocument2 pagesRavago v. Esso Eastern MarineClarence ProtacioNo ratings yet

- Lwtech HR Management FlyerDocument2 pagesLwtech HR Management FlyerAshlee RouseyNo ratings yet

- The International Journal of Business & ManagementDocument13 pagesThe International Journal of Business & Managementmarketplace teamNo ratings yet

- Universal Church V MyeniDocument29 pagesUniversal Church V MyeniLeonardo MakuyaNo ratings yet

- A Nationwide Evaluation of Municipal Law 2014Document70 pagesA Nationwide Evaluation of Municipal Law 2014dmronlineNo ratings yet

- Job DesignDocument19 pagesJob DesignJibesaNo ratings yet