Professional Documents

Culture Documents

Ac - Acctggov Act. 01 Problem 1

Uploaded by

TRCLNOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ac - Acctggov Act. 01 Problem 1

Uploaded by

TRCLNCopyright:

Available Formats

Ma. Theresa A.

Aclan February 8, 2022

45022 AcctgGov 9:00-10:00

AC_ACCTGGOV ACT. 01

PROBLEM 1

1. A) Government Accounting

2. B) Commission on Audit

3. D) Promulgating Accounting and Auditing Rules and Regulations

4. C) Non-Stock, Non-Profit Hospital

5. B) Reliability

6. D) Relevance

7. A) Inter-comparability

8. A) Substance

9. A)Comparability

10. B) Bureau of Treasury

11. D) Zero-Based Budgeting

12. A) Zero-Based Budgeting

13. D) The current year’s budget is formulated without regard to the previous year’s budget.

14. D) Budget Call from DBMM

15. D) Performance Review

16. A) Notice of Allocation

17. B) Allotment

18. C) Appropriation

19. D) Obligation

20. B) Responsibility Center

PROBLEM 2

Requirement 1

A. No journal entry required. The appropriation will be recorded in the Registry of Appropriations and Allotments (RAPAL).

B. No journal entry required. The allotment will be recorded in the Registry of Appropriations and Allotments (RAPAL) and Registries of

Allotments, Obligations and Disbursements (RAOD).

C. No journal entry required. The obligations will be recorded in the Obligation Request and Status (ORS) and Registries of Allotments, Obligations

and Disbursements (RAOD).

D. Cash-Modified Disbursement System (MDS), Regular 430,000

Subsidy from National Government 430,000

E. Salaries and Wages, Regular 70,000

Personal Economic Relief Allowance (PERA) 10,000

Due to BIR 18,000

Due to GSIS 4,000

Due to Pag-IBIG 1,000

Due to PhilHealth 2,000

Due to Officers and Employees 55,000

Advances for Payroll 55,000

Cash-Modified Disbursement System (MDS), Regular 55,000

Due to Officers and Employees 55,000

Advances for Payroll 55,000

F. Office Equipment 200,000

Accounts Payable 200,000

Depreciation-Machinery and Equipment 38,000

Accumulated Depreciation – Office Equipment 38,000

Accounts Payable 200,000

Due to BIR 12,000

Cash – Modified Disbursement System (MDS), Regular 188,000

H. Office Supplies Inventory 100,000

Due to BIR 5,000

Cash – Modified Disbursement System (MDS), Regular 95,000

I.Office Supplies Expense 90,000

Office Supplies Inventory 90,000

J. Advances to Officers and Employees 20,000

Cash – Modified Disbursement System (MDS), Regular 20,000

Advances to Officers and Employees 17,000

Cash – Modified Disbursement System (MDS), Regular 17,000

Cash – Collecting Officers 3,000

Advances to Officers and Employees 3,000

Cash – Treasury/Agency Deposit, Regular 3,000

Cash – Collecting Officers 3,000

K. Cash – Collecting Officers 40,000

Permit Fees 40,000

To recognize collection of unbilled service income.

Cash-Treasury/Agency Deposit, Regular 30,000

Cash – Collecting Officers 30,000

L. Water Expenses 5,000

Electricity Expenses 10,000

Due to BIR 2,000

Cash – Modified Disbursement System (MDS), Regular 13,000

M. Cash-Tax Remittance Advice 37,000

Subsidy from National Government 37,000

Due to BIR 37,000

Cash-Tax Remittance Advice 37,000

N. Due to GSIS 4,000

Due to Pag-IBIG 1,000

Due to PhilHealth 2,000

Cash-Modified Disbursement System (MDS), Regular 7,000

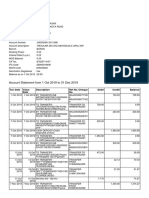

Requirement 2

UNADJUSTED TRIAL BALANCE

ACCOUNTS DEBIT CREDIT

Cash - Collecting Officers 10,000

Cash-Treasury/Agency Dep., Reg. 33,000

Cash-MDS, Regular 52,000

Cash-Tax Remittance Advice –

Office Supplies Inventory 10,000

Office Equipment 200,000

Accumulated Depreciation –

Equipment 38,000

Advances for Payroll –

Advances to Officers and Employees –

Accounts Payable –

Due to Officers and Employees –

Due to BIR –

Due to GSIS –

Due to Pag-IBIG –

Due to PhilHealth –

Accumulated Surplus (Deficit) –

Permit Fees 40,000

Subsidy from National Government 467,000

Salaries and Wages, Regular 70,000

PERA 10,000

Travelling Expenses - Local 17,000

Office Supplies Expense 90,000

Water Expenses 5,000

Electricity Expenses 10,000

Depreciation-Machinery & Equipment 38,000

TOTAL 545,000 545,000

You might also like

- Governement Accounting - Journal Entries-1Document8 pagesGovernement Accounting - Journal Entries-1LorraineMartinNo ratings yet

- CH Proble 3 8 PDFDocument29 pagesCH Proble 3 8 PDFYogun Bayona100% (1)

- The Government Accounting Process: Problem 3-1: True or FalseDocument41 pagesThe Government Accounting Process: Problem 3-1: True or Falsemaria isabella75% (8)

- Project in Government Accounting and Accounting FoDocument11 pagesProject in Government Accounting and Accounting FoRosy MoradosNo ratings yet

- Bclte Part 2Document141 pagesBclte Part 2Jennylyn Favila Magdadaro96% (25)

- AC - Acctg Gov Quiz 01 SolutionsDocument12 pagesAC - Acctg Gov Quiz 01 SolutionsErjohn Papa100% (1)

- 7.1 Completing The Cycle SampleDocument4 pages7.1 Completing The Cycle SampleKena Montes Dela PeñaNo ratings yet

- Governement Accounting - Journal Entries-2Document16 pagesGovernement Accounting - Journal Entries-2LorraineMartin100% (1)

- Ucp 21 - Financial Accounting Unit-1 - Branch Accounts: Type: 80% Theory - 20% Problem Question & AnswersDocument59 pagesUcp 21 - Financial Accounting Unit-1 - Branch Accounts: Type: 80% Theory - 20% Problem Question & AnswersrhadityaNo ratings yet

- FAR Lecture NotesDocument80 pagesFAR Lecture NotesJuan Miguel Suerte Felipe100% (2)

- Lecture 3Document3 pagesLecture 3Philip Jhon BayoNo ratings yet

- Je Homework GovaccDocument6 pagesJe Homework GovaccEizzel SamsonNo ratings yet

- Engaging Activity 1-Unit 3 Government Accounting ProcessDocument6 pagesEngaging Activity 1-Unit 3 Government Accounting ProcessJaihlyn DemataNo ratings yet

- Gov Acc Assignment JohnDocument5 pagesGov Acc Assignment JohnArvin Glen BeltranNo ratings yet

- Problem 3 56 GOVTDocument5 pagesProblem 3 56 GOVTskmasambongcouncilNo ratings yet

- Answer Key AccgovDocument13 pagesAnswer Key AccgovDeloria DelsaNo ratings yet

- Activity1 JournalizingDocument3 pagesActivity1 JournalizingLightNo ratings yet

- Local Media6884512623317631833Document29 pagesLocal Media6884512623317631833Yogun BayonaNo ratings yet

- Accounting 7Document17 pagesAccounting 7Sophia Anne MonillasNo ratings yet

- The Government Accounting ProcessDocument33 pagesThe Government Accounting Processanna paulaNo ratings yet

- Asi Chapter 3 The Govt Acctg ProcessDocument41 pagesAsi Chapter 3 The Govt Acctg ProcessSunshine PaglinawanNo ratings yet

- AE119 Group-2Document7 pagesAE119 Group-2Richard Rhamil Carganillo Garcia Jr.No ratings yet

- A. Record The Transactions and Events: Plaza, Nerish MDocument12 pagesA. Record The Transactions and Events: Plaza, Nerish MaskmokoNo ratings yet

- PrelimsDocument2 pagesPrelimsBryan IbarrientosNo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- Module 7 GAM IllustrationDocument21 pagesModule 7 GAM IllustrationElla EspenesinNo ratings yet

- The Government Accounting ProcessDocument24 pagesThe Government Accounting Processyen claveNo ratings yet

- Government Accounting Process: Basic Transactions of The Government EntityDocument20 pagesGovernment Accounting Process: Basic Transactions of The Government EntityMaricar San AntonioNo ratings yet

- Government AccountingDocument3 pagesGovernment Accountingchibi.otaku.neesanNo ratings yet

- ADVACC3 ATsDocument5 pagesADVACC3 ATsgazer beam100% (1)

- Illustrative Problem Basic RecordingDocument36 pagesIllustrative Problem Basic RecordingLeila OuanoNo ratings yet

- Receipt of Foreign Grant For The Construction of ExpresswayDocument7 pagesReceipt of Foreign Grant For The Construction of ExpresswayLorraineMartinNo ratings yet

- Government Accounting Chapter 3: Government Accounting ProcessDocument5 pagesGovernment Accounting Chapter 3: Government Accounting Process뿅아리No ratings yet

- Panada, Terence Angelo F.-Bsma-3 3-8 Worksheet Preparation A.Rapal B.Rapal and Raod c.ORS and RAOD D.RancaDocument30 pagesPanada, Terence Angelo F.-Bsma-3 3-8 Worksheet Preparation A.Rapal B.Rapal and Raod c.ORS and RAOD D.RancaJeth MahusayNo ratings yet

- Mahusay-Bsa416 E-PortfolioDocument15 pagesMahusay-Bsa416 E-PortfolioJeth MahusayNo ratings yet

- Answers To Problems 1-4: Handout On Cash and Cash Equivalents Problem 1 15,000Document2 pagesAnswers To Problems 1-4: Handout On Cash and Cash Equivalents Problem 1 15,000JusticeLaKiddoNo ratings yet

- 3 GovaccDocument1 page3 Govaccyes yesnoNo ratings yet

- Chapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDocument12 pagesChapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDrew BanlutaNo ratings yet

- Government Accounting Quiz 4 Write The Letter Pertaining To Best AnswerDocument6 pagesGovernment Accounting Quiz 4 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Book of Accounts and RegistriesDocument7 pagesBook of Accounts and RegistriesRonalyn Torino ParacuelesNo ratings yet

- 9024 - Government Accounting ManualDocument8 pages9024 - Government Accounting ManualAljur SalamedaNo ratings yet

- 9420 - Government Accounting ManualDocument8 pages9420 - Government Accounting ManualShannen D. CalimagNo ratings yet

- Chapter 3 The Government Accounting ProcessDocument10 pagesChapter 3 The Government Accounting ProcessEthel Joy Tolentino GamboaNo ratings yet

- Personal Assignment Week 4-GovernDocument6 pagesPersonal Assignment Week 4-GoverndivaNo ratings yet

- Accounting GovernmentDocument21 pagesAccounting GovernmentJolianne SalvadoOfcNo ratings yet

- Acctg Special TransDocument24 pagesAcctg Special TransMina JjangNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- Financial Statements PreparationDocument6 pagesFinancial Statements Preparationana lopezNo ratings yet

- 3 - Chapter-3-Govt Accounting Process - Part 2Document6 pages3 - Chapter-3-Govt Accounting Process - Part 2Joebet DebuyanNo ratings yet

- 2 GovaccDocument1 page2 Govaccyes yesnoNo ratings yet

- Ale Aubrey - Bsma 3 1.exercise123Document28 pagesAle Aubrey - Bsma 3 1.exercise123Astrid XiNo ratings yet

- JOURNAL ENTRIES WPS OfficeDocument3 pagesJOURNAL ENTRIES WPS OfficeEki SunriseNo ratings yet

- National Government Agency BooksDocument5 pagesNational Government Agency BooksJames Bradley HuangNo ratings yet

- Government Accounting Quiz 2 Write The Letter Pertaining To Best AnswerDocument6 pagesGovernment Accounting Quiz 2 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- SeatworkDocument10 pagesSeatworkRochelle Mae DiestroNo ratings yet

- Chapter 3 - The Government ProcessDocument48 pagesChapter 3 - The Government ProcessJoyce CandelariaNo ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- PDF Review Materials For Finals Q - CompressDocument20 pagesPDF Review Materials For Finals Q - CompressAndrea Florence Guy Vidal100% (1)

- QuizDocument2 pagesQuizaprilbetito02No ratings yet

- Basic Recording Discussion 1Document47 pagesBasic Recording Discussion 1Leila OuanoNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- PSY159 Lecture Notes 8Document3 pagesPSY159 Lecture Notes 8TRCLNNo ratings yet

- Physical Expenditure Cycle: Cash DisbursementsDocument3 pagesPhysical Expenditure Cycle: Cash DisbursementsTRCLNNo ratings yet

- Date Transaction Remaining Liters Per Buy Cost No. of Liters Cost Per Liter Total Cost Liters Sold Selling Price Profit Per Liter Total RevenueDocument3 pagesDate Transaction Remaining Liters Per Buy Cost No. of Liters Cost Per Liter Total Cost Liters Sold Selling Price Profit Per Liter Total RevenueTRCLNNo ratings yet

- Objectives For Chapter 5Document3 pagesObjectives For Chapter 5TRCLNNo ratings yet

- Dennise MichelleDocument1 pageDennise MichelleTRCLNNo ratings yet

- NP-accrued Interest 800/35000NP-accrued Interest 3500Document6 pagesNP-accrued Interest 800/35000NP-accrued Interest 3500TRCLNNo ratings yet

- Smith Company Statement of Realization and LiquidationDocument5 pagesSmith Company Statement of Realization and LiquidationTRCLNNo ratings yet

- Differential Analysis 1 - CompressedDocument14 pagesDifferential Analysis 1 - CompressedTRCLNNo ratings yet

- Test Bank DayagDocument37 pagesTest Bank DayagTRCLNNo ratings yet

- Aclan - Case 15 NetflixDocument2 pagesAclan - Case 15 NetflixTRCLNNo ratings yet

- What Is Strategic Business AnalysisDocument1 pageWhat Is Strategic Business AnalysisTRCLNNo ratings yet

- Communication in The 21 CenturyDocument11 pagesCommunication in The 21 CenturyTRCLNNo ratings yet

- Chapter 6 ModuleDocument6 pagesChapter 6 ModuleTRCLNNo ratings yet

- Baladhay PhilipDocument8 pagesBaladhay PhilipTRCLNNo ratings yet

- Communication in The 21 Century: WWW - Academia.edu WWW - Brainly.phDocument8 pagesCommunication in The 21 Century: WWW - Academia.edu WWW - Brainly.phTRCLNNo ratings yet

- Communication in THR 21 CenturyDocument6 pagesCommunication in THR 21 CenturyTRCLNNo ratings yet

- Adarlo, Katherine FayeDocument9 pagesAdarlo, Katherine FayeTRCLNNo ratings yet

- Communication in The Twenty-First Century1Document9 pagesCommunication in The Twenty-First Century1TRCLNNo ratings yet

- Communication in 21 CenturyDocument5 pagesCommunication in 21 CenturyTRCLNNo ratings yet

- Communication in The 21 CenturyDocument8 pagesCommunication in The 21 CenturyTRCLNNo ratings yet

- Hafiz Salman Majeed: Composed & SolvedDocument13 pagesHafiz Salman Majeed: Composed & SolvedFun NNo ratings yet

- Summary of EliminationsDocument7 pagesSummary of EliminationsSella DestikaNo ratings yet

- Adv Acct Quiz 3 Chapter 4Document5 pagesAdv Acct Quiz 3 Chapter 4Nikki Harris100% (1)

- Balance of PaymentsDocument39 pagesBalance of PaymentsMarta Amarillo GarridoNo ratings yet

- Dini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Document29 pagesDini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Dini Kusuma100% (2)

- Traning Material On Implementation of Accounting StandardsDocument308 pagesTraning Material On Implementation of Accounting StandardsAnupam GoyalNo ratings yet

- Format: The Format/specimen of A Double Column Cash Book Is Given BelowDocument7 pagesFormat: The Format/specimen of A Double Column Cash Book Is Given Belowjoshua stevenNo ratings yet

- Accounting Fundamentals: in This ChapterDocument37 pagesAccounting Fundamentals: in This ChapterSafi UllahNo ratings yet

- T Q1 XEQCzp 59 YHkn CDocument8 pagesT Q1 XEQCzp 59 YHkn CCT LIBRARYNo ratings yet

- Session 3Document55 pagesSession 3ahmedNo ratings yet

- Chap 15Document17 pagesChap 15pdmallari12No ratings yet

- Ncert Solutions For Class 11 Accountancy Chapter 5 Bank Reconciliation StatementDocument24 pagesNcert Solutions For Class 11 Accountancy Chapter 5 Bank Reconciliation StatementLivin Verghese LijuNo ratings yet

- Banks - No ParticularsDocument12 pagesBanks - No ParticularsCes RiveraNo ratings yet

- TallyGURU Table of ContentDocument20 pagesTallyGURU Table of ContentSaibal DuttaNo ratings yet

- Famba 8e - SM - Mod 03 - 040320 1Document77 pagesFamba 8e - SM - Mod 03 - 040320 1Shady Mohsen MikhealNo ratings yet

- Acc Account Name Trial Balance Debit CreditDocument6 pagesAcc Account Name Trial Balance Debit CreditNofi NurlailaNo ratings yet

- Oracle Glossary: A Absorption AccountDocument8 pagesOracle Glossary: A Absorption AccountmrturtletanNo ratings yet

- Toaz - Info Cash PRDocument16 pagesToaz - Info Cash PRNil Justeen GarciaNo ratings yet

- Jaiib I 50q-PrinciplesDocument33 pagesJaiib I 50q-PrinciplessharmilaNo ratings yet

- The General Ledger SystemDocument6 pagesThe General Ledger SystemGlensh Reigne CarlitNo ratings yet

- Audit - Mock Board Examination - Sy2019-20Document15 pagesAudit - Mock Board Examination - Sy2019-20Mark Domingo MendozaNo ratings yet

- Unit - 2 - Financial Statement and RatioDocument37 pagesUnit - 2 - Financial Statement and Ratiodangthanhhd7967% (6)

- Mycbseguide: Class 12 - Accountancy Sample Paper 06Document14 pagesMycbseguide: Class 12 - Accountancy Sample Paper 06sneha muralidharanNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Facility AgreementDocument51 pagesFacility AgreementHaseeb Ur-RehmanNo ratings yet

- Oracle Financials Functional Modules Online TrainingDocument10 pagesOracle Financials Functional Modules Online TrainingEbs FinancialsNo ratings yet

- Chapter 8 Question Review PDFDocument13 pagesChapter 8 Question Review PDFCris ComisarioNo ratings yet