0% found this document useful (0 votes)

517 views7 pagesSample Restaurant Training Proposal

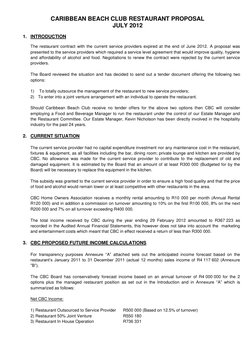

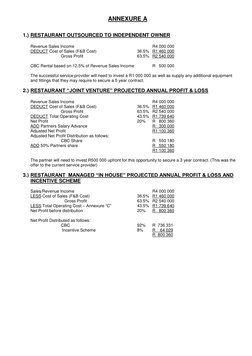

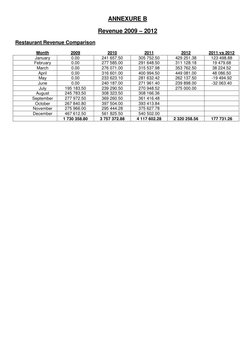

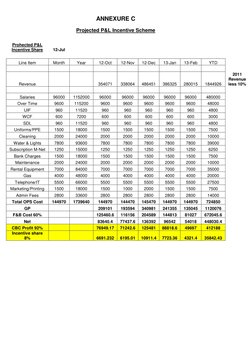

This document provides a proposal for a new restaurant contract at the Caribbean Beach Club. It outlines 3 options: 1) outsourcing management to a new service provider, 2) a joint venture partnership, or 3) in-house management. Financial projections are provided for each option based on past annual sales, estimating CBC's net income would be $500,000, $550,180, and $736,331 respectively. A SWOT analysis of each option will be presented in an annexure.

Uploaded by

Senami ZambaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

517 views7 pagesSample Restaurant Training Proposal

This document provides a proposal for a new restaurant contract at the Caribbean Beach Club. It outlines 3 options: 1) outsourcing management to a new service provider, 2) a joint venture partnership, or 3) in-house management. Financial projections are provided for each option based on past annual sales, estimating CBC's net income would be $500,000, $550,180, and $736,331 respectively. A SWOT analysis of each option will be presented in an annexure.

Uploaded by

Senami ZambaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Current Situation

- Introduction

- Proposed Options

- Conclusion

- Annexure A

- Annexure B

- Annexure C

- Annexure D