Professional Documents

Culture Documents

Fill in The Shaded Portion Based On Information in The Case

Uploaded by

Pooja GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fill in The Shaded Portion Based On Information in The Case

Uploaded by

Pooja GuptaCopyright:

Available Formats

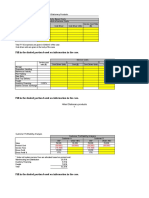

Allied Stationery Products

Activity Based Costs

Calculation of service Costs

Total FY 92 Service Cost Rate

Value Added Activities Exp ($) Cost Driver Cost Driver Units ($)

Storage

Requisition Handling

Warehouse Activity

Pick Packing

Data Entry

Desk Top Delivery

Total FY 92 expenses are given in Exhibit 3 of the case

Cost driver units are given in the body of the case

Fill in the shaded portion based on information in the case.

Service Costs

Service cost A B

rate ($) Cost Driver Units Cost ($) Cost Driver Units Cost ($)

Storage

Requisition Handling

Warehouse Activity

Pick Packing

Data Entry

Desk Top Delivery

Freight

Inventory Financing 13.50%

Inactive Service Surcharge

Fill in the shaded portion based on information in the case.

Allied Stationary products

1

Customer Profitability Analysis

Customer Profitability Analysis

Customer A Customer B

Old* Under ABC Old* Under ABC

Sales 79,320 79,320 79,320 79,320

Product Cost (50,000) (50,000) (50,000) (50,000)

Service Fees (16,100) (16,100)

Gross Profit 13,220 13,220

Gross Profit % 17% 17%

* Under old system service Fees are allocated based on product cost:

Warehousing and Distribution 20.50%

Inventory Financing 4.70%

Freight 7.00%

Total 32.20%

Fill in the shaded portion based on information in the case.

Allied Stationary products

2

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Allied Template 2Document2 pagesAllied Template 2Pooja GuptaNo ratings yet

- Allied Services Case Study ABC CostingDocument20 pagesAllied Services Case Study ABC CostingYoong YingNo ratings yet

- Ch15 AnsDocument12 pagesCh15 Ansgohasap_303011511No ratings yet

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationFrom EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNo ratings yet

- Activity Based Costing:: A Tool To Aid Decision MakingDocument20 pagesActivity Based Costing:: A Tool To Aid Decision Makingmelody gerongNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Management Control SystemDocument9 pagesManagement Control SystemAyushi JalanNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Dakota Office ProductsDocument10 pagesDakota Office ProductssourabhphanaseNo ratings yet

- Cost of Ownership: Process: Process ExampleDocument7 pagesCost of Ownership: Process: Process ExampleAlexander C MarquesNo ratings yet

- Soal Akuntansi ManajemenDocument7 pagesSoal Akuntansi ManajemenInten RosmalinaNo ratings yet

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- Questions: Kaplan Pu BlishingDocument36 pagesQuestions: Kaplan Pu BlishingArifur RahmanNo ratings yet

- Paper-8: Cost and Management Accounting: Revisionary Test Paper - Intermediate - Syllabus 2008 - Dec 2014Document70 pagesPaper-8: Cost and Management Accounting: Revisionary Test Paper - Intermediate - Syllabus 2008 - Dec 2014Basant OjhaNo ratings yet

- Dakota Office ProductsDocument10 pagesDakota Office ProductsMithun KarthikeyanNo ratings yet

- Dakota Office Products (DOP)Document16 pagesDakota Office Products (DOP)smitharsNo ratings yet

- Logistics &SCM - Chap 4,5,7,8Document11 pagesLogistics &SCM - Chap 4,5,7,8srujanakrishna AVULANo ratings yet

- Level 3 Costing & MA Text Update June 2021pdfDocument125 pagesLevel 3 Costing & MA Text Update June 2021pdfAmi KayNo ratings yet

- Problems: AF102 Additional Tutorial - S2 2017Document4 pagesProblems: AF102 Additional Tutorial - S2 2017Yashaal ChandNo ratings yet

- Cost and Management Accounting 01 - Class NotesDocument114 pagesCost and Management Accounting 01 - Class NotessaurabhNo ratings yet

- Day 7 (My)Document11 pagesDay 7 (My)Jhilmil JeswaniNo ratings yet

- Activity-Based CostingDocument2 pagesActivity-Based CostingClaire BarbaNo ratings yet

- SPE-ESCO Financial Model Tool v3.3Document21 pagesSPE-ESCO Financial Model Tool v3.3santhiNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Cee3 - CH - 03 (Cost Concepts and Behaviors)Document28 pagesCee3 - CH - 03 (Cost Concepts and Behaviors)VismoNo ratings yet

- Chapter 7 Applying Excel Student FormDocument2 pagesChapter 7 Applying Excel Student FormSaleh AlizadeNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- Dakota Office Products Case StudyDocument12 pagesDakota Office Products Case StudyAnkit TiwariNo ratings yet

- Activity Based CostingDocument29 pagesActivity Based CostingpoojaNo ratings yet

- Solution To WilkersonDocument5 pagesSolution To WilkersonChinee Natividad100% (2)

- Soal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DDocument4 pagesSoal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DSarah Dzuriyati SamiyahNo ratings yet

- Assignment FinanceDocument8 pagesAssignment FinanceAkshat BansalNo ratings yet

- Model Chapter 12 - ThipDocument14 pagesModel Chapter 12 - ThipThipparatM60% (5)

- Week 5 (To Be Discussed) AnswersDocument3 pagesWeek 5 (To Be Discussed) AnswersThirusha balamuraliNo ratings yet

- Management Advisory Services: 2017 Search For The NCR FrontlinersDocument11 pagesManagement Advisory Services: 2017 Search For The NCR FrontlinersRojohn ValenzuelaNo ratings yet

- Chapter 10: Fundamentals of Cost ManagementDocument13 pagesChapter 10: Fundamentals of Cost ManagementaweysNo ratings yet

- Activity Based CostingDocument3 pagesActivity Based Costingsumit kumarNo ratings yet

- Case Dakota Office Products - Group 1Document10 pagesCase Dakota Office Products - Group 1charlotteNo ratings yet

- Accounts U2 Spec2022Document40 pagesAccounts U2 Spec2022AbbyNo ratings yet

- Law On Obligations and Contracts in TheDocument15 pagesLaw On Obligations and Contracts in TheRojohn ValenzuelaNo ratings yet

- Master of Professional Accounting Week 4 Lecture and Tutorial E6.25 Job Costing and Pricing: Interior Decorating FirmDocument32 pagesMaster of Professional Accounting Week 4 Lecture and Tutorial E6.25 Job Costing and Pricing: Interior Decorating FirmSahil PuniaNo ratings yet

- GG Toys WAC Final PDFDocument9 pagesGG Toys WAC Final PDFTanaya SahaNo ratings yet

- Chapter 5. Activity Based CostingDocument28 pagesChapter 5. Activity Based CostingbellaNo ratings yet

- BBA211 Vol5 Marginal&AbsortptionCostingDocument15 pagesBBA211 Vol5 Marginal&AbsortptionCostingAnisha SarahNo ratings yet

- Part D - Schedule 1 - Pricing Y1 Floor Covering Services 2022Document2 pagesPart D - Schedule 1 - Pricing Y1 Floor Covering Services 2022Amir SachsNo ratings yet

- Depreciation - Inventory Valuation MethodsDocument48 pagesDepreciation - Inventory Valuation MethodsArun Panwar100% (1)

- P6.36 Job Costing: Consulting FirmDocument11 pagesP6.36 Job Costing: Consulting FirmPat0% (1)

- GSTL FM Project ReportDocument12 pagesGSTL FM Project Reportmuhammad shamsadNo ratings yet

- Model Solution - Assessment 2Document12 pagesModel Solution - Assessment 2rajeshkinger_1994100% (2)

- Activity Based-WPS OfficeDocument6 pagesActivity Based-WPS OfficeTakudzwa BenjaminNo ratings yet

- Individual Assignment (Fall 2023) 2Document11 pagesIndividual Assignment (Fall 2023) 2RealGenius (Carl)No ratings yet

- Activity Based Costing: DR Meena BhatiaDocument23 pagesActivity Based Costing: DR Meena BhatiaAkashbaldwinNo ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Allied Office ProductsDocument10 pagesAllied Office Productsdian ratnasari100% (7)

- Backflush Costing & Lean Accounting-EditDocument3 pagesBackflush Costing & Lean Accounting-EditsafiraNo ratings yet

- Principles of Cost AccountingDocument28 pagesPrinciples of Cost AccountingNin WaramNo ratings yet

- PMA0064 Midterm (Q) Tri 3 2021Document6 pagesPMA0064 Midterm (Q) Tri 3 2021NABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- David Fletcher CaseDocument5 pagesDavid Fletcher CasePooja GuptaNo ratings yet

- Lifetime ValueasasDocument6 pagesLifetime ValueasasAshish BhartiNo ratings yet

- Lifetime ValueasasDocument6 pagesLifetime ValueasasAshish BhartiNo ratings yet

- Lifetime ValueasasDocument6 pagesLifetime ValueasasAshish BhartiNo ratings yet

- Customer Lifetime Value Calculator For Financial Institutions: Follow The Four Steps and Input Your CLV DataDocument29 pagesCustomer Lifetime Value Calculator For Financial Institutions: Follow The Four Steps and Input Your CLV DataPooja GuptaNo ratings yet

- Mueller-Lehmkuhl GMBH: Fasteners Attachment Total Source Machines Revenue CgsDocument1 pageMueller-Lehmkuhl GMBH: Fasteners Attachment Total Source Machines Revenue CgsPooja GuptaNo ratings yet

- M-L ExhibitsDocument1 pageM-L ExhibitsPooja GuptaNo ratings yet

- M-L ExhibitsDocument1 pageM-L ExhibitsPooja GuptaNo ratings yet

- Layout EvaluationDocument12 pagesLayout EvaluationAnkit MehtaNo ratings yet

- ERP Evaluation TemplateDocument5 pagesERP Evaluation Templatejancukjancuk50% (2)

- Procedure For Materials Issuance (Atc)Document4 pagesProcedure For Materials Issuance (Atc)Muhammed Noman Fazal Siddiqui100% (2)

- Chapter 4 The Revenue Cycle PDFDocument2 pagesChapter 4 The Revenue Cycle PDFKent Braña Tan100% (1)

- Inside SAP APO CCR (Comparison and Reconciliation) and Future AspectDocument10 pagesInside SAP APO CCR (Comparison and Reconciliation) and Future Aspectsrinivas0212No ratings yet

- Contemporary Logistics 12th Edition Murphy Solutions ManualDocument35 pagesContemporary Logistics 12th Edition Murphy Solutions Manualalgidityabductzo6n100% (20)

- Serviceheft en Web 2017 Ks FastenersDocument102 pagesServiceheft en Web 2017 Ks FastenersHua Hidari Yang100% (1)

- Ware Housing and DistributionDocument32 pagesWare Housing and DistributionChintan Ramnani100% (1)

- Binuatan CreationsDocument35 pagesBinuatan Creationsmarymen_mestidio100% (3)

- Om Case StudyDocument13 pagesOm Case StudyMariya NoorNo ratings yet

- Executive Order No. 133, Department Administrative Order No. 07, Series of andDocument21 pagesExecutive Order No. 133, Department Administrative Order No. 07, Series of andleandro_santos_134No ratings yet

- Revenue Cycle Conceptual SystemDocument7 pagesRevenue Cycle Conceptual SystemLil ConicNo ratings yet

- 2019 Market SurveyDocument17 pages2019 Market SurveyAnonymous 9zTLjw100% (1)

- ICD Visit ReportDocument17 pagesICD Visit Reportysh100% (2)

- Presented By:: Aastha Garg Akanksha Malhotra Manasvi Singh Mayank Kapoor Mohit Bhambri Pankul Ashok Parv BansalDocument26 pagesPresented By:: Aastha Garg Akanksha Malhotra Manasvi Singh Mayank Kapoor Mohit Bhambri Pankul Ashok Parv BansalShilpi PachauriNo ratings yet

- 2Document36 pages2juankudrizNo ratings yet

- GSCM520 Unit7 Learning Activity SolutionsDocument4 pagesGSCM520 Unit7 Learning Activity Solutions蔡承恩No ratings yet

- 5S Best Practices For Lean WarehousingDocument3 pages5S Best Practices For Lean WarehousingDharmvir UppalNo ratings yet

- Cardillo Frank ResumeDocument2 pagesCardillo Frank ResumeChristopher HodgeNo ratings yet

- HSE Books: Catalogue May 2011Document36 pagesHSE Books: Catalogue May 2011Palaniraja RajarathinamNo ratings yet

- GD Gdpmds Draft1Document24 pagesGD Gdpmds Draft1Syaiful NazwanNo ratings yet

- Abhishek Agarwal SAP WM/MM Consultant, PH: (608) 481-6241 Email: Professional SummaryDocument6 pagesAbhishek Agarwal SAP WM/MM Consultant, PH: (608) 481-6241 Email: Professional SummaryBalu ReddyNo ratings yet

- PH ManualDocument129 pagesPH ManualBiniyam12No ratings yet

- PIS Stores Managment Inventory Control Synopsis)Document9 pagesPIS Stores Managment Inventory Control Synopsis)Vikram AroraNo ratings yet

- Growing Pains: Tata MotorsDocument5 pagesGrowing Pains: Tata MotorsNaseem AhmadNo ratings yet

- Slide of Chapter 4 - Agribusiness Supply ChainDocument13 pagesSlide of Chapter 4 - Agribusiness Supply ChainAref WanuNo ratings yet

- Rapid Deployment of SAP Extended Warehouse Management:: Business Needs Service No.Document2 pagesRapid Deployment of SAP Extended Warehouse Management:: Business Needs Service No.Vishal Sathe0% (1)

- Al Titel PharmaDocument15 pagesAl Titel Pharmaahmedalwared66No ratings yet

- 1.1 Meaning and Scope of Materials ManagementDocument11 pages1.1 Meaning and Scope of Materials ManagementHemanth KumarNo ratings yet

- Apics CpimDocument16 pagesApics CpimAnubhav PandeyNo ratings yet