Professional Documents

Culture Documents

Exercise On Risk and Return CAPM (Chapter 8)

Uploaded by

AMIRTHARAAJ A/L VIJAYAN MBS211063Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise On Risk and Return CAPM (Chapter 8)

Uploaded by

AMIRTHARAAJ A/L VIJAYAN MBS211063Copyright:

Available Formats

MBSA 1453/1463 Financial Management and Corporate Governance/Strategic Financial Management

Exercise (Chapter 8)

Risk and Return - CAPM

No Question Reference

FM book, 13th Edition

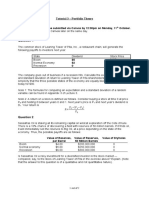

1 Penny Francis inherited a $200,000 portfolio of investments from her

grandparents when se turned 21 years of age. The portfolio is comprised 8-5

of treasury bills and stock in Ford (F) and Harley Davidson (HOG)

Expected $ Value

return

Treasury 4.5% 80,000

bills

Ford (F) 8% 60,000

Harley 12% 60,000

Davidson

(HOG)

a) Based on the current portfolio composition and the expected

rates of return, what is the expected rate of return for Penny’s

portfolio?

b) If penny wants to increase her expected portfolio rate of return,

she can increase the allocation weight of the portfolio she has

invested in stock (Ford and Harley Davidson) and decrease her

holdings of Treasury bills. If penny moves all her money out of

treasury bills and splits it evenly between the two stocks, what

will be her expected rate of return?

c) If penny does move money out of treasury bills and into the two

stocks, she will reap a higher expected portfolio return, so why

would anyone want to hold treasury bills in their portfolio?

2 Breckenridge Inc. has a beta of 0.85. If the expected market portfolio 8-17

return is 10.5% and the risk free rate is 3.5%, what is the appropriate

expected return of Breckenridge (using the CAPM)?

3 CSB Inc. has a beta of 0.765. If the expected market portfolio return is 8-18

10.5% and the risk free rate is 3.5%, what is the appropriate expected

return of Breckenridge (using the CAPM)?

4 You are putting together a portfolio made up of four different stocks. 8-23

Prepared by: Assoc Prof Dr Maizaitulaidawati Md Husin Page 1

MBSA 1453/1463 Financial Management and Corporate Governance/Strategic Financial Management

However, you’re considering to possible weightings:

Portfolio weightings

Asset Beta First Second

portfolio portfolio

A 2.5 10% 40%

B 1.0 10% 40%

C 0.5 40% 10%

D -1.5 40% 10%

a) What is. The beta on each portfolio?

b) Which portfolio is riskier?

c) If the risk free rate of interest is 4% and the market risk premium

is 5%, what rate of return do you expect to earn from each of the

portfolios?

Prepared by: Assoc Prof Dr Maizaitulaidawati Md Husin Page 2

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Exercise On Risk and Return CAPM (Chapter 8) AnswerDocument3 pagesExercise On Risk and Return CAPM (Chapter 8) AnswerAMIRTHARAAJ A/L VIJAYAN MBS211063No ratings yet

- FM 1 - Chapter 08 - Dodic PratamaDocument2 pagesFM 1 - Chapter 08 - Dodic PratamadodicNo ratings yet

- Tutorial 4Document3 pagesTutorial 4sera porotakiNo ratings yet

- Tutorial Risk & ReturnDocument3 pagesTutorial Risk & ReturnNhi Hoang100% (1)

- Practice Questions (CAPM) : FIN 350 Global Financial ManagementDocument2 pagesPractice Questions (CAPM) : FIN 350 Global Financial Managementsarge19860% (1)

- Structure of Case Study Invest Policy Hewlett Foundation.Document4 pagesStructure of Case Study Invest Policy Hewlett Foundation.SulaimanAl-SulaimaniNo ratings yet

- Soal Asis 4 IPMDocument2 pagesSoal Asis 4 IPMPutri Dianasri ButarbutarNo ratings yet

- Risk and ReturnDocument4 pagesRisk and ReturnHira MohsinNo ratings yet

- 3017 Tutorial 11Document2 pages3017 Tutorial 11rosea267No ratings yet

- 615 Risk, Return Problems and QuestionsDocument7 pages615 Risk, Return Problems and Questionslittle_lady26100% (3)

- FM1 04 Investment Risk and Return ExcercisesDocument2 pagesFM1 04 Investment Risk and Return ExcercisesGabrielle Marie Crucillo0% (1)

- Problemas Cap 12Document5 pagesProblemas Cap 12angel guarinNo ratings yet

- Problem Set 2Document4 pagesProblem Set 2Spencer0% (1)

- FIN MGT 2 Quiz 1Document3 pagesFIN MGT 2 Quiz 1Alelie dela CruzNo ratings yet

- Assignment - 4 Jul 31Document5 pagesAssignment - 4 Jul 31spectrum_48No ratings yet

- Practice QuestionsDocument6 pagesPractice QuestionsAashish SharmaNo ratings yet

- AC513 Midterm Review.Document14 pagesAC513 Midterm Review.Lauren ObrienNo ratings yet

- Tutorial 3 - Risk Return (Part 2) PDFDocument2 pagesTutorial 3 - Risk Return (Part 2) PDFChamNo ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- Risk and Return: 1. Chapter 11 (Textbook) : 7, 13, 14, 24Document3 pagesRisk and Return: 1. Chapter 11 (Textbook) : 7, 13, 14, 24anon_355962815100% (1)

- Inferior Investment Alternatives What Will Be The ExpectedDocument1 pageInferior Investment Alternatives What Will Be The ExpectedM Bilal SaleemNo ratings yet

- Chapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSDocument10 pagesChapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual50% (2)

- Study Questions Risk and ReturnDocument4 pagesStudy Questions Risk and ReturnAlif SultanliNo ratings yet

- INA W5Formative TSDocument5 pagesINA W5Formative TSNayden GeorgievNo ratings yet

- HSBC Risk Profiling Questionnaire V3Document3 pagesHSBC Risk Profiling Questionnaire V3anilmm2006No ratings yet

- Test Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoDocument8 pagesTest Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoamiraNo ratings yet

- CF Week9 Seminar3Document4 pagesCF Week9 Seminar3KesyadwikaNo ratings yet

- Problem Set 1Document3 pagesProblem Set 1ikramraya0No ratings yet

- Financial Management - Theory & Practice by Brigham-266-273Document8 pagesFinancial Management - Theory & Practice by Brigham-266-273Muhammad AzeemNo ratings yet

- Econ F315 1923 T1M 2017 1Document4 pagesEcon F315 1923 T1M 2017 1Abhishek GhoshNo ratings yet

- DuPont Corporation Sale of Performance CoatingsDocument1 pageDuPont Corporation Sale of Performance Coatingsj2203950% (2)

- Tutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberDocument2 pagesTutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberVivienLamNo ratings yet

- Mock Test QuestionsDocument7 pagesMock Test QuestionsMyraNo ratings yet

- Exam Practice QuestionsDocument6 pagesExam Practice Questionssir bookkeeperNo ratings yet

- Case Discussion Questions Fall 2014Document6 pagesCase Discussion Questions Fall 2014ketanNo ratings yet

- FIN300 Homework 3Document4 pagesFIN300 Homework 3JohnNo ratings yet

- Tutorial 5 PDFDocument2 pagesTutorial 5 PDFBarakaNo ratings yet

- Filmore EnterprisesDocument7 pagesFilmore EnterprisesJoshua Everett100% (1)

- Problem Risk Return CAPMDocument12 pagesProblem Risk Return CAPMbajujuNo ratings yet

- Test 092403Document10 pagesTest 092403Janice ChanNo ratings yet

- Practice-Risk and ReturnDocument3 pagesPractice-Risk and Returnelysepa7No ratings yet

- Principles of Corporate Finance 11th Edition Brealey Test BankDocument61 pagesPrinciples of Corporate Finance 11th Edition Brealey Test Bankrandallperrykdepbtozqf100% (26)

- Module 3 - FILMORE ENTERPRISES - QuestionsDocument4 pagesModule 3 - FILMORE ENTERPRISES - Questionsseth litchfieldNo ratings yet

- Questões Cap6Document5 pagesQuestões Cap6João EspositoNo ratings yet

- Chapter 5 - Introduction To Risk and ReturnDocument63 pagesChapter 5 - Introduction To Risk and ReturnDeok NguyenNo ratings yet

- Merger & Acquisition: RequiredDocument19 pagesMerger & Acquisition: RequiredBKS SannyasiNo ratings yet

- CFA Level 1 Practice Questions For Portfolio Management Page 1 of ...Document18 pagesCFA Level 1 Practice Questions For Portfolio Management Page 1 of ...b00812473No ratings yet

- Tutorial 9 QuestionsDocument1 pageTutorial 9 QuestionsAmber Yi Woon NgNo ratings yet

- Topic 4 Tutorial QuestionsDocument2 pagesTopic 4 Tutorial QuestionsThirusha balamuraliNo ratings yet

- Principles of Corporate Finance 11Th Edition Brealey Test Bank Full Chapter PDFDocument68 pagesPrinciples of Corporate Finance 11Th Edition Brealey Test Bank Full Chapter PDFgephyreashammyql0100% (7)

- FinanceDocument6 pagesFinanceHassanNo ratings yet

- AccountingDocument6 pagesAccountingHaneefa Soomro0% (1)

- MBA 8230 - Corporation Finance (Part II) Practice Final Exam #2Document6 pagesMBA 8230 - Corporation Finance (Part II) Practice Final Exam #2lilbouyinNo ratings yet

- Far Eastern University: ACT 1109 HO-01Document2 pagesFar Eastern University: ACT 1109 HO-01Maryrose Sumulong100% (1)

- Quiz 3 Version ADocument2 pagesQuiz 3 Version AMishal KhalidNo ratings yet

- Assignment 2 - Risk, Required Rate of Return EssayDocument2 pagesAssignment 2 - Risk, Required Rate of Return EssayJerry ToledoNo ratings yet

- Invest Like a Fox... Not Like a Hedgehog: How You Can Earn Higher Returns With Less RiskFrom EverandInvest Like a Fox... Not Like a Hedgehog: How You Can Earn Higher Returns With Less RiskNo ratings yet

- Competitive Advantage in Investing: Building Winning Professional PortfoliosFrom EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosNo ratings yet

- Charlie-Rose Evans ResumeDocument3 pagesCharlie-Rose Evans Resumeapi-309085679No ratings yet

- Respiratory System NotesDocument8 pagesRespiratory System NotesKomalesh TheeranNo ratings yet

- Review of LiteratureDocument18 pagesReview of LiteratureVimal VickyNo ratings yet

- Nepal Conference BrochureDocument20 pagesNepal Conference BrochureSuresh Kumar BhandariNo ratings yet

- 27 August To 02 SeptemberDocument16 pages27 August To 02 SeptemberpratidinNo ratings yet

- Clase 8. IPv6 AddressingDocument51 pagesClase 8. IPv6 AddressingRober PalaciosNo ratings yet

- FM200Document18 pagesFM200a_salehiNo ratings yet

- Paul Councel - Your Stars and DestinyDocument26 pagesPaul Councel - Your Stars and DestinyBoris Zaslichko100% (1)

- Preboring Works To DWall With Air-Lift & RCD Core Barrer - 17.6.14 PDFDocument18 pagesPreboring Works To DWall With Air-Lift & RCD Core Barrer - 17.6.14 PDFErick SmithNo ratings yet

- Full CCNP Service Provider Routing LabDocument14 pagesFull CCNP Service Provider Routing LabMksNo ratings yet

- PHP Architect - 2017 01 JanuaryDocument52 pagesPHP Architect - 2017 01 JanuaryRafi SMNo ratings yet

- Assignment 1 - Time Dose Fractionation TDF ConceptsDocument3 pagesAssignment 1 - Time Dose Fractionation TDF Conceptsapi-299138743No ratings yet

- 2021 Annual Budget Report - Luna, ApayaoDocument40 pages2021 Annual Budget Report - Luna, ApayaoMarvin OlidNo ratings yet

- Tle 10 Agricrop Production Quarter 2 Week 8 Summative TestDocument5 pagesTle 10 Agricrop Production Quarter 2 Week 8 Summative TestRosalieMarCuyaNo ratings yet

- Permanent Magnet DC MotorDocument7 pagesPermanent Magnet DC MotorJesse Jones Seraspe100% (1)

- COVID-19Document9 pagesCOVID-19Tony BernardNo ratings yet

- Manual To KivyDocument2 pagesManual To KivyvalkmaxNo ratings yet

- The Hero ofDocument5 pagesThe Hero ofkhushnood aliNo ratings yet

- Propulsion of VLC C 19993990Document7 pagesPropulsion of VLC C 19993990hpss77No ratings yet

- Lockout-Tag Out (MOL)Document35 pagesLockout-Tag Out (MOL)javariam99No ratings yet

- Ribeiro Et Al 2003Document7 pagesRibeiro Et Al 2003baglamaNo ratings yet

- How To Use Prepositions PDFDocument4 pagesHow To Use Prepositions PDFVikash Kumar0% (1)

- Tungkung Langit and AlunsinaDocument3 pagesTungkung Langit and AlunsinaPatrick FedilusNo ratings yet

- Biot Savart LawDocument7 pagesBiot Savart LawTornadoNo ratings yet

- Microsoft Power Bi TrainingDocument2 pagesMicrosoft Power Bi TrainingYazanMohamedNo ratings yet

- University of GhanaDocument4 pagesUniversity of GhanaDon ArthurNo ratings yet

- Unit 2 (RC 5)Document18 pagesUnit 2 (RC 5)hrishita.bhandaryNo ratings yet

- Grade 6 PollutionDocument3 pagesGrade 6 PollutionNermine Mouallem75% (4)

- 0900766b8141d079 PDFDocument12 pages0900766b8141d079 PDFEbrahim SabouriNo ratings yet

- Symbolism in Everyday Life PDFDocument6 pagesSymbolism in Everyday Life PDFIzhar AliNo ratings yet