Professional Documents

Culture Documents

Exercise On Risk and Return CAPM (Chapter 8) Answer

Uploaded by

AMIRTHARAAJ A/L VIJAYAN MBS2110630 ratings0% found this document useful (0 votes)

19 views3 pagesThis document contains an exercise on risk and return using the Capital Asset Pricing Model (CAPM). It includes 4 questions that ask students to:

1) Calculate the expected return of Penny Francis' investment portfolio based on its composition and the expected returns of its components.

2) Calculate the expected return if Penny changes the portfolio's composition.

3) Explain why someone would hold treasury bills in their portfolio.

4) Calculate the betas and expected returns of two sample portfolios with different asset weightings using given asset betas, risk-free rate, and market risk premium.

Original Description:

Original Title

Exercise on Risk and Return CAPM (chapter 8) Answer

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains an exercise on risk and return using the Capital Asset Pricing Model (CAPM). It includes 4 questions that ask students to:

1) Calculate the expected return of Penny Francis' investment portfolio based on its composition and the expected returns of its components.

2) Calculate the expected return if Penny changes the portfolio's composition.

3) Explain why someone would hold treasury bills in their portfolio.

4) Calculate the betas and expected returns of two sample portfolios with different asset weightings using given asset betas, risk-free rate, and market risk premium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views3 pagesExercise On Risk and Return CAPM (Chapter 8) Answer

Uploaded by

AMIRTHARAAJ A/L VIJAYAN MBS211063This document contains an exercise on risk and return using the Capital Asset Pricing Model (CAPM). It includes 4 questions that ask students to:

1) Calculate the expected return of Penny Francis' investment portfolio based on its composition and the expected returns of its components.

2) Calculate the expected return if Penny changes the portfolio's composition.

3) Explain why someone would hold treasury bills in their portfolio.

4) Calculate the betas and expected returns of two sample portfolios with different asset weightings using given asset betas, risk-free rate, and market risk premium.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

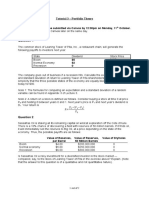

MBSA 1453/1463 Financial Management and Corporate Governance/Strategic Financial Management

Exercise (Chapter 8)

Risk and Return - CAPM

No Question Reference Answer

FM book, 13th

Edition

1 Penny Francis inherited a $200,000

portfolio of investments from her 8-5

grandparents when se turned 21 years of

age. The portfolio is comprised of treasury

bills and stock in Ford (F) and Harley

Davidson (HOG)

Expected $ Value

return

Treasury 4.5% 80,000

bills

Ford (F) 8% 60,000

Harley 12% 60,000

Davidson

(HOG)

a) Based on the current portfolio

composition and the expected

rates of return, what is the

expected rate of return for Penny’s

portfolio?

Prepared by: Assoc Prof Dr Maizaitulaidawati Md Husin Page 1

MBSA 1453/1463 Financial Management and Corporate Governance/Strategic Financial Management

b) If penny wants to increase her

expected portfolio rate of return,

she can increase the allocation

weight of the portfolio she has

invested in stock (Ford and Harley

Davidson) and decrease her

holdings of Treasury bills. If penny

moves all her money out of

treasury bills and splits it evenly

between the two stocks, what will

be her expected rate of return?

c) If penny does move money out of

treasury bills and into the two

stocks, she will reap a higher

expected portfolio return, so why

would anyone want to hold

treasury bills in their portfolio?

2 Breckenridge Inc. has a beta of 0.85. If the 8-17

expected market portfolio return is 10.5%

and the risk free rate is 3.5%, what is the

appropriate expected return of

Breckenridge (using the CAPM)?

3 CSB Inc. has a beta of 0.765. If the 8-18

expected market portfolio return is 10.5%

and the risk free rate is 3.5%, what is the

appropriate expected return of

Breckenridge (using the CAPM)?

Prepared by: Assoc Prof Dr Maizaitulaidawati Md Husin Page 2

MBSA 1453/1463 Financial Management and Corporate Governance/Strategic Financial Management

4 You are putting together a portfolio made

up of four different stocks. However,

you’re considering to possible weightings:

Portfolio weightings

Asset Beta First Second

portfolio portfolio

A 2.5 10% 40%

B 1.0 10% 40%

C 0.5 40% 10%

D -1.5 40% 10%

a) What is. The beta on each

portfolio?

b) Which portfolio is riskier?

c) If the risk free rate of interest is 4%

and the market risk premium is 5%,

what rate of return do you expect

to earn from each of the

portfolios?

Prepared by: Assoc Prof Dr Maizaitulaidawati Md Husin Page 3

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Structure of Case Study Invest Policy Hewlett Foundation.Document4 pagesStructure of Case Study Invest Policy Hewlett Foundation.SulaimanAl-SulaimaniNo ratings yet

- HSE Policy Statement A4 ENGLISH WebDocument1 pageHSE Policy Statement A4 ENGLISH WebHunter100% (1)

- Filmore EnterprisesDocument7 pagesFilmore EnterprisesJoshua Everett100% (1)

- Bitstream Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDocument6 pagesBitstream Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDeepesh Shenoy50% (2)

- 615 Risk, Return Problems and QuestionsDocument7 pages615 Risk, Return Problems and Questionslittle_lady26100% (3)

- 4 - Problem - Set FRM - PS PDFDocument3 pages4 - Problem - Set FRM - PS PDFValentin IsNo ratings yet

- Economics Notes Class 11 All in OneDocument0 pagesEconomics Notes Class 11 All in Onewww.bhawesh.com.np85% (46)

- Dunkin Donut ThesisDocument94 pagesDunkin Donut ThesisPaulo Alomia75% (4)

- Problem Set 2Document4 pagesProblem Set 2Spencer0% (1)

- Tutorial 3 - Risk Return (Part 2) PDFDocument2 pagesTutorial 3 - Risk Return (Part 2) PDFChamNo ratings yet

- Test Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoDocument8 pagesTest Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoamiraNo ratings yet

- Module 3 - FILMORE ENTERPRISES - QuestionsDocument4 pagesModule 3 - FILMORE ENTERPRISES - Questionsseth litchfieldNo ratings yet

- Merger & Acquisition: RequiredDocument19 pagesMerger & Acquisition: RequiredBKS SannyasiNo ratings yet

- Medical Research Corporation Is Expanding Its Research and Production CapacityDocument1 pageMedical Research Corporation Is Expanding Its Research and Production CapacityAmit PandeyNo ratings yet

- FEU Quiz 2 Conso SYDocument6 pagesFEU Quiz 2 Conso SYclarissa paragas50% (2)

- Exercise On Risk and Return CAPM (Chapter 8)Document2 pagesExercise On Risk and Return CAPM (Chapter 8)AMIRTHARAAJ A/L VIJAYAN MBS211063No ratings yet

- FM 1 - Chapter 08 - Dodic PratamaDocument2 pagesFM 1 - Chapter 08 - Dodic PratamadodicNo ratings yet

- Tutorial 4Document3 pagesTutorial 4sera porotakiNo ratings yet

- 3017 Tutorial 11Document2 pages3017 Tutorial 11rosea267No ratings yet

- Inferior Investment Alternatives What Will Be The ExpectedDocument1 pageInferior Investment Alternatives What Will Be The ExpectedM Bilal SaleemNo ratings yet

- Tutorial Risk & ReturnDocument3 pagesTutorial Risk & ReturnNhi Hoang100% (1)

- Practice Questions (CAPM) : FIN 350 Global Financial ManagementDocument2 pagesPractice Questions (CAPM) : FIN 350 Global Financial Managementsarge19860% (1)

- FM1 04 Investment Risk and Return ExcercisesDocument2 pagesFM1 04 Investment Risk and Return ExcercisesGabrielle Marie Crucillo0% (1)

- Problemas Cap 12Document5 pagesProblemas Cap 12angel guarinNo ratings yet

- Mock Test QuestionsDocument7 pagesMock Test QuestionsMyraNo ratings yet

- Problem Set 1Document3 pagesProblem Set 1ikramraya0No ratings yet

- Soal Asis 4 IPMDocument2 pagesSoal Asis 4 IPMPutri Dianasri ButarbutarNo ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- Study Questions Risk and ReturnDocument4 pagesStudy Questions Risk and ReturnAlif SultanliNo ratings yet

- Chapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSDocument10 pagesChapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual50% (2)

- Risk and ReturnDocument4 pagesRisk and ReturnHira MohsinNo ratings yet

- Tutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberDocument2 pagesTutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberVivienLamNo ratings yet

- HSBC Risk Profiling Questionnaire V3Document3 pagesHSBC Risk Profiling Questionnaire V3anilmm2006No ratings yet

- AC513 Midterm Review.Document14 pagesAC513 Midterm Review.Lauren ObrienNo ratings yet

- Assignment 2 - Risk, Required Rate of Return EssayDocument2 pagesAssignment 2 - Risk, Required Rate of Return EssayJerry ToledoNo ratings yet

- Test 092403Document10 pagesTest 092403Janice ChanNo ratings yet

- FIN MGT 2 Quiz 1Document3 pagesFIN MGT 2 Quiz 1Alelie dela CruzNo ratings yet

- Econ F315 1923 T1M 2017 1Document4 pagesEcon F315 1923 T1M 2017 1Abhishek GhoshNo ratings yet

- Practice QuestionsDocument6 pagesPractice QuestionsAashish SharmaNo ratings yet

- Assignment - 4 Jul 31Document5 pagesAssignment - 4 Jul 31spectrum_48No ratings yet

- Activity 2 - Risk, and Required Rate of Return: EssayDocument1 pageActivity 2 - Risk, and Required Rate of Return: Essaykyle GipulanNo ratings yet

- INA W5Formative TSDocument5 pagesINA W5Formative TSNayden GeorgievNo ratings yet

- Tutorial 5 PDFDocument2 pagesTutorial 5 PDFBarakaNo ratings yet

- Risk and Return: 1. Chapter 11 (Textbook) : 7, 13, 14, 24Document3 pagesRisk and Return: 1. Chapter 11 (Textbook) : 7, 13, 14, 24anon_355962815100% (1)

- Exam Practice QuestionsDocument6 pagesExam Practice Questionssir bookkeeperNo ratings yet

- Topic 4 Tutorial QuestionsDocument2 pagesTopic 4 Tutorial QuestionsThirusha balamuraliNo ratings yet

- CF Week9 Seminar3Document4 pagesCF Week9 Seminar3KesyadwikaNo ratings yet

- Stratégies de Réplication Des Hedge Funds: Conséquences Pour Les Investisseurs Et Les RégulateursDocument12 pagesStratégies de Réplication Des Hedge Funds: Conséquences Pour Les Investisseurs Et Les RégulateursS KARMINo ratings yet

- Case Discussion Questions Fall 2014Document6 pagesCase Discussion Questions Fall 2014ketanNo ratings yet

- Financial Management - Theory & Practice by Brigham-266-273Document8 pagesFinancial Management - Theory & Practice by Brigham-266-273Muhammad AzeemNo ratings yet

- Problem Risk Return CAPMDocument12 pagesProblem Risk Return CAPMbajujuNo ratings yet

- C 11Document5 pagesC 11Phương ThùyNo ratings yet

- Tutorial 7 Risk & Return & CAPM SVDocument4 pagesTutorial 7 Risk & Return & CAPM SVHiền NguyễnNo ratings yet

- 2023 - Tute 7 - Risk, Return, CAPMDocument4 pages2023 - Tute 7 - Risk, Return, CAPMThảo TrươngNo ratings yet

- FMA - Tute 7 - Risk, Return, CAPMDocument4 pagesFMA - Tute 7 - Risk, Return, CAPMHà ĐàoNo ratings yet

- FinanceDocument6 pagesFinanceHassanNo ratings yet

- AssessmentDocument24 pagesAssessmentt_hargonNo ratings yet

- Homework Fin InvestmentDocument5 pagesHomework Fin Investmentdamtuan11012000No ratings yet

- Invstmt Mid Exam BRN RGLRDocument3 pagesInvstmt Mid Exam BRN RGLRTalila SidaNo ratings yet

- 8230 Sample Final 1Document8 pages8230 Sample Final 1lilbouyinNo ratings yet

- Tutorial 9 QuestionsDocument1 pageTutorial 9 QuestionsAmber Yi Woon NgNo ratings yet

- Invest Like a Fox... Not Like a Hedgehog: How You Can Earn Higher Returns With Less RiskFrom EverandInvest Like a Fox... Not Like a Hedgehog: How You Can Earn Higher Returns With Less RiskNo ratings yet

- Customer Satisfaction Chapter 3Document13 pagesCustomer Satisfaction Chapter 3Hanif HardiansahNo ratings yet

- European Central BankDocument2 pagesEuropean Central BanknairpranavNo ratings yet

- Traditional Supply ChainDocument8 pagesTraditional Supply ChainAkaash JainNo ratings yet

- Robert K. Schaeffer - After Globalization-Routledge (2021)Document416 pagesRobert K. Schaeffer - After Globalization-Routledge (2021)Leonardo ChagasNo ratings yet

- ACCT505 Week3 Case2Document2 pagesACCT505 Week3 Case2ashibhallauNo ratings yet

- SumanDocument3 pagesSumanDibya Kumari RaiNo ratings yet

- Industrial Management ModelDocument2 pagesIndustrial Management Modelrajendrakumar100% (1)

- COST ACCOUNTING - Sem VIDocument4 pagesCOST ACCOUNTING - Sem VISiddheshNo ratings yet

- Project Report On BFLDocument33 pagesProject Report On BFLSaurabh BhagatNo ratings yet

- Cover LetterDocument1 pageCover LetterAnonymous QNTETBNo ratings yet

- Black Book - pg1Document3 pagesBlack Book - pg1Sakshi JainNo ratings yet

- MakalahDocument12 pagesMakalahbudiNo ratings yet

- MATH11 ADM Org Man Q2 Module16 The Basic Concept of Small Family BusinessDocument16 pagesMATH11 ADM Org Man Q2 Module16 The Basic Concept of Small Family BusinessMark James Rico50% (2)

- MT 103 Gpi 23.8M CodesDocument2 pagesMT 103 Gpi 23.8M CodesEllerNo ratings yet

- 2013 IA COAG Report National Infrastructure Plan LR PDFDocument140 pages2013 IA COAG Report National Infrastructure Plan LR PDFLauren FrazierNo ratings yet

- Negotiation Skills and Effective CommunicationDocument1 pageNegotiation Skills and Effective CommunicationNin LenNo ratings yet

- SSI FAQs Updated 2021Document2 pagesSSI FAQs Updated 2021Indiana Family to FamilyNo ratings yet

- BP&EM External ImpsDocument19 pagesBP&EM External ImpsKiran ansurkarNo ratings yet

- Car Service InvoiceDocument2 pagesCar Service InvoiceVivek AnandNo ratings yet

- SystemicRiskFactors Weib PDFDocument19 pagesSystemicRiskFactors Weib PDFkarimNo ratings yet

- NPC International, Inc. Research AnlysisDocument7 pagesNPC International, Inc. Research Anlysisacademicwriter peterNo ratings yet

- Process Costing of Amul Ice CreamsDocument5 pagesProcess Costing of Amul Ice CreamsSatwikNo ratings yet

- Student List RSDocument6 pagesStudent List RSIfa ChanNo ratings yet

- Sathyabama University: Bachlor of Business AdministrationDocument98 pagesSathyabama University: Bachlor of Business AdministrationatulsudhirNo ratings yet

- ApindoDocument3 pagesApindoqoer udinNo ratings yet