Professional Documents

Culture Documents

YOLO Crowd Loads Up On Protect

Uploaded by

Matheus Augusto Campos PiresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

YOLO Crowd Loads Up On Protect

Uploaded by

Matheus Augusto Campos PiresCopyright:

Available Formats

This document is being provided for the exclusive use of GUILHERME MAMPRIN at LOYALL INVESTIMENTOS LTDA.

Not for redistribution.

Bloomberg News Story

01/31/2022 11:27:56 [BFW] Bloomberg First Word

YOLO Crowd Loads Up on Protection at a Record Pace: Taking Stock

By Elena Popina

(Bloomberg) -- A year ago, newbie traders took the stock market by storm, bidding up certain left-for-dead

equities and schooling some of the pros. Twelve months later, the group is known for other reasons. One is that it

has no appetite for buying dips.

As the S&P 500 spent the week struggling to take a break from a nearly month-long rout, small-lot

options traders -- those trading 10 contracts or less -- spent a record amount of money establishing

new bearish positions. The average daily premium spent on small-lot put contracts also reached the

highest level in recent history.

It’s the latest evidence that the day-trader frenzy -- a hallmark feature of the stock market since the

onset of the pandemic -- is changing. The newbie crowd is getting less interested in buying dips -- a

departure from the trend between the summer of 2020 and middle of last year.

The “steady declines in apparent retail participation on the call side alongside incrementally higher

participation on the put side” is supportive “of the idea that retail participants on the option side are

generally chasing momentum and not aggressively buying dips,” said Christopher Jacobson, a strategist

at Susquehanna International Group Inc.

Source: SusquehannaSource: Bloomberg

The daily average premium that small-lot traders shelled out for protection jumped to $963 million,

twice the level seen in October, Options Clearing Corp. data analyzed by Susquehanna’s Jacobson

show. The smallest traders with bite-sized bets spent a record $6.5 billion buying put contracts last

week, data compiled by SentimenTrader show.

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP ("BFLP") and its

subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the ("BFLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg LP ("BLP"). BLP provides BFLP

with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their

affiliates do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® Printed on 01/31/2022 Page 1 of 4

This document is being provided for the exclusive use of GUILHERME MAMPRIN at LOYALL INVESTIMENTOS LTDA. Not for redistribution.

Bloomberg News Story

Demand for protection has been rising as the stock market kept falling in a sign that day traders could

be bracing for more losses to come. Uncertainty about the Federal Reserve’s pace of rate hikes is

weighing on sentiment and the earnings season is shaping up to be mixed at best. Geopolitical jitters

aren’t helping sentiment, either. Goldman Sachs Group Inc. strategist David Kostin said Monday he sees

downside risks to his target for U.S. stocks, adding to a chorus of Wall Street voices becoming more

pessimistic.

But while the sentiment among the newbie crowd has been getting grimmer by the week, one-off events

could be contributing to spikes in bearish volumes, Jacobson notes. A disappointing earnings release

from Tesla Inc. was one such instance. The electric-vehicle maker -- which enjoys some of the biggest

options volumes in ordinary sessions -- saw a jump in put trading following its results.

Futures on the S&P 500 are trading lower before a busy week, after the cash index staged a late-session

rebound on Friday to finish the week in the green.

SECTORS IN FOCUS:

U.S-listed Chinese tech stocks climb in premarket trading Monday after regulators made positive

comments about the sector over the weekend.

Major U.S. technology and internet names rise in premarket trading, hinting that the Nasdaq 100’s

rebound could extend after Apple’s results buoyed sentiment on Friday.

U.S. hotels and casino operators could be in focus after Macau Legend Development tumbled by a

record 30% following the arrest of its CEO on suspicion of money laundering and illegal gambling

activities.

Shares of Philippine tourism and leisure-related companies may trade actively as the government

relaxes mobility restrictions amid slowing Covid cases.

COMPANY NEWS:

Joe Rogan pledged more balance and better research for his podcast in an apology aimed at quelling

growing controversy about misleading coronavirus information that wiped almost $4 billion from Spotify

Technology SA’s market value last week.

Elliott Investment Management and Vista Equity Partners are nearing an agreement to acquire software-

maker Citrix Systems Inc. for around $13 billion, people familiar with the matter said.

See the U.S. Movers column for today’s most active stocks

NOTES FROM THE SELL-SIDE:

Click here to see other analyst ratings news in the U.S

UPCOMING EVENTS:

Eco Data

9:45am: Jan. MNI Chicago PMI, est. 61.8, prior 63.1, revised 64.3

10:30am: Jan. Dallas Fed Manf. Activity, est. 8.5, prior 8.1

11am: Jan. Export Inspections - Soybeans, prior 1.3m

11am: Jan. Export Inspections - Wheat, prior 401,000

11am: Jan. Export Inspections - Corn, prior 1.12m

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP ("BFLP") and its

subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the ("BFLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg LP ("BLP"). BLP provides BFLP

with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their

affiliates do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® Printed on 01/31/2022 Page 2 of 4

This document is being provided for the exclusive use of GUILHERME MAMPRIN at LOYALL INVESTIMENTOS LTDA. Not for redistribution.

Bloomberg News Story

3pm: Dec. Agricultural Prices Paid, prior 8.1%

3pm: Dec. Cattle Inventory YoY, est. -1.2%, prior -1.3%

3pm: Dec. Agriculture Prices Received, prior 17.4%

Central Banks

11:30am: Fed’s Daly Speaks at Reuters Live Event

Earnings

Premarket

Atkore Inc. (ATKR US)

L3Harris Technologies Inc. (LHX US)

Trane Technologies Plc (TT US)

Postmarket

Agnc Investment Corp. (AGNC US)

Alexandria Real Estate Equities Inc. (ARE US)

Axalta Coating Systems Ltd. (AXTA US)

Cabot Corp. (CBT US)

Cirrus Logic Inc. (CRUS US)

Credit Acceptance Corp. (CACC US)

Fabrinet (FN US)

Graco Inc. (GGG US)

Heartland Financial USA Inc. (HTLF US)

Helmerich & Payne Inc. (HP US)

J. & J. Snack Foods Corp. (JJSF US)

Kemper Corp. (KMPR US)

Kilroy Realty Corp. (KRC US)

NXP Semiconductors NV (NXPI US)

PotlatchDeltic Corp. (PCH US)

Sanmina Corp. (SANM US)

Woodward Inc. (WWD US)

Other

Otis Worldwide Corp. (OTIS US)

Other:

Annual general meetings: ENR US, IBIO US, PTC US

Other/M&A: MCRB US, MDGL US

For a look at key upcoming global events, click here

To contact the reporter on this story:

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP ("BFLP") and its

subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the ("BFLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg LP ("BLP"). BLP provides BFLP

with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their

affiliates do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® Printed on 01/31/2022 Page 3 of 4

This document is being provided for the exclusive use of GUILHERME MAMPRIN at LOYALL INVESTIMENTOS LTDA. Not for redistribution.

Bloomberg News Story

Elena Popina in New York at epopina@bloomberg.net

To contact the editor responsible for this story:

Michael P. Regan at mregan12@bloomberg.net

This story was produced with the assistance of Bloomberg Automation.

This report may not be modified or altered in any way. The BLOOMBERG PROFESSIONAL service and BLOOMBERG Data are owned and distributed locally by Bloomberg Finance LP ("BFLP") and its

subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the ("BFLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg LP ("BLP"). BLP provides BFLP

with all the global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. BFLP, BLP and their

affiliates do not provide investment advice, and nothing herein shall constitute an offer of financial instruments by BFLP, BLP or their affiliates.

Bloomberg ® Printed on 01/31/2022 Page 4 of 4

You might also like

- The Committee to Destroy the World: Inside the Plot to Unleash a Super Crash on the Global EconomyFrom EverandThe Committee to Destroy the World: Inside the Plot to Unleash a Super Crash on the Global EconomyNo ratings yet

- InvestingDocument62 pagesInvestingAlexander HertzbergNo ratings yet

- GSL001 0Document68 pagesGSL001 02imediaNo ratings yet

- Facebook, Inc. (FB) : Buy SellDocument17 pagesFacebook, Inc. (FB) : Buy SellalvisNo ratings yet

- 20 Contrarian Value Buy 2011Document8 pages20 Contrarian Value Buy 2011mosqiNo ratings yet

- Weekly View Feb 11, 2013Document3 pagesWeekly View Feb 11, 2013gkerschensteinerNo ratings yet

- 10 - 16th January 2008 (160108)Document5 pages10 - 16th January 2008 (160108)Chaanakya_cuimNo ratings yet

- August 182010 PostsDocument273 pagesAugust 182010 PostsAlbert L. PeiaNo ratings yet

- Sequoia Fund, Inc.Document8 pagesSequoia Fund, Inc.twoeight100% (1)

- 2011-09-19 Horizon CommentaryDocument4 pages2011-09-19 Horizon CommentarybgeltmakerNo ratings yet

- Market Playground: The Good, The Bad & The Ugly: Is Labopharm (NASDAQ:DDSS) Done?Document9 pagesMarket Playground: The Good, The Bad & The Ugly: Is Labopharm (NASDAQ:DDSS) Done?nhwiiiNo ratings yet

- Don't Wait For May SAUT 041910Document5 pagesDon't Wait For May SAUT 041910careyescapitalNo ratings yet

- Q2 2020 Letter BaupostDocument16 pagesQ2 2020 Letter BaupostLseeyouNo ratings yet

- October 21, 2011: Market OverviewDocument12 pagesOctober 21, 2011: Market OverviewValuEngine.comNo ratings yet

- Bailout of Money Funds Seems To Stanch Outflow: MarketsDocument4 pagesBailout of Money Funds Seems To Stanch Outflow: MarketsrtimuasNo ratings yet

- 11-18-2010 Term Sheet - Thursday, November 1833Document6 pages11-18-2010 Term Sheet - Thursday, November 1833Sri ReddyNo ratings yet

- Chaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesDocument8 pagesChaanakya Chaanakya Chaanakya Chaanakya: National HeadlinesChaanakya_cuimNo ratings yet

- Stock Market InvestorsDocument4 pagesStock Market InvestorsPreeti HaridasNo ratings yet

- Asia Stocks To Edge Higher AsDocument5 pagesAsia Stocks To Edge Higher Aslakshankrishantha524No ratings yet

- Hedge Funds Fighting Short RaidsDocument2 pagesHedge Funds Fighting Short RaidsGoldfish2021No ratings yet

- Snack With Dave: David A. RosenbergDocument9 pagesSnack With Dave: David A. RosenbergroquessudeNo ratings yet

- Comments On The 15 Growth IllusionDocument4 pagesComments On The 15 Growth IllusionekidenNo ratings yet

- The Global Macro Digest: Stocks Rebounded On FridayDocument3 pagesThe Global Macro Digest: Stocks Rebounded On FridayJames BoothNo ratings yet

- Newsletter: Latest UpdatesDocument6 pagesNewsletter: Latest Updatesapi-199476594No ratings yet

- 1Q 2019 PresentationDocument8 pages1Q 2019 Presentationaugtour4977No ratings yet

- Nikko AM Pulse 08-12 - FinalDocument2 pagesNikko AM Pulse 08-12 - FinalmaxamsterNo ratings yet

- Home Construction Sinks, Building Permits DownDocument30 pagesHome Construction Sinks, Building Permits DownAlbert L. PeiaNo ratings yet

- Inside JobDocument52 pagesInside JobMariaNo ratings yet

- February: February 6, 2014.pdf6, 2014Document7 pagesFebruary: February 6, 2014.pdf6, 2014Malanga Jeffrey Mposha IINo ratings yet

- EconForecast 財經預測Document3 pagesEconForecast 財經預測SAWNo ratings yet

- Selector September 2008 Quarterly NewsletterDocument23 pagesSelector September 2008 Quarterly Newsletterapi-237451731No ratings yet

- ValueInvestorInsight Issue 284Document24 pagesValueInvestorInsight Issue 284kennethtsleeNo ratings yet

- #CCC #MFGlobal White Paper Revised - 12-1-11Document11 pages#CCC #MFGlobal White Paper Revised - 12-1-11englishbob618No ratings yet

- The Big Mac IndexDocument2 pagesThe Big Mac IndexParilla13No ratings yet

- Zero HedgeDocument12 pagesZero HedgeRasta PapaNo ratings yet

- MergerDocument12 pagesMergerGulfam AnsariNo ratings yet

- ValuEngine Weekly Newsletter August 12, 2011Document11 pagesValuEngine Weekly Newsletter August 12, 2011ValuEngine.comNo ratings yet

- Third Point (Dan Loeb) Q3 2018 Investor Letter: The Good PlaceDocument8 pagesThird Point (Dan Loeb) Q3 2018 Investor Letter: The Good PlaceYui ChuNo ratings yet

- Drexel 10 Yr RetrospectiveDocument41 pagesDrexel 10 Yr RetrospectiveDan MawsonNo ratings yet

- Seth Klarman Baupost Group LettersDocument58 pagesSeth Klarman Baupost Group LettersAndr Ei100% (4)

- March 112010 PostsDocument10 pagesMarch 112010 PostsAlbert L. PeiaNo ratings yet

- TopmfDocument4 pagesTopmfapi-3719573No ratings yet

- GlobalizationlgDocument4 pagesGlobalizationlgapi-301266313No ratings yet

- Inside Job - Movie Review (The Story of Global Recession 2008) PDFDocument21 pagesInside Job - Movie Review (The Story of Global Recession 2008) PDFVALLIAPPAN.P100% (2)

- Aug 4thDocument15 pagesAug 4thshefalijnNo ratings yet

- 3 Stocks That Can Turn $100,000 Into $1 Million by 2030Document8 pages3 Stocks That Can Turn $100,000 Into $1 Million by 2030Gia KhangNo ratings yet

- Peak Profits TorporationDocument4 pagesPeak Profits TorporationDouglas CamposNo ratings yet

- Ormalization: ECONOMIC DATA With Impact Positive ImpactsDocument5 pagesOrmalization: ECONOMIC DATA With Impact Positive Impactsfred607No ratings yet

- Third Point Q3 2014 Investor Letter TPOIDocument11 pagesThird Point Q3 2014 Investor Letter TPOIValueWalkNo ratings yet

- Trojan Investing Newsletter - Volume 2 Issue 1Document6 pagesTrojan Investing Newsletter - Volume 2 Issue 1AlexNo ratings yet

- 7 - 1st December 2007 (011207)Document4 pages7 - 1st December 2007 (011207)Chaanakya_cuimNo ratings yet

- Week Ending Friday, August 3, 2018: Exchange Yoy MomDocument13 pagesWeek Ending Friday, August 3, 2018: Exchange Yoy MomsirdquantsNo ratings yet

- 06 - 10 Wither Green ShootsDocument4 pages06 - 10 Wither Green Shootsrichardck30No ratings yet

- Global Investors Should Focus On The Dynamic Economic and Geo-Political LandscapeDocument14 pagesGlobal Investors Should Focus On The Dynamic Economic and Geo-Political LandscapeHarshvardhan SurekaNo ratings yet

- Perry Capital MLP ThesisDocument5 pagesPerry Capital MLP ThesisWriteMyPaperCheapBillings100% (2)

- The Signs Were There: The clues for investors that a company is heading for a fallFrom EverandThe Signs Were There: The clues for investors that a company is heading for a fallRating: 4.5 out of 5 stars4.5/5 (2)

- If It's Raining in Brazil, Buy StarbucksFrom EverandIf It's Raining in Brazil, Buy StarbucksRating: 4.5 out of 5 stars4.5/5 (4)

- FLRY3.SA Tearsheet 2021-11-13Document7 pagesFLRY3.SA Tearsheet 2021-11-13Matheus Augusto Campos PiresNo ratings yet

- Optimizacion de QueriesDocument5 pagesOptimizacion de Queriescarla contreras ulloaNo ratings yet

- JOIM Demystifying Managed FuturesDocument17 pagesJOIM Demystifying Managed Futuresjrallen81No ratings yet

- BLPAPI Python SDK On Windows: Installation GuideDocument6 pagesBLPAPI Python SDK On Windows: Installation GuideMatheus Augusto Campos PiresNo ratings yet

- Super Cheatsheet Deep LearningDocument13 pagesSuper Cheatsheet Deep LearningcidsantNo ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

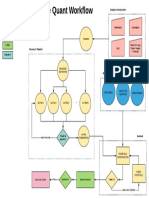

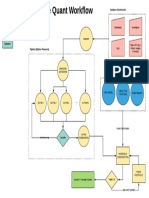

- Quant Workflow PDFDocument1 pageQuant Workflow PDFMatheus Augusto Campos PiresNo ratings yet

- Bloomberg BQL FactSheetDocument5 pagesBloomberg BQL FactSheetMatheus Augusto Campos PiresNo ratings yet

- Dynamic Array Functions: Customer Name Unique List Sort Sort UniquesDocument11 pagesDynamic Array Functions: Customer Name Unique List Sort Sort UniquesMatheus Augusto Campos PiresNo ratings yet

- SSRN Id806664 PDFDocument25 pagesSSRN Id806664 PDFMatheus Augusto Campos PiresNo ratings yet

- Three Quant Lessons From COVID-19 PDFDocument15 pagesThree Quant Lessons From COVID-19 PDFMatheus Augusto Campos PiresNo ratings yet

- SSRN Id806664 PDFDocument25 pagesSSRN Id806664 PDFMatheus Augusto Campos PiresNo ratings yet

- QuantWorkflow PDFDocument1 pageQuantWorkflow PDFMatheus Augusto Campos PiresNo ratings yet

- Three Quant Lessons From COVID-19 PDFDocument15 pagesThree Quant Lessons From COVID-19 PDFMatheus Augusto Campos PiresNo ratings yet

- QuantWorkflow PDFDocument1 pageQuantWorkflow PDFMatheus Augusto Campos PiresNo ratings yet

- PB3 Moni+MatDocument2 pagesPB3 Moni+MatMatheus Augusto Campos PiresNo ratings yet

- FratiniDocument2 pagesFratiniMatheus Augusto Campos PiresNo ratings yet

- Case Interview FrameworksDocument6 pagesCase Interview Frameworkserika KNo ratings yet

- Rights of The AccusedDocument9 pagesRights of The AccusedVeah CaabayNo ratings yet

- Western Union - CPS20-00480 - Pyae Phyoe Hein PDFDocument3 pagesWestern Union - CPS20-00480 - Pyae Phyoe Hein PDFKhin Myat Noe100% (1)

- Tupan AnnoucementDocument4 pagesTupan Annoucementmizukangen2021No ratings yet

- F Accountancy MS XI 2023-24Document9 pagesF Accountancy MS XI 2023-24bhaiyarakesh100% (1)

- Undertaking by Imran RashidDocument2 pagesUndertaking by Imran Rashidfyza imranNo ratings yet

- BD 041222 ICC Update Bank ListDocument18 pagesBD 041222 ICC Update Bank ListArdian MantowNo ratings yet

- Chapter 1 - Introduction To AccountingDocument17 pagesChapter 1 - Introduction To AccountingPatrick John AvilaNo ratings yet

- Checklist For Audit HSEMSDocument12 pagesChecklist For Audit HSEMSBalla BammouneNo ratings yet

- Superposition TheoremDocument9 pagesSuperposition TheoremAditya SinghNo ratings yet

- Mount Sinai Eye and Ear 2018 FinancialsDocument47 pagesMount Sinai Eye and Ear 2018 FinancialsJonathan LaMantiaNo ratings yet

- Prosec ResolDocument4 pagesProsec ResolMary Anne Guanzon VitugNo ratings yet

- Max Weber On Law and The Rise of CapitalismDocument9 pagesMax Weber On Law and The Rise of CapitalismMuhammadAliMughalNo ratings yet

- 5 Heirs - of - Sarili - v. - LagrosaDocument9 pages5 Heirs - of - Sarili - v. - LagrosaVincent john NacuaNo ratings yet

- Invoice No.: 10068722025019159244 Invoice No.: 10068722025019159244Document1 pageInvoice No.: 10068722025019159244 Invoice No.: 10068722025019159244Muhammad Rashid Instructor (Computer Science) IET KhairpurNo ratings yet

- Procurment Management Plan TemplateDocument15 pagesProcurment Management Plan TemplateMonil PatelNo ratings yet

- S7-1200 TCBDocument60 pagesS7-1200 TCBJack RosalesNo ratings yet

- Icc OpinionsDocument19 pagesIcc OpinionsJhoo AngelNo ratings yet

- SCL Delay and Disruption Protocol - Rider 1 - FINALDocument18 pagesSCL Delay and Disruption Protocol - Rider 1 - FINALTanveerAhmed NiaziNo ratings yet

- Sorcery at Court and Manor - Margery JourdemayneDocument15 pagesSorcery at Court and Manor - Margery Jourdemayneianm_researchNo ratings yet

- Noli Me Tangere & El FilibusterismoDocument3 pagesNoli Me Tangere & El FilibusterismoMaria Alyana VillarbaNo ratings yet

- Francisco Vs NLRCDocument2 pagesFrancisco Vs NLRCCamille GrandeNo ratings yet

- Prof DR Ismail Omar Uthm: Rentice For TNBDocument16 pagesProf DR Ismail Omar Uthm: Rentice For TNBmadzrulNo ratings yet

- Rajiv Gandhi National University of Law, PunjabDocument2 pagesRajiv Gandhi National University of Law, PunjabShubham PandeyNo ratings yet

- African AmericansDocument4 pagesAfrican Americansapi-385469593No ratings yet

- Detective Casey Neptune, Warwick, FrancDocument2 pagesDetective Casey Neptune, Warwick, FrancLawrence LongNo ratings yet

- Filipinas Marble CorporationDocument1 pageFilipinas Marble CorporationAllan Cj SangkateNo ratings yet

- Kuda - External Analysis Delta FinalDocument10 pagesKuda - External Analysis Delta Finalkays chapanda100% (2)

- Course in Real Analysis 1st Junghenn Solution ManualDocument38 pagesCourse in Real Analysis 1st Junghenn Solution Manualmitchellunderwooda4p4d100% (15)

- Ancient GreeceDocument26 pagesAncient GreeceGiuseppe De CorsoNo ratings yet

- Investment CodeDocument23 pagesInvestment CodeMaricrisNo ratings yet