Professional Documents

Culture Documents

In The High Court of Gujarat at Ahmedabad R/TAX APPEAL NO. 957 of 2018

In The High Court of Gujarat at Ahmedabad R/TAX APPEAL NO. 957 of 2018

Uploaded by

Rohit LalwaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In The High Court of Gujarat at Ahmedabad R/TAX APPEAL NO. 957 of 2018

In The High Court of Gujarat at Ahmedabad R/TAX APPEAL NO. 957 of 2018

Uploaded by

Rohit LalwaniCopyright:

Available Formats

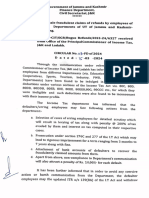

C/TAXAP/957/2018 ORDER

IN THE HIGH COURT OF GUJARAT AT AHMEDABAD

R/TAX APPEAL NO. 957 of 2018

==========================================================

M/S ASTRA LIFECARE ( INDIA ) PVT LTD

Versus

COMMISSIONER OF CENTRAL EXCISE

==========================================================

Appearance:

ANANDODAYA S MISHRA(8038) for the Appellant(s) No. 1

for the Opponent(s) No. 1

==========================================================

CORAM: HONOURABLE MR.JUSTICE J.B.PARDIWALA

and

HONOURABLE MR.JUSTICE A.C. RAO

Date : 27/06/2019

ORAL ORDER

(PER : HONOURABLE MR.JUSTICE J.B.PARDIWALA)

This Tax Appeal is admitted on the following substantial

questions of law:

“[A] Whether the Honourable CESTAT is correct in upholding

the order of the Ld. Commissioner [Appeals] and restricting the

amount of refund on the basis of the Sr.No.10, 12 & 13 of

FormA in case of goods.

[B] Whether the Notification no. 05/2006 CE [NT] dated

14.03.2006 amended by Notification no. 27/2012 CE [NT]

dated 18.06.2012 would prevail over the Rule 5 of the Cenvat

Credit Rules, 2004 and is ultra vires of the Cenvat Credit Rules.

Page 1 of 2

Downloaded on : Tue Sep 03 19:22:23 IST 2019

C/TAXAP/957/2018 ORDER

[C] Whether the formula for restricting on the basis of

formula prescribed under Rule 5 of the Cenvat Credit Rules,

2004 and the refund given in Sr. No.1 and 2 of the FormA can

be made applicable in case of 100% EOUs.

[D] Whether a formula can be devised which ultimately

results into exporting of taxes by reduction of refund of actual

duty incidence and intention of entire CENVAT scheme.”

(J. B. PARDIWALA, J)

(A. C. RAO, J)

KUMAR ALOK

Page 2 of 2

Downloaded on : Tue Sep 03 19:22:23 IST 2019

You might also like

- Texas v. Midland Funding, LLC, Et Al.Document16 pagesTexas v. Midland Funding, LLC, Et Al.Fred Schwinn100% (7)

- Pam Form Clause 30Document2 pagesPam Form Clause 30Xin YanNo ratings yet

- Leon County Booking Report 6-3-2021Document4 pagesLeon County Booking Report 6-3-2021WCTV Digital TeamNo ratings yet

- Deed of DonationDocument4 pagesDeed of Donationbhem silverioNo ratings yet

- Amit Cotton Industries vs. Principal Commissioner of Customs Gujarat High CourtDocument49 pagesAmit Cotton Industries vs. Principal Commissioner of Customs Gujarat High CourtMaragani MuraligangadhararaoNo ratings yet

- CGG TOO RehostingDocument2 pagesCGG TOO RehostingMega rani RNo ratings yet

- The Hon'Ble Supreme Court of India: BeforeDocument17 pagesThe Hon'Ble Supreme Court of India: BeforeNandini SrivastavaNo ratings yet

- Vakratunda EnterprisesDocument8 pagesVakratunda EnterprisesKunal MhaddalkarNo ratings yet

- Uploads UPLOADS Files Uploads Print Noting1623317170914Document42 pagesUploads UPLOADS Files Uploads Print Noting1623317170914surajthebestNo ratings yet

- VILGST - SGST - High Court Cases - 2022-VIL-124-GUJDocument17 pagesVILGST - SGST - High Court Cases - 2022-VIL-124-GUJJAYKISHAN VIDHWANINo ratings yet

- GAIL TenderDocument133 pagesGAIL Tenderanshuljainy1No ratings yet

- Recovery of Mobilization Advance Aganist Bank Guarantee ICADPW MS75Document2 pagesRecovery of Mobilization Advance Aganist Bank Guarantee ICADPW MS75PAO TPT PAO TPTNo ratings yet

- Versus: Efore Anmohan AND Anjeev ArulaDocument9 pagesVersus: Efore Anmohan AND Anjeev Arulaveer vikramNo ratings yet

- Circular-ITR of Salaried Employees-Suspicious Claims..Document9 pagesCircular-ITR of Salaried Employees-Suspicious Claims..Damodar SurisettyNo ratings yet

- Pennar StayDocument2 pagesPennar StayIshita FarsaiyaNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Page 1 of 4Document4 pagesPage 1 of 4Sunil ShahNo ratings yet

- Yap VS CoaDocument15 pagesYap VS CoaMichael Vincent P.No ratings yet

- Concor Bill Payment StatusDocument23 pagesConcor Bill Payment Statusanuj sharmaNo ratings yet

- MOLEX INDIA PVT LTD Vs CCTDocument4 pagesMOLEX INDIA PVT LTD Vs CCTSHANTANU SINGHNo ratings yet

- 2017 1 1501 39247 Judgement 19-Oct-2022Document149 pages2017 1 1501 39247 Judgement 19-Oct-2022aasthadip7No ratings yet

- WashingDocument1 pageWashingPRADEEP RNo ratings yet

- Supreme Court of India: Miscellaneous Matters To Be Listed On 17-09-2021 ADVANCE LIST - AL/100/2021Document51 pagesSupreme Court of India: Miscellaneous Matters To Be Listed On 17-09-2021 ADVANCE LIST - AL/100/2021CandyNo ratings yet

- NIT 016 Isolation Valves PDFDocument150 pagesNIT 016 Isolation Valves PDFAbhishek SinghNo ratings yet

- OpTransactionHistoryUX302 10 2019 PDFDocument2 pagesOpTransactionHistoryUX302 10 2019 PDFSiva RamanNo ratings yet

- Choksi Exports Vs Union of India Gujarat High CourtDocument13 pagesChoksi Exports Vs Union of India Gujarat High CourtIrfan ShaikhNo ratings yet

- Bank StatementDocument3 pagesBank StatementKushal BhatiaNo ratings yet

- Vs. COMMISSION ON AUDIT, RespondentDocument10 pagesVs. COMMISSION ON AUDIT, RespondentAM CruzNo ratings yet

- Motor Insurance Certificate Cum Policy Schedule Public Carriers Three Wheelers Package Policy - Zone CDocument2 pagesMotor Insurance Certificate Cum Policy Schedule Public Carriers Three Wheelers Package Policy - Zone CcursorkkdNo ratings yet

- 22) ASIAN TRANSMISSION Vs CIR - J.BersaminDocument5 pages22) ASIAN TRANSMISSION Vs CIR - J.BersaminStalin LeningradNo ratings yet

- Madhvi Acharya Sca 8152Document72 pagesMadhvi Acharya Sca 8152Ramesh ParmarNo ratings yet

- Integra Engineering India LTDDocument9 pagesIntegra Engineering India LTDByomkesh PandaNo ratings yet

- ICCL CustomersDocument2 pagesICCL CustomersJoseph KimNo ratings yet

- Credit and Credit Administration LatestDocument297 pagesCredit and Credit Administration LatestPravin GhimireNo ratings yet

- Dot Notice ZD080623051455D 20230615041115Document5 pagesDot Notice ZD080623051455D 20230615041115khushinagar9009No ratings yet

- Green Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. EB Case Nos. 1801 & 1808 (C.T.A. Case No. 8988), (October 14, 2019) PDFDocument22 pagesGreen Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. EB Case Nos. 1801 & 1808 (C.T.A. Case No. 8988), (October 14, 2019) PDFKriszan ManiponNo ratings yet

- Cta 2D CV 08872 M 2017jun07 AssDocument15 pagesCta 2D CV 08872 M 2017jun07 AssLarry Tobias Jr.No ratings yet

- Tender SPV Rooftop 45 MWDocument106 pagesTender SPV Rooftop 45 MWVikas JainNo ratings yet

- Asian Transmission Corporation vs. CIRDocument8 pagesAsian Transmission Corporation vs. CIRErole John AtienzaNo ratings yet

- GST Weekly Update - 42-2023-24Document4 pagesGST Weekly Update - 42-2023-24broabhi143No ratings yet

- Gujarat HC Reserved Category 421540Document52 pagesGujarat HC Reserved Category 421540Chaudhary HarshNo ratings yet

- G.R. No. 246173. June 22, 2021Document12 pagesG.R. No. 246173. June 22, 2021ChatNo ratings yet

- Divi's Labs Ltd. vs. CCE SEZ ST ExmptnDocument6 pagesDivi's Labs Ltd. vs. CCE SEZ ST ExmptnChakravarthi B ANo ratings yet

- April 19 March 20 PDFDocument86 pagesApril 19 March 20 PDFMalik MuzafferNo ratings yet

- Final Survey 5921Document5 pagesFinal Survey 5921Davinder Kumar GargNo ratings yet

- CIR v. COMELECDocument10 pagesCIR v. COMELECJoyce GarciaNo ratings yet

- Ravi Poddar Jaipur Vs Acit Jaipur On 24 March 2017Document12 pagesRavi Poddar Jaipur Vs Acit Jaipur On 24 March 2017praveen chokhaniNo ratings yet

- GST APL-01 Siddhi Vinayak ExtrusionDocument14 pagesGST APL-01 Siddhi Vinayak ExtrusionUtkarsh KhandelwalNo ratings yet

- Essar SteelDocument164 pagesEssar SteelvinNo ratings yet

- (2022) 138 Taxmann - Com 500 (Orissa) - (2022) 287 Taxman 320 (Orissa) (04-03-2022) Indian Metal and Ferro Alloys Ltd. vs. Commissioner of Income-TaxDocument6 pages(2022) 138 Taxmann - Com 500 (Orissa) - (2022) 287 Taxman 320 (Orissa) (04-03-2022) Indian Metal and Ferro Alloys Ltd. vs. Commissioner of Income-TaxSatish JethvaniNo ratings yet

- Circular 3 of 2024Document3 pagesCircular 3 of 2024rajbirsingh91996No ratings yet

- Dividend Zakat & Tax Deduction ReportsDocument4 pagesDividend Zakat & Tax Deduction ReportsfahadullahNo ratings yet

- DCIT Vs Bhilwara Energy Ltd. 14ADocument2 pagesDCIT Vs Bhilwara Energy Ltd. 14AAnkur ShahNo ratings yet

- DCIT Vs Bhilwara Energy Ltd. 14ADocument2 pagesDCIT Vs Bhilwara Energy Ltd. 14AAnkur ShahNo ratings yet

- Air IndiaDocument13 pagesAir Indiabluebird PGNo ratings yet

- Transactions Inquiry - Main File 01.08.17 To 02.07.19Document45 pagesTransactions Inquiry - Main File 01.08.17 To 02.07.19amit kadamNo ratings yet

- F6d664b36234e6782ae565d3bf1dda1 - CL 2020 21 3 6Document9 pagesF6d664b36234e6782ae565d3bf1dda1 - CL 2020 21 3 6nidasak12No ratings yet

- 6521-Tender DocumentDocument779 pages6521-Tender Documentsitikantha routNo ratings yet

- Ca22023 GJHC240464442010 303 03072023Document2 pagesCa22023 GJHC240464442010 303 03072023customsrraahmedabadNo ratings yet

- CAA LetterDocument1 pageCAA LetterFuzail BeediwalaNo ratings yet

- Aircel LTD PDFDocument2 pagesAircel LTD PDFanantNo ratings yet

- Aircel Ltd. CP 298-2018 NCLT ON 10.06.2019 INTERIMDocument2 pagesAircel Ltd. CP 298-2018 NCLT ON 10.06.2019 INTERIManantNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Economics of Climate Change Mitigation in Central and West AsiaFrom EverandEconomics of Climate Change Mitigation in Central and West AsiaNo ratings yet

- Taxap9912017 GJHC240572302017 1 23112017Document6 pagesTaxap9912017 GJHC240572302017 1 23112017Rohit LalwaniNo ratings yet

- Maintenance of Critical Coal Supplies During Covid-19Document3 pagesMaintenance of Critical Coal Supplies During Covid-19Rohit LalwaniNo ratings yet

- FAQ Pointers AMLTFCOVDocument4 pagesFAQ Pointers AMLTFCOVRohit LalwaniNo ratings yet

- Sr. No. Itc Hs Code DescriptionDocument1 pageSr. No. Itc Hs Code DescriptionRohit LalwaniNo ratings yet

- FinalDocument13 pagesFinalRaymond MianNo ratings yet

- PUMBA - DSE A - 506 - LDIM - 1.2 Principles of International Business Contract - NotesDocument3 pagesPUMBA - DSE A - 506 - LDIM - 1.2 Principles of International Business Contract - NotesTô Mì HakkaNo ratings yet

- Chapter X (Secs. 182 To 238) of The Indian Contract Act, 1872Document87 pagesChapter X (Secs. 182 To 238) of The Indian Contract Act, 1872Ujjwal AnandNo ratings yet

- Good Quality Free Legal Aid in India A Distant Dream: Mr. Hrishikesh JaiswalDocument10 pagesGood Quality Free Legal Aid in India A Distant Dream: Mr. Hrishikesh JaiswalHrishikeshNo ratings yet

- TIMMO Deed - 024852Document4 pagesTIMMO Deed - 024852Remile Official (Shacy)No ratings yet

- Constitution (2) Pa Major Sigh HahaDocument11 pagesConstitution (2) Pa Major Sigh HahaaldrinNo ratings yet

- Signage FormsDocument4 pagesSignage FormsradzNo ratings yet

- A4 PDFDocument29 pagesA4 PDFAradhanaNo ratings yet

- MALTC vs. PeopleDocument2 pagesMALTC vs. PeopleCocoyPangilinanNo ratings yet

- The Andhra Pradesh Dotted Lands (Updation in Re-Settlement Regiser) Act 2017Document7 pagesThe Andhra Pradesh Dotted Lands (Updation in Re-Settlement Regiser) Act 2017Pavan Kumar ArigiNo ratings yet

- Rule 1-14 Digests PDFDocument76 pagesRule 1-14 Digests PDFlalaine grace malagaNo ratings yet

- Crimes Committed by Public Officers: Article 203Document22 pagesCrimes Committed by Public Officers: Article 203Earl Andre PerezNo ratings yet

- 31 - People Vs Lo Ho Wing (PACIS)Document2 pages31 - People Vs Lo Ho Wing (PACIS)Vince Llamazares LupangoNo ratings yet

- Banks and Deposit Companies Amendment Act 2018Document4 pagesBanks and Deposit Companies Amendment Act 2018BernewsAdminNo ratings yet

- 280 - C155 Occupational Safety and Health Convention (1981)Document8 pages280 - C155 Occupational Safety and Health Convention (1981)Sherin K MonNo ratings yet

- Absolute Validity, Absolute Immunity - Is There Something Wrong With Article 103 of The UN CharterDocument18 pagesAbsolute Validity, Absolute Immunity - Is There Something Wrong With Article 103 of The UN CharterAbhimanyu SinghNo ratings yet

- People Vs GomezDocument2 pagesPeople Vs GomezRaegan L. CapunoNo ratings yet

- US Emergency Motion To Enforce Consent Decree, Motion To Modify, Memorandum of Law 2011Document18 pagesUS Emergency Motion To Enforce Consent Decree, Motion To Modify, Memorandum of Law 2011Rick ThomaNo ratings yet

- Harte-Hanks Phils vs. CIRDocument2 pagesHarte-Hanks Phils vs. CIRCaroline A. Legaspino50% (2)

- Preamble of The ConstitutionDocument24 pagesPreamble of The ConstitutionAbhilash RNo ratings yet

- How To Fill Gratuity Form FDocument3 pagesHow To Fill Gratuity Form Fనీలం మధు సూధన్ రెడ్డిNo ratings yet

- International Court of Justice IcjDocument6 pagesInternational Court of Justice IcjsimranNo ratings yet

- MCom PII-3 Corporate and Business LawDocument3 pagesMCom PII-3 Corporate and Business LawMuhammad BilalNo ratings yet

- 16 - Gloria v. de GuzmanDocument4 pages16 - Gloria v. de GuzmanKarla BeeNo ratings yet

- De Ocampo V Delizo 69 SCRA 216Document12 pagesDe Ocampo V Delizo 69 SCRA 216LASNo ratings yet

- Awareness, Acceptance and Perception of Don Mariano Marcos Memorial State University Stakeholders Towards Its Vision, Mission, Goals and ObjectivesDocument4 pagesAwareness, Acceptance and Perception of Don Mariano Marcos Memorial State University Stakeholders Towards Its Vision, Mission, Goals and ObjectivesPAANONo ratings yet