Professional Documents

Culture Documents

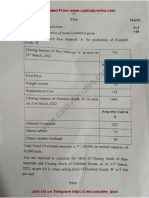

Divi'S Laboratories Ltd. Divi'S Laboratories LTD.: Shareholding Pattern (%)

Uploaded by

TANYA AGGARWALOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Divi'S Laboratories Ltd. Divi'S Laboratories LTD.: Shareholding Pattern (%)

Uploaded by

TANYA AGGARWALCopyright:

Available Formats

Divi’s Laboratories Ltd.

Pratik Musale (C033)-80012100010

Divi’s Laboratories Ltd.

Company Overview: ESG Considerations

Financials: Environmental

Dividend Policy:

ShareHolding Divis Laboratories conducts its business

Pattern(%)

Face Value/Par Value Rs. 2 in a sustainable and responsible manner

Green Belt Safety Dividend Payout Ratio

by optimizing processes, conserving

Carbon Footprint

Book Value Rs. 350.12 Development

Safety Approach

Upgrades

0.32 resources,

0.31 and taking necessary steps to

Market Price

9.01 4.38% Rs. 4654.4 Maintaining Health and

0.31 Safety protect the

0.31 environment.

Ecological 0.3

%

Market

2.01 Capitalization Rs. 123,559.70 cr Balance 0.3 Culture Comprehensive approach towards

% 0.29 environmental sustainability includes,

Energy and Water Conservation

0.28

Belief System continuously reviewing and evaluating

Price Earnings Ratio 57.26 0.27 manufacturing processes 0.27 thereby

Providing clean

drinking water

13.35%

Earnings per Share 80.47 0.26 Commitment eliminating wastages and follow green

Resource

51.59% towards

0.25 community

Cost of Equity 6.66%

Conservation

2018

chemistry

2019

principles;

2020

recover,

2021

recycle,

Waste and reuse solvents by continuously

Child

19.30% Management

The Empowerment

company follows upgrading

regular processes;

dividend policy. Standardize

It

declares dividend every material

year.handling

In case ofand reduce

excess leaks or

profits,

the company withheld wastages.

the profits as retained earnings.

The company has Divis

a laboratories

steady ltd diligently

cash flow carry out

and stable

Social

earnings and henceitsitsocial makesresponsibility

sense to have efforts in order

regular

Promoters

dividend policy. Hence, to striveDivi’s

to createLabsa positive

is low impact

risk in

FIIs/FPI

227 Schools investment as the

dividend lives

paymentsof people

are through

regular but initiatives

not

Mutual Funds/UTI ~21,000 Students high.Promoting aimed at improving quality of life. Divis,

Others

Education Laboratories has been focusing on social

initiatives by reaching out to deprived

Capital Structure:

General Public Working Capital:

80 Locations

~2, 10,000 sections of society around its

People

Financial Institutions

Providing Safe manufacturing sites. Some of key focus

Drinking water areas include, promoting education,

Debt to Equity (2021) public health, rural development,

Divi’s Laboratories was established ~1, 10,000 Saplings Days of Inventory at handwomen,

empowering 329promoting rural

in 1990 as Divi’s Research Center. planted in 2019-20

0.005 Encouraging sports, animal welfare and

The company initially started Days of sales outstanding

Afforestation 88

developing commercial processes development, support to differently

for the manufacturing99.5% of APIs and abled people, livelihood enhancement

Days of Payables projects, safe drinking 117 water, and

intermediates. Divi’s Research

environment sustainability. It also

Center changed its name to Divi’s

Debt Equity

Cash Cycle 300

contributed an amount of 11 crores

Laboratories limited in 1994 to

signal its intent to enter the API andaims to provide towards various rural development

The Company’s financial strategy

intermediates manufacturing The average receivable period is 88 days. That means

adequate capital for its growth plans forGovernance:

sustained Theto Board of the

industry. value.Following this, the objective is to the company is able recover thecompany

cash fromhas itsdiverse

stakeholder The company’s mix of Executives and Non-Executive

companyits ability

established its asfirst customers quickly compared to days of inventory at

safeguard to continue a going concern, so Directors, Pursuant to SEBI

manufacturing facility in 1996. In for shareholders hand and days of payables. Its days of inventory is 329listing

that it can continue to provide returns regulations, the company appointed a

2002, thefor other

company’s second days, which is a cause of concern as inventory is

and benefits stakeholders. And Depending on non-executive director as chairman of

manufacturing facility commenced accumulating and not able to convert it into cash. The

the financial market scenario, nature of the funding Board

operations and at costChippada near cash conversion cycle is ofof300 Directors

days. That’seffective

means fromit 01

requirements of such funding, the company

Visakhapatnam. takes 300 days for the company to convert its raw of

April, 2020. The board comprises

decides the optimum capital structure. The company

The atcompany went apublic with its base so as to materials into cash. twelve directors, five of whom are

aims maintaining

th

strong capital Executive and remaining are Non-

IPO on 17

maintain February

adequate 2003.ofIn funds

supply 2010, towards future

Executive Independent Directors,

the company

growth plans as established a research

a going concern. including two women directors of

center in Hyderabad.

which one is non-executive

You might also like

- For Those of Us With Thick Skulls by Paul-Ben: ZaccardiDocument40 pagesFor Those of Us With Thick Skulls by Paul-Ben: Zaccardismo-kay94% (110)

- Wipro Esg Dashboard Fy 2020 21Document20 pagesWipro Esg Dashboard Fy 2020 21Rithesh KNo ratings yet

- Music Management AgreementDocument3 pagesMusic Management Agreementrhodora exNo ratings yet

- Comp - XM-XXXDocument4 pagesComp - XM-XXXFrankNo ratings yet

- PDICDocument3 pagesPDICElah ViktoriaNo ratings yet

- Deloitte CH Fs en Summary Ecosystems 2021 PDFDocument24 pagesDeloitte CH Fs en Summary Ecosystems 2021 PDFميلاد نوروزي رهبرNo ratings yet

- SEC OpDocument11 pagesSEC OpeasyisthedescentNo ratings yet

- Chap 11 - Decision Making and Relevant Information (1) PrintDocument28 pagesChap 11 - Decision Making and Relevant Information (1) PrintranjithaNo ratings yet

- Sustainability Report 2017-2018Document153 pagesSustainability Report 2017-2018Ravikumar ANo ratings yet

- Tamfi Directory 2011 2012 PDFDocument61 pagesTamfi Directory 2011 2012 PDFsimmy68100% (1)

- Jean Marie Part 2 - The InterviewsDocument5 pagesJean Marie Part 2 - The Interviewsekramcal100% (1)

- Sustainability Report 2021Document27 pagesSustainability Report 2021Eugene GaraninNo ratings yet

- Master Budgeting: June July August September October Third QuarterDocument10 pagesMaster Budgeting: June July August September October Third QuarterЭниЭ.No ratings yet

- Vale - e-SR 2022 Layout Design-ENG-FullDraft2607Document71 pagesVale - e-SR 2022 Layout Design-ENG-FullDraft2607Gatot WinotoNo ratings yet

- L and T PPT Nfs New 3Document3 pagesL and T PPT Nfs New 3Aman BhandariNo ratings yet

- Infosys Esg Report Print Version 2021 22Document64 pagesInfosys Esg Report Print Version 2021 22HARSH RAWATNo ratings yet

- L & T Annual Report Nfs New 2Document2 pagesL & T Annual Report Nfs New 2Aman BhandariNo ratings yet

- Aston Martin Lagonda 2022 Sustainability ReportDocument96 pagesAston Martin Lagonda 2022 Sustainability ReportlamolalpNo ratings yet

- Names Section Date BM602: Property of STIDocument3 pagesNames Section Date BM602: Property of STIStephanie Kyle ConcepcionNo ratings yet

- Biotechnology Infographic December 2023Document1 pageBiotechnology Infographic December 2023raghunandhan.cvNo ratings yet

- Intro - BV - Sustainability - Race To Net Zero - KADINDocument23 pagesIntro - BV - Sustainability - Race To Net Zero - KADINGandhito GandhitoNo ratings yet

- VietnamCaseStudiesforPrint ENDocument60 pagesVietnamCaseStudiesforPrint ENHoang TraNo ratings yet

- Cimb Ar 2021 PDFDocument232 pagesCimb Ar 2021 PDFAtiqah AzmanNo ratings yet

- 2021 04 Polymetal ESGDayDocument36 pages2021 04 Polymetal ESGDayChristian RamaculaNo ratings yet

- UltraTech ESGDocument7 pagesUltraTech ESGHarsh ShahNo ratings yet

- ACC-SD-Report 02 240816Document132 pagesACC-SD-Report 02 240816lucasNo ratings yet

- Woodbois SR 2021Document68 pagesWoodbois SR 2021Suresh PoojariNo ratings yet

- Consumer Satisfaction and Operational Performance2Document1 pageConsumer Satisfaction and Operational Performance2samiya sabraNo ratings yet

- Lemontree HotelsDocument199 pagesLemontree Hotelsshubham guptaNo ratings yet

- CPES Component 2 Infographics 0Document1 pageCPES Component 2 Infographics 0jcNo ratings yet

- Company ProfileDocument40 pagesCompany ProfilerakaprdptNo ratings yet

- MAHB Annual Report 2022 - Part 2Document169 pagesMAHB Annual Report 2022 - Part 2Thaw ZinNo ratings yet

- Sustainability Report 2022Document105 pagesSustainability Report 2022Mayank MNo ratings yet

- Procurement-Info-Sheets PDF DownloadassetDocument4 pagesProcurement-Info-Sheets PDF Downloadassetcuccuc7902No ratings yet

- Strategic Report 2022 PDFDocument85 pagesStrategic Report 2022 PDFSerge KabatiNo ratings yet

- Annual Report and Accounts 2022 PDFDocument292 pagesAnnual Report and Accounts 2022 PDFSerge KabatiNo ratings yet

- Results Presentation: Fourth Quarter and Year Ended March 31, 2018Document32 pagesResults Presentation: Fourth Quarter and Year Ended March 31, 2018Nagbhushan SinghNo ratings yet

- Final 3 Topics (FA 1 Resubmission)Document3 pagesFinal 3 Topics (FA 1 Resubmission)Sherilyn BunagNo ratings yet

- Hitachi Sustainability Report: Fiscal 2019 ResultsDocument2 pagesHitachi Sustainability Report: Fiscal 2019 ResultssaddamNo ratings yet

- En Sustainability2020Document150 pagesEn Sustainability2020AyeshaNo ratings yet

- 28-Article Text-137-1-10-20190801Document12 pages28-Article Text-137-1-10-20190801Alfin TrisevNo ratings yet

- Dimian 2021Document18 pagesDimian 2021Edison RamirezNo ratings yet

- Atb 2024 Institutional Investor Conference PresentationDocument15 pagesAtb 2024 Institutional Investor Conference Presentationcharlie.priceNo ratings yet

- Unit 4: How To Maximize Positive Impact and Profitability Through SustainabilityDocument17 pagesUnit 4: How To Maximize Positive Impact and Profitability Through SustainabilityAnonymousNo ratings yet

- BASF in India Factsheet 2022Document2 pagesBASF in India Factsheet 2022Daniel ChangNo ratings yet

- Bank BRI Annual Sustainability Bond Report 2020Document11 pagesBank BRI Annual Sustainability Bond Report 2020bunga.j.juhediNo ratings yet

- CSRBOX India CSR Outlook Report 2022 - Full VersionDocument36 pagesCSRBOX India CSR Outlook Report 2022 - Full VersionAkramul HoqueNo ratings yet

- Sustainability Report 2021 v2 PDFDocument58 pagesSustainability Report 2021 v2 PDFJs Engineering WorkshopNo ratings yet

- 2022 Acer Sustainability ReportDocument175 pages2022 Acer Sustainability ReportFahmida sultana nodiNo ratings yet

- AL Sustainability-Report 2021-22-1Document59 pagesAL Sustainability-Report 2021-22-1ramramram011998No ratings yet

- Final Placement Report PGP 2020 22 NiRFDocument7 pagesFinal Placement Report PGP 2020 22 NiRFPritish NayakNo ratings yet

- VNM Sustainability ReportDocument93 pagesVNM Sustainability ReportNguyen Thi PhuongNo ratings yet

- Investing in A Sustainable Future: Sustainability Report 2018Document35 pagesInvesting in A Sustainable Future: Sustainability Report 2018afaq AhmadNo ratings yet

- Arena REIT Results PresentationDocument32 pagesArena REIT Results PresentationTim MooreNo ratings yet

- 04 e SustainabilityDocument2 pages04 e SustainabilitysaddamNo ratings yet

- Sustainability InpracticeDocument31 pagesSustainability Inpracticemohan k rongalaNo ratings yet

- IDC #EUR149711922 Schneider Infographic Final Dec 2022Document1 pageIDC #EUR149711922 Schneider Infographic Final Dec 2022FrancoNo ratings yet

- For Our Sustainability Report Photos Quality2022enDocument74 pagesFor Our Sustainability Report Photos Quality2022enAli AliyevNo ratings yet

- Report 2019Document32 pagesReport 2019knajikNo ratings yet

- Sustainability: Laporan KeberlanjutanDocument31 pagesSustainability: Laporan KeberlanjutanSalsa SalsaNo ratings yet

- ESG Informational Booklet Series 1 by TeamTech EHSDocument16 pagesESG Informational Booklet Series 1 by TeamTech EHSsrimanta.official21No ratings yet

- IndusInd Bank Integrated Report 2020 21Document61 pagesIndusInd Bank Integrated Report 2020 21arumugamNo ratings yet

- FY2023 Lenovo Sustainability ReportDocument143 pagesFY2023 Lenovo Sustainability ReportMaria Jose Felix MesiasNo ratings yet

- Annual Report - FY 23Document255 pagesAnnual Report - FY 23Ricky SafayaNo ratings yet

- Costing of Mfis: Main FindingsDocument13 pagesCosting of Mfis: Main FindingsapsyadavNo ratings yet

- Role of Environmental Management Accounting (EMA) in Managing Rice Husks Reduction of Rice Mills Companies in BatangasDocument7 pagesRole of Environmental Management Accounting (EMA) in Managing Rice Husks Reduction of Rice Mills Companies in BatangasSherilyn BunagNo ratings yet

- MGT FRM.07-01 HSE Management ProgramDocument2 pagesMGT FRM.07-01 HSE Management ProgramAbla NedjmaNo ratings yet

- 4 - Environmental Reporting 2021Document10 pages4 - Environmental Reporting 2021Saiju PuthoorNo ratings yet

- Pollution Control Technologies for Small-Scale OperationsFrom EverandPollution Control Technologies for Small-Scale OperationsNo ratings yet

- Hit With The Office Blues and Need A ?: Quick GetawayDocument5 pagesHit With The Office Blues and Need A ?: Quick GetawayTANYA AGGARWALNo ratings yet

- C049 Division C Tanya AggarwalDocument5 pagesC049 Division C Tanya AggarwalTANYA AGGARWALNo ratings yet

- Anushka Chauhan 80012100054Document6 pagesAnushka Chauhan 80012100054TANYA AGGARWALNo ratings yet

- Assignment 2Document3 pagesAssignment 2TANYA AGGARWALNo ratings yet

- Anushka Chauhan - 80012100054 - Cost & Management AccountingDocument7 pagesAnushka Chauhan - 80012100054 - Cost & Management AccountingTANYA AGGARWALNo ratings yet

- Business Research Methodology Theses Report: Narsee Monjee Institute of Management StudiesDocument9 pagesBusiness Research Methodology Theses Report: Narsee Monjee Institute of Management StudiesTANYA AGGARWALNo ratings yet

- Business Research Methodology Theses Report: Narsee Monjee Institute of Management StudiesDocument8 pagesBusiness Research Methodology Theses Report: Narsee Monjee Institute of Management StudiesTANYA AGGARWALNo ratings yet

- Corporate Finance Assignment: Financial AnalysisDocument2 pagesCorporate Finance Assignment: Financial AnalysisTANYA AGGARWALNo ratings yet

- Accounting GR 12 Exemplar Ans Book 2008 EnglishDocument20 pagesAccounting GR 12 Exemplar Ans Book 2008 EnglishAudrey RobinsonNo ratings yet

- Assignment 1Document54 pagesAssignment 1Albert ShihNo ratings yet

- 3rd Amended Complaint Against Former Stanford EmployeesDocument58 pages3rd Amended Complaint Against Former Stanford EmployeesAllenStanford100% (1)

- CA Inter Accounts QP Nov 2022Document15 pagesCA Inter Accounts QP Nov 2022Partibha GehlotNo ratings yet

- National IncomeDocument32 pagesNational IncomeShoaib MohammadNo ratings yet

- (Jpia) Chapter 1 - New Conceptual Framework Lecture & ExerciseDocument3 pages(Jpia) Chapter 1 - New Conceptual Framework Lecture & ExerciseMaureen Derial PantaNo ratings yet

- MCQ and Case Based QuestionsDocument31 pagesMCQ and Case Based QuestionsHussain CyclewalaNo ratings yet

- AnnuityDocument6 pagesAnnuitymasyatiNo ratings yet

- NDVO Supplementary Student Application FormDocument8 pagesNDVO Supplementary Student Application FormisaacNo ratings yet

- Non-Payment Notice Lease Agreement 2025Document2 pagesNon-Payment Notice Lease Agreement 2025Jordan FarleyNo ratings yet

- Account Receivable ClassDocument30 pagesAccount Receivable ClassBeast aNo ratings yet

- Estate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheDocument29 pagesEstate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheNikka Adrienne Menchavez0% (1)

- Model Question For Account409792809472943360Document8 pagesModel Question For Account409792809472943360yugeshNo ratings yet

- Prepared By, Ms. Ekta S Patel, I Year M.SC NursingDocument174 pagesPrepared By, Ms. Ekta S Patel, I Year M.SC Nursingjasleen kaurNo ratings yet

- CB1 0Document6 pagesCB1 0Nathan RkNo ratings yet

- Shariah Issues in IslamicDocument14 pagesShariah Issues in IslamicEwan PeaceNo ratings yet

- Avenue Product ListDocument1,766 pagesAvenue Product ListLeandro Zenni EstevaoNo ratings yet

- Module 1Document4 pagesModule 1Alpha RamoranNo ratings yet

- PS 1Document3 pagesPS 1Yasemin YücebilgenNo ratings yet

- STAN J. CATERBONE AND THE LISA MICHELLE LAMBERT CASE January 22, 2017 PDFDocument2,301 pagesSTAN J. CATERBONE AND THE LISA MICHELLE LAMBERT CASE January 22, 2017 PDFStan J. CaterboneNo ratings yet

- OFFICIAL RATES 2020 PRINCESS GOLDEN BEACH INDpdfDocument3 pagesOFFICIAL RATES 2020 PRINCESS GOLDEN BEACH INDpdfMocanu AdrianNo ratings yet