Professional Documents

Culture Documents

Aa Answer Base

Aa Answer Base

Uploaded by

Aastha Shetty0 ratings0% found this document useful (0 votes)

4 views3 pagesThis document lists various risks associated with auditing a new client and proposes corresponding responses to address each risk. Key risks include an inexperienced audit team being unfamiliar with the client's accounting policies, incomplete inventory counts, untested reconciliations, and potential manipulation of profits or assets related to an overdraft. The proposed responses focus on obtaining an understanding of the client's business and controls, detailed testing and cut-off procedures, discussions with management, and maintaining professional skepticism.

Original Description:

Audit and assurance

Original Title

AA ANSWER BASE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists various risks associated with auditing a new client and proposes corresponding responses to address each risk. Key risks include an inexperienced audit team being unfamiliar with the client's accounting policies, incomplete inventory counts, untested reconciliations, and potential manipulation of profits or assets related to an overdraft. The proposed responses focus on obtaining an understanding of the client's business and controls, detailed testing and cut-off procedures, discussions with management, and maintaining professional skepticism.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesAa Answer Base

Aa Answer Base

Uploaded by

Aastha ShettyThis document lists various risks associated with auditing a new client and proposes corresponding responses to address each risk. Key risks include an inexperienced audit team being unfamiliar with the client's accounting policies, incomplete inventory counts, untested reconciliations, and potential manipulation of profits or assets related to an overdraft. The proposed responses focus on obtaining an understanding of the client's business and controls, detailed testing and cut-off procedures, discussions with management, and maintaining professional skepticism.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

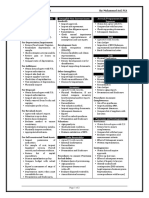

RISK RESPONSES

NEW CLIENT SUITABLE EXPERIENCED TEAM

TEAM NOT FAMILIAR WITH ACCOUNTING ALLOCATE TIME TO OBTAIN UNDERSTANDING OF

POLICIES COMPANY

INCREASED DETECTION RISK PERFORM A THOROGH BACKGROUND CHECK

DETAILED TEAM BRIEFING TO COVER KEY AREAS OF RISK

WORK IN PROGRESS DISCUSS WITH MANAGEMENT THE PROCESS OF

LEVEL OF WIP NEEDS TO BE ASSESSED AT YEAR VALUATION

END REVIEW PROCESS WHILE ATTENDING INVENTORY

INVENTORY MAY BE OVER OR UNDERSTATED COUNT

DUE TO MM IN WIP CONSIDER INDEPENDENT EXPERT

PURCHASES IN TRANSIT/CONT. PRODUCTION UNDERTAKE DETAILED CUT OFF TESTING OF

RISK OF CUT OFF NOT BEING ACCURATE FOR PURCHASES/PRODUCTION AND INCREASE SAMPLE FOR

PURCHASES AND INVENTORY TESTING TO ENSURE CUT OFF IS COMPLETE AND

ACCURATE

INVENTORY COUNT (UNABLE TO ATTEND ALL) ASSESS AND ATTEND COUNTS WITH MOST MATERIAL

MAY NOT OBTAIN SUFFICIENT EVIDENCE INVENTORY OR THOSE WITH HIGH RISK OF MS

INCREASED DETECTION RISK FOR THOSE NOT VISITED, REVIEW DOCS AND DISCUSS

WITH MANAGEMENT ANY ISSUES THAT ARISE

INVENTORY COUNT (PERPETUAL) COMPLETENESS OF THE COUNT MUST BE REVIEWED

UNDER THIS SYSTEM, ALL INVENTORY MUST CONTROLS OVER COUNTS AND ADJUSTMENTS TO

BE COUNTED AT LEAST ONCE RECORDS SHOULD BE TESTED

RISK OF OVER OR UNDER STATEMETN OF

INVENTORY IF THIS IS NOT COMPLETE

INVENTORY OBSOLETE REVIEW AGED INVENTORY REPORT AND DISCUSS

IAS 2 INVENTORIES NATURE OF INVENTORY WITH MANAGEMENT (SLOW

SHOULD BE AT LOWER OF COST AND NRV MOVING)

RISK THAT INV. IS OVERSTATED TEST FOR COST AND NRV CALCULATIONS

NEW ACCOUNTING SYSTEM UNDERTAKE DETAILED TESTING TO CONFIRM ALL

RISK THAT BALANCES MAY BE MISSTATED OR BALANCES WERE TRANSFERRED

DATA MAY BE LOST DUE TO NOT BEING DOCUMENT AND TEST THE NEW SYSTEM WITH DUMMY

TRANSFERRED TRANSACTIONS

CONTROL RISK WOULD NOT BE IDENTIFIED

RECONCILIATIONS NOT CARRIED OUT DISCUSS ISSUE WITH FINANCE DIRECTOR AND ENSURE

RISK THAT BALANCES MAY BE MISSTATED ALL RECOS ARE PERFORMED

SINCE SOME RECOS HAVE NOT BEEN CARRIED TEST AND AGREE SUPPORTING DOCS

OUT LEADING TO NO CROSS CHECK

PROVISON DISCUSS WITH MANAGEMENT THE BASIS OF PROVISION

IAS 37 PROVISIONS, CL AND CA CALCULATION AND COMPARE WITH POST YEAR END

REQUIRE JUDGEMENT AS IT IS UNCERTAIN CLAIMS

PROVISION CAN BE UNDERSTATED DISCUSS THE RATIONALE BEHIND THE JUDGEMENT

REDUNDANCY COSTS HAVE TO BE COMPARE WITH PRIOR YEAR PROVISION WITH ACTUAL

ANNOUNCED CLAIM TO ASSESS REASONABLENESS

OVERDRAFT REVIEW CALCULATIONS AND IDENTIFY IF ANY DEFAULTS

WITH REPAYMENT TERMS AND PROFIT/ASSET HAVE BEEN MADE

AGREEMENT MAINTAIN PROFESSIONAL SCEPTICISM BE ALERT TO

RISK OF MANIPULATION OF PROFIT THE RISK OF OVERSTATEMENT OF PROFIT/ASSETS

IF CASH IS NOT SUFFICIENT TO REPAY, GOING

CONCERN IMPLICATIONS

INTANGIBLE ASSETS REVIEW A BREAKDOWN OF THE COSTS

COSTS INCURRED SHOULD BE CORRECTLY AGREE INVOICES TO ASSESS NATURE OF EXPENSE

ALLOCATED BETWEEN REVENUE AND CAPITAL REVIEW FS TO ENSURE CORRECT TREATMENT IS MADE

EXPENSE

MISTATED IF EXPENSES HAVE BEEN TREATED

INCORRECTLY

PHYSICAL ASSETS DISCUSS WITH MANAGEMENT ABOUT PURCHASE AND

NEAR YEAR END ASSET PURCHASE WHETHER IT WAS PRESENT BEFORE YEAR END

ONLY ASSETS PRESENT AT YEAR END INSPECT LEGAL DOCUMENTS AND ENSURE THESE ARE

PHYSICALLY CAN BE RECORDED DATED PRIOR TO YEAR END AND IN THE COMPANYS

RISK OF OVERSTATEMENT IF THIS IS NOT NAME

FOLLOWED

FINANCE REVIEW DOCUMENTATION TO CONFIRM ITS NATURE

RISK OF INCORRECT CLASSIFICATION CONFIRM CLASSIFICATION IN FS

SHARES INTO SC AND SP ENSURE AND REVIEW DISCLOSURES MADE FOR

LOAN INTO CL AND NCL COMPLIANCE

IRREDEEMABLE PREF. SHARES AS EQUITY

RATHER THAN NCL

RISK OF MM IF THEY ARE CLASSIFIED

INCORRECTLY

FINANCE COSTS RECALCULATE FC AND THE INCREASED AMOUNT DUE TO

INCREASED DEBT LEADS TO INCREASED FC NEW DEBT

POSSIBLE RISK THAT FC MAY NOT BE PROPERLY AGREE INTEREST PAYMENTS IN CASH BOOK

CHARGED

DEPRECIATION DISCUSS RATIONALE BEHIND EXTENSION OF ASSET

IAS 16 PPE LIVES

INCREASING LIFE LEADS TO REDUCED DEP REVIEW PAST DISPOSALS OF SAME CLASS OF ASSETS TO

CHARGE LEADING TO INCREASED PROFITS ESTIMATE LIFE

RISK THAT THIS IS DONE TO BOOST PROFIT

REVALUATION DISCUSS PROCESS FOR VALUATION AND IF AN EXPERT

NCA MAY BE INCORRECTLY STATED IF WAS USED.

REVALUATION IS NOT CARRIED OUT AS PER IAS REVIEW FOR COMPLIANCE WITH IAS 16

16 PPE

DISPOSAL AGREE THE ASSET HAS BEEN REMOVED, RECALCULATE

LOSS ON DISPOSAL MAY NOT BE REMOVED LOSS ON DISPOSAL, AGREE SUPPORTING DOCS

PROPERLY DISCUSS DEP. POLICY WITH MANAGEMENT AND ASSESS

INCORRECT DEPRECIATION POLICY REASONABLENESS. REVIEW OTHER DISPOSALS TO

ASCERTAIN EXTENT OF POLICY ISSUE

INCREASED CREDIT PERIOD REVIEW REVISED CREDIT TERMS AND POST YEAR END

CUSTOMER GRANTED EXTENDED CREDIT REPAYMENTS (IF ANY)

PERIOD DISCUSS WITH FINANCE DIRECTOR IF HE INTENDS TO

INCREASED RISK THAT RECIEVABLE IS NOT MAKE ALLOWANCE FOR REC.

RECOVERABLE HENCE OVERVALUED REVIEW EXISTING ALLOWANCES

SALES RELATED BONUS SCHEME INCREASE AFTER DATE CASH RECIEPT TESTING FOR NEW

INCREASED REVENUE DUE TO CREDIT TERMS ACCOUNTS

GRANTED. RISK OF BAD DEBTS INCREASE CUT OFF TESTING AND REVIEW POST YEAR

CUT OFF MS DUE TO SALESMEN TRYING TO END RETURNS

INCREASE BONUS

PRODUCT RECALL DISCUSS WITH FINANCE DIRECTOR ABOUT WRITE OFFS

RISK OF OVERSTATED INVENTORY IF AND MODIFICATIONS

PRODUCTS SENT WERE RECALLED TEST COSTS OF INVENTORY AND VALUATION

REPAYMENT DEBT TO CUSTOMERS AGREE SALE REMOVAL FROM REVENUE AND CREATION

RECOGNITION OF LIABILITY/REPAYMENT EXPENSE

OVERSTATED REVENUE IF IT IS NOT REVERSED

LEGAL ACTION WRITE TO COMPANYS LAWYERS ENQUIRING ABOUT

LEGAL PROVISION OR CONTINGENT LIABILITY LIKELIHOOD OF SUCCESS

RECOGNITION MAY NOT BE MADE ASSESS AND AGREE PROVISION IN FS

EARLY AUDIT COMPLETION CONFIRM TIMETABLE WITH FINANCE DIRECTOR

REDUCTION IN AUDIT TIMETABLE WILL CONSIDER PERFORMING INTERIM AUDIT OR

INCREASE DETECTION RISK COMMENCING AUDIT EARLIER

PLACE ADDITIONAL PRESSURE ON TEA, TO MAIN PROFESSIONAL SCEPTICISM AND BE ALERT

OBTAIN SUFFICIENT APPROPRIATE EVIDENCE

FINANCE TEAM WILL HAVE TO COMPLETE FS

EARLY INCREASING CHANCES OF MS

DIVIDEND DISCUSS ISSUE AND CONFIRM THAT DIVIDEND WILLL

ONLY DIVIDEND ANNOUNCED CAN BE NOT BE PRESENT IN FS

RECOGNISED REVIEW FS TO ENSURE THE SAME

RISK OF INCORRECT RECOGNITION IF

ANYTHING ELSE IS DONE

IAS 10 EVENTS AFTER REPORTING PERIOD,

DIVIDEND SHOULD BE DISCLOSED

DIRECTOR NAMES DISCUSS MATTER WITH MANAGEMENT AND REVIEW

IFRS ACCEPTABLE BUT IF LOCAL LEGISLATION THE REQUIREMENTS OF LOCAL LEGISLATION TO

ASKS FOR INDIVIDUAL NAMES, THEY MUST BE DETERMINE IF DISCLOSURE IN FS IS APPROPRIATE

DISCLOSED

NOT DOING SO LEADS TO NON COMPLIANCE

WITH LOCAL LEGISLATION

GROSS AND NET MARGIN COMPARE CLASSIFICATION OF COSTS TO PY TO ENSURE

CHANGES IN GM AND NM MUST BE SIMILAR CONSISTENCY

IF NOT, POSSIBLE OMMISSION OR INCREASE CUT OFF TESTING TO ENSURE COSTS ARE

MISCLASSIFICATION MAY HAVE OCCURRED COMPLETE

OUTSOURCED FUNCTION DISCUSS WITH MANAGEMENT THE EXTENT OF RECORDS

DETECTION RISK INCREASES MAINTAINED WITH THEM

IF THIRD PARTY FAILS TO PROVIDE SUFF. APPR. CONSIDER CONTACTING SERVICE ORGS. AUDITOR TO

EVIDENCE CONFIRM CONTROLS IN PLACE

THEIR CONTROLS MAY NOT BE TESTED

FRAUD DISCUSS WITH FINANCE DIRECTORS PROCEDURES

PREVIOUS FRAUD MEANS MORE FRAUD CAN ADOPTED TO PREVENT AND DETECT FRAUD

BE EXISTING IN FS MAINTAIN PROFESSIONAL SCEPTICISM

FS COULD INCLUDE ERRORS IF THESE ARE NOT

UNCOVERED

You might also like

- CFA Exercise With Solution - Chap 08Document2 pagesCFA Exercise With Solution - Chap 08Fagbola Oluwatobi Omolaja100% (1)

- Big Press Release BookDocument162 pagesBig Press Release BookSyed Arif Ali100% (3)

- The Holy Grail of TaxDocument182 pagesThe Holy Grail of TaxJay FollowellNo ratings yet

- Chapter 7 Importance of Money and Capital MarketsDocument9 pagesChapter 7 Importance of Money and Capital MarketsSyrill CayetanoNo ratings yet

- Chapter 2-Audits of Financial Statements PDFDocument23 pagesChapter 2-Audits of Financial Statements PDFCaryll Joy BisnanNo ratings yet

- F8 Theory NotesDocument29 pagesF8 Theory NotesKhizer KhalidNo ratings yet

- 5.10 Risk Assessment and Approach To Assessed RiskDocument7 pages5.10 Risk Assessment and Approach To Assessed Riskkit coopeNo ratings yet

- Bridgewater: Daily ObservationsDocument15 pagesBridgewater: Daily Observationsdanielkps2903No ratings yet

- Assessing The Risk of Material Misstatements Module 2Document3 pagesAssessing The Risk of Material Misstatements Module 2TERRIUS AceNo ratings yet

- Claims DefensibilityDocument12 pagesClaims DefensibilityQBE European Operations Risk ManagementNo ratings yet

- ABMFABM2 q1 Mod5 FundOfAcctng Financial Statement Analysis v2 1Document60 pagesABMFABM2 q1 Mod5 FundOfAcctng Financial Statement Analysis v2 1Fiana DolinogNo ratings yet

- Audit & Assurance PrincipleDocument35 pagesAudit & Assurance PrincipleArielson CalicaNo ratings yet

- Chapter 13 The Auditors ReportDocument36 pagesChapter 13 The Auditors ReportJoe CastroNo ratings yet

- Auditing and Assurance PrinciplesDocument38 pagesAuditing and Assurance PrinciplesBryzan Dela CruzNo ratings yet

- MIdterm Examiation PRE 1 1Document3 pagesMIdterm Examiation PRE 1 1fond whiteNo ratings yet

- Repeated AUDIT RISKDocument6 pagesRepeated AUDIT RISKDawood ZahidNo ratings yet

- CH 13 UpdatedDocument14 pagesCH 13 UpdatedRayhanNo ratings yet

- As 28 - Impairment of AssetsDocument30 pagesAs 28 - Impairment of Assetslegendstillalive4826No ratings yet

- Accounting DocumentDocument42 pagesAccounting DocumentAmelyn Kim DimaNo ratings yet

- Mergers AcquisitionsDocument34 pagesMergers AcquisitionsAnik GadiaNo ratings yet

- Assessment of Control RiskDocument2 pagesAssessment of Control RiskTERRIUS AceNo ratings yet

- Question SEP Haris HanifDocument2 pagesQuestion SEP Haris HanifAliNo ratings yet

- Cfas Events After Reporting PeriodDocument18 pagesCfas Events After Reporting PeriodJerry ToledoNo ratings yet

- Notes To Financial StatementsDocument4 pagesNotes To Financial StatementsGlayca PallerNo ratings yet

- Ch. 6 Risk AssessmentDocument14 pagesCh. 6 Risk AssessmentIvy NjorogeNo ratings yet

- Leading Indicators of Goodwill Impairment: Hayn HughesDocument43 pagesLeading Indicators of Goodwill Impairment: Hayn HughesTabitaNo ratings yet

- BJVJGDocument5 pagesBJVJGAvinash AcharyaNo ratings yet

- Materi Presentasi Audit GabunganDocument39 pagesMateri Presentasi Audit GabunganRenny NNo ratings yet

- Discipline: by Prof. Sujit SenDocument14 pagesDiscipline: by Prof. Sujit SencmukherjeeNo ratings yet

- CFA InstituteDocument20 pagesCFA InstituteayuduNo ratings yet

- HurlingDocument6 pagesHurlingMansoor SharifNo ratings yet

- Internal Customer SatisfactionDocument30 pagesInternal Customer Satisfactionmind2008No ratings yet

- 1.introduction To Audit and AssuranceDocument23 pages1.introduction To Audit and AssuranceJaskaran SinghNo ratings yet

- Group 8Document23 pagesGroup 8samuel tettehNo ratings yet

- Considering Specific Financial Statement Items 1Document12 pagesConsidering Specific Financial Statement Items 1mark ebaoNo ratings yet

- Assurance Engagements & Other Services of A PractitionerDocument22 pagesAssurance Engagements & Other Services of A PractitionerkngnhngNo ratings yet

- Finman2b ReportDocument6 pagesFinman2b ReportLey MiclatNo ratings yet

- Mining Economic Course: Donie WijatmikaDocument42 pagesMining Economic Course: Donie WijatmikaSam BasNo ratings yet

- Audit Risk NOTESDocument8 pagesAudit Risk NOTESAtka FahimNo ratings yet

- Assurance EngagementDocument6 pagesAssurance EngagementEmmaNo ratings yet

- Audit Risk SummaryDocument2 pagesAudit Risk SummaryCheong WahNo ratings yet

- No Audit Report If Total Asset or Total Liability ISLESS THAN P600,000Document2 pagesNo Audit Report If Total Asset or Total Liability ISLESS THAN P600,000Felicity AnneNo ratings yet

- Isa 240 Auditor Responsibility Relating To FraudDocument6 pagesIsa 240 Auditor Responsibility Relating To Fraudnurmaisarahnurazim1No ratings yet

- Fundamentals of Assurance ServicesDocument32 pagesFundamentals of Assurance ServicesDavid alfonsoNo ratings yet

- Handouts 2Document34 pagesHandouts 2eiraNo ratings yet

- Lecture 2 - Auditor Responsibility ObjectivesDocument32 pagesLecture 2 - Auditor Responsibility ObjectivesPriscella LlewellynNo ratings yet

- Audit Risk NotesDocument14 pagesAudit Risk NotesRana NadeemNo ratings yet

- Agreed Upon Procedure EngagementDocument11 pagesAgreed Upon Procedure EngagementChristine Mae FelixNo ratings yet

- Chapter 5Document11 pagesChapter 5fekadegebretsadik478729No ratings yet

- AT 8901 PPT Material For UploadDocument62 pagesAT 8901 PPT Material For UploadMay Grethel Joy PeranteNo ratings yet

- Chapter 4 An Auditor's ServicesDocument22 pagesChapter 4 An Auditor's ServicesAisa TriNo ratings yet

- Audit Risk NotesDocument8 pagesAudit Risk NotesAditya KanabarNo ratings yet

- As 11Document24 pagesAs 11Jayant JoshiNo ratings yet

- As-11-Accounting For The Effects of Changes in Foreign Exchange RatesDocument24 pagesAs-11-Accounting For The Effects of Changes in Foreign Exchange RatesKripansh GroverNo ratings yet

- As-11-Accounting For The Effects of Changes in Foreign Exchange RatesDocument24 pagesAs-11-Accounting For The Effects of Changes in Foreign Exchange RatesSayantan BhowmikNo ratings yet

- Faa Unit 1 Theory NDocument6 pagesFaa Unit 1 Theory NArnav 123No ratings yet

- AA Knowledge Based PracticeDocument8 pagesAA Knowledge Based Practicedanyal projectsNo ratings yet

- CAF 09 - Procedures Sheet By: Muhammad Asif, FCADocument2 pagesCAF 09 - Procedures Sheet By: Muhammad Asif, FCAsidra awanNo ratings yet

- Audit ReportDocument10 pagesAudit ReportParth MundhadaNo ratings yet

- Balance Sheet RatiosDocument30 pagesBalance Sheet Ratiosumar iqbalNo ratings yet

- Penalties CCADocument26 pagesPenalties CCAHarpreet SinghNo ratings yet

- FINANCIAL STATEMENT BASED ON PAS Statement of Financial PositionDocument9 pagesFINANCIAL STATEMENT BASED ON PAS Statement of Financial PositionrueNo ratings yet

- Chapter 7 Cash and Cash EquivalentsDocument34 pagesChapter 7 Cash and Cash Equivalentsetet100% (1)

- Change in PSR Full Solution With ConceptsDocument15 pagesChange in PSR Full Solution With ConceptsANTECNo ratings yet

- Pengantar Praktik Pengauditan Audit Planning (1-5)Document12 pagesPengantar Praktik Pengauditan Audit Planning (1-5)willyNo ratings yet

- Beyond Sarbanes-Oxley Compliance: Effective Enterprise Risk ManagementFrom EverandBeyond Sarbanes-Oxley Compliance: Effective Enterprise Risk ManagementNo ratings yet

- UntitledDocument5 pagesUntitledAastha ShettyNo ratings yet

- UntitledDocument7 pagesUntitledAastha ShettyNo ratings yet

- UntitledDocument4 pagesUntitledAastha ShettyNo ratings yet

- Business Communication - IDocument204 pagesBusiness Communication - IAastha Shetty0% (1)

- Sales ManagementDocument202 pagesSales ManagementdsatyNo ratings yet

- Entrepreneurship ManagementDocument63 pagesEntrepreneurship ManagementAastha ShettyNo ratings yet

- Capital Markets-GROUP 4Document27 pagesCapital Markets-GROUP 4Aastha ShettyNo ratings yet

- Invitation To BidDocument2 pagesInvitation To BidJerald LunaNo ratings yet

- Chicken Poultry SME in Papua New GuineaDocument6 pagesChicken Poultry SME in Papua New GuineaAl-n RiedNo ratings yet

- Case 6 MathDocument16 pagesCase 6 MathSaraQureshiNo ratings yet

- Presentation On Preferential Allotment' - by Mahavir LunawatDocument37 pagesPresentation On Preferential Allotment' - by Mahavir LunawatArunachalam SubramanianNo ratings yet

- AFM FinalDocument20 pagesAFM FinalDeepak RahejaNo ratings yet

- Basis For Conclusions ISAs 800 805 Rev and Red PDFDocument11 pagesBasis For Conclusions ISAs 800 805 Rev and Red PDFSanath FernandoNo ratings yet

- Calculus Mathematics For BusinessDocument112 pagesCalculus Mathematics For BusinessR. Mega MahmudiaNo ratings yet

- UntitledDocument13 pagesUntitledJocelyn GiselleNo ratings yet

- Dec Price DropDocument143 pagesDec Price Dropnikhildhande3600gmaiNo ratings yet

- Bbjconst Corporate EmaillistDocument4 pagesBbjconst Corporate EmaillistAnup PrakashNo ratings yet

- IAS 16 PPE Lecture Slides (Updated)Document39 pagesIAS 16 PPE Lecture Slides (Updated)Ndila mangalisoNo ratings yet

- Sobha LTD Q2 FY 2020 21 Investor PresentationDocument47 pagesSobha LTD Q2 FY 2020 21 Investor PresentationAdarsh Reddy GuthaNo ratings yet

- Bhartiya Post April 2008Document34 pagesBhartiya Post April 2008K V Sridharan General Secretary P3 NFPENo ratings yet

- Institute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsMuhammad AsifNo ratings yet

- Curriculum Vitae E.tinazvoDocument4 pagesCurriculum Vitae E.tinazvoDominic HuniNo ratings yet

- Punjab Bio Energy Company.: House No. 34-A, Block A, New Muslim Town, Lahore. PH: 042-35948867Document8 pagesPunjab Bio Energy Company.: House No. 34-A, Block A, New Muslim Town, Lahore. PH: 042-35948867Muhammad Asif ShabbirNo ratings yet

- New Zealand 2009 Financial Knowledge SurveyDocument11 pagesNew Zealand 2009 Financial Knowledge SurveywmhuthnanceNo ratings yet

- Karnataka EconomyDocument14 pagesKarnataka EconomyPrathvi NaikNo ratings yet

- Economic History of The PhilippinesDocument17 pagesEconomic History of The PhilippinesGrace Cassandra VirayNo ratings yet

- Indian Companies Act 1956Document32 pagesIndian Companies Act 1956Meet ThakkerNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- SMA H1 Trading SystemDocument5 pagesSMA H1 Trading SystemChrisLaw123No ratings yet

- Appendix 44 - Instructions - LRDocument1 pageAppendix 44 - Instructions - LRpdmu regionix100% (1)

- BusOrg - Chapter 2Document3 pagesBusOrg - Chapter 2Zyra C.No ratings yet