Professional Documents

Culture Documents

Simple LBO Model - Equity Value and Enterprise Value in A Cash-Free, Debt-Free Deal

Uploaded by

merag76668Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simple LBO Model - Equity Value and Enterprise Value in A Cash-Free, Debt-Free Deal

Uploaded by

merag76668Copyright:

Available Formats

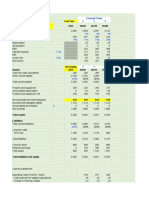

Simple LBO Model - Equity Value and Enterprise Value in a Cash-Free, Debt-Free Deal

($ in Millions)

Assumptions:

EBITDA Purchase Multiple: 8.0 x Year 0 Revenue: $ 250

Purchase Enterprise Value: $ 800 Annual Revenue Growth Rate: 5.0%

Purchase Equity Value: 620 Annual EBITDA Margin: 40.0%

% Debt: 50.0% D&A % Revenue: 3.0%

Debt Used: 400 CapEx % Revenue: 4.5%

Investor Equity Contribution: 400 Change in WC % Change in Revenue: (15.0%)

Minimum Cash Balance: $ 25

Interest Rate: 5.0%

Tax Rate: 25.0%

Income Statement: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Revenue: $ 250 $ 263 $ 276 $ 289 $ 304 $ 319

EBITDA: 100 105 110 116 122 128

(-) Depreciation & Amortization: (8) (8) (9) (9) (10)

(-) Interest: (20) (19) (16) (13) (9)

Pre-Tax Income: 77 83 91 100 109

(-) Taxes: (19) (21) (23) (25) (27)

Net Income: $ 58 $ 62 $ 68 $ 75 $ 82

Cash Flow Projections: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Net Income: $ 58 $ 62 $ 68 $ 75 $ 82

(+) Depreciation & Amortization: 8 8 9 9 10

(+/-) Change in Working Capital: (2) (2) (2) (2) (2)

(-) CapEx: (12) (12) (13) (14) (14)

Beginning Cash: - 25 25 25 25

(+) Free Cash Flow: 52 56 62 68 74

(-) Minimum Cash: (25) (25) (25) (25) (25)

Cash Flow Used for Debt Repayment: 27 56 62 68 74

Pre-Txn: Post-Txn:

Debt Balance: 200 400 373 317 255 186 112

Cash Balance: 20 - 25 25 25 25 25

Equity Value and Enterprise Value: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

EBITDA Purchase/Exit Multiple: 8.0 x 8.0 x 8.5 x 9.0 x 9.5 x 10.0 x

Enterprise Value: 800 840 937 1,042 1,155 1,276

Beginning Equity Value: 400 492 646 812 993

(+) Change in Cash Attrib. to Common Shareholders: 52 56 62 68 74

(+) Change in Core-Business Assets: 40 97 105 113 122

Ending Equity Value: 492 646 812 993 1,189

Returns Attribution Analysis: Exit Calculations:

EBITDA Growth: $ 221 Exit Enterprise Value: $ 1,276

Multiple Expansion: 255 (-) Debt: (112)

Debt Paydown and Cash Generation: 313 (+) Cash: 25

Return to Equity Investors: $ 789 Equity Proceeds: $ 1,189

Money-on-Money (MoM) Multiple: 3.0 x

Internal Rate of Return (IRR): 24.3%

You might also like

- Assumptions:: Simple LBO Model - Key Drivers and Rules of ThumbDocument2 pagesAssumptions:: Simple LBO Model - Key Drivers and Rules of Thumbw_fibNo ratings yet

- Simple Example of Original Issue Discount (OID) On The Financial StatementsDocument1 pageSimple Example of Original Issue Discount (OID) On The Financial StatementsziuziNo ratings yet

- 02 - Assignment Integration Exercise - SolutionDocument4 pages02 - Assignment Integration Exercise - SolutionAgustín RosalesNo ratings yet

- Liston Mechanic CorporationDocument14 pagesListon Mechanic CorporationKunal MehtaNo ratings yet

- Cash Flow Explanatory SheetDocument4 pagesCash Flow Explanatory SheetTony DarwishNo ratings yet

- FCFF of Coke & Home Depot, WalmartDocument8 pagesFCFF of Coke & Home Depot, WalmartSatish KumarNo ratings yet

- D.1. Financial Statement AnalysisDocument4 pagesD.1. Financial Statement AnalysisCode BeretNo ratings yet

- Aiswarya Rachy Johnson p19105 Group GDocument10 pagesAiswarya Rachy Johnson p19105 Group GAthulya SanthoshNo ratings yet

- Sampa Video Solution Harvard Case Solution 1Document10 pagesSampa Video Solution Harvard Case Solution 1Héctor SilvaNo ratings yet

- PrepzFy - LBO - VemptyDocument3 pagesPrepzFy - LBO - VemptykouakouNo ratings yet

- Matrix Ltd. financial statements analysisDocument9 pagesMatrix Ltd. financial statements analysisbipin kumarNo ratings yet

- Forecasting Brigham Case SolutionDocument7 pagesForecasting Brigham Case SolutionShahid Mehmood100% (1)

- Docshare - Tips - Sampa Video Solution Harvard Case Solution PDFDocument10 pagesDocshare - Tips - Sampa Video Solution Harvard Case Solution PDFnimarNo ratings yet

- Midterm Excel Worksheet Olivieri Version 2Document21 pagesMidterm Excel Worksheet Olivieri Version 2Emanuele OlivieriNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Ch03 Tool Kit 2017-09-11Document20 pagesCh03 Tool Kit 2017-09-11Roy HemenwayNo ratings yet

- 05. LBO Model and Venture Capital Scenario AnalysisDocument73 pages05. LBO Model and Venture Capital Scenario Analysisharshit.dwivedi320No ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138No ratings yet

- Financial Management Mock 2Document7 pagesFinancial Management Mock 2sadathamid03No ratings yet

- Consolidation Accounting For Noncontrolling Interests - IntroductionDocument10 pagesConsolidation Accounting For Noncontrolling Interests - IntroductionManeeshNo ratings yet

- DCF ModelDocument5 pagesDCF Modelibs56225No ratings yet

- Chapter 6Document32 pagesChapter 6SyedAunRazaRizviNo ratings yet

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case SolutiontroyanxNo ratings yet

- FM Assignment SolutionDocument18 pagesFM Assignment SolutionumeshNo ratings yet

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case Solutionalka murarka50% (14)

- Ch03 Tool KitDocument24 pagesCh03 Tool KitNino Natradze100% (1)

- NBA ADVANCED - Happy Hour Co - DCF COMPLETEDDocument10 pagesNBA ADVANCED - Happy Hour Co - DCF COMPLETEDViinnii Kumar100% (1)

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoNo ratings yet

- 3 Statement Model STRAT 5XXXDocument6 pages3 Statement Model STRAT 5XXXdawson.ber2zNo ratings yet

- Lanka Realty Investments PLC: Interim Financial Statements 31ST DECEMBER 2021Document12 pagesLanka Realty Investments PLC: Interim Financial Statements 31ST DECEMBER 2021girihellNo ratings yet

- Discounted Cash Flow AnalysisDocument5 pagesDiscounted Cash Flow AnalysisoussemNo ratings yet

- Chap 006Document15 pagesChap 006Phan AnhNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNo ratings yet

- The Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021Document11 pagesThe Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021ShivamNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- WSP Basic LBO - VF 2Document12 pagesWSP Basic LBO - VF 2jason.sevin02No ratings yet

- Additional ExcelSpreadsheetsDocument35 pagesAdditional ExcelSpreadsheetsbipin kumarNo ratings yet

- Park Hotels & Resorts Inc. - Operating Model and Valuation: Name Name Name Year Date $ As Stated Millions # # % % %Document10 pagesPark Hotels & Resorts Inc. - Operating Model and Valuation: Name Name Name Year Date $ As Stated Millions # # % % %merag76668No ratings yet

- Valuation Model - Comps, Precedents, DCF, Football Field - BlankDocument10 pagesValuation Model - Comps, Precedents, DCF, Football Field - BlankNmaNo ratings yet

- Tutorial 2 Discount Rate WACC AfterDocument12 pagesTutorial 2 Discount Rate WACC AfteroussemNo ratings yet

- Kim's Value Profit and Loss Account Notes Operating Capacity 1 2 3Document10 pagesKim's Value Profit and Loss Account Notes Operating Capacity 1 2 3sulthanhakimNo ratings yet

- Case 06 Financial Detective 2016 F1763XDocument6 pagesCase 06 Financial Detective 2016 F1763XJosie KomiNo ratings yet

- UltraTech Cements and Jaiprakash AssociatesDocument8 pagesUltraTech Cements and Jaiprakash AssociatesanushaNo ratings yet

- EBIT-EPS AnalysisDocument15 pagesEBIT-EPS AnalysisKailas Sree ChandranNo ratings yet

- Financial Accounting - Reporting November 2021 Suggested SolutionsDocument6 pagesFinancial Accounting - Reporting November 2021 Suggested SolutionsMunodawafa ChimhamhiwaNo ratings yet

- Credit Management in BanksDocument10 pagesCredit Management in BanksmarufNo ratings yet

- FactBookFY 2021andq1 2022Document26 pagesFactBookFY 2021andq1 2022Prateek PandeyNo ratings yet

- Management and Cost Accounting 10th Edition Drury Solutions ManualDocument17 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manualeliasvykh6in8100% (27)

- Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFDocument38 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFirisdavid3n8lg100% (9)

- Drivers: FY 19 FY 20 FY 21 FY 22Document6 pagesDrivers: FY 19 FY 20 FY 21 FY 22Ammon BelyonNo ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current InputsÃarthï ArülrãjNo ratings yet

- FcffevaDocument6 pagesFcffevaShobhit GoyalNo ratings yet

- Tablet-Case-SpreadsheetDocument138 pagesTablet-Case-SpreadsheetdynaNo ratings yet

- NWC model + CF new versionDocument1 pageNWC model + CF new versionmichael odiemboNo ratings yet

- Hard Rock (Pty) LTD - SolutionDocument8 pagesHard Rock (Pty) LTD - SolutionNicolasNo ratings yet

- Click File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPADocument9 pagesClick File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPAMessias MorettoNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- Gone Rural Historical Financials Reveal Growth Over TimeDocument31 pagesGone Rural Historical Financials Reveal Growth Over TimeHumphrey OsaigbeNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 80 03 Apartment Construction AfterDocument5 pages80 03 Apartment Construction Aftermerag76668No ratings yet

- 70 06 Reserves To Statements AfterDocument4 pages70 06 Reserves To Statements Aftermerag76668No ratings yet

- 70 05 Oil Gas Reserves AfterDocument2 pages70 05 Oil Gas Reserves Aftermerag76668No ratings yet

- 70 07 Key Metrics Ratios AfterDocument16 pages70 07 Key Metrics Ratios Aftermerag76668No ratings yet

- 62 01 OverviewDocument6 pages62 01 Overviewmerag76668No ratings yet

- 70 02 Oil Gas StatementsDocument10 pages70 02 Oil Gas Statementsmerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 61 02 Charge Offs Recoveries AfterDocument3 pages61 02 Charge Offs Recoveries Aftermerag76668No ratings yet

- 70 02 Oil Gas StatementsDocument10 pages70 02 Oil Gas Statementsmerag76668No ratings yet

- 70 04 Oil Gas Accounting AfterDocument4 pages70 04 Oil Gas Accounting Aftermerag76668No ratings yet

- 61 02 Charge Offs Recoveries AfterDocument3 pages61 02 Charge Offs Recoveries Aftermerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 60 06 RegulationsDocument10 pages60 06 Regulationsmerag76668No ratings yet

- 61 02 Charge Offs Recoveries AfterDocument3 pages61 02 Charge Offs Recoveries Aftermerag76668No ratings yet

- 61 02 Charge Offs Recoveries AfterDocument3 pages61 02 Charge Offs Recoveries Aftermerag76668No ratings yet

- 61 01 Overview Loan Projections AfterDocument2 pages61 01 Overview Loan Projections Aftermerag76668No ratings yet

- 60 02 Balance SheetDocument2 pages60 02 Balance Sheetmerag76668No ratings yet

- 60 06 RegulationsDocument5 pages60 06 Regulationsmerag76668No ratings yet

- Programme L2 2008 2009 DoubleDocument2 pagesProgramme L2 2008 2009 Doublemerag76668No ratings yet

- Financial Statements - Key Differences Between a Normal Company and BankDocument13 pagesFinancial Statements - Key Differences Between a Normal Company and Bankmerag76668No ratings yet

- 60 06 Basel III II ComparisonDocument1 page60 06 Basel III II Comparisonmerag76668No ratings yet

- WSO&WSP-Shortcuts Cheat SheetsDocument10 pagesWSO&WSP-Shortcuts Cheat SheetsibraNo ratings yet

- 60 05 CL Provisions AfterDocument4 pages60 05 CL Provisions Aftermerag76668No ratings yet

- 60 03 BS To IS AfterDocument10 pages60 03 BS To IS Aftermerag76668No ratings yet

- Wall Street Prep DCF Financial ModelingDocument7 pagesWall Street Prep DCF Financial ModelingJack Jacinto100% (1)

- ICICI Bank HPCL Super Saver Internal PPT Without MasterCardDocument14 pagesICICI Bank HPCL Super Saver Internal PPT Without MasterCarddhruvNo ratings yet

- DenizBank A.Ş. - EMTN Programme Update - Base ProspectusDocument297 pagesDenizBank A.Ş. - EMTN Programme Update - Base ProspectusSSH GsmonfaredNo ratings yet

- How To Measure Company ReturnsDocument11 pagesHow To Measure Company ReturnsnpapadokostasNo ratings yet

- Direct Credit Facility Form 2023Document3 pagesDirect Credit Facility Form 2023AnnyssSyahidaNo ratings yet

- Kami Export - Keira Timmins - Federal Budget WebquestDocument4 pagesKami Export - Keira Timmins - Federal Budget WebquestKeira TimminsNo ratings yet

- Corporate Finance HomeworkDocument3 pagesCorporate Finance HomeworkNguyen Doan Thanh HaNo ratings yet

- Technical Analysis Indicates Buying Momentum for Asian PaintsDocument14 pagesTechnical Analysis Indicates Buying Momentum for Asian PaintsThota VenkatNo ratings yet

- Exercise Foreign Exchange Market - SOLVEDDocument3 pagesExercise Foreign Exchange Market - SOLVEDamer_wah100% (1)

- Chemical Process Design Analysis NPVDocument7 pagesChemical Process Design Analysis NPVHaematomaNo ratings yet

- Albuquerque Journal Homestyle 07/31/2016Document15 pagesAlbuquerque Journal Homestyle 07/31/2016Albuquerque JournalNo ratings yet

- Athens - BESTDocument27 pagesAthens - BESTCatNo ratings yet

- ECN 301 Intermediate Macroeconomics AssignmentDocument3 pagesECN 301 Intermediate Macroeconomics AssignmentLanre WillyNo ratings yet

- Bond Price and YieldDocument13 pagesBond Price and YieldHarsh RajNo ratings yet

- 16-17 - DE - Profit & Loss AccountDocument14 pages16-17 - DE - Profit & Loss AccountsamaNo ratings yet

- Example: Historical Financial StatementsDocument10 pagesExample: Historical Financial StatementstopherxNo ratings yet

- Create A Intelligent Debt Consolidation Loans Plan With One of These Recommendationsapujo PDFDocument3 pagesCreate A Intelligent Debt Consolidation Loans Plan With One of These Recommendationsapujo PDFforkmaria0No ratings yet

- Management of Financial ServicesDocument309 pagesManagement of Financial ServicesSeena AlexanderNo ratings yet

- Tax Invoice: Previous Charges Amount (RM) Current Charges Amount (RM)Document7 pagesTax Invoice: Previous Charges Amount (RM) Current Charges Amount (RM)Abdul NorNo ratings yet

- 57 Managing Supplier Risk in The Transportation and Infrastructure IndustryDocument14 pages57 Managing Supplier Risk in The Transportation and Infrastructure IndustryAmineDoumniNo ratings yet

- Signed Off General Mathematics11 q1 m6 Simple and Compound Interests v3Document32 pagesSigned Off General Mathematics11 q1 m6 Simple and Compound Interests v3Joy Dizon100% (1)

- Rmo 63-99Document1 pageRmo 63-99saintkarriNo ratings yet

- Chapter 1 - Mercantilism: A) Meaning and Definition of MercantilismDocument7 pagesChapter 1 - Mercantilism: A) Meaning and Definition of MercantilismHasnath AhmedNo ratings yet

- SORTIS RE Presentation 20090403 enDocument21 pagesSORTIS RE Presentation 20090403 enmvpaevNo ratings yet

- Chapter 16 Managing Bond Portfolios: Multiple Choice QuestionsDocument29 pagesChapter 16 Managing Bond Portfolios: Multiple Choice Questionsleam37No ratings yet

- Quote CNC BDM20220824012HDocument1 pageQuote CNC BDM20220824012HMyNameSuperFeforNo ratings yet

- Invt BankingDocument23 pagesInvt Bankingarjunmba119624100% (1)

- Axis Bank AptitudeDocument94 pagesAxis Bank AptitudeladmohanNo ratings yet

- Market Risk SlidesDocument80 pagesMarket Risk SlidesChen Lee Kuen100% (5)

- Credit BossDocument8 pagesCredit Bossuttamdas79No ratings yet

- Marico RatiosDocument8 pagesMarico RatiosAmarnath DixitNo ratings yet