Professional Documents

Culture Documents

Aviation Financial Sustainability Infographic

Uploaded by

Hao SuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviation Financial Sustainability Infographic

Uploaded by

Hao SuCopyright:

Available Formats

WELCOME

TO

My Infographic

Is it worth?

Duong Investment in Airline

Hoang Trong Topic:

S3872865 Financial

sustainability

in the

Aviation

value chain

AV I AT I O N

FINANCIAL

SUSTANABILITY

VALUE CHAIN

What is value chain, its structure, features,...?

AIRLINE SECTOR

Some facts, some parameters of this sector in the

value chain

PERFORMANCE OF VALUE CHAIN

The value chian is evaluated based on 4 aspects:

Investment, Returns on investment, Credit rating,

Market power.

FINANCIAL SUSTAINABILITY AND

INVESTMENT IN AIRLINES INDUSTRY

Short description about sustainability and

conclusion about sustainability in aviation.

Answer the question: "is it worth investing in

airlines?"

CONCLUSION AND SOLUTION

A summary about key ideas. Suggest some

solutions for the whole chain

MISUNDERSTANDING

VALUE CHAIN VS

SUPPLY CHAIN

VALUE CHAIN SUPPLY CHAIN

1. Definition

The process in which a The supply chain is all the steps

company adds value to its raw required to get the product to

materials to produce products the customer.

eventually sold to consumers

2. Activity

Adds values to the product Facilitates production and

distribution of the product

3. Purpose

Provides competitive Offers customers satisfaction

advantage

VALUE CHAIN STRUCTURE

Manufacturers Infrastructure Service Providers

Airframes Airports Insurance

Engines ANSPs Ground services

Components Communications MROs

... Caterers

Lessors/

Capitals

Upstream factors

The airlines

Downstream factors

Distribution Distribution

Of Freight Of Passengers

Freight forwarders Global Distribution

Integrators Systems (GDSs)

Travel agents

i.g. FedEx, UPS, Integrator/ tour operators

DHL,...

Is a Global Value Chain because Consists of a number of

the operation of each sectors is interlinked sectors

cross-border

Airline industry is the hub for

other sector in the chain

ICAO, national air

safety regulators

Establish standards

for sale, travel

documents, financial

Establish transactions between

standards and value chain partners

recommended

regulations,

facilities, AVIATION

operation,... VALUE CHAIN

i.g. standardize IATA

FEATURES

airport design

HIgh degree of vertical Companies in the chain do not

disintegration operate in isolation

Need the participation of Each participant performs a

diffeent sectors, companies limited subset of activities

Create a finished product

THE AIRLINE SECTOR

gENERAL

FEATURES Did You Know?

Net profit:

THE ANCHOR OF

THE WHOLE CHAIN In 2011 is 8.3 $billion

Airlines are indispensable

part, other sectors operate

based on input and output

$ In 2017 is 37.6 $billion

needs of airlines

In 2019 is 26.4 $billion

THE WEAKNESS

Although being the central

part, airline industry also be

the most vulnerable sector

! Outbreake

of covid:

In 2020 is -137.7 $billion

DEREGULATION

Deregulation acts

dramatically transformed

the industry resulting in both

% In 2021 is -51.8 $billion

pros and cons

PROFITABILITY

Keep improving but profit

margins continue to be

alarmingly thin

@

THE AIRLINE SECTOR

Influcing factors

Volatile fuel

prices Economic

downturns

Intense

competitions

Airline

profitability Impact of

terrorism

Natural

disaters

Government

austerity Pandemics

measures

THE AIRLINE SECTOR

deregulation

Deregulation

of the industry

Increasing competition between Advantages

airlines to obtain the highest

benefits possible for users.

Strengthen safety, security, Removed

environmental regulations. unnecessary

government

Government control of pricing; regulations

route, ownership,... other

aspects of airline economic has Greater number of

largely been removed. flights, non-stop

destinations

Increase

productivity

Improvement in

drawbacks for capacity utilization

airlines

Too much competition, good for

customers but the substantial

cost in the form of lower

profitability for airline industry. Nowadays, airlines have

Airlines always compete for invested in certain supply

price down to the marginal cost

of providing service, lower

chain partners like:

overall fares.

Providers of fuel, ground

handling, in-airport

Airlines have limited or no customer services,

ownership interest in other

sectors of the value chain

catering, cargo terminal

facilities, trucking

operation...

Aspects of a value chain

INVESTMENT

Showing how money flows in and be distributed inside the value chain by the

parameter from IATA in 2011

RATE OF RETURNS ON INVESTMENT

Illustrating returns on investment of each sector, which sector earns the least? the most?

by analyzing a major study of McKinsey which is commissioned by IATA

CREDIT RATING

Another metric can be used to examine sustainability performance along the value chain

MARKET POWER

Showing some part of the chain is manipulating the airline as well as other partners

along the calue chain

ASPECTS OF VALUE CHAIN

INVESTMENT

Capital investment in the Aviation Value

Chain in 2011 (USD Billion)

69

27

48

506

293

source: IATA

Airlines (53.66%) Airports (31.07%) Lessors (5.09%)

Manufacturers (2.86%) Others (7.32%)

Lessors

Airlines primarily It is often 5%

invest in new or unnoticed that

replacement airport Manufacturers

aircraft engines, investment is 3%

other substantial,

components, also 31%

in ground Have low asset Others, 7% including

equipment and turnover Air Navigation

corporate compared to Service Providers,

resources airlines Freight forwarders,

Largest Low ratio of Ground service

investment, 57% annual providers, travel

Low ratio of revenue to agent, Maintainance-

annual revenue to invested Repair-Operations,

invested capital, capital, only Global Distribution

only 1.0 0.2% Systems,...

ASPECTS OF VALUE CHAIN

RETURNS

Estimate the returns on

investment in the aviation

- by McKinsey, commissioned by IATA in

2013

Airlines provide the The airline sector is

The rate of returns the worst-

lowest rate of return

on invested capital performing

on invested capital

varies widely The rate of return for

for shareholders

between different compared to other airlines falls short of

sectors of the value sectors of the the cost of capital

chain aviation supply invested in this

chain industry

Return on Invested Capital in the commercial

aviation value chain 2004-2011

CRS or GDSs

Travel Agents

Freight forwarders

All Services

Lessors

ANSPs

Manufacturers

Airports

Airlines

0 10 20 30 40

Return on Invested capital Cost of capital

Source: McKinsey & Company, Air Travel Value

Chain Analysis, February 2013.

ASPECTS OF VALUE CHAIN

RETURNS

Return on Invested Capital in the commercial

aviation value chain 2004-2011

CRS or GDSs

Travel Agents

Freight forwarders

All Services

Lessors

ANSPs

Manufacturers

Airports

Airlines

0 10 20 30 40

Return on Invested capital Cost of capital

The airline industry is the worst The airport

Top performers performer Somewhat better

Global Distribution Return on invested capital varies

than airlines in

by region. (i.g. airlines in the

Systems (20%) Middle East, Asia, Latin America terms of financial

Travel usually have higher return) returns

agents (44%) The return also differs by the

But still the second

Freight forwarders business model. (i.g. top-

(15%) performing airlines often follow lowest earner in the

some variant of the Low Cost chain

Carrier, although not all LCCs are

profitable)

Summary

The airline sector is the center of the value chain but is the least profitable node

in the chain

For many years the industry has failed to achieve sufficient returns to cover the

cost of capital

Investors derive no benefit from the improved cost performance as the value is

entirely passed on to the customers downstream

This poor return puts other members of the value chain at some risk

ASPECTS OF VALUE CHAIN

CREDIT RATING

Credit rating for High credit rating

firms in different Airport are generally

aviation sectors can rated as investment

be used to examine grade

sustainability Similarly, Air traffic

performance along control providers (i.g. Air

the value chain Services Australia, Nav

Canada...) are also rated

as investment grade.

In contrast, airlines are the

low credit rating and not

rated as investment grade

Even airline shares are rated

as "junk" or "speculative"

Low credit rating grade.

results in an increase

in the cost of capital

for airlines

This is problematic for airlines in particular

and the value chain in general. Rising two

issues:

It narrows the pool of potential investors and

thus limits access to capital for airlines and

impede the expansion of activity in the chain

Who should bear risk in the industry?

ASPECTS OF VALUE CHAIN

MARKET POWER

Market power refers to a Because the rate of return relative

company's relative ability to to the cost of capital is different

manipulate the price of a for each sector, some sectors even

marketplace. have outstanding high returns

Whether substantial market

power exists in other

sectors of the value chain?

1st case is the extremely high returns being

earned by Global Distribution System providers

GDSs were divested by Market power is still remain

their airline owners GDSs will discipline an

The government airline that seeks

removed regulation of

the GDSs alternative channels or

technology providers

DEREGULATION REALITY

ORIGINALITY POST- PRACTICAL

DEREGUALTION EXAMPLE

Trusting new The Lawsuit between US

This sector distribution channels or Airway, American Airway

war created against GDS providers:

by airlines technology providers

would emerge Sabre, Travelport

Creating the needed

competition to prevent Biasing display away from

market power abuse the US Airway and

American Airline

Charging excessive booking

fees.

Another sector with signs of market

power is freight fowarder

Since a large number of These players make critical

freight forwarders but much decisions in the air cargo

of the market is concentrated industry

among a small group of large (i.g. which airport gateway will

global players be used)

DEFINITION OF

FINANCIAL

SUSTAINABILITY

REQUIREMENTS

To be considered as Financial

In aviation

Sustainability:

1. The industry or the value chain

must be able to cover the cost of Financial sustainability:

operation.

2. Can provide a reasonable Must be achieved not

return on investment so that only by a value chain as

capital can be renewed. a whole

But also by each sector

of the value chain

individually

Inadequate performance of

conslusion only one sector can still have

the potential to destroy the

There is no firm conclusion that sustainability of the entire

can be drawn to answer the system.

question: whether commercial

aviation is sustainable?

Some experts say the airline

industry can never reach a

financially sustainable

equilibrium

Some experts believe in

general the aviation value

chain is financially

sustainable, but there are

profit problems that need to

be solved.

It depends on each person's

view.

IS IT WORTH IT?

INVESTMENT IN

AIRLINES

Airlines around the globe Airlines earn a small profit

consistently post low returns margin

on invested capital

Why is the investment in the

airline industry is largest?

How airlines can attract

investors?

Because the airline industry

is highly leveraged and

generates a higher return

on investor's equity or net

worth

Consider shareholder's equity from 6 airlines

Airline Net profit margin Return on Net Worth

The return on equity

WestJet 7.1% 16.5% (whether positive or

negative) exceeded the

United/Continental -1.9% -16.6% magnitude of the profit

margin by a factor of 2-

Southwest 2.5% 6.0% 3 or even higher

(Lufthansa and United)

Qantas -1.6% -4.1%

All Nippon Airways 2.0% 5.1%

Lufthansa 3.6% 14.9%

Source: InterVISTAS analysis based on 2012 annual reports

for All Nippon Airways, LAN, Qantas, and WestJet; 2012

operating statement for Southwest; 2012 financial

The airline sector has

statement for Lufthansa and K-10 Form for still attracted

United/Continental. investment

CONCLUSION AND

SOLUTION

Based on the structure and 4

aspects of the value chain

The central part, Certain segments in

receiving the largest the value chain have

investment, the market power and

airline sector itself is are able to transfer

the weakness node profit from airlines

in the chain to themself.

KEY PROBLEM

FACED BY THE

AIRLINE INDUSTRY

It makes profits for

everyone along the

value chain except

for itself.

It is still worth

to invest in

airlines

REMEMBER

Financial leverage Not only 2 times, 3

Return on investor's times profit

net worth will But also can be 2

generally be 2-3 times, 3 times loss.

times profit margin

CONCLUSION AND

SOLUTION

Commercial

aviation can be

considered

financially

sustainable or

not, depending

on individuals.

Several

solutions to

increase the

financial

sustainability in

the industry. Injecting

Rebalancing

competition in

the value

sectors that are

chain

earning huge

economic profits

Removing regulatory

impediments to air

carriers reaping some

benefit from other parts

of the value chain

You might also like

- Gage Rhetorical VirtueDocument9 pagesGage Rhetorical Virtuerws_sdsuNo ratings yet

- Apex Learning - Courses-32Document12 pagesApex Learning - Courses-32AMNo ratings yet

- Adsorption-Based Strategies For Removing Uremic Toxins From Blood - Ma 2021Document15 pagesAdsorption-Based Strategies For Removing Uremic Toxins From Blood - Ma 2021MauNo ratings yet

- The Imperial BrochureDocument15 pagesThe Imperial BrochureKomalNo ratings yet

- Bluedart - INVOICE FORMAT - Courier DetailsDocument1 pageBluedart - INVOICE FORMAT - Courier DetailsPranay PanditaNo ratings yet

- Annual Question Paper 2019Document43 pagesAnnual Question Paper 2019Dr. Finto Raphel100% (1)

- Family Medicine Clerkship Logbook G3 FinalDocument76 pagesFamily Medicine Clerkship Logbook G3 FinalMohammed AlomarNo ratings yet

- SSRN Id2718869Document49 pagesSSRN Id2718869Mariana van GelderenNo ratings yet

- Transforms and Partial Differential Equations: (For Semester III)Document676 pagesTransforms and Partial Differential Equations: (For Semester III)rajavelNo ratings yet

- IS516 Part1 Sec1 2021Document20 pagesIS516 Part1 Sec1 2021Manoj Kumar SinghNo ratings yet

- Smart Drive Two Wheeler InsuranceDocument2 pagesSmart Drive Two Wheeler InsuranceAaditya raj SuryaNo ratings yet

- InvoiceDocument2 pagesInvoicesravani ReddyNo ratings yet

- UPS User ManualDocument52 pagesUPS User ManualStephen Rey CaldeaNo ratings yet

- K-Means Clustering Algorithm Described in DetailDocument10 pagesK-Means Clustering Algorithm Described in Detailadin80No ratings yet

- Zerihun AjibewDocument78 pagesZerihun AjibewMiskerNo ratings yet

- In The High Court of Sindh at KarachiDocument24 pagesIn The High Court of Sindh at KarachiAsad IshaqNo ratings yet

- Courier Shipping Bill (CSB) - V (See Regulation 6 (3) ) : Page 1 of 2Document10 pagesCourier Shipping Bill (CSB) - V (See Regulation 6 (3) ) : Page 1 of 2VENI PRAKASH MANIHARNo ratings yet

- Chapter 1: The Accountant'S Role in The Organization: True/FalseDocument9 pagesChapter 1: The Accountant'S Role in The Organization: True/FalseSittie Ainna A. UnteNo ratings yet

- Whitney Review 6869 WhitDocument60 pagesWhitney Review 6869 WhitrataburguerNo ratings yet

- ENKOnail Nail MachineDocument1 pageENKOnail Nail MachinelipezaoNo ratings yet

- List State Wise Nodal Officers NewDocument20 pagesList State Wise Nodal Officers NewSurbhi SonigraNo ratings yet

- 1987 Haapasalo, M., & Ørstavik, D. (1987) - in Vitro Infection and of Dentinal Tubules. Journal of Dental ResearchDocument5 pages1987 Haapasalo, M., & Ørstavik, D. (1987) - in Vitro Infection and of Dentinal Tubules. Journal of Dental ResearchAlexandra Illescas GómezNo ratings yet

- Crompton Fans Decor Catalogue 2020 5ffea83880b6b8000158ed63Document120 pagesCrompton Fans Decor Catalogue 2020 5ffea83880b6b8000158ed63Vr BenioNo ratings yet

- Coconut Vinegar Production GuideDocument2 pagesCoconut Vinegar Production GuideAllan BeceraNo ratings yet

- Report - Case No. 21-001-1 With Exhibits For PublicDocument128 pagesReport - Case No. 21-001-1 With Exhibits For PublicAdam ThompsonNo ratings yet

- Pb5a 2ansDocument20 pagesPb5a 2ansDevika Sharma100% (1)

- OC Relaxation Circular Dated 07.07.2022Document3 pagesOC Relaxation Circular Dated 07.07.2022hussain maNo ratings yet

- NSDC REoI Oct2022-23 AndhraPradeshDocument49 pagesNSDC REoI Oct2022-23 AndhraPradeshDiwakar DwivediNo ratings yet

- Sickle Cell Disease - The Indian PerspectiveDocument209 pagesSickle Cell Disease - The Indian PerspectiveV L Gupta100% (2)

- Mycotoxins: Factors Influencing Production and Control StrategiesDocument32 pagesMycotoxins: Factors Influencing Production and Control StrategiesMarcio SitoeNo ratings yet

- Financial Competency Assessment Model 2167 0234 1000317Document7 pagesFinancial Competency Assessment Model 2167 0234 1000317sabetaliNo ratings yet

- Https Onetimeregn - Haryana.gov - in PrintApp - AspxDocument3 pagesHttps Onetimeregn - Haryana.gov - in PrintApp - AspxYogita TanwarNo ratings yet

- Lady Beetles: A Beneficial Biocontrol Agent for Crop ProtectionDocument8 pagesLady Beetles: A Beneficial Biocontrol Agent for Crop ProtectionRhene BarcelonNo ratings yet

- J Tust 2014 04 007Document9 pagesJ Tust 2014 04 007YudiNo ratings yet

- Dec - Nithya - istqbAT - Vue Bill2Document2 pagesDec - Nithya - istqbAT - Vue Bill2kumarinithuNo ratings yet

- Phys 158 Final Exam PackageDocument35 pagesPhys 158 Final Exam PackageIsha ShuklaNo ratings yet

- Estimate Gadawara Power Plant NTPCDocument418 pagesEstimate Gadawara Power Plant NTPCSarin100% (1)

- ISA 3.0 E-Learning Assessment TestDocument20 pagesISA 3.0 E-Learning Assessment TestCAAniketGangwalNo ratings yet

- Solutions Manual For Stochastic Modeling: Analysis and SimulationDocument130 pagesSolutions Manual For Stochastic Modeling: Analysis and SimulationhaidarNo ratings yet

- CLASS LESSONS ON ANIMAL HEROESDocument17 pagesCLASS LESSONS ON ANIMAL HEROESNguyen Hoang NguyenNo ratings yet

- Sim Automotive-Industries 1899-12 1 4Document17 pagesSim Automotive-Industries 1899-12 1 4Jonathan BachmannNo ratings yet

- My Zone Card Statement: Payment SummaryDocument2 pagesMy Zone Card Statement: Payment SummaryKunal DasNo ratings yet

- Excel Practice - ExcelRDocument158 pagesExcel Practice - ExcelRSuraj suryawanshiNo ratings yet

- 20.12 Desember 2022Document6 pages20.12 Desember 2022cemplon007No ratings yet

- Senco Gold RHPDocument499 pagesSenco Gold RHPRahul MehtaNo ratings yet

- Analysis of Key Factors Affecting The Variation of Labour Productivity in Construction ProjectsDocument9 pagesAnalysis of Key Factors Affecting The Variation of Labour Productivity in Construction ProjectsJohn AjishNo ratings yet

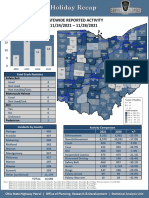

- Thanksgiving Holiday Traffic Report Ohio State Highway PatrolDocument2 pagesThanksgiving Holiday Traffic Report Ohio State Highway PatrolWKYC.comNo ratings yet

- Catalog CarPakDocument684 pagesCatalog CarPakBillNo ratings yet

- Corporate finance quizDocument43 pagesCorporate finance quizPriyanka MahajanNo ratings yet

- UML Class Diagram Explained With C++ Samples CPDocument2 pagesUML Class Diagram Explained With C++ Samples CPPAVAN MUTALIKDESAINo ratings yet

- 90 Days Roadmap: Dsa SheetDocument30 pages90 Days Roadmap: Dsa SheetJyothi BurlaNo ratings yet

- 22 1184 ResolutionDocument3 pages22 1184 ResolutionTMJ4 NewsNo ratings yet

- Itb - CCW Crane Upgrade RevDocument41 pagesItb - CCW Crane Upgrade RevElavarasan JayachandranNo ratings yet

- Bharat - The Neo India Report - FINALDocument40 pagesBharat - The Neo India Report - FINALAdityaSarafNo ratings yet

- AccuraCap PMSDocument35 pagesAccuraCap PMSAnkur100% (1)

- Statistics Chapter 15a (Index Numbers)Document20 pagesStatistics Chapter 15a (Index Numbers)Majid JamilNo ratings yet

- Admisions Brochure PGDM 2023 25Document31 pagesAdmisions Brochure PGDM 2023 25Pritish NayakNo ratings yet

- Group Personal Accident-Claim FormDocument4 pagesGroup Personal Accident-Claim FormVipul SharmaNo ratings yet

- X Rep Prim Nys 051822Document6 pagesX Rep Prim Nys 051822Paul BedardNo ratings yet

- Value Creation - Negara Bagian NSWDocument16 pagesValue Creation - Negara Bagian NSWasliBenoNo ratings yet

- AERO2321 - AERO2384 Lecture Presentation Canvas - Human Factors in Aviation - 2022Document72 pagesAERO2321 - AERO2384 Lecture Presentation Canvas - Human Factors in Aviation - 2022Hao SuNo ratings yet

- Aviation Safety and Security System: TRANS WORLD AIRLINES FLIGHT 800 CaseDocument13 pagesAviation Safety and Security System: TRANS WORLD AIRLINES FLIGHT 800 CaseHao SuNo ratings yet

- HF Issues Led to Fatal Aviation AccidentDocument7 pagesHF Issues Led to Fatal Aviation AccidentHao SuNo ratings yet

- PROPULSION. Short Introduction To Turboprop and TurbofanDocument15 pagesPROPULSION. Short Introduction To Turboprop and TurbofanHao SuNo ratings yet

- Making Wooden Glider in RMIT ReportDocument25 pagesMaking Wooden Glider in RMIT ReportHao SuNo ratings yet

- Connecting Flight Arrival InstructionsDocument1 pageConnecting Flight Arrival InstructionsAnna MNo ratings yet

- 2020年2月英語Document3 pages2020年2月英語うるるんNo ratings yet

- Citycraft: BOEING 737-8D6Document9 pagesCitycraft: BOEING 737-8D6Jose Cachay100% (1)

- Air Cargo DissertationDocument5 pagesAir Cargo DissertationHelpInWritingPaperIrvine100% (1)

- BRU Ops Contacts 15jun17Document3 pagesBRU Ops Contacts 15jun17marcoNo ratings yet

- 7 P's of Marketing Mix for Air IndiaDocument9 pages7 P's of Marketing Mix for Air Indiadivyanshu ranjanNo ratings yet

- CAP2547 - A Guide To The Airspace Modernisation StrategyDocument9 pagesCAP2547 - A Guide To The Airspace Modernisation StrategyMario GutiérrezNo ratings yet

- Advanced Air Mobility Emerging As A Multifaceted Industry - Aviation Week NetworkDocument6 pagesAdvanced Air Mobility Emerging As A Multifaceted Industry - Aviation Week NetworkturandotNo ratings yet

- HHCBDocument845 pagesHHCBVân LêNo ratings yet

- Answer (A) : Local Time in Singapore Is 11 Hours Ahead of TrinidadDocument11 pagesAnswer (A) : Local Time in Singapore Is 11 Hours Ahead of Trinidadfatima malhiNo ratings yet

- Ted Talk TravelDocument5 pagesTed Talk TravelAnka A. PeNo ratings yet

- Awb UsDocument2 pagesAwb UsAgungAchmadNo ratings yet

- OMC Compliance ChecklistDocument4 pagesOMC Compliance ChecklistNicole FerriNo ratings yet

- Aerodynamics QuestionsDocument37 pagesAerodynamics QuestionsTAMILARASU PNo ratings yet

- Manual - GloballArt - CYUL - Montreal v1.3Document10 pagesManual - GloballArt - CYUL - Montreal v1.3Marc ThomasNo ratings yet

- Riga ATCC1Document43 pagesRiga ATCC1Vakaris DobrovolskasNo ratings yet

- Shipping Guidelines For Lithium Ion Batteries: Dok-Typ: Information Dok-Nr.: IM - L - 005 Rev.: DDocument13 pagesShipping Guidelines For Lithium Ion Batteries: Dok-Typ: Information Dok-Nr.: IM - L - 005 Rev.: DKotadamNo ratings yet

- Aviation News 11.2022 PDFDocument84 pagesAviation News 11.2022 PDFNicky HoldenNo ratings yet

- Training On The Albatros L39 With "Fly & Fun": Breaking NewsDocument3 pagesTraining On The Albatros L39 With "Fly & Fun": Breaking NewsHit EssNo ratings yet

- Route StructureDocument3 pagesRoute StructureAndrei Gideon ReyesNo ratings yet

- 2021 - 09 - 17 Boeing Freight Transport Update For AirAsia-TeleportDocument24 pages2021 - 09 - 17 Boeing Freight Transport Update For AirAsia-TeleportRojana ChareonwongsakNo ratings yet

- Agi Questions Pages 2Document2 pagesAgi Questions Pages 2vardahorzeNo ratings yet

- Third Edition, 1963.Document46 pagesThird Edition, 1963.João MachadoNo ratings yet

- Airport and Airways EngineeringDocument25 pagesAirport and Airways EngineeringIrish Joy ValdehuezaNo ratings yet

- L8 Air TransportDocument28 pagesL8 Air TransportNiran NadarajaNo ratings yet

- Preflight Briefing ChecklistDocument1 pagePreflight Briefing ChecklistMohamed SamirNo ratings yet

- ConcordeDocument4 pagesConcordeSwaroop BurluNo ratings yet

- MRO Business Model - A Comprehensive GuideDocument9 pagesMRO Business Model - A Comprehensive GuideAndrew NaiduNo ratings yet

- Airport Engineering - Loksewa Full NoteDocument177 pagesAirport Engineering - Loksewa Full NoteAshish Thapa Magar100% (2)

- PRINT AGO 1 Airline GeographyDocument8 pagesPRINT AGO 1 Airline GeographyArosha RanaweeraNo ratings yet