Professional Documents

Culture Documents

Ethical Dilemmas Faced by The Company in The Past or Present

Uploaded by

Sanaiya JokhiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ethical Dilemmas Faced by The Company in The Past or Present

Uploaded by

Sanaiya JokhiCopyright:

Available Formats

Ethical Dilemmas faced by the company in the past or present:

As per the Torrent power limited v/s Gujarat electricity regulatory commission case, we can

say that paying taxes to the Government is a must. The top-most unethical practice that most

of the companies are accused some time or later is the practice of sabotaging the books of

accounts for either tax evasion or increasing the profits by wrong means. There always lies an

ethical dilemma of paying taxes to the government for the welfare of the society or using the

money saved by tax evasion in the growth of the company. Well, the ethical dilemma is

whether to work for the betterment of the whole society which lets you do your business in

the first place and which should be one of your moral duties or illicitly evade the taxes for the

betterment of only your company.

Here, in the second case, Torrent Power Ltd. was supposed to have only around 7000 tons of

coal, whereas at that time they were possessing around 9000 tons of coal. When the custom

duty department was not allowed by Torrent Power Ltd. to carry out their inquiries, the

matter was handed over to the court. Here, the judgement came that the custom duties

department should be allowed to carry out further investigations. This shows us that there

would be some fault or some doubt at the part of Torrent Power Ltd. and only then would the

court allow the custom duties department to carry investigations. Now the ethical dilemma

here is, is it fine to possess the illicit amount of coal, which is a rare resource and indulging in

such activities.

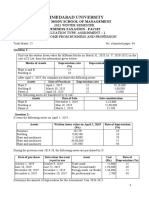

For these ethical dilemmas mentioned above, we should carry out the three-step check list:

The Case Is it illegal? Does it violate any Does it affect any

professional

people?

standards?

Torrent power limited v/s Yes Yes Yes

Gujarat electricity regulatory

commission

Torrent power ltd. v/s Union of Yes* Yes* No

India

Torrent power ltd. v/s Mahendra No No Yes*

Singh

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Jio SIM Card: Microeconomics Project I Submitted To Faculty: Sonal Yadav Date of Submission: 24 September, 2018Document10 pagesJio SIM Card: Microeconomics Project I Submitted To Faculty: Sonal Yadav Date of Submission: 24 September, 2018Sanaiya JokhiNo ratings yet

- Business Ethics (Mgt161) : Tata Sons PVT LTDDocument13 pagesBusiness Ethics (Mgt161) : Tata Sons PVT LTDSanaiya JokhiNo ratings yet

- Business Ethics (MGT161) Section 1 Report On Tata Sons Pvt. Ltd. Assignment - 2Document27 pagesBusiness Ethics (MGT161) Section 1 Report On Tata Sons Pvt. Ltd. Assignment - 2Sanaiya JokhiNo ratings yet

- SanaiyaJokhi 1811391 BTAssignment2Document11 pagesSanaiyaJokhi 1811391 BTAssignment2Sanaiya JokhiNo ratings yet

- Business Taxation Win 21Document71 pagesBusiness Taxation Win 21Sanaiya JokhiNo ratings yet

- BT PPTs AllDocument213 pagesBT PPTs AllSanaiya JokhiNo ratings yet

- FAC125 BT Asgn 1 Win 21Document4 pagesFAC125 BT Asgn 1 Win 21Sanaiya JokhiNo ratings yet

- MGT 333 - Group 8 - ReportDocument27 pagesMGT 333 - Group 8 - ReportSanaiya JokhiNo ratings yet