Professional Documents

Culture Documents

Accounting Concept

Uploaded by

NISHANTH P CHOYAL 22285120 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

Accounting concept

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageAccounting Concept

Uploaded by

NISHANTH P CHOYAL 2228512Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

'i.

nancial Statements - I · 337

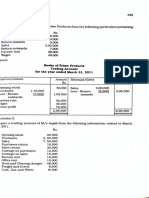

Analysle of Trial Balance of Anldt u on March 31, 2011

. .

Account Title Elements L.F. Debit Credit

Amount r Amount

Rs. Rs.

Cash Asset 1,000

Capital Equity 12,000

Bank Asset 5,000

Sales Revenue 1,25,000

Wages Expense 8,000

Creditors Liability 15,000

Salaries Expense 25,000

10% Long-term loan Liability 5,000

'

(raised on April 0 1, 2004)

Furniture Asset 15,000

Commission received Revenue 5,000

Rent of building Expense 13,000

Debtors Asset 15,500

Bad debts Expense 4,500

Purchases Expense 75,000

'

1,62,000 1,62,000

1.4 Trading and Profit and Loss Account

'rading and Profit and

Loss account is prepared to determine the profit earned

r loss sustained by the business enterprise during the accounting period. It

; basically a summaiy of revenues and expenses of the business and calculates

lie net figure termed as profit or loss. Profit is revenue less expenses. If

xpenses .are more than revenues, the figure is termed as loss. Trading and

rofit and Loss account summarises the performance for an accounting period.

: is achieved by transferring the balances of revenues and ·expenses to the

rading and profit and loss account from the trial balance. Trading and Profit

nd Loss account is also an account with Debit and Credit sides. It can be

bserved that debit balances (representing expenses) and losses are transferred

) the debit side of the Trading and a Profit and Loss account and creqit

alance (representing revenues/gains) are transfered to its credit side'. •

.4.1 Relevant Items

1

in Trading and Profit and Loss Account·

he different items appearing in the trading and profit and loss account are

~lained hereunder:

:ems on the debit side .

(i) Opening stock : It is the stock of goods in hand at the beginning of the

accounting year. This is the stock .of goods which has been carried foiward

You might also like

- Class 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIDocument70 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIPathan KausarNo ratings yet

- Financial statements analysisDocument3 pagesFinancial statements analysisFEBRI IRAWANNo ratings yet

- Financial Statements AdjustmentsDocument65 pagesFinancial Statements AdjustmentsBhartiNo ratings yet

- Diagnostic Quiz On Accounting 2Document9 pagesDiagnostic Quiz On Accounting 2Anne Ford67% (3)

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- Financial Statements - II: 360 AccountancyDocument65 pagesFinancial Statements - II: 360 AccountancyshantX100% (1)

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- Financial StatementsDocument65 pagesFinancial StatementsApollo Institute of Hospital AdministrationNo ratings yet

- Journal and Ledger With List of Accounts PDFDocument2 pagesJournal and Ledger With List of Accounts PDFJen RossNo ratings yet

- Unit 3 AdjustmentsDocument8 pagesUnit 3 Adjustmentsdilipkumar.1267No ratings yet

- TASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraDocument4 pagesTASK-10: Submitted by Sincy Mathew Institute of Management and Technology, PunnapraSincy MathewNo ratings yet

- Chapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsDocument9 pagesChapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsSimran HarchandaniNo ratings yet

- Acct 2301 Spring 2010 TestDocument6 pagesAcct 2301 Spring 2010 Testamittutorials1985No ratings yet

- Basic Accounting EquationsDocument26 pagesBasic Accounting EquationsPradeep GuptaNo ratings yet

- Running a Small BusinessDocument20 pagesRunning a Small BusinessJenecil JavierNo ratings yet

- PRACTICE-SET-IN-BASIC-ACCOUNTING-converted (Repaired)Document33 pagesPRACTICE-SET-IN-BASIC-ACCOUNTING-converted (Repaired)mary josefaNo ratings yet

- Accounting Tutorials Day 1Document8 pagesAccounting Tutorials Day 1Richboy Jude VillenaNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- SET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsDocument9 pagesSET 1. Q.1 Explain Any Two Accounting Concepts With Example? AnsmuravbookNo ratings yet

- Dream Guitar Shop Financial ProjectionsDocument3 pagesDream Guitar Shop Financial ProjectionsJennilyn SolimanNo ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- Financial Accounting & AnalysisDocument2 pagesFinancial Accounting & AnalysisTangerine Ila TomarNo ratings yet

- Lecture 2Document23 pagesLecture 2Dalia SamirNo ratings yet

- Accounting 2 - Unit 3 - Lesson 1 To 3Document62 pagesAccounting 2 - Unit 3 - Lesson 1 To 3Merdwindelle AllagonesNo ratings yet

- Corporate Liquidation Problem SetDocument7 pagesCorporate Liquidation Problem SetMary Rose ArguellesNo ratings yet

- Only Chosen Records Are Maintained, Some Transaction Are Recorded in Narrative FormDocument3 pagesOnly Chosen Records Are Maintained, Some Transaction Are Recorded in Narrative FormmarinNo ratings yet

- Acct615 NjitDocument24 pagesAcct615 NjithjnNo ratings yet

- Financial Prep EntrepreneursDocument66 pagesFinancial Prep EntrepreneursRAHKAESH NAIR A L UTHAIYA NAIR100% (1)

- Accounting AssignmentDocument16 pagesAccounting AssignmentAarya SharmaNo ratings yet

- Statement of Cash Flows ExplainedDocument6 pagesStatement of Cash Flows ExplainedJmaseNo ratings yet

- Philippine high school student's accounting worksheetDocument7 pagesPhilippine high school student's accounting worksheetCha Eun WooNo ratings yet

- FABM 1 Lesson 7 The Accounting EquationDocument19 pagesFABM 1 Lesson 7 The Accounting EquationTiffany Ceniza100% (1)

- Acctg 111 Assign3 ReviewerDocument5 pagesAcctg 111 Assign3 ReviewerChris Jay LatibanNo ratings yet

- Week 2-1 SlidesDocument30 pagesWeek 2-1 SlidesLIAW ANN YINo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- ACCT1111 Chapter 2 LectureDocument61 pagesACCT1111 Chapter 2 LectureWky Jim100% (1)

- Session 1 Practice 3Document4 pagesSession 1 Practice 3yimin liuNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Financial Accounting by PmtycoonDocument56 pagesFinancial Accounting by PmtycoonsachinNo ratings yet

- Liquidation of CorporationDocument15 pagesLiquidation of CorporationMacie MenesesNo ratings yet

- MB0025 Financial and Management AccountingDocument7 pagesMB0025 Financial and Management Accountingvarsha100% (1)

- Acc 111Document10 pagesAcc 111adrian CharlesNo ratings yet

- Venture Valuation MethodsDocument2 pagesVenture Valuation MethodsEmily HackNo ratings yet

- TEML10ACTIVITY 38 2nd CDocument3 pagesTEML10ACTIVITY 38 2nd CJennilyn SolimanNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- Lesson 4: Analyzing TransactionsDocument3 pagesLesson 4: Analyzing TransactionsDante SausaNo ratings yet

- Lesson 4 Week 5 FABM 2Document21 pagesLesson 4 Week 5 FABM 2Mikel Nelson AmpoNo ratings yet

- L03 - Accounting Classification and EquationsDocument29 pagesL03 - Accounting Classification and EquationsmardhiahNo ratings yet

- As 22.deffered - TaxDocument7 pagesAs 22.deffered - TaxabrastogiNo ratings yet

- Unit - 1 Accounting Equations & Journal & Ledger & TBDocument43 pagesUnit - 1 Accounting Equations & Journal & Ledger & TBShreyash PardeshiNo ratings yet

- Fabm SG 11 Q3 0903Document32 pagesFabm SG 11 Q3 0903James Kirby CuervoNo ratings yet

- Chap 3 Accounting Classification & Equation (Basic+Expended) - ClassDocument37 pagesChap 3 Accounting Classification & Equation (Basic+Expended) - Classnabkill100% (1)

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- Unit 3 - Trial BalanceDocument11 pagesUnit 3 - Trial Balancegogo chanNo ratings yet

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- ACT 1600 Fundamental of Financial Accounting The Basic Accounting EquationDocument34 pagesACT 1600 Fundamental of Financial Accounting The Basic Accounting EquationAbu AhmedNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Eco 3Document1 pageEco 3NISHANTH P CHOYAL 2228512No ratings yet

- Eco 1Document1 pageEco 1NISHANTH P CHOYAL 2228512No ratings yet

- EconomicsDocument1 pageEconomicsNISHANTH P CHOYAL 2228512No ratings yet

- Eco 2Document1 pageEco 2NISHANTH P CHOYAL 2228512No ratings yet

- Concepts of AccountingDocument1 pageConcepts of AccountingNISHANTH P CHOYAL 2228512No ratings yet

- Concepts of FinanceDocument1 pageConcepts of FinanceNISHANTH P CHOYAL 2228512No ratings yet

- (A) To Present A True: The BDocument1 page(A) To Present A True: The BNISHANTH P CHOYAL 2228512No ratings yet

- Books of Prime Products Account For The Year Ended March 31, 2011 CRDocument1 pageBooks of Prime Products Account For The Year Ended March 31, 2011 CRNISHANTH P CHOYAL 2228512No ratings yet

- Name PlateDocument13 pagesName PlateNISHANTH P CHOYAL 2228512No ratings yet

- 11 Working Capital ManagementDocument34 pages11 Working Capital Managementaashulheda100% (1)

- Theme 5 Management Science and Financial Management Course GuideDocument48 pagesTheme 5 Management Science and Financial Management Course Guidedanielnebeyat7No ratings yet

- Assumption College Final Exam ReviewDocument7 pagesAssumption College Final Exam ReviewJudithaNo ratings yet

- 6 Pas 23 28 PDFDocument1 page6 Pas 23 28 PDFcherry blossomNo ratings yet

- FM1 ActivityDocument4 pagesFM1 ActivityChieMae Benson Quinto100% (1)

- Project Report On Starting A New Business.... (Comfort Jeans)Document30 pagesProject Report On Starting A New Business.... (Comfort Jeans)lalitsingh76% (72)

- Chapter 1-Fundamentals of Financial AccountingDocument20 pagesChapter 1-Fundamentals of Financial AccountingAudrey ReyesNo ratings yet

- Chapter 1 With Quick CheckDocument48 pagesChapter 1 With Quick CheckSigit AryantoNo ratings yet

- 9706 m17 Ms 22Document11 pages9706 m17 Ms 22FarrukhsgNo ratings yet

- MYOB Accounting GlossaryDocument14 pagesMYOB Accounting GlossarySyirleen Adlyna OthmanNo ratings yet

- Sol Q5Document5 pagesSol Q5Elle VernezNo ratings yet

- REPORT ON BINGO INDUSTRIES' STRATEGIES AND PERFORMANCEDocument8 pagesREPORT ON BINGO INDUSTRIES' STRATEGIES AND PERFORMANCERaghav Rawat 2027407No ratings yet

- Advanced Financial Accounting 6th Edition Beechy Test BankDocument38 pagesAdvanced Financial Accounting 6th Edition Beechy Test Bankpottpotlacew8mf1t100% (15)

- Balance Sheet: As at 31st March, 2019Document2 pagesBalance Sheet: As at 31st March, 2019Mandeep BatraNo ratings yet

- Corporate Governance and Firm Performance in Emerging MarketsDocument40 pagesCorporate Governance and Firm Performance in Emerging MarketsThương PhạmNo ratings yet

- Gulf Air Co-Phil Branch v. CIRDocument3 pagesGulf Air Co-Phil Branch v. CIRJustine GaverzaNo ratings yet

- Economic Value Added Momentum TraditionalprofitabilitymeasuresDocument14 pagesEconomic Value Added Momentum TraditionalprofitabilitymeasuresWilliamCNo ratings yet

- Stone Container CorporationDocument11 pagesStone Container CorporationMeena100% (3)

- Investment Vs SavingsDocument2 pagesInvestment Vs Savingsgaurav dedhiaNo ratings yet

- Share Accounting-WPS OfficeDocument5 pagesShare Accounting-WPS OfficeSurendra SharmaNo ratings yet

- Grantmakers in the Arts National Capitalization Project Literature ReviewDocument19 pagesGrantmakers in the Arts National Capitalization Project Literature ReviewRoel SisonNo ratings yet

- Professional Ethics - , Accountancy For Lawyers and Bench-BarDocument27 pagesProfessional Ethics - , Accountancy For Lawyers and Bench-BarArpan Kamal100% (6)

- Financial Analysis Case StudyDocument14 pagesFinancial Analysis Case StudyPratik Prakash BhosaleNo ratings yet

- Dividend Decisions SolutionsDocument13 pagesDividend Decisions SolutionsHarsha VardhanNo ratings yet

- PT Zamklik Closing Journal Entry December 2022 (In Rupiah)Document1 pagePT Zamklik Closing Journal Entry December 2022 (In Rupiah)ahmadiNo ratings yet

- Cost Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesCost Accounting: The Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Types of Tenders ExplainedDocument7 pagesTypes of Tenders ExplainedajithNo ratings yet

- MBA Accounting 4 Managers MSTDocument2 pagesMBA Accounting 4 Managers MSTrichadinrajNo ratings yet

- Topic 5 - Single-Entry MethodDocument49 pagesTopic 5 - Single-Entry MethodMary Yvonne AresNo ratings yet

- On January 1 2018 The General Ledger of Dynamite FireworksDocument2 pagesOn January 1 2018 The General Ledger of Dynamite FireworksAmit PandeyNo ratings yet