Professional Documents

Culture Documents

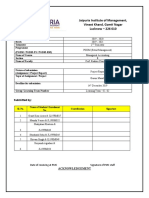

Simple Specimen of Cost Sheet

Uploaded by

Krishna Giri0 ratings0% found this document useful (0 votes)

9 views5 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views5 pagesSimple Specimen of Cost Sheet

Uploaded by

Krishna GiriCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Simple Specimen of Cost Sheet

Statement of Cost Sheet

For the period ……………

Particular Amount

Direct material cost------------------------------------------------------------------------------------------------------ xxx

Direct labour cost-------------------------------------------------------------------------------------------------------- xxx

Direct expenses or chargeable expenses--------------------------------------------------------------------------- xxx

Prime cost---------------------------------------------------------------------------------------------------------- xxx

Add: Factory Overhead------------------------------------------------------------------------------------------------- xxx

Factory Cost/Work Cost/Manufacturing Cost------------------------------------------------------------- xxx

Add: Office and administrative overhead-------------------------------------------------------------------------- xxx

Cost of Production (COP)--------------------------------------------------------------------------------------- xxx

Add: Selling and distribution overhead----------------------------------------------------------------------------- xxx

Total cost /Cost of sales------------------------------------------------------------------------------------------ xxx

Add: Profit----------------------------------------------------------------------------------------------------------------- xxx

Sales Revenue------------------------------------------------------------------------------------------------------ xxx

Tender or Quotation sheet

Tender or quotation price is estimated price for future period. For determination

of tender or quotation price generally the following two bases are used.

On the basis of output units

On the basis of Percentages of Overhead

1. % of factory overhead on Direct wages/ Productive wages/direct labour

= Factory overhead X 100 = …%

Direct wages

2. % of factory overhead on prime cost = Factory overhead X 100 = …%

Prime cost

3. % of office overhead on factory cost = Office overhead X 100 = …%

Factory cost

4. % of selling overhead on factory cost = Selling overhead X 100 = …%

Factory cost

5. Raw material per unit = Raw material used

Production unit

6. % of net profit on cost = Net profit X 100 = …%

Total cost

7. % of net profit on sales = Net profit X 100 = …%

Sales

Details Specimen of Cost Sheet

Statement of Cost Sheet

For the period ……………

Particulars Details Amounts Rs.

Opening stock of raw material-------------------------------------------------------- xxx

Add: Purchase of raw materials------------------------------------------------------------- xxx

Carriage, carriage inwards, carriage on purchase---------------------------------- xxx

Customs duty, octroi charge, import duty, freight on purchase------------------ xxx

Shipping charge, primary packing charge…………………………………… xxx

Less: Closing stock of raw material--------------------------------------------------------- (xxx)

Purchase return/Return outward------------------------------------------------------ (xxx)

Raw material scrap--------------------------------------------------------------------- (xxx) xxx

A Cost of raw material used/ value of raw material used-----------------------

Add: Direct wages, direct labour, productive wages, factory labour------------------ xxx xxx

Direct or Chargeable expenses------------------------------------------------------ xxx xxx

B Prime cost-------------------------------------------------------------------------------

Add: Factory overhead/work on cost

Indirect material, indirect wages, indirect labour, unproductive wage---------- xxx

Factory rent, rates and taxes, Factory insurance, Factory heating and lighting, xxx

Factory repairs and maintenance, power, fuel, coal, gas and water, xxx

depreciation on plant and machinery, depreciation on factory building, xxx

cleaning charges of factory, royalties on production, Drawing office salaries, xxx

Haulage charge, experimental charge, postage and telephone, estimation xxx

expenses xxx

work general overhead, lubricants, consumable stores, work manager salary, xxx xxx

Welfare expenses of labour, Other factory/work/manufacturing overhead----- xxx xxx

Less: sale of scrap or by-product----------------------------------------------------------- (xxx) xxx

C Manufacturing cost/ Factory cost/Work cost incurred----------------------- (xxx)

Add: Opening stock of Work-in-progress (WIP)----------------------------------------- xxx

Less: Closing stock of Work-in-progress (WIP)------------------------------------------

D Manufacturing cost/ Factory cost/Work cost-----------------------------------

Add: Office and administrative overhead/ office on cost

xxx

Office rent and rates, insurance, printing and stationery, legal charge, Bank

xxx

Charges, general expenses, Telephone and telegram charges, Office salaries

xxx

Depreciation on furniture and office equipment and maintenance of office

xxx

Equipment, counting house salaries, Audit fees, Establishment expenses, xxx

xxx

General manager remuneration, Salaries to managing directors and office xxx

xxx

Staff, insurance of office building, sundry expenses, miscellaneous expenses xxx

xxx

Travelling expenses for office------------------------------------------------------- (xxx)

E Cost of Production (COP)----------------------------------------------------------- xxx

Add: Opening stock of Finished

goods-----------------------------------------------------

Less : Closing stock of Finished goods-----------------------------------------------------

F Cost of goods sold (COGS)----------------------------------------------------------- xxx

Add: Selling and distribution overhead xxx

Advertisement, Publicity expenses, Rent of showroom, warehouse ------------ xxx

Lighting, Heating and cleaning charge of showroom and warehouse-------------- xxx

Rent of delivery van, Depreciation of delivery van, showroom and warehouse-- xxx xxx

Sales man's salary, Sales manager remuneration, Travelling expenses------------- xxx xxx

Sales promotion charge, Exhibition charge, carriage on sales, Carriage outward, xxx xxx

Sales men's commission, Rent of sales department, Sales tax, sales of printing xxx

And stationery, Samples and other free gift, Bad debts and market research exp. XXX

G Cost of Sales/ Total cost-----------------------------------------------------------------

H Add/Less: Net profit/ Loss--------------------------------------------------------------

Sales Revenue ----------------------------------------------------------------------------

Determination of Profit

If sales is given, Profit = Net sales – Total cost or Cost of sales

If amount of sales is not given

a) If --------- percentage of profit on cost is given

Net profit = Total cost X % of profit on cost

b) If --------- percentage of profit on sales or selling price is given

Net profit = Total cost/ Cost of sales X % of profit X 100

100 - % of profit

Tender or Quotation sheet

Tender or quotation price is estimated price for future period. For determination

of tender or quotation price generally the following two bases are used.

On the basis of output units

On the basis of Percentages of Overhead

1. % of factory overhead on Direct wages/ Productive wages/direct labour

= Factory overhead X 100 = …%

Direct wages

2. % of factory overhead on prime cost = Factory overhead X 100 = …%

Prime cost

3. % of office overhead on factory cost = Office overhead X 100 = …%

Factory cost

4. % of selling overhead on factory cost = Selling overhead X 100 = …%

Factory cost

5. Raw material per unit = Raw material used

Production unit

6. % of net profit on cost = Net profit X 100 = …%

Total cost

7. % of net profit on sales = Net profit X 100 = …%

Sales

You might also like

- Cost and Cost SheetDocument10 pagesCost and Cost Sheetirfpav06No ratings yet

- Revised Unit 1 - Ch. - Methods of Costing - 25!07!2021Document9 pagesRevised Unit 1 - Ch. - Methods of Costing - 25!07!2021aayushgiri21No ratings yet

- Manufacturing Account-Ref - Material: SyllabusDocument5 pagesManufacturing Account-Ref - Material: SyllabusMohamed MuizNo ratings yet

- 7487 - SS2 First Term - 01 - Manufacturing AccountDocument6 pages7487 - SS2 First Term - 01 - Manufacturing AccountDon SimauluNo ratings yet

- Marathon Notes - Cost SheetDocument15 pagesMarathon Notes - Cost Sheetprogamerqwerty1122No ratings yet

- Unit and Output Cost Xost AccountingDocument2 pagesUnit and Output Cost Xost Accountingdk8393117No ratings yet

- Manufacturing Accounts Notes and QuestionsDocument31 pagesManufacturing Accounts Notes and QuestionsRoshan RamkhalawonNo ratings yet

- CHP 6. Cost Sheet - CapranavDocument14 pagesCHP 6. Cost Sheet - CapranavMonikaNo ratings yet

- Chapter 4 Income Measurement and ReportingDocument13 pagesChapter 4 Income Measurement and ReportingOmisha KhatiwadaNo ratings yet

- Manufacturing AccountsDocument10 pagesManufacturing Accountsamosoundo59No ratings yet

- 5.5 Manufacturing AccountsDocument6 pages5.5 Manufacturing AccountsZaynab ChowdhuryNo ratings yet

- Specimen of Cost SheetDocument3 pagesSpecimen of Cost SheetReema MahtoNo ratings yet

- Cost SheetDocument5 pagesCost Sheetgaurav gauravNo ratings yet

- Unit or Output Costing-I: (Cost Sheet, Cost Statement and Production Account)Document27 pagesUnit or Output Costing-I: (Cost Sheet, Cost Statement and Production Account)Anonymous 9bu4u6bNo ratings yet

- Calculate Product CostsDocument18 pagesCalculate Product Costsharsh singhNo ratings yet

- Calculate Product CostsDocument97 pagesCalculate Product CostsSumiya AkterNo ratings yet

- CA & CMA StatementsDocument2 pagesCA & CMA StatementsArsalan KhalidNo ratings yet

- Cost of Goods Sold StatementDocument5 pagesCost of Goods Sold Statementaisharafiq1987100% (10)

- Income Statement and Balance SheetDocument20 pagesIncome Statement and Balance Sheetpankaj tiwariNo ratings yet

- Cost SheetDocument6 pagesCost SheetabhineshNo ratings yet

- Cost Marathon Notes Session 1 Pranav PopatDocument71 pagesCost Marathon Notes Session 1 Pranav PopatRohit bhulNo ratings yet

- Manufacturing Account LESSON NOTESDocument11 pagesManufacturing Account LESSON NOTESKourtnee Francis100% (2)

- Mickey EntrepreneurshipDocument80 pagesMickey EntrepreneurshipJamaica AdayNo ratings yet

- Cost Accountancy: Bba - Ii Semester - IiiDocument19 pagesCost Accountancy: Bba - Ii Semester - IiiNishikant RayanadeNo ratings yet

- Chapter 4 Cost SheetDocument9 pagesChapter 4 Cost SheetDevender SinghNo ratings yet

- (A) Prime Cost (+) Factory OverheadsDocument1 page(A) Prime Cost (+) Factory OverheadsDimpy SoniNo ratings yet

- Manufacturing AccountDocument2 pagesManufacturing Accountmeelas123100% (2)

- CH - 3 Cost AccountingDocument23 pagesCH - 3 Cost AccountingKhushali OzaNo ratings yet

- Chargeable ExpensesDocument33 pagesChargeable ExpensesMahmud MugdhoNo ratings yet

- Chapter 7:manufacturing AccountDocument23 pagesChapter 7:manufacturing Accountmariyam_aziz_193% (14)

- Unit 2 - Manufacturing Accounts Lecture NotesDocument9 pagesUnit 2 - Manufacturing Accounts Lecture Noteslashy123booNo ratings yet

- Dr. (CA) Ankita Jain: Unit - IiiDocument11 pagesDr. (CA) Ankita Jain: Unit - IiiBHAVYA SHARMANo ratings yet

- Financial Tools Week 2 Block BDocument15 pagesFinancial Tools Week 2 Block BBelen González BouzaNo ratings yet

- 103 Sample ChapterDocument28 pages103 Sample ChapterRithik VisuNo ratings yet

- 103 Sample Chapter PDFDocument28 pages103 Sample Chapter PDFKomal MusaleNo ratings yet

- Accounting For Labor & Manufacturing OverheadDocument10 pagesAccounting For Labor & Manufacturing OverheadSarah Nicole S. LagrimasNo ratings yet

- Manufacturing AccountDocument50 pagesManufacturing AccountfarissaharNo ratings yet

- Accounting ReviewerDocument7 pagesAccounting ReviewerJaphet RiveraNo ratings yet

- Cost AscertainmentDocument36 pagesCost AscertainmentParamjit Sharma100% (6)

- Chapter 13Document11 pagesChapter 13Avox EverdeenNo ratings yet

- Manufacturing Presentation 1Document6 pagesManufacturing Presentation 1tshenolochristianNo ratings yet

- Job OrderDocument53 pagesJob OrderAdilla DillaNo ratings yet

- Week 02 - Manufacturing AccountsDocument7 pagesWeek 02 - Manufacturing AccountsTeresa ManNo ratings yet

- Manufacturing Accounts NotesDocument9 pagesManufacturing Accounts NotesFegason FegyNo ratings yet

- Accounting For Managers, IIAM-VizagDocument13 pagesAccounting For Managers, IIAM-VizagDileep DeepuNo ratings yet

- Manufacturing AccountsDocument5 pagesManufacturing AccountsADEYANJU AKEEMNo ratings yet

- Cost Sheet Detail FormatDocument5 pagesCost Sheet Detail Formatchoudharyleena.mbaNo ratings yet

- Format Cost Sheet Calculate Product CostsDocument3 pagesFormat Cost Sheet Calculate Product CostsShubakar ReddyNo ratings yet

- Manufacturing AccountDocument36 pagesManufacturing AccountSaksham RainaNo ratings yet

- Engineering Economic CostingDocument70 pagesEngineering Economic CostingKishiwaNo ratings yet

- Cost & Elements of Costs: Isb & MDocument23 pagesCost & Elements of Costs: Isb & MAdarsh AgarwalNo ratings yet

- Manufacturing AccountDocument26 pagesManufacturing AccountwilbertNo ratings yet

- Cost NotesDocument49 pagesCost NotesHarriniNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- Garam Masala Project ReportDocument14 pagesGaram Masala Project ReportAman SrivastavaNo ratings yet

- Financial Accounting 2A Sick Test MemoDocument10 pagesFinancial Accounting 2A Sick Test MemoMapsipiexNo ratings yet

- Financial Statement AnalysisDocument37 pagesFinancial Statement AnalysisShilpa AroraNo ratings yet

- Azgard Nine Ratio AnalysisDocument6 pagesAzgard Nine Ratio AnalysisMohammad Adil ChoudharyNo ratings yet

- BP.080 F P M: Fixed AssetsDocument26 pagesBP.080 F P M: Fixed AssetsKrishaNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- 9706 s12 QP 43Document8 pages9706 s12 QP 43Adrian JosephianNo ratings yet

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- Hul Wacc PDFDocument1 pageHul Wacc PDFutkNo ratings yet

- PAS 33: Earnings Per Share: Prepared By: Llanah Mae S. Moambing Faculty - Accountancy Dep'tDocument29 pagesPAS 33: Earnings Per Share: Prepared By: Llanah Mae S. Moambing Faculty - Accountancy Dep'tGeoff MacarateNo ratings yet

- AS Book PDFDocument68 pagesAS Book PDFmonikaNo ratings yet

- Nelson Daganta CashDocument10 pagesNelson Daganta CashDan RioNo ratings yet

- Friedlan4e SM Ch03Document115 pagesFriedlan4e SM Ch03Sunrise ConsultingNo ratings yet

- Lecture Discussion On Worksheet Preparation To Post Closing Trial Balance November 092020Document18 pagesLecture Discussion On Worksheet Preparation To Post Closing Trial Balance November 092020Garp BarrocaNo ratings yet

- Pyramid Analysis Solution: Strictly ConfidentialDocument3 pagesPyramid Analysis Solution: Strictly ConfidentialSueetYeingNo ratings yet

- MonteBianco-Solution - With Comments and AlternativesDocument27 pagesMonteBianco-Solution - With Comments and AlternativesGiudittaBiancaLuràNo ratings yet

- p2 - Guerrero Ch11Document24 pagesp2 - Guerrero Ch11JerichoPedragosa100% (2)

- Business Combination: Expense ImmediatelyDocument7 pagesBusiness Combination: Expense ImmediatelyKristel SumabatNo ratings yet

- Income Tax Return Sat-Ita22: Official StampDocument6 pagesIncome Tax Return Sat-Ita22: Official Stamptsere butsere50% (2)

- Principles-Based Versus Rules-Based StandardsDocument8 pagesPrinciples-Based Versus Rules-Based StandardsKrisanNo ratings yet

- Comparative StatementDocument21 pagesComparative StatementMukulNo ratings yet

- Basic Accounting Terms ListDocument5 pagesBasic Accounting Terms ListRichardDinongPascualNo ratings yet

- Business Math and Financial StatementsDocument3 pagesBusiness Math and Financial StatementsJohnCzyril Deladia Domens100% (1)

- Depreciation Methods GuideDocument3 pagesDepreciation Methods GuideGhulam-ullah KhanNo ratings yet

- Annual Report Analysis - Oct-14-EDEL PDFDocument259 pagesAnnual Report Analysis - Oct-14-EDEL PDFhiteshaNo ratings yet

- Abs3 TheoryDocument31 pagesAbs3 TheoryHassenNo ratings yet

- Profitability Analysis Report SampleDocument11 pagesProfitability Analysis Report SampleArfel Marie FuentesNo ratings yet

- Assignment 2Document7 pagesAssignment 2Dat DoanNo ratings yet

- Corporate Liquidation-ExercisesDocument5 pagesCorporate Liquidation-ExercisesGel Bert Jalando-onNo ratings yet

- Problem 1Document3 pagesProblem 1Shiene MedrianoNo ratings yet