Professional Documents

Culture Documents

Chapter 15

Uploaded by

Ellyssa Ann MorenoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 15

Uploaded by

Ellyssa Ann MorenoCopyright:

Available Formats

CHAPTER 15—1 (ACP)

Template Company provided the following with respect to marketable equity securities held as

“trading”.

1. The entity carried the following securities on December 31, 2020:

Cost Market

A ordinary – 4,000 shares 330,000 300,000

B ordinary – 1,000 shares 200,000 160,000

C preference – 2,000 shares 300,000 310,000

830,000 770,000

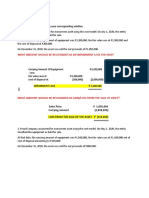

2. On June 30, 2021, the entity sold all the B ordinary shares for P140,000.

3. On December 31, 2021, the securities are quoted as follows:

A Ordinary 80

C Preference 180

Required:

Prepare journal entries to record the transactions.

CHAPTER 15—2 (IAA)

On January 1, 2020, Spark Company purchased the following trading securities:

Cost FV 12/31/20

Aura Company ordinary 600,000 650,000

Bora Company preference 350,000 200,000

Cara Company bonds 500,000 400,000

On October 1, 2021, the entity sold one-half of Aura Company ordinary for P375,000.

On December 31, 2021, the fair value of the remaining securities was P800,000.

Required:

Prepare journal entries to record the transactions.

CHAPTER 15—3 (IAA)

Splendid Company purchased equity securities during 2020 to be held as investments. The cost

and market value of the investments are:

December 31, 2020 Cost Market

Trading securities 2,000,000 2,500,000

Securities not held for trading 3,000,000 2,900,000

December 31, 2021

Trading securities 2,000,000 2,200,000

Securities not held for trading 3,000,000 2,300,000

The securities not held for trading are measured at fair value through other comprehensive

income by irrevocable election.

Required:

Prepare journal entries to record the transactions.

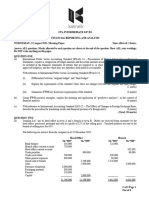

CHAPTER 15—4 (IAA)

Transitory Company acquired the following equity securities:

December 31, 2020 Cost Market

Moon Company 200,000 120,000

Star Company 400,000 280,000

Sun Company 600,000 650,000

December 31, 2021

Moon Company 200,000 220,000

Star Company 400,000 300,000

Sun Company 600,000 580,000

The equity securities do not qualify as held for trading.

The entity has elected irrevocably to present changes in fair value in other comprehensive

income.

Required:

Prepare journal entries on December 31, 2020 and December 31, 2021.

CHAPTER 15—5 (IAA)

Aborigine Company reported the following accounts in the statement of financial position on

January 1, 2020:

Noncurrent assets

Financial asset – FVOCI 4,000,000

Market adjustment for unrealized loss ( 500,000)

Market Value 3,500,000

Other comprehensive income

Unrealized loss ( 500,000)

An analysis of the investment portfolio revealed the following on December 31, 2020.

XYZ ordinary share 1,000,000 1,200,000

ABC ordinary share 2,500,000 2,000,000

RST preference share 500,000 200,000

4,000,000 3,400,000

On July 1, 2021, the ABC ordinary share was sold for P2,100,000.

On December 31, 2021, the remaining investments have the following market value:

XYZ ordinary share 1,000,000

RST preference share 150,000

Required:

1. Prepare journal entry to recognize the decrease in value on December 31, 2020.

2. Prepare journal entry to record the sale of ABC ordinary share on July 1, 2021.

3. Prepare journal entry on December 31, 2021 to recognize the change in fair value.

CHAPTER 15—6 (IAA)

During 2020, the first year of operations, Beneath Company purchased the following equity

securities:

Cost MV 12/31/20 MV 12/31/21

Security One 2,200,000 1,400,000 900,000

Security Two 700,000 1,000,000 1,100,000

Security Three 1,600,000 1,500,000 1,600,000

Security Four 2,000,000 2,500,000 1,200,000

Security One and Security Two are held for trading and Security Three and Security Four are

measured as at fair value through other comprehensive income by election.

During 2021, the entity sold one-half of Security One for P1,000,000, and one-half of Security

Four for P1,300,000.

Required:

Prepare journal entries for 2020 and 2021.

CHAPTER 15—7 (ACP)

You might also like

- Chapter 09 Testbank: 9-1 EducationDocument21 pagesChapter 09 Testbank: 9-1 Educationerma MONTERDE100% (5)

- Use The Following Information For The Next Two (2) QuestionsDocument37 pagesUse The Following Information For The Next Two (2) QuestionsAbdulmajed Unda Mimbantas50% (4)

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAngelo Payawal100% (1)

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho100% (2)

- Investment Quizzers Investment QuizzersDocument16 pagesInvestment Quizzers Investment QuizzersAnna Taylor0% (1)

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho50% (2)

- Apr 4/accounting For Business Combinations: General InstructionDocument8 pagesApr 4/accounting For Business Combinations: General InstructionJoannah maeNo ratings yet

- Auditing Investments 2Document5 pagesAuditing Investments 2Sabel FordNo ratings yet

- Shareholders EquityDocument2 pagesShareholders EquityAudrey LiberoNo ratings yet

- Ratio (1) FDocument4 pagesRatio (1) FKathryn Bianca Acance100% (1)

- Instalment/Consignment Sales: Partl: Theory of AccountsDocument5 pagesInstalment/Consignment Sales: Partl: Theory of AccountsFeliz Victoria CañezalNo ratings yet

- Uniform Format of Accounts For Central Automnomous BodiesDocument46 pagesUniform Format of Accounts For Central Automnomous Bodiesarun197467% (6)

- Marketable SecuritiesDocument18 pagesMarketable Securitiesammaramansoor133% (3)

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDianna DayawonNo ratings yet

- Lecture 03 FA at FV Through OCIDocument1 pageLecture 03 FA at FV Through OCIJohnallenson DacosinNo ratings yet

- Financial Assets at Fair Value ProblemsDocument5 pagesFinancial Assets at Fair Value ProblemsJames R JunioNo ratings yet

- FAR Review InvestmentsDocument14 pagesFAR Review Investmentsduguitjinky20.svcNo ratings yet

- Financial Assets at Fair Value (Investments) Basic ConceptsDocument2 pagesFinancial Assets at Fair Value (Investments) Basic ConceptsMonica Monica0% (1)

- InvestmentsDocument7 pagesInvestmentsIvan LandaosNo ratings yet

- InvestDocument5 pagesInvestJesselle H. BANAWOLNo ratings yet

- Soal Asistensi 9 AK2 - 2021 (IND)Document3 pagesSoal Asistensi 9 AK2 - 2021 (IND)Zaki Al MadaniNo ratings yet

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezNo ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Pract 1 - Exam1Document8 pagesPract 1 - Exam1MimiNo ratings yet

- Accounting For Business Combinations Final Term ExaminationDocument3 pagesAccounting For Business Combinations Final Term ExaminationJasper LuagueNo ratings yet

- Audit Problem Investments Part 1Document3 pagesAudit Problem Investments Part 1Rio Cyrel CelleroNo ratings yet

- Aud Sample UpdatedDocument36 pagesAud Sample Updatedreynald john dela cruzNo ratings yet

- Exercise - Part 3Document10 pagesExercise - Part 3lois martinNo ratings yet

- Seatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Document4 pagesSeatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Joseph AsisNo ratings yet

- Components of Comprehensive IncomeDocument24 pagesComponents of Comprehensive IncomeApril Mae Intong TapdasanNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Lec8 - Class Exercise 4aDocument2 pagesLec8 - Class Exercise 4aMUHAMMAD HAMIZAN BIN ROSMAN MoeNo ratings yet

- Lec8 - Class Exercise 4aDocument2 pagesLec8 - Class Exercise 4aMUHAMMAD HAMIZAN BIN ROSMAN MoeNo ratings yet

- Use The Following Information For The Next Seven Questions:: Activity 2.4Document2 pagesUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- Audit of Investments - Set BDocument4 pagesAudit of Investments - Set BZyrah Mae Saez0% (1)

- Hyperinflation and Current CostDocument2 pagesHyperinflation and Current CostAna Marie IllutNo ratings yet

- 15 Questions Financial Asset at Fair Value 1Document1 page15 Questions Financial Asset at Fair Value 1bernadeth.lorzanoNo ratings yet

- Chapter15 BuenaventuraDocument10 pagesChapter15 BuenaventuraAnonnNo ratings yet

- 5 6145300324501422422 PDFDocument3 pages5 6145300324501422422 PDFBeverly MindoroNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Chapter 33 PFRS 5 Discontinued OperationsDocument2 pagesChapter 33 PFRS 5 Discontinued OperationsstudentoneNo ratings yet

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersAlyssa CasimiroNo ratings yet

- Intermediate Accounting Chapters 6,7,8Document63 pagesIntermediate Accounting Chapters 6,7,8Jonathan NavalloNo ratings yet

- B02 Final Exam Review QuestionsDocument8 pagesB02 Final Exam Review QuestionsnigaroNo ratings yet

- 6898 - Equity InvestmentsDocument2 pages6898 - Equity InvestmentsAljur SalamedaNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- December 2021 CA Zambia QaDocument403 pagesDecember 2021 CA Zambia QaChisanga Chiluba100% (1)

- CTFP Unit 2 CG ProblemsDocument3 pagesCTFP Unit 2 CG ProblemsKshitishNo ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- Exercise Number 8 (E08) : InvestmentsDocument12 pagesExercise Number 8 (E08) : Investmentszhyrus macasilNo ratings yet

- Quiz 1 ForexDocument8 pagesQuiz 1 ForexSara ChanNo ratings yet

- AFAR - 10-Foreign Currency - Transaction and TranslationDocument5 pagesAFAR - 10-Foreign Currency - Transaction and TranslationDaniela AubreyNo ratings yet

- Audit of Liabilities - Set BDocument4 pagesAudit of Liabilities - Set BZyrah Mae Saez0% (1)

- Tutorial 10 Consolidation: Intragroup Transactions (Chapter 28)Document4 pagesTutorial 10 Consolidation: Intragroup Transactions (Chapter 28)DGNo ratings yet

- AP - InvestmentDocument7 pagesAP - InvestmentGrace Patricia TeopeNo ratings yet

- ACC 121 Chapter 55Document4 pagesACC 121 Chapter 55Mohammad saripNo ratings yet

- 04 Additional Exercises On InvestmentsDocument3 pages04 Additional Exercises On InvestmentsMaxin TanNo ratings yet

- Wa0003.Document6 pagesWa0003.joanNo ratings yet

- Individual AssignmentDocument3 pagesIndividual AssignmentLoveness NyakurimwaNo ratings yet

- AFA Worksheet IIDocument7 pagesAFA Worksheet IIAbebeNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Moreno, Ellyssa Ann S. (Reaction Paper)Document3 pagesMoreno, Ellyssa Ann S. (Reaction Paper)Ellyssa Ann MorenoNo ratings yet

- Milo CommercialDocument1 pageMilo CommercialEllyssa Ann Moreno100% (1)

- FAR-4210 Investment Property & Other Fund Investments: - T R S A ResaDocument4 pagesFAR-4210 Investment Property & Other Fund Investments: - T R S A ResaEllyssa Ann MorenoNo ratings yet

- Activity 03 Name: - ID No.: - Score: - Rating: - Problem 01Document3 pagesActivity 03 Name: - ID No.: - Score: - Rating: - Problem 01Ellyssa Ann MorenoNo ratings yet

- Financial Accounting The Impact On Decision Makers 10Th Edition Porter Solutions Manual Full Chapter PDFDocument68 pagesFinancial Accounting The Impact On Decision Makers 10Th Edition Porter Solutions Manual Full Chapter PDFchristinecohenceyamrgpkj100% (11)

- Royal Ceramic Lanka Financial Report AssesmentDocument6 pagesRoyal Ceramic Lanka Financial Report AssesmentRoshan Akaravita100% (1)

- Seatwork 11.1 TaliteDocument10 pagesSeatwork 11.1 Taliteandrea taliteNo ratings yet

- Chapter 1Document34 pagesChapter 1Aira Nhaira MecateNo ratings yet

- PAL0022 T3 - Topic 3Document10 pagesPAL0022 T3 - Topic 3Samuel KohNo ratings yet

- Cost Accounting: S.ClementDocument97 pagesCost Accounting: S.Clementshrav888No ratings yet

- Montgomery Public Schools AuditDocument105 pagesMontgomery Public Schools AuditMike CasonNo ratings yet

- Five Important Factors Influence Cost Volume Profit Analysis AreDocument9 pagesFive Important Factors Influence Cost Volume Profit Analysis Aresuraj banNo ratings yet

- Laporan Keuangan Kimia Farma PDFDocument197 pagesLaporan Keuangan Kimia Farma PDFAlmira ZulaikhaNo ratings yet

- 2016 AICPA FAR - DifficultDocument51 pages2016 AICPA FAR - DifficultTai D Giang100% (1)

- Dabur Financial ModelDocument44 pagesDabur Financial Modelpallavi thakurNo ratings yet

- Ch. IND AS 7 - Statement of Cash FlowDocument10 pagesCh. IND AS 7 - Statement of Cash FlowCharu JagetiaNo ratings yet

- Faculty of Commerce Department of Accountancy & Law SYLLABUS/QUESTION BANK (Session 2020-21)Document9 pagesFaculty of Commerce Department of Accountancy & Law SYLLABUS/QUESTION BANK (Session 2020-21)KARTIK SHARMANo ratings yet

- Financial Evaluation of LEASINGDocument7 pagesFinancial Evaluation of LEASINGmba departmentNo ratings yet

- Income Statement: (This Must Be in Landscape Upon Copy Pasting in Chapter 7 Strama Implem and Recom of Strama PaperDocument10 pagesIncome Statement: (This Must Be in Landscape Upon Copy Pasting in Chapter 7 Strama Implem and Recom of Strama PaperJoseph Angelo Aldea EscarezNo ratings yet

- Acct 108 Accounting For Business Combinations Quiz 4 - Intercompany Sales of AssetsDocument2 pagesAcct 108 Accounting For Business Combinations Quiz 4 - Intercompany Sales of AssetsGround ZeroNo ratings yet

- Proton Holdings BHD: New Inspiration From InspiraDocument5 pagesProton Holdings BHD: New Inspiration From InspiraikrambambangNo ratings yet

- Performance Evaluation and CompensationDocument34 pagesPerformance Evaluation and CompensationarunprasadvrNo ratings yet

- Cebu Company Answer KeyDocument4 pagesCebu Company Answer KeyMarcoNo ratings yet

- TRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseDocument44 pagesTRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseYukiNo ratings yet

- Prelims - P2 MockboardsDocument15 pagesPrelims - P2 MockboardsRommel RoyceNo ratings yet

- Individual Assignment Financial Accounting and Report 1Document7 pagesIndividual Assignment Financial Accounting and Report 1Sahal Cabdi AxmedNo ratings yet

- BEML - Visit Update - Oct 14Document5 pagesBEML - Visit Update - Oct 14Pradeep RaghunathanNo ratings yet

- 12 Task Performance 1Document2 pages12 Task Performance 1Zeniah LouiseNo ratings yet

- Assignment - 1 Marks - 25 Answer Any One of The Question Given Below in 1000 Words EachDocument3 pagesAssignment - 1 Marks - 25 Answer Any One of The Question Given Below in 1000 Words EachManibalanNo ratings yet