Professional Documents

Culture Documents

Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable Offence

Uploaded by

krishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable Offence

Uploaded by

krishCopyright:

Available Formats

This Question Paper is copyrighted property of AIR1CA Career Institute.

Sharing and Circulating it without

permission is punishable offence.

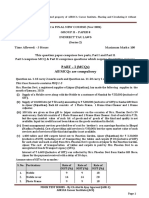

CA FINAL NEW COURSE (Nov 2021)

GROUP II – PAPER 7

DIRECT TAX LAWS

(Series 2)

Time Allowed: - 3 Hours Maximum Marks: 100

This question paper comprises two parts, Part I and Part II.

Part I comprises MCQ & Part II comprises questions which require descriptive answers.

All questions relate to A.Y. 2021-22 unless stated otherwise in the question.

PART – I (MCQs)

All MCQs are compulsory

Question no. 1-10 carry 2 marks each and Question no. 11-20 carry 1 mark each

This Case Scenario contains MCQ 1-4

Mr. Sarthak (age 37 years) a share broker, sold a building to his friend Anay, who is a dealer in

automobile spare parts, for ₹ 120 lakh on 10.11.2020, when the stamp duty value was ₹ 150 lakh.

The agreement was, however, entered into on 1.9.2020 when the stamp duty value was ₹ 140 lakh.

Mr. Sarthak had received a down payment of ₹ 15 lakh by a crossed cheque from Anay on the date

of agreement. Mr. Sarthak purchased the building for ₹ 95 lakh on 10.5.2018. Further, Mr. Sarthak

also sold an agricultural land (situated in a town which has a population of 9,800) for ₹ 60 lakhs to

Mr. Vivek on 01.03.2021, which he acquired on 15.06.2015 for ₹ 45 lakhs. Stamp duty value of

agricultural land as on 1.3.2021 is ₹ 75 lakhs

CII for F.Y. 2015-16; 254; F.Y. 2018-19: 280; F.Y. 2020-21: 301.

In the light of the above facts, you are required to answer the following:

1. Is there any requirement to deduct tax at source on consideration paid or payable on transfer

of building and agricultural land?

(a) No; no tax is required to be deducted at source on transfer of any capital asset

(b) Yes; Mr. Anay is required to deduct tax at source under section 194-IA.

(c) Yes; Mr. Vivek is required to deduct tax at source under section 194-IA.

(d) Yes; Mr. Sarthak is required to deduct tax at source under section 194-IA.

2. In respect of transfer of building, capital gains chargeable to tax in the hands of Mr. Sarthak

would be -

(a) long-term capital gains of ₹ 57,87,500

(b) long-term capital gains of ₹ 47,87,500

(c) short-term capital gains of ₹ 45,00,000

(d) short-term capital gains of ₹ 55,00,000

3. Assuming that Mr. Sarthak has other income exceeding basic exemption limit, the tax

payable (excluding surcharge and health and education cess) on transfer of building and

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 1

agricultural land, would be -

(a) ₹10,95,800

(b) ₹13,97,500

(c) ₹9,95,800

(d) ₹10,97,500

4. In respect of purchase of building from Mr. Sarthak, income chargeable to tax in the hands of

Mr. Anay would be –

(a) ₹20 lakh

(b) ₹ 30 lakhs

(c) ₹ 15 lakhs

(d) Nil

This Case Scenario contains MCQ 5-10

Mr. Manohar, a resident individual, age 53 years provides consultancy services in the field of

Taxation. His Income and Expenditure account for the year ended 31 st March, 2021 is as follows:

Income and Expenditure account for the year ending 31st March, 2021

Expenditure Amount (₹) Income Amount (₹)

To Salary 4,00,000 By Consulting fees 58,00,000

To Motor car expenses 88,000 By Share of Profit from HUF 55,000

To Depreciation 87,500 By Interest on saving bank

25,000

deposits

To Medical expenses 70,000 By Interest on income tax

26,000

refund

To Purchase of computer 90,000

To Bonus 25,000

To General expenses 1,05,000

To Office & administrative 1,15,000

To Excess of income over

Expenditure 49,25,500

59,06,000 59,06,000

The following other information relates to the financial year 2020-21:

(i) Salary includes a payment of ₹ 22,000 per month to his sister-in-law who is in-charge of the

marketing department. However, in comparison to similar business, the reasonable salary of

a marketing supervisor is ₹ 18,000 per month.

(ii) Written down value of the assets as on 1st April, 2020 are as follows:

Motor Car (25% used for personal use) ₹ 3,50,000

Furniture and Fittings ₹80,000

(iii) Medical expenses includes:

Family planning expenditure ₹ 15,000 incurred for the employees which was revenue in

nature.

Medical expenses for his father ₹ 55,000. (Father's age is 65 years and he is not covered

under any medical insurance policy). ₹ 2,500 incurred in cash and remaining by credit

card.

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 2

(iv) The computer was purchased on 5th June, 2020 on credit. The total invoice was paid in the

following manner:

₹ 18,000 paid in cash as down payment on the date of purchase.

Remaining amount was paid through account payee cheque on 10 th August, 2020.

(v) Bonus was paid on 30th September, 2021.

(vi) General expenses include commission payment of ₹ 42,000 to Mr. Mahesh for the promotion

of business on 17th September, 2020 without deduction of tax at source.

(vii) He also received gold coins from a family friend on the occasion of marriage anniversary on

15th November, 2020. The market value of the coins on the said date was ₹85,000.

The consultancy fees for the previous year 2019-20 was ₹ 52,50,300.

5. In respect of above, calculate the deduction to be allowed under Chapter VI-A

(a) 55,000

(b) 70,000

(c) 52,500

(d) 50,000

6. Find out the Income from Other Sources

(a) 1,36,000

(b) 85,000

(c) 51,000

(d) 1,01,000

7. Amount of Share of Profit from HUF to be taxable

(a) 55,000

(b) 50,000

(c) 10,000

(d) Nil

8. Depreciation allowable under Income Tax Act, 1961

(a) 36,800

(b) 76,175

(c) 47,375

(d) 68,175

9. Treatment of Bonus of ₹ 25,000

(a) Bonus should be disallowed as it was unpaid on 31st March, 2021

(b) 30% Bonus should be disallowed as it was unpaid on 31st March, 2021

(c) Bonus should be allowed as an expense

(d) None of the above

10. What is the total income of Mr. Manohar for the assessment year 2021-22

(a) 52,11,430

(b) 51,11,430

(c) 53,11,430

(d) 49,11,430

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 3

11. All companies other than those covered u/s 25 are required to file return of Income in:

(a) Form ITR 6 (b) Form ITR 5

(c) Form ITR 4 (d) Form ITR 7

12. The objective of carrying out assessment u/s 147 is to bring under the tax net _________:

(a) Any money, bullion, jewellery, valuable article, etc. which are undisclosed

(b) Any income which has escaped assessment

(c) Any of the above

(d) Both of the above

13. The AAR has to pronounce its ruling within a statutory time limit of _________ of the receipt of

the application

(a) 6 Months (b) 3 Months

(c) 1 Months (d) None of these

14. The due date of furnishing the return of income for assessment year 2021-22 in case of

charitable trust is:

(a) 30th June of the assessment year

(b) 31st July of the assessment year

(c) 31st October of the assessment year

(d) 30th September of the assessment year

15. The last date for issue of notice U/S 148 was 31.3.2021. The Assessing Officer issued the

notice on 31.3.2021 which was received by the assessee on 4.4.2021. In this case, the notice:

(a) is not a valid notice

(b) is a valid notice

(c) is not a valid notice as it should be received by the assessee on or before 31.3.2021

(d) None of the above

16. Expenditure incurred by an hotelier on replacement of linen and carpets in his hotel. Such

expenditure shall be considered as:

(a) Revenue expenditure (b) Deferred revenue expenditure

(c) Capital expenditure (d) Illegal expenditure

17. In case the Key man insurance policy is taken in name of any other person any sum received

on its maturity by such person shall be taxable under the head:

(a) Salaries

(b) Profits & Gains of Business or Profession

(c) Capital Gain

(d) Income from Other Sources

18. A REIT derives rental income of Rs.2 crore from real estate property directly owned by it and

short term capital gains of Rs.1 crore on sale of developmental properties. It also receives

interest income of Rs.3 crore from Gamma Ltd., an Indian company, in which it holds

controlling interest. The REIT holds 80% of the shareholding of Gamma Ltd. Which of the

following statements is correct?

(a) All the above income are taxable in the hands of REIT

(b) REIT enjoys pass through status in respect of the above income and hence, such

income are taxable in the hands of the unit holders.

(c) REIT enjoys pass through status in respect of interest income from Gamma Ltd. and

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 4

hence, such income is taxable in the hands of the unit holders. Rental income and

short-term capital gains are taxable in the hands of the REIT

(d) REIT enjoys pass through status in respect of interest income from Gamma Ltd. and

rental income from directly owned real estate property and hence, such income are

taxable in the hands of the unit holders. Short-term capital gains is taxable in the

hands of the REIT

19. Two methods were found suitable for determination of the Arm’s Length Price (ALP). As per

CUP methods, it was found to be Rs. 1,200 per unit and as per resale price method, it was Rs.

1,250 per unit. The ALP per unit will be taken as:

(a) Rs. 1,200 since it is more favourable to the assesse

(b) Rs. 1,250 since it is more favourable to the Department

(c) Rs. 1,225

(d) None of the above

20. In which of the following cases, it is mandatory to file return of income in India?

(a) Ram is resident in India and has earned total income of Rs 2,00,000 during the PY

2020-21. However, he has bank account outside India.

(b) Shyam is resident in India and has earned total income of Rs 1,50,000 during the PY

2020-21. However, he is the owner of bungalow outside India.

(c) Both (a) and (b)

(d) None of the above

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 5

PART – II (Descriptive Answers)

This part comprises 6 questions. Question No. 1 is compulsory. Attempt any

4 questions out of the remaining 5 questions.

1 Mercury Construction Ltd., an Indian company is engaged in the business of 14

executing civil contracts awarded by various companies, Central Government and

State Governments in relation to infrastructure facility.

Statement of Profit & Loss for the year ended 31st March, 2021 reveals a net profit

(before tax) amounting to ₹ 85,00,000 after debiting/crediting the following

items:

(a) Interest of ₹ 3,00,000 due to a public financial institution for the last

quarter of the financial year 2020-21 paid on 20th November , 2021.

(b) ₹ 6,00,000 paid in India to Mr. Philip, a non-resident towards fee for

technical services without deduction of tax at source. TDS was, however,

paid on 30th November, 2021.

(c) Damages amounting to ₹ 15,00,000 paid to the Government of West Bengal

as per the terms of contract for defects found in construction of a flyover

after 5 years of its construction.

(d) Depreciation charged ₹ 20,00,000.

(e) Marked to market loss amounting to ₹ 6,00,000 in respect of an unsettled

derivative contract. The contract was settled in May, 2021 with a gain of ₹

1,00,000.

(f) Profit of ₹ 10,00,000 on sale of land to Neptune Inc., U.S.A. which is a wholly

owned subsidiary company.

(g) Retention money amounting to ₹ 10,00,000 held by a public sector

undertaking which can be released after expiry of two years on the

satisfaction of certain performance criteria as per the terms of contract.

(h) ₹ 3,00,000 being interest on fixed deposit made with a bank as margin

money for obtaining a guarantee required by a State Government for a

particular contract.

(i) Dividend of ₹ 10,00,000 received from a Real Estate Investment Trust

(REIT), the break- up of which is as follows

- Component of short-term capital gain on sale of development

properties by the REIT ₹ 6,00,000.

- Component of rental income from properties owned by the REIT ₹

4,00,000.

Other Information:

(i) Depreciation as per Income-tax Rules ₹ 25,00,000.

(ii) Land sold to Neptune Inc. was acquired at a cost of ₹ 30,00,000 in the

financial year 2015-16. Value on the date of sale assessed by the Stamp

Valuation Authority was ₹ 50,00,000 (Cost Inflation Index- Financial Year

2016-17: 264 ; Financial Year 2020-21: 301)

(iii) The company informs you that till Assessment Year 2020-21 the company

did not include retention money in its total income in absence of right to

receive such money based on judicial pronouncements, which has also been

accepted by the Assessing Officer consistently.

(iv) During the year 20 new employees (qualifying as "workman" under the

Industrial Disputes Act, 1947) were recruited. All these new employees

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 6

contribute to recognized provident fund. 15 employees out of 20

employees joined on 1st May, 2020 and the other 5 employees joined in

November, 2020. 10 employees, who joined on 1st May, 2020 were offered

salary of ₹ 24,500 per month and the other employees who joined on the

same date drew salary of ₹ 32,000 per month. One employee who joined on

1st May, 2020 at salary of ₹ 24,500 per month drew his salary by bearer

cheques of ₹ 12,500 and ₹ 12,000 every fortnight in a month.

(v) The company's accounts are required to be audited under sections 44AB of

the Income- tax Act.

Compute total income for the Assessment Year 2021-22 indicating reasons for

treatment of each item and ignoring the provisions relating to minimum alternate

tax (MAT). The due date for filing of return of income for Assessment Year 2021-

22 be taken as 31-10-2020.

2 (a) The following are the particulars relating to two Indian companies, namely, Alpha 8

Ltd. and Beta Ltd., which are subject to tax audit u/s 44AB, for A.Y.2021-22 –

Particulars Alpha Ltd. Beta Ltd.

Date of setting up/ registration 1.4.2018 1.11.2020

Main object Manufacture of Manufacture of

steel leather

Place Vaishali, Bihar Ranipet, Tamil

Nadu

Turnover of P.Y. 2018-19 ₹ 251 crores -

Turnover of P.Y. 2019-20 ₹ 401 crores -

Turnover of P.Y. 2020-21 ₹ 270 crores ₹ 120 crores

Value of new plant and machinery ₹ 8 crore ₹ 5 crore

installed and put to use on 1.11.2020

Gross Total Income of P.Y.2020-21 ₹ 5 crore ₹ 3 crore

No. of new employees employed on the 750 750

date of setting up/registration the

company

Monthly emoluments to employees by

ECS through bank account:

250 employees ₹ 20,000 per ₹ 21,000 per

employee employee

250 employees ₹ 25,000 per ₹ 25,000 per

employee employee

250 employees ₹ 28,000 per ₹ 27,000 per

employee employee

From the above details -

(i) Compute the tax liability of Alpha Ltd. and Beta Ltd. for A.Y.2021-22,

assuming that they avail the beneficial tax rates under the special

provisions inserted by the Taxation Laws (Amendment) Act, 2019 in the

Income-tax Act, 1961 by fulfilling the conditions specified thereunder.

Assume that the gross total income reflects the computation under the

special provisions.

(ii) Would it be beneficial for Alpha Ltd. to opt for the special provisions

inserted by the Taxation Laws (Amendment) Act, 2019 instead of opting

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 7

for the regular provisions of the Income-tax Act, 1961? Examine.

2 (b) Beta Inc. having its business in Singapore has advanced a loan of SD 1,60,000 to 6

Beta Ltd, Mumbai. Book value of total assets of Beta Ltd was ₹ 125 lakhs. Beta

Ltd provides software backup support to Beta Inc. Beta Ltd has spent 50,000

manhour during the financial year 2020-21 for the services rendered to Beta

Inc. The cost for Beta Ltd is SD 75 / manhour. Beta Ltd has billed Beta Inc. at SD

90.75 / manhour.

Gama Ltd. in Mumbai which has a similar business model, provides software

backup support to Olive Inc. in Penang, Malaysia. Gama Ltd's cost and operating

profits are as hereunder:

Particulars INR in lakhs

Direct costs 600

Indirect costs 200

Operating profits 200

(1) Calculate Arm’s Length Price for the transaction between Beta Ltd. and

Beta Inc. based on the above data of Gama Ltd. using the Transactional Net

Margin Method. Assume 1 SD = ₹ 45.

(2) Explain, if there is any adjustment to be made to the total income of Beta

Ltd.

Note: SD = Singapore Dollars

3 (a) GVB Charitable Trust engaged in the activities of running a charitable hospital 8

and medical college since 8 years, has been merged with a Corporate hospital on

31st March, 2021. The said Corporate Hospital is not eligible for registration

under section 12AA of the Act. The position of assets and liabilities of the

Charitable trust as on the date of merger are furnished as under:

Properties and Assets : ₹

(a) Shares and securities held by Trust acquired out of 25 lakhs

agricultural income exempt u/s 10(1) of the Act:

(b) Book value of Quoted shares and securities: 35 lakhs

Market value (Average of lowest and highest price of 40 lakhs

such shares as on date of merger quoted on recognised

stock exchange)

(c) Book value of Land and Buildings held by Trust: 60 lakhs

Value of Immovable Properties (Land & Buildings) as 40 lakhs

per valuation report from Registered Valuer:

Stamp Duty value: 38 lakhs

(d) The Trust was created on 1st January, 2014 and obtained registration

under section 12AA on 31st March, 2015.

(e) The Trust holds 40% of equity shares in an unlisted

company and the financial position of said unlisted

company as on date of merger is as under :

Book value of assets (other than immovable property) 25 lakhs

Fair Market value of Immovable Property 45 lakhs

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 8

Reserves and Surplus 15 lakhs

Provision for taxation 5 lakhs

Total amount of Paid-up Equity Share Capital 25 lakhs

Liabilities:

(f) Liability in respect of shares and securities (unlisted) 8 lakhs

(g) Bank Liability in respect of quoted shares and 15 lakhs

securities

(h) Provision for Tax 12 lakhs

Compute the tax liability, if any, of Charitable Trust, arising out of above merger,

giving explanation for treatment of each item in the context of relevant

provisions contained in the Act. Assume that the trust has no tax liability in

respect of other activities undertaken during previous year 2020-21.

3 (b) During the previous year 2020-21, Ms. Indu, a citizen of India is a resident of 6

both India and a foreign country with which India has a DTAA, which provides

that “the income would be taxable in country where it is earned and not in other

country, but would be included for computation of tax rate in such other

country”. Her income is Rs. 3,25,000 from business in India and Rs. 6,00,000

from business in foreign country. In foreign country, the rate of tax is 20%.

During the year, she paid a premium of Rs. 32,000 to insure the health of her

mother, a non-resident, aged 82 years, not dependent on her, through her credit

card.

(i) Compute the tax payable by Ms. Indu in India for the A.Y. 2021-22.

(ii) Also, show the tax payable by Ms. Indu in India, had there been no DTAA

with such foreign country.

4 (a) M/s A Ltd. had admitted ₹ 180 lakhs as its total income in its return filed for the 8

Assessment Year 2017-18 on 15-9-2017. The total income was enhanced to ₹

200 lakhs as per the order under section 143(3) passed on 20-9-2019 by the

Assessing Officer. Subsequently on an information that there was concealment

of income, reassessment proceedings were initiated and an order for

reassessment was passed on 20 -10-2020 determining a total income of ₹ 250

lakhs.

The Company had the following prepaid taxes to its credit:

Tax deducted at source ₹ 5 lakhs

Advance Tax paid on

4-6-2016 ₹ 8 lakhs

14-9-2016 ₹ 17 lakhs

14-12-2016 ₹ 16 lakhs

15-3-2017 ₹ 14 lakhs

Self-Assessment tax paid on 15-9-2017 ₹ 2.50

lakhs

Tax paid on 25-9-2019 ₹ 7 lakhs

The return in response to the reassessment notice was filed after 20 days from

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 9

the due date mentioned in the notice. Assume the tax rate to be 33.063%.

Determine interest payable by the Company under various sections of the

Income-tax Act on account of reassessment. Give necessary explanations for

your answer.

4 (b) The following data is furnished by Mr. Sumedh, a non-resident and a person of 6

Indian Origin, for the financial year ended 31-3-2021:

A: Long-term capital gains arising on transfer of foreign ₹ 6,50,000

exchange asset on 31.7.2020 (computed)

Expenditure wholly and exclusively incurred in ₹ 80,000

connection with such transfer (not considered above)

Interest on deposits held with private limited companies ₹ 5,90,000

Interest on Government Securities ₹ 95,000

Interest on deposits with pubic limited companies ₹ 2,60,000

B: Savings and Investments

Investment in notified savings certificates referred to in ₹ 2,00,000

section 10(4B) on 30.3.2021

Investment in shares of Indian public limited companies ₹ 3,00,000

on 31.12.2021

C: Tax deducted at source ₹ 1,83,000

Compute balance tax payable/refund due for the assessment year 2021-22 in

accordance with special provisions applicable to non-residents.

5 (a) Answer the following in the context of provisions contained in the Income-tax Act, 8

1961:

(i) The assessment for A.Y. 2016-17 was completed as per section 143(3)

considering the various claims so made by the assessee on 23.12.2017.

Subsequently, this was reopened under section 147 on certain issues, but

excluding the claim of the assessee as to “Lease Equalisation Fund”. The

order of reassessment was passed on 18.11.2018. The Commissioner

within the powers vested under section 263 passed an order on 11.4.2020

rejecting the claim of assessee as to “Lease Equalisation Fund”. The

assessee challenges that the action of the CIT is not sustainable because

the same was barred by limitation.

(ii) Is Commissioner (Appeals) empowered to consider an appeal filed by an

assessee challenging the order of assessment in respect of which the

proceedings before the Settlement Commission abates? Examine.

5 (b) Arnold Ltd. (incorporated in UK) has a branch office (PE) in India. The Net Profit 6

of the Branch as per the statement of profit and loss for the year ended

31.03.2021 was ₹ 83 lakhs. It includes the following:

(i) Dividend from Indian companies (listed) ₹ 8,00,000.

(ii) Dividend from Indian companies (unlisted) ₹ 4,00,000.

(iii) Interest received from MMS Ltd. of Mumbai ₹ 7,00,000. The amount was

received by the Indian company MMS Ltd. in foreign currency as per loan

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 10

agreement dated 01.04.2015 (section 194LC applicable).

(iv) Fee for technical services received from Barun Co. Ltd., Kolkata ₹

25,00,000. The agreement was made on 10.08.2008 and was approved by

Central Government. Expenditure incurred for providing technical service

amounts to ₹ 6,00,000.

Additional information:

Total income chargeable to tax as per regular provisions of the Income-tax Act,

1961 (Act) is ₹ 20,00,000 (without considering the items (i) to (iv) above).

You are required to compute the book profit tax under section 115JB of the Act for

the assessment year 2021-22 and also the total income-tax liability of the

assessee.

Your working should be supported by notes.

6 (a) Prakash, a member in two AOPs, namely, “AOP & Co.” and “Prakash & Akash”, 6

provides the following details of his income for the year ended 31.3.2020:

(a) “AOP & Co.”, assessed at normal rates of tax, had credited in his account,

amount of ₹ 2,10,000 as interest on capital, ₹ 4,96,000 as salary and ₹

20,000 as share of profit.

(b) A house property located at Jaipur was purchased on 1.7.2010 with the

borrowed capital in “Prakash & Akash” jointly shared equally and

occupied by both of them for self-residential purposes. Total interest paid

for the year 2019-20 on the borrowed capital was ₹ 4,10,000.

Compute the income and the tax liability thereon for the A.Y. 2020-21 and

support your answer with brief reasons and the provisions of the Act.

6 (b) Narmada Ltd., an Indian Company has borrowed ₹ 80 crores on 01-04-2020 from 4

M/s. Thames Inc, a Company incorporated in London, at an interest rate of 10%

p.a. The said loan is repayable over a period of 5 years. Further, loan is guaranteed

by M/s Tyne Inc. incorporated in UK. M/s. Tweed Inc, a non-resident, holds shares

carrying 40% of voting power both in M/s Narmada Ltd. and M/s Tyne Inc.

Net profit of M/s. Narmada Ltd. for P.Y. 2020-21 was ₹ 7 crores after debiting the

above interest, depreciation of ₹ 4 crores and income-tax of ₹ 3 crores. Calculate

the amount of interest to be disallowed under the head “Profits and gains of

business or profession” in the computation of M/s Narmada Ltd., giving

appropriate reasons.

6 (c) What is the difference between OECD Model Convention, 2017 and UN Model 4

Convention, 2017 relating to right of Source State to tax business profits of an

enterprise? Explain.

MOCK TEST SERIES – By CA Atul & Ajay Agarwal (AIR-1)

AIR1CA Career Institute (ACI)

Page 11

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- TAXES 101: Let's Talk About TaxDocument7 pagesTAXES 101: Let's Talk About TaxCarla DellosaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quiz Home Office and Branch AccountingDocument4 pagesQuiz Home Office and Branch AccountingJhaybie San Buenaventura50% (2)

- Hair Replacement and Salon Business PlanDocument32 pagesHair Replacement and Salon Business PlanAdeNo ratings yet

- Credit Appraisal of Project Financing and Working CapitalDocument70 pagesCredit Appraisal of Project Financing and Working CapitalSami ZamaNo ratings yet

- Marketing Plan - Flavors of France Lipsticks: Norris Robinson, Carla Lieblein, Monique Balgobin, Kristie BookhoutDocument17 pagesMarketing Plan - Flavors of France Lipsticks: Norris Robinson, Carla Lieblein, Monique Balgobin, Kristie BookhoutRohan AgrawalNo ratings yet

- Partnership Termination and LiquidationDocument29 pagesPartnership Termination and LiquidationTrinidad Cris Gerard67% (3)

- Project Feasibility Report On Dairy FarmingDocument49 pagesProject Feasibility Report On Dairy FarmingBivash Das100% (5)

- Florist Shop Business PlanDocument19 pagesFlorist Shop Business PlanBrave King100% (1)

- Ilovepdf MergedDocument58 pagesIlovepdf MergedkrishNo ratings yet

- Level I - Financial Reporting and Analysis: InventoriesDocument30 pagesLevel I - Financial Reporting and Analysis: InventorieskrishNo ratings yet

- Level I - Financial Reporting and Analysis: Long-Lived AssetsDocument38 pagesLevel I - Financial Reporting and Analysis: Long-Lived AssetskrishNo ratings yet

- Level I - Financial Reporting and Analysis: Income TaxesDocument32 pagesLevel I - Financial Reporting and Analysis: Income TaxeskrishNo ratings yet

- Level I - Financial Reporting and Analysis: Non-Current (Long-Term) LiabilitiesDocument37 pagesLevel I - Financial Reporting and Analysis: Non-Current (Long-Term) LiabilitieskrishNo ratings yet

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument9 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffencekrishNo ratings yet

- FR 2 New Question PaperDocument7 pagesFR 2 New Question PaperkrishNo ratings yet

- IDT 2 New Question PaperDocument15 pagesIDT 2 New Question PaperkrishNo ratings yet

- Management Accounting Notes1Document170 pagesManagement Accounting Notes1Anish Gambhir100% (1)

- Acca f6 Taxation Vietnam 2012 Jun QuestionDocument12 pagesAcca f6 Taxation Vietnam 2012 Jun QuestionNguyễn GiangNo ratings yet

- Basic Cost Management Concepts: Mcgraw-Hill/IrwinDocument51 pagesBasic Cost Management Concepts: Mcgraw-Hill/Irwinsunanda mNo ratings yet

- Volume 5 - Budgeting Resource Tools and ApproachesDocument82 pagesVolume 5 - Budgeting Resource Tools and ApproachesBong RicoNo ratings yet

- Cost of Accident190423Document46 pagesCost of Accident190423Jallela SomeshNo ratings yet

- SBI Annual Report 2022-207Document1 pageSBI Annual Report 2022-207Radhika GoelNo ratings yet

- Financial Statment ExamDocument2 pagesFinancial Statment ExamsyafiraNo ratings yet

- Tutorial Letter 102/0/2023: TAX4861 NTA4861Document50 pagesTutorial Letter 102/0/2023: TAX4861 NTA4861THABO CLARENCE MohleleNo ratings yet

- AD Business PlanDocument21 pagesAD Business PlanGetie TigetNo ratings yet

- 12 Accountancy Lyp 2014 Compt Outside Delhi Set1Document25 pages12 Accountancy Lyp 2014 Compt Outside Delhi Set1Ashish GangwalNo ratings yet

- Hba 2401 Advanced Financial Reporting Cat March 2024Document5 pagesHba 2401 Advanced Financial Reporting Cat March 2024PhilipNo ratings yet

- D12999R64581 PDFDocument8 pagesD12999R64581 PDFNoor Liza AliNo ratings yet

- HE21Round2Document8 pagesHE21Round2Vartika VashistaNo ratings yet

- Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 1 Introduction To AccountingDocument10 pagesKerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 1 Introduction To AccountinghadiyxxNo ratings yet

- Latest Sample Basic Slides For BP PresentationDocument54 pagesLatest Sample Basic Slides For BP PresentationSeri Liny HotelNo ratings yet

- Fin Acc Part 2Document6 pagesFin Acc Part 2Jolina cunananNo ratings yet

- Chap 004Document16 pagesChap 004Ela PelariNo ratings yet

- List of Ledgers in Tally ERP 9Document1 pageList of Ledgers in Tally ERP 9jssheruleNo ratings yet

- Department of Labor and Employment Wage Distortion Formula: Where Exponent Is Represented by NDocument10 pagesDepartment of Labor and Employment Wage Distortion Formula: Where Exponent Is Represented by NJonnalyn ObaNo ratings yet

- Practice Exam: TEXT: PART A - Multiple Choice QuestionsDocument12 pagesPractice Exam: TEXT: PART A - Multiple Choice QuestionsMelissa WhiteNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Chapter 5 Thesis ExampleDocument12 pagesChapter 5 Thesis ExampleAure MengoNo ratings yet