Professional Documents

Culture Documents

Cu vs. Small Business Guarantee & Finance Corp

Uploaded by

Renato C. Silvestre Jr.0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

4.-CU-vs.-SMALL-BUSINESS-Week-4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesCu vs. Small Business Guarantee & Finance Corp

Uploaded by

Renato C. Silvestre Jr.Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

CU VS. SMALL BUSINESS GUARANTEE & FINANCE CORP.

G.R. NO. 211222 | AUGUST 07, 2017

CAGUIOA, J:

(Liquidation)

FACTS:

SB Corp. is a government financial institution by virtue of RA 6977, mandated to provide

easy access credit to qualified MSMEs through direct lending. Golden 7 (G7) Bank, its client,

was granted an increased credit line and authorized any two of its officers, Fidel L. Cu, Allan S.

Cu [Cu], Lucia C. Pascual & Norma B. Cueto, as signatories to loan documents and postdated

checks.

On 2008, G7 Bank was placed under receivership to Philippine Deposit Insurance

Corporation (PDIC) which took over the bank and consequently closed all of G7 Bank's deposit

accounts with other banks including its checking account with Land Bank of the Philippines

(LBP) against which the disputed checks were issued. Upon maturity of subject postdated

checks, SB Corp. deposited the same to its account but all of them were dishonored for reason of

"Account Closed". SB Corp. to file a Complaint-Affidavit for Violation of B.P. 22. Meantime,

PDIC filed a Petition for Assistance in the Liquidation of G7 Bank. MTC and RTC dismissed the

complaint against Cu and Pascual. SB Corp. then filed a petition for review and CA reversed the

decision.

ISSUES:

1. Whether or not CA erred in not dismissing the SB Corp.'s petition.

2. WON the CA erred in reversing the of the RTC.

RULING:

YES. (1) SB Corp. lacked the authority to represent the State in the appeal of the criminal

cases before the CA as this authority is solely vested in the OSG. (2) The Court finds that the

MeTC and RTC acted correctly and did not gravely abuse their discretion when they ordered the

dismissal of the B.P. 22 cases against Cu. Significantly, when PDIC filed a Petition for

Assistance in the Liquidation of G7 Bank with the RTC, in effect on interest payments: "The

liability of a bank to pay interest on deposits and all other obligations as of closure shall cease

upon its closure" and on final decisions against the closed bank: "The execution and enforcement

of a final decision of a court other than the liquidation court against the assets of a closed bank

shall be stayed.

The petition for assistance in the liquidation of a closed bank is a special proceeding. It is

a proceeding in rem and the liquidation court has exclusive jurisdiction to adjudicate claims.

That, at the time SB Corp. presented the subject checks for deposit/encashment in October 2008,

it had no right to demand payment because the underlying obligation was not yet due and

demandable from Cu and he could not be held liable for the civil obligations of G7 covered by

the subject dishonored checks on account of the Monetary Board's closure of G7 and the

takeover by PDIC. SB Corp. acted in clear bad faith because it knew at the time it deposited the

subject postdated checks that G7 Bank was already under receivership and PDIC had already

taken over therefore it was legally impossible for Cu to fund those checks on the dates indicated

therein.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Central Bank Digital CurrenciesDocument46 pagesCentral Bank Digital CurrenciesluisNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Cash Audit ProgramDocument7 pagesCash Audit Program구니타67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- False Affidavits in ForeclosuresDocument7 pagesFalse Affidavits in ForeclosuresZen Master100% (2)

- Pribhdas J. Mirpuri vs. Ca, Director of Patents and The Barbizon Corporation FactsDocument12 pagesPribhdas J. Mirpuri vs. Ca, Director of Patents and The Barbizon Corporation FactsRenato C. Silvestre Jr.No ratings yet

- 10 First Planters Pawnshop Vs BIR CaseDocument2 pages10 First Planters Pawnshop Vs BIR CaseRenato C. Silvestre Jr.No ratings yet

- Dragnet ClauseDocument2 pagesDragnet ClauseAlarm GuardiansNo ratings yet

- DEEPAKDocument54 pagesDEEPAKBittu ChoudharyNo ratings yet

- Consolidated Companies ListDocument31 pagesConsolidated Companies ListSamir OberoiNo ratings yet

- GUMABON vs. PNB Week 3Document2 pagesGUMABON vs. PNB Week 3Renato C. Silvestre Jr.No ratings yet

- 6gumabon Vs PNBDocument1 page6gumabon Vs PNBRenato C. Silvestre Jr.No ratings yet

- 5 Banking DigestsDocument3 pages5 Banking DigestsRenato C. Silvestre Jr.No ratings yet

- 6 Del Monte Corp Vs CADocument5 pages6 Del Monte Corp Vs CARenato C. Silvestre Jr.No ratings yet

- 3 Mcdonalds Vs LC Big MakDocument10 pages3 Mcdonalds Vs LC Big MakRenato C. Silvestre Jr.No ratings yet

- 5 Etepha Vs Board of PatentsDocument2 pages5 Etepha Vs Board of PatentsRenato C. Silvestre Jr.No ratings yet

- 4 Mcdonalds Corp Vs Macjoy CorpDocument6 pages4 Mcdonalds Corp Vs Macjoy CorpRenato C. Silvestre Jr.No ratings yet

- Melvin Colinares vs. Court of Appeals G. R. No. 90828 September 5, 2000 Davide JR., C.J.Document1 pageMelvin Colinares vs. Court of Appeals G. R. No. 90828 September 5, 2000 Davide JR., C.J.Renato C. Silvestre Jr.No ratings yet

- China Banking Corporation vs. Court of Appeals G. R. No. 140687 December 18, 2006 Chico-Nazario, J.Document1 pageChina Banking Corporation vs. Court of Appeals G. R. No. 140687 December 18, 2006 Chico-Nazario, J.Renato C. Silvestre Jr.No ratings yet

- Bangko Sentral NG Pilipinas vs. Hon. Nina G. Antonio-Valenzuela G. R. No. 184778 October 2, 2009 Velasco JR., J.Document1 pageBangko Sentral NG Pilipinas vs. Hon. Nina G. Antonio-Valenzuela G. R. No. 184778 October 2, 2009 Velasco JR., J.Renato C. Silvestre Jr.No ratings yet

- Annexure 2Document77 pagesAnnexure 2Maheshkumar AmulaNo ratings yet

- ' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPDocument2 pages' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPvinothmcakmdNo ratings yet

- Wise Transaction Invoice Transfer 934057029 2319312755 enDocument2 pagesWise Transaction Invoice Transfer 934057029 2319312755 enbouamara.ferhat1515No ratings yet

- APi 1140Document2 pagesAPi 1140MukeshNo ratings yet

- Bcm33 - Banking Theory, Law and Practice Multiple Choice QuestionsDocument3 pagesBcm33 - Banking Theory, Law and Practice Multiple Choice QuestionsPal SumanNo ratings yet

- Doc1544 9849Document1 pageDoc1544 9849georgebates1979No ratings yet

- Presentation of Rama RajuDocument59 pagesPresentation of Rama RajuAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Cash SeatworkDocument3 pagesCash SeatworkRed TigerNo ratings yet

- Merger of BOB, Dena Bank and Vijaya Bank: Insights MindmapsDocument2 pagesMerger of BOB, Dena Bank and Vijaya Bank: Insights MindmapsHarshita SinghNo ratings yet

- Lec 4 Money MarketDocument43 pagesLec 4 Money MarketTanmayNo ratings yet

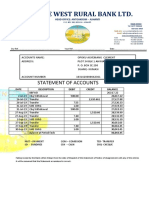

- Statement of Accounts AmansieDocument1 pageStatement of Accounts AmansieAgyei MichimelandNo ratings yet

- Inspection - SoDocument44 pagesInspection - SoK V Sridharan General Secretary P3 NFPENo ratings yet

- Commercial Banks: Investopedia)Document3 pagesCommercial Banks: Investopedia)Minmin WaganNo ratings yet

- Characteristics of Service Industry With Reference ToDocument12 pagesCharacteristics of Service Industry With Reference Toisha_patel897471100% (3)

- MR - Ramesh Rao DDocument2 pagesMR - Ramesh Rao DrameshraodNo ratings yet

- Citigroup CB Internship ProgramDocument1 pageCitigroup CB Internship ProgramSandra DeeNo ratings yet

- Pelican StoresDocument6 pagesPelican StoresDavid EscurraNo ratings yet

- Ufce FormatDocument2 pagesUfce FormatPankaj GuptaNo ratings yet

- Syllabus CCB PDFDocument6 pagesSyllabus CCB PDFiamitgarg7No ratings yet

- Crans Montana Presentation PDFDocument49 pagesCrans Montana Presentation PDFJohn OxNo ratings yet

- Monetary and Financial SystemDocument9 pagesMonetary and Financial SystemChristopher MungutiNo ratings yet

- Unit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovDocument5 pagesUnit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovMarcusNo ratings yet

- Life Line ProductsDocument13 pagesLife Line Productsdreamgirl00001No ratings yet

- Tutorial 5 & 6 - SolutionDocument6 pagesTutorial 5 & 6 - SolutionHamza IftekharNo ratings yet