Professional Documents

Culture Documents

Nulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021

Uploaded by

Shyamal dasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021

Uploaded by

Shyamal dasCopyright:

Available Formats

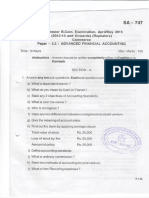

Total Pages: 02 KNU/2021/SEM I/BCOMHC101

UG 1st Semester Examination- 2021

Award: B.Com. (Honours)

Discipline: Commerce

Course Type : CC-1

Course Code : BCOMHC101

Course Name: Financial Accounting

Full Marks: 40 Time: 2 Hours

The figures in the right-hand margin indicate full marks. Candidates are required to give the answers

in their own words as far as practicable. Illustrate the answers wherever necessary.

1. Answer any five questions : 5x1=5

(a) What is the full form of GAAP?

(b) Define accounting

(c) What is Recurring Expenditure?

(d) Give an example of Deferred Revenue Expenditure.

(e) What is meant by Cash Down Price?

(f) What is pro forma invoice?

(g) What is entity concept?

(h) What is meant by dissolution of a partnership firm?

2. Answer any five questions : 5x2=10

(a) Distinguish between Capital expenditure and Revenue Expenditure.

(b) What are the adjustment accounts opened in General Ledger in case of Self Balancing

system?

(c) What is Piecemeal Distribution in connection with the dissolution of Partnership?

(d) What is the treatment of abnormal loss in the books of the consignor?

(e) What is contingent liability? Give one example.

(f) What is Del-credere Commission?

(g) What is journal proper?

(h) What is Account Sales?

3. Answer any three questions: 3x5=15

(a) Distinguish between hire Purchase system and Instalment payment system.

(b) State in brief the decision of Garner vs. Murray case. Is the rule in Garner vs. Murray

applicable in India?

(c) Distinguish between sectional balancing system and self-balancing system.

(d) A of Mumbai sent goods worth Rs. 12000 to B of Kolkata to be sold on a 5%

commission. Rs. 300 were spent on sending the goods. B sold three fourth of the

goods for Rs. 10000 and spent Rs. 600 in connection therewith. Insurance premium of

Rs. 150 was also paid by B. A fire broke out and destroyed the remaining goods. Rs.

3000 were recovered from the insurance company.

Prepare Consignment Account in the books of A

(e) From the following information, prepare Debtors Ledger Adjustment Account to be

maintained in the General Ledger, where Self-Balancing System is followed:

Opening Balance of Debtors Rs. 25,000 (Dr.)

Opening Balance of Debtors Rs. 600 (Cr.)

Credit Sales during the year Rs. 75,000

Cash received from Debtors Rs. 50,000

Discount Allowed Rs. 2,000

Bad Debts written off Rs. 700

Reserve for Bad Debts Rs. 1,000

Bad Debts Recovered Rs. 100

Bills Receivable received from customers Rs. 2,000

Bills dishonored Rs. 500

Closing Balance of Debtors Rs. 100 (Cr.)

4. Answer any one question: 1x10=10

(a) Explain: (i) Going Concern Concept (ii) Doctrine of Conservatism (5+5)

(b) Mr X sells goods on hire purchase basis at a profit of 50% on cost. Prepare Hire

Purchase Trading Account from the following particulars :

Rs.

Hire Purchase stock (at selling price) on 1.1.2020 9,000

Instalment due on 1.1.2020 5,000

Goods sold on hire purchase during the year (at selling price) 87,000

Cash received from hire purchase customers during the year 60,000

Goods repossessed (instalment due Rs. 2000) valued at 500

Hire Purchase stock (at selling price) on 31.12.2020 30,000

Instalment due on 31.12.2020 9,000

(c) Mr. A, Mr. B and Mr. C were partners in a firm sharing profits and losses in the ratio

of 2:2:1. The Balance Sheet as on 31st December, 2021 was as follows:

Liabilities Rs. Assets Rs.

Sundry Creditors 25,000 Cash 3,000

Bills Payable 12,000 Sundry Debtors 20,000

Capital A/Cs: Mr A 40,000 Less, Provision 1,000 19,000

Mr B 40,000 Closing Stock 30,000

Mr C 30,000 110,000 Furniture 10,000

Reserve 15,000 Plant & Machinery 40,000

Building 60,000

162,000 162,000

On 31st December, 2021 Mr B retired. The terms of retirement provided the

following:

(i) Goodwill of the firm to be valued at Rs.20,000.

(ii) Furniture and Plant & Machinery are to be depreciated @ 10% and @ 5%

respectively.

(iii)Provisions for doubtful debts is to be increased to Rs.1,500.

(iv) The Reserve is to be transferred to the Capital Accounts of the partners.

(v) The amount due to Mr B is to be transferred to a separate Loan Account

carrying interest @ 10% p.a.

Show the Partners Capital Accounts, Revaluation Account and the Balance Sheet

immediately after Mr B’s retirement.

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Letter Request For Cash Advance 2020Document2 pagesLetter Request For Cash Advance 2020toni annNo ratings yet

- 11 Accountancy First Term Set BDocument6 pages11 Accountancy First Term Set Bmcsworkshop777No ratings yet

- RISE ITA Model Paper SolutionDocument15 pagesRISE ITA Model Paper Solutionzaffiii.293No ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- 11 Accountancy First Term Set ADocument6 pages11 Accountancy First Term Set Amcsworkshop777No ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- 1018 - Comcc1 - L - 2 - Financial AccountingDocument2 pages1018 - Comcc1 - L - 2 - Financial AccountingPrashantNo ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- 11th Annual Benedict's PDFDocument15 pages11th Annual Benedict's PDFYugam RathiNo ratings yet

- Paper - 2 Accounting SyllabusDocument40 pagesPaper - 2 Accounting SyllabusNguyen Dac ThichNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- Chapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oDocument9 pagesChapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oabi100% (1)

- RISE All CAF Subjects Mock With Solutions Regards Saboor AhmadDocument139 pagesRISE All CAF Subjects Mock With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- Practice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsDocument4 pagesPractice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsSNPS BhadraNo ratings yet

- ACY 53 Summative Exam 2 CH 26 28 Answer KeyDocument3 pagesACY 53 Summative Exam 2 CH 26 28 Answer KeyAMIKO OHYANo ratings yet

- Revision Accountancy XI Term II 8.12.2022 FinalDocument15 pagesRevision Accountancy XI Term II 8.12.2022 FinalNIRMALA COMMERCE DEPTNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- MTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial AccountingDocument7 pagesMTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial Accountingvikash guptaNo ratings yet

- Xi Accounting Set 4Document8 pagesXi Accounting Set 4aashirwad2076No ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- Financial Accounting Ii-2Document5 pagesFinancial Accounting Ii-2gautham rajeevanNo ratings yet

- 2015 Bcom Iisem AfaDocument4 pages2015 Bcom Iisem AfaSanthosh KumarNo ratings yet

- Accounts QN PaperDocument8 pagesAccounts QN PaperNandhini ShanmugamNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- Accounts Mock - 29178435Document6 pagesAccounts Mock - 29178435mopibam555No ratings yet

- 11th Accountancy DraftDocument8 pages11th Accountancy Draftmohit pandeyNo ratings yet

- Intro. To Accounting July 2013Document4 pagesIntro. To Accounting July 2013adv.erumfatimaNo ratings yet

- 12 AccountancyDocument10 pages12 AccountancyBhaswati SurNo ratings yet

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- Account XII For Board Exam PracticeDocument18 pagesAccount XII For Board Exam PracticeBicky ShahNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Board Question Paper: September 2021: Book Keeping & AccountancyDocument5 pagesBoard Question Paper: September 2021: Book Keeping & AccountancyPriyansh ShahNo ratings yet

- 2020-06 Icmab FL 001 Pac Year Question June 2020Document3 pages2020-06 Icmab FL 001 Pac Year Question June 2020Mohammad ShahidNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Corporate Accounting (CC) (Code: 52414403) : AssignmentDocument3 pagesCorporate Accounting (CC) (Code: 52414403) : AssignmentAnkushNo ratings yet

- Cbse Class XII Accountancy Sample Paper - 1: I. Ii. IIIDocument224 pagesCbse Class XII Accountancy Sample Paper - 1: I. Ii. IIIAnubhav PareekNo ratings yet

- Model Question Financial Accounting - IIDocument3 pagesModel Question Financial Accounting - IIEswari Gk100% (1)

- Accountancy em Iii RevisionDocument7 pagesAccountancy em Iii RevisionMalathi RajaNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoDocument4 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoAbhishek ChaubeyNo ratings yet

- II Puc Acc Mid Term MQP - 2Document5 pagesII Puc Acc Mid Term MQP - 2parvathis2606No ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationDocument6 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage Examinationduniya t vNo ratings yet

- Test Paper 12Document6 pagesTest Paper 12Sukhjinder SinghNo ratings yet

- +1 Acc Model Hly Ans (EM) 2022Document7 pages+1 Acc Model Hly Ans (EM) 2022BABA AssociatesNo ratings yet

- ElementsBookKeepingAccountancy SQPDocument7 pagesElementsBookKeepingAccountancy SQPKanya PrakashNo ratings yet

- Model Test Paper-1Document24 pagesModel Test Paper-1dawraparul27No ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- Question Paper Code: 3B1Z101: First SemesterDocument3 pagesQuestion Paper Code: 3B1Z101: First SemesterBavin VincentNo ratings yet

- Class 12 Accountancy Sample Paper Term 2Document3 pagesClass 12 Accountancy Sample Paper Term 2Ayaan KhanNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- 11 Sample Papers Accountancy 2Document10 pages11 Sample Papers Accountancy 2AvcelNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- Chapter 13Document16 pagesChapter 13Anuj MadaanNo ratings yet

- Chapter 9Document20 pagesChapter 9anil.gelra5140No ratings yet

- Sample File For The Sem 2 Hons Students To Write: Course Outcome (CO)Document2 pagesSample File For The Sem 2 Hons Students To Write: Course Outcome (CO)Shyamal dasNo ratings yet

- Sample File For The Sem 2 Hons Students To Write: Program Specific Outcome (PSO) Semester IDocument1 pageSample File For The Sem 2 Hons Students To Write: Program Specific Outcome (PSO) Semester IShyamal dasNo ratings yet

- ComparitiveDocument6 pagesComparitivesanath vsNo ratings yet

- The Theory of The Firm: An Overview of The Economic Mainstream, Revised EditionDocument331 pagesThe Theory of The Firm: An Overview of The Economic Mainstream, Revised EditionPaul WalkerNo ratings yet

- Installment Payment Agreement With Penalty InterestDocument2 pagesInstallment Payment Agreement With Penalty InterestAmado III VallejoNo ratings yet

- (Business Finance) - M1 - LOLO - GATESDocument3 pages(Business Finance) - M1 - LOLO - GATESCriestefiel LoloNo ratings yet

- CHP 7Document32 pagesCHP 7asiflarik.mb14No ratings yet

- Economics EOQ 2019Document9 pagesEconomics EOQ 2019Charles AbelNo ratings yet

- Energy Audit Questionnaire SampleDocument5 pagesEnergy Audit Questionnaire SampleJulius Ian JuradoNo ratings yet

- RECEIPT UTILITIES 20210312 Elektrik EapDocument1 pageRECEIPT UTILITIES 20210312 Elektrik EapTahap TeknikNo ratings yet

- Financial Inclusion - RBI - S InitiativesDocument12 pagesFinancial Inclusion - RBI - S Initiativessahil_saini298No ratings yet

- Abcd Concepts of CGDocument5 pagesAbcd Concepts of CGCalisto MaruvaNo ratings yet

- HCO 615 Module 6 - Episode 1 TranscriptDocument2 pagesHCO 615 Module 6 - Episode 1 TranscriptAnanyaBandyopadhyayNo ratings yet

- Module 4 Contemporary Models of Development and UnderdevelopmentDocument3 pagesModule 4 Contemporary Models of Development and Underdevelopmentkaren perrerasNo ratings yet

- 2020 Gr12 Textbk GeographyDocument1 page2020 Gr12 Textbk GeographyEskay DevandalNo ratings yet

- Homework Chapter 3 PDFDocument4 pagesHomework Chapter 3 PDFPhạm Nguyễn Bảo QuyênNo ratings yet

- Momerendum Pemeriksaan Kapal - MPMT Xi 1 2Document1 pageMomerendum Pemeriksaan Kapal - MPMT Xi 1 2Alifian Arfa Rosyadi100% (1)

- International Economics Problem SetDocument5 pagesInternational Economics Problem SetBucha GetachewNo ratings yet

- 2307 - SMCDocument1 page2307 - SMCRolando Jr. SantosNo ratings yet

- Provisional ISCENE 2024 Programme 030624Document6 pagesProvisional ISCENE 2024 Programme 030624Rocky EspirituNo ratings yet

- International Expansion StrategiesDocument11 pagesInternational Expansion StrategiesDark PrincessNo ratings yet

- JAIIB 2024 BrochureDocument13 pagesJAIIB 2024 BrochureSUBRAMANIAN NAGANo ratings yet

- Sara Semar - 043647655 - Tugas 3 Bahasa Inggris Niaga ADBI4201Document3 pagesSara Semar - 043647655 - Tugas 3 Bahasa Inggris Niaga ADBI4201Francesc Richard WengerNo ratings yet

- OR Post: AZA Group. Investment in A HotelDocument8 pagesOR Post: AZA Group. Investment in A HotelShedrine WamukekheNo ratings yet

- Performance of The ASEAN Iron and Steel Industry in 2015 and Outlook - 2016Document35 pagesPerformance of The ASEAN Iron and Steel Industry in 2015 and Outlook - 2016imetallurgyNo ratings yet

- Maths CH-4 PPT-1Document31 pagesMaths CH-4 PPT-1newaybeyene5No ratings yet

- M21 HL Paper 3 IB1 Mark SchemeDocument8 pagesM21 HL Paper 3 IB1 Mark SchemeJane ChangNo ratings yet

- GE 11 Third ExamDocument2 pagesGE 11 Third ExamJENDRI ELLORINNo ratings yet

- All Sister Concern ProfileDocument15 pagesAll Sister Concern Profileanowar hossainNo ratings yet

- Macroeconomics ExamDocument16 pagesMacroeconomics ExamCarlo SantosNo ratings yet

- Presentation Submitted By: Mustafa - M - MushrifDocument9 pagesPresentation Submitted By: Mustafa - M - MushrifpriNo ratings yet