Professional Documents

Culture Documents

1018 - Comcc1 - L - 2 - Financial Accounting

Uploaded by

PrashantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1018 - Comcc1 - L - 2 - Financial Accounting

Uploaded by

PrashantCopyright:

Available Formats

UG/CBCS/B.Com./Hons./1st Sem.

/Commerce/COMCC1/2020

UNIVERSITY OF NORTH BENGAL

B.Com. Honours 1st Semester Examination, 2020

CC1-COMMERCE

FINANCIAL ACCOUNTING

Time Allotted: 2 Hours Full Marks: 60

ASSIGNMENT

The figures in the margin indicate full marks.

Candidates should answer in their own words and adhere to the word limit as practicable.

All symbols are of usual significance.

Answer all the questions 15×4 = 60

1. X Transport Ltd. purchased from Y Motor 3 scooties costing Rs. 50,000 each on 15

hire purchase basis on 01.01.2011. Payment are to be made Rs. 30,000 down and

the remainder in 3 equal annual instalments payable on 31.12.11, 31.12.12 and

31.12.13 together with interest @ 9% p.a. X Transport Ltd. write off depreciation

@ 20% on W.D.V. method. It paid the instalment due on 31.12.11 but could not

pay the instalment due on 31.12.12. Y Motor agreed to leave one scooty with the

purchaser on 01.01.2013 adjusting the value of other scooties against the amount

due on 31.12.12. The scooties were valued on the basis of 30% depreciation

annually.

Pass necessary journal entries in the books of X Transport Ltd. for all the three

year.

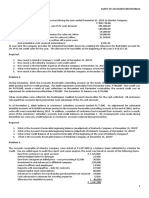

2. X Ltd. of Siliguri has its branch at Birpara to which goods are sent @ 20% above 15

cost. Branch expenses are met partly from the H.O. and partly by the branch.

Following are the particulars relating to the branch for the year 2011. Prepare

necessary Ledger accounts in the books of the H.O.:

Rs.

Goods sent to Branch at cost 2,00,000

Goods received by the branch at I.P. 2,20,000

Credit sales for the year at I.P. 1,65,000

Cash sales for the year at I.P. 59,000

Cash remitted to H.O. 2,22,500

Expenses paid by the H.O. 12,000

Bad debts written off 750

1018 1 Turn Over

UG/CBCS/B.Com./Hons./1st Sem./Commerce/COMCC1/2020

Balances on: 01.01.11 31.12.11

Stock 25,000 28,000

(at cost) (at I.P.)

Debtors 32,750 26,000

Cash 5,000 2,500

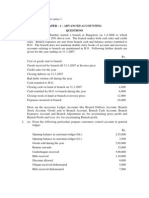

3. A, B and C are partners in a firm sharing profits and losses in the ratio of 4:3:3. 15

They decide to dissolve the firm and appoint B to realise the assets and distribute

the proceeds and he is to receive 5% of the amount realised from stock and

debtors as his remunerations and to bear all expenses of realisation.

The following is the Balance Sheet of the firm as on 31.12.12

Amount Amount

Liabilities Assets

Rs. Rs.

Creditors 59,000 Cash 1,500

Capital: A 30,000 Stock 60,000

B 20,000 Debtors 45,500

Less: Provision

for bad debts 2,500 43,000

Capital : C 4,500

1,09,000 1,09,000

Rs. 35,000 was realised from Debtors and Rs. 45,000 realised from stock.

Goodwill is sold for Rs. 2,000. Creditors are paid Rs. 57,500 in full settlement.

Unrecorded liabilities have also been paid Rs. 500. The expenses of realisation

amounted to Rs. 600.

A and B agree to receive from C Rs. 3,000 in full settlement of the firm’s claim

against him.

Prepare Realisation Account, Capital Account and Bank Account in the books of

the firm. (Apply Garner vs. Murray Rule)

4. Write short notes on: 15

(i) Principles of Conservatism

(ii) Matching Principle

(iii) Full Disclosure Principle.

——×——

1018 2

You might also like

- 2018 Fin Acc Sem 1Document4 pages2018 Fin Acc Sem 1Namrata BaruaNo ratings yet

- B.Com Degree Examination December 2014 Advanced Financial Accounting Question PaperDocument7 pagesB.Com Degree Examination December 2014 Advanced Financial Accounting Question PaperEmind Annamalai JPNagarNo ratings yet

- Financial Accounting exam questionsDocument3 pagesFinancial Accounting exam questionsVishwas Srivastava 371No ratings yet

- Nulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Document2 pagesNulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Shyamal dasNo ratings yet

- 07 - Mock Paper 1Document6 pages07 - Mock Paper 1monster gamerNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- CU-2021 B. Com. (Honours) Financial Accounting-II Part-II Paper-C-22A QPDocument5 pagesCU-2021 B. Com. (Honours) Financial Accounting-II Part-II Paper-C-22A QPiamloser74No ratings yet

- Midterm Examination Suggested AnswersDocument9 pagesMidterm Examination Suggested AnswersJoshua CaraldeNo ratings yet

- Advanced Accounting exam questionsDocument4 pagesAdvanced Accounting exam questionsAbdul MalikNo ratings yet

- Set - B - SolutionDocument2 pagesSet - B - Solutionyh9bzwtzwmNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Accountancy Revision Test 1Document3 pagesAccountancy Revision Test 1KHUSHI ARORA SOSHNo ratings yet

- Test Series: August, 2018 Foundation Course Mock Test Paper - 1 Paper - 1: Principles and Practice of Accounting (Time Allowed: 3 Hours) (100 Marks)Document118 pagesTest Series: August, 2018 Foundation Course Mock Test Paper - 1 Paper - 1: Principles and Practice of Accounting (Time Allowed: 3 Hours) (100 Marks)Gaming king 02 officialNo ratings yet

- Chapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oDocument9 pagesChapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oabi100% (1)

- Piecemeal Distribution NMIMSDocument4 pagesPiecemeal Distribution NMIMSShubham ChitkaraNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Document5 pagesSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNo ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Audit of Accounts ReceivablesDocument5 pagesAudit of Accounts ReceivablesIzza Mae Rivera KarimNo ratings yet

- II Pu Acc 23 Dis Pre QprsDocument92 pagesII Pu Acc 23 Dis Pre QprskrupithkNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Monthly Test Xii Acc September 2023-24Document2 pagesMonthly Test Xii Acc September 2023-24Deepak patidarNo ratings yet

- Guided Exercises 1 Current LiabilitiesDocument2 pagesGuided Exercises 1 Current Liabilitiescharizza.ashleyNo ratings yet

- Mock Test Paper 2: Key Financial StatementsDocument5 pagesMock Test Paper 2: Key Financial StatementsRajesh MondewadNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDeepak YadavNo ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- II PUC Accountancy Paper Model PaperDocument6 pagesII PUC Accountancy Paper Model PaperCommunity Institute of Management Studies100% (1)

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Model Question Financial Accounting - IIDocument3 pagesModel Question Financial Accounting - IIEswari Gk100% (1)

- Paper - 2 Accounting SyllabusDocument40 pagesPaper - 2 Accounting SyllabusNguyen Dac ThichNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- B.Com Financial Accounting Single Entry ConversionDocument91 pagesB.Com Financial Accounting Single Entry ConversionJ RajputNo ratings yet

- Class 12 Accountancy Sample Paper Term 2Document3 pagesClass 12 Accountancy Sample Paper Term 2Ayaan KhanNo ratings yet

- Test Bank 3 - Ia 1Document25 pagesTest Bank 3 - Ia 1JEFFERSON CUTENo ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Accounting: Page 1 of 3Document3 pagesAccounting: Page 1 of 3Laskar REAZNo ratings yet

- Bcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Document6 pagesBcom 4 Sem Corporate Accounting 2 21100875 Mar 2021Zakkiya ZakkuNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Piecemeal DistributionDocument5 pagesPiecemeal DistributionYashfeen HakimNo ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- UNIT 1 Discussion ProblemsDocument13 pagesUNIT 1 Discussion ProblemsMarynelle Labrador SevillaNo ratings yet

- Accountancy 12th SPSDocument4 pagesAccountancy 12th SPSMahesh TandonNo ratings yet

- Far 103 - Accounting For Receivables and Notes ReceivableDocument4 pagesFar 103 - Accounting For Receivables and Notes ReceivablePatrishaNo ratings yet

- Dissolution of Partnership Firm Accounting ProblemsDocument5 pagesDissolution of Partnership Firm Accounting ProblemsPrageeth Roshan WeerathungaNo ratings yet

- Home Assinment 2021-22new Microsoft Office Word DocumentDocument4 pagesHome Assinment 2021-22new Microsoft Office Word DocumentGanesh AdhalraoNo ratings yet

- MB-104-–BASICS-OF-ACCOUNTING-AND-FINANCE (1)Document3 pagesMB-104-–BASICS-OF-ACCOUNTING-AND-FINANCE (1)rajeshpatnaikNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Forest Ecosystem By: Hamza ShamsDocument27 pagesForest Ecosystem By: Hamza ShamsPrashantNo ratings yet

- Details of Natural Person: Dilip Kumar Rathi AD: 1978-02-13 M 0403044/2149 Jhapa 2007-03-07 1301510000264913Document4 pagesDetails of Natural Person: Dilip Kumar Rathi AD: 1978-02-13 M 0403044/2149 Jhapa 2007-03-07 1301510000264913PrashantNo ratings yet

- 1018 - Comcc1 - L - 2 - Financial AccountingDocument2 pages1018 - Comcc1 - L - 2 - Financial AccountingPrashantNo ratings yet

- Consignment AccountDocument15 pagesConsignment AccountMahmudul Mahmud100% (1)

- Consignment AccountDocument15 pagesConsignment AccountMahmudul Mahmud100% (1)

- Prashant Rathi PDFDocument4 pagesPrashant Rathi PDFPrashantNo ratings yet

- Adobe Scan Sep 29, 2020Document3 pagesAdobe Scan Sep 29, 2020PrashantNo ratings yet

- 1019 - Comcc2 - L - 1 - Business LawDocument1 page1019 - Comcc2 - L - 1 - Business LawPrashantNo ratings yet

- Aquatic and Desert EcosystemsDocument2 pagesAquatic and Desert EcosystemsPrashantNo ratings yet

- ENVIRONMENTAL STUDIESDocument3 pagesENVIRONMENTAL STUDIESPrashantNo ratings yet

- Mkt382 Part 2Document5 pagesMkt382 Part 2Samrin HassanNo ratings yet

- Toba 2013Document234 pagesToba 2013Nila FatimahNo ratings yet

- Performance Evaluation of Banks - IIM Indore Session 3,4,5Document99 pagesPerformance Evaluation of Banks - IIM Indore Session 3,4,5LEO BABU PGP 2021-23 BatchNo ratings yet

- International Trade Agreements ExplainedDocument5 pagesInternational Trade Agreements ExplainedBen Wekesa100% (2)

- Thesis Statement On Raising Minimum WageDocument5 pagesThesis Statement On Raising Minimum Wagegof1mytamev2100% (2)

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- Project On The Effect of Money Supply On Inflation in NigeriaDocument54 pagesProject On The Effect of Money Supply On Inflation in Nigeriaawom christopher bernardNo ratings yet

- DISBURSEMENT VOUCHER (JC) - AugustDocument2 pagesDISBURSEMENT VOUCHER (JC) - Augusthekeho3180No ratings yet

- International Financial Management 13th Edition Madura Test BankDocument25 pagesInternational Financial Management 13th Edition Madura Test BankMichaelSmithspqn100% (53)

- Profel1 AC Activity Assets Part1Document2 pagesProfel1 AC Activity Assets Part1Dizon Ropalito P.No ratings yet

- How George Soros Broke the Bank of England in a $2 Billion Speculative AttackDocument4 pagesHow George Soros Broke the Bank of England in a $2 Billion Speculative AttackIrin200No ratings yet

- Revision tips for Class XII Accountancy NPODocument136 pagesRevision tips for Class XII Accountancy NPOChinu GuptaNo ratings yet

- Unit III Manufacturing ConcernDocument12 pagesUnit III Manufacturing ConcernAlezandra SantelicesNo ratings yet

- ScratchDocument1 pageScratchRaghav NegiNo ratings yet

- Hustler USA - Anniversary 2023Document138 pagesHustler USA - Anniversary 2023ธนวัฒน์ ปิยะวิสุทธิกุล67% (6)

- Paulsen JPL Effects Land Development Municipal Finance As PublishedDocument21 pagesPaulsen JPL Effects Land Development Municipal Finance As PublishedMinnie.NNo ratings yet

- RLB Construction Market Update Vietnam Q2 2018Document8 pagesRLB Construction Market Update Vietnam Q2 2018Miguel AcostaNo ratings yet

- Econ Macro Principles of Macroeconomics Canadian 1st Edition Oshaughnessy Test BankDocument25 pagesEcon Macro Principles of Macroeconomics Canadian 1st Edition Oshaughnessy Test Bankotisfarrerfjh2100% (22)

- Deed of Absolute Sale: Transfer Certificate of Title No.Document3 pagesDeed of Absolute Sale: Transfer Certificate of Title No.Elle Woods100% (1)

- Zimbabwe School of Mines: Serving The SADC Mining IndustryDocument7 pagesZimbabwe School of Mines: Serving The SADC Mining IndustryFelix TinasheNo ratings yet

- Your GIRO Payment Plan For Income Tax: DBS/POSB xxxxxx9205Document2 pagesYour GIRO Payment Plan For Income Tax: DBS/POSB xxxxxx9205Karaoui LaidNo ratings yet

- Investing in The Time of Covid 19 PDFDocument31 pagesInvesting in The Time of Covid 19 PDFROHIT RANENo ratings yet

- BUMA 20043: International Business and TradeDocument2 pagesBUMA 20043: International Business and TradeKim BihagNo ratings yet

- Interest Rate FuturesDocument73 pagesInterest Rate Futuresvijaykumar4No ratings yet

- Entrepreneur - Section From Republic Act 9501 or The Magna Carta For Small EnterprisesDocument2 pagesEntrepreneur - Section From Republic Act 9501 or The Magna Carta For Small EnterprisesLove KimNo ratings yet

- The Importance of SavingsDocument12 pagesThe Importance of SavingsKenza HazzazNo ratings yet

- BankDocument73 pagesBankSunil NikamNo ratings yet

- Slide 1: Features of Nepalese Economy and Its Nature (System)Document19 pagesSlide 1: Features of Nepalese Economy and Its Nature (System)Narayan TimilsainaNo ratings yet

- SC102Document29 pagesSC102Jasper VincentNo ratings yet

- Gartner Reprint-Predicts 2022 Customer Service and SupportDocument13 pagesGartner Reprint-Predicts 2022 Customer Service and SupportSazones Perú Gerardo SalazarNo ratings yet