Professional Documents

Culture Documents

TDS Certificate1363095

TDS Certificate1363095

Uploaded by

MathanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Certificate1363095

TDS Certificate1363095

Uploaded by

MathanCopyright:

Available Formats

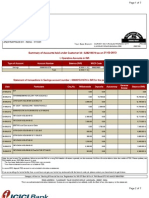

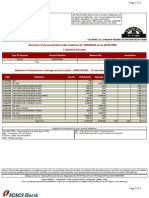

S Global Knowledge Park +91 120 3355131

19A & 19B, Sector-125,Noida-201301 info@spicemoney.com

(U.P.) India

Dated: 11-08-2022

The Manager

CANARA BANK

CNRB0002340

Sub : Exemption — Deduction of TDS u/s 194N for the Business Correspondent - CSP

Dear Sir

This is to inform you that Spice Money Limited (Formerly known as Spice Digital limited) is working as Business Correspondent-

Corporate of IndusInd Bank. Under this arrangement, Spice Money is authorized to appoint Business Correspondent (CSP) to

provide tlte various services to the end customers. IndusInd Bank is providing multiple services like Domestic Money Remittance,

Aadhar Enable Payment System (AePS) in line with Guideline issued by the Reserve Bank of India and NPCI through the

Business Correspondent - (CSP) appointed by the Spice Money Limited.

As you are aware that w.e.f. 1st of Sept 2019 onwards, tax will be deducted @ 2% on cash withdrawal over & above 1 Crore but

following persons are exempted from the provision of the above mentioned section as per notification of THE FINANCE (NO.2)

ACT, 2019 NO. 23 OF 2019 dated 1st Aug 2019 the Gazette of India (Relevant Extract)

1. The Government,

2. Any banking company or co-operative society engaged in carrying on the business of banking or a post Office;

3. Any Business Correspondent of a banking company or co-operative society engaged in carrying on the business of

banking, in accordance with the guidelines issued in this regards by the Reserve Bank of India under the Reserve

Bank of India Act, 1934.

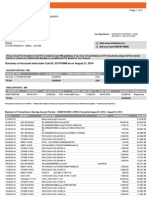

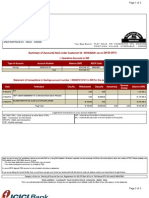

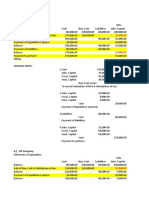

Mr. Arulraj (sdl1363095), Business Correspondents - (CSP) appointed by Spice Money Limited under the agreement with

IndusInd Bank is maintaining below bank account in your branch and using this bank account for withdrawing money in cash. As

Spice Money Limited is crediting amount against the settlement of the transaction related to AePS in this bank accounts of the

business correspondent (CSP) so cash withdrawal of such credited amount is emanating from Business Correspondence activity

and is exempt u/s sect ion 194N of the Income Tax Act, and TDS should not be deducted on such Cash withdrawals.

Name of Bank Account : CANARA BANK

Account no. : 2340101055300

IFSC Code : CNRB0002340

So you are requested to update or make suitable markup/change in your system so that TDS on Cash withdrawal against such

credit is not deducted. Alternatively, if required, Mr. Arulraj (sdl1363095) can open a fresh/new Bank Account to avail such

exemption u/s 194N as per notification mentioned under this communication.

This letter is being issued at the specific request of our Business Correspondent - CSP which is required to be submitted for its

taxation purposes, without any risk, recommendation or guarantee on the part of the Spice Money Limited or its Directors/Officers.

Thanks & Regards

Spice Money Limited (Formerly known as Spice Digital Limited)

ENCLOSED: BC CERTIFICATE

You might also like

- A Summary of Your Relationship/s With Us:: Sanam Sreenivasulu ReddyDocument4 pagesA Summary of Your Relationship/s With Us:: Sanam Sreenivasulu ReddySreenivasulu Reddy SanamNo ratings yet

- MR - Suraj Gorakhnath RautDocument1 pageMR - Suraj Gorakhnath Rautsuraj rautNo ratings yet

- 0af1012a0000000409264 ESTATEMENT 082022 0af1012a00000004Document4 pages0af1012a0000000409264 ESTATEMENT 082022 0af1012a00000004Rahul RajNo ratings yet

- Summary of Accounts Held Under Cust ID: 511365502 As On May 31, 2014Document2 pagesSummary of Accounts Held Under Cust ID: 511365502 As On May 31, 2014viswakshaNo ratings yet

- Accounting For Manager - Module 9Document7 pagesAccounting For Manager - Module 9Godz gAMERNo ratings yet

- Sep2022 - Indus Ind-Statement PDFDocument5 pagesSep2022 - Indus Ind-Statement PDFChandrashekar BGNo ratings yet

- Statement of Account 201003072715: Eljos 40/1 GF Muktidham Estate Opp Danav Park Nikol AHMEDABAD 382350 Gujarat IndiaDocument6 pagesStatement of Account 201003072715: Eljos 40/1 GF Muktidham Estate Opp Danav Park Nikol AHMEDABAD 382350 Gujarat IndiaAnonymous n30qTRQPoINo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Fy201213Document7 pagesFy201213Ramesh KomiriNo ratings yet

- Grace-AST Module 10Document5 pagesGrace-AST Module 10Devine Grace A. MaghinayNo ratings yet

- Pricing Decisions - MCQsDocument26 pagesPricing Decisions - MCQsMaxwell;No ratings yet

- Sep2015Document2 pagesSep2015Sidhantha JainNo ratings yet

- Statement of Account 85749-JAN14-0011SDocument4 pagesStatement of Account 85749-JAN14-0011SAmit JajuNo ratings yet

- PDFDocument3 pagesPDFPrabha KaranNo ratings yet

- QT12009Document2 pagesQT12009Piyush SrivastavaNo ratings yet

- The Power of Why Simon Sinek PDFDocument21 pagesThe Power of Why Simon Sinek PDFMaksi UnairNo ratings yet

- ICICI Dec 13Document2 pagesICICI Dec 13rakeshsingh9811100% (1)

- Summary of Accounts Held Under Cust ID: 531747968 As On August 31, 2014Document3 pagesSummary of Accounts Held Under Cust ID: 531747968 As On August 31, 2014JayaDeyBodhakNo ratings yet

- 01034694Document6 pages01034694shaffiNo ratings yet

- PDFDocument2 pagesPDFSanjiv VermaNo ratings yet

- TOSHIBA ACCOUNTING SCANDAL - Mini CaseDocument5 pagesTOSHIBA ACCOUNTING SCANDAL - Mini CaseNicholas AlexanderNo ratings yet

- MR - Augustin Mathew: Page 1 of 1 M-6163060Document1 pageMR - Augustin Mathew: Page 1 of 1 M-6163060AUGUSTINMATHEWNo ratings yet

- Summary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013Document2 pagesSummary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013S Deva PrasadNo ratings yet

- 0a1d01080000001709195 ESTATEMENT 012022 0a1d010800000017Document5 pages0a1d01080000001709195 ESTATEMENT 012022 0a1d010800000017Chandan VNo ratings yet

- CreditCardStatement PDFDocument3 pagesCreditCardStatement PDFManoranjan DashNo ratings yet

- Customer No.: 23502898 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument4 pagesCustomer No.: 23502898 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressKrish KalyanNo ratings yet

- Aatma Bodha667 Knowledge of SelfDocument6 pagesAatma Bodha667 Knowledge of SelfAnvith KingNo ratings yet

- (103850091) 522888932 - Sep2013Document3 pages(103850091) 522888932 - Sep2013Ankit AroraNo ratings yet

- Customer Experience in Ecommerce - Ebook CompressedDocument67 pagesCustomer Experience in Ecommerce - Ebook CompressedcojyNo ratings yet

- CreditCardStatement PDFDocument3 pagesCreditCardStatement PDFSrinivasDukkaNo ratings yet

- 00131369Document5 pages00131369Omprakash PipasaNo ratings yet

- AMAZON GO Case Study WGA1Document4 pagesAMAZON GO Case Study WGA1samiksha agarwalNo ratings yet

- MR - Vipin SharmaDocument1 pageMR - Vipin SharmaVIPIN SHARMANo ratings yet

- Ms - Syamaladevi V: Page 1 of 1 M-0Document1 pageMs - Syamaladevi V: Page 1 of 1 M-0sumarNo ratings yet

- Inv Ipl 23-24 D 1462Document1 pageInv Ipl 23-24 D 1462Vishnu DwivediNo ratings yet

- MR - Ankit Sharma: Page 1 of 1 M-76543125-1Document1 pageMR - Ankit Sharma: Page 1 of 1 M-76543125-1chaitanya200039No ratings yet

- Summary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012Document3 pagesSummary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012skbansal1976No ratings yet

- Shriram Transport Intimation Letter A4Document1 pageShriram Transport Intimation Letter A4AdhiNo ratings yet

- Feb2012Document1 pageFeb2012satya6a9246No ratings yet

- 0c5d014f0000001401929 ESTATEMENT 082023 0c5d014f00000014Document14 pages0c5d014f0000001401929 ESTATEMENT 082023 0c5d014f00000014ho.ubiquityNo ratings yet

- Sep2019 PDFDocument1 pageSep2019 PDFAaryanyayate20No ratings yet

- QT22017Document2 pagesQT22017Anandan GunasekaranNo ratings yet

- Jul2019 PDFDocument2 pagesJul2019 PDFGaurav KumarNo ratings yet

- ProsthesisDocument4 pagesProsthesisSam Bradley DavidsonNo ratings yet

- 0be501670000003a07351 ESTATEMENT 042023 0be501670000003aDocument11 pages0be501670000003a07351 ESTATEMENT 042023 0be501670000003aho.ubiquityNo ratings yet

- QT12017Document4 pagesQT12017Anandan GunasekaranNo ratings yet

- Feb2015 PDFDocument1 pageFeb2015 PDFAshok DargarNo ratings yet

- Rectangular ScrewsDocument3 pagesRectangular ScrewsSam Bradley DavidsonNo ratings yet

- Mr. Rajendra Jain File Scanned.Document36 pagesMr. Rajendra Jain File Scanned.tharundigistudiotmkNo ratings yet

- 200 500 Imo Board Meeting 20230215Document19 pages200 500 Imo Board Meeting 20230215Contra Value BetsNo ratings yet

- Account Type A/C Bala Fixed Deposits (Total B NominationDocument6 pagesAccount Type A/C Bala Fixed Deposits (Total B NominationAnurag ChaitanyaNo ratings yet

- Statement of Axis Account No:924010015798929 For The Period (From: 01-04-2024 To: 30-04-2024)Document2 pagesStatement of Axis Account No:924010015798929 For The Period (From: 01-04-2024 To: 30-04-2024)tred.ganesh12No ratings yet

- Aleena Textile Reply After Appeal OrderDocument2 pagesAleena Textile Reply After Appeal OrderAsif IqbalNo ratings yet

- 2 CMP00000000729320734Document1 page2 CMP00000000729320734aschawda1414No ratings yet

- Jan2012Document2 pagesJan2012venu26No ratings yet

- Ms - Kakani Sai Priyanka Chowdari: Page 1 of 1 M-8515039Document1 pageMs - Kakani Sai Priyanka Chowdari: Page 1 of 1 M-8515039Sai Raavan Chowdary KakaniNo ratings yet

- Summary of Accounts Held Under Cust ID: 400899386 As On September 30, 2014Document2 pagesSummary of Accounts Held Under Cust ID: 400899386 As On September 30, 2014Nilam NikiNo ratings yet

- Icici Bank Dec 2020Document2 pagesIcici Bank Dec 2020Shashikant JoshiNo ratings yet

- Ms - Diptiben Nirenkumar Patel: Page 1 of 1 M-0Document1 pageMs - Diptiben Nirenkumar Patel: Page 1 of 1 M-0niren4u1567No ratings yet

- Debenture Holders Communication PDFDocument42 pagesDebenture Holders Communication PDFV RadhakrishnanNo ratings yet

- Summary of Accounts Held Under Cust ID: 530111494 As On April 30, 2014Document2 pagesSummary of Accounts Held Under Cust ID: 530111494 As On April 30, 2014Santosh ThakurNo ratings yet

- ISIN Active & 2 Inactive in Market With Company Details and SBI BSDA ServicesDocument12 pagesISIN Active & 2 Inactive in Market With Company Details and SBI BSDA ServicesPrashant PatilNo ratings yet

- Regd. Off.: ICICI Bank Limited, "Landmark", Race Course Circle, Vadodara - 390007, IndiaDocument2 pagesRegd. Off.: ICICI Bank Limited, "Landmark", Race Course Circle, Vadodara - 390007, Indiasrinureddy2014No ratings yet

- RDocument2 pagesRMukesh ManwaniNo ratings yet

- Ind As Roadmap Bank and Insurance 2016 (1)Document2 pagesInd As Roadmap Bank and Insurance 2016 (1)SURYA SNo ratings yet

- 0c9a01720000001308070 ESTATEMENT 102023 0c9a017200000013Document9 pages0c9a01720000001308070 ESTATEMENT 102023 0c9a017200000013ho.ubiquityNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Chapter 2 - Single ItemlDocument49 pagesChapter 2 - Single ItemlBùi Quang MinhNo ratings yet

- E 18 P.P of H.R.M. PDF VersionDocument17 pagesE 18 P.P of H.R.M. PDF VersionInigo Alonso de Roman Alonso de RomanNo ratings yet

- Consult 4Document6 pagesConsult 4Bernadette LeaNo ratings yet

- Persuasive: InterviewingDocument32 pagesPersuasive: Interviewingnuzhat nowreenNo ratings yet

- Strategic Marketing Assigment1Document4 pagesStrategic Marketing Assigment1Rupama JoshiNo ratings yet

- Quantity SurveyingDocument25 pagesQuantity Surveyingmercy atienoNo ratings yet

- Accounting For Finance Lease PROBLEMSDocument30 pagesAccounting For Finance Lease PROBLEMSJhon baal S. SetNo ratings yet

- Entrepreneurship - MisconceptionsDocument21 pagesEntrepreneurship - MisconceptionsAayush AgnihotriNo ratings yet

- Literature Review On Human Resource Management PracticesDocument5 pagesLiterature Review On Human Resource Management Practicesc5qz47smNo ratings yet

- Mobile Banking As A Business Strategy Customer Lifestyle Segmentation and Factors Affecting User Loyalty (Case Study at Bank Mandiri, Indonesia)Document7 pagesMobile Banking As A Business Strategy Customer Lifestyle Segmentation and Factors Affecting User Loyalty (Case Study at Bank Mandiri, Indonesia)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Journalism Glossary Coms 113Document3 pagesJournalism Glossary Coms 113seapolelomoneiNo ratings yet

- X16 - Bộ Chứng Từ Xuất Khẩu Máy Cắt Thạch DừaDocument10 pagesX16 - Bộ Chứng Từ Xuất Khẩu Máy Cắt Thạch Dừatd342003No ratings yet

- 689140894Document7 pages689140894HATEMNo ratings yet

- Business Studies p1 Memo Gr11 Nov2022 - EnglishDocument31 pagesBusiness Studies p1 Memo Gr11 Nov2022 - EnglishllesedilebekoNo ratings yet

- NR 533 Financial Management in Healthcare Organizations Business Plan WorksheetDocument3 pagesNR 533 Financial Management in Healthcare Organizations Business Plan WorksheetDanny Clinton0% (1)

- Multiple Choice Questions: EC1002 Introduction To EconomicsDocument3 pagesMultiple Choice Questions: EC1002 Introduction To EconomicsRicardo ValverdeNo ratings yet

- Form 13A (Request For Availability of Name)Document2 pagesForm 13A (Request For Availability of Name)Zaim Adli100% (1)

- Global Marketing Org Structure 1 Nov 09Document13 pagesGlobal Marketing Org Structure 1 Nov 09vinayak nNo ratings yet

- Affise ReachDocument12 pagesAffise ReachMario IbarraNo ratings yet

- Assistant Manager Interview QuestionsDocument2 pagesAssistant Manager Interview QuestionsDurga prasad mummaneniNo ratings yet

- (Download PDF) Equity Asset Valuation Cfa Institute Investment Series 4Th Edition Pinto Online Ebook All Chapter PDFDocument42 pages(Download PDF) Equity Asset Valuation Cfa Institute Investment Series 4Th Edition Pinto Online Ebook All Chapter PDFpamela.szekely925100% (11)

- Busn 233 CH 08Document101 pagesBusn 233 CH 08Pramod VasudevNo ratings yet

- Solution QUIZ Partnership LiquidationDocument6 pagesSolution QUIZ Partnership Liquidationchezyl cadinongNo ratings yet