Professional Documents

Culture Documents

BLW 302 Midterm Exam

Uploaded by

Tatine Avelino0 ratings0% found this document useful (0 votes)

50 views1 pageOriginal Title

BLW 302 Midterm Exam (1) Converted

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views1 pageBLW 302 Midterm Exam

Uploaded by

Tatine AvelinoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

SUBJECT : BLW 302 (LAW ON NEGOTIABLE INSTRUMENTS)

Midterm Examination

TRUE OR FALSE. (Explain if your answer is False)

1. Negotiable instruments need not be in writing.

2. A negotiable promissory note is considered as a substitute for money.

3. Where the promissory note is not dated, it will be considered to be dated as of the time it

was issued.

4. A restrictive indorsement prohibits the further negotiation of the instrument.

5. A negotiable bill of exchange increases the medium of currency in circulation.

6. Where a signature is so placed upon a promissory note that it is not clear in what capacity

the person making the same intended to sign, he is to be deemed a maker.

7. A negotiable instrument is a legal tender.

8. An instrument is negotiated when it is transferred from one person to another in such

manner as to constitute the transferee the holder thereof.

9. A negotiable promissory note must be signed by the drawer.

10. Where value has at any time been given for the promissory note, the holder is deemed a

holder in due course in respect to all parties who became such prior to that time.

11. An instrument is payable on demand if it is expressed to be payable on presentation.

12. A negotiable bill of exchange must be signed by the drawee and must always be in writing.

13. A blank indorsement constitutes the indorsee the agent of the indorser.

14. A negotiable instrument must not contain a conditional promise to pay a sum certain in

money.

15. One requisite of a negotiable promissory note is that it must be payable to order or bearer.

16. Where the promissory note is addressed to a drawee, he must be named or otherwise

indicated therein with reasonable certainty.

17. The person to whom a post-dated bill of exchange is delivered acquires the title thereto as of

the date of delivery.

18. Where no time for payment is expressed, the instrument is payable on demand.

19. A special indorsement vests the title in the indorsee in trust for or to the use of some other

person.

20. Where the sum payable in a bill of exchange is expressed in words and also in figures and

there is a discrepancy between the two, the sum denoted by the figures is the sum payable.

21. A negotiable promissory note may be payable on demand.

22. Where a promissory note provides for the payment of interest, without specifying the

date from which interest is to run, the interest runs from the date of the promissory note, and

if the promissory note is undated, from the issue thereof.

23. A promissory note payable to bearer is negotiated by delivery;

24. Where a promissory note containing the words "I promise to pay" is signed by two or more

persons, they are deemed to be jointly liable thereon.

25. A holder for value is any person who has given valuable consideration for the instrument.

26. A person who has signed a promissory note as indorser, without receiving value therefor,

and for the purpose of lending his name to some other person is called an “accommodation

party”.

27. A negotiable promissory note is deemed prima facie to have been issued for a valuable

consideration; and every person whose signature appears thereon to have become a party

thereto for value.

28. A bill of exchange payable to order is negotiated by the indorsement of the holder.

29. A qualified indorsement constitutes the indorser a mere assignor of the title to the

instrument. It may be made by adding to the indorser's signature the words "without

recourse" or any words of similar import.

30. The holder of a negotiable instrument may sue thereon in his own name.

You might also like

- BLW 302 Final ExamDocument2 pagesBLW 302 Final ExamTatine AvelinoNo ratings yet

- Concept of Negotiable InstrumentsDocument6 pagesConcept of Negotiable InstrumentsJemmieNo ratings yet

- Neglaw EpassfinalDocument68 pagesNeglaw EpassfinalrdNo ratings yet

- CCCCC CCC: Negotiation AND EndorsementDocument22 pagesCCCCC CCC: Negotiation AND EndorsementAnkita Maity100% (5)

- Brief Note On Negotiable Instruments ActDocument6 pagesBrief Note On Negotiable Instruments Actnazimuddin703597No ratings yet

- Definition of A Promissory NoteDocument3 pagesDefinition of A Promissory NoteJohnWilliamsNo ratings yet

- Negotiable Instrument Act Module 4Document20 pagesNegotiable Instrument Act Module 4SANAT MishraNo ratings yet

- Negotiable Instruments Qanda NotesDocument20 pagesNegotiable Instruments Qanda NotesRamon Joma BungabongNo ratings yet

- Negotiable Instrument ActDocument9 pagesNegotiable Instrument ActHimanshu DarganNo ratings yet

- Reviewer CodeDocument41 pagesReviewer CodeCaren deLeonNo ratings yet

- Quiz 1 PrelimsDocument1 pageQuiz 1 PrelimsRewsEnNo ratings yet

- Business Law: Certificate LevelDocument14 pagesBusiness Law: Certificate LevelRafidul IslamNo ratings yet

- NEGOTIABLE INSTRUMENTS LAwDocument11 pagesNEGOTIABLE INSTRUMENTS LAwMorgana BlackhawkNo ratings yet

- The Negotiable Instruments ActDocument38 pagesThe Negotiable Instruments ActPJr MilleteNo ratings yet

- Exam #2 Midterm Business LawDocument4 pagesExam #2 Midterm Business LawJoben Vernan CuencaNo ratings yet

- Basic financial instruments explainedDocument21 pagesBasic financial instruments explainedLeena100% (1)

- Vocabulary Negotiable InstrumentsDocument6 pagesVocabulary Negotiable InstrumentsJan Joshua Paolo GarceNo ratings yet

- II. Negotiable InstrumentDocument3 pagesII. Negotiable InstrumentCRISTINA GAJISAN100% (1)

- The Negotiable Instrument Act, 1881Document18 pagesThe Negotiable Instrument Act, 1881GarimaNo ratings yet

- Ni PDFDocument67 pagesNi PDFShubham SharmaNo ratings yet

- Negotiable instruments types and implicationsDocument5 pagesNegotiable instruments types and implicationsAlexis KingNo ratings yet

- Negotiable InstrumentsDocument6 pagesNegotiable Instrumentskero keropiNo ratings yet

- THE NEGOTIABLE INSTRUMENTS ACTDocument32 pagesTHE NEGOTIABLE INSTRUMENTS ACTJohanna FrancisNo ratings yet

- The Negotiable Instruments ActDocument63 pagesThe Negotiable Instruments ActRavi KumarNo ratings yet

- Features of A Negotiable InstrumentDocument4 pagesFeatures of A Negotiable InstrumentAditi100% (7)

- Payments Guaranteed: Understanding Negotiable InstrumentsDocument12 pagesPayments Guaranteed: Understanding Negotiable InstrumentsSneha OchaniNo ratings yet

- Unit 6b.law BBA 4th SemDocument47 pagesUnit 6b.law BBA 4th Semnischal bhattaraiNo ratings yet

- Corporate legal environment study notesDocument13 pagesCorporate legal environment study notesHardik KothiyalNo ratings yet

- Act 2031, 03 February 1911 Sec. 60, New Central Bank Act, R.A. 7653 Art. 1249, CCDocument57 pagesAct 2031, 03 February 1911 Sec. 60, New Central Bank Act, R.A. 7653 Art. 1249, CCrdNo ratings yet

- Unit 3 law[1]Document70 pagesUnit 3 law[1]sonkerkrrishNo ratings yet

- Negotiable Instrument Hand OutsDocument51 pagesNegotiable Instrument Hand OutsHenry Jones UrsalesNo ratings yet

- Lecture Notes, Negotiable InstrumentsDocument10 pagesLecture Notes, Negotiable Instrumentsشوكت حياتNo ratings yet

- Features of Negotiable InstrumentDocument3 pagesFeatures of Negotiable InstrumentUnEeb WaSeemNo ratings yet

- Negotiable Instruments - General Principles Purpose of CodificationDocument22 pagesNegotiable Instruments - General Principles Purpose of Codificationapril75No ratings yet

- Negotiable Instruments Law Act No. 2031 overviewDocument24 pagesNegotiable Instruments Law Act No. 2031 overviewCyn ThiaNo ratings yet

- Negotiable Instrument: of Exchange or Cheque Payable Either, To Order or To Bearer."Document21 pagesNegotiable Instrument: of Exchange or Cheque Payable Either, To Order or To Bearer."Muhammad Nausherwan0% (1)

- Functions and characteristics of negotiable instrumentsDocument2 pagesFunctions and characteristics of negotiable instrumentsGerson Lipaygo Dela PeñaNo ratings yet

- NEGOTIATION AND ENDORSEMENT UNDER BANKING LAWDocument18 pagesNEGOTIATION AND ENDORSEMENT UNDER BANKING LAWUdisha SinghNo ratings yet

- Negotiable Instruments LawDocument23 pagesNegotiable Instruments LawPhilippe AmbasNo ratings yet

- New The Negotiable Instruments Act 1881 381011348Document93 pagesNew The Negotiable Instruments Act 1881 381011348Nikita FernandesNo ratings yet

- TPB - Module 3 - Reference MaterialDocument12 pagesTPB - Module 3 - Reference MaterialYashitha CaverammaNo ratings yet

- Assignment Negotiable InstrumentDocument11 pagesAssignment Negotiable InstrumentMuhammad AhmadNo ratings yet

- Negotiable IntstrumentDocument2 pagesNegotiable IntstrumentJayson AbadNo ratings yet

- Negotiable Instruments Endorsement GuideDocument27 pagesNegotiable Instruments Endorsement GuidevirendraysNo ratings yet

- Law Relating To Negotiable InstrumentDocument4 pagesLaw Relating To Negotiable InstrumentBikrOm BaRuaNo ratings yet

- Essential features of negotiable instrumentsDocument4 pagesEssential features of negotiable instrumentsShamaarajShankerNo ratings yet

- B Law 3Document14 pagesB Law 3Momina HaroonNo ratings yet

- Nego Finals ReviewerDocument22 pagesNego Finals ReviewerAnna Katrina VistanNo ratings yet

- 13th Week-Negotiable Instruments (Repaired)Document39 pages13th Week-Negotiable Instruments (Repaired)Muhammad WasifNo ratings yet

- Nego Reviewer FinalDocument159 pagesNego Reviewer FinalI.G. Mingo MulaNo ratings yet

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsShamaarajShankerNo ratings yet

- Negotiable Instruments Law Memory AidDocument15 pagesNegotiable Instruments Law Memory AidMelvin Pernez100% (1)

- Cle Presentation 1Document18 pagesCle Presentation 1rohitNo ratings yet

- Negotiable InstrumentDocument9 pagesNegotiable Instrumentvishal bagariaNo ratings yet

- Negotiable Instruments ACT, 1881: Legal Aspects of BusinessDocument25 pagesNegotiable Instruments ACT, 1881: Legal Aspects of BusinessVipul BatraNo ratings yet

- Negotiable Instrument Act, 1881Document18 pagesNegotiable Instrument Act, 1881Pappu YadavNo ratings yet

- Nego ReviewerDocument17 pagesNego Reviewerandy bilanNo ratings yet

- When is an instrument payable to order or bearerDocument4 pagesWhen is an instrument payable to order or bearerLoNo ratings yet

- Faareha Insurance Project SqueezedDocument14 pagesFaareha Insurance Project Squeezedaisha aliNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- BLW 302 Midterm ExamDocument1 pageBLW 302 Midterm ExamTatine AvelinoNo ratings yet

- Chap 1 2 3 Bres 301 Stiff Picks Baking NeedsDocument30 pagesChap 1 2 3 Bres 301 Stiff Picks Baking NeedsTatine AvelinoNo ratings yet

- Stiff Picks Baking Needs Questionnaires Bres 301Document7 pagesStiff Picks Baking Needs Questionnaires Bres 301Tatine AvelinoNo ratings yet

- BLW 302 Prefinal ExamDocument4 pagesBLW 302 Prefinal ExamTatine AvelinoNo ratings yet

- BLW 302 Prefinal ExamDocument4 pagesBLW 302 Prefinal ExamTatine AvelinoNo ratings yet

- Avelino - Markangelo Pre EmploymentDocument23 pagesAvelino - Markangelo Pre EmploymentTatine AvelinoNo ratings yet

- List of Members Consolidated Personal & Family InfoDocument42 pagesList of Members Consolidated Personal & Family InfoTatine AvelinoNo ratings yet

- Golden Arches offers Manager Trainee positionDocument8 pagesGolden Arches offers Manager Trainee positionTatine AvelinoNo ratings yet

- List of Members Consolidated San JOSESSSDocument71 pagesList of Members Consolidated San JOSESSSTatine AvelinoNo ratings yet

- List of Members Consolidated San JoseDocument44 pagesList of Members Consolidated San JoseTatine AvelinoNo ratings yet

- List of Members Consolidated Personal & Family InfoDocument42 pagesList of Members Consolidated Personal & Family InfoTatine AvelinoNo ratings yet

- List of Members Consolidated San Jose PHDocument85 pagesList of Members Consolidated San Jose PHTatine AvelinoNo ratings yet

- List of Members Consolidated San JosePHHDocument48 pagesList of Members Consolidated San JosePHHTatine AvelinoNo ratings yet

- List of Members Consolidated San JosePHDocument44 pagesList of Members Consolidated San JosePHTatine AvelinoNo ratings yet

- List of Members Consolidated 40 ParticipantsDocument13 pagesList of Members Consolidated 40 ParticipantsTatine AvelinoNo ratings yet

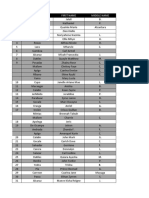

- Student RosterDocument60 pagesStudent RosterTatine AvelinoNo ratings yet

- List of Members Consolidated San Jose Ph1Document85 pagesList of Members Consolidated San Jose Ph1Tatine AvelinoNo ratings yet

- List of Members Consolidated San JOSDocument60 pagesList of Members Consolidated San JOSTatine AvelinoNo ratings yet

- List of Members Consolidated San Jose FormsDocument85 pagesList of Members Consolidated San Jose FormsTatine AvelinoNo ratings yet

- List of Members Consolidated San Jose PHDocument85 pagesList of Members Consolidated San Jose PHTatine AvelinoNo ratings yet

- Saint Bernadette College of Alabang business proposalDocument112 pagesSaint Bernadette College of Alabang business proposalTatine AvelinoNo ratings yet

- EXPANZS Registration - DayalanDocument1 pageEXPANZS Registration - DayalanManikandan BaskaranNo ratings yet

- Excise TaxDocument4 pagesExcise TaxCalvin Cempron100% (1)

- 441 Fares May2022Document1 page441 Fares May2022Cerberus BochéNo ratings yet

- Bayz Tower by Danube - Frequently Asked Question: GeneralDocument8 pagesBayz Tower by Danube - Frequently Asked Question: GeneralSomar KarimNo ratings yet

- 8th Maths Chapter 8Document25 pages8th Maths Chapter 8Ankita PattnaikNo ratings yet

- Intax FINAL EXAMDocument20 pagesIntax FINAL EXAMSteph TubuNo ratings yet

- OpTransactionHistoryUX524 08 2023Document2 pagesOpTransactionHistoryUX524 08 2023Praveen SainiNo ratings yet

- OpTransactionHistory09 02 2023Document11 pagesOpTransactionHistory09 02 2023Ishita KadamNo ratings yet

- IDFC FIRST Bank - Credit Card - Statement - 22062023Document5 pagesIDFC FIRST Bank - Credit Card - Statement - 22062023Udaya KumarNo ratings yet

- SA100 Tax Return English 2020Document10 pagesSA100 Tax Return English 2020Mal WilliamsonNo ratings yet

- Allocating Cash Dividends Between Preferred and Co PDFDocument3 pagesAllocating Cash Dividends Between Preferred and Co PDFrockerNo ratings yet

- SSU KL Fee Schedule AY23!24!1 NovDocument1 pageSSU KL Fee Schedule AY23!24!1 NovAisyah NorzilanNo ratings yet

- RTGS NEFT RequestDocument2 pagesRTGS NEFT RequestElegante World50% (2)

- Invoice Dell PDFDocument1 pageInvoice Dell PDFprashant bachimattiNo ratings yet

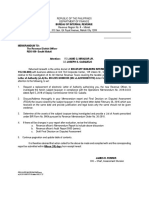

- BIR memorandum on tax investigationDocument2 pagesBIR memorandum on tax investigationAddy GuinalNo ratings yet

- Updated PS Addendum ManilaDocument1 pageUpdated PS Addendum ManilaJennell ArellanoNo ratings yet

- Cost Sharing Not TaxableDocument4 pagesCost Sharing Not TaxableCzarina Danielle EsequeNo ratings yet

- (Original For Recipient) : Billing Address Shipping AddressDocument1 page(Original For Recipient) : Billing Address Shipping AddressVaru NayanNo ratings yet

- Tax Bar Q TopicsDocument18 pagesTax Bar Q TopicsMaeNo ratings yet

- House PropertyDocument33 pagesHouse PropertypriyaNo ratings yet

- RMC 47-2019Document2 pagesRMC 47-2019RichardNo ratings yet

- Buda-Fighter Card CloningDocument3 pagesBuda-Fighter Card Cloningגולדה מאיר100% (3)

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- Social Gaming Merchant AccountDocument2 pagesSocial Gaming Merchant AccountstarprocessingusNo ratings yet

- Form 16 TDS certificateDocument2 pagesForm 16 TDS certificateSuchitra BakulyNo ratings yet

- Acctg. For Disb. (Government Accounting)Document17 pagesAcctg. For Disb. (Government Accounting)Paquito Alvez IIINo ratings yet

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- GTR 61 Stamp Refund FormDocument1 pageGTR 61 Stamp Refund FormShail JNo ratings yet

- Percentage Taxes: Line of Business/ Activity Tax Base Tax RateDocument2 pagesPercentage Taxes: Line of Business/ Activity Tax Base Tax RateMae MaupoNo ratings yet

- DNC-05 Clara Patricia (Kel 12)Document24 pagesDNC-05 Clara Patricia (Kel 12)clara_patricia_2No ratings yet

![Unit 3 law[1]](https://imgv2-2-f.scribdassets.com/img/document/724231307/149x198/0305771038/1713430790?v=1)