Professional Documents

Culture Documents

IA PortfolioC en

IA PortfolioC en

Uploaded by

Rahil JadhaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IA PortfolioC en

IA PortfolioC en

Uploaded by

Rahil JadhaniCopyright:

Available Formats

Internal assessment portfolio C

Commentary 1

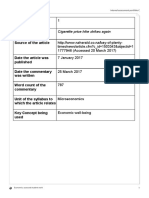

Title of the article Cigarette price hike strikes again

Source of the article http://www.nzherald.co.nz/bay-of-plenty-

times/news/article.cfm?c_id=1503343&objectid=1

1777946 (Accessed 20 March 2017)

Date the article was 7 January 2017

published

Date the commentary 25 March 2017

was written

Word count of the 787

commentary

Unit of the syllabus to Microeconomics

which the article relates

Key Concept being Economic well-being

used

Economics assessed student work 1

Internal assessment portfolio C

Article

Smoker Zoran Cacic is having to go cold turkey due to the cigarette

price hike. Photo/Andrew Warner

The annual cigarette price hike has forced one Tauranga smoker to go cold

turkey.

"I haven't got a choice now, the price is out of my budget," said Zoran Cacic

, a smoker for 32 years.

He had not been able to buy a packet since the 10 per cent tax increase

rolled into effect on January 1 2017.

In the 32 years since Mr Cacic started smoking he had tried to stop a few

Economics assessed student work 2

Internal assessment portfolio C

times, finding the gum and patches ineffective.

"I had cut myself down to 3 to 4 smokes a day, I was slowly weaning myself

off from the 20 to 30 cigarettes a day I used to smoke."

He said it had been nice to have the option to stop on his own terms but

since the latest price hike, he's had to go cold turkey.

"I'm a stubborn person, I refuse to try to find the extra money. I'm sure

it's not going to be easy."

An amputee and on the sickness benefit, Mr Cacic's budget just would not

allow the price increase for him to continue his weaning off process - "and

it's not like my circumstances are going to change in a hurry."

Mr Cacic had been smoking since he was 14 - when society told him it was

cool and not lethal.

"All the sportsmen, movie stars smoked. No one was saying it was going

to give me cancer and I got hooked," he said.

The price hike has been good news for electronic cigarette retailers in

Tauranga, who have seen an upswing in converts in the New Year.

Ben Kitson, owner of E-Juice Bar on Cameron Rd, said the tax hike and

New Year's resolutions were pushing people to an alternative.

"It's been huge, there have been hundreds of people coming in."

E-Juice Bar had to move to a bigger premises and take on three new staff

members to keep up with the demand in the previous three months.

Naked Vapour in Papamoa owner Lia Haskett said they had been busy

over the holiday period.

"Price has had an effect on people, it's always a factor in helping people

along to make the decision to change over."

A staff member at Park Mini Mart said she noticed on December 30 and

31 people bought two packets instead of one, thinking of the price increase

ahead.

"Now, people are not very happy. But they know they have to stop sooner

or later."

She said the price hike made her worried the mart would be robbed as

people get desperate for cigarettes - "this is what gave rise to the heinous

acts last year."

"The punishment should be more for robbery - it's not enough at the

moment."

Quitline CEO Andrew Slater said the holiday period saw a big influx of

calls.

"Quitting smoking is not an easy thing for everyone, most people don't

succeed on their first attempt, but you need to keep trying."

The Government will be increasing the tax on cigarettes every year for four

years, hoping to become smoke free by 2025.

- Bay of Plenty Times

Economics assessed student work 3

Internal assessment portfolio C

Commentary

The article discusses the response of cigarette consumers after the imposition of a

cigarette tax in Tauranga, New Zealand. Excise taxes are fees levied on producers

and consumers by the government. The tax introduced in the article is ad valorem tax,

which is a fixed percentage of the price of the good or service1 to curb the consumption

of cigarette - a demerit good considered unhealthy or unfavorable for consumers. The

government is looking after the economic well being of the nation, through present

and future economic choices.

1

Tragakes, E. (2012). Economics for the IB Diploma Second Edition. Cambridge University

Press. p.73

Economics assessed student work 4

Internal assessment portfolio C

In January 1 2017, a 10-percent tax ‘rolled into effect’. The tax is implemented to serve

the purpose of bringing about the economic well being through correcting negative

externalities - negative and harmful side-effects on the society. Negative externalities

of the consumption of cigarettes are lung cancer and other health problems paid in the

form of healthcare. Besides, using cigarettes put a constraint on the healthcare system

due to the involvement of passive smokers.

In the diagram, MPB curve is greater than the MSC because smoking creates external

costs on non-smokers, so the society benefits as a whole less than the smokers

themselves. This signals that there is an overallocation of resources to the production

of cigarettes and the society would be better off if less than the level of output Q m is

produced.

The tax rate of 10% on cigarette results in an upward shift of the supply curve from S1

to S2. This new curve is steeper than the original one because as the price increases,

so does the tax per unit. The tax internalizes the negative externalities since it causes

a decrease in the level of output. This is based on the ground that fewer smokers can

afford cigarettes at price Pt. “...the price is out of my budget”. Thus, an attempt at

achieving economic well-being is being made through forced economic choices. If the

tax equals external costs, the MSB curve will intersect MPB curve at the socially

optimal level of output, and the quantity produced and consumed drops to the social

optimum level. The tax therefore allows allocative efficiency to be achieved.

Economics assessed student work 5

Internal assessment portfolio C

Since cigarettes and e-cigarettes are close substitutes, or in other words, products

that satisfy a similar need and a fall in price of one results in a fall in the demand of

the other2, the demand for e-cigarettes is affected. This relationship is explained by

the concept of cross-price elasticity (XED) which is a measure of the responsiveness

of demand for one good to a change in price of another good3. In this case, “the price

2

Tragakes, E. (2012). Economics for the IB Diploma Second Edition. Cambridge University

Press. p.24

3

Tragakes, E. (2012). Economics for the IB Diploma Second Edition. Cambridge University

Press. p.59

Economics assessed student work 6

Internal assessment portfolio C

hike has resulted in an upswing in converts in the New Year” and “It’s (the demand for

e-cigarettes) has been huge”. This proved that the absolute XED value of cigarettes

and e-cigarettes is relatively high.

In the diagram, 𝐷𝐷𝐷𝐷1 and 𝐷𝐷𝐷𝐷2 represents the original and the new demand curves of e-

cigarettes. When the price for cigarettes increases, there is a rightward shift of the

demand curve from 𝐷𝐷𝐷𝐷1 to 𝐷𝐷𝐷𝐷2 of e-cigarettes. The movement results in the change in

quantity demanded and supplied from 𝑄𝑄𝑄𝑄1 to 𝑄𝑄𝑄𝑄2 and an increase in price paid by

consumers, which means electronic cigarette retailers earn a greater revenue (𝑄𝑄𝑄𝑄2× 𝑃𝑃𝑃𝑃2

as opposed to 𝑄𝑄𝑄𝑄1× 𝑃𝑃𝑃𝑃1) and are better off in this decision. If the smokers recklessly

continue substituting smoking to e- cigarettes, the government may begin intervening

in the e-cigarettes market too to sustain the economic well being of the nation.

In the short run, the tax imposed is beneficial as its purpose is twofold: bringing about

a source of revenue for the government, which is the area ACIH in the diagram, and

reducing the consumption of cigarettes. When they are produced less, there will be

allocative efficiency as the capital investment and labour can be redistributed to merit

goods. This, in the long run, leads to a healthier population with more productive capacity

or enhanced economic well-being hence the government can focus their spending on

other welfare.

Nevertheless, there are certain difficulties in this approach worthy of consideration. In

the short term, the tax induces the underground markets where cigarettes are sold at

Economics assessed student work 7

Internal assessment portfolio C

“people who get desperate for cigarettes”. Additionally, a lower amount of output

means fewer workers are needed therefore there may occur some unemployment in the

cigarette industry. Another downside of the approach might be the difficulties in

measuring the value of external costs in order to completely eradicate the external cost.

A key concept in this commentary is economic well- being. By implementing taxes, the

government has brought about certain success to put an end to smoking in Tauranga, but

it will also depend upon the consumers choices towards their own economic well-being.

Bibliography

Tragakes, E. (2012). Economics for the IB Diploma Second Edition. Cambridge University Press.

Blink, J., & Norton, I. (2012). IB Economics Course Book: 2nd Edition. Oxford University Press.

Economics assessed student work 8

Internal assessment portfolio C

Commentary 2

Title of the article Markets see South Africa cutting rates to boost

growth

Source of the article https://www.cnbcafrica.com/trending/sa-

downgrade/20 17/06/08/markets-see-south-

africa-cutting-rates/ (Accessed 17 July 2017

Date the article was 7 June 2017

published

Date the commentary was 27 July 2017

written

Word count of the 762

commentary

Unit of the syllabus to Macroeconomics

which the article relates

Key Concept being used Intervention

Economics assessed student work 9

Internal assessment portfolio C

Article

Markets see South Africa

cutting rates to boost growth by

Reuters JUNE 7, 2017

Photo: Shutterstock.

Mfuneko Toyana | JOHANNESBURG

South African bonds priced in a higher likelihood of a 50 basis point rate cut by the central bank

sooner than anticipated after the economy unexpectedly slipped into recession and raised the

risk of further credit downgrades.

Economics assessed student work 10

Internal assessment portfolio C

Forward rate markets on Wednesday were pricing in a nearly 30 percent chance of a 50 basis

point interest rate cut at the next policy meeting in July, up from a 9 percent probability seen

before the May policy meeting.

The South African Reserve Bank (SARB) has treaded a cautious policy path in the last 18

months; keeping benchmark rates on hold at 7 percent while signaling it had reached the end of

a tightening cycle that began in early 2014.

The bank may however be pushed to act to save the economy by cutting lending rates sooner

than planned to make money cheaper in a bid to boost consumer spending, analysts said.

Data on Tuesday showed the economy contracted by 0.7 percent in the first quarter of 2017

after shrinking 0.3 percent in the fourth quarter of last year.

At its policy meeting in May, Reserve Bank Governor Lesetja Kganyago played down the

prospects of cheaper borrowing costs, citing risks to inflation posed by currency volatility in light

of domestic political uncertainty and credit ratings downgrades.

Economists also said risks to inflation and the currency, posed by large capital and trade deficits,

had faded.

“For a whole host of reasons the prospect of a rate cut has definitely increased. The bank

could very well prioritize growth, putting it higher than has been case where inflation has

been front and centre,” said director ETM Analytics George Glynos.”

“These traditional drags on the rand are no longer there and as a result they will probably feel a

lot more comfortable in reducing interest rates.”

Economics assessed student work 11

Internal assessment portfolio C

The country’s trade balance swung to a 11.4 billion rand surplus in March and has remained in

the black since then, while the current account narrowed to a six-year low in the first quarter.

“Cutting next year would be too late and that will have driven the economy into a permanent

recession,” said senior economist at Old Mutual Johann Els.

“Cutting rates now would potentially boost confidence and the growth outlook and that would be

positive for rating expectations because the agencies have said they’re looking for growth

possibilities that will aid fiscal sustainability.”

(Reporting by Mfuneko Toyana; editing by Mark Heinrich)

Economics assessed student work 12

Internal assessment portfolio C

Commentary

In the article Markets see South Africa cutting rates to boost growth, Reuters' journalist

Mfuneko Toyana touches on the high possibility of the South African Reserve Bank

(SARB) to sanction an interest rate cut, an intervention in response to the prospective

recession, which is an economic contraction, where there is falling real GDP and

increasing unemployment of resources. Interest rate is defined as “the percentage of the

amount of the loan to be paid each year” (Tragakes 331). Adjusting the rate of interest is

the responsibility of the central bank and is referred to as monetary policy.

In the diagram above, there has been a leftward shift of the aggregate demand curve

from AD1 to AD2 , resulting in a 0.7 % contraction of South African economy in the first

Economics assessed student work 13

Internal assessment portfolio C

quarter of 2017. The shift has resulted in a fall in price from PL 1 to PL2 and GDP

From Y 1 to Y 2, creating a recessionary gap in the short-run. A variety of factors must

have hindered the four components of the aggregate demand, including consumption,

investment, government spending and net export. In fact, it is asserted in the article that

“trade balance swung to a 11.4 billion rand surplus”, which means that the ability to

consume imported goods has decreased, and the government intervention has been

focusing on export to save the economy from further recession.

According to director ETM Analytics George Glynos, “the prospect of a rate cut has

definitely increased”. Given such case, a target rate will be decided upon and the SARB

will be incrementally adjusting the interest rate. In the diagram, the money supply curve

shifts rightwards, resulting in an approximately a 50 basis point (0.5 per cent) rate cut,

from 9.0% to 8.5%. This intervention means lower cost of borrowing, incentivizing

consumption and investment. The ultimate effect is to increase aggregate demand, and

thus to trigger the outward shift of the real GDP level of South Africa, clearly showing the

Government intervention is an economic tool to achieve its economic objectives.

Economics assessed student work 14

Internal assessment portfolio C

In the short run, the expansionary monetary policy will ‘boost confidence and the growth

outlook’, resulting in a short-term growth, rescuing South Africa from ‘a permanent

recession.’ The short-term recession experienced by South Africa only represents a

temporary state of the economy, which occurred due to changes in determinants of the

aggregate demand. However, over a longer period of time, without any improved

conditions or intervention of the government, the economy might slip into a permanent

recession in which, due to insufficient funding, there are degradation of technology,

reduction in efficiency and inappropriate institutional changes. These factors will

ultimately lead to a leftward shift of the LRAS curve, signifying an economic shrinkage

over the long term.

Economics assessed student work 15

Internal assessment portfolio C

In addition, the monetary policy will show several advantages in ‘fine-tuning’ the economy

towards sustainability. In the short term, monetary policy, compared to fiscal policy, has

quicker implementation, which will be beneficial in the case of South Africa when a

solution is urgently needed. Secondly, in the long term, since its enactment does not

impinge on the government’s budget, this intervention will ensure the ‘fiscal

sustainability’ of the government, which entails the ability of the government to sustain

current spending and other fiscal policies without posing a threat to its solvency (Krejdl

2).

Nevertheless, the increase in money supply is not without disadvantages. This is the

reason why the SARB took a prudent approach. Reserve Bank Governor Lesetja

Kganyago pointed out that the government’s pursuit of the intervention policy may not

necessarily lead to cheaper borrowing due ‘risks of inflation’ induced by ‘currency volatility’

and previous ‘credit ratings downgrades’, which had put South Africa in a less creditworthy

position and would potentially push up the interest rate. Therefore, the bank has been

maintaining the benchmark rates of 7 % despite the end of the tightening monetary period.

Furthermore, the policy does not guarantee its effectiveness in recession. Given the

poor economic performance and volatile currency of the country, consumers and firms

might hold back their borrowing and even spending or investment. At the other end, banks

might not be willing to increase lending either.

The concept of intervention is extremely important here as it is aimed to be the chosen

method to save the economy. Admittedly, the interventionist expansionary monetary

Economics assessed student work 16

Internal assessment portfolio C

policy increases the money supply in the economy but also the several weaknesses of the

policy implementation may not necessarily bring about the desired effect of improving

economic growth. Nevertheless, this kind of government intervention will be the way

forward for South Africa to boost growth.

Economics assessed student work 17

Internal assessment portfolio C

Works cited

Krejdl, AleŠ. “Fiscal Sustainability – Definition, Indicators and Assessment of Czech Public

Finance Sustainability.” Working Paper Series, by Krejdl, Czech National Bank, 2006.

CNB Working Paper Series 3.

Bibliography

https://qz.com/887811/south-africans-are-the-biggest-borrowers-in-the-world-says-the-world-ba

nk/

https://www.weforum.org/agenda/2015/12/what-is-a-credit-rating-downgrade/

Tragakes, Ellie. Economics for the IB Diploma. Second ed., Cambridge UP, 2015.

Economics assessed student work 18

Internal assessment portfolio C

Commentary 3

Title of the article US sets final tariffs on softwood lumber from

Canada

Source of the article BBC News: https://www.bbc.com/news/world-us-canada-

41838828 (Accessed 15 November 2017)

Date the article was 2nd November 2017

published

Date the commentary was 30 November 2017

written

Word count of the 779

commentary

Unit of the syllabus to Global Economy

which the article relates

Key Concept being used Interdependence

Economics assessed student work 19

Internal assessment portfolio C

22/11/2017 Article

AD

US sets final tariffs on softwood lumber from Canada

2 November 2017 US & Canada

Play

Video

Media playback is unsupported on your device

Why are Trump and Trudeau fighting over trees?

The US Department of Commerce has said it has concluded that imports of

Canadian softwood lumber are being unfairly subsidised.

In a statement released on Thursday, it said efforts to reach a negotiated agreement

with Canada have failed.

Canada called the decision on countervailing and anti-dumping duties on lumber

"unfair, unwarranted and deeply troubling".

This is the latest salvo in a lengthy dispute between the two countries.

The US has set final total tariffs for most Canadian softwood lumber producers at

20.8%. A handful of producers were singled out for individual duties, including one of

up to 23.8%.

Except in one instance, those combined countervailing and anti-dumping duties are

below preliminary tariffs issued earlier this year.

Has the US started a Canada trade war?

Economics assessed student work 20

Internal assessment portfolio C

22/11/2017 US sets final tariffs on softwood lumber from Canada - BBC News

The view from the free trade front lines

The final tariffs will be set if the US International Trade Commission (ITC) makes a

determination that the US industry was harmed.

An ITC decision is due by 18 December.

In a joint statement on Thursday, Canada's Foreign Affairs Minister Chrystia Freeland

and Natural Resources Minister Jim Carr said they "will forcefully defend" the domestic

softwood lumber industry.

"We are reviewing our options, including legal action through the North American Free

Trade Agreement (Nafta) and the World Trade Organization, and we will not delay in

taking action," they said.

Softwood lumber products, like pine, fir and spruce, are mainly used in the construction

of single family houses.

The US has claimed for decades that Canada is unfairly subsidising its lumber industry

by charging minimal fees to log public lands.

Commerce Secretary Wilbur Ross said in a statement that the US remains committed

to "free, fair and reciprocal trade with Canada", and that the decision is based on "a full

and unbiased review of the facts in an open and transparent process".

The department said it had determined that Canadian exporters have sold softwood

lumber to the US at 3.2-8.89% less than fair value.

Trudeau and Trump discuss Bombardier row

It also maintains that the country is providing unfair subsidies at rates from 3.34-18.19%.

The US Commerce Department valued softwood lumber imports from Canada at C$7.6bn

(US$5.6bn; £4.3bn) in 2016.

REUTERS

In June, Canada announced C$867m (US$640m; £500m) in relief for the country's

lumber industry.

http://www.bbc.com/news/world-us-canada-41838828 2/7

Economics assessed student work 21

Internal assessment portfolio C

Commentary

This article is about the subsidised lumber market in Canada and the following dumping

of overproduction in American Markets. The United States has responded by placing

tariffs on Canadian lumber imports. This article is about the interdependence of nations,

consumers and producers and their strive for economic growth.

The subsidy provided was a sum of money that the Canadian government paid to

lumber firms. When this happened, firms were able to supply more to consumers at

lower prices while earning the same revenue. The article states that the “US

Department of Commerce has concluded that imports of Canadian softwood lumber are

being unfairly subsidised.” This means that the subsidies to Canadian producers have

lowered prices, including those of exports. The interdependence of the American and

Canadian lumber market is in jeopardy as they pursue their individual interest. The

American market claims that the Canadian producers are dumping their excess supply

at their subsidized lower prices. Dumping is the act of exporting a good at a price that is

lower than the normal price. When this happens, domestic American firms will struggle

to compete with the cheap imports and potentially shutdown or fail to grow. Therefore,

in order to prevent this, the US government placed hefty tariffs on the imports of

Canadian softwood lumber. This increases the overall price of the import, helping

domestic firms stay competitive.

Economics assessed student work 22

Internal assessment portfolio C

Figure 1: Subsidy of Canadian Lumber

Figure 1 shows the effects of the

subsidies the Canadian

government gave to its firms. The

supply curve, once the subsidy is

granted at rates ranging from

3.34-18.19%, shifts downwards

from S to S1. Maintaining

Economics assessed student work 23

Internal assessment portfolio C

the same demand, the firms will now produce at E1, instead of at E. Initially, firms would

have been earning revenue equal to the area PEQ. However, after the subsidy, firms are

now earning revenue equal to the area DXQ1. The size of the subsidy can be seen here

as the area DXP1E1.

The blue area is the additional revenue the firm earns.

Subsidies are typically granted to either boost supply or lower prices. Subsidies

will often cause firms to overproduce and this is what happened with Canadian lumber

suppliers. In order to maximize revenue, this excess production was sold as exports to

the American market and because the subsidy had lowered prices 3.2-8.89% below fair

prices, this was considered dumping. Therefore, to protect domestic producers, the US

government has implemented a tariff as a form of protectionism.

Figure 2: US Tariffs on Canadian Lumber Imports

Figure 2 shows the effects of

the US tariffs on the imports

of Canadian lumber. When

the US market is open to the

Canadian imports, domestic

demand falls from Q to Q1 and

the imports dominate the

market as Q4 - Q1 where Q4 is

the total demand

within the market. Once the tariff of 20.8% is implemented, the world supply curve will

shift upwards. When this happens, domestic supply increases from Q1 to Q2 and imports

decrease from Q4 - Q1 to Q3 - Q2.

Economics assessed student work 24

Internal assessment portfolio C

This tariff will immediately reduce pressure on domestic firms by

increasing the prices of the imports. The unfairly low prices that domestic firms

were forced to meet in order to compete rose, allowing all firms to increase

prices. Thus, protectionism hinders the interdependency of nations with higher

prices for consumers and loss of comparative advantage theory that would lead

increased world production of lumber.

In the short run, domestic firms will be able to become more competitive

and continue to grow. However, if the Canadian government stops subsidising,

once their effects diminish and prices return to fair value, the imports will no longer

be considered dumping. This will warrant a removal of the tariffs but given the

dispute during trade discussions, both countries may be hesitant to return to prior

arrangements.

In the long run, if subsidies and tariffs are maintained, the Canadian lumber

industry will lose competitiveness in the American market and domestic firms will

develop lowering the interdependence of the two nations. While growing, firms

will hire more labour and price levels can eventually fall. Lower prices will also

increase export revenue, increasing overall aggregate demand and GDP in the

US. The government will also earn revenue from the tariffs that can be reinvested

into both private and public sectors.

The concept of interdependence is evident in the successful growth of both

America and Canada. In summary, if the Canadian producers have been granted unfair

subsidies, which have caused them to overproduce, this has impacted them negatively in

the long run. The interdependence of the two nations becomes the premise for mutual

collaboration and action in trade that will lead to the economic welfare of both the nations.

Economics assessed student work 25

You might also like

- Fractions On A Number Line: Home Link 1-11Document1 pageFractions On A Number Line: Home Link 1-11Oscar E. SánchezNo ratings yet

- Scheme of Work Cambridge Igcse History 0470 OverviewDocument4 pagesScheme of Work Cambridge Igcse History 0470 OverviewOscar E. Sánchez50% (2)

- Supply Chain Management Professional (SCMP) National Exam Supply Chain Canada - 2021Document18 pagesSupply Chain Management Professional (SCMP) National Exam Supply Chain Canada - 2021Purnima VermaNo ratings yet

- IB IA Microeconomics Sample 7/7 - Economics HLDocument6 pagesIB IA Microeconomics Sample 7/7 - Economics HLMichelle Elie T.100% (1)

- Oroville Reman & Reload Inc V R - 19 ITLR 25Document28 pagesOroville Reman & Reload Inc V R - 19 ITLR 25Huishien QuayNo ratings yet

- 0470 Teacher Guide (For Examination From 2020)Document26 pages0470 Teacher Guide (For Examination From 2020)Oscar E. SánchezNo ratings yet

- Spanish B - Concepci N Allende Urbieta and Maite de La Fuente-Zof o - Pearson 2011Document412 pagesSpanish B - Concepci N Allende Urbieta and Maite de La Fuente-Zof o - Pearson 2011Oscar E. Sánchez100% (2)

- Economics IA Sample PDFDocument7 pagesEconomics IA Sample PDFdarren boesonoNo ratings yet

- Strong B.C., Bright FutureDocument129 pagesStrong B.C., Bright FutureThe Vancouver SunNo ratings yet

- Economic IA CommentaryDocument6 pagesEconomic IA Commentarynaman agarwalNo ratings yet

- IA EconomicsDocument3 pagesIA EconomicsElisa ElisaNo ratings yet

- Term Paper On Cigarette TaxDocument4 pagesTerm Paper On Cigarette Taxaflsldrzy100% (1)

- Fong Brian 272paperDocument28 pagesFong Brian 272paperDinda MaharaniNo ratings yet

- Exemplar For Internal Achievement Standard Economics Level 3Document16 pagesExemplar For Internal Achievement Standard Economics Level 3Po PoNo ratings yet

- Assignment Cigarette Smoking (Ped)Document10 pagesAssignment Cigarette Smoking (Ped)Hino NissanNo ratings yet

- Effect Cigarette TaxDocument5 pagesEffect Cigarette TaxraymonduskrishnaNo ratings yet

- Problems 3.9 and 4.2 in Book, PG 25Document2 pagesProblems 3.9 and 4.2 in Book, PG 25MrDiazNo ratings yet

- 0 - Referral Paper - 220813 - 121939 - 220813 - 125409Document3 pages0 - Referral Paper - 220813 - 121939 - 220813 - 125409imesha pereraNo ratings yet

- Economics PortfolioDocument27 pagesEconomics PortfolioCK OngNo ratings yet

- Kolej MARA Banting: SEPTEMBER 4, 2020Document6 pagesKolej MARA Banting: SEPTEMBER 4, 2020Syazwan KhirudinNo ratings yet

- Micro Ia Econ IbDocument6 pagesMicro Ia Econ IbAditya ShahNo ratings yet

- Research Paper Cigarette TaxDocument5 pagesResearch Paper Cigarette Taxcafygq1m100% (1)

- Econ IADocument6 pagesEcon IA우다인No ratings yet

- IES I-O Report Draft v2 20221103Document40 pagesIES I-O Report Draft v2 20221103Jovan ZubovicNo ratings yet

- 1 GreenAssetPricingDocument61 pages1 GreenAssetPricingMarcos de CastroNo ratings yet

- 1421 3612 1 SMDocument12 pages1421 3612 1 SMAlma Fortuna KiranaNo ratings yet

- Economics IA - Market FailureDocument3 pagesEconomics IA - Market FailureFaridaNo ratings yet

- 4.0 Negative Externality: Issue of Consumption of CigarettesDocument5 pages4.0 Negative Externality: Issue of Consumption of CigarettesnadiahNo ratings yet

- Tobacco Case Assignment in EconomicsDocument8 pagesTobacco Case Assignment in EconomicsPriyankar PaulNo ratings yet

- 10 1016@j Jclepro 2019 06 218Document13 pages10 1016@j Jclepro 2019 06 218Dr. Maryam IshaqNo ratings yet

- (4b.) Negative Consumption Externalities (Types of Market Failure) - NotesDocument10 pages(4b.) Negative Consumption Externalities (Types of Market Failure) - NotesDBXGAMINGNo ratings yet

- Economics HL Micro IADocument8 pagesEconomics HL Micro IAsofiaNo ratings yet

- Market Failure SampleDocument5 pagesMarket Failure SampleHarshil ChordiaNo ratings yet

- 16 PAPADOPOULOU ANNA MARIA CombinepdfDocument22 pages16 PAPADOPOULOU ANNA MARIA CombinepdfkostasNo ratings yet

- Economics Commentary IBDocument4 pagesEconomics Commentary IBNicole CharlesNo ratings yet

- Ia ExampleDocument20 pagesIa ExampleChibuzo OkoliNo ratings yet

- Quiz Perpajakan 1 - Reishandra Sefa P - 2211031115Document4 pagesQuiz Perpajakan 1 - Reishandra Sefa P - 2211031115reishandrasNo ratings yet

- 3 YIN CombinepdfDocument24 pages3 YIN CombinepdfkostasNo ratings yet

- IB Economics Microeconomics Unit Exemplar IADocument8 pagesIB Economics Microeconomics Unit Exemplar IAcorlisschan12030% (1)

- Prerna Micro CommentaryDocument6 pagesPrerna Micro CommentaryHRITIK JAINNo ratings yet

- Fresh Food Subsidised, Says StudyDocument24 pagesFresh Food Subsidised, Says StudyOscar E. SánchezNo ratings yet

- Microeconomics Commentary Number 1Document6 pagesMicroeconomics Commentary Number 1gqf94jy9rtNo ratings yet

- John Cridland Speech at Launch of CBI Report On Green Business - 5 July 2012Document15 pagesJohn Cridland Speech at Launch of CBI Report On Green Business - 5 July 2012timprobertNo ratings yet

- Does The Increase in The Cigarette Excise Tax Affect Cigarette Consumption?Document15 pagesDoes The Increase in The Cigarette Excise Tax Affect Cigarette Consumption?IJPHSNo ratings yet

- Economics For Managers: Case Number 1Document10 pagesEconomics For Managers: Case Number 1Mildred MeltonNo ratings yet

- Scribd Pension Reform Articles Pension Optimisation.Document6 pagesScribd Pension Reform Articles Pension Optimisation.morganistNo ratings yet

- Economics Commentary Planning-Sheet-Economics IADocument3 pagesEconomics Commentary Planning-Sheet-Economics IAKushal PatelNo ratings yet

- Cigarette Tax Research PaperDocument7 pagesCigarette Tax Research Paperhjqojzakf100% (1)

- Scribd Letter To The President of The United States of America - Regarding Pension Reform and Treasury Efficiencies.Document7 pagesScribd Letter To The President of The United States of America - Regarding Pension Reform and Treasury Efficiencies.morganistNo ratings yet

- Tobacco Consumption in Bangladesh An Analysis On Multiple VariablesDocument5 pagesTobacco Consumption in Bangladesh An Analysis On Multiple VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Economics of TobaccoDocument47 pagesEconomics of TobaccoJesse DanzigNo ratings yet

- IB Economics - Microeconomics CommentaryDocument7 pagesIB Economics - Microeconomics CommentaryMomina Amjad94% (33)

- Taiwan Cigarrete Tax IA V DraftDocument4 pagesTaiwan Cigarrete Tax IA V DraftAngelina ProtikNo ratings yet

- The Effect of Taxes On The Demand For CigarettesDocument8 pagesThe Effect of Taxes On The Demand For CigarettesHoly AminadokiNo ratings yet

- Economics IADocument19 pagesEconomics IASatyam GuptaNo ratings yet

- Economics For Business 02Document14 pagesEconomics For Business 02এম.এ আকবরNo ratings yet

- W 26724Document67 pagesW 26724Dinda MaharaniNo ratings yet

- dhughes3@CLEMSON - EDU: Peer ReviewedDocument20 pagesdhughes3@CLEMSON - EDU: Peer ReviewedPo PoNo ratings yet

- Imposition of Indirect Tax On Cigarettes in Pakistan - Abdullah ADocument3 pagesImposition of Indirect Tax On Cigarettes in Pakistan - Abdullah AjoeNo ratings yet

- How Pricing Pollution WorksDocument5 pagesHow Pricing Pollution WorkshiltonbraiseNo ratings yet

- Wwe ExelepntuplsDocument7 pagesWwe ExelepntuplsAamir HusainNo ratings yet

- Sba Conclusion SamplesDocument4 pagesSba Conclusion SamplesPincianna WilliamsNo ratings yet

- Proposed Tobacco Tax Structure - What Could Be AchievedDocument8 pagesProposed Tobacco Tax Structure - What Could Be AchievedJesse DanzigNo ratings yet

- Economics Lecture Notes - Chapter 7Document46 pagesEconomics Lecture Notes - Chapter 7Yamyam SanjuanNo ratings yet

- Impact of Cigarette Tax Hike On SingaporeDocument11 pagesImpact of Cigarette Tax Hike On SingaporeKelston TanNo ratings yet

- Econ Commentary InternationalDocument25 pagesEcon Commentary Internationaltrayi reddyNo ratings yet

- EIB Working Papers 2019/06 - Promoting energy audits: Results from an experimentFrom EverandEIB Working Papers 2019/06 - Promoting energy audits: Results from an experimentNo ratings yet

- Job Description - Middle School PrincipalDocument5 pagesJob Description - Middle School PrincipalOscar E. SánchezNo ratings yet

- Cambridge Economics 0465Document30 pagesCambridge Economics 0465Oscar E. SánchezNo ratings yet

- Aero SS EstandardsDocument80 pagesAero SS EstandardsOscar E. SánchezNo ratings yet

- History SL (The Move To Global War) - Study Guide - Arent Remmelink - Ib Academy 2018 (Learn-ib-Academy)Document36 pagesHistory SL (The Move To Global War) - Study Guide - Arent Remmelink - Ib Academy 2018 (Learn-ib-Academy)Oscar E. SánchezNo ratings yet

- Economics Workbook - Paul Hoang - Ibid 2013Document285 pagesEconomics Workbook - Paul Hoang - Ibid 2013Oscar E. SánchezNo ratings yet

- IA Portfoliob enDocument18 pagesIA Portfoliob enOscar E. SánchezNo ratings yet

- Fresh Food Subsidised, Says StudyDocument24 pagesFresh Food Subsidised, Says StudyOscar E. SánchezNo ratings yet

- IA PortfolioD Comm enDocument2 pagesIA PortfolioD Comm enOscar E. SánchezNo ratings yet

- Builders Out Look 2019 Issue 5Document16 pagesBuilders Out Look 2019 Issue 5TedEscobedoNo ratings yet

- Notice: North American Free Trade Agreement (NAFTA) Binational Panel Reviews: Soft Wood Lumber Products From— CanadaDocument2 pagesNotice: North American Free Trade Agreement (NAFTA) Binational Panel Reviews: Soft Wood Lumber Products From— CanadaJustia.comNo ratings yet

- LCIA 111790 Request ArbitrationDocument17 pagesLCIA 111790 Request ArbitrationiPoliticsCANo ratings yet

- Dispu Summary95 11 eDocument203 pagesDispu Summary95 11 eCHow GatchallanNo ratings yet

- International Trade Theory PracticeDocument2 pagesInternational Trade Theory Practiceak100% (1)

- Canada: Trade SummaryDocument8 pagesCanada: Trade SummaryCr CryptoNo ratings yet

- Best Memorial (Respondent) - GIMC 2019Document36 pagesBest Memorial (Respondent) - GIMC 2019raj bhoirNo ratings yet

- IA Portfolioc enDocument24 pagesIA Portfolioc enOscar E. SánchezNo ratings yet

- Indonesia - Measures Relating To Raw MaterialsDocument103 pagesIndonesia - Measures Relating To Raw MaterialshendramusNo ratings yet

- mngt3711 sw3 ModulesDocument203 pagesmngt3711 sw3 ModulesMaricel Mendoza CapulongNo ratings yet

- Lumber Duty DepositsDocument10 pagesLumber Duty DepositsForexliveNo ratings yet