Professional Documents

Culture Documents

Accounting and Its Environment

Accounting and Its Environment

Uploaded by

AdrianIlaganCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting and Its Environment

Accounting and Its Environment

Uploaded by

AdrianIlaganCopyright:

Available Formats

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

FINANCIAL ACCOUNTING AND

REPORTING

PROF. ADRIAN A. ILAGAN, CPA, MBA

FINANCIAL ACCOUNTING AND REPORTING 1

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

Lesson 1

ACCOUNTING AND ITS ENVIRONMENT

Learning Objectives:

At the end of the lesson, you should be able to:

• Define accounting and explain it role in business.

• Explain the fundamental accounting concepts and principles.

Lesson Overview:

As business and society become more complex, accounting develops new

concepts and techniques to meet the ever-increasing needs for financial

information. Without such information, many complex economic development

and social programs may never have been undertaken. Without accounting, a

business could not function optimally (Ballada, 2019).

FINANCIAL ACCOUNTING AND REPORTING 2

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

Engagement

Did you know?

https://www.facebook.com/PhilCIPAG/posts/the-richest-person-in-the-philippines-is-a-

cpa/1226959837471025/

Do you know wo this person is? What do you think this person did to become this

rich?

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

FINANCIAL ACCOUNTING AND REPORTING 3

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

Explore

A. Definitions of accounting.

Accounting in its broadest sense is the language of business. Several

institutions have defined accounting for us to better understand its essence.

• The Accounting Standards Council (ASC)

o Accounting is a service activity. Its function is to provide quantitative

information, primarily financial in nature, about economic entities that

is intended to be useful in making economic decisions.

• American Accounting Association (AAA)

o Accounting is the process of identifying, measuring and

communicating economic information to permit informed judgments

and decisions by users of the information.

• American Institute of Certified Public Accountants (AICPA)

o Accounting is the art of recording, classifying and summarizing in a

significant manner and in terms of money, transactions and events

which are, in part at least, of a financial character, and interpreting the

results thereof.

B. Double-entry Bookkeeping

Luca Pacioli is considered the father of double-entry bookkeeping. He

introduced this concept in his book entitled “Summa de Arithmetica,

Geometria, Proportioni et Proportionalita”.

• In this concept, he mentioned that for every debet dare (should give)

there exists a debet habere (should have or should receive).

• In modern applications, it simply states that for every debit, there exists a

corresponding credit.

Note: We will discuss the application of double-entry bookkeeping in

the next lesson.

FINANCIAL ACCOUNTING AND REPORTING 4

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

C. Fundamental Concepts and Basic Principles in Accounting

To further understand accounting, we delve deeper into what makes

accounting a useful tool in decision making. There are fundamental concepts

and basic principles which we should all be familiar of.

• Fundamental Concepts

o Entity Concept

▪ An accounting entity is an organization or a section of an

organization that stands apart from other organizations and

individuals as a separate economic unit.

▪ Simply put, the owner is separate and distinct from the

business.

o Periodicity Concept

▪ An entity’s life can be meaningfully subdivided into equal

time periods for reporting purposes.

▪ For purposes of reporting to outsiders, one year is the usual

accounting period.

o Stable Monetary Unit

▪ It allows accountants to add and subtract peso amounts as

though each peso has the same purchasing power as any

other peso at any time.

▪ Simply put, we ignore the effects of inflation in the

accounting records.

o Going Concern

▪ Financial statements are normally prepared on the

assumption that the reporting entity will continue in

operation for the foreseeable future.

• Basic Principles

o Objectivity

▪ Accounting records and statements are based on the most

reliable data available so that they will be as accurate and as

useful as possible.

o Historical cost

▪ It states that acquired assets should be recorded at their

actual cost and not at what management thinks they are

worth at reporting date.

FINANCIAL ACCOUNTING AND REPORTING 5

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

o Revenue recognition principle

▪ Revenue is to be recognized in the accounting period when

goods are delivered or services are rendered or performed.

o Expense recognition principle

▪ Expenses is to be recognized in the accounting period in

which goods and services are used up to produce revenue

and not when the entity pay for those goods and services.

o Adequate disclosure

▪ Requires that all relevant information that would affect the

user’s understanding and assessment of the accounting entity

be disclosed in the financial statements.

o Materiality

▪ Financial reporting is only concerned with information that

is significant enough to affect evaluations and decisions.

Materiality depends on the size and nature of the item

judged in the particular circumstances of its omission.

o Consistency principle

Firms should use the same accounting method from period to period to achieve

comparability overtime within a single enterprise.

FINANCIAL ACCOUNTING AND REPORTING 6

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

Explain and Extend

NAME: _______________________________________________ SCORE: ______________

COURSE: _____________________________________________ DATE: _______________

In your own words and understanding, answer briefly the following questions.

1. Why is accounting the language of business?

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

___________________________________________________

2. What is going concern?

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

___________________________________________________

3. What is double entry bookkeeping?

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

___________________________________________________

FINANCIAL ACCOUNTING AND REPORTING 7

COLLEGE OF ACCOUNTANCY AND BUSINESS ADMINISTRATION

EVALUATE

NAME: _______________________________________________ SCORE: ______________

COURSE: _____________________________________________ DATE: _______________

Answer briefly the following questions.

1. Can we include a purchase of house and lot of Mr. A in the books of his

business? Why?

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

___________________________________________________

2. Can we have financial statements prepared on a monthly basis?

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

___________________________________________________

FINANCIAL ACCOUNTING AND REPORTING 8

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pfrs 5 - Nca Held For Sale & Discontinued OpnsDocument23 pagesPfrs 5 - Nca Held For Sale & Discontinued OpnsAdrianIlagan100% (1)

- Nama: Destria Ayu Atikah NPK: 11190000098 Tugas: Workshop Akuntansi Keuangan Lanjutan (TM 4) Abesn: 13Document3 pagesNama: Destria Ayu Atikah NPK: 11190000098 Tugas: Workshop Akuntansi Keuangan Lanjutan (TM 4) Abesn: 13destria ayu atikahNo ratings yet

- Pfrs 3 - Business CombinationsDocument17 pagesPfrs 3 - Business CombinationsAdrianIlaganNo ratings yet

- MS 8904 - Standard Costing Variance AnalysisDocument7 pagesMS 8904 - Standard Costing Variance Analysisxara mizpahNo ratings yet

- Case No. 20 - People v. FabonDocument1 pageCase No. 20 - People v. FabonAdrianIlaganNo ratings yet

- Lesson 2Document7 pagesLesson 2AdrianIlaganNo ratings yet

- Journal Activity 2Document1 pageJournal Activity 2AdrianIlaganNo ratings yet

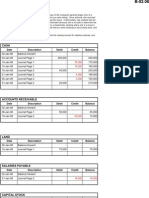

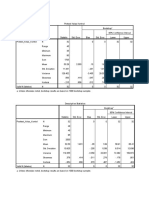

- Accounting Cycle Quiz - Comprehensive ProblemDocument2 pagesAccounting Cycle Quiz - Comprehensive ProblemAdrianIlaganNo ratings yet

- Pfrs 2 - Share-Based PaymentsDocument23 pagesPfrs 2 - Share-Based PaymentsAdrianIlaganNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesAdrianIlaganNo ratings yet

- Pfrs 1 - First-Time Adoption of PfrssDocument14 pagesPfrs 1 - First-Time Adoption of PfrssAdrianIlaganNo ratings yet

- Pfrs 6 - Exploration For and Evaluation of Mineral ResourcesDocument8 pagesPfrs 6 - Exploration For and Evaluation of Mineral ResourcesAdrianIlaganNo ratings yet

- 2 B PDFDocument2 pages2 B PDFNavya jainNo ratings yet

- Chapter 3 Job Order CostingDocument26 pagesChapter 3 Job Order CostingwubeNo ratings yet

- Bill of Quantities Watershed Civil WorksDocument161 pagesBill of Quantities Watershed Civil WorksMolapo HlasoaNo ratings yet

- The Hindu (Weekly Quiz) : Shield IASDocument6 pagesThe Hindu (Weekly Quiz) : Shield IASAbhimanyu SinghNo ratings yet

- Iec 60364 4 43 2008Document15 pagesIec 60364 4 43 2008KristofNo ratings yet

- Unwto Tourism Highlights: 2018 EditionDocument20 pagesUnwto Tourism Highlights: 2018 Editionкристина раджабоваNo ratings yet

- Binomial (HARD)Document6 pagesBinomial (HARD)IB Experts for 7on7 Pvt. Ltd.No ratings yet

- 1 Introduction To Economics and The EconomyDocument11 pages1 Introduction To Economics and The EconomykesianaNo ratings yet

- LADD Technical Clearance Form - Housing (EMD)Document1 pageLADD Technical Clearance Form - Housing (EMD)kenneth molinaNo ratings yet

- ELEC E8409 Answers 5Document6 pagesELEC E8409 Answers 5Τσιμπινός ΣπύροςNo ratings yet

- Solution Manual For Principles of Economics 5th EditionDocument34 pagesSolution Manual For Principles of Economics 5th Editioncolotomytinware.7mc1100% (48)

- Chap 4 Case Study Analysis Chap.4 Decission Making Saudi StyleDocument3 pagesChap 4 Case Study Analysis Chap.4 Decission Making Saudi StyleĐức ThuậnNo ratings yet

- PT Menolak Rugi Jurnal ZeovDocument68 pagesPT Menolak Rugi Jurnal Zeovtarakannnn364No ratings yet

- Cambridge O Level: ACCOUNTING 7707/24Document20 pagesCambridge O Level: ACCOUNTING 7707/24For GamingNo ratings yet

- Electronic Ticket Record: Passenger Name(s)Document1 pageElectronic Ticket Record: Passenger Name(s)Chenaulde BoukouNo ratings yet

- Voucher For Mobilization AdvanceDocument2 pagesVoucher For Mobilization AdvanceSaroj AcharyaNo ratings yet

- 2018 - Modelo Rama 005001 DEF Vol-ValDocument371 pages2018 - Modelo Rama 005001 DEF Vol-ValJorge Javier Mba Nzang MesieNo ratings yet

- Tabel Bunga Ekonomi TeknikDocument32 pagesTabel Bunga Ekonomi TeknikAminatus SaadahNo ratings yet

- Trial Balance PreparationDocument3 pagesTrial Balance PreparationReijen InciongNo ratings yet

- bl.117930956 204130348 BAN 11292023033355.outputDocument5 pagesbl.117930956 204130348 BAN 11292023033355.outputTony GarciaNo ratings yet

- Policy Document PDFDocument1 pagePolicy Document PDFSanjeev KanniNo ratings yet

- Full Download Ebook Ebook PDF Microeconomics 10th Edition by William Boyes PDFDocument41 pagesFull Download Ebook Ebook PDF Microeconomics 10th Edition by William Boyes PDFdanny.wainer321100% (40)

- Public Finance - Chapter 7 - Taxation and Economic EfficiencyDocument88 pagesPublic Finance - Chapter 7 - Taxation and Economic EfficiencyPhạm Trương Uyên ThyNo ratings yet

- Leaflet InventoryDocument8 pagesLeaflet InventoryTanviNo ratings yet

- Emirates Fare ConditionsDocument12 pagesEmirates Fare ConditionsRaghuNo ratings yet

- Pretest Kelas KontrolDocument4 pagesPretest Kelas KontrolNurfadila YusufNo ratings yet

- Cost Control DashboardDocument1 pageCost Control Dashboardahtesham ul haqNo ratings yet

- Impact of Public Debt On Economic GrowthDocument18 pagesImpact of Public Debt On Economic GrowthHajra ANo ratings yet