Professional Documents

Culture Documents

Osborne 278T rpt.2.24.22

Uploaded by

Thomas JonesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Osborne 278T rpt.2.24.22

Uploaded by

Thomas JonesCopyright:

Available Formats

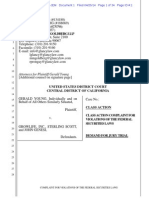

Periodic Transaction Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 (Updated Nov.

2019)

Executive Branch Personnel

Public Financial Disclosure Report:

Periodic Transaction Report (OGE Form 278-T)

Filer's Information

Osborne, Kimberly E

Deputy Executive Director, Department of Veterans Affairs

Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge.

/s/ Osborne, Kimberly E [electronically signed on 02/24/2022 by Osborne, Kimberly E in Integrity.gov]

Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations (subject to

any comments below).

/s/ Daugherty, Brenna, Certifying Official [electronically signed on 06/29/2022 by Daugherty, Brenna in Integrity.gov]

Other review conducted by

U.S. Office of Government Ethics Certification

Data Revised 02/25/2022

Osborne, Kimberly E - Page 1

Transactions

# DESCRIPTION TYPE DATE NOTIFICATION AMOUNT

RECEIVED OVER

30 DAYS AGO

1 VTI Purchase 01/10/2022 No $1,001 - $15,000

2 SCHF Purchase 01/10/2022 No $1,001 - $15,000

3 BSV Purchase 01/10/2022 No $1,001 - $15,000

4 IWM Purchase 01/10/2022 No $1,001 - $15,000

5 VWO Purchase 01/10/2022 No $1,001 - $15,000

6 IEI Purchase 01/11/2022 No $1,001 - $15,000

7 SCHP Purchase 01/10/2022 No $1,001 - $15,000

8 GMED Sale 01/10/2022 No $1,001 - $15,000

9 T Sale 01/10/2022 No $1,001 - $15,000

10 VZ Sale 01/10/2022 No $1,001 - $15,000

11 MASI Sale 01/10/2022 No $1,001 - $15,000

12 ROKU Sale 01/10/2022 No $1,001 - $15,000

13 DIS Sale 01/10/2022 No $1,001 - $15,000

14 RNG Sale 01/10/2022 No $1,001 - $15,000

15 ZM Sale 01/10/2022 No $1,001 - $15,000

16 MSFT Sale 01/10/2022 No $1,001 - $15,000

Endnotes

Osborne, Kimberly E - Page 2

Summary of Contents

The 278-T discloses purchases, sales, or exchanges of securities in excess of $1,000 made on behalf of the filer, the filer's spouse, or dependent child. Transactions are

required to be disclosed within 30 days of receiving notification of a transaction but not later than 45 days after the transaction. Filers need not disclose (1) mutual funds and

other excepted investment funds; (2) certificates of deposit, savings or checking accounts, and money market accounts; (3) U.S. Treasury bills, notes, and bonds; (4) Thrift

Savings Plan accounts; (5) real property; and (6) transactions that are solely by and between the filer, the filer's spouse, and the filer's dependent children.

Privacy Act Statement

Title I of the Ethics in Government Act of 1978, as amended (the Act), 5 U.S.C. app. § 101 et seq., as amended by the Stop Trading on Congressional Knowledge Act of 2012

(Pub. L. 112-105) (STOCK Act), and 5 C.F.R. Part 2634 of the U. S. Office of Government Ethics regulations require the reporting of this information. Failure to provide the

requested information may result in separation, disciplinary action, or civil action. The primary use of the information on this report is for review by Government officials to

determine compliance with applicable Federal laws and regulations. This report may also be disclosed upon request to any requesting person in accordance with sections 105

and 402(b)(1) of the Act or as otherwise authorized by law. You may inspect applications for public access of your own form upon request. Additional disclosures of the

information on this report may be made: (1) to any requesting person, subject to the limitation contained in section 208(d)(1) of title 18, any determination granting an

exemption pursuant to sections 208(b)(1) and 208(b)(3) of title 18; (2) to a Federal, State, or local law enforcement agency if the disclosing agency becomes aware of

violations or potential violations of law or regulation; (3) to a source when necessary to obtain information relevant to a conflict of interest investigation or determination; (4) to

the National Archives and Records Administration or the General Services Administration in records management inspections; (5) to the Office of Management and Budget

during legislative coordination on private relief legislation; (6) when the disclosing agency determines that the records are arguably relevant to a proceeding before a court,

grand jury, or administrative or adjudicative body, or in a proceeding before an administrative or adjudicative body when the adjudicator determines the records to be relevant

to the proceeding; (7) to reviewing officials in a new office, department or agency when an employee transfers or is detailed from one covered position to another, a public

financial disclosure report and any accompanying documents, including statements notifying an employee's supervising ethics office of the commencement of negotiations for

future employment or compensation or of an agreement for future employment or compensation; (8) to a Member of Congress or a congressional office in response to an

inquiry made on behalf of and at the request of an individual who is the subject of the record; (9) to contractors and other non-Government employees working on a contract,

service or assignment for the Federal Government when necessary to accomplish a function related to this system of records; (10) on the OGE Website and to any person,

department or agency, any written ethics agreement, including certifications of ethics agreement compliance, filed with OGE by an individual nominated by the President to a

position requiring Senate confirmation; (11) on the OGE Website and to any person, department or agency, any certificate of divestiture issued by OGE; (12) on the OGE

Website and to any person, department or agency, any waiver of the restrictions contained in Executive Order 13770 or any superseding executive order; (13) to appropriate

agencies, entities and persons when there has been a suspected or confirmed breach of the system of records, the agency maintaining the records has determined that there

is a risk of harm to individuals, the agency, the Federal Government, or national security, and the disclosure is reasonably necessary to assist in connection with the agency's

efforts to respond to the suspected or confirmed breach or to prevent, minimize, or remedy such harm; and (14) to another Federal agency or Federal entity, when the agency

maintaining the record determines that information from this system of records is reasonably necessary to assist the recipient agency or entity in responding to a suspected or

confirmed breach or in preventing, minimizing, or remedying the risk of harm to individuals, the recipient agency or entity, the Federal Government, or national security. See

also the OGE/GOVT-1 executive branch-wide Privacy Act system of records.

Osborne, Kimberly E - Page 3

You might also like

- DelBene 278T Rpt.3.4.22Document3 pagesDelBene 278T Rpt.3.4.22Thomas JonesNo ratings yet

- Raising Money – Legally: A Practical Guide to Raising CapitalFrom EverandRaising Money – Legally: A Practical Guide to Raising CapitalRating: 4 out of 5 stars4/5 (1)

- DelBene 278T rpt.5.22.22Document3 pagesDelBene 278T rpt.5.22.22Thomas JonesNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Abold-Labreche.278T RPT 6.13.22Document3 pagesAbold-Labreche.278T RPT 6.13.22Thomas JonesNo ratings yet

- DelBene 278T Rpt.4.8.22Document3 pagesDelBene 278T Rpt.4.8.22Thomas JonesNo ratings yet

- Remy 278T rpt.6.27.22Document3 pagesRemy 278T rpt.6.27.22Thomas JonesNo ratings yet

- Osborne 278T rpt.5.15.22Document3 pagesOsborne 278T rpt.5.15.22Thomas JonesNo ratings yet

- Abold-Labreche.278T RPT 3.13.22Document3 pagesAbold-Labreche.278T RPT 3.13.22Thomas JonesNo ratings yet

- Summary of Intrastate Crowdfunding Exemptions - Enacted - FinalDocument11 pagesSummary of Intrastate Crowdfunding Exemptions - Enacted - FinalCrowdfundInsiderNo ratings yet

- Contrato Avanzada Progresista (07/18/19)Document8 pagesContrato Avanzada Progresista (07/18/19)TalCualNo ratings yet

- Alibaba Form F-1 - Filing For US IPO (SEC, May 2014)Document345 pagesAlibaba Form F-1 - Filing For US IPO (SEC, May 2014)imranp111No ratings yet

- SEC Filing From Article: $50,000 Raised by IT'S 2 COOL, LTDDocument4 pagesSEC Filing From Article: $50,000 Raised by IT'S 2 COOL, LTDWilliam HarrisNo ratings yet

- Beard 2022.278T RPT 1.22.22Document3 pagesBeard 2022.278T RPT 1.22.22Thomas JonesNo ratings yet

- Contrats de Lobbying de La Gécamines Aux USADocument4 pagesContrats de Lobbying de La Gécamines Aux USALitsani ChoukranNo ratings yet

- Federal Register / Vol. 77, No. 109 / Wednesday, June 6, 2012 / NoticesDocument25 pagesFederal Register / Vol. 77, No. 109 / Wednesday, June 6, 2012 / NoticesMarketsWikiNo ratings yet

- SEC Filing From Article: Granite Resources, LLC Files Form D With The SECDocument4 pagesSEC Filing From Article: Granite Resources, LLC Files Form D With The SECWilliam HarrisNo ratings yet

- 6821 Exhibit AB 20200508 1 PDFDocument75 pages6821 Exhibit AB 20200508 1 PDFOlivier LiffranNo ratings yet

- ZBB Energy Corporation: Form S-1Document53 pagesZBB Energy Corporation: Form S-1Ankur DesaiNo ratings yet

- Vatukoula Gold Mines - AGM - 11 April 2011Document14 pagesVatukoula Gold Mines - AGM - 11 April 2011Intelligentsiya HqNo ratings yet

- Magnitsky Act Sanctions LiftedDocument3 pagesMagnitsky Act Sanctions LiftedDaily MaverickNo ratings yet

- Please Answer The Following QuestionsDocument4 pagesPlease Answer The Following Questionssheryl100% (3)

- Sec Form DDocument5 pagesSec Form DPando DailyNo ratings yet

- Facebook IPO ProspectusDocument148 pagesFacebook IPO ProspectustinylittleworldNo ratings yet

- Omnibus Sworn Statement BOKOD CENTRAL CISDocument3 pagesOmnibus Sworn Statement BOKOD CENTRAL CISList LeicesterNo ratings yet

- 6654 Exhibit AB 20190402 1: Contract Between Atiku and Fein & DelValleDocument10 pages6654 Exhibit AB 20190402 1: Contract Between Atiku and Fein & DelValleKúnlé AdébàjòNo ratings yet

- Purchaser Eligibility Certification: Federal Deposit Insurance CorporationDocument4 pagesPurchaser Eligibility Certification: Federal Deposit Insurance CorporationOneNationNo ratings yet

- Why and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFDocument3 pagesWhy and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFshirticicle02No ratings yet

- Facebook S 1Document147 pagesFacebook S 1tcw9pNo ratings yet

- Opplanet Ear Export Form v1.7Document1 pageOpplanet Ear Export Form v1.7Raul SosaNo ratings yet

- SBIR Application VCOC CertificationDocument3 pagesSBIR Application VCOC CertificationGOKUL PRASADNo ratings yet

- Preliminary Title ReportDocument24 pagesPreliminary Title Reportpournima mohiteNo ratings yet

- Fara IranDocument9 pagesFara IranCasey FrankNo ratings yet

- OMB FARA FormDocument7 pagesOMB FARA FormTitle IV-D Man with a planNo ratings yet

- Prospectus Wise IncomeDocument203 pagesProspectus Wise IncomesmulyuzNo ratings yet

- Gerald Young v. GrowLife, Inc. Et Al Doc 1 Filed 25 Apr 14Document34 pagesGerald Young v. GrowLife, Inc. Et Al Doc 1 Filed 25 Apr 14scion.scionNo ratings yet

- FS Form 1071 (Statement of Ownership)Document2 pagesFS Form 1071 (Statement of Ownership)Benne James100% (3)

- WWW - Sec.gov Archives Edgar Data 1372375 000104746912002246 A2207233zs-1aDocument221 pagesWWW - Sec.gov Archives Edgar Data 1372375 000104746912002246 A2207233zs-1aAnonymous Feglbx5No ratings yet

- Facebook IPO 2012 Prospectus S1 PDFDocument198 pagesFacebook IPO 2012 Prospectus S1 PDFAli AkberNo ratings yet

- Parrish 278T rpt.5.10.22Document3 pagesParrish 278T rpt.5.10.22Thomas JonesNo ratings yet

- Fsa 2041Document2 pagesFsa 2041Steve NguyenNo ratings yet

- 6492 Exhibit AB 20171127 2Document28 pages6492 Exhibit AB 20171127 2Anonymous UpWci5No ratings yet

- Exhibit A To Registration Statement Pursuant To The Foreign Agents Registration Act of 1938, As AmendedDocument8 pagesExhibit A To Registration Statement Pursuant To The Foreign Agents Registration Act of 1938, As AmendedSalah benhsNo ratings yet

- Motion For ExaminationDocument6 pagesMotion For Examinationspacecat007No ratings yet

- Lost Instrument Bond Requirements Releasing A Colorado Dot For A Lost Promissory NoteDocument3 pagesLost Instrument Bond Requirements Releasing A Colorado Dot For A Lost Promissory Noteapi-293779854No ratings yet

- Facebook IPO 2012 Prospectus S1 PDFDocument198 pagesFacebook IPO 2012 Prospectus S1 PDFoObly.com100% (1)

- DB - Ocwen-Serviced Trusts - Notice Re Regulatory Actions 7.21.17Document147 pagesDB - Ocwen-Serviced Trusts - Notice Re Regulatory Actions 7.21.17Nye Lavalle100% (1)

- Ener KemDocument345 pagesEner KemStefanie AndrianiNo ratings yet

- 85 Insurance Certificate 2015Document2 pages85 Insurance Certificate 2015SHARP HOA MANAGEMENT, INC100% (1)

- Sanfilippo.2022 RPTDocument8 pagesSanfilippo.2022 RPTThomas JonesNo ratings yet

- 2U, Inc S-1 FilingDocument272 pages2U, Inc S-1 Filingannjie123456No ratings yet

- Sample Forensic Audit 26045678Document15 pagesSample Forensic Audit 26045678KNOWLEDGE SOURCENo ratings yet

- 004 IM 0501 Bookproof PDFDocument148 pages004 IM 0501 Bookproof PDFInvest StockNo ratings yet

- U.S. Treasury Account Authorization FormDocument1 pageU.S. Treasury Account Authorization Formdarius318100% (3)

- Mortgage Bond - ProspectusDocument48 pagesMortgage Bond - ProspectusfaiyazadamNo ratings yet

- Bank United Master List of REMICs p938 - 2007 REMICs-TrustDocument224 pagesBank United Master List of REMICs p938 - 2007 REMICs-TrustZAYLE777No ratings yet

- 6399 Exhibit AB 20200320 40Document8 pages6399 Exhibit AB 20200320 40Newsbomb AlbaniaNo ratings yet

- DVN 2012 10KDocument182 pagesDVN 2012 10Kbmichaud758No ratings yet

- Credit Report Clean PDFDocument2 pagesCredit Report Clean PDFMarioBlanks100% (2)

- Ross, Patricia.2022 RPTDocument8 pagesRoss, Patricia.2022 RPTThomas JonesNo ratings yet

- Fulton, Brenda - Ne RPTDocument11 pagesFulton, Brenda - Ne RPTThomas JonesNo ratings yet

- Beard.2022 RPTDocument9 pagesBeard.2022 RPTThomas JonesNo ratings yet

- Osborne 278T rpt.5.15.22Document3 pagesOsborne 278T rpt.5.15.22Thomas JonesNo ratings yet

- Gibbs.2022 RPTDocument8 pagesGibbs.2022 RPTThomas JonesNo ratings yet

- Osborne 278T rpt.5.15.22Document3 pagesOsborne 278T rpt.5.15.22Thomas JonesNo ratings yet

- McClain.2022 RPTDocument9 pagesMcClain.2022 RPTThomas JonesNo ratings yet

- Osborne 278T rpt.5.15.22Document3 pagesOsborne 278T rpt.5.15.22Thomas JonesNo ratings yet

- Torres, Linda.2021 NE RPTDocument11 pagesTorres, Linda.2021 NE RPTThomas JonesNo ratings yet

- Beard.2022 RPTDocument9 pagesBeard.2022 RPTThomas JonesNo ratings yet

- Donaghy.2022 RPTDocument13 pagesDonaghy.2022 RPTThomas JonesNo ratings yet

- Farina.2022 RPTDocument10 pagesFarina.2022 RPTThomas JonesNo ratings yet

- Marks.2022 RPTDocument11 pagesMarks.2022 RPTThomas JonesNo ratings yet

- Prietula.2022 RPTDocument11 pagesPrietula.2022 RPTThomas JonesNo ratings yet

- Beard 2022.278T RPT 1.22.22Document3 pagesBeard 2022.278T RPT 1.22.22Thomas JonesNo ratings yet

- Quinn, Matthew.2022 RPTDocument10 pagesQuinn, Matthew.2022 RPTThomas JonesNo ratings yet

- Grosso.2022 RPTDocument34 pagesGrosso.2022 RPTThomas JonesNo ratings yet

- Sanders.2020 Term RPTDocument14 pagesSanders.2020 Term RPTThomas JonesNo ratings yet

- Jacobs.2022 RPTDocument16 pagesJacobs.2022 RPTThomas JonesNo ratings yet

- Sanfilippo.2022 RPTDocument8 pagesSanfilippo.2022 RPTThomas JonesNo ratings yet

- Parrish 278T rpt.5.10.22Document3 pagesParrish 278T rpt.5.10.22Thomas JonesNo ratings yet

- Gonzalez Prats.2022 RPTDocument8 pagesGonzalez Prats.2022 RPTThomas JonesNo ratings yet

- Beard.2022 RPTDocument9 pagesBeard.2022 RPTThomas JonesNo ratings yet

- Osborne 278T rpt.5.15.22Document3 pagesOsborne 278T rpt.5.15.22Thomas JonesNo ratings yet

- Gusse - Ne RPTDocument11 pagesGusse - Ne RPTThomas JonesNo ratings yet

- Sanfilippo.2022 RPTDocument8 pagesSanfilippo.2022 RPTThomas JonesNo ratings yet

- CONSTI 2 Crombonds Short Finals ReviewerDocument15 pagesCONSTI 2 Crombonds Short Finals Reviewervelasquez0731No ratings yet

- Valdez V Dabon (Digest)Document2 pagesValdez V Dabon (Digest)GM AlfonsoNo ratings yet

- BARQDocument2 pagesBARQGreggy LawNo ratings yet

- Analisis Deskriptif City Branding Myanmar: Agung Yudhistira Nugroho Dewi Maria HerawatiDocument25 pagesAnalisis Deskriptif City Branding Myanmar: Agung Yudhistira Nugroho Dewi Maria Herawatimatiusbenu supargiantoNo ratings yet

- 2017-04-07 Amended Complaint 2017-00817Document293 pages2017-04-07 Amended Complaint 2017-00817Daniel J. Sernovitz100% (1)

- BarangayDocument2 pagesBarangayRafael Joshua LedesmaNo ratings yet

- Imm5813 2-Yqul8srDocument2 pagesImm5813 2-Yqul8srAfgan Budagov33% (3)

- A.T Jones-Great Empires of Prophecy From Babylon To The Fall of RomeDocument640 pagesA.T Jones-Great Empires of Prophecy From Babylon To The Fall of RomeDANTZIE100% (2)

- 16.22 US Vs TabianaDocument10 pages16.22 US Vs TabiananazhNo ratings yet

- Application Format For Individual Applicants Application No. Application DateDocument3 pagesApplication Format For Individual Applicants Application No. Application DatejackproewildNo ratings yet

- Movertrade Vs COA PDFDocument13 pagesMovertrade Vs COA PDFBeboy Paylangco EvardoNo ratings yet

- Answer With CrossDocument3 pagesAnswer With CrossTrem GallenteNo ratings yet

- HMS Surprise CombinedDocument20 pagesHMS Surprise CombinedSecu09100% (2)

- Insight Uppint Short 1-1aDocument3 pagesInsight Uppint Short 1-1aKlaudia JakubczakNo ratings yet

- Faith Our Loving Response To God - S RevelationDocument50 pagesFaith Our Loving Response To God - S RevelationArden BacallanNo ratings yet

- Psalm 126 OutlineDocument1 pagePsalm 126 Outlinealan shelbyNo ratings yet

- Ch13 PrejudiceDocument61 pagesCh13 PrejudiceJeyla ShahmirovaNo ratings yet

- Sideco House (Heritage) - SULIVA, Michaela - ARCH31S2Document9 pagesSideco House (Heritage) - SULIVA, Michaela - ARCH31S2Mika SulivaNo ratings yet

- Durarara Golden TimeDocument25 pagesDurarara Golden TimeAlexander SusmanNo ratings yet

- Cluster C Personality DisordersDocument79 pagesCluster C Personality Disordersdrkadiyala20% (1)

- The First Voyage Around The WorldDocument4 pagesThe First Voyage Around The WorldEunizel Tagama AnchetaNo ratings yet

- Katamaran NG Mga PilipinoDocument13 pagesKatamaran NG Mga PilipinoErwin OgenaNo ratings yet

- 02 THE UNITED STATES V. TAYLOR-BigalbalDocument2 pages02 THE UNITED STATES V. TAYLOR-BigalbalIsay Yason100% (1)

- Think L3 Skills Test Units 7-8Document3 pagesThink L3 Skills Test Units 7-8ГолубьNo ratings yet

- Communities Cagayan Inc Vs NanolDocument1 pageCommunities Cagayan Inc Vs NanolDinahNo ratings yet

- 2010 SCMR 1160Document3 pages2010 SCMR 1160UnknownNo ratings yet

- Goldfish Raymond Chandler WikipediaDocument3 pagesGoldfish Raymond Chandler WikipediaTiffany100% (1)

- UDMC-F-SO-02 REV05 - 21 APR 21 - Firearm Sale, Purchase, Repurchase, and Warranty Agreement (PRINTABLE FORM)Document8 pagesUDMC-F-SO-02 REV05 - 21 APR 21 - Firearm Sale, Purchase, Repurchase, and Warranty Agreement (PRINTABLE FORM)Venn Dave DavidNo ratings yet

- Rizal - Chapter 17 BasilioDocument8 pagesRizal - Chapter 17 BasilioCy SgnNo ratings yet

- Feminist Jurisprudence - Why Law Must Consider Womens PerspectiveDocument4 pagesFeminist Jurisprudence - Why Law Must Consider Womens PerspectivesmartjerkNo ratings yet