Professional Documents

Culture Documents

Tax Rates

Uploaded by

Mariah Jans Sasuman0 ratings0% found this document useful (0 votes)

3 views1 pageHelpful for Taxation Subjects.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHelpful for Taxation Subjects.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageTax Rates

Uploaded by

Mariah Jans SasumanHelpful for Taxation Subjects.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

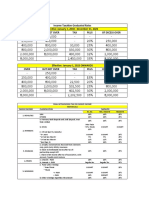

FINAL TAX RATES

INCOME RC NRC RA NRAETB NRANETB DC RC NRC

1. Interest income or yields from LOCAL CURRENCY BANK DEPOSITS or deposit substitutes

a. Short term deposits (less than 5 years maturity date) 20% 20% 20% 20% 25% 20% 20% 30%

b. Long term deposits or Investment Certificates (5 years or more maturity date) Exempt Exempt Exempt Exempt 25% 20% 20% 30%

c. Pre-termination of long term deposits (for Individuals only)

c.1. 5 years or more holding period 0% 0% 0% 0% 25% 20% 20% 30%

c.2. 4 years to less than 5 years holding period 5% 5% 5% 5% 25% 20% 20% 30%

c.3. 3 years to less than 4 years holding period 12% 12% 12% 12% 25% 20% 20% 30%

c.4. Less that 3 years holding period 20% 20% 20% 20% 25% 20% 20% 30%

2. Interest Income or yields from FOREIGN CURRENCY BANK DEPOSITS under FCDU/EFCDU 15% Exempt 15% Exempt Exempt 15% 15% Exempt

3. Interest Income of EFCDU/OBU 10% Exempt 10% Exempt Exempt 10% 10% Exempt

4. Interest on foreign loans RIT RIT RIT RIT RIT RIT RIT 20%

5. DOMESTIC DIVIDENDS, in general

a. From Domestic Coporations 10% 10% 10% 20% 25% Exempt Exempt 30%

b. From Foreign Corporations RIT RIT RIT RIT RIT RIT RIT RIT *NOTE

6. SHARE IN NET INCOME of taxable partnership (business partnership), joint venture

and co-ownership 10% 10% 10% 20% 25% 10% 10% 30%

7. ROYALTIES

a. Literary works, Books and Musical compositions (LBM) 10% 10% 10% 10% 25% 20% 20% 30%

b. Cinematoghraphic films and other similar works 20% 20% 20% 25% 25% 20% 20% 25%

c. Others 20% 20% 20% 20% 25% 20% 20% 30%

8. PRIZES

a. Not exceeding 10,000 RIT RIT RIT RIT 25% RIT RIT 30%

b. Exceeding 10,000 20% 20% 20% 20% 25% RIT RIT 30%

9. WINNINGS

a. PCSO/Lotto Winnings not exceeding 10,000 Exempt Exempt Exempt Exempt 25% Exempt Exempt 30%

b. PCSO/Lotto Winnigs exceeeding 10,000 20% 20% 20% 20% 25% 20% 20% 30%

c. Others 20% 20% 20% 20% 25% RIT RIT 30%

10. Informer's Tax Reward (10% or 1,000,000 whichever is lower; per case basis) 10% 10% 10% 10% 25% 10% 10% 30%

11. Interest on TAX-FREE Corporate Covenant Bond 30% 30% 30% 30% 30% RIT RIT RIT

You might also like

- Enabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesFrom EverandEnabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesNo ratings yet

- C. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptDocument1 pageC. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptNajira HassanNo ratings yet

- Taxation Tax Rates For Individual Taxpayers, Estates and TrustsDocument5 pagesTaxation Tax Rates For Individual Taxpayers, Estates and TrustsSherri BonquinNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument2 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoRaymond RosalesNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Schedule of Withholding TaxDocument2 pagesSchedule of Withholding TaxLance MontealtoNo ratings yet

- Tax SummariesDocument8 pagesTax SummariesLuisa Victoria BelmonteNo ratings yet

- FT TableDocument4 pagesFT TableChantie BorlonganNo ratings yet

- Summary of FWT ThresholdDocument4 pagesSummary of FWT ThresholdAngel Chane OstrazNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Ast TX 502 Tax Rates For Individuals (Batch 22)Document5 pagesAst TX 502 Tax Rates For Individuals (Batch 22)CelestiaNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- Final Income TaxDocument6 pagesFinal Income TaxJñelle Faith Herrera SaludaresNo ratings yet

- Income Taxation RatesDocument2 pagesIncome Taxation RatesStephen ChuaNo ratings yet

- Passive Incomefor Both Individual and Corporation Individual CorporationDocument4 pagesPassive Incomefor Both Individual and Corporation Individual CorporationYrolle Lynart AldeNo ratings yet

- TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Document12 pagesTAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Ciarie Salgado0% (1)

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding TaxesJimbo ManalastasNo ratings yet

- Individuals Corporations RC NRC RA Nraetb Nranetb DC RFC NRFC 1. Interest IncomeDocument1 pageIndividuals Corporations RC NRC RA Nraetb Nranetb DC RFC NRFC 1. Interest IncomePaul Winston Mansing Alcala100% (1)

- Chapter 05 Final Income Taxation1Document2 pagesChapter 05 Final Income Taxation1raven dayritNo ratings yet

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding Taxeskrisha milloNo ratings yet

- PASSIVE INCOME Individual With CREATEDocument2 pagesPASSIVE INCOME Individual With CREATERacelle FlorentinNo ratings yet

- Summary of Final TaxesDocument1 pageSummary of Final TaxesIrizh VillegasNo ratings yet

- Regular Business/Corporate Tax: DC RFC NRFCDocument2 pagesRegular Business/Corporate Tax: DC RFC NRFCGrace Angelie C. Asio-SalihNo ratings yet

- 4.2 Summary Lecture - Final Tax and CGT (Make Up Class)Document2 pages4.2 Summary Lecture - Final Tax and CGT (Make Up Class)Charles MateoNo ratings yet

- Summary of Passive Income and Capital Gains Taxes - MaupoDocument4 pagesSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoNo ratings yet

- Final Tax Rates 2023Document1 pageFinal Tax Rates 2023Mycah AliahNo ratings yet

- Tax - Simplified Table of RatesDocument5 pagesTax - Simplified Table of RatesLouNo ratings yet

- Chapter 05 Final Income Taxation TableDocument4 pagesChapter 05 Final Income Taxation TablejannyNo ratings yet

- FWTX, CWTX and CGTX (Points To Remember and Tax Rates)Document2 pagesFWTX, CWTX and CGTX (Points To Remember and Tax Rates)Justz LimNo ratings yet

- Inbound 2168611759498459938Document2 pagesInbound 2168611759498459938MarielleNo ratings yet

- Final Taxes RatesDocument2 pagesFinal Taxes RatesPanda CocoNo ratings yet

- Tax On Certain Passive IncomeDocument2 pagesTax On Certain Passive IncomeCristel Ann DotimasNo ratings yet

- Taxation Notes by Angelo MonforteDocument32 pagesTaxation Notes by Angelo Monfortemisonim.eNo ratings yet

- Tax Summary Notes by Banggawan and EsguerraDocument28 pagesTax Summary Notes by Banggawan and EsguerraAngelica NimerNo ratings yet

- FT and CGTDocument12 pagesFT and CGTLiyana ChuaNo ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- RateDocument3 pagesRatemikamiiNo ratings yet

- Tax NotesDocument2 pagesTax NotesHyeju SonNo ratings yet

- Taxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDocument7 pagesTaxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDenny Kridex OmolonNo ratings yet

- Income TaxDocument2 pagesIncome TaxEmy EspirituNo ratings yet

- Tax Notes Aug 10-11Document15 pagesTax Notes Aug 10-11Reiner NuludNo ratings yet

- Final Tax Lecture PDFDocument7 pagesFinal Tax Lecture PDFMarlo Caluya ManuelNo ratings yet

- EX EX EX EX: Regular Income TaxDocument7 pagesEX EX EX EX: Regular Income TaxMary Leigh TenezaNo ratings yet

- Tax TablesDocument6 pagesTax TablesChirrelyn Necesario SunioNo ratings yet

- TX 202Document5 pagesTX 202Pau SantosNo ratings yet

- Final Withholding Tax On Passive IncomeDocument1 pageFinal Withholding Tax On Passive IncomeChelsea Anne VidalloNo ratings yet

- Income Category: Summary of Final TaxesDocument3 pagesIncome Category: Summary of Final TaxesKathleen Mae Salenga FontalbaNo ratings yet

- TAX-702 (Tax Rates For Corporations)Document7 pagesTAX-702 (Tax Rates For Corporations)MABI ESPENIDONo ratings yet

- AppendicesDocument8 pagesAppendicescrackheads philippinesNo ratings yet

- FWT, CWT, Gross Income, DividendsDocument10 pagesFWT, CWT, Gross Income, DividendsMohammad Nowaiser MaruhomNo ratings yet

- Income Within Philippine Sources Individual Taxpayers RC NRC RA Nraetb NranetbDocument2 pagesIncome Within Philippine Sources Individual Taxpayers RC NRC RA Nraetb NranetbXandae MempinNo ratings yet

- Tax RatesDocument3 pagesTax RatesPearl Antoniette GasaNo ratings yet

- Final Tax LectureDocument7 pagesFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- Lesson 4 Final Income Taxation PDFDocument4 pagesLesson 4 Final Income Taxation PDFErika ApitaNo ratings yet

- HO4Passive Income - Revision 1Document2 pagesHO4Passive Income - Revision 1Christopher SantosNo ratings yet

- Tax TablesDocument3 pagesTax TablesJimbo HotdogNo ratings yet

- Assignment Ch15&16 Arkawira - 29119255Document9 pagesAssignment Ch15&16 Arkawira - 29119255Arkawira Nul SalamNo ratings yet

- Project On Ibrahim Fibers LTDDocument53 pagesProject On Ibrahim Fibers LTDumarfaro100% (1)

- Lect 12 EOQ SCMDocument38 pagesLect 12 EOQ SCMApporva MalikNo ratings yet

- Alternative Investment Funds in Ifsc09122020071200Document2 pagesAlternative Investment Funds in Ifsc09122020071200SanyamNo ratings yet

- Assignment 1 WorkingDocument9 pagesAssignment 1 WorkingUroosa VayaniNo ratings yet

- Anik Nayak (KP)Document54 pagesAnik Nayak (KP)Meet gayakvadNo ratings yet

- Sector Minero en El Perú - 2020 - BBVADocument63 pagesSector Minero en El Perú - 2020 - BBVAYensi Urbano CamonesNo ratings yet

- Butchery Business Plan-1Document12 pagesButchery Business Plan-1Andrew LukupwaNo ratings yet

- Limits of Authority Policy 2018 FINALDocument8 pagesLimits of Authority Policy 2018 FINALVivek SaraogiNo ratings yet

- Nestle's Problem Child-MaggiDocument4 pagesNestle's Problem Child-MaggiAshiq Thekke EdivettiyakathNo ratings yet

- BS Islamic Banking and FinanceDocument13 pagesBS Islamic Banking and FinanceNaveed Akhtar ButtNo ratings yet

- G11 Organization Management Q1 L4Document4 pagesG11 Organization Management Q1 L4Cherry CieloNo ratings yet

- Client Project Nine - Commonwealth Youth ProgrammeDocument2 pagesClient Project Nine - Commonwealth Youth ProgrammeberthiadNo ratings yet

- BUS 5110 Port. Act Unit 7Document3 pagesBUS 5110 Port. Act Unit 7christian allos100% (3)

- Banking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andDocument10 pagesBanking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andgalilleagalillee100% (1)

- SOP For ExampleDocument2 pagesSOP For Exampleadityash9950% (4)

- Auditing and Assurance: Specialized Industries - Midterm ExaminationDocument14 pagesAuditing and Assurance: Specialized Industries - Midterm ExaminationHannah SyNo ratings yet

- A Comparative Study of E-Banking in Public andDocument10 pagesA Comparative Study of E-Banking in Public andanisha mathuriaNo ratings yet

- Economic Reforms and Agricultural Growth in IndiaDocument6 pagesEconomic Reforms and Agricultural Growth in Indiapaul lekhanNo ratings yet

- Types of Population PyramidDocument4 pagesTypes of Population PyramidEleonor Morales50% (2)

- Sahil Tiwari Personality Develpoment Assignment PDFDocument5 pagesSahil Tiwari Personality Develpoment Assignment PDFsahiltiwari0777No ratings yet

- 26912Document47 pages26912EMMANUELNo ratings yet

- BMA 1 HW#5.1 GUERRERO, RonneLouiseDocument6 pagesBMA 1 HW#5.1 GUERRERO, RonneLouiseLoisaDu RLGNo ratings yet

- Bus 801 PDFDocument310 pagesBus 801 PDF099153432843No ratings yet

- Boundaries of Technical Analysis - Milton BergDocument14 pagesBoundaries of Technical Analysis - Milton BergAlexis TocquevilleNo ratings yet

- COLLATERAL BENEFITS V.9 Final 8MAY2020Document27 pagesCOLLATERAL BENEFITS V.9 Final 8MAY2020cristianNo ratings yet

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document66 pagesKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINo ratings yet

- Subject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Document3 pagesSubject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Noble InfoTechNo ratings yet

- RGPPSEZ - Annual Report - 2022 - ENGDocument149 pagesRGPPSEZ - Annual Report - 2022 - ENGsteveNo ratings yet

- HRMS Project Plan FinalDocument17 pagesHRMS Project Plan FinalSaravana Kumar Papanaidu100% (2)

- Independent University of Bangladesh: An Assignment OnDocument18 pagesIndependent University of Bangladesh: An Assignment OnArman Hoque SunnyNo ratings yet