Professional Documents

Culture Documents

TX 202

Uploaded by

Pau SantosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TX 202

Uploaded by

Pau SantosCopyright:

Available Formats

TX-202 TAXATION OF INDIVIDUALS, TRUST AND ESTATES

I. Final tax rates on certain passive income from Philippine sources

a) Rates of tax on certain passive income

1) Sec. 24(B) – for residents or citizens

a. Interest from any currency bank deposit 20%

b. Yield or any other monetary benefit from deposit substitute (obtained

20%

from 20 or more individual or corporate lenders)

c. Yield or any other monetary benefit from trust funds and similar

20%

arrangements

d. Royalties (except royalties on books and other literary works and musical

20%

compositions)

e. Prizes [except prizes amounting to P10,000 or less which shall be subject

20%

to tax under Sec. 24 (A)]

f. Winnings (except winnings amounting to P10,000 or less from Philippine

20%

Charity Sweepstakes Office (PCSO) games which shall be exempt)

g. Royalties on books and other literary works and musical compositions 10%

h. Tax informer’s reward 10%

2) Sec. 25(A)(2) – for non-resident citizens engaged in trade or business

a. Interest from any currency bank deposit 20%

b. Yield or any other monetary benefit from deposit substitute (obtained

20%

from 20 or more individual or corporate lenders)

c. Yield or any other monetary benefit from trust funds and similar

20%

arrangements

d. Royalties (except royalties on books and other literary works and musical

20%

compositions)

e. Prizes [except prizes amounting to P10,000 or less which shall be subject

20%

to tax under Sec. 24 (A)]

f. Winnings (except winnings amounting to P10,000 or less from Philippine

20%

Charity Sweepstakes Office (PCSO) games which shall be exempt)

g. Royalties on books and other literary works and musical compositions 10%

h. Tax informer’s reward 10%

i. Cinematographic films and similar works shall be subject to the tax

25%

provided under Section 28 of the Tax Code

3) Sec. 25 (B) – For non-resident aliens not engaged in trade or business

a. Interest from any currency bank deposit 25%

b. Yield or any other monetary benefit from deposit substitute (obtained

25%

from 20 or more individual or corporate lenders)

c. Yield or any other monetary benefit from trust funds and similar

25%

arrangements

d. Royalties, in general 25%

e. Royalties on books, as well as other literary works and musical

25%

compositions

f. Prizes 25%

g. Other winnings 25%

Taxation of Individuals, Trusts, and Estates | Page 1 of 5

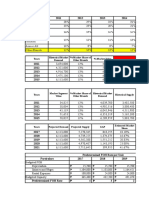

RES/CIT NRAETB NRANETB

a. Interest income received by individual taxpayer

(except non-resident individual) from a

15% Exempt Exempt

depositary bank under expanded foreign

currency deposit system

b. Interest income from long-term deposit or

investment in the form of savings, common or

individual trust funds, deposit substitutes,

investment management accounts and other Exempt Exempt 25%

investments evidenced by certificates in such

form prescribed by Bangko Sentral ng Pilipinas

(BSP)

If pre-terminated before fifth year, a final tax

shall be imposed based on remaining maturity:

4 years but less than 5 years 5% 5% 25%

3 years but less than 4 years 12% 12% 25%

Less than 3 years 20% 20% 25%

b) Cash and/or property dividends

RES/CIT NRAETB NRANETB

a. Cash and/or property dividends actually or

constructively received from a DOMESTIC

CORP. or from JOINT STOCK CO., INSURANCE

10% 20% 25%

or MUTUAL FUND COMPANIES and REGIONAL

OPERATING HEADQUARTERS of multinationals

(beginning January 1, 2000}

b. Share of an individual in the distributable net

income after tax of a PARTNERSHIP (OTHER

THAN a general professional partnership) of 10% 20% 25%

which he is a partner (beginning January 1,

2000)

c. Share of an individual in the net income after

tax of an ASSOCIATION, a JOINT ACCOUNT, or

a JOINT VENTURE or CONSORTIUM taxable as 10% 20% 25%

a corporation of which he is a member or co-

venturer (beginning January 1, 2000)

1. Identify whether the following are subject to final tax or not (year 2018). Taxpayer is RESIDENT

CITIZEN unless otherwise stated (Y/N).

Taxation of Individuals, Trusts, and Estates | Page 2 of 5

II. Capital Gains Tax (CGT)

1. An individual taxpayer holds shares of stock as investment (P120,000 par value). During 2022, he sells

the shares he bought for P100,000 for P180,000 directly to a buyer. How much is the capital gains tax

on the sale, if any?

2. An individual taxpayer holds shares of stock as investment which he bought from a publicly-listed

company for P500,000 (P500,000 par value). The shares are listed and traded in the local stock

exchange. During the current year, he sells them for P750,000.

How much is the percentage tax, if any?

3. An individual taxpayer invested P300,000 in the common shares of SMC Corp (P150,000 par value).

During the current year, he sold these shares to a buyer not through the local stock exchange for

P250,000.

1) How much was the capital gains tax on the sale, if any?

2) Assuming the shares are listed and traded in the local stock exchange, how much was the

percentage tax?

4. During the year 2021, Ms. Kat Antonio sold her vacation house for P500,000. She acquired it for

P700,000 two (2) years ago. The fair market value of the vacation house at the time of sale was

P800,000. Ms. Antonio was going to use the proceeds to build her new principal residence within

eighteen (18) months after informing BIR within thirty (30) days of such intention. How much is the

capital gain tax, if any?

Taxation of Individuals, Trusts, and Estates | Page 3 of 5

5. Mr. C. Avenido acquired his principal residence in 2016 at a cost of P1,000,000. He sold the said property

on January 1, 2018, with a fair market value of P5,000,000 for a consideration of P4,000,000. Within

the 18-month reglementary period he purchased his new principal residence at cost of P7,000,000.

1) How much is the capital gains tax due?

2) How much is the basis of the new principal residence?

6. Using the same data in item no. 5, if for example, Mr. Avenido acquired his new principal residence

within the 18-month reglementary period but did not utilize the entire proceeds of the sale in acquiring

his new principal residence because he only used P3,000,000 thereof in acquiring his new principal

residence.

1) How much is the capital gains tax?

2) How much is the basis of the new principal residence?

III. Tax rates for special aliens and their Filipino counterparts

The preferential income tax rate of 15% of qualified employees of Regional Headquarters, Regional

Operating Headquarters, Offshore Banking Units, and Petroleum Service Contractors and

Subcontractors shall no longer be applicable without prejudice to the application of preferential tax

rates under existing international tax treaties.

Integrative Case:

1. A married resident citizen supports three (3) qualified dependent children and a brother-in-law who is

a PWD, unmarried and not gainfully employed. He has the following data on income and expenses for

the year 2021:

Salary, Philippines 560,000

Gross business income, Philippines (gross sales, P1,700,000) 500,000

Business expenses, Philippines 180,000

Gross business income, USA (gross sales, P1,500,000) 900,000

Business expenses, USA 300,000

Interest income from bank deposit, Philippines 50,000

Interest income from bank deposit, USA 70,000

Interest income from domestic depository bank under EFCDS 80,000

Interest income from a debt instrument not within the coverage of deposit 50,000

substitute, Philippines, gross of 20% creditable withholding tax (issue price

is P300,000)

Interest income from a debt instrument within the coverage of a deposit 60,000

substitute, Philippines (issue price P500,000)

Royalty on book published in the Philippines 100,000

Prize in a contest he joined in the Philippines 5,000

Philippine Charity Sweepstakes winnings 1,000,000

Gain from sale of shares of stock not traded through the local stock 150,000

exchange (P200,000 par value)

Dividend received from a domestic corporation 40,000

Tax payments, first three (3) quarters 100,000

1) How much is the total final tax on certain passive income?

2) How much is the capital gains tax?

3) Can the taxpayer avail of the 8% income tax option?

4) How much is the taxable net income and income tax due and the business tax?

Taxation of Individuals, Trusts, and Estates | Page 4 of 5

2. A resident alien individual supports two (2) qualified dependent adopted children and a foster child.

He asks you to assist him in the preparation of his tax return for his income in 2020. He provides you

the following information:

Gross business income, Philippines (gross sales, P3,000,000) 1,000,000

Gross business income, Japan (gross sales, P7,000,000) 5,000,000

Business expenses, Philippines 200,000

Business expenses, Japan 800,000

Philippine Charity Sweepstakes winnings 500,000

Japanese Sweepstakes winnings 400,000

Interest income, Bank of Tokyo, Japan 100,000

Interest income received from a depository bank under EFCDS, Philippines 300,000

Interest on peso bank deposit, Philippines 100,000

Income taxes paid for the first three (3) quarters 50,000

1) Can the taxpayer avail of the 8% income tax rate?

2) How much was the taxable net income and income tax due if he avails of the 8% income tax rate?

3) How much was the final tax on passive income?

4) Assuming the taxpayer failed to avail of the 8% income tax, how much is his taxable income and the

income tax due?

Taxation of Individuals, Trusts, and Estates | Page 5 of 5

You might also like

- Cash and Cash EquivalentsDocument9 pagesCash and Cash EquivalentsPau Santos76% (29)

- TAX01 Midterm Exam AY 2022 2023Document7 pagesTAX01 Midterm Exam AY 2022 2023robNo ratings yet

- 2008 Taxation Law Bar QuestionsDocument4 pages2008 Taxation Law Bar QuestionsMowan100% (1)

- Financial Distress Situation of Listed Malaysian Shipping CompaniesDocument14 pagesFinancial Distress Situation of Listed Malaysian Shipping CompaniesPau SantosNo ratings yet

- Taxation Tax Rates For Individual Taxpayers, Estates and TrustsDocument5 pagesTaxation Tax Rates For Individual Taxpayers, Estates and TrustsSherri BonquinNo ratings yet

- Ast TX 502 Tax Rates For Individuals (Batch 22)Document5 pagesAst TX 502 Tax Rates For Individuals (Batch 22)CelestiaNo ratings yet

- TAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Document12 pagesTAX-602 (Income Tax Rates - Individuals, Estates & Trusts)Ciarie Salgado0% (1)

- HO4Passive Income - Revision 1Document2 pagesHO4Passive Income - Revision 1Christopher SantosNo ratings yet

- FWTX, CWTX and CGTX (Points To Remember and Tax Rates)Document2 pagesFWTX, CWTX and CGTX (Points To Remember and Tax Rates)Justz LimNo ratings yet

- Final Tax Rates 2023Document1 pageFinal Tax Rates 2023Mycah AliahNo ratings yet

- FT and CGTDocument12 pagesFT and CGTLiyana ChuaNo ratings yet

- A. Final Withholding Tax 1. Passive IncomeDocument7 pagesA. Final Withholding Tax 1. Passive IncomePrincess Corine BurgosNo ratings yet

- ERG-TAX 5.1 FWTand CGTDocument9 pagesERG-TAX 5.1 FWTand CGTJomar PorterosNo ratings yet

- Tax On Certain Passive IncomeDocument2 pagesTax On Certain Passive IncomeCristel Ann DotimasNo ratings yet

- Tax Rate SummaryDocument3 pagesTax Rate SummaryPamela Jean CuyaNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- Source Final Tax: Interest Income or Yield From Local Currency Bank Deposits or Deposit SubstitutesDocument3 pagesSource Final Tax: Interest Income or Yield From Local Currency Bank Deposits or Deposit SubstitutesJhon Ariel JulatonNo ratings yet

- Notes in Tax On IndividualsDocument4 pagesNotes in Tax On IndividualsPaula BatulanNo ratings yet

- TAX-702 (Tax Rates For Corporations)Document7 pagesTAX-702 (Tax Rates For Corporations)MABI ESPENIDONo ratings yet

- Handout - 03 CorporationDocument10 pagesHandout - 03 CorporationKiyo KoNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- Passive-Income MidtermsDocument2 pagesPassive-Income MidtermsJessa Belle EubionNo ratings yet

- 4.2 Summary Lecture - Final Tax and CGT (Make Up Class)Document2 pages4.2 Summary Lecture - Final Tax and CGT (Make Up Class)Charles MateoNo ratings yet

- Tax Module-4Document21 pagesTax Module-4workwithellie1No ratings yet

- Tax TablesDocument6 pagesTax TablesChirrelyn Necesario SunioNo ratings yet

- Taxation-2 2Document5 pagesTaxation-2 2Yeshua Liebt PhoenixNo ratings yet

- Tax RatesDocument3 pagesTax RatesPearl Antoniette GasaNo ratings yet

- Module No 3 - INCOME TAXATION PART1ADocument6 pagesModule No 3 - INCOME TAXATION PART1APrinces S. RoqueNo ratings yet

- Sec. 24 IRC - Tax On IndividualsDocument4 pagesSec. 24 IRC - Tax On IndividualsMav ZamoraNo ratings yet

- Taxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDocument7 pagesTaxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDenny Kridex OmolonNo ratings yet

- Concept of Income TaxDocument28 pagesConcept of Income TaxLau AngelNo ratings yet

- EX EX EX EX: Regular Income TaxDocument7 pagesEX EX EX EX: Regular Income TaxMary Leigh TenezaNo ratings yet

- RR No. 2-2021Document3 pagesRR No. 2-2021Anostasia NemusNo ratings yet

- Tax On CorporationsDocument37 pagesTax On CorporationsvanNo ratings yet

- Income Tax ChartDocument1 pageIncome Tax ChartNikki Andrade100% (1)

- Supplemental Note #2 - Individuals - Final Taxation & Capital Gains TaxationDocument8 pagesSupplemental Note #2 - Individuals - Final Taxation & Capital Gains TaxationRicojay FernandezNo ratings yet

- Taxation-IT For Individuals Part2Document14 pagesTaxation-IT For Individuals Part2EmperiumNo ratings yet

- Passive IncomeDocument5 pagesPassive IncomeRandom VidsNo ratings yet

- Summary of Final Tax Under The Nirc, As Amended Individual Citizen AlienDocument16 pagesSummary of Final Tax Under The Nirc, As Amended Individual Citizen AlienXiaoyu KensameNo ratings yet

- RateDocument3 pagesRatemikamiiNo ratings yet

- Tax Table Corporations 2022Document4 pagesTax Table Corporations 2022Xandredg Sumpt LatogNo ratings yet

- FT TableDocument4 pagesFT TableChantie BorlonganNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument2 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoRaymond RosalesNo ratings yet

- Withholding TaxDocument20 pagesWithholding TaxAngela CanayaNo ratings yet

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- 94-03 Corporate Income Tax - HandoutDocument43 pages94-03 Corporate Income Tax - HandoutSilver LilyNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- Taxation Garcia/Tamayo TX-602: Corporation (Income Tax Rates)Document2 pagesTaxation Garcia/Tamayo TX-602: Corporation (Income Tax Rates)Jun SaintNo ratings yet

- Final Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Document109 pagesFinal Withholding Taxes and Withholdiing of Business Taxes On Government Income Payments (Part Iii)Bien Bowie A. CortezNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Tax RatesDocument1 pageTax RatesMariah Jans SasumanNo ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- Inbound 2168611759498459938Document2 pagesInbound 2168611759498459938MarielleNo ratings yet

- CorporationsDocument37 pagesCorporationsNova PogadoNo ratings yet

- Sec. 24 Tax On IndividualsDocument4 pagesSec. 24 Tax On IndividualsJan P. ParagadosNo ratings yet

- Graduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeDocument9 pagesGraduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeKyle SubidoNo ratings yet

- Final Taxes RatesDocument2 pagesFinal Taxes RatesPanda CocoNo ratings yet

- TaxpayerDocument4 pagesTaxpayerMickaela Jaira AlvarezNo ratings yet

- Tax Reviewer - Train Law - Rates and ComputationsDocument5 pagesTax Reviewer - Train Law - Rates and ComputationsCelestiaNo ratings yet

- Individual Income TaxDocument207 pagesIndividual Income TaxMarianeNo ratings yet

- Business & ProfessionDocument10 pagesBusiness & ProfessionGaurav vaidyaNo ratings yet

- Tax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument4 pagesTax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of Professioniona4andalNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- The Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryFrom EverandThe Present State of the British Interest in India: With a Plan for Establishing a Regular System of Government in That CountryNo ratings yet

- TX 201Document4 pagesTX 201Pau SantosNo ratings yet

- Cpa Lawyer Emilio Aquino Is New Sec CommissionerDocument5 pagesCpa Lawyer Emilio Aquino Is New Sec CommissionerPau SantosNo ratings yet

- Values, Attitudes & Job Satisfaction: Human Behavior in Organization MWF/3:00 PM - 4:00 PM/RM 244Document15 pagesValues, Attitudes & Job Satisfaction: Human Behavior in Organization MWF/3:00 PM - 4:00 PM/RM 244Pau SantosNo ratings yet

- TX 101Document7 pagesTX 101Pau SantosNo ratings yet

- Data FeasibDocument13 pagesData FeasibPau SantosNo ratings yet

- Sample 1Document1 pageSample 1Pau SantosNo ratings yet

- Cash and Cash EquivalentDocument5 pagesCash and Cash EquivalentPau SantosNo ratings yet

- The Professional StandardsDocument1 pageThe Professional StandardsPau SantosNo ratings yet

- Quantitative MethodsDocument19 pagesQuantitative MethodsSerena Van der WoodsenNo ratings yet

- Accounting Information SystemDocument23 pagesAccounting Information SystemPau SantosNo ratings yet

- Rust-Free in An Ease: Name of The CompanyDocument3 pagesRust-Free in An Ease: Name of The CompanyPau SantosNo ratings yet

- At (3) - Auditor'S Responsibility: Employee Fraud. It Involves The Theft of AnDocument1 pageAt (3) - Auditor'S Responsibility: Employee Fraud. It Involves The Theft of AnPau SantosNo ratings yet

- Applied Auditing Audit of Receivables Problem 1: QuestionsDocument9 pagesApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNo ratings yet

- Valuing Continuous-Installment Options: Discussion Paper Series A: No. 2007-184Document23 pagesValuing Continuous-Installment Options: Discussion Paper Series A: No. 2007-184Pau SantosNo ratings yet

- Joint Reso Basketball VolleyballDocument3 pagesJoint Reso Basketball VolleyballPau SantosNo ratings yet

- 14th NCR JpialympicsDocument30 pages14th NCR JpialympicsPau SantosNo ratings yet

- Joint Reso PageantDocument3 pagesJoint Reso PageantPau SantosNo ratings yet

- Characteristics and Principles of Art: Santos, Pauline MDocument13 pagesCharacteristics and Principles of Art: Santos, Pauline MPau SantosNo ratings yet

- Constitution and by Laws JPIA 2015Document8 pagesConstitution and by Laws JPIA 2015Pau SantosNo ratings yet

- CBAA VolleyballDocument1 pageCBAA VolleyballPau SantosNo ratings yet

- NYCIntlProgramsAppForm - LastName, FirstNameDocument3 pagesNYCIntlProgramsAppForm - LastName, FirstNamePau SantosNo ratings yet

- Inventory ReviewerDocument7 pagesInventory ReviewerPau Santos100% (5)

- 14th NCR JpialympicsDocument30 pages14th NCR JpialympicsPau SantosNo ratings yet

- Angeline Marinas 8 Grade, St. AlbericDocument4 pagesAngeline Marinas 8 Grade, St. AlbericPau SantosNo ratings yet

- College of Business Administration and Accountancy I. Company ProfileDocument8 pagesCollege of Business Administration and Accountancy I. Company ProfilePau SantosNo ratings yet

- Basic Concept - : Goods and Services Tax MCQDocument102 pagesBasic Concept - : Goods and Services Tax MCQBighnesh Prasad SahooNo ratings yet

- DE TaxationDocument22 pagesDE TaxationHappy MagdangalNo ratings yet

- TDS Rate Chart For FY 2023-24 (AY 2024-25)Document70 pagesTDS Rate Chart For FY 2023-24 (AY 2024-25)DRK FrOsTeRNo ratings yet

- TAXATION 1 Section 30 To 83 Explanatory NotesDocument37 pagesTAXATION 1 Section 30 To 83 Explanatory NotesyotatNo ratings yet

- Income Tax Rate Table Resident Non-Resident: Non-Resident Alien Not Engaged in Trade or BusinessDocument2 pagesIncome Tax Rate Table Resident Non-Resident: Non-Resident Alien Not Engaged in Trade or BusinessVernis VentilacionNo ratings yet

- Taxation (TX-UK) FA 2020 - Ebook - RepairedDocument756 pagesTaxation (TX-UK) FA 2020 - Ebook - RepairedHajveri Printing ServicesNo ratings yet

- Income Tax Computation For Corporate TaxpayersDocument79 pagesIncome Tax Computation For Corporate TaxpayersPATATASNo ratings yet

- CH 6 Fundamental Analysis - 2Document39 pagesCH 6 Fundamental Analysis - 2Amit PandeyNo ratings yet

- Scan Split 8 FinalDocument39 pagesScan Split 8 FinalJefferson ClineNo ratings yet

- Capital GainsDocument98 pagesCapital GainsManohar LalNo ratings yet

- Excel Files Individuals AopDocument8 pagesExcel Files Individuals Aopapi-3700469No ratings yet

- Tax - PDF of Prof. Mamalateo'sDocument18 pagesTax - PDF of Prof. Mamalateo'sRenante Rodrigo100% (1)

- Islamic Banking and Finance Review (Vol. 4), 186-Article Text-486-1-10-20191122Document20 pagesIslamic Banking and Finance Review (Vol. 4), 186-Article Text-486-1-10-20191122UMT JournalsNo ratings yet

- Systematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market TimingDocument4 pagesSystematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market Timingtilak kumar vadapalliNo ratings yet

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudNo ratings yet

- Capital Gains Notes PDFDocument6 pagesCapital Gains Notes PDFmohanraokp2279No ratings yet

- Income Tax Case Digest 2 PDFDocument156 pagesIncome Tax Case Digest 2 PDFLibay Villamor IsmaelNo ratings yet

- Taxation - United Kingdom (TX-UK) : Syllabus and Study GuideDocument27 pagesTaxation - United Kingdom (TX-UK) : Syllabus and Study Guidepallavi hasandasaniNo ratings yet

- ST Vincent and The Grenadines Tax GuideDocument9 pagesST Vincent and The Grenadines Tax GuideWei LiNo ratings yet

- Taxation On Real Estate TransactionsDocument3 pagesTaxation On Real Estate TransactionsGlynda ChanNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: March, 2022 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDimple KhandheriaNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Discussion Income TaxDocument7 pagesDiscussion Income TaxAljay LabugaNo ratings yet

- REPUBLIC ACT NO. 8424 As Last Amended by REPUBLIC ACT NO. 10963Document20 pagesREPUBLIC ACT NO. 8424 As Last Amended by REPUBLIC ACT NO. 10963Shiela MarieNo ratings yet

- News Letter January 2017Document19 pagesNews Letter January 2017Sujata SinghNo ratings yet

- Tax Calculation Summary Notes: 6 April 2015 To 5 April 2016Document46 pagesTax Calculation Summary Notes: 6 April 2015 To 5 April 2016coolmanzNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 15-2003 Issued OnDocument2 pagesREVENUE MEMORANDUM ORDER NO. 15-2003 Issued OnEarl Russell S PaulicanNo ratings yet

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Document16 pagesReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Mark Lawrence YusiNo ratings yet