Professional Documents

Culture Documents

Form PDF Year 2015-16

Uploaded by

HARISH CHANDRA MISHRACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form PDF Year 2015-16

Uploaded by

HARISH CHANDRA MISHRACopyright:

Available Formats

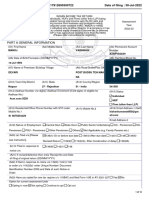

A1. First Name A2. Middle Name A3. Last Name A4.

PAN

HARISH CHANDRA MISHRA AKRPM1535F

A5. Sex A6. Date of Birth (YYYY/MM/DD) A7. Income Tax Ward/Circle

Male 1970-03-24

INFORMATION

A8. Flat / Door / Building A9. Name of Premises / Building / Village A10. Road / Street

PERSONAL

TATA DAV SCHOOL JAMADOBA

A11. Area / Locality A12. Town / City / District A13. State

JAMADOBA DHANBAD JHARKHAND

A14. Country A15. Pincode Status

91- INDIA 828112 Individual

A16. Email Address A17. Residential/Office Mobile No. 1 A18. Mobile No. 2

Phone No. with STD

Code

TRP123DHANBAD@gmail.com ( )- 7631000759

A19 Employer Category OTH

A20 Tax Status Tax Refundable

A21 Residential Status RES- Resident

A22 Return filed under section 11- Voluntarily on or befo

re the due date under secti

on 139(1)

A23 Whether Person governed by Portuguese Civil Code under section 5A No

FILING STATUS

A24 If A23 is applicable, PAN of the Spouse

Whether original or revised return? Original

A25 If under section: 139(5) - revised return:

Original Acknowledgement Number

Date of filing of Original Return(DD/MM/YYYY)

If under section: 139(9) - return in response to defective return notice:

Original Acknowledgment Number

Date of filing of Original Return (DD/MM/YYYY)

Notice Number.

A26 If filed in response to notice u/s 139(9)/142(1)/148/153A/153C,enter the date of such notice

A27 Whether you have Aadhaar Number ?

A28 If A27 is Yes, please provide

B1 Income from Salary / Pension(Ensure to fill Sch TDS1) 1 455276

B2 Type of House Property

Income from one House Property 0

B3 Income from Other Sources (Ensure to fill Sch TDS2) 0

B4 Gross Total Income (B1+B2+B3) 4 455276

C Deductions under chapter VI A (Section)

C1 80C 127397 127397C11 80G 0 0

C2 80CCC 0 0C12 80GG 0 0

INCOME & DEDUCTIONS

C3 80 CCD (1) 0 0C13 80GGA 0 0

(Employees /

Self Employed

Contribution)

C4 80CCD (2) 0 0C14 80GGC 0 0

(Employers

Contribution)

C5 80CCG 0 0C15 80RRB 0 0

C6 80D 0 0C16 80QQB 0 0

C7 80DD 0 0C17 80TTA 0 0

C8 80DDB 0 0C18 80U 0 0

C9 80E 0 0

C10 80EE 0 0

C19 Total Deductions (Total of C1 to C18) C19 127397

C20 Taxable Total Income (B4 - C19) C20 327880

D1 Tax Payable on Total Income (C20) D1 7788

D2 Rebate u/s 87A D2 2000

D3 Tax Payable after Rebate (D1-D2) D3 5788

D4 Surcharge, if C20 exceeds 1 crore D4 0

COMPUTATION

D5 Cess on (D3+D4) D5 174

D6 Total Tax, Surcharge & Cess (D3+D4+D5) D6 5962

TAX

D7 Relief u/s 89 D7 0

D8 Balance Tax After Relief (D6 - D7) D8 5962

D9 Total Interest u/s 234A D9 0

D10 Total Interest u/s 234B D10 0

D11 Total Interest u/s 234C D11 0

Total Interest Payable (D9 + D10 + D11) 0

D12 Total Tax and Interest (D8 + D9 + D10 + D11) D12 5962

Taxes Paid

D13 Total Advance Tax Paid D13 0

TAXES PAID

D14 Total Self Assessment Tax Paid D14 0

D15 Total TDS Claimed D15 8167

D16 Total Taxes Paid(D13 + D14 + D15) D16 8167

D17 Tax Payable(D12 - D16, if D12 > D16) D17 0

D18 Refund(D16 - D12, if D16 > D12) D18 2210

D19 Exempt income only for reporting purposes D19 0

D20 Details of all Bank Accounts (excluding dormant accounts) held in India at any time during the previous year (Mandatory

irrespective of refund due or not)

Total number of savings and current bank accounts held by you at any time during the previous year (excluding 1

dormant accounts)

a) Bank Account in which refund, if any, shall be credited

S.No.IFS Code of the bank Name of the Bank Account Number Bank Account Type

1 BKID0004779 Bank of India 477910110007037 Savings

b) Other Bank account details

S.No.IFS Code of the bank Name of the Bank Account Number Bank Account Type

2

SCH TDS1-Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]

SI.NO Tax Deduction Name of the Employer Income Tax Deducted

Account Number Under Salary

(TAN) of the

Employer

1 RCHT00073D TATA DAV SCHOOL JAMADOBA 327879 8167

Total 8167

SCH TDS2-Details of Tax Deducted at Source on Income Other than Salary [As per FORM 16 A issued by Deductor(s)]

SI.NO Tax Deduction Name of the Deductor Unique TDS Deducted Year Tax Deducted Amount out If A23 is

Account Certificate No. of (5) claimed applicable,

Number (TAN) for this year Amount

of the Deductor Claimed in

the Hands

of Spouse

1

Total 0

SCH IT-Details of Advance Tax and Self Assessment Tax Payments

SI BSR Code Date of Deposit Challan Number Tax Paid

NO

1

Total 0

VERIFICATION

xyz

I, HARISH CHANDRA MISHRA, son/daughter of, UDAY CHANDRA MISHRA, solemnly declare that to the best of my knowledge

and belief, the information given in the return is correct and complete and that the amount of total income and other particulars shown

therein are truly stated and are in accordance with the provisions of the Income- tax Act 1961, in respect of income chargeable to Income-

tax for the previous year relevant to the Assessment Year 2015-16.

Place DHANBAD Date 2015-07-05 PAN AKRPM1535F

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

TRP PIN [10 Digit] Name of the TRP TRP Signature

T003750113 ASHOK KUMAR TRIPATHI

Amount to be paid to TRP 0

You might also like

- Personal information formDocument3 pagesPersonal information formVarun GuptaNo ratings yet

- 2019 10 20 11 13 28 743 - Cixpm4133k - 2016Document3 pages2019 10 20 11 13 28 743 - Cixpm4133k - 2016tarun mathurNo ratings yet

- Form PDF 758837930310815Document2 pagesForm PDF 758837930310815deepkaryan1988No ratings yet

- B1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1Document3 pagesB1 Income From Salary / Pension (Ensure To Fill SCH TDS1) 1santoshkumarNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturngrafikeysNo ratings yet

- ITR-1 Sahaj Individual Income Tax ReturnDocument5 pagesITR-1 Sahaj Individual Income Tax ReturnDc InnovatorsNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnAman AnandNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnImpactianRajenderNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnramnik20098676No ratings yet

- DocumentDocument5 pagesDocumentAkshay KumarNo ratings yet

- Itr-1 Sahaj: Individual Income Tax ReturnDocument7 pagesItr-1 Sahaj: Individual Income Tax ReturnRinku SoraishamNo ratings yet

- Individual Income Tax Return under Rs. 50kDocument5 pagesIndividual Income Tax Return under Rs. 50kNirbhay KumarNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainNo ratings yet

- Form Itr-4 SugamDocument9 pagesForm Itr-4 SugamAccounting & TaxationNo ratings yet

- Form PDF 278241510300722Document68 pagesForm PDF 278241510300722jawedNo ratings yet

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNo ratings yet

- Form PDF 957530660230722Document68 pagesForm PDF 957530660230722kmuditkNo ratings yet

- Form PDF 858747220180722Document38 pagesForm PDF 858747220180722sonu singhNo ratings yet

- ITRForm Arjun 2022Document39 pagesITRForm Arjun 2022Shahrukh Ahmed AnsariNo ratings yet

- Form PDF 501225711170922Document71 pagesForm PDF 501225711170922Kundan SharmaNo ratings yet

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvNo ratings yet

- Form PDF 765250410080722Document69 pagesForm PDF 765250410080722Naresh KUMAR GUPTANo ratings yet

- Form PDF 630396840101022Document38 pagesForm PDF 630396840101022RahamTullaNo ratings yet

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyNo ratings yet

- Deductions Under Chapter VI A (Section) : Date of Filing of Original ReturnDocument2 pagesDeductions Under Chapter VI A (Section) : Date of Filing of Original Returnismailkhan.dbaNo ratings yet

- Form PDF 157539400270722Document41 pagesForm PDF 157539400270722Vidushi JainNo ratings yet

- Form PDF 340519100221221AVTPC0987CDocument8 pagesForm PDF 340519100221221AVTPC0987Csmadvocate049No ratings yet

- Rktarai DetailDocument9 pagesRktarai DetailDeepak SwainNo ratings yet

- Form PDF 432385000170822Document9 pagesForm PDF 432385000170822Khan kingNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam DixitNo ratings yet

- Form PDF 893006160301222Document9 pagesForm PDF 893006160301222manish.toshniwal1No ratings yet

- Form PDF 805452110140722Document41 pagesForm PDF 805452110140722SAYAN SARKARNo ratings yet

- Form PDF 114320560260722Document9 pagesForm PDF 114320560260722DeepNo ratings yet

- Form PDF 658202480080622Document6 pagesForm PDF 658202480080622Chandrasekhar NandigamNo ratings yet

- Form PDF 301906800310714Document2 pagesForm PDF 301906800310714deepkaryan1988No ratings yet

- Indian Income Tax Return Assessment Year 2021 - 22: SugamDocument9 pagesIndian Income Tax Return Assessment Year 2021 - 22: SugamAvnish BhasinNo ratings yet

- Form PDF 845380590170722Document41 pagesForm PDF 845380590170722cchascashcNo ratings yet

- Form PDF 237268260290722Document9 pagesForm PDF 237268260290722cfaprep040No ratings yet

- Form PDF 774514440031122Document9 pagesForm PDF 774514440031122krishna salesNo ratings yet

- Form PDF 804649980151122Document15 pagesForm PDF 804649980151122RAMKISHAN SAHUNo ratings yet

- Form_pdf_344575900310722 (4)Document38 pagesForm_pdf_344575900310722 (4)tingu gangNo ratings yet

- Form PDF 621098631061022Document68 pagesForm PDF 621098631061022nlr726371No ratings yet

- Form PDF 202423770060623Document7 pagesForm PDF 202423770060623shashidharNo ratings yet

- Karishma ITR Computation 2021-22Document38 pagesKarishma ITR Computation 2021-22sunil jadhavNo ratings yet

- Form PDF 215347070090623Document10 pagesForm PDF 215347070090623m sinhaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)harshNo ratings yet

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongreNo ratings yet

- Indian Income Tax Return for IndividualsDocument9 pagesIndian Income Tax Return for IndividualsGood NamNo ratings yet

- Form_pdf_172586610110424Document9 pagesForm_pdf_172586610110424Niraj JaiswalNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewRSC NabardNo ratings yet

- Indian Income Tax Return Form ITR-4 GuideDocument5 pagesIndian Income Tax Return Form ITR-4 GuideJay Prakash shuklaNo ratings yet

- Form PDF 230861000130623Document6 pagesForm PDF 230861000130623Sunil AccountsNo ratings yet

- Form_pdf_179843840280722Document10 pagesForm_pdf_179843840280722rakeshkaydalwarNo ratings yet

- Form PDF 360019890310722Document9 pagesForm PDF 360019890310722Sumit SainiNo ratings yet

- Form PDF 317912690300722Document10 pagesForm PDF 317912690300722harendra godaraNo ratings yet

- Form PDF 720742190260723Document10 pagesForm PDF 720742190260723rishika 61No ratings yet

- Form PDF 308785760300722Document42 pagesForm PDF 308785760300722Rishi KapoorNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 Previewsanthoush sankarNo ratings yet

- Bachelor of Arts (Psychology HR Management) Y3 V2Document1 pageBachelor of Arts (Psychology HR Management) Y3 V2Kenny sylvainNo ratings yet

- The Secret Science of Shaktipat - Guide To Initiation 13 September 2020Document77 pagesThe Secret Science of Shaktipat - Guide To Initiation 13 September 2020Patrick JenksNo ratings yet

- ErgonomicsDocument15 pagesErgonomicsdtmNo ratings yet

- Unit 1 of EthicsDocument110 pagesUnit 1 of EthicsAbhinav kumar SinghNo ratings yet

- The Separation of Coherent and Incoherent Compton X-Ray ScatteringDocument8 pagesThe Separation of Coherent and Incoherent Compton X-Ray ScatteringFaisal AmirNo ratings yet

- SD Series Digital AC Servo System User Manual GuideDocument66 pagesSD Series Digital AC Servo System User Manual GuideAdnene SaanounNo ratings yet

- Bomba de Vacio Part ListDocument2 pagesBomba de Vacio Part ListNayeli Zarate MNo ratings yet

- Material 01 - Human-Computer InteractionDocument8 pagesMaterial 01 - Human-Computer InteractionIlangmi NutolangNo ratings yet

- 2019 Indonesia Salary GuideDocument32 pages2019 Indonesia Salary Guideiman100% (1)

- F2 IS Exam 1 (15-16)Document10 pagesF2 IS Exam 1 (15-16)羅天佑No ratings yet

- Analisis Kinerja Turbin Uap Unit 3 BerdasarkanDocument12 pagesAnalisis Kinerja Turbin Uap Unit 3 BerdasarkanfebriansyahNo ratings yet

- 5G Antenna Talk TWDocument48 pages5G Antenna Talk TWRohit MathurNo ratings yet

- Ruach Ha Kodesh or Holy Religious SpiritDocument10 pagesRuach Ha Kodesh or Holy Religious Spiritharsan100% (1)

- G.raju Reddy Resume (PDF1) PDFDocument3 pagesG.raju Reddy Resume (PDF1) PDFanon_708469687No ratings yet

- Project management software enables collaborationDocument4 pagesProject management software enables collaborationNoman AliNo ratings yet

- Fundamentals of Computer Hardware NotesDocument7 pagesFundamentals of Computer Hardware NotesSreemoyee RoyNo ratings yet

- Ceftriaxone R Salmonella Typhi 02Document8 pagesCeftriaxone R Salmonella Typhi 02docsumitraiNo ratings yet

- Cell Organelles 11Document32 pagesCell Organelles 11Mamalumpong NnekaNo ratings yet

- A History of Linear Electric MotorsDocument400 pagesA History of Linear Electric MotorseowlNo ratings yet

- Sop For FatDocument6 pagesSop For Fatahmed ismailNo ratings yet

- 2nd Chapter Notes Mechanical Engineering DiplomaDocument7 pages2nd Chapter Notes Mechanical Engineering DiplomaUsmanNo ratings yet

- Carbon Emission and Battery Monitoring SystemDocument17 pagesCarbon Emission and Battery Monitoring SystemIJRASETPublicationsNo ratings yet

- CNC Instructables PDFDocument13 pagesCNC Instructables PDFNadim AhmedNo ratings yet

- NYC Chocolate Chip Cookies! - Jane's PatisserieDocument2 pagesNYC Chocolate Chip Cookies! - Jane's PatisserieCharmaine IlaoNo ratings yet

- Engineering Design For A Circular Economy - A List of Design GuidelinesDocument1 pageEngineering Design For A Circular Economy - A List of Design Guidelinesmy oneNo ratings yet

- Electric Charges and Fields Bank of Board QuestionsDocument11 pagesElectric Charges and Fields Bank of Board QuestionsNishy GeorgeNo ratings yet

- Nursing Care Plans for ChildrenDocument4 pagesNursing Care Plans for ChildrenAlexander Rodriguez OlipasNo ratings yet

- Filipino Nationalism LessonDocument24 pagesFilipino Nationalism LessonIan Jay TumulakNo ratings yet

- T2-1 MS PDFDocument27 pagesT2-1 MS PDFManav NairNo ratings yet

- How To VOR WorksDocument23 pagesHow To VOR WorksHai AuNo ratings yet