Professional Documents

Culture Documents

Trade Wing 17-18

Trade Wing 17-18

Uploaded by

Aishvary GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trade Wing 17-18

Trade Wing 17-18

Uploaded by

Aishvary GuptaCopyright:

Available Formats

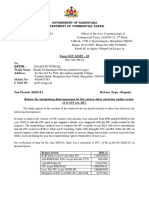

Uttar Pradesh Commercial Tax

Department

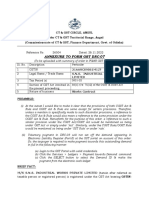

Form GST ASMT-10

(See rule 99(1)]

U/s-61 OF CGST/SGST ACT

RefrenceNo. ZHo°d8221o49836 Date3o-o8: 2o22

FIRM NAME M/S TRADE WINGS

-

LEGAL NAME VINAY

KUMAR GUPTA

ADDRESS:- 128/199, BLOCK, KIDWAI NAGAR KANPUR 208011

GSTIN-09ABEPG1126A1ZG

EMAIL-TRADEWINGS512@GMAIL.COM

Tax Period -SEP-2017

MOBILE- 9415537535

F.Y. - 2017-18

Notice for intimating discrepancies in the return after scrutiny

4T9TR ETT SCREWS, BOLTS, NUTS FAf ATrading TTT AT TTAT I aTHT fA T 2017-18 y

ATYTd ZTRT a 2017-18 TE JULY-17 TO SEP-2017 GSTR-3B T0 893538.00 T fat

7 CGST To 90604.50 SGST 7To 90604.50 tfa fT TATTaf GSTR-01

T0 893538.00 5

fa tTa 47 CGST To 33119.00 ua SGST 7 o 33119.00 Tta H

THTTTI GSTR-3B T GSTR-01 CGST 7 Fo 57485.50 SGST Fo 57485.50 T3TRR

ACT PERIOD TAX

IGST JUL-2017 TO SEP-2017 0.00

SGST JUL-2017 TO SEP-2017

57485.50

CGST JUL-2017 TO SEP-2017

57485.50

CESS JUL-2017 TO SEP-2017

0.00

TOTAL

1,14,971.00

You are hereby directed to explain the reason for the

aforesaid discrepancies by

(date). If no explanation is received by the aforesaid 13-09-2022

date, will be presumed that you have

it

say in the matter and proceeding in the accordance with law nothing to

may be initiated against you without

any further reference to you in this regard. making

SIGNATURE

NAME SUDEEP

:

MUMAR SBPWAS

DESIGNATION: ASSISTANT ÇOMMIssIONER

STATE GST SECTOR-22 KANPUR.

You might also like

- GST Invoice Format For Services in ExcelDocument102 pagesGST Invoice Format For Services in ExcelJugaadi BahmanNo ratings yet

- Case Brief Template #2z47mc7!07!22 15Document4 pagesCase Brief Template #2z47mc7!07!22 15tinaNo ratings yet

- Equity and TrustDocument9 pagesEquity and TrustAgitha GunasagranNo ratings yet

- GST Bill Format in ExcelDocument184 pagesGST Bill Format in Excelkrishna chaitanyaNo ratings yet

- Introduction To UBBL PDFDocument17 pagesIntroduction To UBBL PDFWan IkkhuwaeNo ratings yet

- Salk1000152223-NoidaDocument5 pagesSalk1000152223-NoidaPratik GosaviNo ratings yet

- Vishnu Tukaram Sarang Dtd. 28.12.2020.Document23 pagesVishnu Tukaram Sarang Dtd. 28.12.2020.Imrankhan PathanNo ratings yet

- SV Roofing 2067Document1 pageSV Roofing 2067bikkumalla shivaprasadNo ratings yet

- Legal Method Final ExamDocument118 pagesLegal Method Final ExamGraceSantos0% (1)

- Rousseau Discourse On Political Economy (Masters)Document33 pagesRousseau Discourse On Political Economy (Masters)Giordano BrunoNo ratings yet

- JCB 191 Bill Bidkin June 19Document1 pageJCB 191 Bill Bidkin June 19arjun dalvi0% (1)

- Doa KTT Creditnet Finance 13 June 2022Document26 pagesDoa KTT Creditnet Finance 13 June 2022Mujahid AhmedNo ratings yet

- HERITAGEDocument2 pagesHERITAGEhemanth1234No ratings yet

- DRC07 Order ZD181223066048F 20231231023238Document4 pagesDRC07 Order ZD181223066048F 20231231023238tuensangnagaland2018No ratings yet

- NF Order ZD330523079501L 20230517040905Document4 pagesNF Order ZD330523079501L 20230517040905Boomi BalanNo ratings yet

- Sri ByraveshwaraDocument3 pagesSri Byraveshwarahemanth1234No ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Accounting Voucher-86Document3 pagesAccounting Voucher-86Dhanapal 11No ratings yet

- P P Rolling Mills Mfging Co PVT LTD "Draft Po, Do Not Ship Material On This Basis Without Confirmed Po"Document1 pageP P Rolling Mills Mfging Co PVT LTD "Draft Po, Do Not Ship Material On This Basis Without Confirmed Po"shantanulucknow3333No ratings yet

- Krrish 18-19 DRC 01Document2 pagesKrrish 18-19 DRC 01Sb SharmaNo ratings yet

- Bolero Bill JanuaryDocument1 pageBolero Bill JanuaryMAA KALI ENTERPRISESNo ratings yet

- Loi Wo Petropath Fluids (I) PVT LTDDocument1 pageLoi Wo Petropath Fluids (I) PVT LTDAlok Singh0% (1)

- Sri Chowdeshwari Rice TradersDocument2 pagesSri Chowdeshwari Rice Tradershemanth1234No ratings yet

- Bolpur Ocsc Lease Rent Sep 2023Document1 pageBolpur Ocsc Lease Rent Sep 2023Firoz ShaikhNo ratings yet

- Warshi Bill No-3297Document1 pageWarshi Bill No-3297Aafak KhanNo ratings yet

- GST Invoice Format For Goods in ExcelDocument57 pagesGST Invoice Format For Goods in ExcelJugaadi BahmanNo ratings yet

- GST Invoice Format For Goods in ExcelDocument57 pagesGST Invoice Format For Goods in ExcelJugaadi BahmanNo ratings yet

- Concep Branding 1Document3 pagesConcep Branding 1Rstuv WNo ratings yet

- Page 1/3Document3 pagesPage 1/3Manoj KumarNo ratings yet

- Po 164 RMC Nuvoco SVGLLPDocument1 pagePo 164 RMC Nuvoco SVGLLPAmit Ranjan SharmaNo ratings yet

- Absolute Bill No. 0001Document1 pageAbsolute Bill No. 0001varunclient100No ratings yet

- 2092 Key Stone Developers PVT LTDDocument2 pages2092 Key Stone Developers PVT LTDRishu YadavNo ratings yet

- DRC07 Order ZD080823024156G 20230811042623Document4 pagesDRC07 Order ZD080823024156G 20230811042623khushinagar9009No ratings yet

- Tax Invoice Ohm Sai Engineering Email Id: GSTIN: 27AGGPJ0403J1ZQDocument1 pageTax Invoice Ohm Sai Engineering Email Id: GSTIN: 27AGGPJ0403J1ZQAtish JadhavNo ratings yet

- Sales GST 281Document1 pageSales GST 281ashish.asati1No ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Ashtamurtienterprises GST OF NOV PDFDocument2 pagesAshtamurtienterprises GST OF NOV PDFmanish mishraNo ratings yet

- Bom 487Document1 pageBom 487Roop HariaNo ratings yet

- Vijaya Lakshmi ABL RA BILL - 01Document29 pagesVijaya Lakshmi ABL RA BILL - 01apparao rvNo ratings yet

- DRC07 Order ZD091223315104W 20231219012514Document4 pagesDRC07 Order ZD091223315104W 20231219012514ANAND PATHAKNo ratings yet

- Dot Notice ZD2409230503986 20230929011717Document2 pagesDot Notice ZD2409230503986 20230929011717Ashish MehtaNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Merriden - Inv - 345109Document1 pageMerriden - Inv - 345109kalakauvaNo ratings yet

- Debit Note PDFDocument3 pagesDebit Note PDFMani ShuklaNo ratings yet

- Einvoice of Japla PVC 2nd BillDocument1 pageEinvoice of Japla PVC 2nd BillSAYAN SARKARNo ratings yet

- Sales GST 259Document1 pageSales GST 259ashish.asati1No ratings yet

- June Internet BillDocument1 pageJune Internet BillRajat Kumar NayakNo ratings yet

- 2 Addressed Letterhead SarithaDocument20 pages2 Addressed Letterhead SarithaRaju NairNo ratings yet

- Gateway Feb 2024Document14 pagesGateway Feb 2024kanishk.basuNo ratings yet

- Tax Invoice American Precoat Speciality PVT LTD: Original For Recipient SalesDocument5 pagesTax Invoice American Precoat Speciality PVT LTD: Original For Recipient SalessatendraNo ratings yet

- Tax Invoice: Y. B. Enterprises 003 5-Apr-24Document2 pagesTax Invoice: Y. B. Enterprises 003 5-Apr-24TARUN KUMARNo ratings yet

- Sidel DL 042Document1 pageSidel DL 042cnanda89No ratings yet

- 201102-SCHAFBOCK SanskardhamDocument1 page201102-SCHAFBOCK SanskardhamDIPAL PATWANo ratings yet

- Gasbill 2921591000 202304 20230508210349Document1 pageGasbill 2921591000 202304 20230508210349Gull KhaniNo ratings yet

- Bta s2Document2 pagesBta s2msNo ratings yet

- Asian Steel 2021-22 DRC 01 NEWDocument3 pagesAsian Steel 2021-22 DRC 01 NEWhakkim satharNo ratings yet

- July Bill.2023Document9 pagesJuly Bill.2023Azhar WalikarNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- File JEETDocument1 pageFile JEETrohitNo ratings yet

- Bill No 284Document1 pageBill No 284kk5860232No ratings yet

- BhaeDocument2 pagesBhaeSUBHRAJEET DASNo ratings yet

- Samarttha Buildcon: Subject: Purchase Order Date:05.12.2019Document2 pagesSamarttha Buildcon: Subject: Purchase Order Date:05.12.2019kiranNo ratings yet

- DRC03Document2 pagesDRC03GiriTelecomNo ratings yet

- Credit 243112012575 12 2023Document2 pagesCredit 243112012575 12 2023bhawesh joshiNo ratings yet

- Gem8736 0273Document1 pageGem8736 0273bhumiNo ratings yet

- GTM Industries Pvt. LTDDocument4 pagesGTM Industries Pvt. LTDGTM INDUSTRIES PVT LTDNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- 1942 Rules IndexDocument148 pages1942 Rules IndexAishvary GuptaNo ratings yet

- 09abepg1126a1zg Gstr3b Monthwise Summary (2017-2018)Document6 pages09abepg1126a1zg Gstr3b Monthwise Summary (2017-2018)Aishvary GuptaNo ratings yet

- 09atwpg7637a1zd Gstr2a Annual Summary (2021-2022)Document61 pages09atwpg7637a1zd Gstr2a Annual Summary (2021-2022)Aishvary GuptaNo ratings yet

- 09abepg1126a1zg Gstr1 Detailed Report Summary (2017-2018)Document94 pages09abepg1126a1zg Gstr1 Detailed Report Summary (2017-2018)Aishvary GuptaNo ratings yet

- GSTR3B 09aqrpb2108b1zb 072022Document2 pagesGSTR3B 09aqrpb2108b1zb 072022Aishvary GuptaNo ratings yet

- 09abepg1126a1zg Gstr3br1 Reconciled Summary (2017-2018)Document19 pages09abepg1126a1zg Gstr3br1 Reconciled Summary (2017-2018)Aishvary GuptaNo ratings yet

- Form PDF 127831180260722Document10 pagesForm PDF 127831180260722Aishvary GuptaNo ratings yet

- Sun Tzu Police BrutalityDocument3 pagesSun Tzu Police BrutalityAlix SwannNo ratings yet

- Arbitration Agreement and Its Essential ElementsDocument21 pagesArbitration Agreement and Its Essential ElementsIbrat Khan100% (1)

- Group 4 (WPS)Document5 pagesGroup 4 (WPS)Jonathan Luke MallariNo ratings yet

- Government of Rajasthan Finance Department (Rules Division)Document6 pagesGovernment of Rajasthan Finance Department (Rules Division)Mukesh kumar DewraNo ratings yet

- Full List of 24 Convicts, 86 Ex-Convicts Pardoned by Nigerian GovernmentDocument22 pagesFull List of 24 Convicts, 86 Ex-Convicts Pardoned by Nigerian GovernmentSahara Reporters100% (3)

- LabRel MT Long QuizDocument4 pagesLabRel MT Long QuizDerek EgallaNo ratings yet

- Statement On Religious Exemptions by 419 FirefightersDocument1 pageStatement On Religious Exemptions by 419 FirefightersABC7NewsNo ratings yet

- North South University: Department of LawDocument28 pagesNorth South University: Department of LawShadman Sakib Fahim 1831736030No ratings yet

- NLRB GC - Mandatory Submissions To AdviceDocument10 pagesNLRB GC - Mandatory Submissions To AdviceLaborUnionNews.comNo ratings yet

- What Taxation During The Spanish Period Was Imposed Between 1635 Up To The Middle of The 19th Century Which Was Collected To Crush The Moro RaidsDocument4 pagesWhat Taxation During The Spanish Period Was Imposed Between 1635 Up To The Middle of The 19th Century Which Was Collected To Crush The Moro RaidsMARC RJ GONZALESNo ratings yet

- Republic Vs Jaralve by James PagdangananDocument2 pagesRepublic Vs Jaralve by James PagdangananAly Concepcion100% (1)

- Annex A - Format of Notice of Discrepancy - RMC 102-2020 1Document2 pagesAnnex A - Format of Notice of Discrepancy - RMC 102-2020 1Joanna AbañoNo ratings yet

- Mah. Act 3 of 2007 The Maha. Fire Prevention & LSM Act-2006Document63 pagesMah. Act 3 of 2007 The Maha. Fire Prevention & LSM Act-2006Priya Vishvanathan AjayNo ratings yet

- Corporation LawDocument76 pagesCorporation LawMary Megan TaboraNo ratings yet

- EthicsDocument21 pagesEthicsRandy Albaladejo Jr.No ratings yet

- TPA Bullet NotesDocument166 pagesTPA Bullet NotesvarshiniNo ratings yet

- Resolution Coverd CourtDocument2 pagesResolution Coverd CourtMAY ANTIQUINANo ratings yet

- Telangana BudgetDocument17 pagesTelangana BudgetMichael JacksanNo ratings yet

- Saint Mary Crusade v. Riel, G.R. No. 176508, January 12, 2015Document2 pagesSaint Mary Crusade v. Riel, G.R. No. 176508, January 12, 2015darleneirishcandontolNo ratings yet

- Whistleblower Protection Act Fact SheetDocument5 pagesWhistleblower Protection Act Fact SheetSophya RoeseNo ratings yet

- L-25 POL 110 Introduction To Political Theory Unit-III Liberty. Equality and GenderDocument11 pagesL-25 POL 110 Introduction To Political Theory Unit-III Liberty. Equality and Genderkookie crystalNo ratings yet

- Tuatis VS SPS Escol DigestDocument3 pagesTuatis VS SPS Escol DigestJJ CaparrosNo ratings yet

- Moot ProblemDocument8 pagesMoot ProblemLubhavani ChaturvediNo ratings yet