Professional Documents

Culture Documents

03

Uploaded by

TARUN KUMARCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03

Uploaded by

TARUN KUMARCopyright:

Available Formats

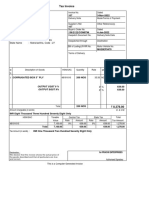

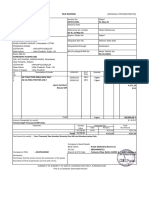

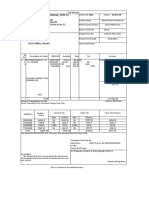

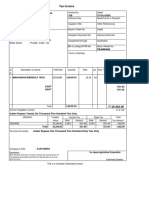

Tax Invoice (ORIGINAL FOR RECIPIENT)

Y. B. ENTERPRISES Invoice No. Dated

KH.NO.2082 AND 2085, SAI PURAM 003 5-Apr-24

NOOR NAGAR, MEERUT 250002 Delivery Note Mode/Terms of Payment

GSTIN/UIN: 09DDOPB6153B1ZP

Reference No. & Date. Other References

State Name : Uttar Pradesh, Code : 09

Buyer’s Order No. Dated

Buyer (Bill to)

JAI MAA TRADERS Dispatch Doc No. Delivery Note Date

296, UTTAM TOYOTA MEERUT ROAD, Vikas Nagar

Industrial Area, Ghaziabad, Uttar Pradesh, 201003 Dispatched through Destination

GSTIN/UIN : 09CGKPM8465K1ZJ

State Name : Uttar Pradesh, Code : 09 Bill of Lading/LR-RR No. Motor Vehicle No.

dt. 5-Apr-24 UP14KT0293

Terms of Delivery

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 USED OIL WITH DRUM 200LTR 2710 7 PCS 4,500.00 PCS 31,500.00

CGST 9% 9 % 2,835.00

SGST 9% 9 % 2,835.00

Total 7 PCS 37,170.00

Amount Chargeable (in words) E. & O.E

INR Thirty Seven Thousand One Hundred Seventy Only

HSN/SAC Taxable CGST SGST/UTGST Total

Value Rate Amount Rate Amount Tax Amount

2710 31,500.00 9% 2,835.00 9% 2,835.00 5,670.00

Total 31,500.00 2,835.00 2,835.00 5,670.00

Tax Amount (in words) : INR Five Thousand Six Hundred Seventy Only

Declaration for Y. B. ENTERPRISES

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

This is a Computer Generated Invoice

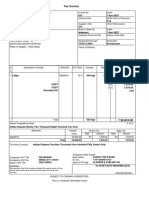

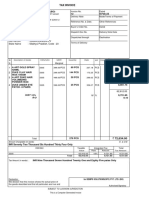

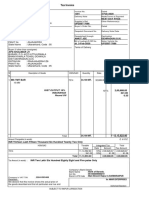

Tax Invoice (DUPLICATE FOR TRANSPORTER)

Y. B. ENTERPRISES Invoice No. Dated

KH.NO.2082 AND 2085, SAI PURAM 003 5-Apr-24

NOOR NAGAR, MEERUT 250002 Delivery Note Mode/Terms of Payment

GSTIN/UIN: 09DDOPB6153B1ZP

Reference No. & Date. Other References

State Name : Uttar Pradesh, Code : 09

Buyer’s Order No. Dated

Buyer (Bill to)

JAI MAA TRADERS Dispatch Doc No. Delivery Note Date

296, UTTAM TOYOTA MEERUT ROAD, Vikas Nagar

Industrial Area, Ghaziabad, Uttar Pradesh, 201003 Dispatched through Destination

GSTIN/UIN : 09CGKPM8465K1ZJ

State Name : Uttar Pradesh, Code : 09 Bill of Lading/LR-RR No. Motor Vehicle No.

dt. 5-Apr-24 UP14KT0293

Terms of Delivery

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 USED OIL WITH DRUM 200LTR 2710 7 PCS 4,500.00 PCS 31,500.00

CGST 9% 9 % 2,835.00

SGST 9% 9 % 2,835.00

Total 7 PCS 37,170.00

Amount Chargeable (in words) E. & O.E

INR Thirty Seven Thousand One Hundred Seventy Only

HSN/SAC Taxable CGST SGST/UTGST Total

Value Rate Amount Rate Amount Tax Amount

2710 31,500.00 9% 2,835.00 9% 2,835.00 5,670.00

Total 31,500.00 2,835.00 2,835.00 5,670.00

Tax Amount (in words) : INR Five Thousand Six Hundred Seventy Only

Declaration for Y. B. ENTERPRISES

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

This is a Computer Generated Invoice

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Sales_001Document2 pagesSales_001TARUN KUMARNo ratings yet

- Tax Invoice (182078)Document2 pagesTax Invoice (182078)Paras TyagiNo ratings yet

- 3 1 PDFDocument3 pages3 1 PDFRISHI BABUNo ratings yet

- Api 107Document1 pageApi 107Abhishek IndraleNo ratings yet

- Tyagi Tyres0Document1 pageTyagi Tyres0ABHISHEK SHARMANo ratings yet

- Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08Document2 pagesJodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08Hemlata LodhaNo ratings yet

- Day AlanDocument1 pageDay AlanTechnetNo ratings yet

- GoodDocument1 pageGoodEntertain with musicNo ratings yet

- Accounting Voucher 289Document1 pageAccounting Voucher 289rajesh puhanNo ratings yet

- Invoice No. SS069 Shreevim UpDocument1 pageInvoice No. SS069 Shreevim Upranjitghosh684No ratings yet

- 01Document2 pages01TARUN KUMARNo ratings yet

- Bbe 7Document2 pagesBbe 7Sanjay LoyalkaNo ratings yet

- Bbe 6Document2 pagesBbe 6Sanjay LoyalkaNo ratings yet

- Assemble 6-8Document1 pageAssemble 6-8ok okNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherAnonymous eKt1FCDNo ratings yet

- Vishnu Saran & Co. Bill No 5045Document1 pageVishnu Saran & Co. Bill No 5045gopukrishna37No ratings yet

- Tax invoice for IT productsDocument1 pageTax invoice for IT productsAbhinav NigamNo ratings yet

- Tax Invoice for Leyland Radiator AssemblyDocument3 pagesTax Invoice for Leyland Radiator Assemblydeepak vashistNo ratings yet

- BCL 025 Inv 9677Document2 pagesBCL 025 Inv 9677Sanjay LoyalkaNo ratings yet

- 158Document2 pages158S MedhiNo ratings yet

- Tax Invoice - Sheet1Document1 pageTax Invoice - Sheet1nonud1000No ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Kamrup Bill - 014Document1 pageKamrup Bill - 014gyan chand kumawatNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- TKNB5Document3 pagesTKNB5JUAN ENTERPRISES MANJERINo ratings yet

- Tax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Document2 pagesTax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Risi Spice industriesNo ratings yet

- Credit Note JSWDocument1 pageCredit Note JSWARIHANT CORPORATIONNo ratings yet

- Bbe 3Document1 pageBbe 3Sanjay LoyalkaNo ratings yet

- OM SHREE MAA 02Document1 pageOM SHREE MAA 02fca.varunduggalNo ratings yet

- Tax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratDocument1 pageTax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratGaurav ChaudharyNo ratings yet

- Proforma Invoice for Hard Disk PurchaseDocument2 pagesProforma Invoice for Hard Disk Purchasesanjib RNo ratings yet

- EfewaraweDocument1 pageEfewarawesunil kumarNo ratings yet

- Tax Invoice: 9-Nov-22 Sanat EnterprisesDocument1 pageTax Invoice: 9-Nov-22 Sanat Enterprisesomkar sawantNo ratings yet

- Bbe 9Document2 pagesBbe 9Sanjay LoyalkaNo ratings yet

- Tax Invoice: G-One Enterprises 31-Mar-22Document2 pagesTax Invoice: G-One Enterprises 31-Mar-22LAKSHAY JAINNo ratings yet

- Bill 1391 PDFDocument1 pageBill 1391 PDFDeep GuptaNo ratings yet

- Accounting Voucher-86Document3 pagesAccounting Voucher-86Dhanapal 11No ratings yet

- Tax InvoiceDocument1 pageTax Invoicepiyush1809No ratings yet

- 18 BillDocument1 page18 Billamityadav.51321No ratings yet

- Ae 4197Document1 pageAe 4197omkar sawantNo ratings yet

- Tax Invoice: Techcons It SolutionsDocument2 pagesTax Invoice: Techcons It SolutionsAnkit JainNo ratings yet

- Maheshwari Mining PVT LTD: SL No. 1Document1 pageMaheshwari Mining PVT LTD: SL No. 1Karthii AjuNo ratings yet

- Bill Format Gypusm BoardDocument8 pagesBill Format Gypusm BoardRamachandra SahuNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPapia ChandaNo ratings yet

- Bbe-6 RectifiedDocument1 pageBbe-6 RectifiedSanjay LoyalkaNo ratings yet

- Tax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21Document1 pageTax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21talabirachp siteNo ratings yet

- Bbe-7 RectifiedDocument1 pageBbe-7 RectifiedSanjay LoyalkaNo ratings yet

- Tax Invoice Jaycee Agricultural CorporationDocument1 pageTax Invoice Jaycee Agricultural Corporationjaycee fertilisersNo ratings yet

- Bbe 8Document2 pagesBbe 8Sanjay LoyalkaNo ratings yet

- TATA ProjectsDocument1 pageTATA ProjectsBoishal Bikash BaruahNo ratings yet

- Eltron 1Document2 pagesEltron 1Haseeb TyzNo ratings yet

- Bbe 10Document2 pagesBbe 10Sanjay LoyalkaNo ratings yet

- Catalyst - C22-2300505Document1 pageCatalyst - C22-2300505Tea CozyNo ratings yet

- 1 PDFDocument1 page1 PDFAkshay Kumar swamiNo ratings yet

- SENCO GOLDDocument1 pageSENCO GOLDtabu 1No ratings yet

- Tax Invoice: Rose Gold Colour With Milky GlassDocument1 pageTax Invoice: Rose Gold Colour With Milky GlassMisbah Ur RehmanNo ratings yet

- 32585Document1 page32585anand suryaNo ratings yet

- Tax Invoice SummaryDocument1 pageTax Invoice Summaryshakir tkNo ratings yet

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionDocument1 pageOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurNo ratings yet

- Tax Invoice: Amarnath Traders 2019-20 Reg0155 19-Jul-2019Document1 pageTax Invoice: Amarnath Traders 2019-20 Reg0155 19-Jul-2019Vivek KumarNo ratings yet

- 01Document2 pages01TARUN KUMARNo ratings yet

- Tax Invoice: Amarnath Traders 2019-20 Reg0155 19-Jul-2019Document1 pageTax Invoice: Amarnath Traders 2019-20 Reg0155 19-Jul-2019Vivek KumarNo ratings yet

- Verification and Renewal Combined Form For Website Updated As On 19.07.2023Document13 pagesVerification and Renewal Combined Form For Website Updated As On 19.07.2023TARUN KUMARNo ratings yet

- 0517NEWDocument1 page0517NEWTARUN KUMARNo ratings yet

- LTC Bill Form-G.a.r. 14-cDocument10 pagesLTC Bill Form-G.a.r. 14-cpraveen reddyNo ratings yet

- 341 Examples of Addressing ModesDocument8 pages341 Examples of Addressing ModesdurvasikiranNo ratings yet

- Codeigniter Library: 77 Free Scripts, Addons, Tutorials and VideosDocument6 pagesCodeigniter Library: 77 Free Scripts, Addons, Tutorials and VideosmbahsomoNo ratings yet

- AAN-32 Installation Manual GuideDocument24 pagesAAN-32 Installation Manual GuideFady MohamedNo ratings yet

- Citibank'S Epay: Online Credit Card Payment. From Any BankDocument2 pagesCitibank'S Epay: Online Credit Card Payment. From Any BankHamsa KiranNo ratings yet

- The Need For International Accounting StandardsDocument1 pageThe Need For International Accounting StandardsYuvaraj RajNo ratings yet

- NEF1 - Non-Directional Earth-Fault Protection Low-Set Stage (NEF1Low) High-Set Stage (NEF1High) Instantaneous Stage (NEF1Inst)Document25 pagesNEF1 - Non-Directional Earth-Fault Protection Low-Set Stage (NEF1Low) High-Set Stage (NEF1High) Instantaneous Stage (NEF1Inst)rajeshNo ratings yet

- High School Students' Characteristics Predict Science Club MembershipDocument4 pagesHigh School Students' Characteristics Predict Science Club MembershipNorma PanaresNo ratings yet

- Group Assignment 1 - FinalDocument13 pagesGroup Assignment 1 - FinalWanteen LeeNo ratings yet

- CMT Charter TermsDocument9 pagesCMT Charter TermsSanjay GowdaNo ratings yet

- List of Private Medical PractitionersDocument7 pagesList of Private Medical PractitionersShailesh SahniNo ratings yet

- Ibert Concerto Tremolo Fingerings by Nestor Herszbaum PDFDocument2 pagesIbert Concerto Tremolo Fingerings by Nestor Herszbaum PDFAmedeo De SimoneNo ratings yet

- PPT 06Document15 pagesPPT 06Diaz Hesron Deo SimorangkirNo ratings yet

- Solution Manual For C Programming From Problem Analysis To Program Design 4th Edition Barbara Doyle Isbn 10 1285096266 Isbn 13 9781285096261Document19 pagesSolution Manual For C Programming From Problem Analysis To Program Design 4th Edition Barbara Doyle Isbn 10 1285096266 Isbn 13 9781285096261Gerald Digangi100% (32)

- Rapid AbgDocument11 pagesRapid AbgDeoMikhailAngeloNuñezNo ratings yet

- Bomba ScholanderDocument4 pagesBomba ScholanderEdwin HansNo ratings yet

- Computer Organization and ArchitectureDocument173 pagesComputer Organization and ArchitecturesalithakkNo ratings yet

- 5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19Document1 page5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19arpannathNo ratings yet

- Role of Business IncubatorsDocument11 pagesRole of Business IncubatorsayingbaNo ratings yet

- Veritas Databerg ReportDocument10 pagesVeritas Databerg Reportboulou750No ratings yet

- Ap04-01 Audit of SheDocument7 pagesAp04-01 Audit of Shenicole bancoroNo ratings yet

- Write Your Own Song with SameDiffDocument2 pagesWrite Your Own Song with SameDiffSyed A H AndrabiNo ratings yet

- Assignment 3Document3 pagesAssignment 3Nate LoNo ratings yet

- iC60L Circuit Breakers (Curve B, C, K, Z)Document1 pageiC60L Circuit Breakers (Curve B, C, K, Z)Diego PeñaNo ratings yet

- ChatroomsDocument4 pagesChatroomsAhmad NsNo ratings yet

- Alrehman Pirani Resume LMCDocument1 pageAlrehman Pirani Resume LMCapi-307195944No ratings yet

- Decoled FR Sas: Account MovementsDocument1 pageDecoled FR Sas: Account Movementsnatali vasylNo ratings yet

- PreviewpdfDocument32 pagesPreviewpdfAleena HarisNo ratings yet

- Special power attorneyDocument4 pagesSpecial power attorneyYen Estandarte Gulmatico0% (1)

- Resume - Savannah RodriguezDocument1 pageResume - Savannah Rodriguezapi-634086166No ratings yet