Professional Documents

Culture Documents

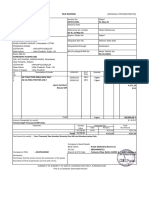

Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Uploaded by

Hemlata LodhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08

Uploaded by

Hemlata LodhaCopyright:

Available Formats

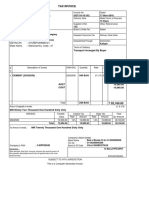

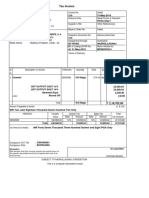

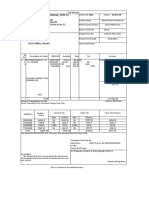

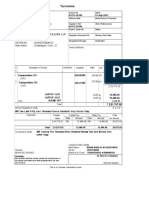

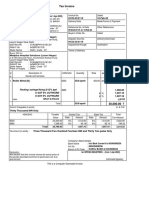

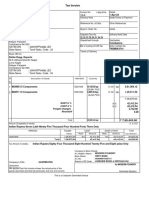

Tax Invoice (ORIGINAL FOR RECIPIENT)

THAKURDAS KHEMCHAND Invoice No. Dated

Katla Bazar, CR/205 13-Jun-2020

Jodhpur - 342 002 Delivery Note

FSSAI # 12218032000314

GSTIN/UIN: 08ADCPK9421C1ZU

Despatch Document No. Delivery Note Date

State Name : Rajasthan, Code : 08

Contact : 0291-2439720

Despatched through Destination

Buyer

Hem Tech

Jodhpur

GSTIN/UIN : 08ABGPL3664C1ZS

State Name : Rajasthan, Code : 08

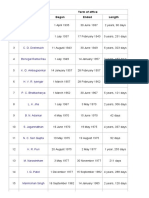

Sl Description of Goods HSN/SAC GST Quantity Rate per Amount

No. Rate

1 Monosodium Glutamate ( 29224220 18 % 300.000 KG 84.75 KG 25,425.00

Ajinotmoto)

Loose

12 x 25 Kgs

CGST 2,288.25

SGST 2,288.25

Round Off (+/-) 0.50

Total 300.000 KG 30,002.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Thirty Thousand Two Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

29224220 25,425.00 9% 2,288.25 9% 2,288.25 4,576.50

Total 25,425.00 2,288.25 2,288.25 4,576.50

Tax Amount (in words) : Indian Rupees Four Thousand Five Hundred Seventy Six and Fifty paise Only

Company’s Bank Details

Bank Name : Central Bank of India

A/c No. : 1299519743

Company’s PAN : ADCPK9421C Branch & IFS Code : Jalori Gate & CBIN0280450

Declaration for THAKURDAS KHEMCHAND

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

SUBJECT TO JODHPUR JURISDICTION

This is a Computer Generated Invoice

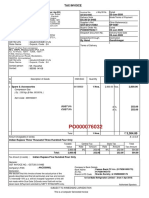

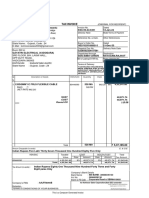

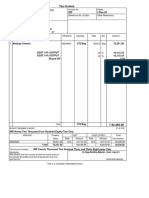

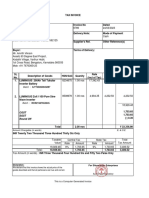

Tax Invoice (DUPLICATE FOR TRANSPORTER)

THAKURDAS KHEMCHAND Invoice No. Dated

Katla Bazar, CR/205 13-Jun-2020

Jodhpur - 342 002 Delivery Note

FSSAI # 12218032000314

GSTIN/UIN: 08ADCPK9421C1ZU

Despatch Document No. Delivery Note Date

State Name : Rajasthan, Code : 08

Contact : 0291-2439720

Despatched through Destination

Buyer

Hem Tech

Jodhpur

GSTIN/UIN : 08ABGPL3664C1ZS

State Name : Rajasthan, Code : 08

Sl Description of Goods HSN/SAC GST Quantity Rate per Amount

No. Rate

1 Monosodium Glutamate ( 29224220 18 % 300.000 KG 84.75 KG 25,425.00

Ajinotmoto)

Loose

12 x 25 Kgs

CGST 2,288.25

SGST 2,288.25

Round Off (+/-) 0.50

Total 300.000 KG 30,002.00

Amount Chargeable (in words) E. & O.E

Indian Rupees Thirty Thousand Two Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

29224220 25,425.00 9% 2,288.25 9% 2,288.25 4,576.50

Total 25,425.00 2,288.25 2,288.25 4,576.50

Tax Amount (in words) : Indian Rupees Four Thousand Five Hundred Seventy Six and Fifty paise Only

Company’s Bank Details

Bank Name : Central Bank of India

A/c No. : 1299519743

Company’s PAN : ADCPK9421C Branch & IFS Code : Jalori Gate & CBIN0280450

Declaration for THAKURDAS KHEMCHAND

We declare that this invoice shows the actual price of

the goods described and that all particulars are true

and correct. Authorised Signatory

SUBJECT TO JODHPUR JURISDICTION

This is a Computer Generated Invoice

You might also like

- Accounting VoucherDocument1 pageAccounting Vouchershailesh patilNo ratings yet

- Tax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21Document1 pageTax Invoice: Bombay Chowk, Jharsuguda GSTIN/UIN: 21AGHPS3530J1ZI State Name: Odisha, Code: 21talabirachp siteNo ratings yet

- Tax Invoice: Amg Polychem PVT - LTDDocument3 pagesTax Invoice: Amg Polychem PVT - LTDARPIT MAHESHWARINo ratings yet

- Tax Invoice Shree Durga Traders: E-Way Bill NoDocument1 pageTax Invoice Shree Durga Traders: E-Way Bill NoRisi Spice industriesNo ratings yet

- UGS - 119 - Petropath Fluids (India) Pvt. Ltd.Document3 pagesUGS - 119 - Petropath Fluids (India) Pvt. Ltd.Alok SinghNo ratings yet

- GoodDocument1 pageGoodEntertain with musicNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherUttam PurohitNo ratings yet

- 03Document2 pages03TARUN KUMARNo ratings yet

- Sales_001Document2 pagesSales_001TARUN KUMARNo ratings yet

- Tax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Document1 pageTax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Sunil PatelNo ratings yet

- 7832 EdvannaparaDocument1 page7832 EdvannaparaSafalsha BabuNo ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsVinayKRaiNo ratings yet

- TCL BillDocument3 pagesTCL BillYoginder SinghNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceAnil KumarNo ratings yet

- 3351 InvoiceDocument1 page3351 InvoicepkNo ratings yet

- Bill Format Gypusm BoardDocument8 pagesBill Format Gypusm BoardRamachandra SahuNo ratings yet

- Tax Invoice Cement SaleDocument2 pagesTax Invoice Cement SaleJwalant JadavNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicemanmojilo4 bharwadNo ratings yet

- BILL-15Document1 pageBILL-15jay_p_shahNo ratings yet

- 161/1, M.G.ROAD Bangar Buildung. ROOM NO.-18 Kolkata GSTIN/UIN: 19BYDPR0678H2ZZ State Name: West Bengal, Code: 19Document1 page161/1, M.G.ROAD Bangar Buildung. ROOM NO.-18 Kolkata GSTIN/UIN: 19BYDPR0678H2ZZ State Name: West Bengal, Code: 19Tripti AgrawalNo ratings yet

- BCL 025 Inv 9677Document2 pagesBCL 025 Inv 9677Sanjay LoyalkaNo ratings yet

- Purchase_142Document16 pagesPurchase_142nitinupadhyay9821No ratings yet

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- Bbe 7Document2 pagesBbe 7Sanjay LoyalkaNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceᴘᴇᴀᴄᴏᴄᴋNo ratings yet

- Accounting Voucher 289Document1 pageAccounting Voucher 289rajesh puhanNo ratings yet

- Sanat Enterprises Tax InvoiceDocument1 pageSanat Enterprises Tax Invoiceomkar sawantNo ratings yet

- KentDocument1 pageKentSunil PatelNo ratings yet

- Medplus 2119Document1 pageMedplus 2119Moseen AliNo ratings yet

- Tax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Document1 pageTax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Moseen AliNo ratings yet

- Tax invoice detailsDocument1 pageTax invoice detailsas constructionNo ratings yet

- LC001Document1 pageLC001ManeeshNo ratings yet

- Tax Invoice: IS9537 25MMDocument1 pageTax Invoice: IS9537 25MMPunit SinghNo ratings yet

- Tax invoice waste scrap ChhattisgarhDocument2 pagesTax invoice waste scrap ChhattisgarhAshu SinghNo ratings yet

- Bbe 6Document2 pagesBbe 6Sanjay LoyalkaNo ratings yet

- Bbe 3Document1 pageBbe 3Sanjay LoyalkaNo ratings yet

- Tax invoice for IT productsDocument1 pageTax invoice for IT productsAbhinav NigamNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPriyanka DevghareNo ratings yet

- PDF&Rendition=1Document2 pagesPDF&Rendition=1chandankaran894No ratings yet

- acrorma0076356_mergedDocument2 pagesacrorma0076356_mergedMatt AustinNo ratings yet

- Sachi Agency 14.09.2022Document1 pageSachi Agency 14.09.2022dheerendrapanwarNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- UPS InvoiceDocument1 pageUPS InvoiceMohammed NazimNo ratings yet

- GST Invoice DetailsDocument1 pageGST Invoice DetailsVinit KumarNo ratings yet

- 2 - P. S. Sikarwar EnterprisesDocument1 page2 - P. S. Sikarwar Enterprisespriyanka singhNo ratings yet

- Ok Lifecare Private Limited (H03) : Tax Collection SummaryDocument3 pagesOk Lifecare Private Limited (H03) : Tax Collection Summaryparveen122133No ratings yet

- AJPL0602Document1 pageAJPL0602shrungar.ornament1No ratings yet

- Bbe 8Document2 pagesBbe 8Sanjay LoyalkaNo ratings yet

- Tax Invoice - Sheet1Document1 pageTax Invoice - Sheet1nonud1000No ratings yet

- Praa 2 PDFDocument1 pagePraa 2 PDFMithun Mathew KottaramkunnelNo ratings yet

- 25.05.2022 EmulsionDocument1 page25.05.2022 EmulsionSBM DGLNo ratings yet

- Catalyst - C22-2300505Document1 pageCatalyst - C22-2300505Tea CozyNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- BRAHMAKAMALDocument1 pageBRAHMAKAMALsales Brahma KamalNo ratings yet

- Tax Invoice for Construction MaterialsDocument1 pageTax Invoice for Construction MaterialsRiya Das RdNo ratings yet

- Tax Invoice e-InvoiceDocument1 pageTax Invoice e-Invoicemalar studioNo ratings yet

- TAX INVOICEDocument1 pageTAX INVOICEAnjani KumariNo ratings yet

- Invoice for 10 HP laptops under Rs. 428,000Document2 pagesInvoice for 10 HP laptops under Rs. 428,000aryandjNo ratings yet

- Industrial Growth Centre Borgaon, Distt. Chhindwara Details of Land AllotmentDocument8 pagesIndustrial Growth Centre Borgaon, Distt. Chhindwara Details of Land AllotmentHemlata LodhaNo ratings yet

- Journal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunDocument6 pagesJournal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunHemlata Lodha100% (1)

- E Numbers Are Number Codes For Food Additives and Are Usually Found On Food Labels ThroughoutDocument16 pagesE Numbers Are Number Codes For Food Additives and Are Usually Found On Food Labels Throughoutez zuhrufNo ratings yet

- List-Kieselgur enDocument7 pagesList-Kieselgur enHemlata LodhaNo ratings yet

- Tip For Greenhouse Growers - Add Silicon - May 2, 2007 - News From The USDA Agricultural Research ServiceDocument1 pageTip For Greenhouse Growers - Add Silicon - May 2, 2007 - News From The USDA Agricultural Research ServiceHemlata LodhaNo ratings yet

- Bio FertilizerDocument4 pagesBio FertilizerHemlata LodhaNo ratings yet

- Suga-Lik® - Dairy SupplementsDocument2 pagesSuga-Lik® - Dairy SupplementsHemlata LodhaNo ratings yet

- The Maharashtra Agro-Industries Development Corporation LimitedDocument10 pagesThe Maharashtra Agro-Industries Development Corporation LimitedHemlata LodhaNo ratings yet

- List of Companies Whose Renewal Is Due Beyong 31.03.2011Document16 pagesList of Companies Whose Renewal Is Due Beyong 31.03.2011Hemlata LodhaNo ratings yet

- BIS - CementDocument12 pagesBIS - CementSuvendu DeyNo ratings yet

- Other Bio Technology CompaniesDocument42 pagesOther Bio Technology CompaniesbhavikNo ratings yet

- Tips For Winter Supplementation of CattleDocument3 pagesTips For Winter Supplementation of CattleHemlata LodhaNo ratings yet

- Delhi Test House: A-62/3, G.T.Karnal Road, Indl. Area, Azadpur, Delhi-110033 PH: 011-47075555 (30 Lines) Fax: 47075550Document3 pagesDelhi Test House: A-62/3, G.T.Karnal Road, Indl. Area, Azadpur, Delhi-110033 PH: 011-47075555 (30 Lines) Fax: 47075550Hemlata LodhaNo ratings yet

- Vastu and Environment, Trees, Plants - Vastu Norms For Environment, Plants, Trees Online at AstroshastraDocument3 pagesVastu and Environment, Trees, Plants - Vastu Norms For Environment, Plants, Trees Online at AstroshastraHemlata LodhaNo ratings yet

- Journal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunDocument6 pagesJournal Entry For Fixed Deposit and Entry in Tally - Best Tally Accounts Finance Taxation SAP FI Coaching Institute in DehradunHemlata Lodha100% (1)

- Industrial Growth Centre Borgaon, Distt. Chhindwara Details of Land AllotmentDocument8 pagesIndustrial Growth Centre Borgaon, Distt. Chhindwara Details of Land AllotmentHemlata LodhaNo ratings yet

- Rdisdue Ren 2010Document41 pagesRdisdue Ren 2010Varghese AlexNo ratings yet

- RBI GovernorsDocument2 pagesRBI GovernorsHemlata LodhaNo ratings yet

- Cetex Micro-SilicaDocument1 pageCetex Micro-SilicaHemlata LodhaNo ratings yet

- Castament FS 20: Technical Data SheetDocument2 pagesCastament FS 20: Technical Data SheetHemlata LodhaNo ratings yet

- WWW - Punjab.bsnl - Co.in Bandhan bb1.htmDocument7 pagesWWW - Punjab.bsnl - Co.in Bandhan bb1.htmHemlata LodhaNo ratings yet

- Indian Patents. 232467 - THE SYNERGISTIC MINERAL MIXTURE FOR INCREASING MILK YIELD IN CATTLEDocument9 pagesIndian Patents. 232467 - THE SYNERGISTIC MINERAL MIXTURE FOR INCREASING MILK YIELD IN CATTLEHemlata LodhaNo ratings yet

- Keshavaprasad B S - Maturity Amount Calculation For Recurring Deposit in MS ExcelDocument2 pagesKeshavaprasad B S - Maturity Amount Calculation For Recurring Deposit in MS ExcelHemlata LodhaNo ratings yet

- The Maharashtra Agro-Industries Development Corporation LimitedDocument10 pagesThe Maharashtra Agro-Industries Development Corporation LimitedHemlata LodhaNo ratings yet

- Fillers in PVC - A Review of The Basics PDFDocument4 pagesFillers in PVC - A Review of The Basics PDFN.B.PNo ratings yet

- Group-1 List of Bis Recognised Laboratoires (An On 25 Oct 2011)Document7 pagesGroup-1 List of Bis Recognised Laboratoires (An On 25 Oct 2011)Hemlata LodhaNo ratings yet

- Section V: Salt Sulphur Earths and Stone Plastering Materials, Lime and CementDocument11 pagesSection V: Salt Sulphur Earths and Stone Plastering Materials, Lime and CementHemlata LodhaNo ratings yet

- List-Kieselgur enDocument7 pagesList-Kieselgur enHemlata LodhaNo ratings yet

- Celite 545 Diatomaceous Earth Filtering AidDocument1 pageCelite 545 Diatomaceous Earth Filtering AidHemlata LodhaNo ratings yet

- Paper On Addition of FlyashDocument9 pagesPaper On Addition of FlyashShashiraj KemminjeNo ratings yet

- Magna Carta For Homeowners and Homeowners AssociationsDocument32 pagesMagna Carta For Homeowners and Homeowners AssociationsGerald MesinaNo ratings yet

- Chapter 3 - Salary Structure DecisionsDocument4 pagesChapter 3 - Salary Structure DecisionsAdoree RamosNo ratings yet

- Entrep ModuleDocument94 pagesEntrep Module죽음No ratings yet

- Unseen Question TemplateDocument2 pagesUnseen Question TemplategeorgeNo ratings yet

- SBR SD22 Examiner ReportDocument15 pagesSBR SD22 Examiner Reportjunk2023No ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- The Effect of Company'S Level of Digitalization On Employee Satisfaction and ProductivityDocument95 pagesThe Effect of Company'S Level of Digitalization On Employee Satisfaction and ProductivitysinanNo ratings yet

- Bhogilal Laherchand v. Commissioner of Income Tax, - ... - On 15 September, 1955Document6 pagesBhogilal Laherchand v. Commissioner of Income Tax, - ... - On 15 September, 1955mansavi bihaniNo ratings yet

- Comfort O. Odoma & CO.: Plot 573 by Livestock House Junction Jabi, Abuja. Tel: 08097579530Document4 pagesComfort O. Odoma & CO.: Plot 573 by Livestock House Junction Jabi, Abuja. Tel: 08097579530Comfort OdomaNo ratings yet

- CIR V de La SalleDocument19 pagesCIR V de La SallePatatas SayoteNo ratings yet

- FAR2 AnswersDocument10 pagesFAR2 Answersjulietpamintuan100% (1)

- Project Report On Working Capital ManageDocument70 pagesProject Report On Working Capital ManageJanaklal ShahNo ratings yet

- Partnership Bar QuestionsDocument4 pagesPartnership Bar QuestionsYollaine GaliasNo ratings yet

- Entrepreneur 1Document35 pagesEntrepreneur 1Rucha TandulwadkarNo ratings yet

- Exercise Chapter 17Document3 pagesExercise Chapter 17karelimmanuelshangraihanNo ratings yet

- The Importance of SavingsDocument12 pagesThe Importance of SavingsKenza HazzazNo ratings yet

- Cover and Content of ProposalDocument5 pagesCover and Content of ProposalTeddy Tyssa TarnoNo ratings yet

- DR March15Document48 pagesDR March15michelle joubertNo ratings yet

- Ial Wec12 01 Oct19Document32 pagesIal Wec12 01 Oct19non100% (1)

- Asme AiDocument1 pageAsme AiTATIANA MARTINEZNo ratings yet

- 70398XXXXX 828046980 3 2024Document2 pages70398XXXXX 828046980 3 2024Biswarup PalNo ratings yet

- 2024 Petcoke Conference BrocDocument8 pages2024 Petcoke Conference Brocsarah latuNo ratings yet

- Rashid Ahmed Barkat Ali V.Rossay NTN: 00000000000: Web Generated BillDocument1 pageRashid Ahmed Barkat Ali V.Rossay NTN: 00000000000: Web Generated BillfahidNo ratings yet

- Amit Project ReportDocument21 pagesAmit Project ReportPankaj UpadhyayNo ratings yet

- HP Economic Survey SummaryDocument3 pagesHP Economic Survey SummaryAnil SharmaNo ratings yet

- Security Analysis (Fundamnetal Analysis)Document8 pagesSecurity Analysis (Fundamnetal Analysis)mohamed AthnaanNo ratings yet

- Restaurant Accounting With Quic - Doug Sleeter-4Document21 pagesRestaurant Accounting With Quic - Doug Sleeter-4ADELALHTBANINo ratings yet

- NWC Financial ForecastDocument9 pagesNWC Financial ForecastTimNo ratings yet

- Level of Guest Experience and Satisfaction of Resorts Found in Sogod Bay Basis For Enhancement of Products and ServicesDocument44 pagesLevel of Guest Experience and Satisfaction of Resorts Found in Sogod Bay Basis For Enhancement of Products and ServicesPink NoodlesNo ratings yet

- Emerson 2012 PresentationDocument128 pagesEmerson 2012 PresentationCapgoods1No ratings yet