Professional Documents

Culture Documents

FA Assignment - 5

FA Assignment - 5

Uploaded by

Sidhant Thakur0 ratings0% found this document useful (0 votes)

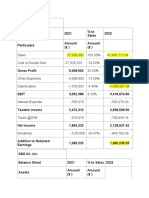

9 views2 pages1. SRF Ltd's assets grew 30% in 2020 compared to 19% growth in current assets, as the company increased fixed assets and capital work in progress.

2. Net worth increased 38% in 2020 compared to 15% in 2019, while short term borrowings and trade payables grew only 12% and 6%.

3. In 2020, sales grew 27% while costs of goods sold grew 21% and expenses 18%, showing improved manufacturing efficiency. Net profit increased 98%.

Original Description:

Financial accounting

Original Title

FA Assignment -5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. SRF Ltd's assets grew 30% in 2020 compared to 19% growth in current assets, as the company increased fixed assets and capital work in progress.

2. Net worth increased 38% in 2020 compared to 15% in 2019, while short term borrowings and trade payables grew only 12% and 6%.

3. In 2020, sales grew 27% while costs of goods sold grew 21% and expenses 18%, showing improved manufacturing efficiency. Net profit increased 98%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesFA Assignment - 5

FA Assignment - 5

Uploaded by

Sidhant Thakur1. SRF Ltd's assets grew 30% in 2020 compared to 19% growth in current assets, as the company increased fixed assets and capital work in progress.

2. Net worth increased 38% in 2020 compared to 15% in 2019, while short term borrowings and trade payables grew only 12% and 6%.

3. In 2020, sales grew 27% while costs of goods sold grew 21% and expenses 18%, showing improved manufacturing efficiency. Net profit increased 98%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Company – SRF Ltd.

1. Index Based Numbers for last 3 years –

Values Index Based

Comment (in approx. 80

2020 2019 2018 2020 2019 2018 words)

Assets

Rs. Cr. Rs. Cr. Rs. Cr.

Cash & Bank Balances 125.47 198.88 96.74 129.70 205.58 100

1.In FY20, Non-current assets

Trade receivables 891.07 1028.75 680.65 130.91 151.14 100

have grown at rapid pace

Inventories 1,201.23 1,224.74 958.18 125.37 127.82 100 (30%) as compared to

Other financial/current asset 688.43 719.92 690.32 99.73 104.29 100 current assets (19%). The

total current asset 2,906 3,172 2,426 119.80 130.77 100 company has increased its

Net Fixed Assets 6,022.93 5,496.45 5,004.78 120.34 109.82 100 fixed asset in addition to

Capital Work In Progress 1393.29 753.61 558.81 249.33 134.86 100 capital work in progress

(grew by 48%).

Other non-current assets 554.36 465.55 373.53 148.41 124.64 100

total non current asset 7,970.58 6,715.61 5,937.12 134.25 113.11 100 2.Net worth has increased at

Total Assets 10,877 9,888 8,363 130.06 118.23 100 a faster rate (38%) in 2020

Short term borrowings 955 1,127 850.78 112.30 132.51 100 wrt to growth of 15% in

Trade payables 1,112 1,382 1,044.24 106.46 132.39 100 2019.

Other current liabilities 1,242 689 637 194.89 108.11 100

3.Short term borrowings and

total current liabilities 3,309 3,199 2,532 130.67 126.32 100

trade payables grew by

Secured Loans 2311.63 2161.34 1,907.26 121.20 113.32 100 meagre 12% &6% compared

Other LT liabilities & prov 148.38 56.63 67.63 219.40 83.74 100 to previous year which

Deferred Tax Liability, Net 175.5 341.98 291.38 60.23 117.37 100 shows that company is

total non-current liabilities 2,636 2,560 2,266 116.29 112.96 100 managing its cash flows in a

better way.

Net worth 4,933 4,129 3,565 138.40 115.84 100

Total Liabilities 10,878 9,888 8,363 130.07 118.23 100

Values Index Based

Income statement 2020 2019 2018 2020 2019 2018 Comment (approx. 90 words)

Rs. Cr. Rs. Cr. Rs. Cr.

7,099.5 1.In FY19, Sales grew at faster rate 25% wrt to

Total Sales

7,209.41 9 5,684.87 126.82 124.89 100 asset increased by 18% which shows

Add : Other Income 49.05 27.97 115.12 42.61 24.30 100 increased asset utilisation but in FY 20 asset

utilisation is marginally reduced (sales grew

3,967.1

Less:Cost of goods sold by 27% and asset by30%).

3,686.97 3 3,032.00 121.60 130.84 100

3,160.4

Gross Profit 2.In FY20, COGS and depreciation increased

3,571.49 3 2,767.99 129.03 114.18 100

by 21% &23% which was less than the sales

Less: Operating 1,835.4

rate increase 26%. It shows better achieved

Expense/Other Expense 2,067.50 6 1,746.63 118.37 105.09 100

manufacturing efficiency levels and pricing

1,324.9

EBIDTA strategy.

1,503.99 7 1,021.36 147.25 129.73 100

Less:Interest 200.68 198.37 123.89 161.98 160.12 100 3. In FY 20, Taxes were negligible which was

Less:Depreciation 388.61 358.17 315.8 123.06 113.42 100 the main reason behind the high growth in

net profit (98%)

PBT 914.70 768.43 581.67 157.25 132.11 100

Less:Tax -1.2 176.85 119.96 -1.00 147.42 100

PAT 915.90 591.58 461.71 198.37 128.13 100

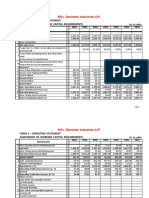

2. Common size numbers for 2 years and peer company (M/s 3M India ) for 1 year –

SRF Ltd. 3M India

Common

Values Common size Values

size Comment (approx. 112 words)

2020 2019 2020 2019 2020

Assets

Rs. Cr. Rs. Cr. % % Rs. Cr. %

Cash & Bank Balances 125.47 198.88 1.15 2.01 780.57 32.92

Trade receivables 891.07 1028.75 8.19 10.40 534.24 22.53

1,224.7

Inventories 1,201.23 4 11.04 12.39 438.65 18.50

Other financial/current

asset 688.43 719.92 6.33 7.28 115.28 4.86

total current asset 2,906 3,172 26.72 32.08 1868.74 78.80

5,496.4

Net Fixed Assets 6,022.93 5 55.37 55.59 261.74 11.04

Capital Work In Progress 1393.29 753.61 12.81 7.62 6.9 0.29

Other non-current assets 554.36 465.55 5.10 4.71 233.97 9.87

total non current asset 7,971 6,716 73.28 67.92 502.61 21.20

Total Assets 10,877 9,888 100.00 100.00 2,371 100.00

Short term borrowings 955 1,127 8.78 11.40 34.71 1.46

Trade payables 1,112 1,382 10.22 13.98 312.86 13.19

Other current liabilities 1,242 689 11.42 6.97 223.67 9.43

total current liabilities 3,309 3,199 30.42 32.35 571.24 24.09

Secured Loans 2311.63 2161.34 21.25 21.86

Other long term liabilities

& prov 148.38 56.63 1.36 0.57 49.18 2.07

Deferred Tax Liability, Net 175.5 341.98 1.61 3.46

total non-current

liabilities 2,636 2,560 24.23 25.89 49 2.07

Net worth 4,933 4,129 45.35 41.76 1750.87 73.84

Total Liabilities 10,878 9,888 100.00 100.00 2,371 100.00

SRF Ltd. 3M India

Values Common size Values Common size

Comment (approx.. 80 words)

Income statement 2020 2019 2020 2019 2020

Rs. Cr. Rs. Cr. Rs. Cr. %

100.0

Total Sales 7,209.41 7,099.59 0 100.00 2986.55 100.00

Add : Other

Income 49.05 27.97 0.68 0.39 45.89 1.54

Less:Cost of goods

sold 3,686.97 3,967.13 51.14 55.88 1736.28 58.14

Gross Profit 3,571.49 3,160.43 49.54 44.52 1,296.16 43.40

Less: Operating

Expense/Other

Expense 2,067.50 1,835.46 28.68 25.85 800.59 26.81

EBIDTA 1,503.99 1,324.97 20.86 18.66 495.57 16.59

Less:Interest 200.68 198.37 2.78 2.79 3.66 0.12

Less:Depreciation 388.61 358.17 5.39 5.04 59.33 1.99

PBT 914.70 768.43 12.69 10.82 432.58 14.48

Less:Tax -1.2 176.85 -0.02 2.49 110.39 3.70

PAT 915.90 591.58 12.70 8.33 322.19 10.79

You might also like

- Cost Accounting: Quiz 1Document11 pagesCost Accounting: Quiz 1ASILINA BUULOLONo ratings yet

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Finance MCQS: A. Financial ManagementDocument8 pagesFinance MCQS: A. Financial ManagementblueNo ratings yet

- Internship Report Audit Firm PakistanDocument76 pagesInternship Report Audit Firm Pakistanibraheym86% (14)

- Joint ArrangementsDocument7 pagesJoint ArrangementsMarinel Mae ChicaNo ratings yet

- Sample ERP Requirements DocumentDocument62 pagesSample ERP Requirements Documenthddon100% (1)

- Accounting Concepts and ConventionsDocument18 pagesAccounting Concepts and ConventionsDr. Avijit RoychoudhuryNo ratings yet

- ch08 Valuation of Inventories Test Bank Answers PDFDocument40 pagesch08 Valuation of Inventories Test Bank Answers PDFKristine VertucioNo ratings yet

- Birth of The Classic Guitar and Its Cultivation in Vienna Reflected in The Career and Composition of Mauro Giuliani PDFDocument534 pagesBirth of The Classic Guitar and Its Cultivation in Vienna Reflected in The Career and Composition of Mauro Giuliani PDFMichael Bonnes100% (2)

- Maintenance Management SystemDocument16 pagesMaintenance Management Systemrjohnzamora100% (5)

- Particulars Absolute Amounts 2018-19 2019-20 2018-19 2019-20 Rs. (In Lakhs) Rs. (In Lakhs) (%) (%) Percentage of Net SalesDocument6 pagesParticulars Absolute Amounts 2018-19 2019-20 2018-19 2019-20 Rs. (In Lakhs) Rs. (In Lakhs) (%) (%) Percentage of Net SalesPrafful VyasNo ratings yet

- Submission#5 Company Assigned: UCO Bank 1) : Non-Current AssetsDocument2 pagesSubmission#5 Company Assigned: UCO Bank 1) : Non-Current AssetsKummNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- CA2Document22 pagesCA2aryanvaish64No ratings yet

- All CombinedDocument19 pagesAll CombinedSibasish AccharyaNo ratings yet

- Analysis by CompanyDocument12 pagesAnalysis by CompanyNadia ZahraNo ratings yet

- AMD Trend Sheet-2Document7 pagesAMD Trend Sheet-2priyathamme.seekerNo ratings yet

- Monte Carlo Fashions Ltd. Forecast - UPDATEDDocument26 pagesMonte Carlo Fashions Ltd. Forecast - UPDATEDsanket patilNo ratings yet

- Hindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument4 pagesHindustan Unilever LTD.: Executive Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- Sample Excel FileDocument60 pagesSample Excel FileFunny ManNo ratings yet

- Financial ReportDocument60 pagesFinancial ReportAastha GuptaNo ratings yet

- Reliance FSA PrachiDocument16 pagesReliance FSA PrachiPrachi SrivastavaNo ratings yet

- Standalone Result Sep, 17Document4 pagesStandalone Result Sep, 17Varun SidanaNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- ICICI ValuationDocument69 pagesICICI ValuationAnonymousNo ratings yet

- FinMan (Common-Size Analysis)Document4 pagesFinMan (Common-Size Analysis)Lorren Graze RamiroNo ratings yet

- Balance Sheet Slide 1: Analysis of Asset Structure and Developments (Horizontal)Document4 pagesBalance Sheet Slide 1: Analysis of Asset Structure and Developments (Horizontal)Thư LuyệnNo ratings yet

- Assignment 5Document2 pagesAssignment 5Amarjeet SinghNo ratings yet

- Invesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512Document5 pagesInvesco Oppenheimer Developing Markets Fund: Kunal Gupta 19BSP3512KUNAL GUPTANo ratings yet

- Name Enrollment Number Project On Section Submitted To DateDocument14 pagesName Enrollment Number Project On Section Submitted To DateL1588AshishNo ratings yet

- Finman Step 5Document59 pagesFinman Step 5PETRUS CANISIUS AXELNo ratings yet

- Tata SteelDocument2 pagesTata Steelapurv chauhanNo ratings yet

- Accounts Project (Sample)Document25 pagesAccounts Project (Sample)siji sajiNo ratings yet

- Chapter 5Document12 pagesChapter 5Arjun Singh ANo ratings yet

- FM WK 5 PmuDocument30 pagesFM WK 5 Pmupranjal92pandeyNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- Company 1 Yr1 Yr2 EPS 10 11 Price 100 110Document38 pagesCompany 1 Yr1 Yr2 EPS 10 11 Price 100 110Bhaskar RawatNo ratings yet

- Three Statement ModelDocument9 pagesThree Statement ModelAnkit SharmaNo ratings yet

- Components of Beneish M-ScoreDocument27 pagesComponents of Beneish M-ScoreRitu RajNo ratings yet

- Centuryply IP Q4FY23Document30 pagesCenturyply IP Q4FY23Sanjeev GoswamiNo ratings yet

- WEOPI FS Highlights Dec 2023Document5 pagesWEOPI FS Highlights Dec 2023Amino BenitoNo ratings yet

- FM2 Great Eastern Toys ExhibitsDocument5 pagesFM2 Great Eastern Toys ExhibitsHarsh VardhanNo ratings yet

- MoneyDocument1 pageMoneySashi TamizhaNo ratings yet

- Trend Analysis Balance SheetDocument4 pagesTrend Analysis Balance Sheetrohit_indiaNo ratings yet

- Data For Financial AnalysisDocument8 pagesData For Financial AnalysisPriyanshu SinghNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Excel Workings ITE ValuationDocument19 pagesExcel Workings ITE Valuationalka murarka100% (1)

- Tomasino's Kakanin Republic Comprehensive Income Statement Comparative AnalysisDocument8 pagesTomasino's Kakanin Republic Comprehensive Income Statement Comparative AnalysisAdam CuencaNo ratings yet

- FM121 - Ba2f - Financial AnalysisDocument12 pagesFM121 - Ba2f - Financial AnalysisStephene MaynopasNo ratings yet

- FCFF Vs Fcfe StudentDocument5 pagesFCFF Vs Fcfe StudentKanchan GuptaNo ratings yet

- Abbott Laboratories (Pakistan) Limited-1Document9 pagesAbbott Laboratories (Pakistan) Limited-1Shahrukh1994007No ratings yet

- Profit Loss AccountDocument8 pagesProfit Loss AccountAbhishek JenaNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- Mohammed Ameen PG23174 (Britannia Financial Modelling Assignment)Document20 pagesMohammed Ameen PG23174 (Britannia Financial Modelling Assignment)mameen2906No ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Web Standalone Sep23Document7 pagesWeb Standalone Sep23coolstiffler08No ratings yet

- Minicase 2Document2 pagesMinicase 2TompelGEDE GTNo ratings yet

- Devmeta Project Report CmaDocument9 pagesDevmeta Project Report CmaharshNo ratings yet

- Name of The Company Last Financial Year First Projected Year CurrencyDocument15 pagesName of The Company Last Financial Year First Projected Year CurrencygabegwNo ratings yet

- Projected Balancesheet For Three Years - Apple: 2018 (In MILLION Usd) 2019 (In MILLION Usd) 2020 (In MILLION Usd)Document3 pagesProjected Balancesheet For Three Years - Apple: 2018 (In MILLION Usd) 2019 (In MILLION Usd) 2020 (In MILLION Usd)srn318No ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- Chapter 10 - Financial PlanDocument8 pagesChapter 10 - Financial PlanKrizia QuiambaoNo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda Motorskaushal_bishtNo ratings yet

- Ir 2022Document7 pagesIr 2022Chimi WangchukNo ratings yet

- 3rd Quarter Report 2021 2022Document12 pages3rd Quarter Report 2021 2022শ্রাবনী দেবনাথNo ratings yet

- Bal SheetDocument4 pagesBal SheetVishal JainNo ratings yet

- Working Capital - LupinDocument13 pagesWorking Capital - Lupinprashantrikame1234No ratings yet

- 2019-12 - EIC Accelerator Pilot - Annex - 4 - Financial Information - Proposal Template Part BDocument3 pages2019-12 - EIC Accelerator Pilot - Annex - 4 - Financial Information - Proposal Template Part BminossotaNo ratings yet

- Assets Current AssetsDocument2 pagesAssets Current AssetsRIAN MAE DOROMPILINo ratings yet

- Management Accounting and Analysis: Name: Rana Vivek SinghDocument8 pagesManagement Accounting and Analysis: Name: Rana Vivek SinghRana Vivek SinghNo ratings yet

- Schindler: Industrial EngineeringDocument12 pagesSchindler: Industrial EngineeringAnh BVNo ratings yet

- UNIT-4 Working Capital ManagementDocument13 pagesUNIT-4 Working Capital ManagementChandanN81No ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- AC20 MIDTERM EXAMINATION FY21 22 - DGCupdDocument10 pagesAC20 MIDTERM EXAMINATION FY21 22 - DGCupdMaricar PinedaNo ratings yet

- DepreciationDocument8 pagesDepreciationfarhadcse30No ratings yet

- Assets FormDocument4 pagesAssets FormAnonymous k5CcMyU6100% (1)

- A Study On Financial Planning and Forecasting Project Done By: - Prince YadavDocument16 pagesA Study On Financial Planning and Forecasting Project Done By: - Prince Yadavprince yadavNo ratings yet

- JP Morgan ChaseDocument14 pagesJP Morgan ChaseAldrich Theo MartinNo ratings yet

- F7-2015-Past Exam - June 2015Document15 pagesF7-2015-Past Exam - June 2015Yulia Melentii0% (1)

- Ratio Analysis (Liquidity Ratio)Document8 pagesRatio Analysis (Liquidity Ratio)shanu yadavNo ratings yet

- AFN ProbDocument3 pagesAFN ProbAli The Banner MakerNo ratings yet

- Balance Sheet of Colgate-Palmolive (India) Limited: Particulars 2021 2020Document42 pagesBalance Sheet of Colgate-Palmolive (India) Limited: Particulars 2021 2020ABHISHEK KHURANANo ratings yet

- Vallourec Press Release Q2 H1 2022 ResultsDocument15 pagesVallourec Press Release Q2 H1 2022 ResultsAditya DeshpandeNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- I Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdDocument2 pagesI Dunno What de Puck Is This2010-06-06 - 1901 I Do03 - EdmomdMuhammad Dennis AnzarryNo ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- Group 3: 1. New Set of BooksDocument5 pagesGroup 3: 1. New Set of Bookschelsea kayle licomes fuentesNo ratings yet

- Xyz HotelDocument12 pagesXyz HotelKyleTyNo ratings yet