Professional Documents

Culture Documents

2 Worked Examples

Uploaded by

Jester LabanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Worked Examples

Uploaded by

Jester LabanCopyright:

Available Formats

Chartered Accountants Program

Financial Accounting & Reporting

WE

Worked example 2.1

Preparing a statement of cash flows using the

reconstruction method

Introduction

The statement of cash flows provides important information to readers about an entity’s sources

and use of cash during a given period. Preparing the statement of cash flows is often a more

complicated exercise than preparing other statements because the cash flows presented must

be derived from the accrual-based accounting records. It also requires an understanding of the

nature of the accounts in the accounting records and the entity’s non-cash activities.

This worked example links to learning outcome:

•• Advise on the requirement for financial statements.

At the end of this worked example you will be able to prepare a statement of cash flows in

accordance with IAS 7 Statement of Cash Flows (IAS 7), using the reconstruction method and your

understanding of the operations of an entity.

It will take you approximately 45 minutes to complete.

Scenario

Louise is a financial accountant at Giles & More, assisting Jump To It Limited (JTI) with the

preparation of their financial statements. She is working with the finance team to finalise the

financial statements for the year ending 30 June 20X2.

Louise has prepared the statement of financial position and statement of profit or loss and

other comprehensive income for JTI for the year ended 30 June 20X2. She has also obtained the

statement of financial position as at 30 June 20X1. These statements are reproduced below:

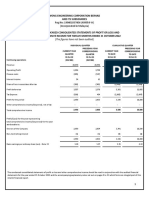

Jump To It Limited

Statement of profit and loss and other comprehensive income for the year ended 30 June 20X2

Notes 20X2

$’000

Sales revenue 1 8,500

Cost of sales (5,440)

Gross profit 3,060

Advertising (303)

Impairment loss – trade receivables (40)

Bad debts (140)

Depreciation – equipment (100)

Depreciation – motor vehicles (65)

Employee benefits (1,237)

Insurance (29)

Interest expense – debentures (135)

fin21402_we_pdf01_01

Unit 2 – Worked examples Page 2-1

Financial Accounting & Reporting Chartered Accountants Program

WE

Jump To It Limited

Statement of profit and loss and other comprehensive income for the year ended 30 June 20X2

Notes 20X2

$’000

Interest expense – overdraft (15)

Loss on disposal of motor vehicle 2 (15)

Rental expense (500)

(2,579)

Profit before tax 481

Income tax expense (190)

Underprovision for income tax expense (8)

(198)

Net profit for the year 283

Total comprehensive income for the year 283

Jump To It Limited

Statement of financial position as at 30 June 20X2

Notes 20X2 20X1

$’000 $’000

Current assets

Cash at bank – 210

Trade receivables 2,990 2,470

Allowance for impairment loss – trade receivables (125) (85)

Prepayments 23 29

Inventory 2,109 1,810

Total current assets 4,997 4,434

Non-current assets

Equipment – cost 1,000 1,000

Equipment – accumulated depreciation and impairment (700) (600)

Motor vehicles – cost 600 450

Motor vehicles – accumulated depreciation and impairment (97) (84)

Total non-current assets 803 766

Total assets 5,800 5,200

Current liabilities

Bank overdraft 180 –

Trade payables 1,920 1,720

Provision for employee entitlements 197 125

Income tax payable 190 150

Page 2-2 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

Jump To It Limited

Statement of financial position as at 30 June 20X2

Notes 20X2 20X1

$’000 $’000

Dividend payable 3 140 105

Debentures 400 –

Total current liabilities 3,027 2,100

Non-current liabilities

Debentures 4 600 1,000

Total liabilities 3,627 3,100

Net assets 2,173 2,100

Shareholders’ equity

Share capital 1,500 1,500

General reserve 300 100

Retained earnings 5 373 500

Total shareholders’ equity 2,173 2,100

Notes

1. All sales were on credit.

2. The proceeds from the sale of the motor vehicle were $33,000. Its carrying value at the time of sale was $48,000.

3. Debentures with a face value of $400,000 will be repaid on 31 December 20X2.

4. The remaining debentures ($600,000) mature on 31 December 20Y3.

5. An interim dividend of $70,000 was paid on 1 December 20X1. A final dividend of $140,000 was declared

on 2 June 20X2. $200,000 of retained earnings was transferred to the general reserve on 1 June 20X2.

Note: Ignore GST.

Task

Alison Giles, a partner of Giles & More, has asked Louise to prepare the statement of cash flows

for the year ended 30 June 20X2 using the direct method explained in IAS 7 paras 18–19.

Alison reminds Louise that JTI’s accounting policy is to include bank overdrafts in cash and

cash equivalents for the purposes of the statement of cash flows.

Solution

Louise worked through the following steps to complete the task.

Step 1 – Review the Standard

Louise reviewed the relevant sections of IAS 7 before starting to prepare the cash flow

statement, including the following relevant paragraphs:

•• IAS 7 para. 6: Definitions of operating, investing and financing activities.

•• IAS 7 para. 10: Presentation of a statement of cash flows.

Unit 2 – Worked examples Page 2-3

Financial Accounting & Reporting Chartered Accountants Program

WE

•• IAS 7 paras 14, 16 and 17: Examples of cash flows within each activity.

•• IAS 7 para. 19: Guidance on the direct method.

•• IAS 7 para. 31: Interest and dividends.

•• IAS 7 para. 35: Taxes on income.

Step 2 – Classify the items in the financial statements

Louise referred to the statement of financial position and the statement of profit or loss and

other comprehensive income that she prepared earlier, as well as the statement of financial

position as at 30 June 20X1. She reviewed each line item and classifies them according to one of

the following categories:

•• Cash.

•• Operating activity.

•• Investing activity.

•• Financing activity.

•• Non-cash item.

Louise then determined which line item in the statement of cash flows each item impacts.

She knew that these amounts are not the actual cash flows, but that they will be used to

calculate the cash flows.

Louise documented her classification of each financial statement line item (or component of a

line item) in a table, with explanations as necessary; first the statement of financial position and

then the statement of profit or loss and other comprehensive income.

Classification of statement of financial position items

Line item 20X2 20X1 Classification Specific cash flow

$’000 $’000

Assets

Current assets

Cash and cash – 210 Cash and cash Is included in the movement in the cash

equivalents equivalents and cash equivalents for the year

Trade and other 2,990 2,470 Operating Receipts from customers

receivables activity

Allowance for (125) (85) Operating Receipts from customers

impairment loss – activity

trade receivables

Prepayments 23 29 Operating Payments to suppliers, employees and

activity others

Inventory 2,109 1,810 Operating Payments to suppliers, employees and

activity others

Page 2-4 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

Classification of statement of financial position items

Line item 20X2 20X1 Classification Specific cash flow

$’000 $’000

Non-current assets

Plant and 1,600 1,450 Investing Payments for acquisition of plant and

equipment activity equipment/proceeds from sale of plant

and equipment

Accumulated (797) (684) Investing Payments for acquisition of plant and

depreciation and activity equipment/proceeds from sale of plant

impairment – plant and equipment

and equipment

Liabilities

Current liabilities

Trade and other (1,920) (1,720) Operating Payments to suppliers, employees and

payables activity others

Borrowings – bank (180) – Cash and cash Is included in the movement in the cash

overdraft equivalents and cash equivalents for the year

Borrowings – (400) – Financing N/A – reclassification from non-current

current portion of activity

debentures

Provisions (197) (125) Operating Payments to suppliers, employees and

– employee activity others

entitlements

Dividend payable (140) (105) Financing Dividends paid

activity

Non-current liabilities

Borrowings – non- (600) (1,000) Financing N/A – reclassification to current

current portion of activity

debentures

Equity

Share capital (1,500) (1,500) Financing N/A – no movement

activity

Reserves (300) (100) Non-cash item N/A – non-cash item

Retained earnings (373)1 (500) Financing Dividends paid

activity

Note: $373,000 = $500,000 (opening retained earnings + $283,000 (net profit) – $200,000 (transfer to general reserve) –

$210,000 (dividends paid and declared).

With the reconstruction method, if a statement of financial position item such as share capital

does not change from the previous year there is no impact on the calculation of the cash flows.

The current portion of the debentures is $400,000 at the 20X2 year end. During the 20X2 year

there was a reclassification between current and non-current but there was no cash flow.

Similarly, there was no cash flow when $200,000 was transferred from retained earnings to the

general reserve.

Unit 2 – Worked examples Page 2-5

Financial Accounting & Reporting Chartered Accountants Program

WE

Classification of statement of profit or loss items

Line item 20X2 Classification Specific cash flow

$’000

Revenue 8,500 Operating activity Receipts from customers

Inventory and materials (5,440) Operating activity Payments to suppliers, employees and others

used – cost of sales

Rental expense (500) Operating activity Payments to suppliers, employees and others

Employee benefits (1,237) Operating activity Payments to suppliers, employees and others

expense

Depreciation on plant (165) Investing activity N/A – used in reconstruction to calculate

and equipment payments for acquisition of plant and

equipment

Impairment loss expense (40) Operating activity N/A – used in reconstruction to calculate

receipts from customers

Bad debts expense (140) Operating activity N/A – used in reconstruction to calculate

receipts from customers

Other expenses (332) Operating activity Payments to suppliers, employees and others

Loss on motor vehicle (15) Investing activity N/A – used in reconstruction to calculate

proceeds from the sale of plant and equipment

Interest expense (150) Operating activity Interest paid

Income tax expense (190) Operating activity Income tax paid

Underprovision for (8) Operating activity Income tax paid

income tax expense

Note: While an expense such as depreciation is non-cash in nature, it will need to be included in the calculation when

using the reconstruction method to account for the movement in the related contra-asset accounts.

Step 3 – Prepare a template for the statement of cash flows

Using the different types of cash flows that she identified, Louise prepared a pro forma for the

statement of cash flows for the year ended 30 June 20X2.

Jump To It Limited

Statement of cash flows for the year ended 30 June 20X2

Notes 20X2

$’000

Cash flows from operating activities

Receipts from customers

Payments to suppliers, employees and others

Finance costs paid

Income tax paid

Net cash flows from operating activities

Cash flows from investing activities

Payments for plant and equipment

Proceeds from sale of plant and equipment

Page 2-6 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

Jump To It Limited

Statement of cash flows for the year ended 30 June 20X2

Notes 20X2

$’000

Net cash flows from investing activities

Cash flows from financing activities

Dividends paid

Net cash flows from financing activities

Net increase/(decrease) in cash and cash equivalents

Cash and cash equivalents at the beginning of the financial year

Cash and cash equivalents at the end of the financial year

Step 4 – Create and reconstruct relevant T-accounts for each cash flow line item

As the major step in the reconstruction method, Louise created and reconstructed a T-account

for each cash flow line item she identified in Step 3 and documented this for Alison’s review.

Where the cash flow is only impacted by a single item from the statement of financial position

and statement of profit or loss and other comprehensive income, Louise simply documented the

amount of the cash flow without going through the T-account process.

T-account to calculate cash receipts from customers

The first T-account Louise created was to calculate cash receipts from customers:

Trade receivables

Dr Cr

$’000 $’000

Opening trade receivables 2,470 Closing trade receivables 2,990

Closing allowance for impairment loss 125 Opening allowance for impairment loss 85

Impairment loss expense 40

Sales revenue 8,500 Bad debts expense 140

Receipts from customers 7,840

11,095 11,095

T-account to calculate payments to suppliers, employees and others

Using the same process, Louise created a T-account to calculate payments to suppliers,

employees and others. Although Louise realised this can be performed in a variety of ways,

she did so by reconstructing accounts payable, in which she also included the other asset and

liability balances identified in Step 2 pertaining to payments to suppliers, employees and others,

along with related expenses:

Unit 2 – Worked examples Page 2-7

Financial Accounting & Reporting Chartered Accountants Program

WE

Trade payables

Dr Cr

$’000 $’000

Closing trade payables 1,920 Opening trade payables 1,720

Opening inventory 1,810 Closing inventory 2,109

Opening prepayments 29 Closing prepayments 23

Closing provisions – employee 197 Opening provisions – employee 125

entitlements entitlements

Payments to suppliers, employees 7,530 Employee benefits expense 1,237

and others

Rental expenses 500

Other expenses 332

Cost of sales 5,440

11,486 11,486

T-account to calculate income tax paid

Louise moved on to calculate the cash outflow for income tax paid. She calculated the tax paid

of $158,000 by adding together the opening current tax liability, the underprovision of tax

and the instalments paid in the year from the trial balance ($150,000 + $8,000 + $190,000). She

confirmed this figure by re-creating the current tax payable T-account.

Current tax payable

Dr Cr

$’000 $’000

Closing current tax liability 190 Opening current tax liability 150

Income tax paid 158 Underprovision for income tax expense 8

Income tax expense 190

348 348

T-account to calculate net carrying amount of plant and equipment sold

Louise now moved on to the cash flows for property, plant and equipment. She recalled that

there was one disposal of a motor vehicle during the year, with sale proceeds of $33,000.

Since this amount is known, a T-account to calculate the cash flows from the sale of plant and

equipment is not required. However, she quickly prepared one to determine the net carrying

amount of the motor vehicle sold, which was required to complete the plant and equipment

T-account.

Disposal of plant and equipment

Dr Cr

$’000 $’000

Net carrying amount of plant and 48 Proceeds from sale of plant and 33

equipment sold equipment

Loss on sale of plant and equipment 15

48 48

Page 2-8 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

T-account for plant and equipment

Louise created the T-account for plant and equipment (combining the equipment and motor

vehicles accounts). In addition to the accounts impacting this cash flow identified in Step 2,

Louise needed to include the net carrying amount of plant and equipment sold during the year

to calculate the cash flow.

Plant and equipment

Dr Cr

$’000 $’000

Opening plant and equipment 1,450 Closing plant and equipment 1,600

Closing accumulated 797 Opening accumulated depreciation 684

depreciation and impairment and impairment

Payments for plant and 250 Depreciation expense 165

equipment

Net carrying amount of plant and 48

equipment sold

2,497 2,497

T-account for dividends paid

Louise created the T-account for dividend payable to calculate the dividends paid in the year.

Dividend payable

Dr Cr

$’000 $’000

Closing dividend payable 140 Opening dividend payable 105

Dividends paid 175 Dividends declared 210

315 315

Step 5 – Calculate remaining items for the statement of cash flows

Louise noted that for some items in the statement of profit or loss and other comprehensive

income there was no related account in the statement of financial position. The cash flow

amount could simply be taken from the statement of profit or loss and other comprehensive

income.

The relevant item is noted in the table below:

Directly calculated cash flows

Cash flow $’000

Interest paid (150)

Finally, Louise calculated the opening and closing cash and cash equivalent balances:

Cash and cash equivalents per statement of cash flows

Account 20X2 20X1

$’000 $’000

Cash and cash equivalents – 210

Bank overdraft (180) –

Total (180) 210

Unit 2 – Worked examples Page 2-9

Financial Accounting & Reporting Chartered Accountants Program

WE

Step 6 – Prepare the statement of cash flows

Louise now prepared the statement of cash flows by entering the cash flows she calculated into

the template she created earlier.

Jump To It Limited

Statement of cash flows for the year ended 30 June 20X2

Notes 20X2

$’000

Cash flows from operating activities

Receipts from customers 7,840

Payments to suppliers, employees and others (7,530)

Interest paid (150)

Income tax paid (158)

Net cash flows from operating activities 2

Cash flows from investing activities

Payments for plant and equipment (250)

Proceeds from sale of plant and equipment 33

Net cash flows used in investing activities (217)

Cash flows from financing activities

Dividends paid (175)

Net cash flows used in financing activities (175)

Net increase/(decrease) in cash and cash equivalents (390)

Cash and cash equivalents at the beginning of the financial year 210

Cash and cash equivalents at the end of the financial year (180)

Page 2-10 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

Worked example 2.2

Calculating cash flows using the spreadsheet

method

Introduction

The statement of cash flows provides important information to readers about an entity’s sources

and use of cash during a given period. Preparing the statement of cash flows is often a more

complicated exercise than preparing other statements because the cash flows presented must

be derived from the accrual-based accounting records. It also requires an understanding of the

nature of the accounts in the accounting records and the entity’s non-cash activities.

This worked example links to learning outcome:

•• Advise on the requirements for financial statements.

It follows on from Worked example 2.1. It is recommended that you attempt Worked

example 2.1 first.

At the end of this worked example you will be able to prepare a statement of cash flows, in

accordance with IAS 7 Statement of Cash Flows (IAS 7), using the spreadsheet method and your

understanding of the operations of an entity.

It will take you approximately 30 minutes to complete.

Scenario

Louise is a financial accountant at Giles & More, assisting Jump To It Limited (JTI) with the

preparation of its financial statements. She is working with the finance team to finalise the

financial statements for the year ended 30 June 20X2, and has just finished preparing the

statement of cash flows using the reconstruction method.

JTI has requested that Giles & More provide it with an IT-based approach that it will be able

to use in future periods to calculate cash flows, thus minimising the work required each year.

Alison Giles, a partner of Giles & More, knows that the ability to roll over a spreadsheet is a key

benefit of using the spreadsheet method.

Preparing the spreadsheet for the current year will demonstrate that it produces the same cash

flows as those calculated earlier using the reconstruction method.

Task

Alison asks Louise to complete the cash flow spreadsheet for the year ended 30 June 20X2 using

the Giles & More template that calculates the cash flows of JTI based on the current and prior

year trial balances, and to use formulas to adjust for non-cash items.

Unit 2 – Worked examples Page 2-11

Financial Accounting & Reporting Chartered Accountants Program

WE

Solution

Louise worked through the following steps to complete the task.

Step 1 – Create or obtain a workings template

Louise created a blank Giles & More cash flow workings template and worked through the

remaining steps to complete the task.

The cash flow spreadsheet (Worked example 2.2 cash flow statement.xlsx) is available online.

Access myLearning to download a copy of the file.

The Step 1 tab of the cash flow spreadsheet shows how the template looks at the completion

of this step.

Step 2 – Populate the trial balance accounts and balances

Working from the blank cash flow workings template, Louise first entered all the trial balance

accounts into Column A of the workings and used links to populate the balance of each account

at 30 June 20X2 and 30 June 20X1 into Columns B and D. She entered debit balances as positive

figures and credit balances as negative figures.

Last year’s closing retained earnings have been inserted into the 20X1 column in cell D25.

The workings contain a balance check in cells B42 and D42 to ensure that all accounts in the trial

balance are included.

The balance check at cell F62 contains a figure indicating there is a balancing problem; however,

this will return to $0 once the remaining steps have been performed. Similarly, the balance

check at cell S42 contains a figure indicating there is a balancing problem; however, again, this

will return to $0 once Step 3 has been performed.

The Step 2 tab of the cash flow spreadsheet shows how the workings look at the completion

of this step, with the results highlighted in yellow.

Step 3 – Complete the movements column

Louise then used column F to calculate the movements in the asset, liability and equity accounts

between 20X2 and 20X1. Only statement of financial position accounts can have year-on‑year

movements, as income and expense accounts do not have opening and closing balances.

Columns D and F have therefore been greyed out for these accounts.

The balance check at cell S42 is now $0, indicating that all movements are accounted for in the

cash flow spreadsheet.

The Step 3 tab of the cash flow spreadsheet shows how the workings look at the completion

of this step, with the results of the step highlighted in yellow.

Step 4 – Label the columns for the different cash flows applicable to JTI

Cash flows from interest paid must be disclosed separately, but can be classified as operating,

investing or financing activities, in accordance with IAS 7. JTI has chosen to classify interest

paid as an operating activity. Louise knows that when classifying cash flows it is important

to be consistent from year to year.

Using her understanding of JTI, Louise inserted the headings for the cash flows relevant to JTI

under the appropriate columns in the workings.

Page 2-12 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

The workings template already has formulas set up to total each column and transfer each

to the particular cash flow statement line item, and also to transfer the headings entered for the

cash flows to the line items in the statement of cash flows.

The Step 4 tab of the cash flow spreadsheet shows how the workings look at the completion

of this step, with the results highlighted in yellow.

Step 5 – Allocate the movements or profit or loss balances

Louise now allocated each movement calculated in Step 3 to one of the columns in the

workings, based on the appropriate type of cash flow and the sub-categories within each.

Rather than entering the value of the account movement, income, expense or dividend, she used

formulas to specify which cell she is allocating to a cash flow column, so that should any further

changes to the trial balance be made (e.g. if a late adjustment needs to be made to the financial

statements), they will flow through the cash flow spreadsheet.

Louise checked that the balance check in the final column is now $nil for all accounts.

This ensures that all accounts have been fully allocated; however, it does not ensure that they

have been allocated under the appropriate cash flow column.

The Step 5 tab of the cash flow spreadsheet shows how the workings look at the completion

of this step, with the results highlighted in yellow.

Step 6 – Adjust allocated amounts as necessary

The allocation Louise completed in Step 5 is just a starting point. Louise knews that she needed

to make adjustments to some of these allocated amounts to account for certain transactions

or non-cash activities that may not flow through automatically. This is why the balance check

at the end of the statement of cash flows in cell F60 did not balance in Step 5.

Adjustment

Louise maked an adjustment for the motor vehicle sold during the year. She determined that the

vehicle sold had a net carrying value of $48,000, an original cost of $100,000 and accumulated

depreciation of $52,000. She adjusted the allocation in the workings for these amounts, and

also the figure in the payments for plant and equipment column. This is because the movement

in the cost of motor vehicles account is due to both a sale and purchases during the year.

(That is, if the overall movement in the cost of motor vehicles account is $150,000 after factoring

in the $100,000 cost of the asset sold during the year, then the actual amount paid to purchase

motor vehicles during the year must have been $250,000.)

The balance check at the end of the statement of cash flows in cell F60 is now $0.

The Step 6 tab of the cash flow spreadsheet shows how the workings look at the completion

of this step, with the results highlighted in yellow.

Louise could have completed Steps 5 and 6 at the same time, using her understanding of each

cash flow when allocating the accounts, but she prefers to do them in sequence.

Step 7 – Review the statement of cash flows

Louise reviewed the workings and the resulting statement of cash flows. She ensures that the

balance checks are nil. She also reviewed the calculated cash flows in the statement of cash

flows to ensure that they are reasonable in the context of her understanding of the entity (and in

this case, match the cash flows calculated earlier using the reconstruction method).

The Step 7 tab of the cash flow spreadsheet shows the finalised statement of cash flows.

In future reporting periods, since the allocation of the trial balance accounts should be

consistent from period to period, JTI will be able to use the spreadsheet created to calculate its

cash flows, after making necessary adjustments each year for particular transactions.

Unit 2 – Worked examples Page 2-13

Financial Accounting & Reporting Chartered Accountants Program

WE

Worked example 2.3

Preparing operating segment disclosures

Introduction

It is important for users of financial statements to be able to assess the risks and returns of

the entity’s operations. Different business activities will face different risks and returns and,

therefore, financial information relating to these activities should be disclosed.

This worked example links to learning outcome:

•• Explain and account for an entity’s operating segments.

At the end of this worked example you will be able to identify an entity’s reportable segments

and apply the requirements for operating segment accounting policies, including the allocation

of assets, liabilities, revenues and expenses, by preparing specific disclosure information in

accordance with IFRS 8 Operating Segments (IFRS 8).

It will take you approximately 30 minutes to complete.

Scenario

This worked example is based on Tsara.

The CFO of Tsara PLC has requested that Tsara A provide the information to enable it to

prepare its IFRS 8 disclosures. Michelle Lam is a financial accountant working at Tsara A.

Operating divisions

Tsara A comprises the following divisions:

A. Fashion Australia: a manufacturer and retailer of men’s and women’s fashion clothing in

Australia.

B. Accessories Australia: a manufacturer and retailer of men’s and women’s fashion

accessories in Australia.

C. Fashion and Accessories New Zealand: a manufacturer and retailer of men’s and women’s

fashion clothing and accessories in New Zealand.

Each division operates independently of the others, with the exception of Accessories Australia

which sells the equivalent of 10% of its external sales to Fashion Australia.

Internal reporting

Peter Cartus, CFO of Tsara A, receives financial information on a monthly basis.

The financial information is prepared using the same principles as those for external reporting

purposes (except for those relating to long service leave).

Page 2-14 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

The report for the year ended 30 June 20X3, which highlights key information, is provided

below:

Tsara A financial information for the year ended 30 June 20X3

Fashion Accessories Fashion and Accessories Tsara A

Australia Australia New Zealand* (Total**)

$ $ $ $

External revenues 20,223,350 8,667,150 1,000,000 29,890,500

Interest expense 215,000 20,000 – 235,000

Depreciation expense 281,250 63,750 30,000 375,000

Income tax expense 69,632 56,038 9,426 135,096

Profit after tax 198,723 159,777 27,113 385,613

Assets 12,035,672 2,092,011 1,488,900 16,624,988

Liabilities 2,148,587 529,044 712,927 4,799,967

* Reported in A$.

** The total column includes unallocated amounts, thus the total of the three divisions does not necessarily equal the

amount in the total column.

Further information relating to the year ended 30 June 20X3

The Australian divisions account for $28,890,500 of Tsara A’s revenue and $9,000,000 of its

$11,904,850 non-current assets. There are no unallocated non-current assets.

As at 30 June 20X3, Fashion Australia had sold all products acquired from Accessories Australia.

During the year, Accessories Australia suffered a fire at one of its vacant warehouses resulting

in an asset impairment loss of $210,000, which is reflected in the above table.

If Tsara A had applied IAS 19 Employee Benefits for internal reporting information provided

to the CFO, profit after tax would have decreased by $100,000. Correspondingly, a long service

leave liability of $142,857 would be recognised, along with a $42,857 deferred tax asset.

Task

Michelle has been asked by Peter Cartus to prepare the operating segment disclosures in

accordance with IFRS 8 paras 23, 28 and 33 for Tsara A for the year ended 30 June 20X3.

The tax rate of Tsara A is 30%.

Solution

Michelle worked through the following steps to complete the task.

Step 1 – Determine whether segment reporting is required

Michelle first reviewed IFRS 8 to assess whether Tsara A is required to report locally

on operating segments under the Standard.

She determined that IFRS 8 applies to for-profit entities whose debt or equity instruments

are traded in a public market, or that are in the process of filing accounts with a regulator

or securities commission for the purpose of issuing a class of instruments in a public market

(IFRS 8 para. 2).

Unit 2 – Worked examples Page 2-15

Financial Accounting & Reporting Chartered Accountants Program

WE

Ordinarily, Tsara A would not be required to apply IFRS 8; however, it has been requested by

Tsara PLC, the parent company, that Tsara A prepare certain disclosures required by IFRS 8.

Step 2 – Identify operating segments

Michelle reviewed IFRS 8 para. 5 to establish whether the three operating divisions are

operating segments under IFRS 8.

She noted that all three divisions engage in business activities from which they earn revenues

and incur expenses. Michelle also observed that the chief operating decision maker (CODM)

reviews the results, and that there is discrete financial information recorded for all three

divisions.

Fashion Australia, Accessories Australia and Fashion and Accessories New Zealand are therefore

all operating segments.

Step 3 – Identify reportable segments

Michelle then reviewed the 30 June 20X3 end of year report to establish whether the segments

are reportable by applying the quantitative thresholds in IFRS 8 para. 13.

She noted that the quantitative threshold for revenue is based on both sales to external

customers and inter-segment sales; therefore, she must take into account the sales from

Accessories Australia to Fashion Australia when considering this threshold.

She created the following table to help her identify whether the divisions are reportable

segments:

Quantitative thresholds

Tsara A’s operating Reportable segment Reason

segment (Yes/No)

Fashion Australia Yes It is a reportable segment as reported revenue (external

and internal) is at least 10% of total revenue (external and

internal) for all segments ($20,233,350 ÷ $30,757,2151 =

65.8%), which meets the quantitative threshold criteria

detailed in IFRS 8 para. 13(a)

Accessories Australia Yes It is a reportable segment as reported revenue (external

and internal) is at least 10% of total revenue (external and

internal) for all segments ($9,533,8652 ÷ $30,757,215 =

31.0%), which meets the quantitative threshold criteria

detailed in IFRS 8 para. 13(a)

Fashion and No It is not a reportable segment because it does not meet any

Accessories New of the quantitative threshold criteria in IFRS 8 para. 13

Zealand

•• Reported revenue (external and internal) is less than

10% of total revenue (external and internal) for all

segments ($1,000,000 ÷ $30,757,215 = 3.3%)

•• Reported profit is less than 10% of total profit for all

segments ($27,113 ÷ $385,613 = 7.0%)

•• Segment assets are less than 10% of total segment

assets ($1,488,900 ÷ $15,616,583 = 9.5%)

Notes

1. $29,890,500 (external revenue) + $866,715 (internal revenue) = $30,757,215.

2. $8,667,150 + $866,715 (internal revenue) = $9,533,865.

Page 2-16 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

Michelle checked that at least 75% of external revenue is reported by operating segments in line

with IFRS 8 para.15. Fashion Australia and Accessories Australia account for 96.7% ($28,890,500

÷ $29,890,500) of total external revenue and so additional segments do not need to be identified

as reportable.

Step 4 – Identify the disclosure requirements

Michelle reviewed IFRS 8 paras 23, 28 and 33 to identify the disclosure requirements specified

by Tsara PLC for the operating segments, and noted that the following disclosures are required:

•• Information about profit or loss, assets and liabilities.

•• Reconciliations between segment disclosures and the entity balances.

•• Information about geographical areas.

Step 5 – Prepare the disclosures

Michelle prepared the operating segment disclosures for Tsara A. She made reference to the

requirements in the Standard, using the internal reporting information for the year ended

30 June 20X3, combined with the further information relating to the year ended 30 June 20X3

as outlined in the scenario.

Profit or loss, assets and liabilities

In accordance with IFRS 8 para. 23, Michelle prepared the following operating segment

disclosures for Tsara A at 30 June 20X3.

Profit or loss, assets and liabilities

Fashion Accessories All other Tsara A

Australia Australia segments total

$’000 $’000 $’000 $’000

External revenues 20,223 8,667 1,000 29,890

Inter-segment revenue – 867 1

– 867

Interest expense 215 20 – 235

Depreciation 281 64 30 375

Impairment of assets – 210 2 – 210

Income tax expense 70 56 9 135

Segment profit after tax 199 160 27 386

Segment assets3 12,036 2,092 2,497 16,625

Segment liabilities4 2,149 529 2,122 4,800

Notes

1. Inter-segment revenue is 10% of external sales of Accessories Australia to Fashion Australia (10% × $8,667,150).

2. The cost associated with the fire damage at the Accessories Australia division is reported as ‘impairment of assets’ and

is material.

3. Includes $1,489,000 of Fashion and Accessories New Zealand’s assets and $1,008,000 of unallocated assets.

4. Includes $713,000 of Fashion and Accessories New Zealand’s liabilities and $1,409,000 of unallocated liabilities.

Unit 2 – Worked examples Page 2-17

Financial Accounting & Reporting Chartered Accountants Program

WE

Reconciliations

Michelle noted that under IFRS 8 para. 28, the following reconciliations are required:

•• A reconciliation of total reportable segments’ revenues to the entity’s revenue; the

reconciling item being inter-segment revenue between Accessories Australia and Fashion

Australia.

•• A reconciliation of total reportable segments’ profit to the entity’s profit.

•• A reconciliation of total reportable segments’ assets to the entity’s assets.

•• A reconciliation of total reportable segments’ liabilities to the entity’s liabilities.

•• A reconciliation of total reportable segments’ other material items to the entity’s other

material items.

The reconciliation of total reportable segments’ profit to the entity’s profit would normally be

based on profit before tax; however, where tax expense/income has been allocated to reportable

segments, the entity may reconcile profit after tax.

Michelle noted that the profit for Tsara A is reported internally by operating segment after tax;

therefore, she uses these figures.

She also noted that the reconciling item is the adjustment for long service leave not accounted

for in accordance with IAS 19 Employee Benefits (IAS 19) for internal reporting purposes.

This adjustment reduces profit and increases liabilities, and therefore appearing as a reconciling

item in three parts of the reconciliation disclosures.

Reconciliations

$’000

Revenues

Total revenue for reportable segments1 29,757

Other revenue 1,000

Less: Elimination of inter-segment revenue (867)

Entity’s revenue 29,890

Profit/(loss) after income tax

Total profit for reportable segments 359

Other profit/(loss) 27

Adjustment for long service leave2 (100)

Entity’s profit after income tax 286

Assets

Total assets for reportable segments 14,128

Other assets3 1,489

Other unallocated amounts4 1,051

Entity’s assets 16,668

Liabilities

Total liabilities for reportable segments 2,678

Other liabilities 713

Other unallocated amounts5 1,552

Entity’s liabilities 4,943

Other material items

Total other material items for reportable segments – impairment loss 210

Entity’s other material items 210

Page 2-18 Worked examples – Unit 2

Chartered Accountants Program Financial Accounting & Reporting

WE

Notes

1. $20,223,000 Fashion Australia external revenue + $8,667,000 Accessories Australia external revenue + $867,000

Accessories Australia inter-segment revenue.

2. This is an after-tax adjustment as it was stated in the scenario that the net profit would have decreased by $100,000 if

IAS 19 was applied.

3. Assets of Fashion and Accessories New Zealand.

4. $1,008,405 unallocated assets + $42,857 deferred tax asset. As a long service leave liability has been recorded as an

adjustment, a corresponding temporary difference is recognised for the related tax effect ($142,857 × 30%) and has

been included within other unallocated amounts.

5. $1,409,409 unallocated liabilities + $142,857. As the $100,000 adjustment for long service leave was after tax, the

liability adjustment is $142,857 ($100,000 ÷ (1 – 30%)).

Geographical information

Michelle reviewed the geographical disclosure requirements in IFRS 8 and noted that para. 33

requires disclosure of revenue and non-current assets.

She created the following table that shows the geographical disclosure information.

Geographical information

Revenues from Non-current assets

external customers

$’000 $’000

Australia 28,890 9,000

New Zealand 1,000 2,905

Total 29,890 11,905

Michelle sent the operating segment disclosures to Peter Cartus as he requested.

Unit 2 – Worked examples Page 2-19

[This page has deliberately been left blank]

Page 2–20 Worked examples – Unit 2

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 4 Worked ExamplesDocument28 pages4 Worked ExamplesJester LabanNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Multiple StepDocument1 pageMultiple StepMerza DyanNo ratings yet

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanNo ratings yet

- Statement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020Document11 pagesStatement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020dineshkumar1234No ratings yet

- Group Annual Accounts and Directors' ReportDocument1 pageGroup Annual Accounts and Directors' ReportBlanche RyNo ratings yet

- Corporate Reporting: Professional 1 Examination - August 2020Document21 pagesCorporate Reporting: Professional 1 Examination - August 2020Issa BoyNo ratings yet

- Kingsmen Creatives LTD.: (Company Registration Number: 200210790Z)Document17 pagesKingsmen Creatives LTD.: (Company Registration Number: 200210790Z)jhnkerenNo ratings yet

- Aji 202206 Q1Document4 pagesAji 202206 Q1Al TanNo ratings yet

- cpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020Document66 pagescpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020kjbewdjNo ratings yet

- PETRONAS IR20 Financial Review and Other InformationDocument8 pagesPETRONAS IR20 Financial Review and Other InformationFendi SamsudinNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument11 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk Şhïï0% (1)

- LVMH 2020 Consolidated Financial StatementDocument99 pagesLVMH 2020 Consolidated Financial StatementGEETIKA PATRANo ratings yet

- AR Ali 102Document1 pageAR Ali 102Lieder CLNo ratings yet

- SBR INT-2018-dec-QPDocument7 pagesSBR INT-2018-dec-QPkeyn1230No ratings yet

- Statement of Comprehensive Income: Basic Financial Statements IiDocument5 pagesStatement of Comprehensive Income: Basic Financial Statements IiEurica LimNo ratings yet

- CosoldatedDocument11 pagesCosoldatedShafiqNo ratings yet

- Consolidated Fi Nancial Statements and Notes To The Consolidated Fi Nancial StatementsDocument5 pagesConsolidated Fi Nancial Statements and Notes To The Consolidated Fi Nancial Statementsria septiani putriNo ratings yet

- Plaquette Annuelle 31 Decembre 2022 EN VdefsDocument80 pagesPlaquette Annuelle 31 Decembre 2022 EN VdefsAbdcNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- 7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Document13 pages7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Quint WongNo ratings yet

- Frsa Module III Problems SolutionsDocument34 pagesFrsa Module III Problems Solutionsaijaz ahmed nagthan01No ratings yet

- Interim 2016 Results HighlightsDocument20 pagesInterim 2016 Results HighlightsHendry ChristiantoNo ratings yet

- Cash Flow - The Coca-Cola Company (KO)Document1 pageCash Flow - The Coca-Cola Company (KO)vijayNo ratings yet

- 9706 s10 Ms 21Document5 pages9706 s10 Ms 21roukaiya_peerkhanNo ratings yet

- FRS 8 Guidance on Accounting Policies ChangesDocument4 pagesFRS 8 Guidance on Accounting Policies ChangesDavid LeeNo ratings yet

- Learnie Inc Annual Financial Statements Review Report - FinalDocument13 pagesLearnie Inc Annual Financial Statements Review Report - FinalThuy Duong HoangNo ratings yet

- Pharmacy2U Pharmacy2U Limited Consolidated Financial StatementsDocument17 pagesPharmacy2U Pharmacy2U Limited Consolidated Financial StatementsYASH AGRAWALNo ratings yet

- Far 202324 t2 Normal LVMH 2019 Eng FinancialstatementsDocument88 pagesFar 202324 t2 Normal LVMH 2019 Eng Financialstatementslingling9905No ratings yet

- Bishop Group (IAS-21 + Cashflow) : Cfap 1: A A F RDocument1 pageBishop Group (IAS-21 + Cashflow) : Cfap 1: A A F R.No ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- 中期报告2011614Document54 pages中期报告2011614yf zNo ratings yet

- Accor 2021 Consolidated Financial StatementsDocument85 pagesAccor 2021 Consolidated Financial StatementsHari ShankarNo ratings yet

- Alfa P&L and Equity StatementsDocument4 pagesAlfa P&L and Equity StatementsAnna Frolova100% (1)

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Ifrs (Usd) (En)Document49 pagesIfrs (Usd) (En)Ameya KulkarniNo ratings yet

- Assignment AccountingDocument12 pagesAssignment AccountingSadia JuiNo ratings yet

- Session 2 Companies Financial StatementsDocument8 pagesSession 2 Companies Financial StatementsEraldo BoechatNo ratings yet

- 2019 LBG q1 Ims CombinedDocument19 pages2019 LBG q1 Ims CombinedsaxobobNo ratings yet

- Interim Management StatementDocument10 pagesInterim Management StatementsaxobobNo ratings yet

- 20 03 12 Financial Statements of RWE AG 2019Document66 pages20 03 12 Financial Statements of RWE AG 2019HoangNo ratings yet

- Assignment Briefs (Module 4)Document8 pagesAssignment Briefs (Module 4)aung sanNo ratings yet

- Company AccountsDocument4 pagesCompany AccountsShlokNo ratings yet

- REVISION Qs FADocument12 pagesREVISION Qs FAhannah ispandiNo ratings yet

- Practice QuestionsDocument19 pagesPractice QuestionsAbdul Qayyum Qayyum0% (2)

- Consolidated income statement in 40 charsDocument4 pagesConsolidated income statement in 40 charsOmolaja IbukunNo ratings yet

- Vitrox q22020Document16 pagesVitrox q22020Dennis AngNo ratings yet

- Acc Cap M - 2019 - Exercise Pack - Without SolutionsDocument15 pagesAcc Cap M - 2019 - Exercise Pack - Without SolutionsValentinNo ratings yet

- AFM Project Sec J Group 10Document32 pagesAFM Project Sec J Group 10J40Santhosh KrishnaNo ratings yet

- Cases Topic 1 2021 Intl Fin RepDocument10 pagesCases Topic 1 2021 Intl Fin Repyingqiao.panNo ratings yet

- Annual Financial Statements 2020 WebDocument42 pagesAnnual Financial Statements 2020 WebNiyati TiwariNo ratings yet

- Charging All Costs To Expense When IncurredDocument27 pagesCharging All Costs To Expense When IncurredAnonymous N9dx4ATEghNo ratings yet

- Sample Problem IncomeDocument4 pagesSample Problem IncomeJoyce Ann Agdippa Barcelona100% (1)

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- CIA Cia3 AppbDocument4 pagesCIA Cia3 AppbertugrulrizvanNo ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Report Q1 2010Document24 pagesReport Q1 2010Frode HaukenesNo ratings yet

- Gtbo Ar 2022Document126 pagesGtbo Ar 2022NURKAMILAH SARINo ratings yet

- F-1919-B.b.a. - Semester-Iv - Paper - 119-Financial ManagementDocument2 pagesF-1919-B.b.a. - Semester-Iv - Paper - 119-Financial Managementhimanshu ranjanNo ratings yet

- Accounting September Memo 2016Document18 pagesAccounting September Memo 2016Jester LabanNo ratings yet

- Reviewer - FinAcc & TaxDocument13 pagesReviewer - FinAcc & TaxJester LabanNo ratings yet

- Depression - A Review: April 2012Document10 pagesDepression - A Review: April 2012Rabya AmjadNo ratings yet

- 2020 Unit Exam 4Document9 pages2020 Unit Exam 4Jester LabanNo ratings yet

- One of The Movers of The Reform MovementDocument2 pagesOne of The Movers of The Reform MovementJester LabanNo ratings yet

- Agency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015Document8 pagesAgency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015Jester LabanNo ratings yet

- MethodologyDocument1 pageMethodologyJester LabanNo ratings yet

- In One of His ArgumentsDocument3 pagesIn One of His ArgumentsJester LabanNo ratings yet

- Answers - V2Chapter 3 2012 PDFDocument17 pagesAnswers - V2Chapter 3 2012 PDFkea paduaNo ratings yet

- AudDocument13 pagesAudKenneth RobledoNo ratings yet

- FifteenDocument4 pagesFifteenrash_anne01No ratings yet

- CH 15Document35 pagesCH 15Clarize R. MabiogNo ratings yet

- Agency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015Document8 pagesAgency MNO Pre-Closing Trial Balance For The Year Ended December 31. 2015Jester LabanNo ratings yet

- Linear Programming FinalDocument9 pagesLinear Programming FinalJester LabanNo ratings yet

- Case StudyDocument30 pagesCase StudyJester LabanNo ratings yet

- Bob Guthrie Develops Ski Helmet with Built-In Cell Phone and RadioDocument5 pagesBob Guthrie Develops Ski Helmet with Built-In Cell Phone and RadioJester LabanNo ratings yet

- Acctg Solution Chapter 19Document17 pagesAcctg Solution Chapter 19xxxxxxxxx33% (3)

- Solution Chapter 18Document61 pagesSolution Chapter 18KUROKONo ratings yet

- Solution Chapter 12Document15 pagesSolution Chapter 12xxxxxxxxx100% (1)

- 2Document15 pages2Charo Santos LeyvaNo ratings yet

- Transferring of ConsiderationDocument26 pagesTransferring of ConsiderationRose CastilloNo ratings yet

- Answers - V2Chapter 1 2012Document10 pagesAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- Corrections: Volume II Chapters 12 To 15: Office - P135,000 Instead of P135,000 Accounts Receivable - P43,000 InsteadDocument1 pageCorrections: Volume II Chapters 12 To 15: Office - P135,000 Instead of P135,000 Accounts Receivable - P43,000 InsteadRose CastilloNo ratings yet

- Solution Chapter 16Document85 pagesSolution Chapter 16Pancit CantonNo ratings yet

- Chapter 17 consolidation problemsDocument68 pagesChapter 17 consolidation problemsxxxxxxxxx100% (6)

- Sample ch01 PDFDocument39 pagesSample ch01 PDFdomingasNo ratings yet

- Calculating unrealized intercompany inventory profit adjustmentDocument22 pagesCalculating unrealized intercompany inventory profit adjustmentxxxxxxxxx100% (3)

- Correction 12 19Document2 pagesCorrection 12 19libraolrackNo ratings yet

- No Par Value Stock DefinitionDocument2 pagesNo Par Value Stock DefinitionblezylNo ratings yet

- CH 1 Test BankDocument17 pagesCH 1 Test BankShiko TharwatNo ratings yet

- CFAS ReviewerDocument5 pagesCFAS ReviewerbanannannaNo ratings yet

- MCIT, IAET and GIT: Key Taxation ConceptsDocument34 pagesMCIT, IAET and GIT: Key Taxation Conceptssha marananNo ratings yet

- Unit-1 Introduction of Indian Financial SystemDocument23 pagesUnit-1 Introduction of Indian Financial Systempranali suryawanshiNo ratings yet

- Q7Document5 pagesQ7Nurul SyakirinNo ratings yet

- Bank Reconciliation ReviewerDocument2 pagesBank Reconciliation Reviewerfred ferrera jrNo ratings yet

- Advanced Accounting - Interactive Online Quiz Ch01Document4 pagesAdvanced Accounting - Interactive Online Quiz Ch01gilli1tr100% (1)

- BAC 211 Group AssDocument12 pagesBAC 211 Group AssStephan Mpundu (T4 enick)No ratings yet

- Series A Term Sheet SummaryDocument16 pagesSeries A Term Sheet SummarySURAJ SINGHNo ratings yet

- Accounting Concepts: Unit 11Document24 pagesAccounting Concepts: Unit 11LuhenNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- Intermediate Accounting 3 Part 1 Statement of Comprehensive Income ProblemsDocument7 pagesIntermediate Accounting 3 Part 1 Statement of Comprehensive Income ProblemsAG VenturesNo ratings yet

- Accounts Paper 1 November 1996Document8 pagesAccounts Paper 1 November 1996xk dreamerNo ratings yet

- Analysis and RatioDocument35 pagesAnalysis and RatioJP80% (5)

- Stock valuation problems using dividend discount modelDocument1 pageStock valuation problems using dividend discount modelJosine JonesNo ratings yet

- FinalsDocument205 pagesFinalsall in one67% (3)

- FDI PolicyCircular 2020 28october2020Document111 pagesFDI PolicyCircular 2020 28october2020Tanya DewaniNo ratings yet

- Ogl 260 Module 3 - UpdatedDocument5 pagesOgl 260 Module 3 - Updatedapi-538745701No ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- Solved Continue With The Results of Problem 35 Prepare The GaapDocument1 pageSolved Continue With The Results of Problem 35 Prepare The GaapAnbu jaromiaNo ratings yet

- Corporate Finance Tutorial Questions on Dividends and Dividend PolicyDocument2 pagesCorporate Finance Tutorial Questions on Dividends and Dividend PolicyAmy LimnaNo ratings yet

- FIN611 Quiz Advance Financial AccountingDocument7 pagesFIN611 Quiz Advance Financial AccountingFarhan Bajwa100% (1)

- Be Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItDocument12 pagesBe Advised, The Template Workbooks and Worksheets Are Not Protected. Overtyping Any Data May Remove ItHappy MichaelNo ratings yet

- Bascic of Financial ManagementDocument17 pagesBascic of Financial ManagementHazlina HusseinNo ratings yet

- FAR 7.1MC - Shareholders' Equity (Part 1) Share CapitalDocument5 pagesFAR 7.1MC - Shareholders' Equity (Part 1) Share CapitalScarlet ReignNo ratings yet

- Nov Paper11 2010Document20 pagesNov Paper11 2010Aung Zaw HtweNo ratings yet

- Exam 2Document19 pagesExam 2SHE50% (2)

- Electronic Timing Inc Eti Is A Small Company Founded 15Document2 pagesElectronic Timing Inc Eti Is A Small Company Founded 15Amit PandeyNo ratings yet

- Homework Assignment 1 PDFDocument2 pagesHomework Assignment 1 PDFDavid RoblesNo ratings yet